Aircraft Braking Systems Market Size - Global Industry, Share, Analysis, Trends and Forecast 2023 - 2032

Published :

Report ID:

Pages :

Format :

Aircraft Braking Systems Market Size - Global Industry, Share, Analysis, Trends and Forecast 2023 - 2032

Report Coverage

- Industry Dynamics

- Market Size and Forecast Data

- Segment Analysis

- Competitive Landscape

- Regional Analysis with a Niche Focus on Country-Level Data

- High Level Analysis - Porter's, PESTEL, Value Chain, etc.

- Company Profiles of Key Players

- Option to Customize the Report As Per Your Specific Need

Request Sample Report

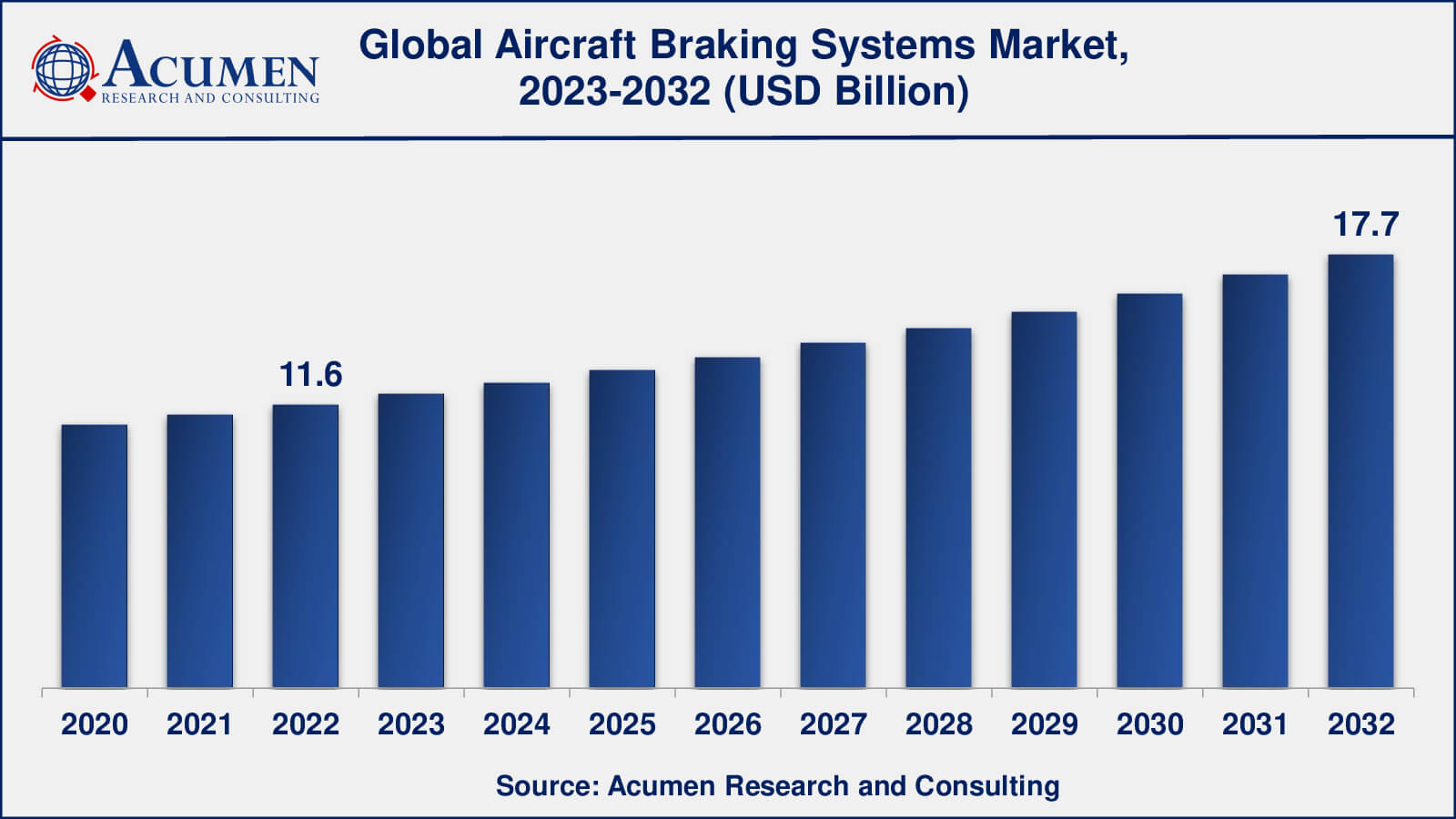

The Global Aircraft Braking Systems Market Size accounted for USD 11.6 Billion in 2022 and is estimated to achieve a market size of USD 17.7 Billion by 2032 growing at a CAGR of 4.4% from 2023 to 2032.

