Air Separation Plant Market Size - Global Industry, Share, Analysis, Trends and Forecast 2023 - 2032

Published :

Report ID:

Pages :

Format :

Air Separation Plant Market Size - Global Industry, Share, Analysis, Trends and Forecast 2023 - 2032

Report Coverage

- Industry Dynamics

- Market Size and Forecast Data

- Segment Analysis

- Competitive Landscape

- Regional Analysis with a Niche Focus on Country-Level Data

- High Level Analysis - Porter's, PESTEL, Value Chain, etc.

- Company Profiles of Key Players

- Option to Customize the Report As Per Your Specific Need

Request Sample Report

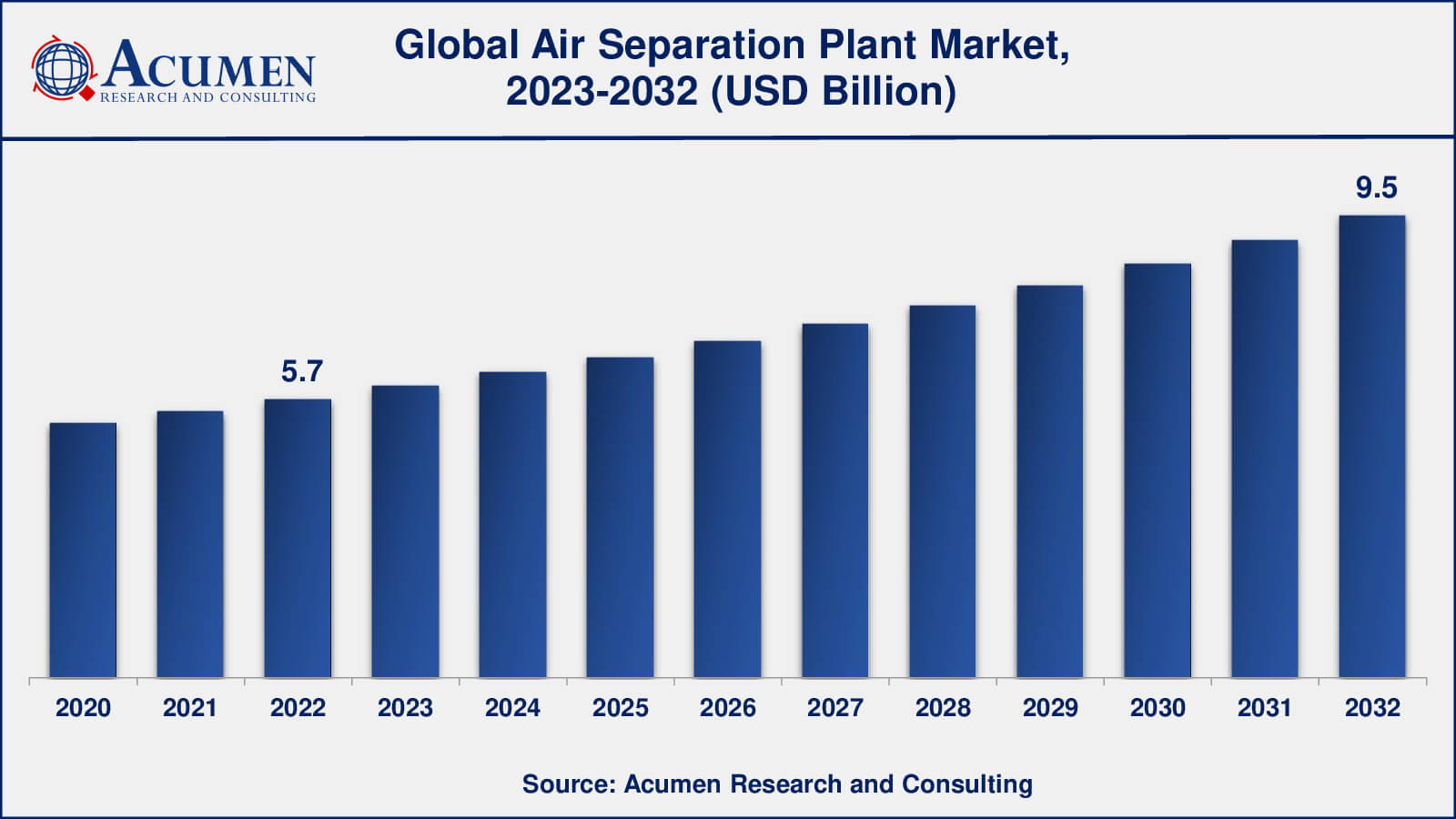

The Global Air Separation Plant Market Size accounted for USD 5.7 Billion in 2022 and is estimated to achieve a market size of USD 9.5 Billion by 2032 growing at a CAGR of 5.3% from 2023 to 2032.

