Airships Market Size - Global Industry, Share, Analysis, Trends and Forecast 2024 - 2032

Published :

Report ID:

Pages :

Format :

Airships Market Size - Global Industry, Share, Analysis, Trends and Forecast 2024 - 2032

Report Coverage

- Industry Dynamics

- Market Size and Forecast Data

- Segment Analysis

- Competitive Landscape

- Regional Analysis with a Niche Focus on Country-Level Data

- High Level Analysis - Porter's, PESTEL, Value Chain, etc.

- Company Profiles of Key Players

- Option to Customize the Report As Per Your Specific Need

Request Sample Report

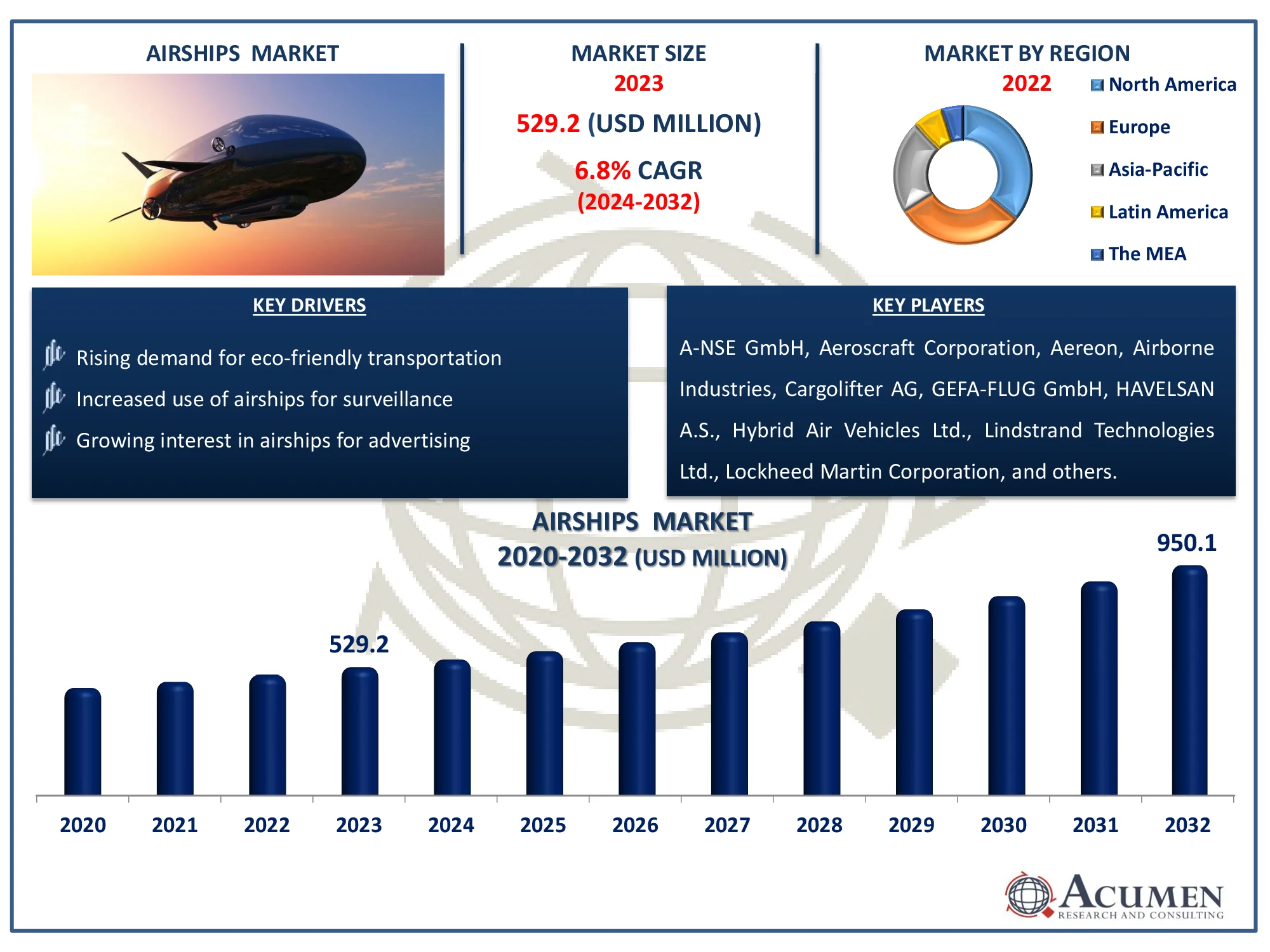

The Global Airships Market Size accounted for USD 529.2 Million in 2023 and is estimated to achieve a market size of USD 950.1 Million by 2032 growing at a CAGR of 6.8% from 2024 to 2032.

Airships Market Highlights

- The global airships market revenue is projected to reach USD 950.1 million by 2032, with a CAGR of 6.8% from 2024 to 2032

