Agricultural Robot Market Size - Global Industry, Share, Analysis, Trends and Forecast 2023 - 2032

Published :

Report ID:

Pages :

Format :

Agricultural Robot Market Size - Global Industry, Share, Analysis, Trends and Forecast 2023 - 2032

Report Coverage

- Industry Dynamics

- Market Size and Forecast Data

- Segment Analysis

- Competitive Landscape

- Regional Analysis with a Niche Focus on Country-Level Data

- High Level Analysis - Porter's, PESTEL, Value Chain, etc.

- Company Profiles of Key Players

- Option to Customize the Report As Per Your Specific Need

Request Sample Report

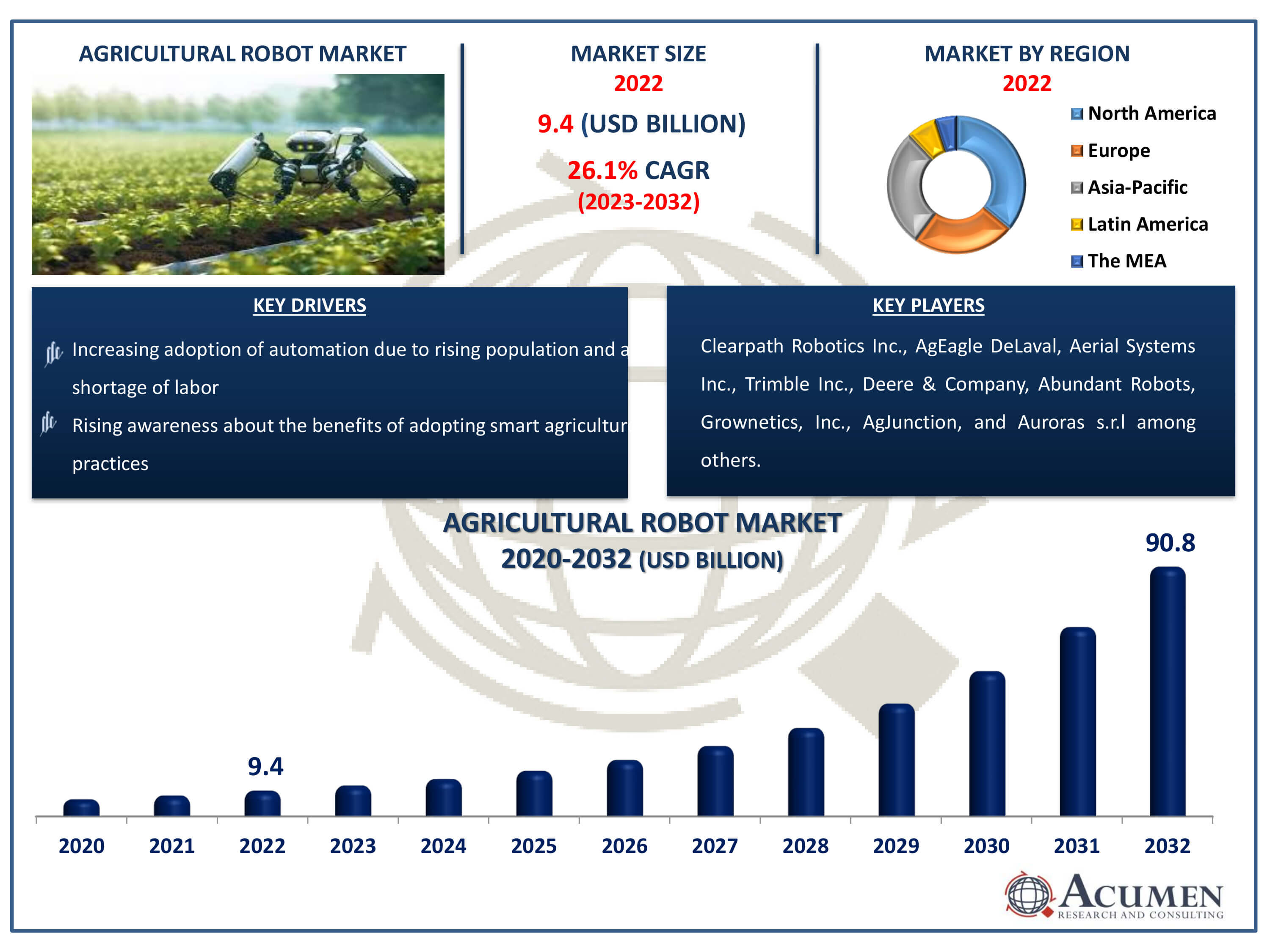

The Agricultural Robot Market Size accounted for USD 9.4 Billion in 2022 and is estimated to achieve a market size of USD 90.8 Billion by 2032 growing at a CAGR of 26.1% from 2023 to 2032.

