AI in Agriculture Market Size - Global Industry, Share, Analysis, Trends and Forecast 2024 - 2032

Published :

Report ID:

Pages :

Format :

AI in Agriculture Market Size - Global Industry, Share, Analysis, Trends and Forecast 2024 - 2032

Report Coverage

- Industry Dynamics

- Market Size and Forecast Data

- Segment Analysis

- Competitive Landscape

- Regional Analysis with a Niche Focus on Country-Level Data

- High Level Analysis - Porter's, PESTEL, Value Chain, etc.

- Company Profiles of Key Players

- Option to Customize the Report As Per Your Specific Need

Request Sample Report

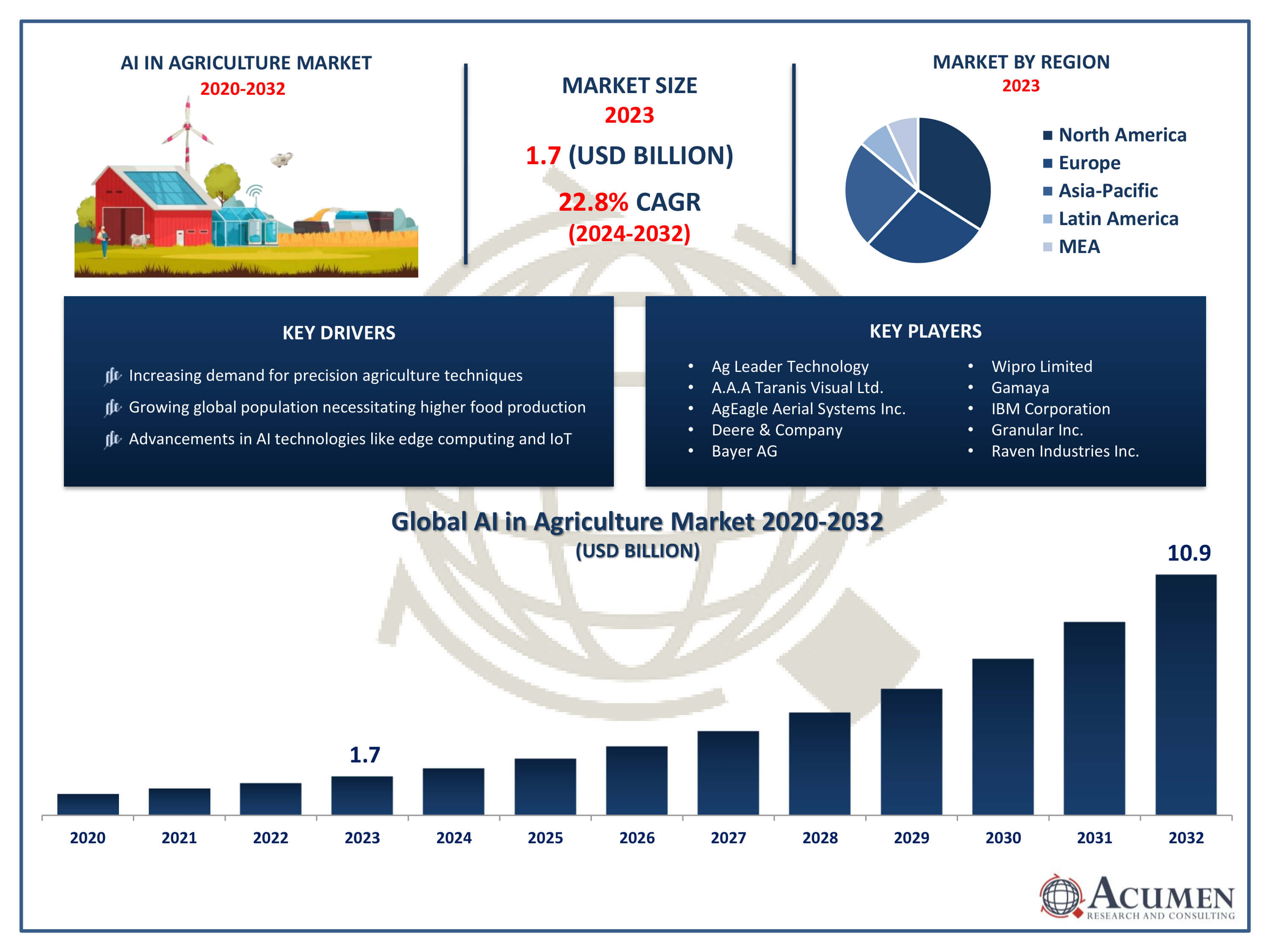

The AI in Agriculture Market Size accounted for USD 1.7 Billion in 2023 and is projected to achieve a market size of USD 10.9 Billion by 2032 growing at a CAGR of 22.8% from 2024 to 2032.

AI in Agriculture Market Highlights

- Global AI in agriculture market revenue is expected to increase by USD 10.9 Billion by 2032, with a 22.8% CAGR from 2024 to 2032

