Aircraft Maintenance Service Market Size - Global Industry, Share, Analysis, Trends and Forecast 2023 - 2032

Published :

Report ID:

Pages :

Format :

Aircraft Maintenance Service Market Size - Global Industry, Share, Analysis, Trends and Forecast 2023 - 2032

Report Coverage

- Industry Dynamics

- Market Size and Forecast Data

- Segment Analysis

- Competitive Landscape

- Regional Analysis with a Niche Focus on Country-Level Data

- High Level Analysis - Porter's, PESTEL, Value Chain, etc.

- Company Profiles of Key Players

- Option to Customize the Report As Per Your Specific Need

Request Sample Report

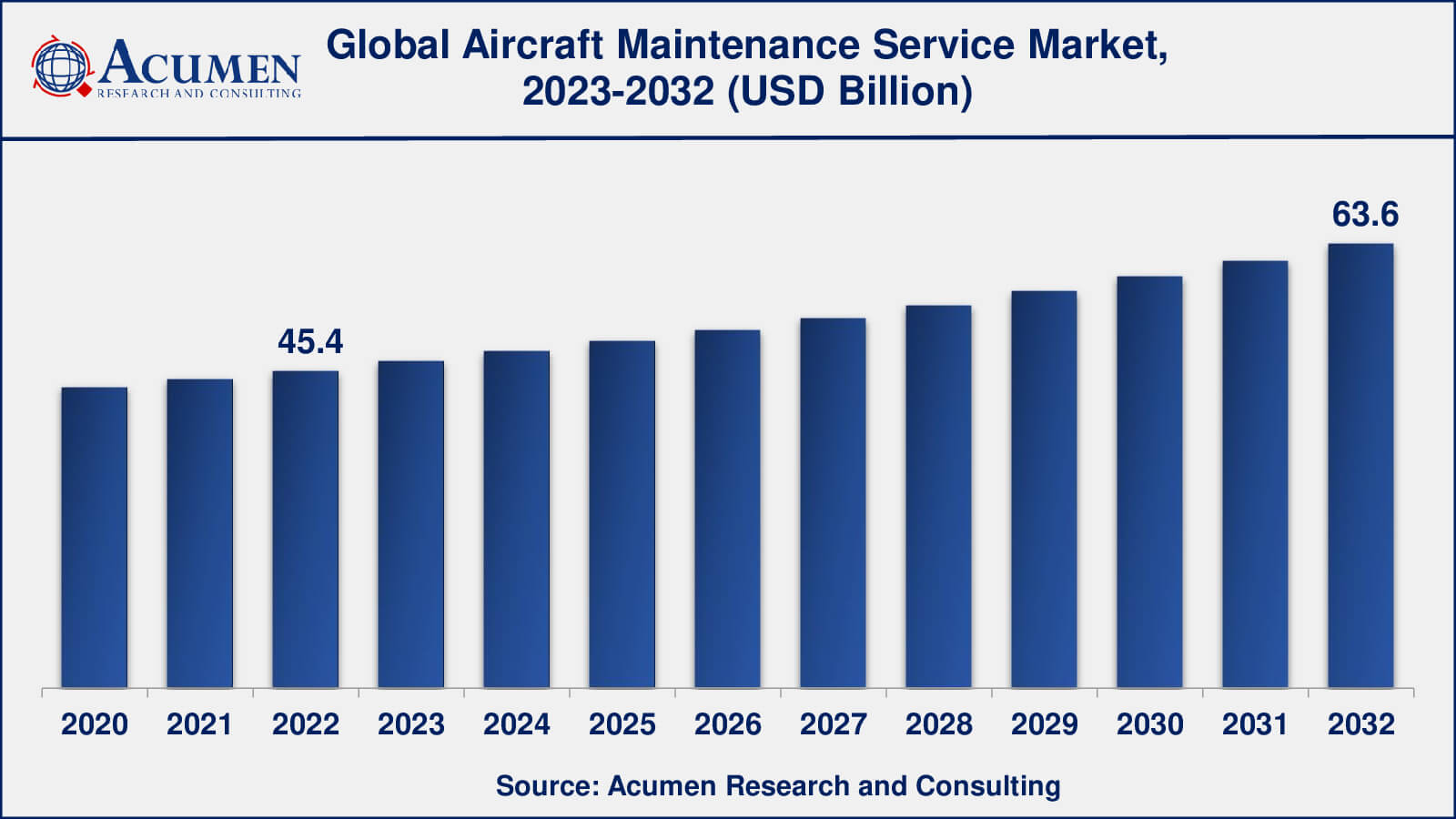

The Global Aircraft Maintenance Service Market Size accounted for USD 45.4 Billion in 2022 and is estimated to achieve a market size of USD 63.6 Billion by 2032 growing at a CAGR of 3.5% from 2023 to 2032.

Aircraft Maintenance Service Market Highlights

- Global aircraft maintenance service market revenue is poised to garner USD 63.6 billion by 2032 with a CAGR of 3.5% from 2023 to 2032

- North America aircraft maintenance service market value occupied more than USD 2 billion in 2022

- Asia-Pacific aircraft maintenance service market growth will record a CAGR of around 9% from 2023 to 2032

