Airline Technology Integration Market Size - Global Industry, Share, Analysis, Trends and Forecast 2023 - 2032

Published :

Report ID:

Pages :

Format :

Airline Technology Integration Market Size - Global Industry, Share, Analysis, Trends and Forecast 2023 - 2032

Report Coverage

- Industry Dynamics

- Market Size and Forecast Data

- Segment Analysis

- Competitive Landscape

- Regional Analysis with a Niche Focus on Country-Level Data

- High Level Analysis - Porter's, PESTEL, Value Chain, etc.

- Company Profiles of Key Players

- Option to Customize the Report As Per Your Specific Need

Request Sample Report

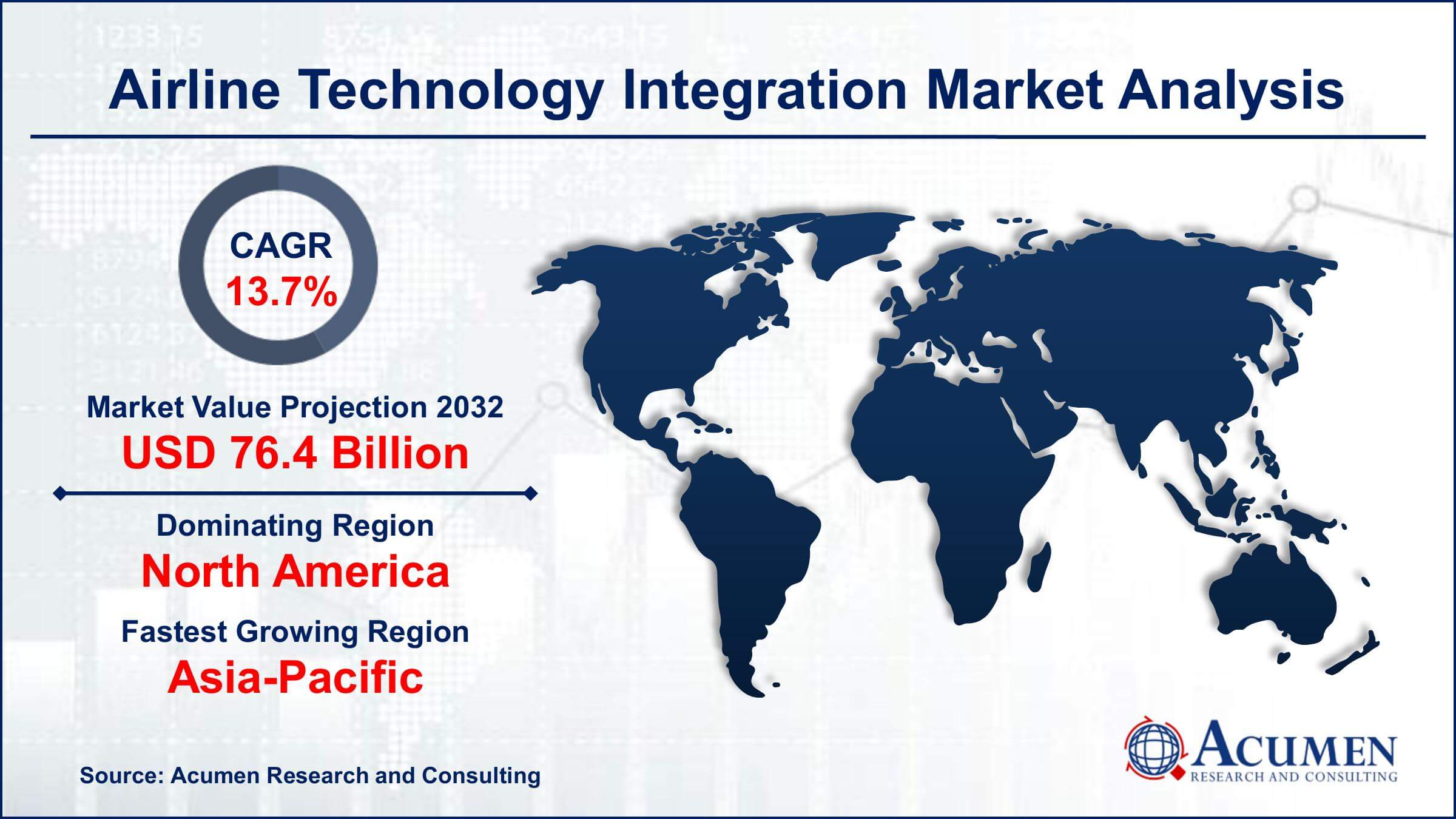

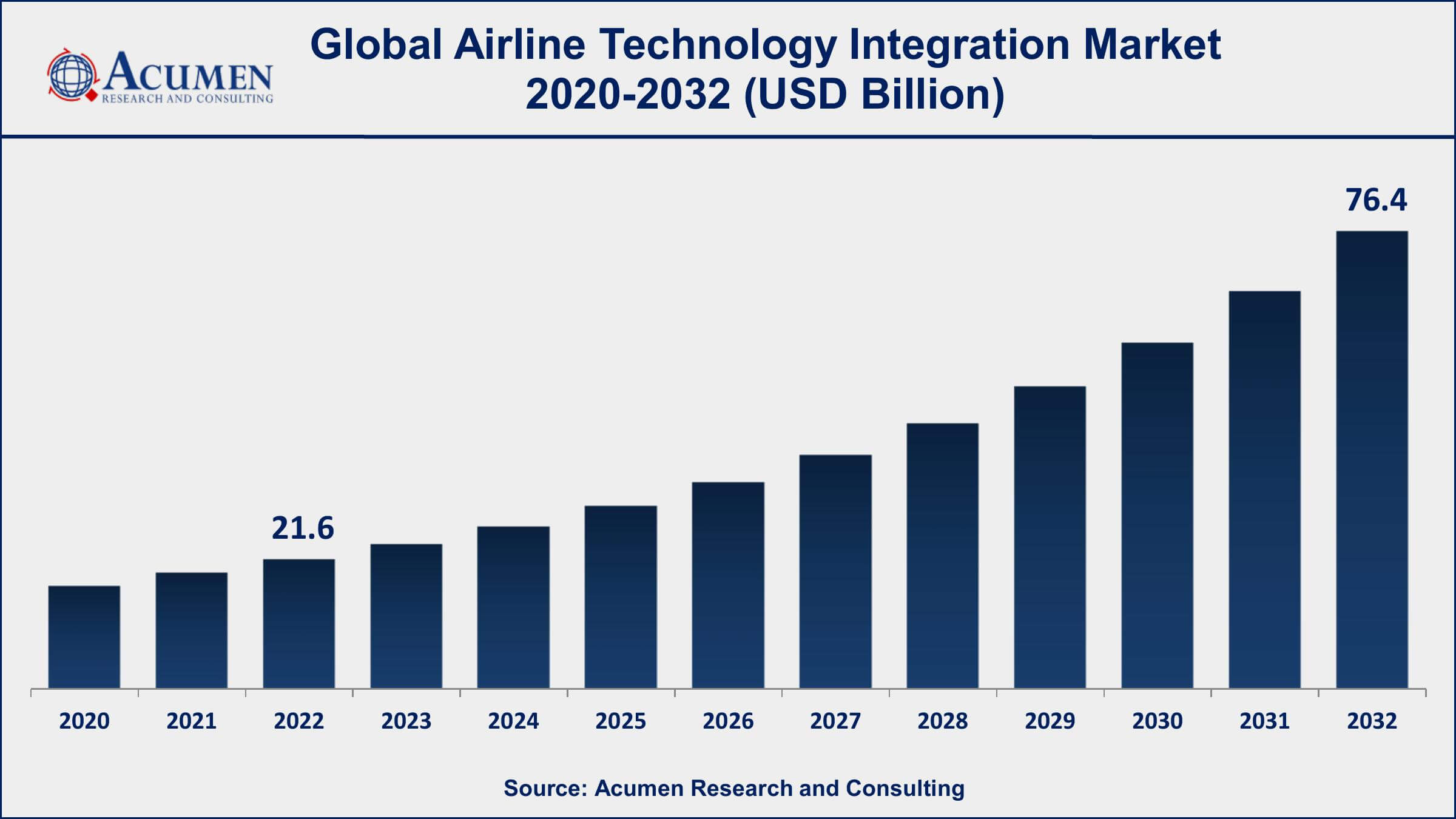

The Global Airline Technology Integration Market Size accounted for USD 21.6 Billion in 2022 and is projected to achieve a market size of USD 76.4 Billion by 2032 growing at a CAGR of 13.7% from 2023 to 2032.

