Air Traffic Control Equipment Market Size - Global Industry, Share, Analysis, Trends and Forecast 2023 - 2032

Published :

Report ID:

Pages :

Format :

Air Traffic Control Equipment Market Size - Global Industry, Share, Analysis, Trends and Forecast 2023 - 2032

Report Coverage

- Industry Dynamics

- Market Size and Forecast Data

- Segment Analysis

- Competitive Landscape

- Regional Analysis with a Niche Focus on Country-Level Data

- High Level Analysis - Porter's, PESTEL, Value Chain, etc.

- Company Profiles of Key Players

- Option to Customize the Report As Per Your Specific Need

Request Sample Report

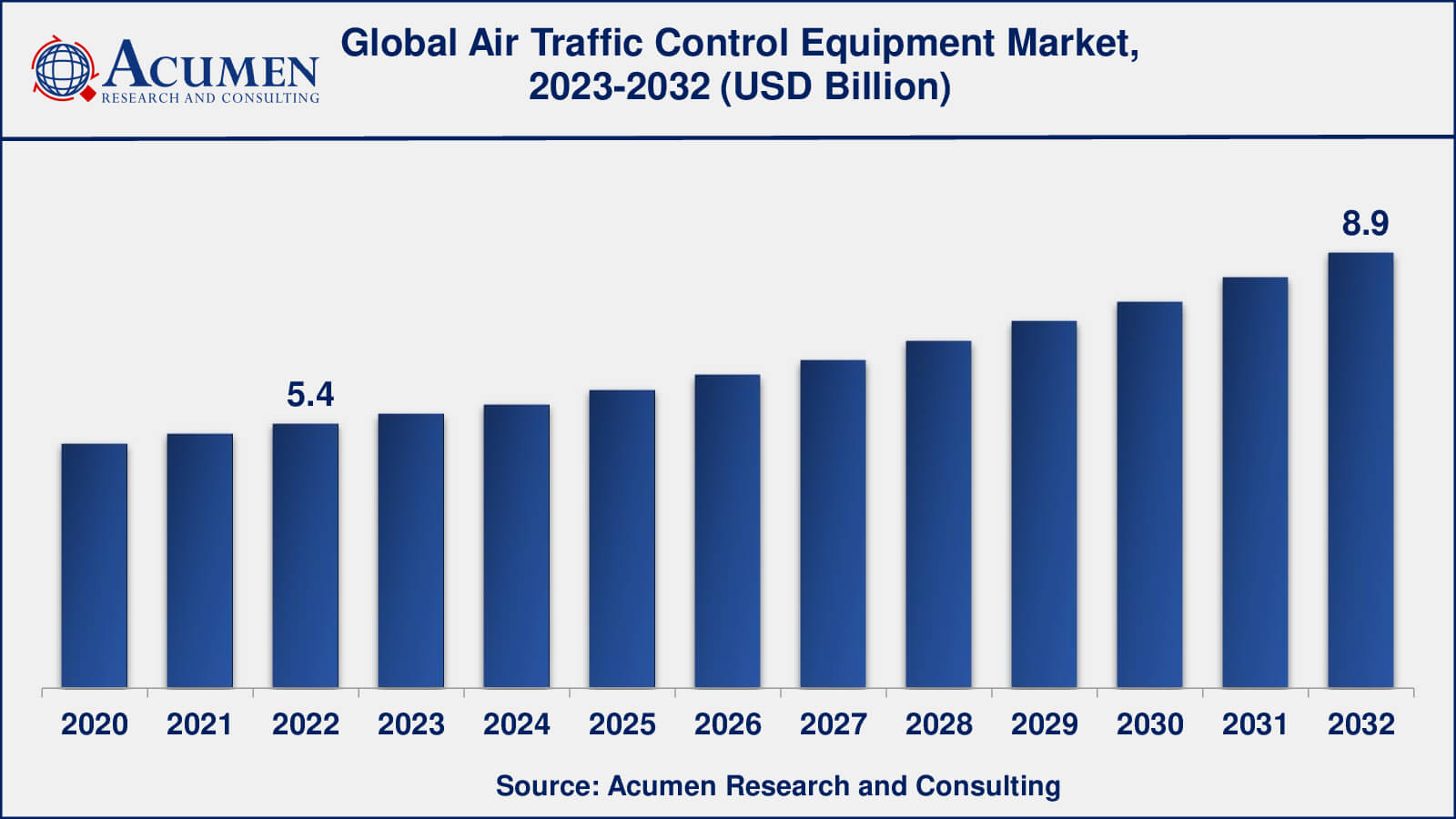

The Global Air Traffic Control (ATC) Equipment Market Size collected USD 5.4 Billion in 2022 and is set to achieve a market size of USD 8.9 Billion in 2032 growing at a CAGR of 5.4% from 2023 to 2032.

Air Traffic Control (ATC) Equipment Market Report Statistics

- Global air traffic control (ATC) equipment market revenue is estimated to reach USD 8.9 Billion by 2032 with a CAGR of 5.4% from 2023 to 2032

- North America air traffic control (ATC) equipment market value occupied more than USD 2.2 billion in 2022

- Asia-Pacific air traffic control (ATC) equipment market growth will record a CAGR of over 5.5% from 2023 to 2032