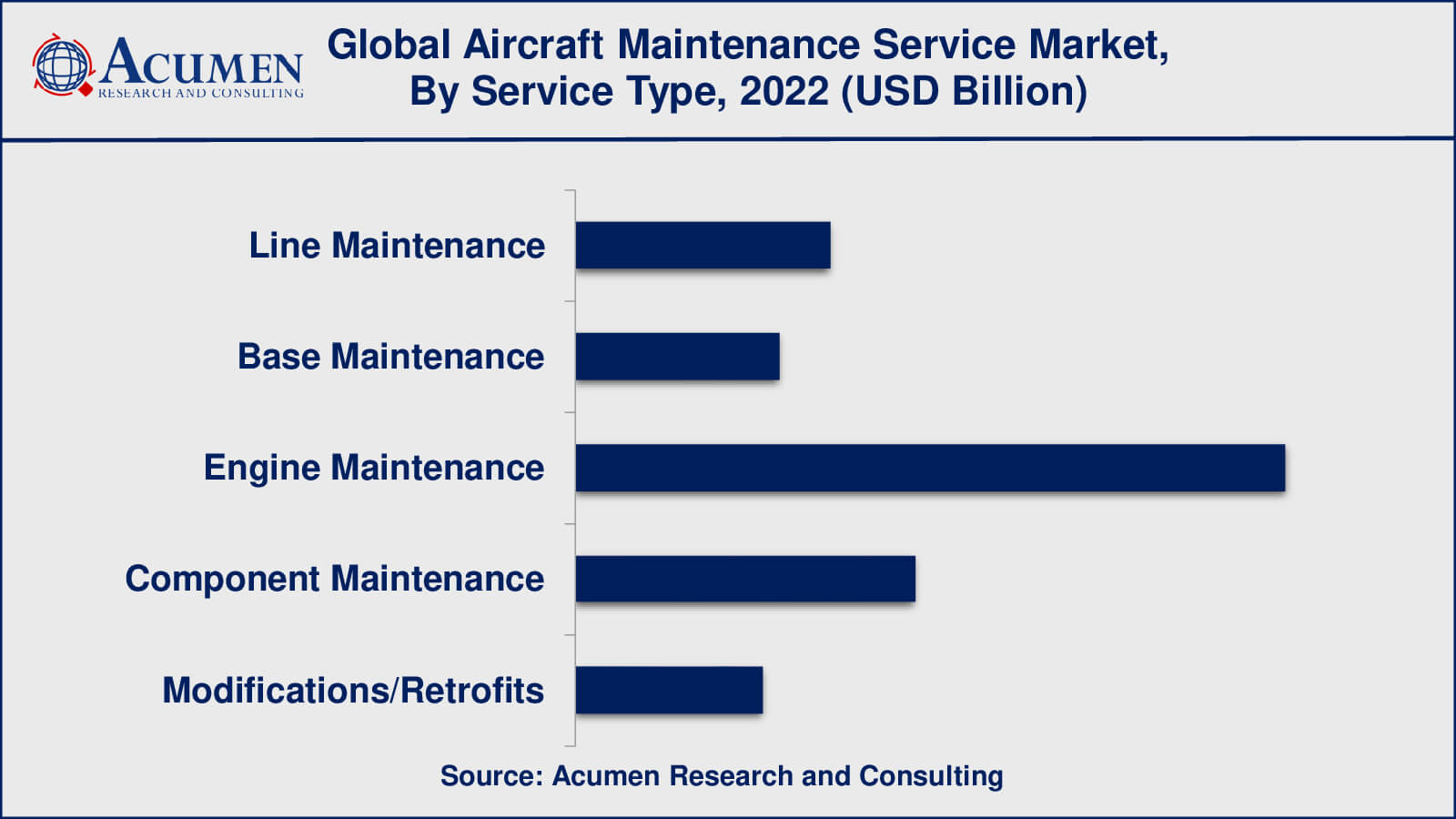

- Among service type, the engine maintenance sub-segment generated around US$ 19.1 billion revenue in 2022

