Aircraft Seating Market (By Aircraft Type: Commercial, Business Jets, Regional Aircraft; By Seat Type: 9G Seats, 16G Seats; By Components: Structure, Foams, Actuators, Electrical Fittings, Others; By End Use: OEM, Aftermarket) - Global Industry Analysis, Market Size, Opportunities and Forecast 2021 - 2028

Published :

Report ID:

Pages :

Format :

Aircraft Seating Market (By Aircraft Type: Commercial, Business Jets, Regional Aircraft; By Seat Type: 9G Seats, 16G Seats; By Components: Structure, Foams, Actuators, Electrical Fittings, Others; By End Use: OEM, Aftermarket) - Global Industry Analysis, Market Size, Opportunities and Forecast 2021 - 2028

Report Coverage

- Industry Dynamics

- Market Size and Forecast Data

- Segment Analysis

- Competitive Landscape

- Regional Analysis with a Niche Focus on Country-Level Data

- High Level Analysis - Porter's, PESTEL, Value Chain, etc.

- Company Profiles of Key Players

- Option to Customize the Report As Per Your Specific Need

Request Sample Report

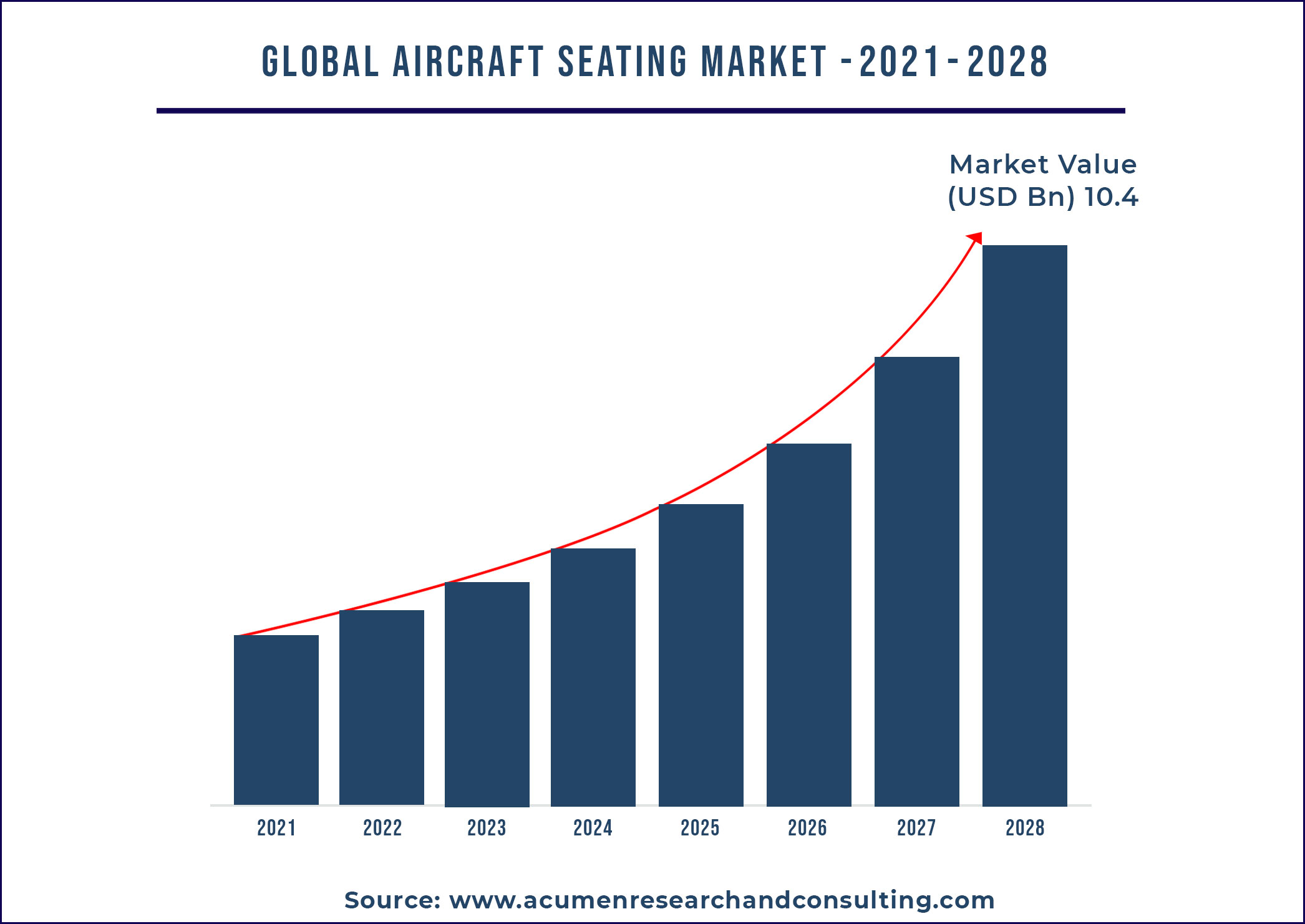

The global aircraft seating market is anticipated to grow at a CAGR of around 5.1% during the forecast period 2021 to 2028 and to reach around US$ 10.4 Bn by 2028.

Report coverage

| Market | Aircraft Seating Market |

| Analysis Period | 2017 - 2028 |

| Base Year | 2020 |

| Forecast Data | 2021 - 2028 |

| Segments Covered | By Aircraft Type, By Seat Type, By Components, By End Use, and By Region |

| Regional Scope | North America, Europe, Asia Pacific, Latin America, and Middle East & Africa |

| Key Companies Profiled | Expliseat SAS, Geven S.p.a., HAECO, Iacobucci HF Aerospace S.p.A., Collins Aerospace, ACRO Aircraft Seating Ltd, Aviointeriors S.p.A., Embraer Aero Seating Technologies, JAMCO Corporation, and Encore, A Boeing Company |

| Report Coverage |

Market Trends, Drivers, Restraints, Competitive Analysis, Player Profiling, Regulation Analysis |

| Customization Scope | 10 hrs of free customization and expert consultation |

