Air Purification System Market Size - Global Industry, Share, Analysis, Trends and Forecast 2024 - 2032

Published :

Report ID:

Pages :

Format :

Air Purification System Market Size - Global Industry, Share, Analysis, Trends and Forecast 2024 - 2032

Report Coverage

- Industry Dynamics

- Market Size and Forecast Data

- Segment Analysis

- Competitive Landscape

- Regional Analysis with a Niche Focus on Country-Level Data

- High Level Analysis - Porter's, PESTEL, Value Chain, etc.

- Company Profiles of Key Players

- Option to Customize the Report As Per Your Specific Need

Request Sample Report

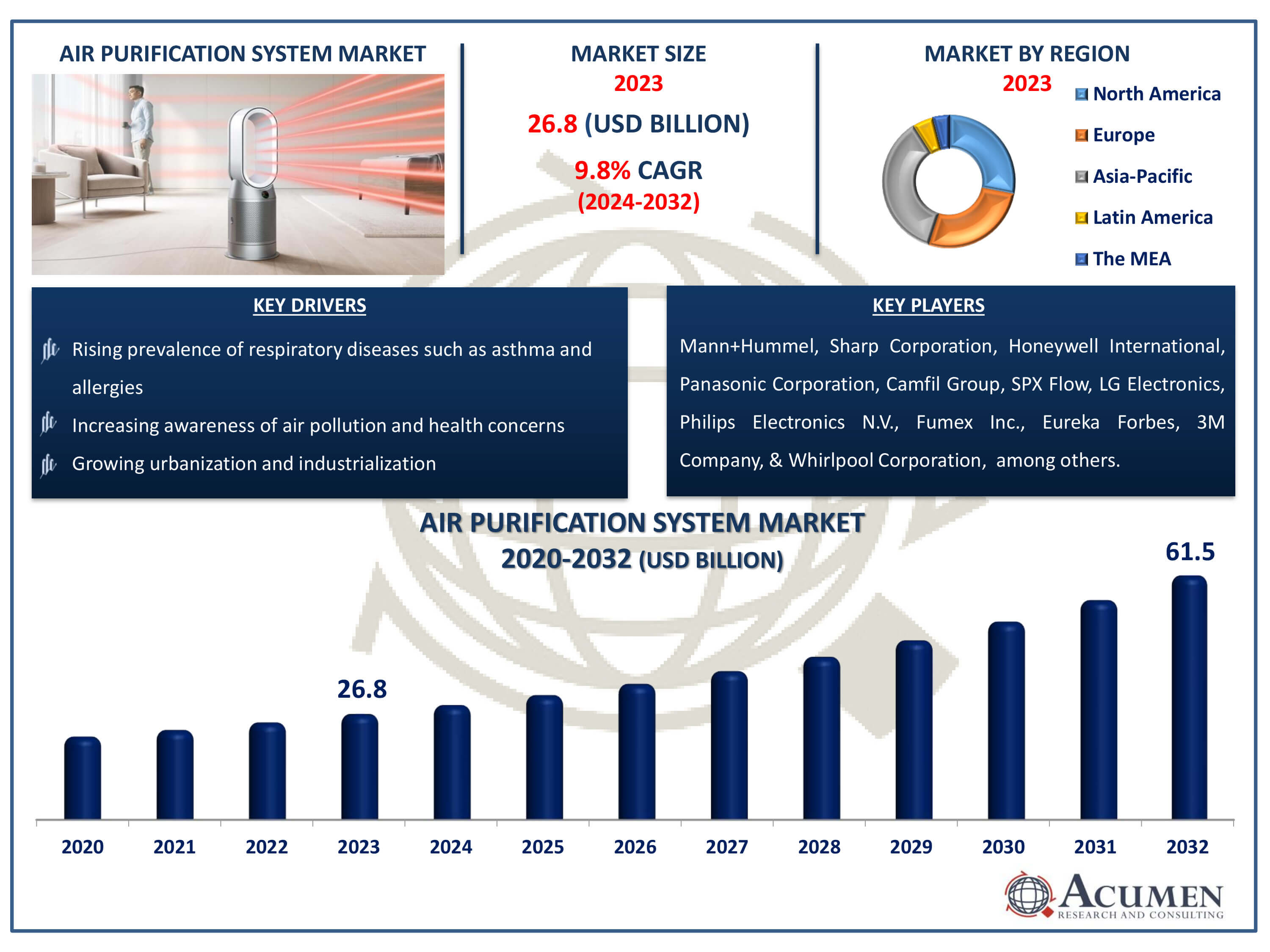

The Air Purification System Market Size accounted for USD 26.8 Billion in 2023 and is estimated to achieve a market size of USD 61.5 Billion by 2032 growing at a CAGR of 9.8% from 2024 to 2032.