Airline Technology Integration Market Highlights

- Global airline technology integration market revenue is expected to increase by USD 76.4 Billion by 2032, with a 13.7% CAGR from 2023 to 2032

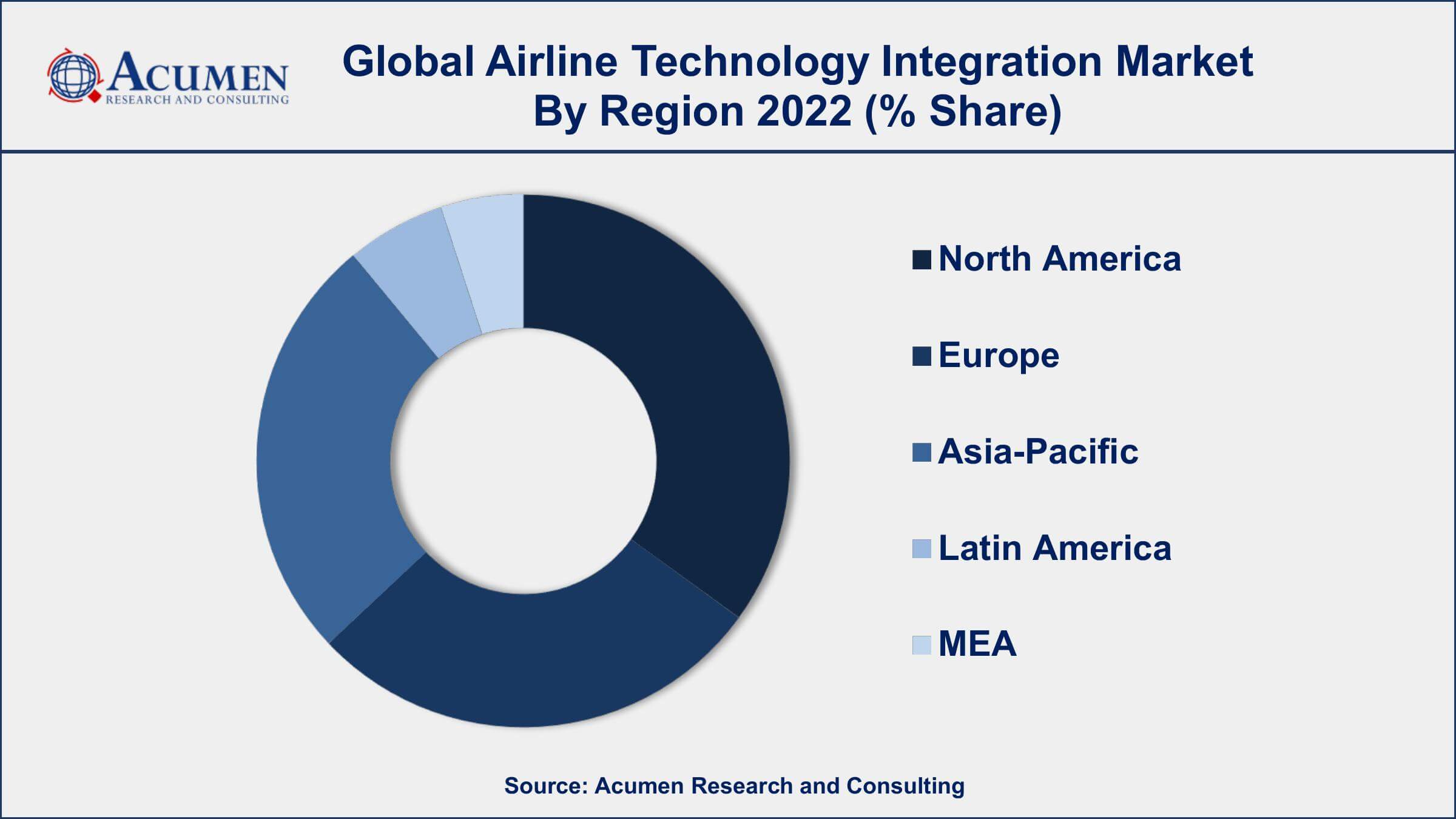

- North America region led with more than 37% of airline technology integration market share in 2022

- Asia-Pacific airline technology integration market growth will record a CAGR of more than 15% from 2023 to 2032

- By technology, the cybersecurity segment has accounted more than 21.4% of the revenue share in 2022.

- By deployment, the cloud segment is expected to expand at the biggest CAGR of 14.8% from 2023 to 2032

- Increasing demand for improved passenger experience, drives the airline technology integration market value

Airline technology integration refers to the process of seamlessly combining various services and features to provide a comprehensive and unified experience for both airlines and passengers. This integration involves streamlining reservations, ticketing, passenger management, flight operations, baggage handling, and other critical airline functions. By integrating these disparate systems, airlines can enhance operational efficiency, improve customer service, and optimize their overall performance.

