Air Bearings Market Size - Global Industry, Share, Analysis, Trends and Forecast 2024 - 2032

Published :

Report ID:

Pages :

Format :

Air Bearings Market Size - Global Industry, Share, Analysis, Trends and Forecast 2024 - 2032

Report Coverage

- Industry Dynamics

- Market Size and Forecast Data

- Segment Analysis

- Competitive Landscape

- Regional Analysis with a Niche Focus on Country-Level Data

- High Level Analysis - Porter's, PESTEL, Value Chain, etc.

- Company Profiles of Key Players

- Option to Customize the Report As Per Your Specific Need

Request Sample Report

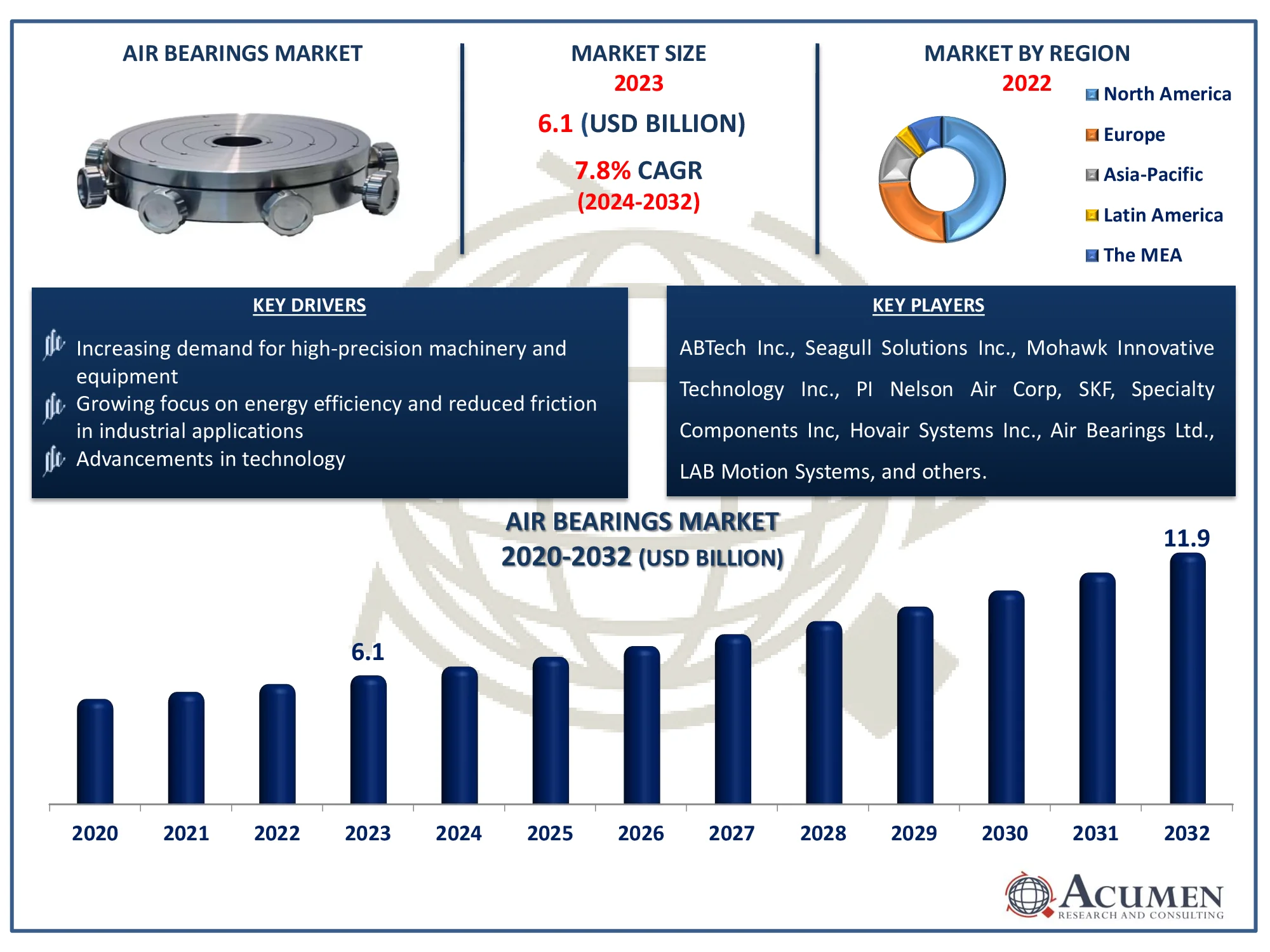

The Global Air Bearings Market Size accounted for USD 6.1 Billion in 2023 and is estimated to achieve a market size of USD 11.9 Billion by 2032 growing at a CAGR of 7.8% from 2024 to 2032.