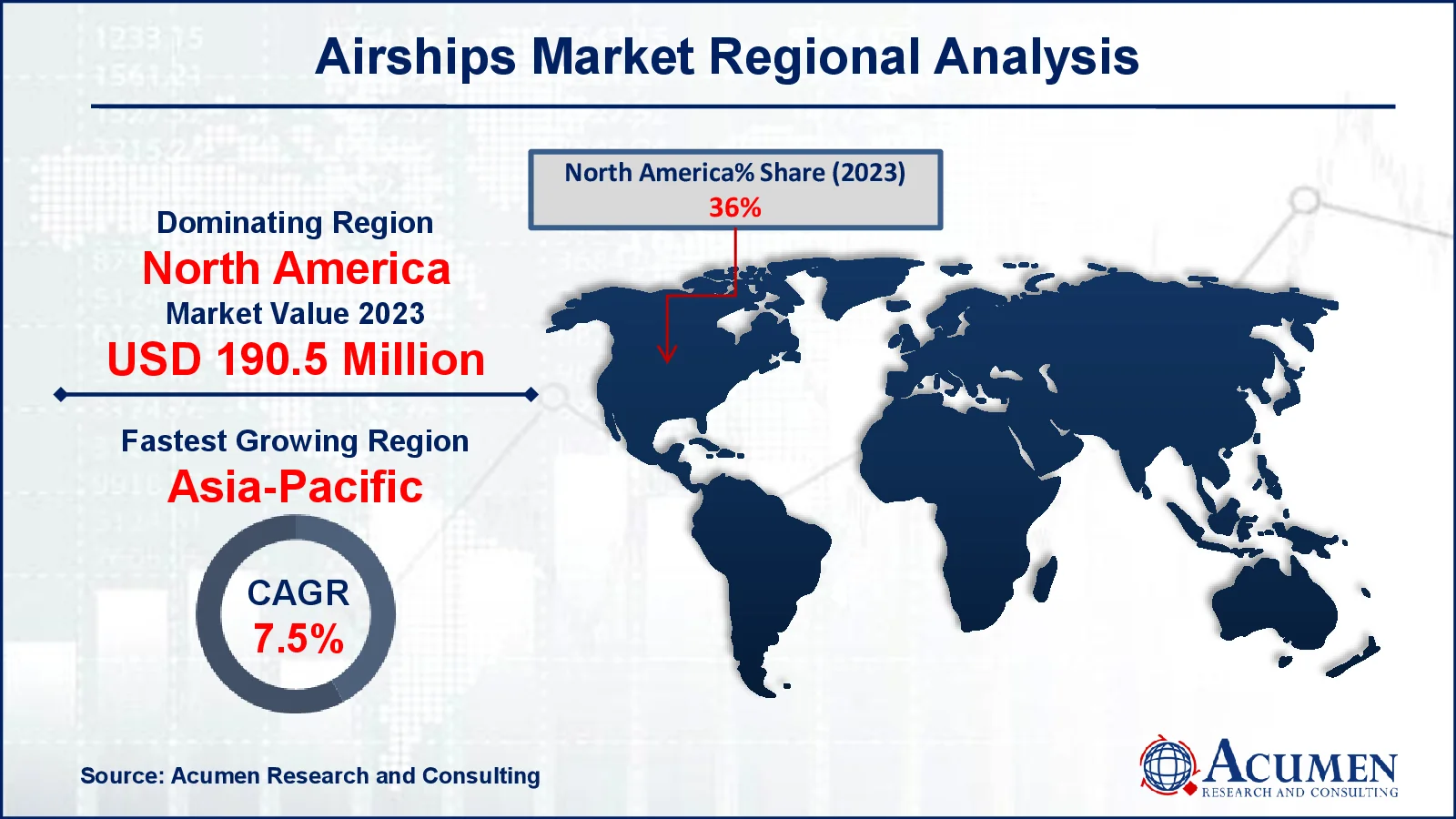

- The North America airships market was valued at approximately USD 190.5 million in 2023

- The Asia-Pacific airships market is expected to grow at a CAGR of over 7.5% from 2024 to 2032

- In 2023, the unmanned sub-segment held a significant market share among operation

- The non-rigid architecture sub-segment also accounted for a notable market share in 2023

- Growing adoption of hybrid airships for eco-friendly cargo transportation and surveillance is the airships market trend that fuels the industry demand

An airship (also known as dirigible), is a type of lighter-than-air aircraft that floats using gas such as helium or hydrogen. The cases of airships vary from blimps to zeppelins. Airships are different from airplanes in that they carry a gas such as helium or hydrogen that is lighter than air and allows them to fly without a lift. However, they possess engines and autos for propulsion and steering, meaning they can make controlled flight. There are three main types of airships: rigid, semi-rigid, and non-rigid. Rigid airships consist of a solid framework. Nonetheless, the draw of airships receded after the 1930s, thanks to the arrival of faster and more fuel-efficient airplanes, and tragedies like the Hindenburg accident. The airship is reviving in the areas of aerial advertisements, tourism, and environmental monitoring, as today, airships attract the public with their noiseless and less fuel-consuming features than conventional aircraft.

Global Airships Market Dynamics

Market Drivers

- Rising demand for eco-friendly and fuel-efficient transportation solutions

- Increased use of airships for surveillance and military reconnaissance applications