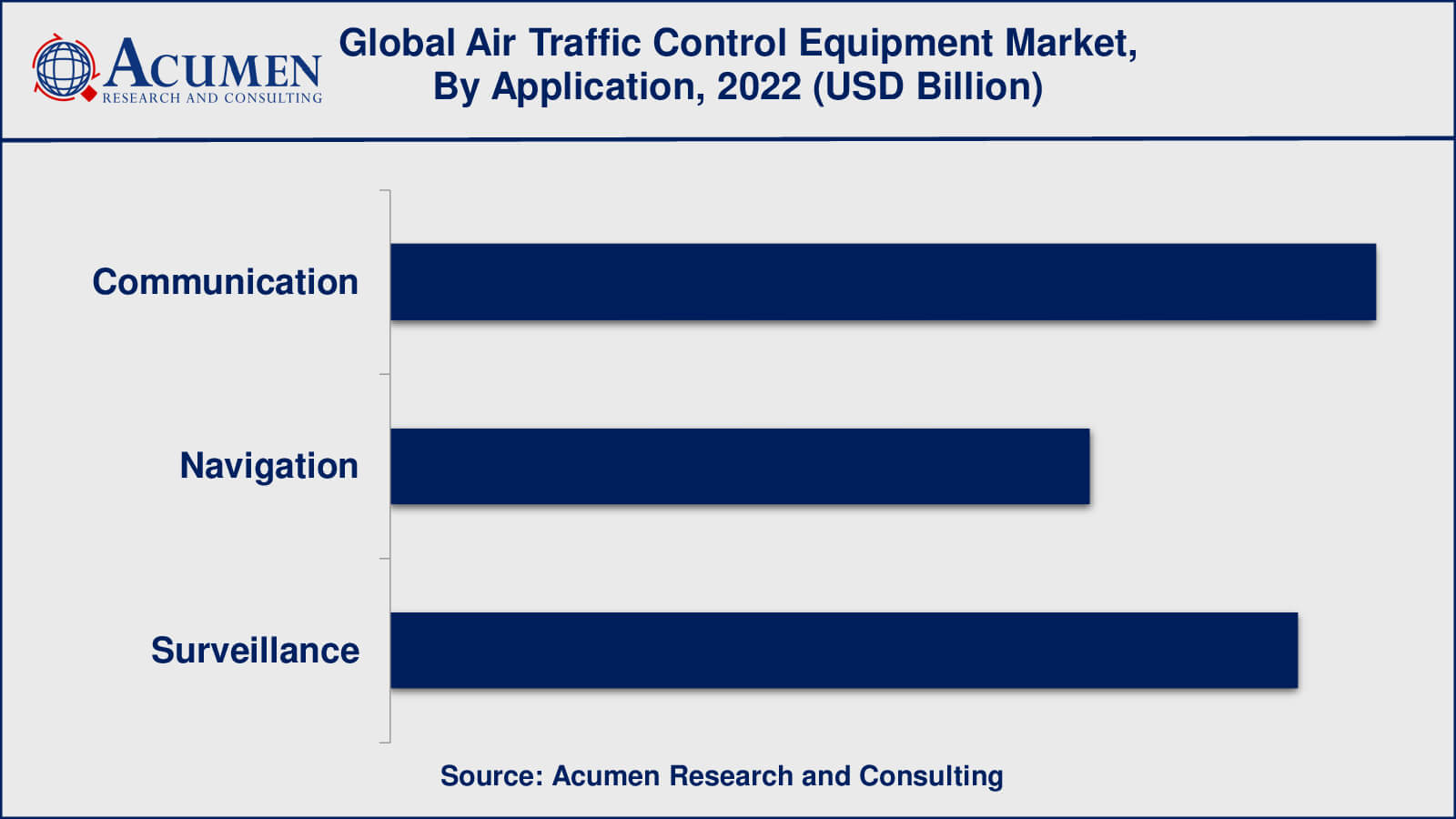

- Among application, the communication sub-segment generated around 38% share in 2022

