Aircraft Actuators Market | Acumen Research and Consulting

Aircraft Actuators Market Size - Global Industry, Share, Analysis, Trends and Forecast 2023 - 2032

Published :

Report ID:

Pages :

Format :

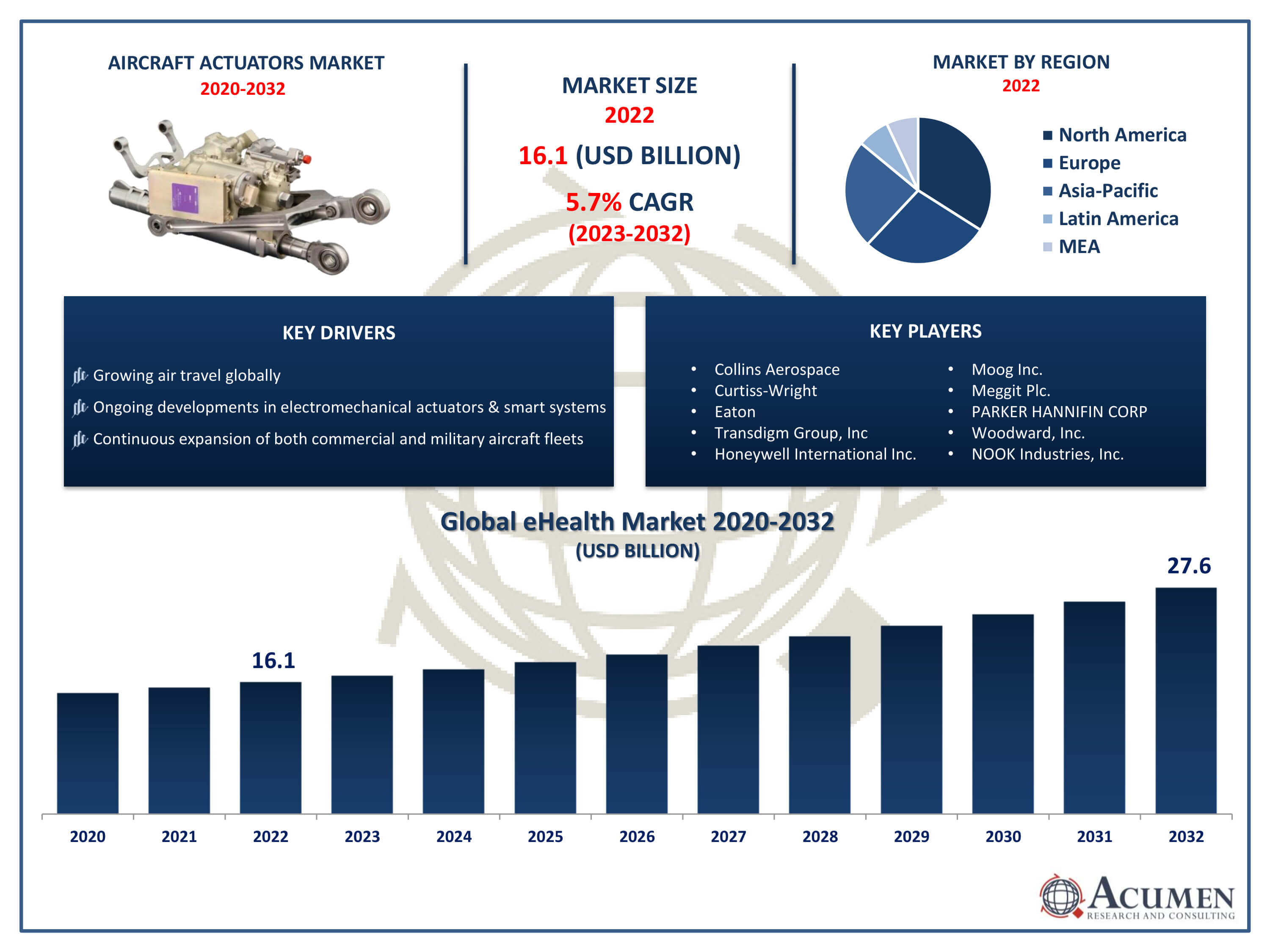

The Aircraft Actuators Market Size accounted for USD 16.1 Billion in 2022 and is projected to achieve a market size of USD 27.6 Billion by 2032 growing at a CAGR of 5.7% from 2023 to 2032.