Agricultural Robot Market Highlights

- Global agricultural robot market revenue is poised to garner USD 90.8 billion by 2032 with a CAGR of 26.1% from 2023 to 2032

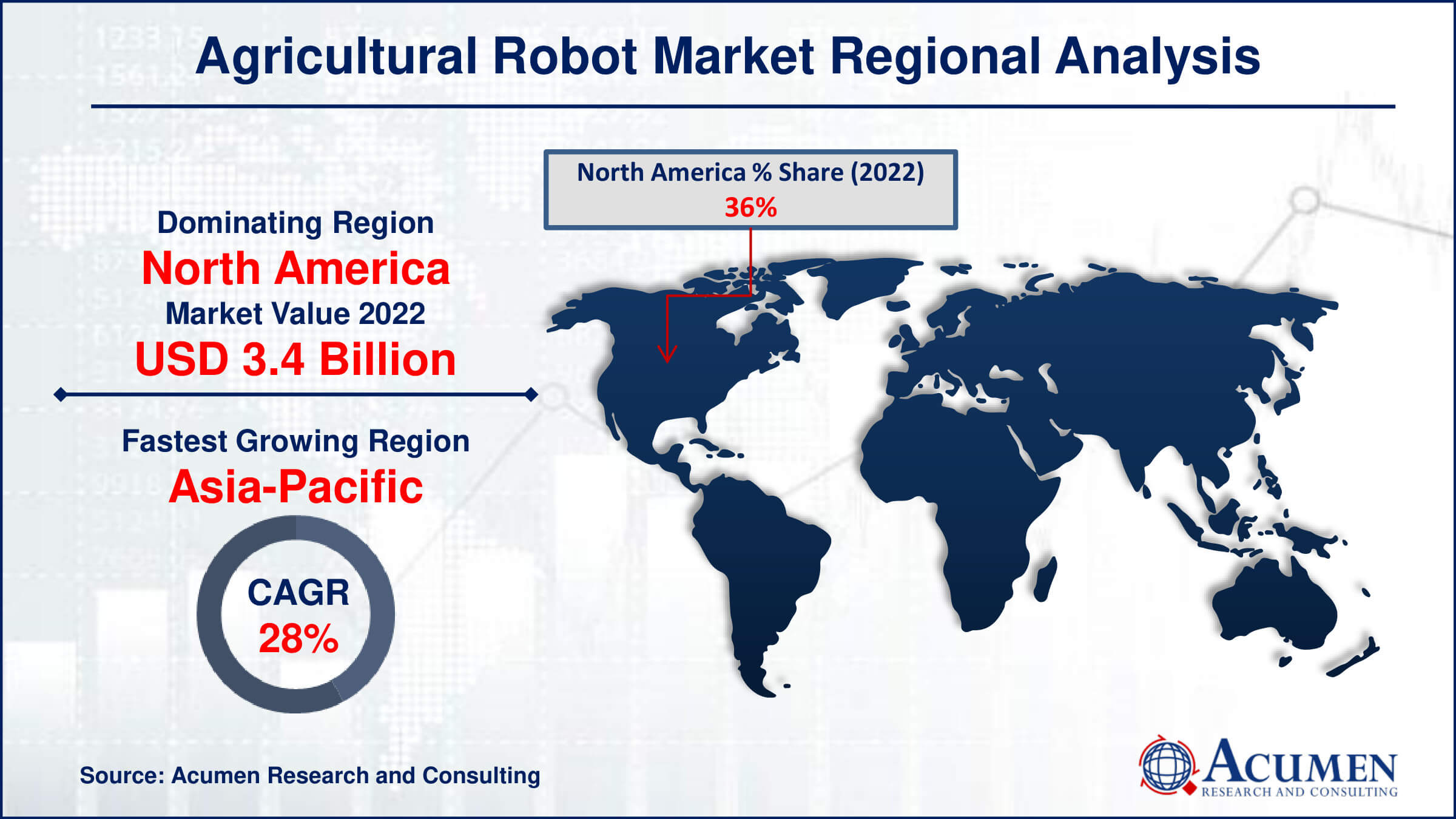

- North America agricultural robot market value occupied around USD 3.4 billion in 2022

- Asia-Pacific agricultural robot market growth will record a CAGR of more than 28% from 2023 to 2032

- Among end user, farm produce sub-segment generated USD 3.9 billion revenue in 2022

- Based on farming environment, outdoor sub-segment generated around 52% market share in 2022

- Increasing awareness about the benefits of adopting smart agriculture practices drives the market growth

Agricultural robots, which are meticulously built for farming purposes, require minimum human interaction. These machines play an important part in a variety of operations such as trimming, mowing, and spraying, meeting the pressing demand for efficient output in the modern agricultural period. One of the intrinsic advantages of these robots is their capacity to perform continuously around the clock, which contributes considerably to increased production. This continuous operation not only improves efficiency, but also assures that farming operations may be carried out at the best times, resulting in higher crop yields and better resource usage.