Air Purification System Market Highlights

- Global air purification system market revenue is poised to garner USD 61.5 billion by 2032 with a CAGR of 9.8% from 2024 to 2032

- Asia-Pacific air purification system market value occupied around USD 9.6 billion in 2023

- North America air purification system market growth will record a CAGR of more than 11% from 2024 to 2032

- Among impurity, the smoke collectors sub-segment generated notable revenue in 2023

- Based on technology, the HEPA purifier sub-segment generated around 40% air purification system market share in 2023

- Growing demand for portable air purifiers is a popular air purification system market trend that fuels the industry demand

Air purification systems are intended to eliminate toxins or pollutants from rooms or buildings, making them necessary for people who suffer from allergies, asthma, and other respiratory diseases. They are also excellent at removing secondhand tobacco smoke, which improves indoor air quality. These systems use two sorts of technologies: active air purifiers, which use ionization to clean the air, and passive air purifiers, which use air filters to catch and remove contaminants. In response to the rapidly increasing demand for air purifiers, many firms are constantly innovating and developing new, improved devices. These developments aim to improve efficiency, minimize energy consumption, and increase the overall effectiveness of air purification systems in a variety of contexts.

Global Air Purification System Market Dynamics

Market Drivers

- Increasing awareness of air pollution and health concerns

- Rising prevalence of respiratory diseases such as asthma and allergies

- Growing urbanization and industrialization

- Government regulations and initiatives promoting clean air

Market Restraints

- High initial cost of air purification systems

- Maintenance and operational costs

- Limited awareness in developing regions

Market Opportunities

- Technological advancements leading to more efficient products

- Expanding market in developing countries

- Integration with smart home systems

Air Purification System Market Report Coverage

| Market | Air Purification System Market |

| Air Purification System Market Size 2022 | USD 26.8 Billion |

| Air Purification System Market Forecast 2032 | USD 61.5 Billion |

| Air Purification System Market CAGR During 2023 - 2032 | 9.8% |

| Air Purification System Market Analysis Period | 2020 - 2032 |

| Air Purification System Market Base Year |

2022 |

| Air Purification System Market Forecast Data | 2023 - 2032 |

| Segments Covered | By Technology, By Impurity, By End User, And By Geography |

| Regional Scope | North America, Europe, Asia Pacific, Latin America, and Middle East & Africa |

| Key Companies Profiled | Mann+Hummel, Sharp Corporation, Honeywell International, Panasonic Corporation, Camfil Group, SPX Flow, LG Electronics, Philips Electronics N.V., Fumex Inc., Eureka Forbes, 3M Company, Whirlpool Corporation, and Daikin Industries. |

| Report Coverage |

Market Trends, Drivers, Restraints, Competitive Analysis, Player Profiling, Covid-19 Analysis, Regulation Analysis |

Air Purification System Market Insights

The global air purification system market is expanding rapidly, owing to a number of important drivers. This expansion is primarily driven by rapid industrialization, rising pollution levels, and an increase in the prevalence of allergy illnesses. The most important of these drivers is the rapid speed of industrialization, which has resulted in large increases in air pollution. The expansion of industrial activity, and the subsequent increase in output levels, has resulted in increasing pollution emissions into the environment. This has prompted the installation of air filtration devices to ensure air quality. The boom in industrialization, especially in developing nations, has significantly increased demand for these systems, fueling market expansion.

Second, increasing pollution levels are a big global concern. Vehicle emissions, industrial discharges, and other human-caused activities are all contributing to increased pollution in urban areas. This increase in environmental pollution needs the use of effective air purification technologies to ensure cleaner and healthier air, hence boosting demand for these systems. In addition, the prevalence of allergic disorders and respiratory conditions such as asthma has increased significantly. The growing number of people affected by these disorders highlights the vital need for air purification systems, which help to reduce airborne allergens and pollutants that worsen these health difficulties. As people become more aware of the health hazards connected with poor air quality, the market for air filtration devices develops.

Moreover, rising disposable incomes in developing nations have increased individuals' ability to invest in health and wellness items, such as air purifiers. This economic growth promotes the broad adoption of air purification systems in a variety of industries, including automotive, building and construction, healthcare and medical, manufacturing, and energy and utilities, further propelling market expansion. In addition, stringent rules governing industrial emissions, as well as increased employee health and safety concerns, have boosted the growth of the air purifier market. Governments and regulatory agencies around the world are implementing strict standards to reduce industrial emissions and protect public health. Compliance with these rules mandates the use of air purification systems, which increases market demand.

Air Purification System Market Segmentation

The worldwide market for air purification system is split based on technology, impurity, end user, and geography.