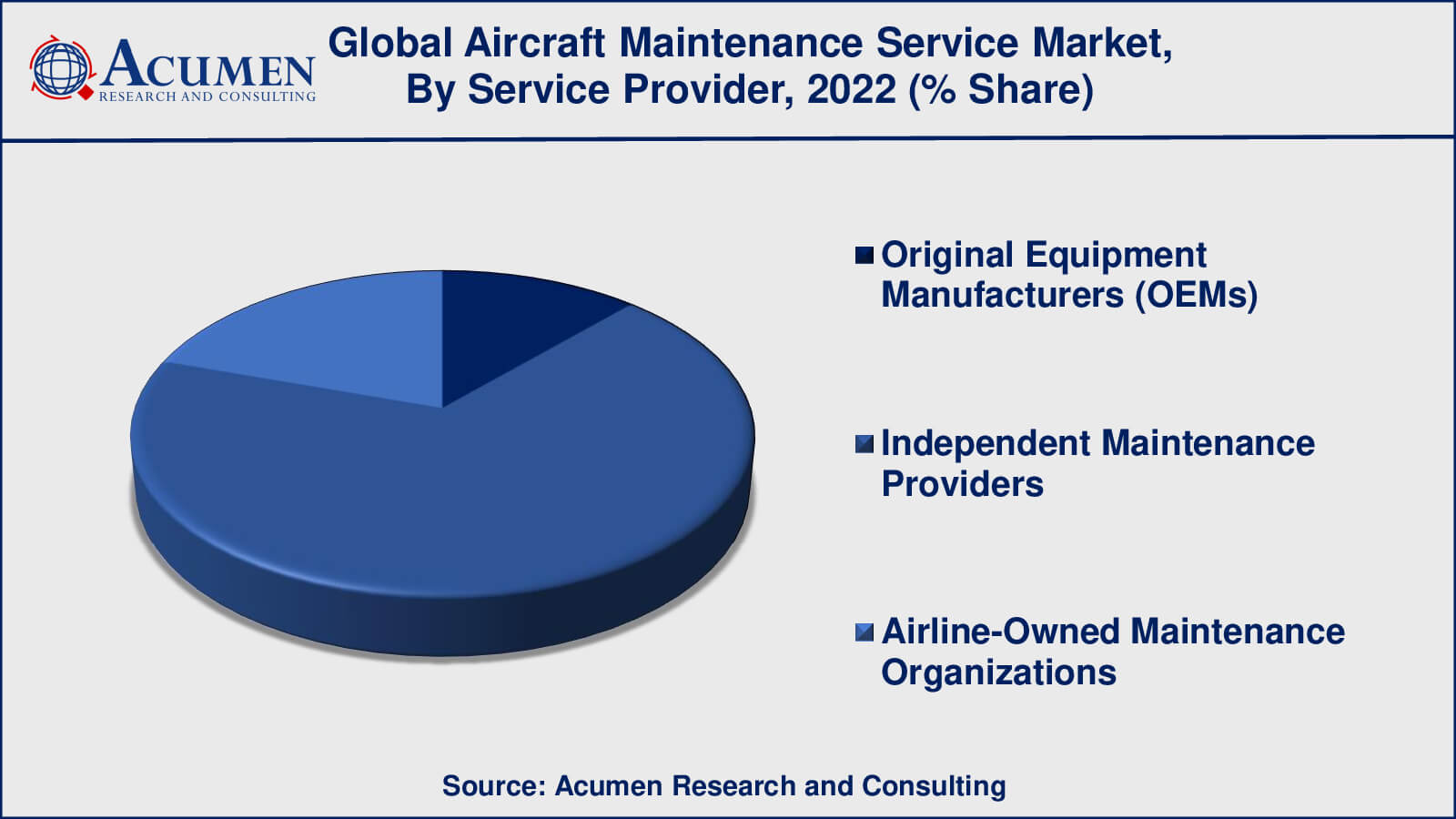

- Based on service provider, the independent maintenance providers sub-segment generated over 68% share in 2022

- Shift towards condition-based maintenance is a popular aircraft maintenance service market trend that fuels the industry demand

An aircraft maintenance service is the overhaul provided to the aircraft to assuring timely maintenance and reparation task which involves modification or inspection of an aircraft component or aircraft for a smooth and long run of aircraft with obstacle-free flights. Maintenance service could include tasks such as ensuring service bulletins or compliance with safety directives. Aircraft maintenance is vastly regulated, and mandatory to ensure the safe and accurate working of flight. The aircraft maintenance service industry is critical to the safety, dependability, and performance of military, commercial, and general aviation aircraft. Inspection, repair, modifications, overhaul, upgrades, and technical support for various aircraft components and systems are all part of aircraft maintenance services.

Global Aircraft Maintenance Service Market Dynamics

Market Drivers

- Increasing global air travel

- Aging aircraft fleet

- Focus on safety and regulatory compliance

- Adoption of digital technologies

Market Restraints

- High costs of maintenance

- Technological complexities

Market Opportunities

- Growing demand for aftermarket services

- Adoption of predictive maintenance

- Emphasis on data-driven decision making

- Increasing demand for specialized services

Aircraft Maintenance Service Market Report Coverage

| Market | Aircraft Maintenance Service Market |

| Aircraft Maintenance Service Market Size 2022 | USD 45.4 Billion |

| Aircraft Maintenance Service Market Forecast 2032 | USD 63.6 Billion |