- Growing interest in airships for advertising and tourism due to visibility

- Technological advancements improving safety and operational efficiency of modern airships

Market Restraints

- High manufacturing and maintenance costs limit widespread adoption

- Vulnerability to weather conditions restricts consistent operation in certain regions

- Regulatory hurdles and strict safety standards slow down market growth

Market Opportunities

- Expanding use of airships in remote area logistics and humanitarian aid

- Growing applications in environmental monitoring and disaster management

- Potential for airships in the development of hybrid and autonomous air vehicles

Airships Market Report Coverage

| Market | Airships Market |

| Airships Market Size 2022 |

USD 529.2 Million |

| Airships Market Forecast 2032 | USD 950.1 Million |

| Airships Market CAGR During 2023 - 2032 | 6.8% |

| Airships Market Analysis Period | 2020 - 2032 |

| Airships Market Base Year |

2022 |

| Airships Market Forecast Data | 2023 - 2032 |

| Segments Covered | By Class, By Operation, By Architecture, By Application, And By Geography |

| Regional Scope | North America, Europe, Asia Pacific, Latin America, and Middle East & Africa |

| Key Companies Profiled | A-NSE GmbH, Aeroscraft Corporation, Aereon, Airborne Industries Inc., Cargolifter AG, GEFA-FLUG GmbH, HAVELSAN A.S., Hybrid Air Vehicles Ltd., Lindstrand Technologies Ltd., Lockheed Martin Corporation, Northrop Grumman Corporation, RosAeroSystems International Ltd., RT Aerostats Systems Ltd., TCOM L.P., and Zeppelin Luftschifftechnik GmbH. |

| Report Coverage |

Market Trends, Drivers, Restraints, Competitive Analysis, Player Profiling, Covid-19 Analysis, Regulation Analysis |