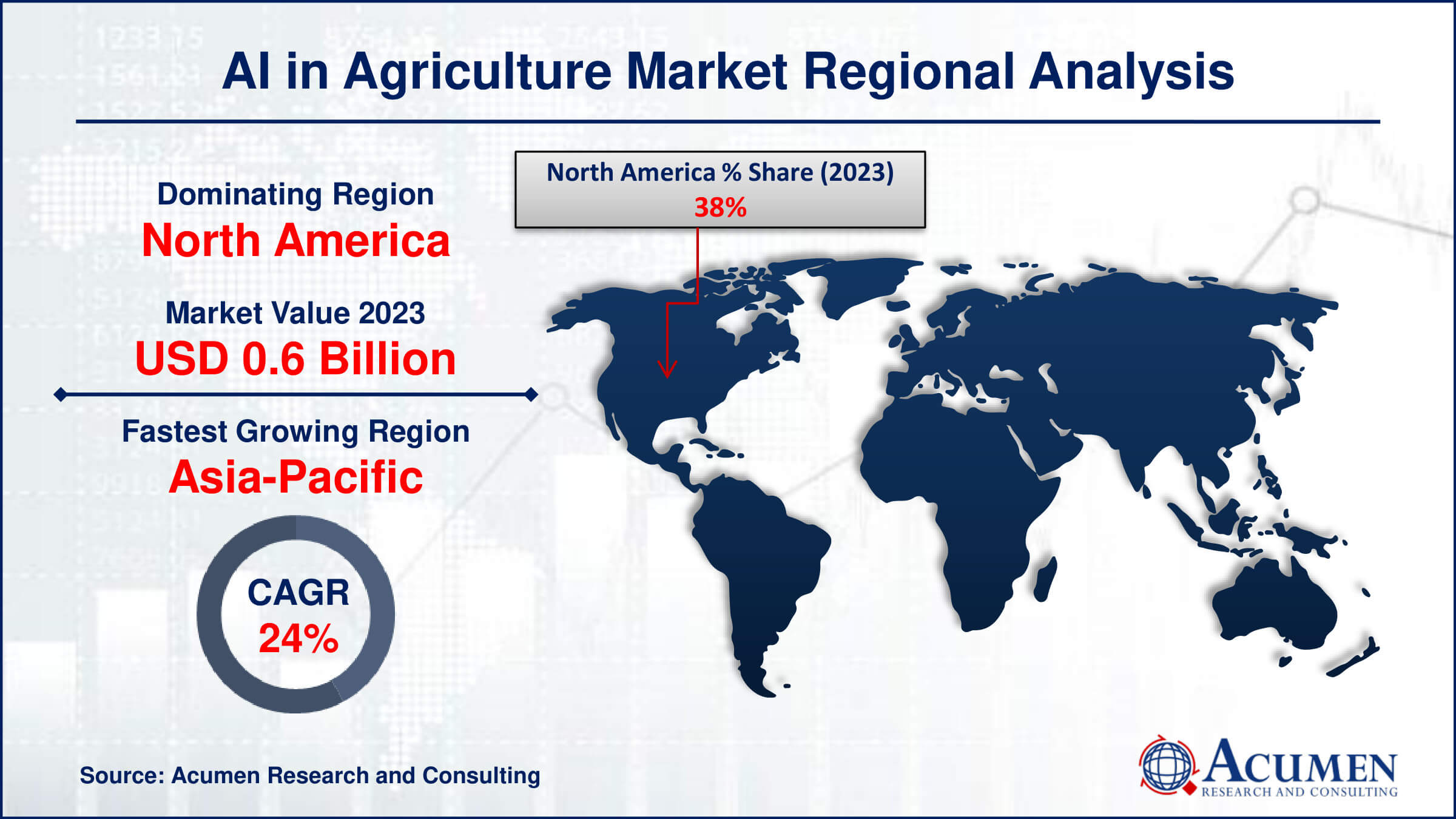

- North America region led with more than 38% of AI in agriculture market share in 2023

- Asia-Pacific AI in agriculture market growth will record a CAGR of more than 24.1% from 2024 to 2032

- By technology, the predictive analytics segment captured more than 45% of revenue share in 2023

- By application, the precision farming segment is projected to expand at the fastest CAGR over the projected period

- Increasing demand for precision agriculture techniques, drives the AI in agriculture market value

AI in agriculture refers to the application of artificial intelligence technologies such as machine learning, computer vision, and data analytics to enhance various agricultural processes. These technologies are employed to optimize crop management, improve resource efficiency, monitor plant health, and automate tasks like harvesting and sorting. By analyzing vast amounts of data collected from sensors, drones, satellites, and other sources, AI algorithms can provide valuable insights and recommendations to farmers, enabling them to make data-driven decisions for better yields, reduced costs, and sustainable practices.

The market for AI in agriculture has experienced significant growth in recent years and is projected to continue expanding. Factors driving this growth include the increasing adoption of precision agriculture techniques, the need to meet the rising global demand for food, and the growing awareness of the importance of sustainability in farming practices. Additionally, advancements in AI technologies, such as edge computing and the Internet of Things (IoT), are making it easier and more cost-effective for farmers to implement AI solutions on their farms. As a result, the AI in agriculture market is attracting investment from both established companies and startups, with a wide range of innovative solutions being developed to address various challenges in the agricultural sector.