Aircraft Braking Systems Market Highlights

- Global aircraft braking systems market revenue is poised to garner USD 17.7 billion by 2032 with a CAGR of 4.4% from 2023 to 2032

- North America aircraft braking systems market value occupied more than USD 4.3 billion in 2022

- Asia-Pacific aircraft braking systems market growth will record a CAGR of more than 5% from 2023 to 2032

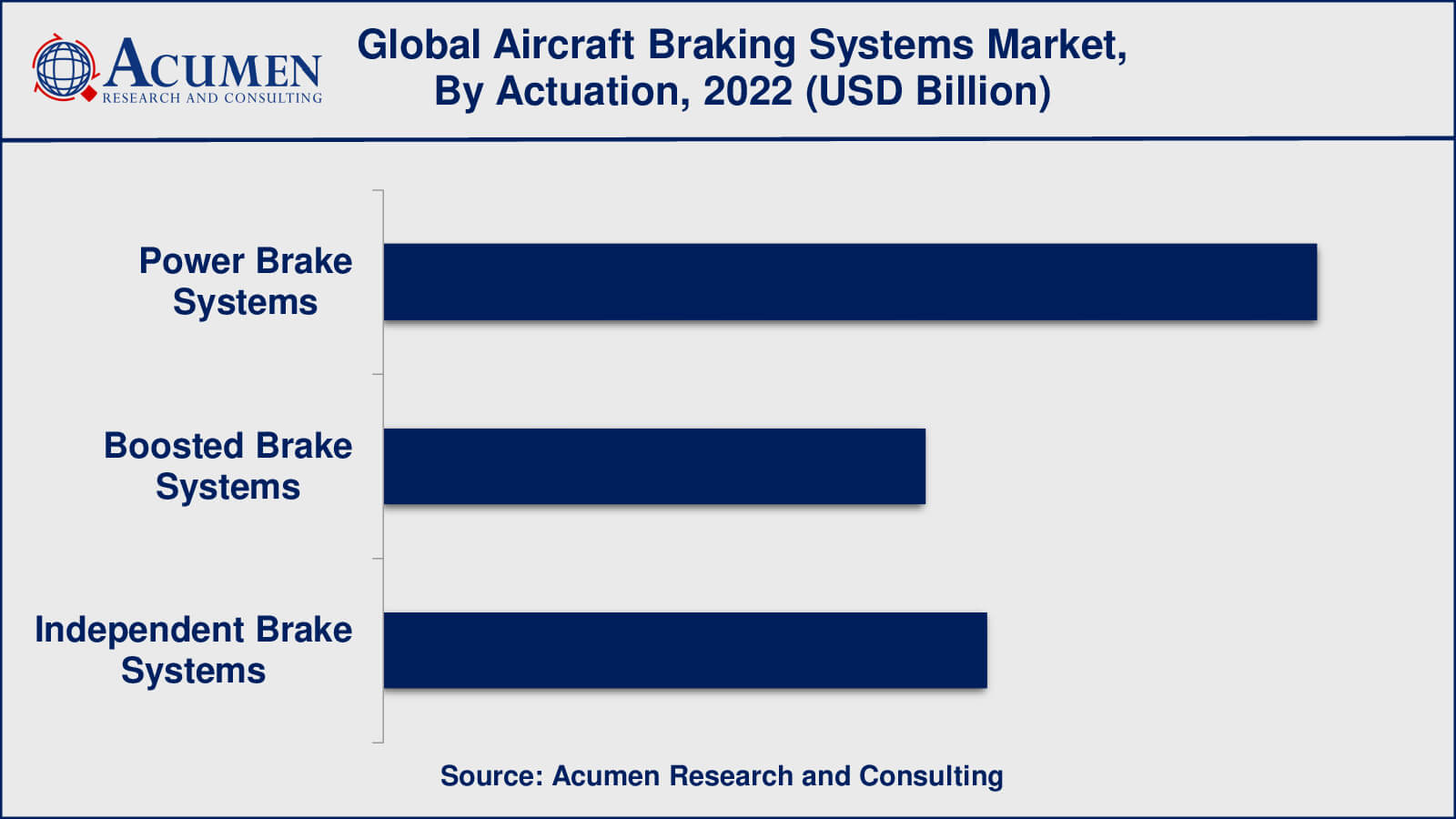

- Among actuation, the power brake systems sub-segment generated over US$ 5.2 billion revenue in 2022