Air Separation Plant Market Highlights

- Global air separation plant market revenue is poised to garner USD 9.5 billion by 2032 with a CAGR of 5.3% from 2023 to 2032

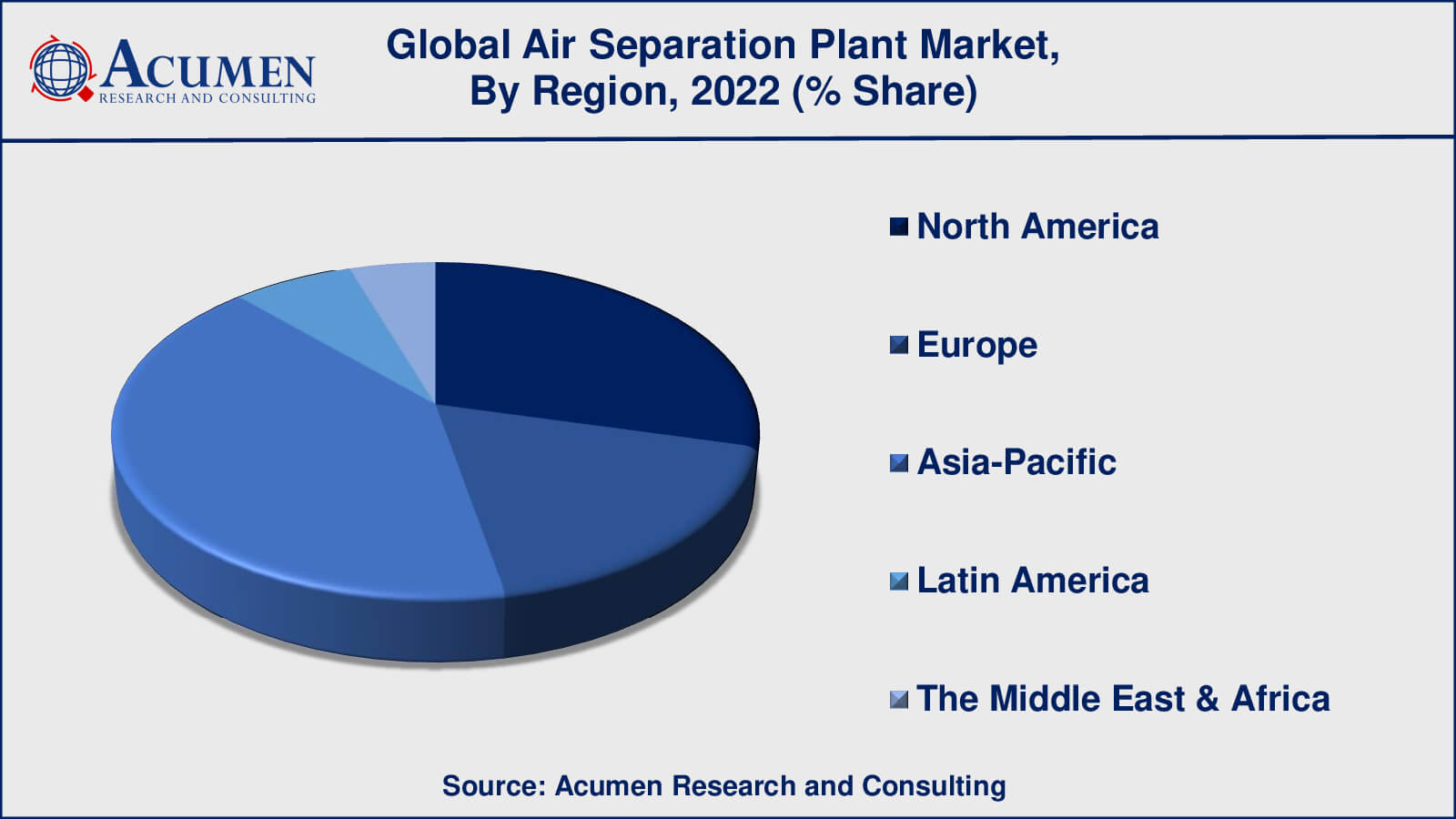

- Asia-Pacific air separation plant market value occupied around USD 2.3 billion in 2022