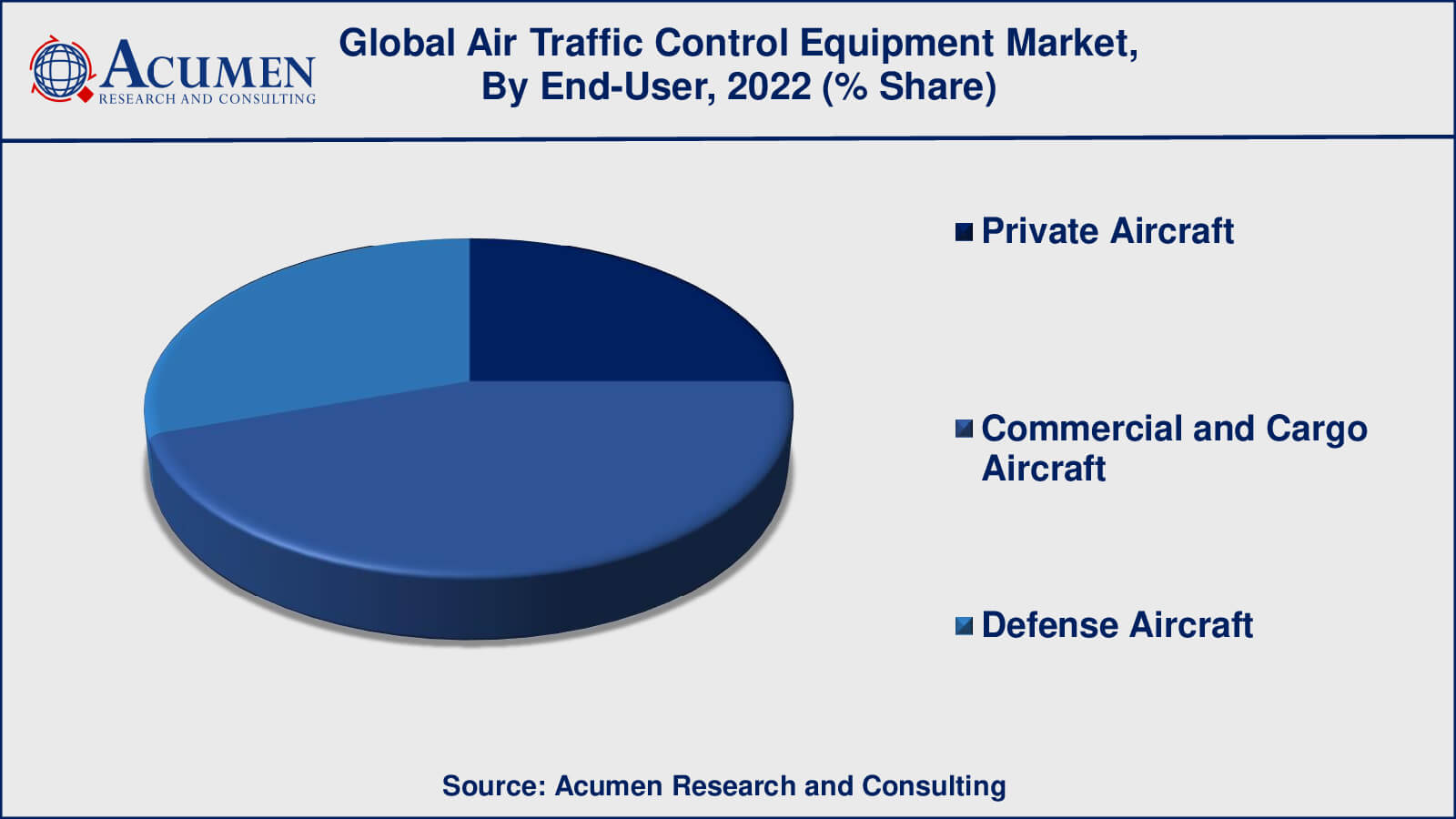

- Based on end-user, the commercial and cargo aircraft generated more than US $ 2.4 billion revenue in 2022

- Increased demand for remote towers is a popular air traffic control (ATC) equipment market trend that fuels the Industry demand

Air traffic control (ATC) equipment is a process of monitoring the quality of air in the surrounding environment and such monitors are developed in accordance with EEC directives that are relevant to monitoring emissions and controlling pollutants released from large combustion plants. Air quality monitors are responsible for maintaining the quality of air in closest spaces as well as open spaces. Demand for Radar Devices air quality monitors is on the rise due to increasing awareness towards health and hygiene among consumers. Activities like painting and cooking can deteriorate the quality of air inside the house by releasing smoke and other particulate matters. DIY hobbies and cleaning can pave the way for introduction of Volatile Organic Compounds (VOCs) in households which has several negative effects on human health. Air quality monitors are gaining significant demand due to increasing cases of air pollution.

Further, air quality monitors are used to detect the intensity of pollutants such as carbon monoxide, nitrous oxide, sulfur dioxide and other harmful gases. Increasing air pollution levels across the globe is one of the key factors driving the demand for air quality monitors. Increasing vehicle population in some of the developed and developing countries such as the U.S., India, and China among others have resulted in increased levels of pollution released from the vehicles. Thus, demand for air quality monitors is on the rise and the impact of this driver is likely to remain high over the forecast period.

Global Air Traffic Control Equipment Market Dynamics

Market Drivers

- Increase in air traffic

- Modernization of airports