Air Bearings Market Highlights

- The global air bearings market is projected to reach USD 11.9 billion by 2032, with a CAGR of 7.8% from 2024 to 2032

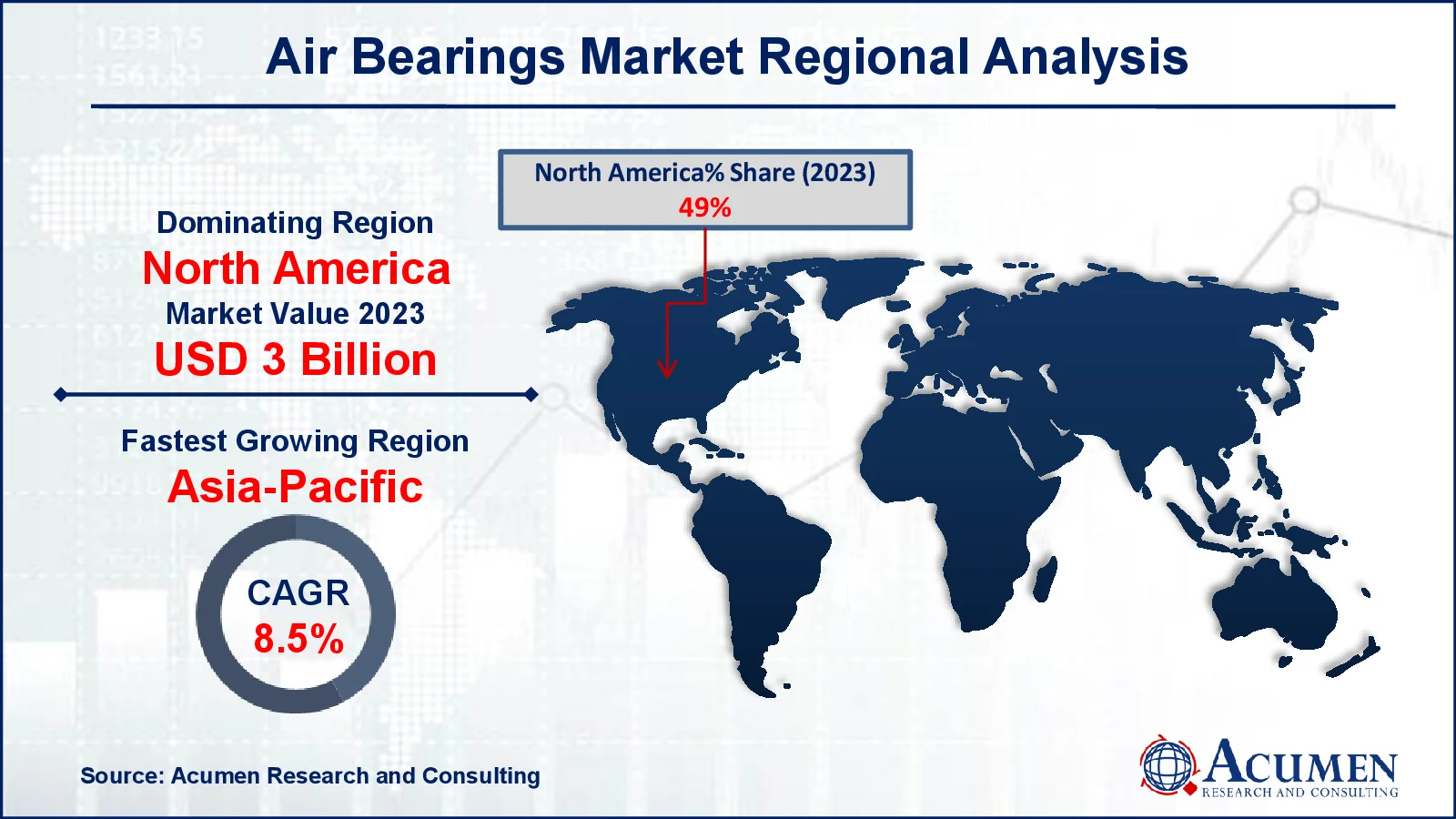

- In 2023, North America's air bearings market was valued at approximately USD 3 billion