- Asia-Pacific air separation plant market growth will record a CAGR of more than 6% from 2023 to 2032

- Among processes, the cryogenic sub-segment generated over US$ 3.4 billion revenue in 2022

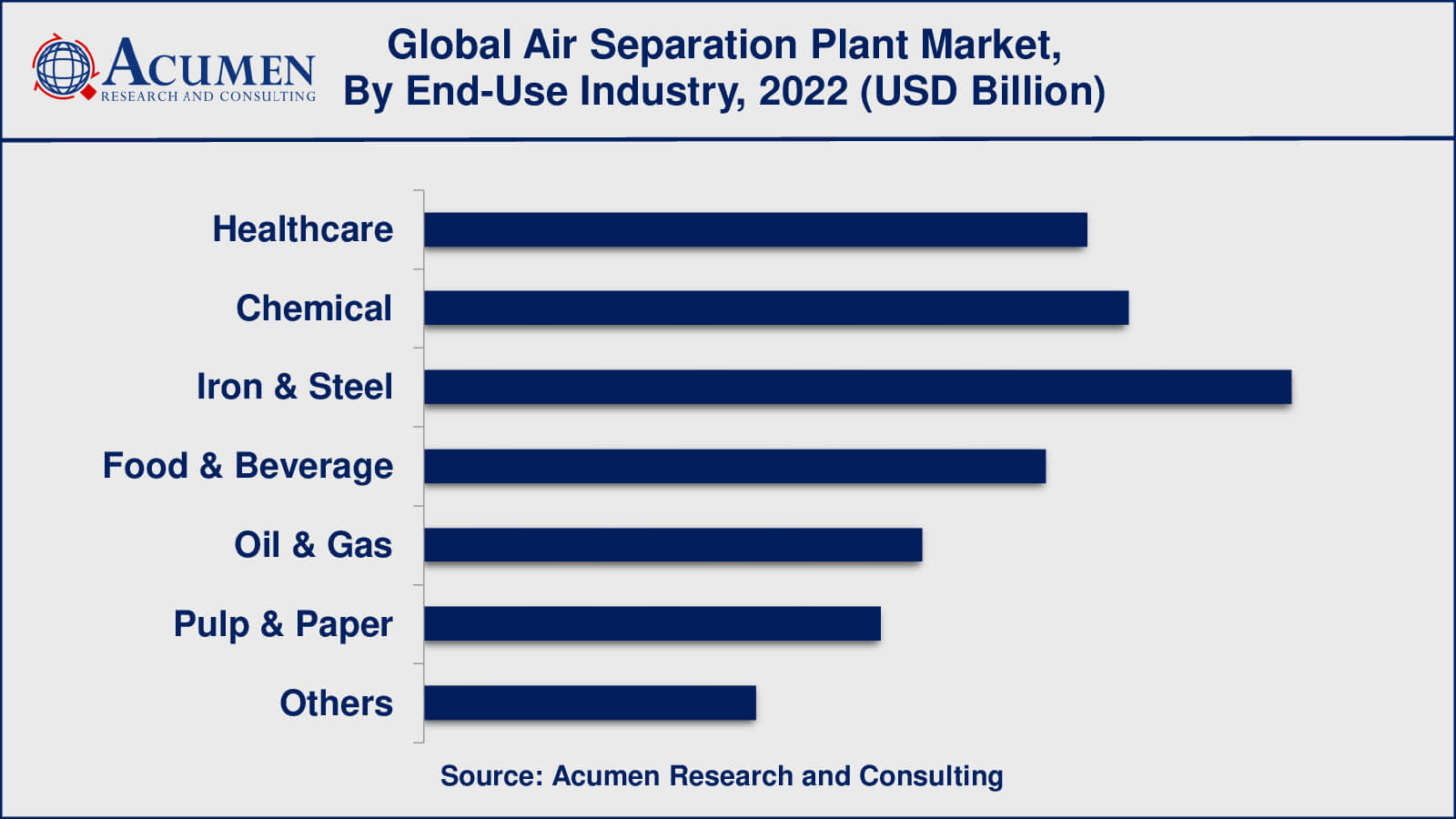

- Based on end-use industry, the iron & steel & sub-segment generated around 21% share in 2022