| Aircraft Maintenance Service Market CAGR During 2023 - 2032 | 3.5% |

| Aircraft Maintenance Service Market Analysis Period | 2020 - 2032 |

| Aircraft Maintenance Service Market Base Year | 2022 |

| Aircraft Maintenance Service Market Forecast Data | 2023 - 2032 |

| Segments Covered | By Service Type, By Aircraft Type, By Service Provider, And By Geography |

| Regional Scope | North America, Europe, Asia Pacific, Latin America, and Middle East & Africa |

| Key Companies Profiled | Airbus SE, Boeing Company, Lufthansa Technik AG, Emirates Engineering, Singapore Technologies Aerospace Ltd. (ST Aerospace), Delta TechOps, United Technologies Corporation (UTC) Aerospace Systems, AAR Corp., General Electric Company (GE) Aviation, Honeywell International Inc., Safran SA, MTU Aero Engines AG, Rolls-Royce Holdings plc, Textron Aviation, and Embraer S.A. |

| Report Coverage |

Market Trends, Drivers, Restraints, Competitive Analysis, Player Profiling, Covid-19 Analysis, Regulation Analysis |

Aircraft Maintenance Service Market Insights

Augmented growth in the aviation sector such as freight transportation, passenger transportation, and air defense coupled with raising the standard of aviation services with advanced technological support are driving the market growth. Moreover, the adoption of new advanced technology and continuous flight operations are surging the need for regular aircraft maintenance. Although such maintenance service is increasing the expense of aviation firms majorly and thus could slow the market growth. However, the maintenance overhaul, inspections, and personnel are all mandatory regulated and stringent protocols by International Civil Aviation Organization (ICAO) to maintain international standards are anticipated to boost the market growth.

