Agricultural Lubricant Market Size - Global Industry, Share, Analysis, Trends and Forecast 2023 - 2032

Published :

Report ID:

Pages :

Format :

Agricultural Lubricant Market Size - Global Industry, Share, Analysis, Trends and Forecast 2023 - 2032

Report Coverage

- Industry Dynamics

- Market Size and Forecast Data

- Segment Analysis

- Competitive Landscape

- Regional Analysis with a Niche Focus on Country-Level Data

- High Level Analysis - Porter's, PESTEL, Value Chain, etc.

- Company Profiles of Key Players

- Option to Customize the Report As Per Your Specific Need

Request Sample Report

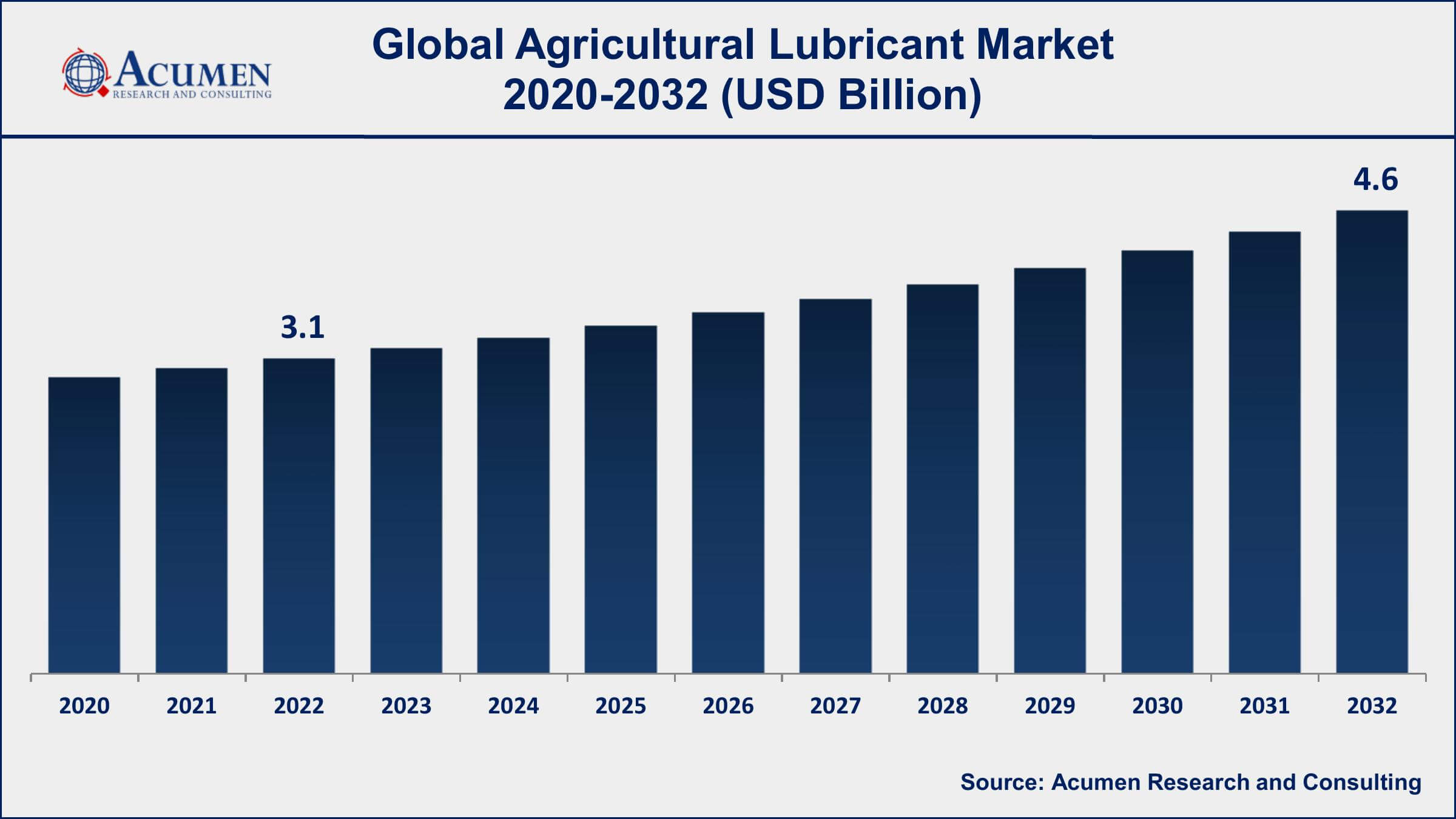

The Global Agricultural Lubricant Market Size accounted for USD 3.1 Billion in 2022 and is projected to achieve a market size of USD 4.6 Billion by 2032 growing at a CAGR of 4% from 2023 to 2032.