Aircraft Actuators Market Highlights

- Global Aircraft Actuators Market revenue is expected to increase by USD 27.6 Billion by 2032, with a 5.7% CAGR from 2023 to 2032

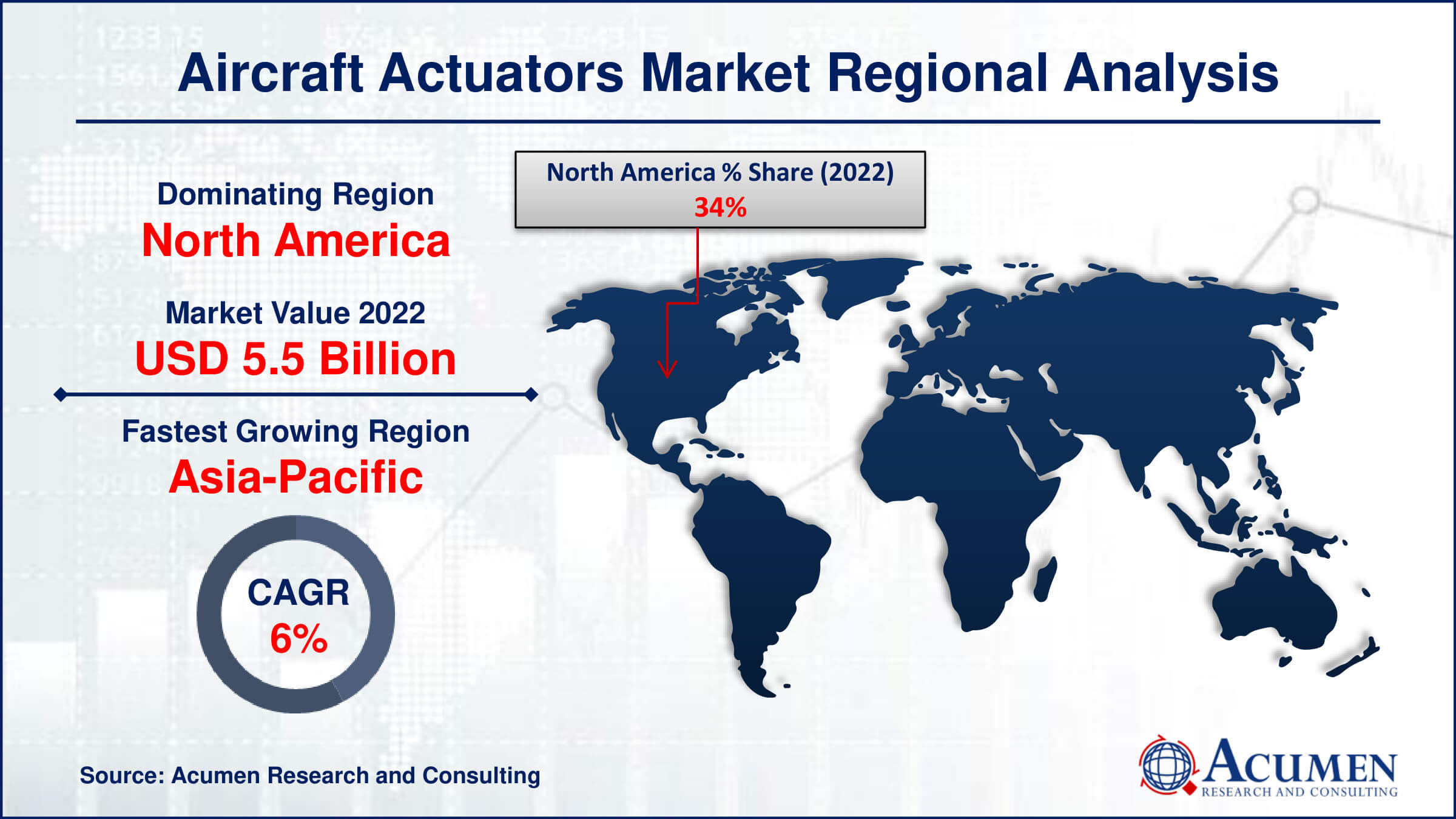

- North America region led with more than 34% of Aircraft Actuators Market share in 2022

- Asia-Pacific Aircraft Actuators Market growth will record a CAGR of around 6.3% from 2023 to 2032

- By system, the hydraulic actuators segment is the largest segment in the market, accounting for over 45% of the market share in 2022

- By type, the linear segment has recorded more than 78% of the revenue share in 2022

- Continuous expansion of both commercial and military aircraft fleets, drives the Aircraft Actuators Market value

Aircraft actuators are essential components in aviation systems, responsible for converting electrical signals into mechanical movement or force to control various functions of an aircraft. These functions include controlling flight surfaces such as ailerons, elevators, and rudders, as well as managing landing gear, thrust reversers, and other critical systems. Actuators play a crucial role in ensuring the precise and reliable operation of these systems, contributing to the overall safety and performance of an aircraft.

The market for aircraft actuators has experienced significant growth in recent years, driven by several factors. The increasing demand for commercial air travel, coupled with the expanding fleet of both commercial and military aircraft, has led to a rising need for advanced and efficient actuation systems. Technological advancements, such as the development of electromechanical actuators and smart actuation systems, have also spurred market growth. These innovations offer benefits such as reduced weight, increased reliability, and enhanced control capabilities, aligning with the aerospace industry's