- Rising demand for rare gases in electronics and semiconductor industries is a popular air separation plant market trend that fuels the industry demand

An air separation plant is a type of industrial facility that separates ambient air into its constituent gases, such as nitrogen, oxygen, and argon. Cryogenic distillation technology is commonly used in the separation process, in which air is chilled to extremely low temperatures to liquefy and separate its constituents depending on their boiling points.

Air separation facilities are vital because they generate enormous amounts of industrial gases, which are used in a variety of sectors such as healthcare, metallurgy, chemical, and electronics. Industrial gases generated by air separation facilities are used in a variety of industries, including welding and metal fabrication, as well as the manufacture of electronics, glass, and culinary goods.

The rising need for industrial gases in many sectors has increased the demand for air separation facilities. In many production processes and applications, the utilization of industrial gases has become crucial. The increased demand for industrial gases is being driven by global industrialization and urbanization. Furthermore, the usage of industrial gases is increasing in emerging nations, which is projected to fuel the expansion of the air separation plant market in these areas.

Global Air Separation Plant Market Dynamics

Market Drivers

- Increasing demand for industrial gases in various end-use industries

- Growing investments in the healthcare sector to support the increasing demand for medical oxygen

- Rapid industrialization and urbanization in developing economies

- Advancements in technology and automation in the air separation plant industry

- Favorable government regulations promoting the use of industrial gases

Market Restraints

- High capital costs associated with the establishment and maintenance of air separation plants

- Availability of alternative methods for producing industrial gases, such as electrolysis and gas reforming

- The volatile nature of raw materials used in air separation plants, leading to price fluctuations

- Stringent regulations on the emission of greenhouse gases from air separation plants

- High energy consumption and carbon footprint associated with air separation plants

Market Opportunities

- Growing demand for liquefied natural gas (LNG) and other cryogenic applications

- Expansion of the industrial gas market in emerging economies

- Increasing focus on renewable energy sources

- Development of small-scale air separation plants for on-site production of industrial gases

Air Separation Plant Market Report Coverage

| Market | Air Separation Plant Market |

| Air Separation Plant Market Size 2022 | USD 5.7 Billion |

| Air Separation Plant Market Forecast 2032 | USD 9.5 Billion |

| Air Separation Plant Market CAGR During 2023 - 2032 | 5.3% |

| Air Separation Plant Market Analysis Period | 2020 - 2032 |

| Air Separation Plant Market Base Year | 2022 |

| Air Separation Plant Market Forecast Data | 2023 - 2032 |

| Segments Covered | By Process, By Gas Type, By End-Use Industry, And By Geography |

| Regional Scope | North America, Europe, Asia Pacific, Latin America, and Middle East & Africa |

| Key Companies Profiled | Air Liquide S.A., Air Products and Chemicals, Inc., Chart Industries, Inc., Cryogenic Industries AG (a subsidiary of Nikkiso Co., Ltd.), Enerflex Ltd., Hangzhou Hangyang Co., Ltd., Linde plc, Messer Group GmbH, Praxair, Inc. (a subsidiary of Linde plc), Taiyo Nippon Sanso Corporation, Technex Ltd., and Universal Industrial Gases, Inc. |

| Report Coverage |

Market Trends, Drivers, Restraints, Competitive Analysis, Player Profiling, Covid-19 Analysis, Regulation Analysis |

Air Separation Plant Market Insights

The air separation plant market is being pushed for a number of reasons, including rising demand for industrial gases, technological and automation developments, and favorable government regulations. One of the key drivers of the air separation plant market is the increasing need for industrial gases in various end-use sectors such as healthcare, metallurgy, food & beverages, and electronics. As emerging economies continue to industrialize and urbanize, the demand for industrial gases is likely to rise. This tendency is projected to propel the expansion of the air separation plant market even more.