Global Agricultural Robot Market Dynamics

Market Drivers

- Increasing adoption of automation due to rising population and a shortage of labor

- Rising awareness about the benefits of adopting smart agriculture practices

- Growing interest in milking robots broadens the market's potential

Market Restraints

- Potential hazards linked to the use of AI-driven agricultural robots pose challenges

- Market expansion may face obstacles due to regulations surrounding data privacy

- High cost of agricultural robots

Market Opportunities

- Growing incorporation of AI technology into agricultural robots

- Increasing governmental efforts to promote new technologies

- Implementation of automated technologies

Agricultural Robot Market Report Coverage

| Market | Agricultural Robot Market |

| Agricultural Robot Market Size 2022 | USD 9.4 Billion |

| Agricultural Robot Market Forecast 2032 |

USD 90.8 Billion |

| Agricultural Robot Market CAGR During 2023 - 2032 | 26.1% |

| Agricultural Robot Market Analysis Period | 2020 - 2032 |

| Agricultural Robot Market Base Year |

2022 |

| Agricultural Robot Market Forecast Data | 2023 - 2032 |

| Segments Covered | By Type, By Farming Environment, And By Geography |

| Regional Scope | North America, Europe, Asia Pacific, Latin America, and Middle East & Africa |

| Key Companies Profiled | Clearpath Robotics Inc., AgEagle Aerial Systems Inc., Trimble Inc., Deere & Company, AgJunction, DeLaval, Abundant Robots, Grownetics, Inc., Auroras s.r.l., GAMAYA (Switzerland). |

| Report Coverage |

Market Trends, Drivers, Restraints, Competitive Analysis, Player Profiling, Covid-19 Analysis, Regulation Analysis |

Agricultural Robot Market Insights

The growing awareness among farmers about the benefits of smart agriculture is leading to higher adoption of agricultural robots. The integration of agricultural robots in smart farming practices not only enhances food production but also improves the overall quality of agricultural output. Key players have unveiled new technologies to enhance working conditions and soil improvement. For instance, in 2022, Naio Technologies unveiled the Orio agriculture robot at Ag Expo 2022. The Orio agriculture robot serves as an eco-friendly substitute for herbicides, contributing to enhanced working conditions, soil improvement, and data collection for smart farming practices. These factors collectively contribute to the market's growth throughout the forecast period.

Additionally, the rising interest in milking robots within the agricultural sector is expected to fuel the expansion of the agricultural robot market. These milking robots, alternatively known as voluntary and automatic milking systems, are designed for the extraction of milk from animals. Their implementation not only contributes to decreased labor costs but also leads to an augmented milk yield. The milking process facilitated by these machines typically lasts approximately 7 minutes.

The significant cost associated with implementing automation on small farms ranging from 10 to 1,000 acres is anticipated to pose a substantial obstacle, potentially impeding the growth of the agricultural robot market throughout the forecast period. To address this issue, key players launched a new model robot. For instance, in 2022, Verdant Robotics launched a Robot-as-a-Service (RaaS) model, aiming to provide easier access for specialty crop farmers seeking more profitable and sustainable cultivation methods. Verdant utilizes these tools to deliver improved results, including higher yields, larger crops, and substantial cost savings.

Additionally, the growing threats posed by the deployment of AI-based agricultural robots, including cyberattacks, worker exploitation, environmental risks, and exacerbation of the divide between subsistence and commercial farmers, could impede the market's growth. The increasing adoption of artificial intelligence (AI) in agricultural robots is expected to generate profitable opportunities for market growth. For instance, in 2021, Future Acres launched its first robot, Carry, specifically designed for picking grapes. Carry uses advanced technology called artificial intelligence (AI) to move hand-picked crops. This innovation aims to address the difficulties caused by a lack of labor, making the process more efficient.

Moreover, governments worldwide are taking actions and providing financial support to make farmers more aware of automated technologies. For instance, the European Union initiated projects like Robs4Crops in 2021, promoting the use of fully autonomous farming systems. Robs4Crops helps farmers cope with labor shortages, bringing positive changes to agriculture. This is expected to open up opportunities for the market and enhance the prospects of the agricultural robots market.