Market Dynamics

Flourishing aviation industry in developed and developing countries, rising passenger preference for air travel and increasing investment by government are major factors expected to drive the growth of global aircraft seating market. In 2021, 313,668 domestic passengers flew recording the highest number since resumption of domestic flights in 2020. Government is implementing various airport development projects in order to streamline and enhance the rising passenger traffic. India had 153 operational airports in 2020 and has envisaged increasing the number of operational airports to 190-200 by 2040. Rising tourism in the countries such as India, China and Australia the government is focused investing high and enhance the consumer experience. According to India Brand Equity Foundation, in 2021, the Indian domestic and international aircraft movements reached 1,062 thousand and 135 thousand. With the high spending the Indian traveler’s spending on travel is expected to grow by US$ 136 Bn in 2021. This is expected to increase demand for enhanced and efficient seats in the aircrafts which is expected to augment the market growth. Major players approach towards enhancing the business through introduction of new seats and business acquisitions is expected to augment the growth of aircraft seating market.

In 2019, Acro, a global aircraft product & service provider launched new Series 6LC Economy Class seat. The new products are soft touch matte-black synthetic leather with border stitching and modern aesthetic. This product launch is expected to increase the customer base and increase the revenue share.

In 2019, Tapis Corporation, a global high-performance fabric seating service provider launched new seats at its Aircraft Seating Innovation Center the Butterfly’s Single Aisle Lie Flat (SALF) seat, Rebel Aero’s S3 seat, Molon Labe’s side-slip seat, and Safran Seats’ Slim Plus. This is expected to help company to attract new customers and increase the revenue share.