Another key driver of the air separation unit market is rising healthcare spending to meet the rising demand for medicinal oxygen. The COVID-19 epidemic has underlined the need for medical oxygen, and governments and healthcare organizations are now substantially investing in medical oxygen production and delivery to ensure a sufficient supply.

Technological and automation advancements are also propelling the growth of the air separation plant market. Automation has allowed air separation facilities to become more efficient and dependable, and new technologies are being developed to increase efficiency and minimize energy use.

However, the air separation unit industry faces a number of problems. The high capital expenditures of establishing and maintaining air separation plants are a substantial barrier to entry for new market participants. The availability of other industrial gas production processes, such as electrolysis and gas reforming, is also a problem for the air separation plant business.

Stringent controls on greenhouse gas emissions from air separation facilities are also a source of worry. The air separation plant business is one of the greatest emitters of greenhouse gases, and as governments throughout the globe focus on lowering greenhouse gas emissions, the industry faces new restrictions and greater costs.

Air Separation Plant Market Segmentation

The worldwide market for air separation plant is split based on process, gas type, end-use industry, and geography.

Air Separation Plant Processes

- Cryogenic

- Non-Cryogenic

- Pressure Swing Adsorption

- Vacuum Pressure Swing Adsorption

- Membrane Separation

According to air separation plant industry analysis, the cryogenic air separation process includes freezing and compressing air to temperatures below -300°F (-184°C) to convert it to a liquid form, which is then separated into its component gases using distillation columns. This technique is very efficient and capable of creating enormous volumes of high-quality industrial gases. It is often used to produce oxygen, nitrogen, and argon, which are employed in a variety of sectors including healthcare, metallurgy, food and drinks, electronics, and chemical processing.

Non-cryogenic air separation, on the other hand, includes separating air using adsorption, membrane filtering, or pressure swing adsorption (PSA) methods. This technique is less energy-intensive than the cryogenic process and is often used to produce smaller amounts of gases such as carbon dioxide, helium, and hydrogen.

While the non-cryogenic technique is becoming more popular in some applications, such as hydrogen generation, it is still not as frequently employed as the cryogenic process. This is owing to the non-cryogenic process's constraints, which include lower purity levels, restricted production quantities, and greater capital and operational expenses. As a consequence, the cryogenic air separation technique is projected to continue dominating the market for air separation plants in the near future.

Air Separation Plant Gas Types

- Oxygen

- Nitrogen

- Argon

- Others

As per the air separation plant market forecast, oxygen is the dominant gas type in the air separation plant market. It is the most common gas generated in the air separation plant business and is utilized in a variety of end-use industries such as healthcare, metallurgy, and chemical manufacturing. Oxygen is crucial for human existence, and its demand has skyrocketed as a result of the COVID-19 epidemic since medical oxygen is critical for treating individuals with severe respiratory difficulties.

Nitrogen is the second most often generated gas in the air separation plant industry, and it is employed in a variety of industries such as food preservation, medicines, and electronics. Argon is the third most abundant gas and is largely utilized in metallurgy for welding and cutting.

Carbon dioxide, helium, hydrogen, and rare gases such as neon, krypton, and xenon are also generated in air separation facilities. Carbonation and refrigeration are two applications of carbon dioxide in the food and beverage sector. Helium is employed in many different sectors, including electronics and medicine. Rare gases are employed in the electronics and semiconductor industries, whereas hydrogen is used in the chemical sector and for fuel cells.

Air Separation Plant End-Use Industries

- Healthcare

- Chemical

- Iron & Steel

- Food & Beverage

- Oil & Gas

- Pulp & Paper

- Others

The iron and steel sector has long dominated the air separation plant end-use industry. Oxygen is used in the steelmaking process to improve blast furnace efficiency and minimize the quantity of coke required for steel production. Nitrogen is also utilized in the steelmaking process to keep the steel cold and prevent oxidation.

The second-largest end-use industry for air separation facilities is the chemical industry. Oxygen, nitrogen, and hydrogen are industrial gases that are utilized in a variety of chemical processes such as oxidation, hydrogenation, and ammonia synthesis.