Global AI in Agriculture Market Trends

Market Drivers

- Increasing demand for precision agriculture techniques

- Growing global population necessitating higher food production

- Advancements in AI technologies like edge computing and IoT

- Rising awareness of sustainability in farming practices

- Government and organizational investments in agricultural AI initiatives

Market Restraints

- High initial implementation costs for AI technologies

- Limited access to AI infrastructure and expertise in rural areas

Market Opportunities

- Development of AI solutions for climate change adaptation in agriculture

- Expansion of AI applications in crop disease detection and management

AI in Agriculture Market Report Coverage

| Market | AI in Agriculture Market |

| AI in Agriculture Market Size 2022 | USD 1.7 Billion |

| AI in Agriculture Market Forecast 2032 |

USD 10.9 Billion |

| AI in Agriculture Market CAGR During 2023 - 2032 | 22.8% |

| AI in Agriculture Market Analysis Period | 2020 - 2032 |

| AI in Agriculture Market Base Year |

2022 |

| AI in Agriculture Market Forecast Data | 2023 - 2032 |

| Segments Covered | By Component, By Technology, By Application, And By Geography |

| Regional Scope | North America, Europe, Asia Pacific, Latin America, and Middle East & Africa |

| Key Companies Profiled | Ag Leader Technology, A.A.A Taranis Visual Ltd., AgEagle Aerial Systems Inc., Deere & Company, Bayer AG, Wipro Limited, Gamaya, International Business Machines Corporation, Granular Inc. (DuPont de Nemours, Inc.), Raven Industries Inc., Oracle Corporation, and Trimble Inc. |

| Report Coverage |

Market Trends, Drivers, Restraints, Competitive Analysis, Player Profiling, Covid-19 Analysis, Regulation Analysis |