- The Asia-Pacific air bearings market is expected to grow at a CAGR of over 8.5% from 2024 to 2032

- Aerostatic bearings accounted for 70% of the market share in 2023 based on type

- Bearings with speed capacity <1000 rpm held 60% of the market share in 2023

- Precision material tools applications captured 55% of the air bearings market share in 2023

- Rising use in medical devices and imaging equipment for ultra-smooth motion and noise reduction is a popular air bearings market trend that fuels the industry demand

Air bearings use air coils instead of balls. The hovercraft is the most common use for air chambers. Large fans blow beneath the hovercraft, catching the air in a "skirt" of rubber. This coil not only increases the weight of the ship, but it also acts as a smooth well, letting it to glide gently over water or land. A same principle applies to air coils, which deliver high-pressure air into the space between stationary bearings and a rotary shaft. The gap is incredibly small, about 1/100 of a millimeter, allowing air pressure to be maintained in the coil. Aerodynamic rolls are chosen over other types of rolls because of their high velocity and acceleration. The entire designed load can be supported at nil velocity. Low-heat aerotatic rollers with precise rotation can be employed. Furthermore, aerotatic routing is less stiff, allowing for easier handling of smaller load capacities. Aerostatic coverings are useful in a variety of applications, including micro positioning, machining, and grinding, where greater friction-free performance at zero velocity is required.

Global Air Bearings Market Dynamics

Market Drivers

- Increasing demand for high-precision machinery and equipment in various industries

- Growing focus on energy efficiency and reduced friction in industrial applications

- Advancements in technology leading to the development of innovative air bearing designs

Market Restraints

- High initial costs associated with the implementation of air bearing systems

- Limited awareness and understanding of air bearings among end-users

- Potential challenges in maintenance and reliability compared to traditional bearings

Market Opportunities

- Expanding applications in emerging industries such as aerospace, robotics, and medical devices

- Rising investments in automation and smart manufacturing practices

- Increasing demand for sustainable and environmentally friendly solutions in manufacturing processes

Air Bearings Market Report Coverage

| Market | Air Bearings Market |

| Air Bearings Market Size 2022 |

USD 6.1 Billion |

| Air Bearings Market Forecast 2032 | USD 11.9 Billion |

| Air Bearings Market CAGR During 2023 - 2032 | 7.8% |

| Air Bearings Market Analysis Period | 2020 - 2032 |

| Air Bearings Market Base Year |

2022 |

| Air Bearings Market Forecast Data | 2023 - 2032 |

| Segments Covered | By Type, By Speed Capacity, By Application, By End Use, By Distribution Channel, And By Geography |

| Regional Scope | North America, Europe, Asia Pacific, Latin America, and Middle East & Africa |

| Key Companies Profiled | ABTech Inc., Seagull Solutions Inc., Mohawk Innovative Technology Inc., PI Nelson Air Corp, SKF, Specialty Components Inc, Hovair Systems Inc., Air Bearings Ltd., LAB Motion Systems, IBS Precision Engineering, OAV Air Bearings, Celera Motion, and Professional Instruments Company. |

| Report Coverage |

Market Trends, Drivers, Restraints, Competitive Analysis, Player Profiling, Covid-19 Analysis, Regulation Analysis |

Air Bearings Market Insights

The air bearings industry has made tremendous developments, from early opening rooms to porous air bearings. Previously, mechanical bearing guiding was used to effectively address movement applications. However, the necessity for angular repeatability, accuracy, and geometric efficiency has shifted end-users' attention to air coils. The air bearing phase has been viewed as a rather practical solution, as it employs one of its preloaded systems and eliminates mechanical contact, hence avoiding friction, hysteresis, and wear. The rolling-element bearings have shown a similar shift in preference. Consumers have turned to air roller coils as a proven and best-fit technology for various motion control apps to meet demands such as precise movement and exact results due to their technical advantages.