Airships Market Insights

The airship market is driven by several key factors that make these aircraft an attractive option for specific industries. The main factor is the upsurge in eco-friendly and fuel-efficient transportation solutions that airship firms are increasingly looking for, as airships require significantly less fuel than airplanes. Their yet ease of being laden with heavy items and traversing long distances at a lower environmental cost is a perfect fit in remote areas for logistics. Furthermore, indeed, they are also being utilized for military surveillance, reconnaissance, and border patrol, whereby the airships can stay in the air for a long time, monitor the areas continuously, and let the soldiers attack only when it is necessary. Besides, technological developments have also improved the safety, efficiency, and maneuverability of nowadays airships, which proves their attractiveness for commercial use.

However, there are also some restraints that impede the wider adoption of airships. Very large manufacturing and maintenance costs are still the main problem even for companies that are looking for a cheaper method of transportation or surveillance. High susceptibility to distinct marine operational weather conditions like strong winds or storms is another disadvantage of airships that clearly affects their operational reliability. Furthermore, the need for stricter safety regulations and the slow certification processes in various regions are also challenges in these markets; especially in the regions where airship technology is still emerging or experimental the situation is more difficult for the market players.

Airship opportunities are not only blooming in the overall market but also their applications in some niches such as environmental monitoring, disaster management, and humanitarian aid. The airships can access remote places or disaster areas where the conventional aircraft find it difficult to reach thus, they become of great value in rescue and supply missions. More so, the advancements in hybrid airships and fully autonomous models bring in more, for the airships, higher productivity and more functionality in the future. In addition to the rising interest in sustainability, airships could make a significant contribution in areas such as aerial advertising, tourism, and even scientific exploration, thus, providing an avenue for the growth of the market.

Airships Market Segmentation

The worldwide market for airships is split based on class, operation, architecture, application, and geography.

Airship Market By Class

- Small

- Medium

- Large

According to the airships industry analysis, the large airship segment was the airships market leader because it was able to transport heavier payloads and cover long distances. Logistics, humanitarian aid, and disaster relief operations are also relevant here due to their ability to transport large cargo in places with poor infrastructure. Hybrid airship technology has also made large models more fuel-efficient and versatile which has bolstered their adoption across industries. Military and defense applications have a preference for them for surveillance, reconnaissance, and intelligence gathering purposes because of their long endurance and carrying of advanced communication and monitoring equipment. The market's large airship preference stems from their superior functionality as well as the rising demand for long-range, eco-friendly means of transportation.

Airship Market By Operation

- Manned

- Unmanned

In 2023, the manned airship segment gathered the utmost market share due to its widespread use in commercial applications such as tourism, advertising, and cargo transportation. Manned airships are favored for these areas due to the fact that they provide more control, safety, and flexibility for such complicated operations like transporting people, goods, and services. Not to forget, manned airships are widely exploited in purposes of military and defense sectors as well, for instance, they are skilled in long-range surveillance and reconnaissance missions, which require human controlling and decision-making capabilities. Yet, the unmanned systems development trend shows that the versatility and safety of employed airships design are fundamental for the success of the sector.

Airship Market By Architecture

- Non Rigid

- Rigid

- Semi Rigid

In the airships non-rigid segment, the airships non-rigid segment has been experiencing a growing success in the market due to the advantages of low cost and the possibility of custom design. Non-rigid airships, which are more popularly known as blimps, do not have a solid internal structure since they rely on the internal pressure of the lifting gas to keep their shape. This fact attests to the fact that they are lighter, and thus, easier to manufacture, and more economical to operate than rigid or semi-rigid alternatives. The particulars of the operations of the airships have made them the first choice in promoting advertising, security, and tourism, where both low operational costs and ease of deployment are critical factors. Furthermore, the recent improvements in materials and technology have been the reasons for the strength and stability of the non-rigid airships, which motivated the use of non-rigid airships for both commercial and governmental sectors.