Healthcare is the third-largest industry that has recently dominated the air separation plant market. The COVID-19 epidemic has increased the need for medical oxygen dramatically, and air separation plants have been vital in addressing this demand. Medical oxygen is used to treat patients with respiratory issues, and the pandemic has underlined the need of maintaining a consistent and sufficient supply of medical oxygen.

Food and beverage, oil and gas, pulp and paper, and electronics are among the important end-use sectors for air separation facilities. In the food and beverage sector, oxygen and nitrogen are used for freezing, packing, and carbonation, whereas helium is employed in the electronics industry for semiconductor fabrication.

Air Separation Plant Market Regional Outlook

North America

- U.S.

- Canada

Europe

- U.K.

- Germany

- France

- Spain

- Rest of Europe

Asia-Pacific

- India

- Japan

- China

- Australia

- South Korea

- Rest of Asia-Pacific

Latin America

- Brazil

- Mexico

- Rest of Latin America

The Middle East & Africa

- South Africa

- GCC Countries

- Rest of the Middle East & Africa (ME&A)

Air Separation Plant Market Regional Analysis

The Asia-Pacific air separation plant market is predicted to increase significantly in the coming years, driven by rising demand for industrial gases from end-use sectors such as healthcare, chemical, iron, and steel. China is the region's largest market, and it has experienced considerable growth in the number of air separation facilities in recent years.

North America is a market leader in the air separation plant industry. The region has a strong industrial foundation and a high demand for industrial gases from a variety of end-use sectors, including healthcare, chemical, and oil and gas. The United States is the region's largest market, having a considerable number of air separation facilities in operation.

Europe is another important area in the air separation plant industry, with large markets including Germany, France, and the United Kingdom. The region has a highly developed industrial base and a substantial need for industrial gases in numerous applications, including metallurgy, healthcare, and electronics.

Air Separation Plant Market Players

Some of the top air separation plant companies offered in our report include Air Liquide S.A., Air Products and Chemicals, Inc., Chart Industries, Inc., Cryogenic Industries AG (a subsidiary of Nikkiso Co., Ltd.), Enerflex Ltd., Hangzhou Hangyang Co., Ltd., Linde plc, Messer Group GmbH, Praxair, Inc. (a subsidiary of Linde plc), Taiyo Nippon Sanso Corporation, Technex Ltd., and Universal Industrial Gases, Inc.

In May 2021, Linde announced a contract with ExxonMobil to provide hydrogen and carbon dioxide to ExxonMobil's new manufacturing plant in Singapore, which will be one of the world's largest aromatics plants.

In December 2020, Air Liquide announced a long-term agreement with Gulf Coast Growth Ventures (GCGV) to provide oxygen and nitrogen to GCGV's new petrochemical complex in Texas, USA.

Frequently Asked Questions

What was the market size of the global air separation plant in 2022?

The market size of air separation plant was USD 5.7 billion in 2022.

What is the CAGR of the global air separation plant market from 2023 to 2032?

The CAGR of air separation plant is 5.3% during the analysis period of 2023 to 2032.

Which are the key players in the air separation plant market?

The key players operating in the global market are including Air Liquide S.A., Air Products and Chemicals, Inc., Chart Industries, Inc., Cryogenic Industries AG (a subsidiary of Nikkiso Co., Ltd.), Enerflex Ltd., Hangzhou Hangyang Co., Ltd., Linde plc, Messer Group GmbH, Praxair, Inc. (a subsidiary of Linde plc), Taiyo Nippon Sanso Corporation, Technex Ltd., and Universal Industrial Gases, Inc.

Which region dominated the global air separation plant market share?

Asia-Pacific held the dominating position in air separation plant industry during the analysis period of 2023 to 2032.

Which region registered fastest CAGR from 2023 to 2032?

Asia-Pacific region exhibited fastest growing CAGR for market of air separation plant during the analysis period of 2023 to 2032.

What are the current trends and dynamics in the global air separation plant industry?

The current trends and dynamics in the air separation plant industry include increasing demand for industrial gases in various end-use industries, growing investments in the healthcare sector to support the increasing demand for medical oxygen, and rapid industrialization and urbanization in developing economies.

Which process held the maximum share in 2022?

The cryogenic process type held the maximum share of the air separation plant industry.