constant pursuit of improved efficiency and safety. As the aviation sector continues to evolve and modernize, the aircraft actuator market is expected to witness further expansion, driven by ongoing research and development efforts to enhance performance and address emerging industry requirements.

Global Aircraft Actuators Market Trends

Market Drivers

- Growing air travel globally

- Ongoing developments in electromechanical actuators and smart systems

- Continuous expansion of both commercial and military aircraft fleets

- Regulatory requirements for enhanced safety in aviation systems

Market Restraints

- High initial investment required for advanced actuation systems

- Stringent certification processes in the aviation industry

Market Opportunities

- Growing use of UAVs creates opportunities for specialized actuators

- Increasing aerospace activities in emerging economies

Aircraft Actuators Market Report Coverage

| Market | Aircraft Actuators Market |

| Aircraft Actuators Market Size 2022 | USD 16.1 Billion |

| Aircraft Actuators Market Forecast 2032 | USD 27.6 Billion |

| Aircraft Actuators Market CAGR During 2023 - 2032 | 5.7% |

| Aircraft Actuators Market Analysis Period | 2020 - 2032 |

| Aircraft Actuators Market Base Year |

2022 |

| Aircraft Actuators Market Forecast Data | 2023 - 2032 |

| Segments Covered | By Type, By System, By Aircraft Type, By End User Type, And By Geography |

| Regional Scope | North America, Europe, Asia Pacific, Latin America, and Middle East & Africa |

| Key Companies Profiled | Collins Aerospace, Curtiss-Wright, Eaton, Transdigm Group, Inc, Honeywell International Inc., Moog Inc., Meggit Plc., PARKER HANNIFIN CORP, Woodward, Inc., and NOOK Industries, Inc. |

| Report Coverage |

Market Trends, Drivers, Restraints, Competitive Analysis, Player Profiling, Covid-19 Analysis, Regulation Analysis |