Agricultural Robot Market Segmentation

The worldwide market for agricultural robot is segmented into type, farming environment, end-user, and region.

Agricultural Robot Market by Type

- Milking Robot

- Unmanned Arial Vehicles (UAVs)

- Driverless Tractors

- Automated Harvesting Systems

- Other Robots

According to the agricultural robot market analysis, the market is divided into milking robots, unmanned aerial vehicles (UAVs), driverless tractors, automated harvesting systems, and other robots. The milking robot leads the agricultural robot industry because of its capacity to improve cost-efficiency through manpower optimization. Traditional milking methods are far more expensive, time-consuming, and demand more work. Furthermore, milking robots have the potential to boost milk output. For example, milking robots increase milk output while also making milk extraction easier. As a result of these factors, milk production increases. Overall, these novel systems will increase milk yield, enhance efficiency, and reduce costs, therefore expanding the agricultural robot industry.

Agricultural Robot Market by Farming Environment

- Indoor

- Outdoor

According to the agricultural robot market, there are two types of farming environments: indoor and outdoor. Outdoor farming is expected to dominate the agricultural robot market in the coming year, owing to the extensive area needs and demanding circumstances of outdoor farming. These robots excel at operations such as planting, spraying, harvesting, and weeding, allowing farmers to increase crop yields, cut labor costs, and improve pest and disease resistance.

Agricultural Robot Market by End User

- Farm Produce

- Dairy And Livestock

Based on the end-users, market is segmented into farm produce, and dairy and livestock. According to the agricultural robot market projection, farm produce will dominate the agricultural robot market in the near future. For example, Iron Ox describes it as "the world's first autonomous farm," with an 8,000-square-foot space that resembles a research laboratory rather than a conventional farm. Within this area, two cloud-connected robots cultivate a variety of leafy greens including romaine lettuce, bok choy, kale, butterhead lettuce, different herbs, and arugula.

Agricultural Robot Market Regional Outlook

North America

- U.S.

- Canada

Europe

- U.K.

- Germany

- France

- Spain

- Rest of Europe

Asia-Pacific

- India

- Japan

- China

- Australia

- South Korea

- Rest of Asia-Pacific

Latin America

- Brazil

- Mexico

- Rest of Latin America

The Middle East & Africa

- South Africa

- GCC Countries

- Rest of the Middle East & Africa (ME&A)

Agricultural Robot Market Regional Analysis

Based on regional analysis, the agricultural robot market is divided into North America, Europe, Asia Pacific, Latin America, the Middle East, and Africa. North America controls the agricultural robotics business. North America has evolved as a hugely significant market, thanks in great part to its vast farmlands. For example, the United States Agriculture Department announced in February 2022 that the average farm size in 2021 was 445 acres, slightly higher than the previous year's 444 acres. Managing such big farms manually is difficult and resource-intensive. To overcome this, North American farmers are relying on robotics and technology to streamline labor and boost agricultural yields.

Agricultural Robot Market Players

Some of the top agricultural robot market companies offered in our report include Clearpath Robotics Inc., AgEagle Aerial Systems Inc., Trimble Inc., Deere & Company, AgJunction, DeLaval, Abundant Robots, Grownetics, Inc., Auroras s.r.l., and GAMAYA among others.

Frequently Asked Questions

How big is the agricultural robot market?

The agricultural robot Market size was valued at USD 9.4 billion in 2022.

What is the CAGR of the global agricultural robot market from 2023 to 2032?

The CAGR of nerve repair and regeneration is 26.1% during the analysis period of 2023 to 2032.

Which are the key players in the agricultural robot market?

The key players operating in the global market are including Clearpath Robotics Inc., AgEagle Aerial Systems Inc., Trimble Inc., Deere & Company, AgJunction, DeLaval, Abundant Robots, Grownetics, Inc., Auroras s.r.l., and GAMAYA among others.

Which region dominated the global agricultural robot market share?

North America held the dominating position in the agricultural robot market analysis period of 2023 to 2032.

Which region registered fastest CAGR from 2023 to 2032?

Asia-Pacific region exhibited fastest growing CAGR for market of nerve repair and regeneration during the analysis period of 2023 to 2032.

What are the current trends and dynamics in the global nerve repair and regeneration industry?

The current trends and dynamics in the agricultural robot market are the increasing adoption of automation due to rising population and a shortage of labor, rising awareness about the benefits of adopting smart agriculture practices, and growing interest in milking robots broadens the market's potential.

Which segment dominates the market by type?

Milking robot segment dominate the agricultural robot market.