- Use of automation and artificial intelligence

Market Restraints

- Complex regulatory environment

- Lack of skilled personnel

Market Opportunities

- Growing demand for unmanned aerial vehicles (UAVs)

- Increasing investment in infrastructure

- Adoption of satellite-based navigation systems

Air Traffic Control ATC Equipment Market Report Coverage

| Market | Air Traffic Control (ATC) Equipment Market |

| Air Traffic Control (ATC) Equipment Market Size 2022 | USD 5.4 Billion |

| Air Traffic Control (ATC) Equipment Market Forecast 2032 | USD 8.9 Billion |

| Air Traffic Control (ATC) Equipment Market CAGR During 2023 - 2032 | 5.4% |

| Air Traffic Control (ATC) Equipment Market Analysis Period | 2020 - 2032 |

| Air Traffic Control (ATC) Equipment Market Base Year | 2022 |

| Air Traffic Control (ATC) Equipment Market Forecast Data | 2023 - 2032 |

| Segments Covered | By Device Type, By Application, By End-User, And By Geography |

| Regional Scope | North America, Europe, Asia Pacific, Latin America, and Middle East & Africa |

| Key Companies Profiled | BAE Systems plc, Thales SA, Raytheon Company, Northrop Grumman Corporation, Indra Sistemas, S.A, Saab Ab, Aeronav Group, Aquila, Searidge Technologies, and Intelcan Technosystems. |

| Report Coverage |

Market Trends, Drivers, Restraints, Competitive Analysis, Player Profiling, Covid-19 Analysis, Regulation Analysis |

Air Traffic Control Equipment Market Growth Factors

The rapid demand for air quality monitors is also attributed to the initiatives taken by regulating bodies regarding industrial emissions. The increasing levels of pollution have become a major concern for everyone due to the set-up of several new manufacturing plants across the globe. Additionally, high demand is also attributed to the increasing awareness towards health and wellness among the consumer and the urge to install air quality monitors inside their homes to maintain a clean environment.