Air Purification System Technologies

- HEPA Purifier

- Ionic Air Purifier

- Electrostatic Precipitators

- Ultra Violet (UV) Light Purifier

- Activated Carbon Purifier

- Others

According to air purification system industry analysis, the high-efficiency particulate air (HEPA) purifier category is the largest in the market due to its higher ability to remove airborne particles. HEPA filters are intended to collect at least 99.97% of particles as small as 0.3 microns, which include dust, pollen, mold spores, and germs. Because of their high effectiveness, HEPA purifiers are especially popular in residential, commercial, and industrial environments where air quality is critical. Furthermore, rising awareness of air pollution-related health issues, as well as an increase in allergies and respiratory diseases, have fueled demand for HEPA purifiers. Their demonstrated effectiveness and dependability make them the preferred choice for both consumers and enterprises.

Air Purification System Impurities

- Oil & Mist Collectors

- Smoke Collectors

- Fume Extraction

- Exhaust Filtration

- Others

Smoke collectors are expected to be the largest section of the air purification system market. Smoke collectors serve an important role in many industries by successfully eliminating toxic smoke particles and gases produced during manufacturing processes, welding operations, and industrial activities. As enterprises around the world face increased pressure to comply with severe environmental requirements and maintain worker safety, there is a growing demand for efficient smoke collectors. These systems not only improve workplace air quality, but also help to promote sustainable behaviors by lowering emissions and increasing general environmental health. Smoke collectors are projected to continue to be adopted and expanded in the global air purifier market as industrialization increases and the requirement for cleaner manufacturing environments grows.

Air Purification System End-Users

- Residential

- Commercial

- Industrial

The commercial segment is anticipated to be the largest in the air purification system market. This growth is driven by the increasing adoption of air purification systems in offices, hotels, restaurants, shopping malls, and other commercial spaces. Commercial establishments prioritize maintaining clean and healthy indoor air quality to enhance customer satisfaction, employee productivity, and overall comfort. Moreover, stringent regulations regarding indoor air quality standards in commercial buildings further boost the demand for effective air purification solutions. As awareness of the health benefits associated with clean air continues to grow among businesses and consumers alike, the commercial sector is expected to witness robust growth in the adoption of air purification systems. This trend is supported by ongoing advancements in technology, which offer more efficient and cost-effective solutions tailored to commercial applications.

Air Purification System Market Regional Outlook

North America

- U.S.

- Canada

Europe

- U.K.

- Germany

- France

- Spain

- Rest of Europe

Asia-Pacific

- India

- Japan

- China

- Australia

- South Korea

- Rest of Asia-Pacific

Latin America

- Brazil

- Mexico

- Rest of Latin America

The Middle East & Africa

- South Africa

- GCC Countries

- Rest of the Middle East & Africa (ME&A)