Aircraft Maintenance Service Market, By Segmentation

The worldwide market for aircraft maintenance service is split based on service type, aircraft type, service provider, end-user, and geography.

Aircraft Maintenance Service Types

- Line Maintenance

- Base Maintenance

- Engine Maintenance

- Component Maintenance

- Modifications/Retrofits

According to aircraft maintenance service industry analysis, engine maintenance is one of the significant segment share in 2022. Engine maintenance services are concerned with the inspection, repair, and overhaul of aeroplane engines. Engines are critical components of an aircraft that require specialised maintenance to ensure peak performance and dependability. Engine maintenance services may include engine inspections, repairs, component replacements, and performance enhancements.

The component maintenance sub-segment, on the other hand, is expected to grow at the fastest rate between 2023 and 2032. Individual aircraft components such as avionics, landing gears, brakes, and other systems are inspected, repaired, and overhauled as part of component maintenance services. Component maintenance is typically performed by specialised service providers and may necessitate the use of sophisticated equipment and expertise. The need for timely replacement or repair of ageing or damaged components, as well as compliance with regulatory standards, drive demand for component maintenance services.

Aircraft Maintenance Service Aircraft Types

- Narrow-Body

- Wide-Body

- Regional Jet

- Others

According to our research, narrow-body aircraft are expected to dominate the aircraft maintenance services market. Narrow-body aircraft are typically smaller, single-aisle planes used for short- to medium-haul flights, and they are widely used for various routes and operations by both low-cost and full-service airlines. Narrow-body aircraft have a larger fleet size than other types of aircraft, such as wide-body or regional jet aircraft. Because of their versatility, efficiency, and cost-effectiveness for short- to medium-haul routes, many airlines around the world use narrow-body aircraft as their primary fleet. Furthermore, narrow-body aircraft are used for a variety of purposes, including regional, domestic, and international flights. They are appropriate for a variety of routes, ranging from short-haul flights between neighbouring cities to medium-haul routes connecting different regions or countries. Because of the wide range of applications for narrow-body aircraft, there is a high demand for maintenance services to ensure their airworthiness, safety, and operational reliability.

Aircraft Maintenance Service Providers

- Original Equipment Manufacturers (OEMs)

- Independent Maintenance Providers

- Airline-Owned Maintenance Organizations

According to the aircraft maintenance service market forecast, independent maintenance providers (IMPs) are expected to dominate the aircraft maintenance market. Independent maintenance providers are third-party companies that specialise in providing aircraft maintenance services to airlines and other operators, as opposed to OEMs and airline-owned maintenance organisations. Line maintenance, base maintenance, engine maintenance, component maintenance, modifications/retrofits, and other specialised maintenance services are available. IMP has developed extensive expertise in various aspects of aircraft maintenance and is specialised in providing aircraft maintenance services. When compared to OEMs and airline-owned maintenance organisations, these providers are frequently known for their cost-effective solutions.

Aircraft Maintenance Service End-User

- Commercial Airlines

- Military/Government

- General Aviation

- Cargo/Freight Operators

Commercial airlines, which include passenger airlines and cargo/freight operators, are the aviation industry's largest segment and have a high demand for aircraft maintenance services. Commercial airlines operate a large fleet of aircraft that must be maintained, repaired, and overhauled on a regular basis to ensure safe and efficient operations. These airlines frequently outsource their maintenance needs to specialised service providers such as OEMs, independent maintenance providers (IMPs), and airline-owned maintenance organisations.