Aircraft Actuators Market Dynamics

Aircraft actuators are crucial components within aviation systems that facilitate the controlled movement and operation of various mechanical functions on an aircraft. These electromechanical devices convert electrical signals into mechanical motion, allowing for precise control of critical systems. Actuators are employed in a variety of applications across an aircraft, ranging from controlling flight surfaces such as ailerons, elevators, and rudders to managing landing gear, thrust reversers, and other essential systems. These components play a pivotal role in ensuring the maneuverability, stability, and overall safety of the aircraft during different phases of flight. In the context of flight control, actuators enable the pilot or the aircraft's computerized control systems to adjust the orientation and position of control surfaces, thereby influencing the aircraft's attitude and trajectory. For instance, when a pilot commands a turn or change in altitude, the corresponding actuators manipulate the necessary flight surfaces to achieve the desired maneuver.

The aircraft actuators market has witnessed robust growth in recent years, driven by a combination of factors contributing to the modernization and expansion of the aviation industry. With a surge in global air travel demand, airlines and aircraft manufacturers are increasingly investing in advanced technologies to improve efficiency, safety, and performance. The need for precise and reliable control of flight surfaces, landing gear, and other critical systems has propelled the demand for innovative aircraft actuators. Technological advancements, such as the integration of electro-hydrostatic actuators (EHAs) and fly-by-wire systems, have played a pivotal role in shaping the market landscape. EHAs offer significant weight savings, reduced maintenance requirements, and enhanced energy efficiency compared to traditional hydraulic systems. Moreover, the adoption of smart actuators with embedded sensors and communication capabilities has enabled real-time monitoring and diagnostics, contributing to improved overall system reliability.

Aircraft Actuators Market Segmentation

The global Aircraft Actuators Market segmentation is based on type, system, aircraft type, end user type, and geography.

Aircraft Actuators Market By Type

- Rotary

- Linear

According to the aircraft actuators industry analysis, the linear segment accounted for the largest market share in 2022. Linear actuators play a crucial role in controlling the movement of various components in an aircraft, such as flight control surfaces, landing gear, and thrust reversers. The demand for linear actuators has been driven by the aviation industry's pursuit of lightweight and efficient solutions, as these actuators offer precise control with reduced weight compared to traditional hydraulic systems. One significant contributor to the growth of the linear segment is the adoption of electromechanical actuators, which provide a more energy-efficient and environmentally friendly alternative to hydraulic counterparts. Electromechanical linear actuators offer benefits such as reduced maintenance requirements, improved reliability, and increased control precision.

Aircraft Actuators Market By System

- Hydraulic Actuators

- Pneumatic Actuators

- Electrical Actuators

- Mechanical Actuators

In terms of systems, the hydraulic actuators segment is expected to witness significant growth in the coming years. Hydraulic actuators remain integral components in aviation, especially for critical applications where high force and precision control are paramount. These actuators are commonly employed in systems such as landing gear retraction, high-lift devices, and thrust reversers, where their robust and reliable performance is crucial for ensuring the safety and functionality of the aircraft. The growth of the hydraulic actuators segment is driven by their proven track record of durability, high power density, and the ability to handle heavy loads under demanding operational conditions. Despite the increasing popularity of alternative technologies, hydraulic actuators are still favored in certain aerospace applications due to their ability to provide rapid and forceful responses.

Aircraft Actuators Market By Aircraft Type

- Rotary wing

- Fixed wing

According to the aircraft actuators market forecast, the rotary wing segment is expected to witness significant growth in the coming years. Rotary-wing aircraft rely on a variety of actuators to control their complex flight dynamics, including pitch, roll, and yaw movements, as well as rotor blade adjustments. The versatility and agility of helicopters make them crucial for missions such as search and rescue, medical evacuation, and military operations, contributing to the increased adoption of rotary-wing platforms and, consequently, the growth of the associated actuator market. In recent years, technological advancements in rotary-wing aircraft design have led to the development of more sophisticated and efficient actuation systems. Fly-by-wire technology and the integration of smart actuators equipped with sensors and advanced control algorithms have enhanced the precision and responsiveness of rotary-wing aircraft, making them safer and more versatile in various operating environments.