AI in agriculture refers to the utilization of artificial intelligence technologies such as machine learning, computer vision, and data analytics to revolutionize various aspects of agricultural practices. These technologies enable farmers and agricultural stakeholders to collect, analyze, and interpret vast amounts of data related to crop health, soil conditions, weather patterns, and more. By leveraging AI algorithms, farmers can make informed decisions in real-time, optimizing resource allocation, enhancing productivity, and minimizing environmental impact. The applications of AI in agriculture are diverse and encompass every stage of the farming process. For instance, AI-powered drones and satellite imagery can provide detailed insights into crop growth and field conditions, allowing farmers to detect issues such as pest infestations or nutrient deficiencies early on. Machine learning algorithms can analyze historical data to predict crop yields, helping farmers plan their harvest and manage supply chains more efficiently.

The AI in agriculture market has been experiencing robust growth in recent years, driven by several key factors. One significant driver is the increasing demand for precision farming techniques, which utilize AI technologies to optimize crop management practices. By leveraging machine learning algorithms and data analytics, farmers can make more informed decisions regarding planting, irrigation, fertilization, and pest control, leading to higher yields and reduced resource wastage. Additionally, the growing global population and the need to produce more food with limited resources have spurred the adoption of AI in agriculture to improve productivity and efficiency. Furthermore, advancements in AI technologies, such as computer vision and remote sensing, are expanding the scope of applications in agriculture. These technologies enable farmers to monitor crop health, detect diseases and pests, and assess soil conditions with greater accuracy and efficiency.

AI in Agriculture Market Segmentation

The global AI in agriculture market segmentation is based on component, technology, application, and geography.

AI in Agriculture Market By Component

- Hardware

- Services

- Software

According to the AI in agriculture industry analysis, the software segment accounted for the largest market share in 2023. This growth is propelled by the increasing adoption of AI-powered solutions by farmers and agricultural enterprises worldwide. These software solutions encompass a wide range of applications, including crop monitoring, yield prediction, pest and disease detection, farm management, and supply chain optimization. By leveraging advanced algorithms and data analytics, AI software enables farmers to make data-driven decisions, optimize resource allocation, and improve productivity across various stages of the agricultural value chain. One key driver of the growth in the software segment is the rising demand for precision agriculture solutions. Precision agriculture relies heavily on AI software to analyze data from sensors, drones, satellites, and other sources to provide farmers with real-time insights into crop health, soil conditions, and environmental factors.

AI in Agriculture Market By Technology

- Machine Learning & Deep Learning

- Computer Vision

- Predictive Analytics

In terms of technologys, the predictive analytics segment is expected to witness significant growth in the coming years. Predictive analytics leverages historical data, machine learning algorithms, and statistical modeling techniques to analyze patterns and trends, enabling farmers to anticipate future outcomes and take proactive measures to mitigate risks. By providing insights into weather patterns, market trends, and crop performance, predictive analytics empowers farmers to make informed decisions regarding planting schedules, resource allocation, and crop management practices, ultimately leading to improved productivity and profitability. One key driver of the growth in the predictive analytics segment is the increasing adoption of precision agriculture practices. As farmers seek to maximize yields while minimizing input costs and environmental impact, there is a growing demand for predictive analytics solutions that can optimize resource allocation and improve farm efficiency.