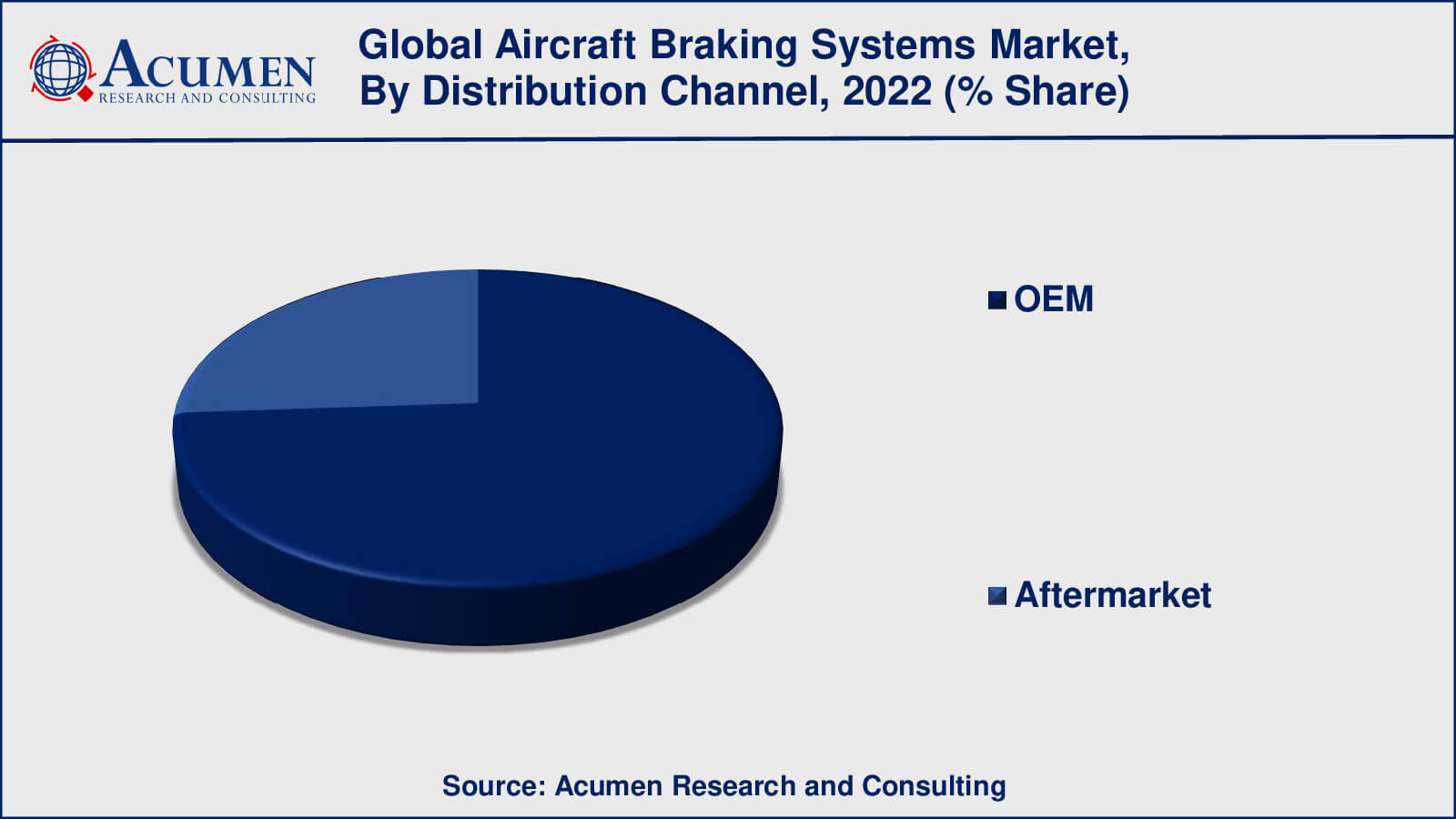

- Based distribution channel, the OEM sub-segment generated 74% share in 2022

- Increasing demand for military aircraft is a popular aircraft braking systems market trend that fuels the industry demand

An aircraft braking system is a critical component of a landing gear system that is designed to slow and stop the aircraft after landing. It is a complex system with many components and functions, such as hydraulic, pneumatic, and mechanical systems.

An aircraft braking system's primary function is to reduce the aircraft's speed and bring it to a complete stop. This is accomplished by converting the kinetic energy of the moving aircraft into heat energy via friction, which is generated by the aircraft's wheels making contact with the ground. The pilot uses the rudder pedals to control the aircraft's braking system.

When the pilot depresses the brake pedals, hydraulic or pneumatic pressure is applied to the brake pads, causing them to engage with the wheels of the aircraft. This slows the aircraft, and as the speed of the aircraft decreases, so does the braking force, allowing the aircraft to come to a complete stop.

Global Aircraft Braking Systems Market Dynamics

Market Drivers

- Increasing demand for aircraft due to rising air travel and cargo transportation

- Growing demand for high-performance braking systems

- Technological advancements in aircraft braking systems

- Increasing adoption of lightweight materials, such as carbon fiber composites

Market Restraints

- High initial costs associated with the development and implementation

- Supply chain disruptions and logistics issues

- Technological complexities and safety concerns

Market Opportunities

- Growing demand for electric aircraft braking systems

- Increasing demand for advanced braking systems for military and defense applications

- Growing demand for aircraft braking systems in emerging markets

- Rising demand for retrofitting existing aircraft braking systems with advanced technologies

Aircraft Braking Systems Market Report Coverage

| Market | Aircraft Braking Systems Market |

| Aircraft Braking Systems Market Size 2022 | USD 11.6 Billion |