Air bearings confront a number of issues similar to traditional bearings, including oil handling, friction, and wear. Their distinctive benefits in high-speed and precision machining applications include the installation of air bearings on a growth path. The increased usage of high-precision instruments and spindles in car manufacturing has resulted in a strong demand for air rooms, expanding market players' opportunities.

Accuracy develops as a hallmark of the new age of industry. Because of the increased demand for precision, precise machining has necessitated the development of efficient parts that can operate seamlessly across a wide range of application domains. These parts, which are the preferred choice of makers, bring air bearings into focus. Precision machining instruments require the invention and manufacture of instruments, machines, and other industrial elements in order to maintain dynamic stability and precision. Air chambers with reduced friction drags are utilized in accurate machining equipment to obtain high velocity at low vibration rates.

Technological advancements are driving innovation in the air bearings industry. Although air rockets improve the performance of a wide range of equipment, firms continue to apply technological breakthroughs to increase the efficiency of air rockets. Air bearings used in many pieces of equipment must be supervised and inspected on a regular basis in order to ensure their dependability, uniformity, efficiency, and cost effectiveness. Future cars can be designed to address the issues in automotive testing by advancing air-bearing technology, which is expected to boost global automobile sales through a variety of frictionless mobility options.

Micromachines and nanotechnology play an important role in the miniaturization of parts, ranging from biomedical applications to sensors and chemical micro reactors. Extreme force and velocity control are required in high-performance micromachining centres. Producers that require tight control of tiny incremental motions, fast speeds, low forces, and exceptional level resolution and repeatability understand the benefits of air-bearing technology utilized to counterbalance zero-friction. Energy and operational efficiency remain a priority for modern computer manufacturers. The companies are concerned with low maintenance, quiet operations, and low energy consumption of air bearings. Their contribution to reducing operational costs, optimal energy consumption, and precision helps producers achieve the necessary sustainability.

Air Bearings Market Segmentation

The worldwide market for air bearings is split based on type, speed capacity, application, end use, distribution channel, and geography.

Air Bearing Market By Type

- Aerodynamic Bearings

- Aerostatic Bearings

According to air bearings industry analysis, aerostatic bearings dominate industry due to their high load-carrying capability and precision. These bearings use a thin coating of pressurized air to create a frictionless surface, resulting in substantially lower wear and maintenance than standard bearings. Their ability to deliver constant performance in high-speed applications makes them especially appealing in industries like aircraft, semiconductor production, and precision machinery. As the demand for high-precision and economical equipment grows, aerostatic bearings gain popularity due to their dependability and unique design.

Air Bearing Market By Speed Capacity

- >60000 rpm

- <1000 rpm

- 1000 – 60000 rpm

According to air bearings industry analysis, bearings with a speed capacity of <1000 RPM are commonly used in precise machinery and equipment, making this category dominant. This speed range is appropriate for businesses requiring consistent and precise processes, such as semiconductor production, metrology, and optics. Bearings that operate at less than 1000 RPM benefit from less friction, which increases their longevity and reduces maintenance requirements. As manufacturers prioritize precision and dependability, the <1000 RPM category is expected to increase further.

Air Bearing Market By Application

- High Speed Machines

- Coordinate Measuring Machines

- Precision Material Tools

- Others

According to air bearings industry analysis, precision material tools dominate market because to their vital role in sectors requiring high accuracy and low friction. These instruments are critical for applications such as CNC machining, aerospace, and semiconductor production, where even little variations can result in substantial quality difficulties. By using air bearings, manufacturers may improve the performance and longevity of their precision equipment, resulting in higher product quality and operating efficiency.

Air Bearing Market By End Use

- Automotive

- Aviation

- Wastewater Management

- Medical

- Semiconductor

- Others

According to air bearings market forecast, the semiconductor sector dominates, driven by the demand for ultra-precise and dependable manufacturing processes. Air bearings are crucial in semiconductor fabrication equipment because they reduce friction and enable smooth, vibration-free motion, which is critical for preserving the integrity of fragile components. As the demand for smaller, faster, and more efficient semiconductor devices grows, air bearings provide the performance benefits required for new manufacturing procedures.