AI in Agriculture Market By Application

- Precision Farming

- Livestock Monitoring

- Agriculture Robots

- Drone Analytics

- Others

According to the AI in agriculture market forecast, the precision farming segment is expected to witness significant growth in the coming years. Precision farming, also known as precision agriculture, involves the use of AI-powered solutions to precisely manage resources such as water, fertilizers, and pesticides, tailored to specific conditions within a farm. This approach enables farmers to maximize crop yields, minimize input costs, and reduce environmental impact by applying inputs only where and when they are needed most effectively. One significant driver of the growth in the precision farming segment is the rising demand for sustainable agriculture practices. With increasing pressure to produce more food to feed a growing global population while minimizing the environmental footprint of agriculture, farmers are turning to precision farming solutions to improve resource efficiency and reduce waste. AI-powered technologies, including machine learning algorithms and IoT sensors, enable farmers to collect and analyze data on soil conditions, weather patterns, and crop health, allowing for precise decision-making and targeted interventions to optimize yields while minimizing environmental impact.

AI in Agriculture Market Regional Outlook

North America

- U.S.

- Canada

Europe

- U.K.

- Germany

- France

- Spain

- Rest of Europe

Asia-Pacific

- India

- Japan

- China

- Australia

- South Korea

- Rest of Asia-Pacific

Latin America

- Brazil

- Mexico

- Rest of Latin America

The Middle East & Africa

- South Africa

- GCC Countries

- Rest of the Middle East & Africa (ME&A)

AI in Agriculture Market Regional Analysis

North America dominates the AI in agriculture market due to several key factors that contribute to its leadership position in the industry. North America is home to a large number of technologically advanced agricultural enterprises and research institutions that are driving innovation in AI and its applications in agriculture. With a strong emphasis on research and development, North American companies and institutions have been at the forefront of developing AI-powered solutions tailored to the unique needs and challenges of modern agriculture. Additionally, North America benefits from robust infrastructure and widespread adoption of digital technologies in the agriculture sector. The region has extensive coverage of high-speed internet and mobile networks, enabling seamless connectivity and data sharing across farms. This infrastructure facilitates the deployment of AI solutions, such as IoT sensors, drones, and satellite imagery, for real-time monitoring and analysis of agricultural systems. Moreover, North American farmers are increasingly recognizing the potential of AI to improve productivity, efficiency, and sustainability in farming practices, driving greater adoption of AI technologies across the region. Furthermore, supportive government policies and initiatives are contributing to the growth of the AI in agriculture market in North America.

AI in Agriculture Market Player

Some of the top AI in agriculture market companies offered in the professional report include Ag Leader Technology, A.A.A Taranis Visual Ltd., AgEagle Aerial Systems Inc., Deere & Company, Bayer AG, Wipro Limited, Gamaya, International Business Machines Corporation, Granular Inc. (DuPont de Nemours, Inc.), Raven Industries Inc., Oracle Corporation, and Trimble Inc.

Frequently Asked Questions

How big is the AI in agriculture market?

The AI in agriculture market size was USD 1.7 Billion in 2023.

What is the CAGR of the global AI in agriculture market from 2024 to 2032?

The CAGR of AI in agriculture is 22.8% during the analysis period of 2024 to 2032.

Which are the key players in the AI in agriculture market?

The key players operating in the global market are including Ag Leader Technology, A.A.A Taranis Visual Ltd., AgEagle Aerial Systems Inc., Deere & Company, Bayer AG, Wipro Limited, Gamaya, International Business Machines Corporation, Granular Inc. (DuPont de Nemours, Inc.), Raven Industries Inc., Oracle Corporation, and Trimble Inc.

Which region dominated the global AI in agriculture market share?

North America held the dominating position in AI in agriculture industry during the analysis period of 2024 to 2032.

Which region registered fastest CAGR from 2024 to 2032?

Asia-Pacific region exhibited fastest growing CAGR for market of AI in agriculture during the analysis period of 2024 to 2032.

What are the current trends and dynamics in the global AI in agriculture industry?

The current trends and dynamics in the AI in agriculture industry include increasing demand for precision agriculture techniques, growing global population necessitating higher food production, and advancements in AI technologies like edge computing and IoT.

Which technology held the maximum share in 2023?

The predictive analytics technology held the maximum share of the AI in agriculture industry.