However, high cost of such products is likely to inhibit the growth of air traffic control (ATC) equipment market. High cost of air traffic control equipment devices is expected to restrict the market growth mainly in developing countries as the consumers in these countries refrain themselves from buying such products due to the higher cost. Less awareness towards the use of such products among the consumers is another major factor barring the growth of the market. However, rising industrialization in the developing countries is expected to be a suitable opportunity for the growth of this market. Penetration of new industries in the developing countries would result in the increase in level of pollution and therefore, would complement the growth of air traffic control (ATC) equipment market. Technological advancement is another suitable opportunity for the growth of air traffic control (ATC) equipment market. Increasing scope in the field of research and development would ensure the introduction of new and advanced air quality monitors in the future, thus complementing the growth of the market.

Air Traffic Control ATC Equipment Market Segmentation

The worldwide ATC equipment market is categorized based on device type, application, distributional channel, and geography.

Air Traffic Control (ATC) Equipment Market By Device Type

- Radar Devices

- Simulator Devices

- Proximity Devices

- Information System Devices

- Safety and Navigational Devices

According to the air traffic control (ATC) equipment market forecast, radar devices will dominate the largest share in the air traffic control equipment market. This is because radar devices have long been the backbone of the air traffic control system, providing accurate information on aircraft location and speed. However, as new technologies and requirements are introduced, other types of equipment such as simulator devices, proximity devices, information system devices, and safety and navigational devices are gaining market importance. Simulators, for example, are progressively being used to train air traffic controllers, and proximity devices like ADS-B (Automatic Dependent Surveillance-Broadcast) are becoming more common as a way of providing precise and trustworthy data on the position of aircraft. In general, the air traffic control equipment market is expected to expand further, owing to rising demand for more efficient and safe air traffic management systems, which will necessitate a variety of devices and equipment.

Air Traffic Control (ATC) Equipment Market By Application

- Navigation

- Communication

- Surveillance

In recent years, surveillance accounted for the largest share of the air traffic control equipment Market. The surveillance application focuses on tracking aircraft location, speed, and altitude, which is an important aspect of air traffic control. Traditionally, radar-based systems were used for surveillance, but newer technologies such as Automatic Dependent Surveillance-Broadcast (ADS-B) and satellite-based systems are becoming more common. These technologies provide more accurate and reliable surveillance data and are being adopted by air traffic management providers worldwide. Navigation and communication are also important applications of air traffic control equipment, with navigation equipment providing accurate information on an aircraft's position and heading and communication equipment allowing pilots and air traffic controllers to communicate effectively. The increasing complexity of air traffic management and the requirement for more efficient and reliable systems are driving up demand for navigation and communication equipment in the coming years.

Air Traffic Control (ATC) Equipment Market By End-User

- Private Aircraft

- Commercial and Cargo Aircraft

- Defense Aircraft

According to an Industry analysis of air traffic control (ATC) equipment, the commercial and cargo aircraft end-use segment has historically gathered the largest share. This is due to the fact that commercial airlines and cargo carriers are the most frequent users of air traffic control services and equipment. With rising air traffic volumes and rising demand for air travel, the need for efficient and safe air traffic management systems has never been greater. Aside from commercial and cargo aircraft, the defense aircraft sector makes extensive use of air traffic control equipment, especially for military air traffic management and flight operations. Private aircraft, while not as important in terms of market size as commercial and military aircraft, use air traffic control services and equipment, especially at larger airports and in congested airspace. In general, the market for air traffic control equipment is expected to expand across all end-use segments, owing to rising demand for more efficient and safe air traffic management systems, especially in emerging markets with expanding aviation industries.