| Aircraft Braking Systems Market Forecast 2032 | USD 17.7 Billion |

| Aircraft Braking Systems Market CAGR During 2023 - 2032 | 4.4% |

| Aircraft Braking Systems Market Analysis Period | 2020 - 2032 |

| Aircraft Braking Systems Market Base Year | 2022 |

| Aircraft Braking Systems Market Forecast Data | 2023 - 2032 |

| Segments Covered | By Component, By Aircraft Type, By Actuation, By Fit Type, By Distribution Channel, And By Geography |

| Regional Scope | North America, Europe, Asia Pacific, Latin America, and Middle East & Africa |

| Key Companies Profiled | Honeywell International Inc., Meggitt PLC, Safran Landing Systems, Parker Hannifin Corporation, Beringer Aero, Collins Aerospace, Lufthansa Technik AG, Crane Aerospace & Electronics, Goodrich Corporation, Mersen SA, and UTC Aerospace Systems. |

| Report Coverage |

Market Trends, Drivers, Restraints, Competitive Analysis, Player Profiling, Covid-19 Analysis, Regulation Analysis |

Aircraft Braking Systems Market Insights

Several factors are expected to drive growth in the aircraft braking systems market in the coming years. The global aviation industry's expansion is a key market driver, with increased air travel and cargo transportation driving demand for aircraft. In addition, there is increasing regulatory pressure to improve aviation safety, which is driving the adoption of advanced and dependable aircraft braking systems. Technological advancements, such as the development of electric and carbon brakes, are also propelling market growth, as these technologies provide improved performance, reliability, and safety.

The growing retrofit market, as older aircraft are upgraded with new braking systems, and the rising demands for military aircraft, which require high-performance and reliable braking systems, are also driving market growth. Finally, the aviation industry's emphasis on reducing fuel consumption and enhancing fuel effectiveness is driving the adoption of advanced aircraft braking systems, which can aid in reducing aircraft weight and improving overall efficiency. Overall, these factors will aid in the development of the aircraft braking systems market in the coming years.