Airline technology integration refers to the process of seamlessly combining various services and features to provide a comprehensive and unified experience for both airlines and passengers. This integration involves streamlining reservations, ticketing, passenger management, flight operations, baggage handling, and other critical airline functions. By integrating these disparate systems, airlines can enhance operational efficiency, improve customer service, and optimize their overall performance.

The market for airline technology integration has experienced significant growth over the past few years. Advancements in technology, increasing demand for improved passenger experience, and the need for airlines to remain competitive have been the driving forces behind this growth. Integrated airline solutions enable airlines to manage their operations more effectively, reduce costs, and better respond to dynamic market conditions. Additionally, the rise of digitalization and the Internet of Things (IoT) has facilitated the integration of various airline systems, providing real-time data access and enabling proactive decision-making.

Global Airline Technology Integration Market Trends

Global Airline Technology Integration Market Trends

Market Drivers

- Increasing demand for improved passenger experience

- Advancements in technology and digitization

- Need for airlines to optimize operational efficiency and reduce costs

- Growing adoption of IoT and connected solutions

- Rising focus on data-driven decision-making and real-time analytics

Market Restraints

- Complex legacy systems and integration challenges

- High initial investment and implementation costs

Market Opportunities

- Integration of artificial intelligence (AI) and machine learning (ML) for predictive analytics

- Utilization of blockchain technology for secure and transparent transactions

Airline Technology Integration Market Report Coverage

| Market | Airline Technology Integration Market |

| Airline Technology Integration Market Size 2022 | USD 21.6 Billion |

| Airline Technology Integration Market Forecast 2032 | USD 76.4 Billion |

| Airline Technology Integration Market CAGR During 2023 - 2032 | 13.7% |

| Airline Technology Integration Market Analysis Period | 2020 - 2032 |

| Airline Technology Integration Market Base Year | 2022 |

| Airline Technology Integration Market Forecast Data | 2023 - 2032 |

| Segments Covered | By Offering, By Technology, By Deployment, And By Geography |

| Regional Scope | North America, Europe, Asia Pacific, Latin America, and Middle East & Africa |

| Key Companies Profiled | Amadeus IT Group, Sabre Corporation, SITA, Travelport, Hitit Computer Services, Radixx International, IBS Software, Unisys Corporation, Lufthansa Systems, Honeywell Aerospace, Rockwell Collins, and Thales Group |

| Report Coverage |

Market Trends, Drivers, Restraints, Competitive Analysis, Player Profiling, Covid-19 Analysis, Regulation Analysis |

Airline technology integration is a process of consolidating various systems and services within an airline's operations to create a seamless and interconnected ecosystem. It involves integrating different aspects of airline operations, such as reservation and ticketing systems, passenger management, crew scheduling, flight operations, baggage handling, maintenance, and more. The main objective is to enable efficient communication and data sharing between these systems, leading to improved operational efficiency, enhanced passenger experiences, and better decision-making for airline management.

Applications of airline technology integration are diverse and impactful. One key application is enhancing the passenger journey. Integrated reservation and check-in systems allow passengers to book flights, select seats, and check-in seamlessly through various channels, such as websites or mobile apps. Additionally, integrated baggage handling systems help ensure smooth luggage transfers and reduce the likelihood of lost baggage. This end-to-end integration contributes to a more enjoyable and hassle-free travel experience for passengers.

The airline technology integration market has experienced significant growth in recent years, driven by several key factors. One of the main drivers is the increasing demand for improved passenger experience. Airlines are recognizing the importance of providing a seamless and convenient travel journey to their customers. By integrating various services such as online booking, mobile check-in, personalized in-flight entertainment, and streamlined baggage handling, airlines can enhance customer satisfaction and loyalty. As travelers become more tech-savvy and expect a connected experience, airlines are investing in integrated solutions to meet these evolving demands.

Airline Technology Integration Market Segmentation

The global airline technology integration market segmentation is based on offering, technology, deployment, and geography.

Airline Technology Integration Market By Offering

- Hardware

- Software

According to the airline technology integration industry analysis, the software segment accounted for the largest market share in 2022. The increasing adoption of advanced technologies and the need for streamlined operations have been the primary drivers of this growth. Airlines are increasingly relying on software solutions to integrate various aspects of their operations, such as reservations, inventory management, passenger handling, crew scheduling, and flight operations. Integrated software platforms provide airlines with a unified view of their entire operation, allowing them to make data-driven decisions, optimize resources, and enhance overall efficiency. Furthermore, the COVID-19 pandemic has further accelerated the demand for software solutions in the airline industry.