Agricultural Lubricant Market Key Highlights

- Global agricultural lubricant market revenue is expected to increase by USD 4.6 Billion by 2032, with a 4% CAGR from 2023 to 2032

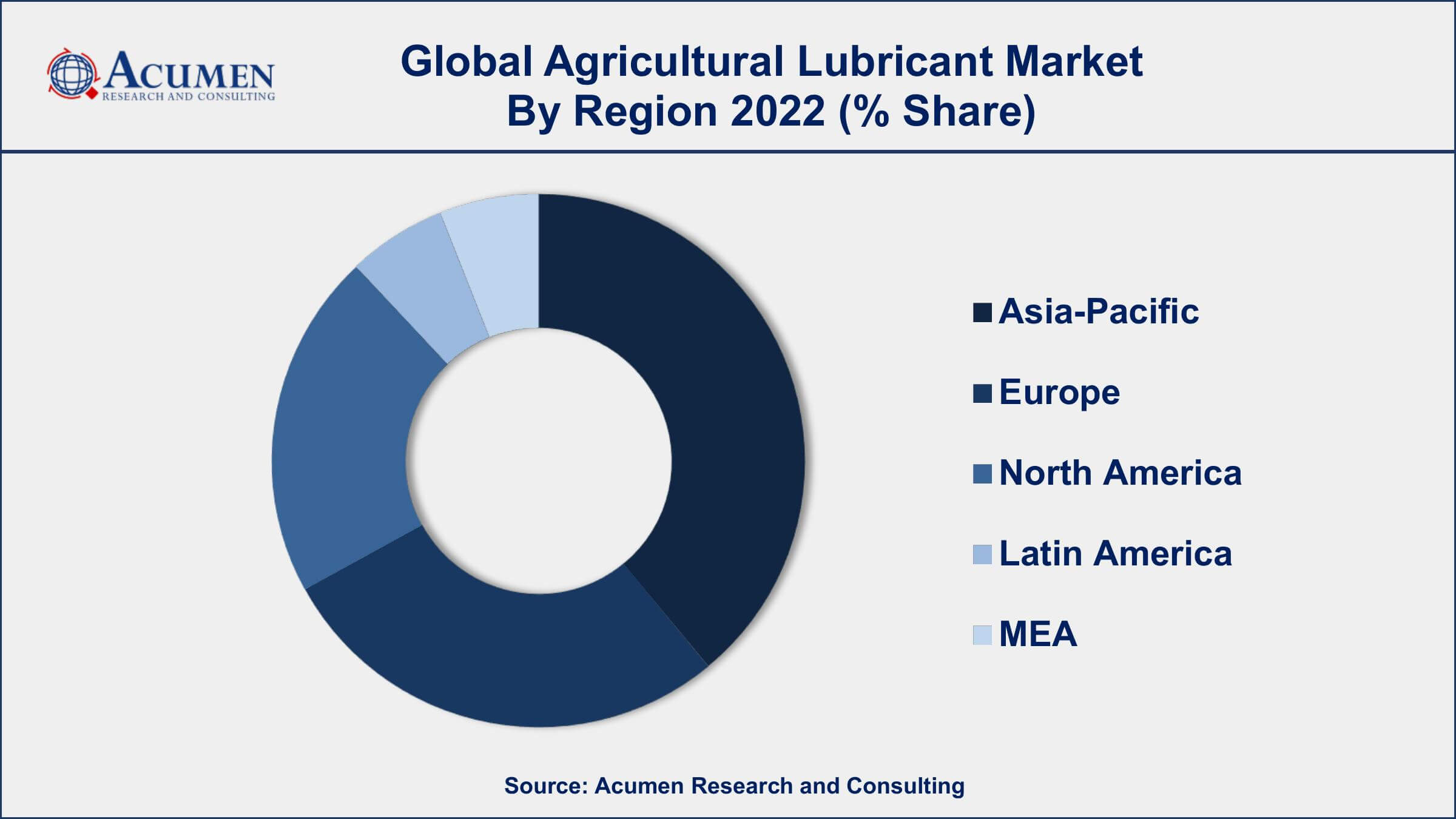

- Asia-Pacific region led with more than 45% of agricultural lubricant market share in 2022