Airship Market By Application

- Tourism and Recreational

- Research and Surveillance

- Advertisement and Cargo

- Military and Communication

According to the airships market forecast, the military and communication sector is set to be a major player in the airship market over the next decade, from 2024 to 2032. This growth is powered by the airship's rising applications in surveillance, intelligence gathering, and border security because of its remaining airborne for long periods while providing monitoring in real time. Military airships are also the most preferred ones for their capability to carry advanced communication equipment and carry out reconnaissance missions even if they are in remote or difficult-to-access areas. Moreover, their low fuel consumption and the capability to operate at high altitudes enhance their value in defense and security operations. With defense budgets around the world growing and the need for continuous surveillance increasing, the military and communication sector is well positioned to be the airship market leader during this period.

Airships Market Regional Outlook

North America

- U.S.

- Canada

Europe

- U.K.

- Germany

- France

- Spain

- Rest of Europe

Asia-Pacific

- India

- Japan

- China

- Australia

- South Korea

- Rest of Asia-Pacific

Latin America

- Brazil

- Mexico

- Rest of Latin America

The Middle East & Africa

- South Africa

- GCC Countries

- Rest of the Middle East & Africa (ME&A)

Airships Market Regional Analysis

In terms of the global market for airships, North America is the most important actor and it is expected to grow fast during the forecast period. A plethora of major players in the industry, nonstop technology breakthroughs, and an insatiable appetite for airships for numerous applications are some of the elements that maintain the North American region's supremacy in the global airship market. The region's strong military sector is the main factor in boosting growth, as airship technology is used in such important missions as cargo transport, surveillance, and reconnaissance, which security and efficiency of operations are increased and national security is strengthened.

The Asia-Pacific area is seeing an increasing trend in shipping and advertising applications. Airships are increasingly employed to convey freight to remote locations with difficult terrain. Furthermore, there is an increase in aerial advertising campaigns promoting products and services, utilizing the mobility of airships for marketing in densely populated metropolitan areas.

South America and the Middle East and Africa are likely to account for a lesser percentage of the entire market. Nonetheless, these regions are likely to rise steadily in the next years, driven by increased awareness of the benefits of airships and a growing need for transportation and surveillance options.

Airships Market Players

Some of the top airships companies offered in our report include A-NSE GmbH, Aeroscraft Corporation, Aereon, Airborne Industries Inc., Cargolifter AG, GEFA-FLUG GmbH, HAVELSAN A.S., Hybrid Air Vehicles Ltd., Lindstrand Technologies Ltd., Lockheed Martin Corporation, Northrop Grumman Corporation, RosAeroSystems International Ltd., RT Aerostats Systems Ltd., TCOM L.P., and Zeppelin Luftschifftechnik GmbH.

Frequently Asked Questions

How big is the airships market?

The Airships market size was valued at USD 529.2 Million in 2023.

What is the CAGR of the global airships market from 2024 to 2032?

The CAGR of Airships is 6.8% during the analysis period of 2024 to 2032.

Which are the key players in the airships market?

The key players operating in the global market are including A-NSE GmbH, Aeroscraft Corporation, Aereon, Airborne Industries Inc., Cargolifter AG, GEFA-FLUG GmbH, HAVELSAN A.S., Hybrid Air Vehicles Ltd., Lindstrand Technologies Ltd., Lockheed Martin Corporation, Northrop Grumman Corporation, RosAeroSystems International Ltd., RT Aerostats Systems Ltd., TCOM L.P., and Zeppelin Luftschifftechnik GmbH.

Which region dominated the global airships market share?

North America held the dominating position in airships industry during the analysis period of 2024 to 2032.

Which region registered fastest CAGR from 2024 to 2032?

Asia-Pacific region exhibited fastest growing CAGR for market of airships during the analysis period of 2024 to 2032.

What are the current trends and dynamics in the global airships industry?

The current trends and dynamics in the airships industry include rising demand for eco-friendly and fuel-efficient transportation solutions, increased use of airships for surveillance and military reconnaissance applications., growing interest in airships for advertising and tourism due to visibility, and technological advancements improving safety and operational efficiency of modern airships.

Which class held the maximum share in 2023?

The large class held the maximum share of the airships industry.