Air Bearing Market By Distribution Channel

- Direct

- Indirect

According to air bearings market forecast, the direct distribution channel dominates due to its efficiency in connecting manufacturers and end users, resulting in faster delivery and lower costs. By eliminating intermediaries, businesses may offer bespoke solutions that fit unique consumer demands while preserving more price and inventory management control. This method strengthens ties between manufacturers and customers, allowing for more effective communication and support throughout the purchasing process. As industries value direct access to high-quality products, the direct distribution channel is critical to driving growth in the air bearings market.

Air Bearings Market Regional Outlook

North America

- U.S.

- Canada

Europe

- U.K.

- Germany

- France

- Spain

- Rest of Europe

Asia-Pacific

- India

- Japan

- China

- Australia

- South Korea

- Rest of Asia-Pacific

Latin America

- Brazil

- Mexico

- Rest of Latin America

The Middle East & Africa

- South Africa

- GCC Countries

- Rest of the Middle East & Africa (ME&A)

Air Bearings Market Regional Analysis

Regional analysis of air bearings market, North America held the largest share of the market, accounting for more than 49% of the general sector in 2023. The technical advancements and prosperous automobile industries in this region are propelling the air bearings market in particular. Air bearing is a highly competitive industry, with relatively high investment and technological thresholds. There are also projections of a surge in demand for air chambers for industrial machinery due to increased global output, which serves to raise the associated fixed investment costs. The automotive industry's dominance in the United States has resulted in greater demand for air room.

The air bearings market in Asia-Pacific is expected to grow at a CAGR of approximately 8.5%. Furthermore, investment in research and development has resulted in rapid growth in the automobile and space plane sectors. The development of the aviation sector and rapid industrialization in the region are the result of Asia-Pacific economic boom. Manufacturers of air chambers for the steel industry are mostly concentrated in Japan, Europe, China and North America.

China shows notable growth in market. This scope accounts for China's high consumption of semiconductor devices, since the Smartphone market is quickly developing. Another aspect of this economy that air-bearing producers are interested in is the rising automotive industry, both in terms of manufacturing and consumption. As air rollers have grown increasingly important in the global automotive sector, expanding footprints in China may be the most profitable plan.

Air Bearings Market Players

Some of the top air bearings companies offered in our report include ABTech Inc., Seagull Solutions Inc., Mohawk Innovative Technology Inc., PI Nelson Air Corp, SKF, Specialty Components Inc, Hovair Systems Inc., Air Bearings Ltd., LAB Motion Systems, IBS Precision Engineering, OAV Air Bearings, Celera Motion, and Professional Instruments Company.

Frequently Asked Questions

How big is the air bearings market?

The air bearings market size was valued at USD 6.1 billion in 2023.

What is the CAGR of the global air bearings market from 2024 to 2032?

The CAGR of air bearings is 7.8% during the analysis period of 2024 to 2032.

Which are the key players in the air bearings market?

The key players operating in the global market are including ABTech Inc., Seagull Solutions Inc., Mohawk Innovative Technology Inc., PI Nelson Air Corp, SKF, Specialty Components Inc, Hovair Systems Inc., Air Bearings Ltd., LAB Motion Systems, IBS Precision Engineering, OAV Air Bearings, Celera Motion, and Professional Instruments Company.

Which region dominated the global air bearings market share?

North America held the dominating position in air bearings industry during the analysis period of 2024 to 2032.

Which region registered fastest CAGR from 2024 to 2032?

Asia-Pacific region exhibited fastest growing CAGR for market of air bearings during the analysis period of 2024 to 2032.

What are the current trends and dynamics in the global air bearings industry?

The current trends and dynamics in the air bearings industry include increasing demand for high-precision machinery and equipment in various industries, growing focus on energy efficiency and reduced friction in industrial applications, and advancements in technology leading to the development of innovative air bearing designs.

Which speed capacity held the maximum share in 2023?

The <1000 rpm rpm held the maximum share of the air bearings industry