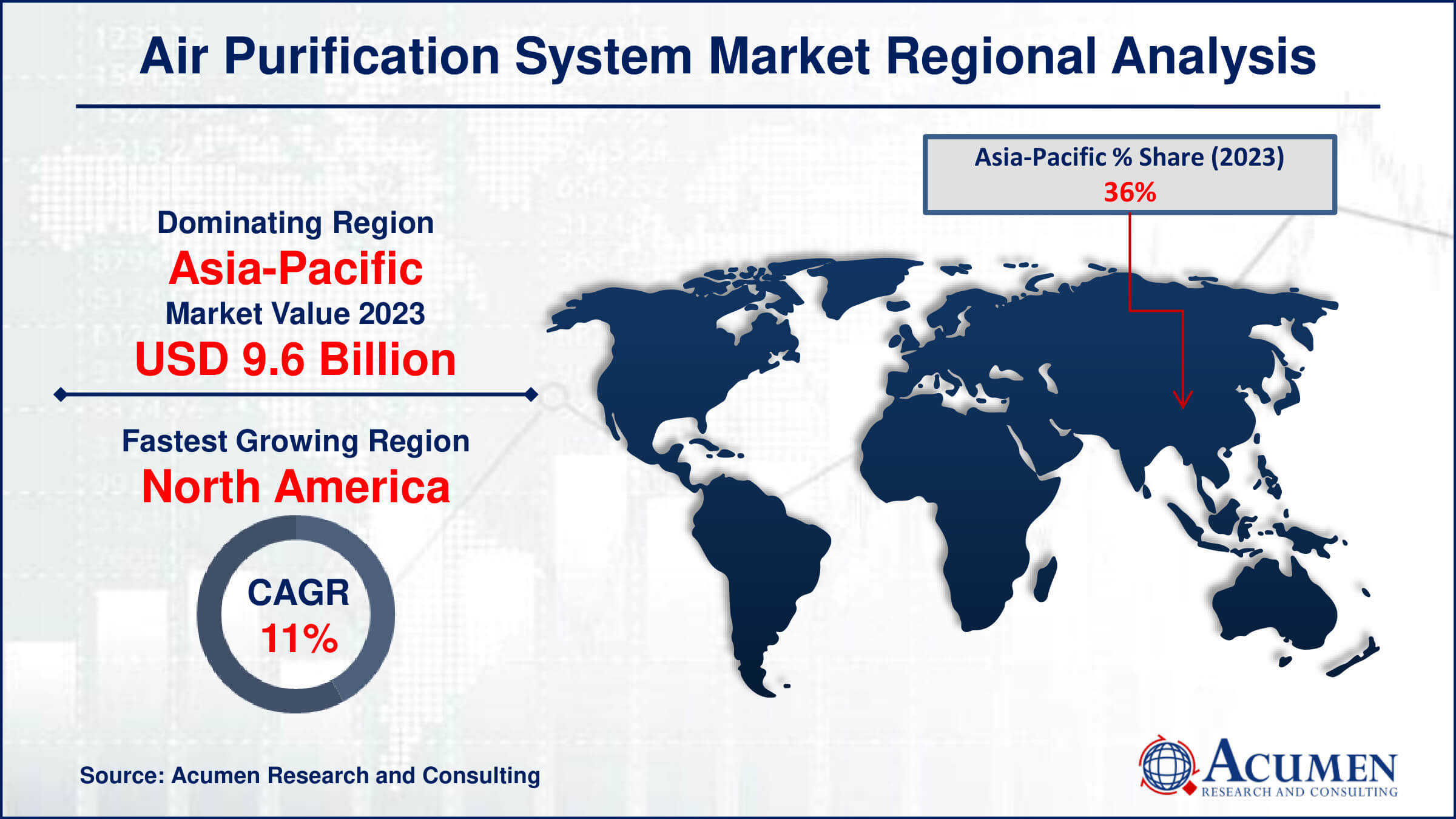

Air Purification System Market Regional Analysis

In terms of air purification system market analysis, the Asia-Pacific region dominates the global air purification system market, driven by rapid urbanization and growing industrialization in countries such as China and India. Increasing disposable income and growing concerns about the ill effects of air pollution on human health have fueled the growth of the Asia-Pacific air purification market. Additionally, strict regulatory laws related to toxic emission control are also contributing to the market's growth in this region.

The markets in North America and Europe are expected to expand at a steady pace during the air purification system market forecast period. The implementation of stringent government industrial norms and increasing awareness related to employee health are key factors driving market growth. Well-developed infrastructure and rising awareness in the healthcare, tourism, and hospitality sectors will foster the demand for air purification systems. Additionally, air purification systems for residential areas are still in an emerging stage but are expected to rise during the forecast period due to indoor air quality concerns.

Latin America and the Middle East & Africa (LAMEA) are expected to be emerging during the air purification system industry forecast period due to growth in the commercial sector. The global air purification systems market is anticipated to expand significantly in the developing region of Latin America. Increasing industrialization and commercial activities, especially in the Middle East, are fueling the market's growth.

Air Purification System Market Players

Some of the top air purification system companies offered in our report includes Mann+Hummel, Sharp Corporation, Honeywell International, Panasonic Corporation, Camfil Group, SPX Flow, LG Electronics, Philips Electronics N.V., Fumex Inc., Eureka Forbes, 3M Company, Whirlpool Corporation, and Daikin Industries.

Frequently Asked Questions

How big is the air purification system market?

The air purification system market size was valued at USD 26.8 billion in 2023.

What is the CAGR of the global air purification system market from 2024 to 2032?

The CAGR of air purification system is 9.8% during the analysis period of 2024 to 2032.

Which are the key players in the air purification system market?

The key players operating in the global market are including Mann+Hummel, Sharp Corporation, Honeywell International, Panasonic Corporation, Camfil Group, SPX Flow, LG Electronics, Philips Electronics N.V., Fumex Inc., Eureka Forbes, 3M Company, Whirlpool Corporation, and Daikin Industries

Which region dominated the global air purification system market share?

Asia-Pacific held the dominating position in air purification system industry during the analysis period of 2024 to 2032.

Which region registered fastest CAGR from 2024 to 2032?

North America region exhibited fastest growing CAGR for market of air purification system during the analysis period of 2024 to 2032.

What are the current trends and dynamics in the global air purification system industry?

The current trends and dynamics in the air purification system industry include increasing awareness of air pollution and health concerns, rising prevalence of respiratory diseases such as asthma and allergies, growing urbanization and industrialization, and government regulations and initiatives promoting clean air.

Which technology held the maximum share in 2023?

The HEPA purifier technology held the maximum share of the air purification system industry.