Air Traffic Control (ATC) Equipment Market Regional Outlook

North America

- U.S.

- Canada

Europe

- U.K.

- Germany

- France

- Spain

- Rest of Europe

Asia-Pacific

- India

- Japan

- China

- Australia

- South Korea

- Rest of Asia-Pacific

Latin America

- Brazil

- Mexico

- Rest of Latin America

The Middle East & Africa

- South Africa

- GCC Countries

- Rest of the Middle East & Africa (ME&A)

Air Traffic Control (ATC) Equipment Market Regional Analysis

The ATC equipment market is expected to witness the highest growth in the Asia-Pacific. Currently, North America and Europe lead the commercial ATC equipment market owing to a high number of air travelers and the presence of large and technologically advanced airports in these regions. However, Middle Eastern and APAC countries have been investing significantly in the modernization of existing airports and the construction of new airports, on account of the rising passenger traffic. This growth can be attributed to the liberalization of regulations related to air transport, an increase in government spending for infrastructure development, an increase in demand for air travel, and the growing GDP of these regions. Thus, the global air traffic control equipment market in Asia-Pacific and the Middle East is analyzed significantly and is expected to reach its peak over the forecast period.

Countries such as Japan, China, India, UAE, and Brazil are analyzed to register significant growth levels in the market during the forecast period. The ATC equipment market in Asia-Pacific is estimated to register high growth, as the Revenue Passenger Kilometers (RPK) and aircraft movements are analyzed to be twice as compared to other regions. China is expected to be the swiftest growing market during the forecast period, due to significant investments in the modernization of existing airports as well as the construction of new airports.

North America dominated the global ATC equipment market in 2014 and is expected to maintain its dominance in the coming years. With the U.S. national aviation authority collaborating with various industry partners and aiming at initiatives to transform ATC facilities to the standard automation replacement system from the traditional automated radar terminal system, the North American market is expected to thus have a positive outlook in the near future. The ATC equipment market ecosystem comprises airports, air navigation service providers, airlines, regulatory authorities, and equipment suppliers, among others.

Air Traffic Control (ATC) Equipment Market Players

Some of the key players in the global air traffic control (ATC) equipment market include BAE Systems plc, Thales SA, Raytheon Company, Northrop Grumman Corporation, Indra Sistemas, S.A, Saab Ab, Aeronav Group, Aquila, Searidge Technologies, and Intelcan Technosystems.

Frequently Asked Questions

What was the market size of the global Air Traffic Control (ATC) Equipment in 2022?

The market size of air traffic control (ATC) equipment was USD 5.4 Billion in 2022.

What is the CAGR of the global Air Traffic Control (ATC) Equipment market during forecast period of 2023 to 2032?

The CAGR of air traffic control (ATC) equipment market is 5.4% during the analysis period of 2023 to 2032.

Which are the key players operating in the market?

The key players operating in the global market are BAE Systems plc, Thales SA, Raytheon Company, Northrop Grumman Corporation, Indra Sistemas, S.A, Saab Ab, Aeronav Group, Aquila, Searidge Technologies, and Intelcan Technosystems.

Which region held the dominating position in the global Air Traffic Control (ATC) Equipment market?

North America held the dominating position in air traffic control (ATC) equipment market during the analysis period of 2023 to 2032.

Which region registered the fastest growing CAGR for the forecast period of 2023 to 2032?

Asia-Pacific region exhibited fastest growing CAGR for air traffic control (ATC) equipment market during the analysis period of 2023 to 2032.

What are the current trends and dynamics in the global Air Traffic Control (ATC) Equipment market?

The current trends and dynamics in the air traffic control (ATC) equipment industry include increasing awareness of air pollution, government regulations and initiatives, and rising industrialization and urbanization.

Which device type held the maximum share in 2022?

The simulator devices device type held the maximum share of the air traffic control (ATC) equipment market.