Aircraft Actuators Market By End User Type

- Commercial Aircraft

- General Aviation Aircraft

- Military Aircraft

Based on the end-user type, the commercial aircraft segment is expected to continue its growth trajectory in the coming years. This growth is fueled by the increasing global demand for air travel. As airlines strive to enhance operational efficiency, reduce fuel consumption, and improve overall passenger experience, there has been a growing focus on advanced technologies, including sophisticated actuation systems. Commercial aircraft utilize actuators for a range of critical functions, including the control of flight surfaces such as ailerons, elevators, and flaps, as well as landing gear deployment and retraction. The demand for fuel-efficient, lightweight, and reliable actuation solutions in the commercial aviation sector has spurred innovation and growth in the aircraft actuators market. Technological advancements, such as the widespread adoption of fly-by-wire systems and the integration of electromechanical actuators, have played a pivotal role in meeting the evolving needs of modern commercial aircraft.

Aircraft Actuators Market Regional Outlook

North America

- U.S.

- Canada

Europe

- U.K.

- Germany

- France

- Spain

- Rest of Europe

Asia-Pacific

- India

- Japan

- China

- Australia

- South Korea

- Rest of Asia-Pacific

Latin America

- Brazil

- Mexico

- Rest of Latin America

The Middle East & Africa

- South Africa

- GCC Countries

- Rest of the Middle East & Africa (ME&A)

Aircraft Actuators Market Regional Analysis

North America has asserted its dominance in the aircraft actuators market owing to several factors that contribute to the region's leadership in the aerospace industry. The presence of major aircraft manufacturers, such as Boeing and Airbus (with a significant manufacturing presence in the United States), has driven the demand for cutting-edge technologies, including advanced actuators. These companies continuously invest in research and development to enhance aircraft performance, efficiency, and safety, creating a robust market for actuators. Additionally, the region hosts a thriving ecosystem of aerospace suppliers, technology developers, and research institutions, fostering innovation and the development of state-of-the-art actuation systems. The North American aviation sector is characterized by a high level of technological sophistication, with a focus on integrating smart technologies, electromechanical actuators, and fly-by-wire systems into both military and commercial aircraft. The stringent safety regulations and certification standards in the region also contribute to the demand for high-quality and reliable actuators, further solidifying North America's position as a dominating force in the global aircraft actuators market.

Aircraft Actuators Market Player

Some of the top aircraft actuators market companies offered in the professional report include Collins Aerospace, Curtiss-Wright, Eaton, Transdigm Group, Inc, Honeywell International Inc., Moog Inc., Meggit Plc., PARKER HANNIFIN CORP, Woodward, Inc., and NOOK Industries, Inc.

Frequently Asked Questions

How big is the aircraft actuators market?

The aircraft actuators market size was USD 16.1 Billion in 2022.

What is the CAGR of the global aircraft actuators market from 2023 to 2032?

The CAGR of aircraft actuators is 5.7% during the analysis period of 2023 to 2032.

Which are the key players in the aircraft actuators market?

The key players operating in the global market are including Collins Aerospace, Curtiss-Wright, Eaton, Transdigm Group, Inc, Honeywell International Inc., Moog Inc., Meggit Plc., PARKER HANNIFIN CORP, Woodward, Inc., and NOOK Industries, Inc.

Which region dominated the global aircraft actuators market share?

Which region dominated the global aircraft actuators market share?

Which region registered fastest CAGR from 2023 to 2032?

Asia-Pacific region exhibited fastest growing CAGR for market of aircraft actuators during the analysis period of 2023 to 2032.

What are the current trends and dynamics in the global aircraft actuators industry?

The current trends and dynamics in the aircraft actuators industry include growing air travel globally, ongoing developments in electromechanical actuators and smart systems, and continuous expansion of both commercial and military aircraft fleets.

Which system held the maximum share in 2022?

The hydraulic actuators system held the maximum share of the aircraft actuators industry.