While the market for aircraft braking systems is expected to grow in the coming years, there are several factors that could potentially limit market growth. The high cost of advanced braking technologies such as carbon brakes and electric brakes, which can be prohibitively expensive for some airlines and aircraft manufacturers, is one of the major constraints. This could limit the adoption of advanced technologies and slow market growth.

Another potential impediment is the aviation industry's growing emphasis on environmental sustainability. While advanced aircraft braking systems can help reduce fuel consumption and improve fuel efficiency, they may also have negative environmental consequences, such as increased carbon emissions from the manufacture and disposal of carbon brakes. This could limit market growth as the industry focuses more on reducing its environmental impact.

Finally, geopolitical factors such as trade disputes and political insecurity could stifle the growth of the aircraft braking systems market. These factors can disrupt global supply chains and create market uncertainty, making it more difficult for businesses to invest in new technologies and expand their operations.

Aircraft Braking Systems Market Segmentation

The worldwide market for aircraft braking systems is split based on component, aircraft type, actuation, fit type, distribution channel, and geography.

Aircraft Braking Systems Components

- Brake Discs

- Wheels

- Electronics

- Brake Housing

- Others

As per the aircraft braking systems industry analysis, brake discs and wheels are the two components that predominantly influence the aircraft braking systems market in terms of market share. Brake discs are an important component of aircraft braking systems because they absorb the heat generated by the braking process and dissipate it into the surrounding air. These discs are typically made of high-strength materials like steel or carbon fibre, and they must be able to withstand high temperatures and repeated use without deterioration.

Wheels are an important component of aircraft braking systems because they transmit braking force from the brake system to the aircraft. These wheels must be capable of withstanding the substantial loads generated during the braking process, as well as the aircraft's weight.

Aircraft Braking Systems Aircraft Types

- Commercial

- Regional Jet

- General Aviation

- Helicopter

- Military

In terms of market share, commercial aircraft typically dominate the aircraft brake systems market. This is because, in order to handle the high speeds and weights involved in commercial air travel, commercial aircraft, such as large passenger jets, typically require larger and more advanced braking systems than other types of aircraft.

Regional jets, which are smaller aircraft used for shorter-distance flights, account for a sizable portion of the aircraft braking systems market because they, too, require advanced and dependable braking systems to ensure safe takeoffs and landings.

Although general aviation, which includes smaller private planes and small commercial aircraft, accounts for a smaller portion of the market, it still necessitates dependable and high-performance braking systems to ensure safe operations.

Aircraft Braking Systems Actuations

- Power Brake Systems

- Boosted Brake Systems

- Independent Brake Systems

In terms of actuation type, power brake systems typically dominate the aircraft brake systems market. This is due to the fact that power brake systems have several advantages over other types of actuation systems, such as greater control over braking force and improved reliability. Power brake systems actuate the brakes with hydraulic or pneumatic power, allowing for precise and consistent control over the braking force applied to the aircraft's wheels.

Boosted brake systems, which actuate the brakes with a combination of hydraulic and mechanical power, are also commonly used in aircraft braking systems. These systems, which offer a good balance of performance and reliability, are frequently used in smaller aircraft or as backup systems for larger aircraft.

Independent brake systems, which use mechanical or hydraulic power to operate the brakes on each individual wheel of the aircraft, are less common in aircraft braking systems than power and boosted brake systems. They may, however, be used in some specialised aircraft or as backup systems in the event that the primary braking system fails.

Aircraft Braking Systems Fit Types

- Line-Fit

- Retrofit

The market for aircraft braking systems is dominated by line-fit installations. Line-fit installations are when aircraft braking systems are installed during the manufacturing process, whereas retrofit installations are when braking systems are installed on existing aircraft after they have been delivered to the customer. Line-fit installations are commonly preferred By Aircraft Type manufacturers and airlines because they can be integrated into the design and manufacturing processes, reducing installation time and costs. Furthermore, line-fit installations can be tailored to the specific needs of the aircraft, ensuring optimal performance and safety.