Commercial airlines operate large aircraft fleets that require routine maintenance and repair to meet regulatory requirements and preserve operational efficiency. Commercial airlines operate in an intensely regulated and competitive environment where operational efficiency and safety are critical. They require specialised maintenance services in order to guarantee that their aircraft are maintained to the highest standards and that they are in compliance with regulatory requirements. Furthermore, many commercial airlines prefer to outsource their maintenance needs to specialised service providers so that they can focus on their core business of flying passengers and transporting cargo.

Aircraft Maintenance Service Market Regional Outlook

North America

- U.S.

- Canada

Europe

- U.K.

- Germany

- France

- Spain

- Rest of Europe

Asia-Pacific

- India

- Japan

- China

- Australia

- South Korea

- Rest of Asia-Pacific

Latin America

- Brazil

- Mexico

- Rest of Latin America

The Middle East & Africa

- South Africa

- GCC Countries

- Rest of the Middle East & Africa (ME&A)

Aircraft Maintenance Service Market Regional Analysis

North America is a major region for the aircraft maintenance service market, with the United States being the most important market. The region's commercial airlines, cargo/freight operators, and general aviation activities fuel demand for aircraft maintenance services. The presence of established aircraft manufacturers, original equipment manufacturers, and independent maintenance providers in North America also contributes to market growth. Furthermore, the region has stringent regulatory requirements for aircraft safety and maintenance, which boosts demand for aircraft maintenance services.

The Asia-Pacific region is experiencing rapid growth in the aircraft maintenance service market, which is being driven by factors such as an expanding aviation industry, increased air passenger traffic, and rising demand for air cargo transportation. China, India, and Japan are key markets in the region, with a large number of commercial airlines, cargo/freight operators, and general aviation operations. Rising disposable incomes and changing consumer preferences for air travel are expected to drive demand for aircraft maintenance services in Asia-Pacific.

Aircraft Maintenance Service Market Players

Some of the top aircraft maintenance service companies offered in the professional report Airbus SE, Boeing Company, Lufthansa Technik AG, Emirates Engineering, Singapore Technologies Aerospace Ltd. (ST Aerospace), Delta TechOps, United Technologies Corporation (UTC) Aerospace Systems, AAR Corp., General Electric Company (GE) Aviation, Honeywell International Inc., Safran SA, MTU Aero Engines AG, Rolls-Royce Holdings plc, Textron Aviation, and Embraer S.A.

Frequently Asked Questions

What was the market size of the global aircraft maintenance service in 2022?

The market size of aircraft maintenance service was USD 45.4 billion in 2022.

What is the CAGR of the global aircraft maintenance service from 2023 to 2032?

The CAGR of aircraft maintenance service is 3.5% during the analysis period of 2023 to 2032.

Which are the key players in the aircraft maintenance service market?

The key players operating in the global aircraft maintenance service market is includes Airbus SE, Boeing Company, Lufthansa Technik AG, Emirates Engineering, Singapore Technologies Aerospace Ltd. (ST Aerospace), Delta TechOps, United Technologies Corporation (UTC) Aerospace Systems, AAR Corp., General Electric Company (GE) Aviation, Honeywell International Inc., Safran SA, MTU Aero Engines AG, Rolls-Royce Holdings plc, Textron Aviation, and Embraer S.A.

Which region dominated the global aircraft maintenance service market share?

North America held the dominating position in aircraft maintenance service industry during the analysis period of 2023 to 2032.

Which region registered fastest CAGR from 2023 to 2032?

Asia-Pacific region exhibited fastest growing CAGR for market of aircraft maintenance service during the analysis period of 2023 to 2032.

What are the current trends and dynamics in the global aircraft maintenance service industry?

The current trends and dynamics in the aircraft maintenance service industry include increasing global air travel, aging aircraft fleet, focus on safety and regulatory compliance, and adoption of digital technologies.

Which service type held the maximum share in 2022?

The engine maintenance held the maximum share of the aircraft maintenance service industry.?