Factors such as high product cost and soaring cost involved in production and maintenance of seats are major factors expected to hamper the growth of global aircraft seating market. In addition, an economical change is expected to impact the airlines industry lowering the demand for seats this is expected to challenge the growth of target market. However, rapid urbanization and demand for low cost airline are factors expected to create new opportunities for players operating in the global aircraft seating market over the forecast period. In addition, increasing merger activities by players in order to enhance the business is expected to support the revenue transaction of the target market

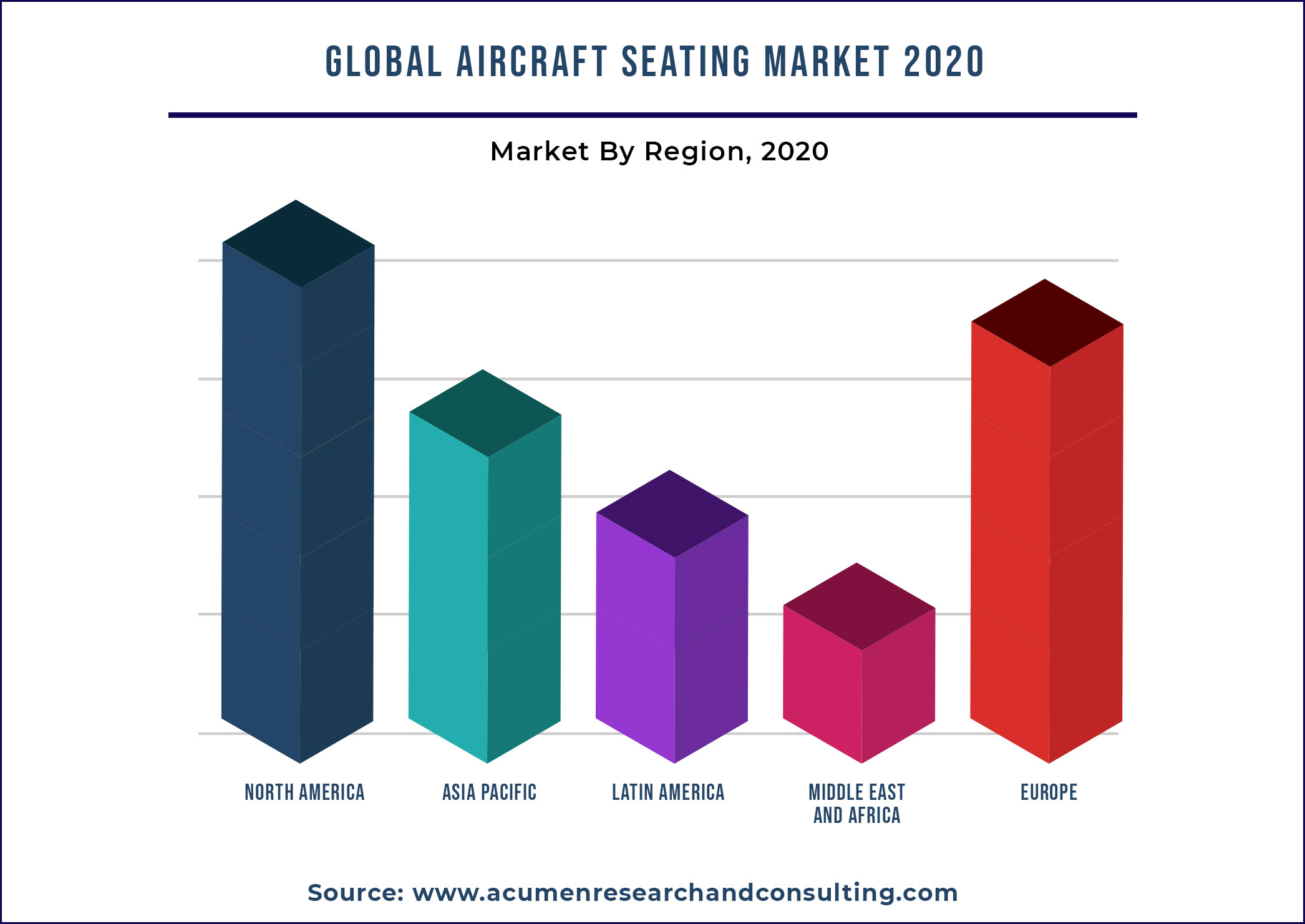

Segment Analysis by Region

The market in Asia Pacific is expected to witness faster growth in the target market due to high spending by the government to develop the air travel infrastructure. With the high spending capacity and rising air travel demand from consumers the airports are witnessing high passenger flow. Government is implementing various airport development projects in order to streamline and enhance the rising passenger traffic. India had 153 operational airports in 2020 and has envisaged increasing the number of operational airports to 190-200 by 2040.

Rising tourism in the countries such as India, China and Australia the government is focused investing high and enhance the consumer experience. According to India Brand Equity Foundation, in 2021, the Indian domestic and international aircraft movements reached 1,062 thousand and 135 thousand. With the high spending the Indian traveler’s expenditure on travel is expected to grow by US$ 136 Bn in 2021. This is expected to increase demand for enhanced and efficient seats in the aircrafts which is expected to augment the market growth. Favorable business policies by the government of developing countries and availability of 100% FDI in is expected to attract major players to emerging economies this is expected to support the growth of aircraft seating regional market.

Competitive Landscape

The global aircraft seating market is highly competitive due to presence of large number of players and innovative product offerings. In addition, business expansion activities through partnerships and agreements are factors expected to further increase the competition.