Retrofit installations, on the other hand, can be more complex and time-consuming because they require the removal and replacement of the aircraft's existing braking systems. Retrofit installations, on the other hand, can be a feasible alternative for older aircraft that may require improvements or improvements to their braking systems, and can help to extend the aircraft's lifespan.

Aircraft Braking Systems Distribution Channels

- OEM

- Aftermarket

As per the aicrraft braking systems market forecast, the original equipment manufacturer (OEM) segment typically dominates the aircraft braking systems market in terms of distribution channel. This is due to the fact that aircraft braking systems are typically installed during the aircraft manufacturing process and are an essential part of the entire design and function of the aircraft. OEMs collaborate closely with airline companies to design and develop braking systems that meet the aircraft's specific requirements, such as weight, speed, and payload capacity. OEMs are also responsible for ensuring that braking systems meet regulatory standards and safety requirements, as well as providing ongoing support and maintenance to the systems throughout the aircraft's lifecycle.

While the aftermarket segment accounts for a sizable portion of the aircraft braking systems market, it typically consists of retrofit and replacement parts for existing aircraft rather than new installations. Aftermarket suppliers must collaborate closely with OEMs and airlines to guarantee that their products meet the necessary specifications and safety standards, as well as that they can provide ongoing support and maintenance to their customers.

Aircraft Braking Systems Market Regional Outlook

North America

- U.S.

- Canada

Europe

- U.K.

- Germany

- France

- Spain

- Rest of Europe

Asia-Pacific

- India

- Japan

- China

- Australia

- South Korea

- Rest of Asia-Pacific

Latin America

- Brazil

- Mexico

- Rest of Latin America

The Middle East & Africa

- South Africa

- GCC Countries

- Rest of the Middle East & Africa (ME&A)

Aircraft Braking Systems Market Regional Analysis

North America is a significant market for aircraft braking systems, owing to the presence of major aircraft manufacturers and airlines in the region. New aircraft demand, particularly in the commercial and military segments, is expected to drive growth in this region.

Europe is another important market for aircraft braking systems, thanks to the presence of major aircraft manufacturers like Airbus and Boeing, as well as a large number of airlines. A significant number of MROs, that provide maintenance and repair services for aircraft braking systems, are also located in the region.

The Asia-Pacific region is expected to see significant growth in the aircraft braking systems market, owing to the region's rising demand for air travel. Countries such as China and India are expected to be major contributors to market growth, owing to their expanding economies and increased air traffic.

Aircraft Braking Systems Market Players

Some of the top aircraft braking systems companies offered in the professional report include Honeywell International Inc., Meggitt PLC, Safran Landing Systems, Parker Hannifin Corporation, Beringer Aero, Collins Aerospace, Lufthansa Technik AG, Crane Aerospace & Electronics, Goodrich Corporation, Mersen SA, and UTC Aerospace Systems.

Frequently Asked Questions

What was the market size of the global aircraft braking systems in 2022?

The market size of aircraft braking systems was USD 11.6 billion in 2022.

What is the CAGR of the global aircraft braking systems market from 2023 to 2032?

The CAGR of aircraft braking systems is 4.4% during the analysis period of 2023 to 2032.

Which are the key players in the aircraft braking systems market?

The key players operating in the global market are including Honeywell International Inc., Meggitt PLC, Safran Landing Systems, Parker Hannifin Corporation, Beringer Aero, Collins Aerospace, Lufthansa Technik AG, Crane Aerospace & Electronics, Goodrich Corporation, Mersen SA, and UTC Aerospace Systems.

Which region dominated the global aircraft braking systems market share?

North America held the dominating position in aircraft braking systems industry during the analysis period of 2023 to 2032.

Which region registered fastest CAGR from 2023 to 2032?

Asia-Pacific region exhibited fastest growing CAGR for market of aircraft braking systems during the analysis period of 2023 to 2032.

What are the current trends and dynamics in the global aircraft braking systems industry?

The current trends and dynamics in the aircraft braking systems industry include increasing demand for aircraft due to rising air travel and cargo transportation, growing demand for high-performance braking systems, and technological advancements in aircraft braking systems.

Which component held the maximum share in 2022?

The brake discs component held the maximum share of the aircraft braking systems industry.