Airline Technology Integration Market By Technology

- Internet of Things (IoT)

- Artificial Intelligence

- Cybersecurity

- Wearable Technology

- Advanced Analytics

- Blockchain

- Biometrics

- Others

In terms of technologies, the cybersecurity segment is expected to witness significant growth in the coming years. This growth is due to the escalating threat landscape and the critical need to protect airlines' digital assets and sensitive data. As airlines increasingly rely on integrated systems to manage their operations, reservations, and passenger information, they become more susceptible to cyberattacks. Cybercriminals target airlines to steal personal and financial data, disrupt operations, and create chaos. As a result, there has been a growing realization among airlines about the importance of robust cybersecurity measures. The COVID-19 pandemic and the subsequent increase in remote work and digital interactions further underscored the significance of cybersecurity for airlines.

Airline Technology Integration Market By Deployment

- On-Premises

- Cloud

According to the airline technology integration market forecast, the cloud segment is expected to witness significant growth in the coming years. Cloud computing has revolutionized the aviation industry by offering airlines a flexible, scalable, and cost-effective solution for integrating and managing their operations. Airlines are increasingly turning to cloud-based platforms to streamline their processes, improve collaboration, and enhance overall efficiency. Cloud solutions enable airlines to access their data and applications from anywhere, at any time, facilitating real-time decision-making and fostering agility in responding to market changes and customer demands. The COVID-19 pandemic further accelerated the adoption of cloud solutions in the airline industry. With disruptions caused by travel restrictions and remote work becoming the norm, airlines embraced cloud technology to maintain business continuity and support remote operations.

Airline Technology Integration Market Regional Outlook

North America

- U.S.

- Canada

Europe

- U.K.

- Germany

- France

- Spain

- Rest of Europe

Asia-Pacific

- India

- Japan

- China

- Australia

- South Korea

- Rest of Asia-Pacific

Latin America

- Brazil

- Mexico

- Rest of Latin America

The Middle East & Africa

- South Africa

- GCC Countries

- Rest of the Middle East & Africa (ME&A)

Airline Technology Integration Market Regional Analysis

Geographically, North America dominates the airline technology integration market in 2022. North America is home to some of the world's largest and most established airlines, which have been early adopters of advanced technology solutions. These airlines have invested heavily in integrated systems to enhance their operational efficiency, improve customer experience, and gain a competitive edge. As industry leaders, their practices and technology choices have influenced the broader market, encouraging other airlines in the region to follow suit and invest in similar solutions. Moreover, North America has a robust and mature technology ecosystem, with numerous software and IT service providers specializing in Airline Technology Integration. These companies have developed a wide range of innovative solutions tailored to the unique needs of airlines, which has contributed to the widespread adoption of integrated systems in the region. Additionally, the availability of skilled IT professionals and a favorable regulatory environment for technology adoption have further supported the market growth of the airline technology integration in North America.

Airline Technology Integration Market Player

Some of the top airline technology integration market companies offered in the professional report include Amadeus IT Group, Sabre Corporation, SITA, Travelport, Hitit Computer Services, Radixx International, IBS Software, Unisys Corporation, Lufthansa Systems, Honeywell Aerospace, Rockwell Collins, and Thales Group.

Frequently Asked Questions

What was the market size of the global airline technology integration in 2022?

The market size of airline technology integration was USD 21.6 Billion in 2022.

What is the CAGR of the global airline technology integration market from 2023 to 2032?

The CAGR of Airline Technology Integrationis 13.7% during the analysis period of 2023 to 2032.

Which are the key players in the airline technology integration market?

The key players operating in the global market are including Amadeus IT Group, Sabre Corporation, SITA, Travelport, Hitit Computer Services, Radixx International, IBS Software, Unisys Corporation, Lufthansa Systems, Honeywell Aerospace, Rockwell Collins, and Thales Group.

Which region dominated the global airline technology integration market share?

North America held the dominating position in airline technology integration industry during the analysis period of 2023 to 2032.

Which region registered fastest CAGR from 2023 to 2032?

Asia-Pacific region exhibited fastest growing CAGR for market of airline technology integration during the analysis period of 2023 to 2032.

What are the current trends and dynamics in the global airline technology integration industry?

The current trends and dynamics in the airline technology integration industry include increasing demand for improved passenger experience, advancements in technology and digitization, and need for airlines to optimize operational efficiency and reduce costs.

Which technology held the maximum share in 2022?

The cybersecurity technology held the maximum share of the airline technology integration industry.