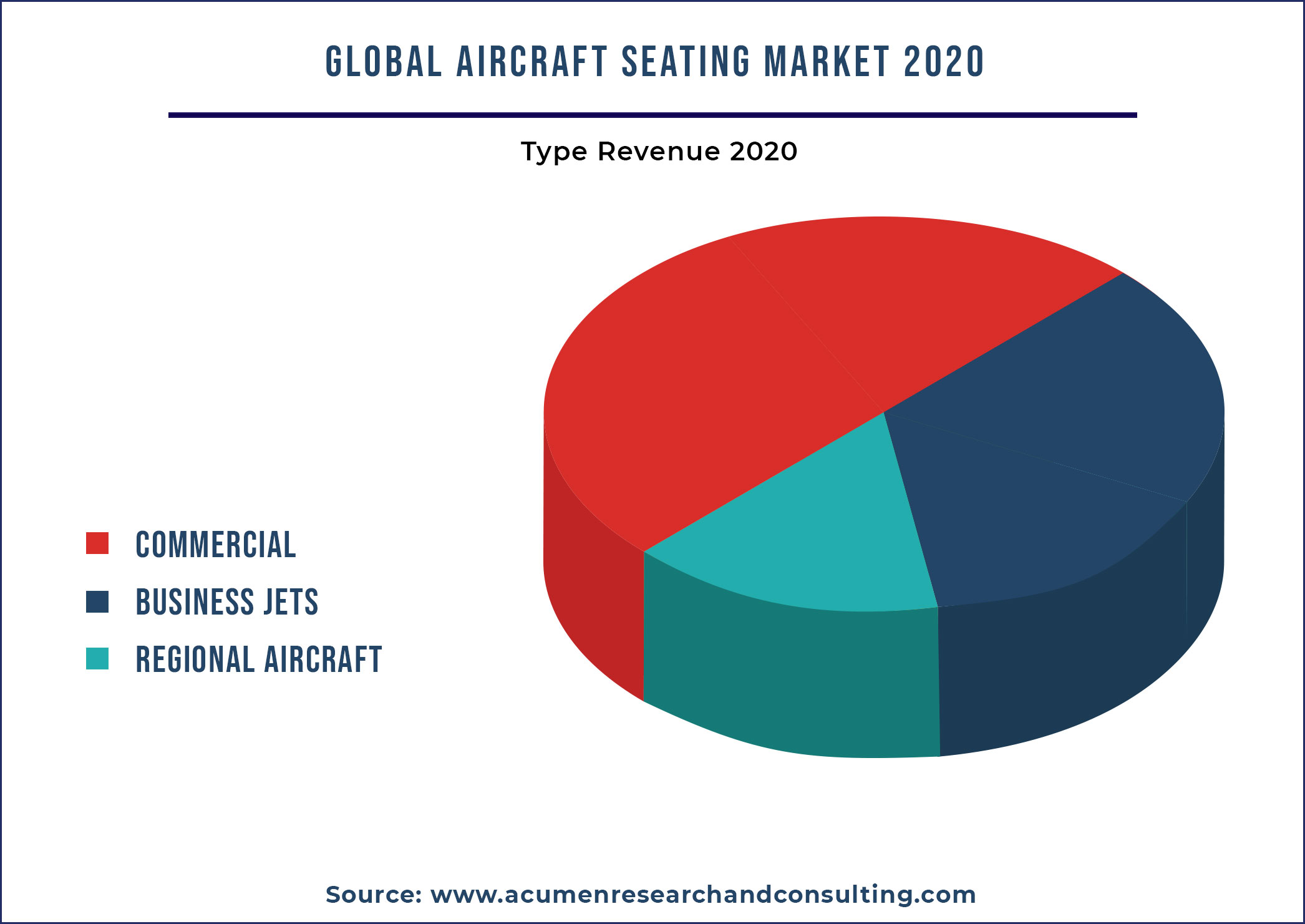

Aircraft Seating Market Segment Analysis, 2020

The global aircraft seating market is segmented into aircraft type, seat type, components, and end use. The components segment is divided into structure, foams, actuators, electrical fittings, and others.

Among components the foams segment is expected to account for noticeable revenue share in the global aircraft seating market. The aircraft type segment is divided into commercial, business jets, and regional aircraft. Players operating in the global aircraft seating market are Expliseat SAS, Geven S.p.a., HAECO, Iacobucci HF Aerospace S.p.A., Collins Aerospace, ACRO Aircraft Seating Ltd, Aviointeriors S.p.A., Embraer Aero Seating Technologies, JAMCO Corporation, and Encore, A Boeing Company.

Market Segmentation

Market By Aircraft Type

Commercial

Business Jets

Regional Aircraft

Market By Seat Type

9G Seats

16G Seats

Market By Components

Structure

Foams

Actuators

Electrical Fittings

Others

Market By End Use

OEM

Aftermarket

Market By Geography

North America

• U.S.

• Canada

Europe

• U.K.

• Germany

• France

• Spain

• Rest of Europe

Asia-Pacific

• China

• Japan

• India

• Australia

• South Korea

• Rest of Asia-Pacific

Latin America

• Brazil

• Mexico

• Rest of Latin America

Middle East & Africa

• GCC

• South Africa

• Rest of Middle East & Africa

Frequently Asked Questions

What will be the market size of global aircraft seating market in 2028?

The global aircraft seating market in 2028 is expected to be above US$ 10.4 Bn.

What is the CAGR of the global aircraft seating market?

The CAGR of the global aircraft seating market from 2021-2028 is above 5.1%.

Which is the major factor expected to drive the global market?

Flourishing aviation industry in developed and developing countries, rising passenger preference for air travel and increasing investment by government are major factors expected to drive the growth of global aircraft seating market.

Which segment is growing in seat type segment?

In seat type the 9G seats segment is growing at faster pace.

Which region is expected to grow faster?

In the global market the Asia Pacific region is expected to grow faster.

What are the players considered in the report scope?

Some of the players considered in the report scope are Collins Aerospace, ACRO Aircraft Seating Ltd, Aviointeriors S.p.A., and Embraer Aero Seating Technologies.

Which region is expected to account for major revenue share in the global market?

The North America is expected to account for major revenue share in the global market.