- Europe agricultural lubricant market growth will record a CAGR of over 5% from 2023 to 2032

- By type, the mineral oil segment captured 49% of revenue share in 2022

- By application, the hydraulics segment is projected to grow at a CAGR of 4.7% from 2023 to 2032

- Increasing demand for food and expanding agricultural production, drives the agricultural lubricant market value

Agricultural lubricants are specially formulated oils and greases used to lubricate and protect machinery and equipment used in farming and agriculture. These lubricants play a vital role in maintaining the performance and lifespan of farming equipment such as tractors, harvesters, and irrigation systems. They are designed to withstand the harsh conditions of agricultural environments, including extreme temperatures, high humidity, dust, and dirt.

The agricultural lubricant market has experienced significant growth in recent years, driven by several factors. One of the main drivers is the increasing demand for food, which has led to an expansion in agricultural production and an increase in the use of farming equipment. As a result, there is a growing need for high-performance lubricants that can help to reduce downtime, lower maintenance costs, and improve overall equipment efficiency. Additionally, the increasing focus on sustainability and environmentally-friendly practices has led to the development of more eco-friendly lubricants that meet the stringent regulations set by various environmental agencies.

Global Agricultural Lubricant Market Trends

Market Drivers

- Increasing demand for food and expanding agricultural production

- Need for high-performance lubricants that reduce downtime and lower maintenance costs

- Technological advancements in farming equipment and machinery

- Increasing focus on sustainability and eco-friendliness

- Rising demand for bio-based lubricants

Market Restraints

- Fluctuating prices of crude oil, which affects the cost of lubricants

- Limited availability of raw materials for bio-based lubricants

Market Opportunities

- Growing adoption of precision farming techniques

- Increasing demand for synthetic lubricants

Agricultural Lubricant Market Report Coverage

| Market | Agricultural Lubricant Market |

| Agricultural Lubricant Market Size 2022 | USD 3.1 Billion |

| Agricultural Lubricant Market Forecast 2032 | USD 4.6 Billion |

| Agricultural Lubricant Market CAGR During 2023 - 2032 | 4% |

| Agricultural Lubricant Market Analysis Period | 2020 - 2032 |

| Agricultural Lubricant Market Base Year | 2022 |

| Agricultural Lubricant Market Forecast Data | 2023 - 2032 |

| Segments Covered | By Type, By Application, And By Geography |

| Regional Scope | North America, Europe, Asia Pacific, Latin America, and Middle East & Africa |

| Key Companies Profiled | ExxonMobil, Royal Dutch Shell, Chevron Corporation, Total S.A., BP p.l.c., Fuchs Petrolub SE, The Lubrizol Corporation, Phillips 66 Company, Petro-Canada Lubricants Inc., Idemitsu Kosan Co., Ltd., Renewable Lubricants Inc., and Schaeffer Manufacturing Co. |

| Report Coverage |

Market Trends, Drivers, Restraints, Competitive Analysis, Player Profiling, Covid-19 Analysis, Regulation Analysis |

A lubricant is a substance that is used to reduce abrasion or friction between two surfaces that are in contact with each other. It helps in the eradication of heat, and transition of power and is available in the liquid, solid, and gaseous states. They are also found in semisolid forms. Greases are one of the most common examples of lubricants in a semisolid state. Additives (5-30%) are added to lubricants to enhance their performance. Lubricants are used in agricultural equipment to increase productivity.

The decline in the availability of agricultural workers, leading to increased labor costs is the major driving factor for the agricultural lubricant market. Moreover, the growing focus on mechanization in the agricultural sector is also one of the factors augmenting the growth of the agricultural lubricants market. Also, the subsidies provided by the government for agricultural equipment boost the growth of the agricultural lubricants market. However, the high cost of bio-based lubricants is the major restraining factor for market growth. Nevertheless, the extensive possibility for the rise in farmhouse systematization in India and China provides major growth opportunities for manufacturers of agricultural lubricants.

Agricultural Lubricant Market Segmentation

The global agricultural lubricant market segmentation is based on type, application, and geography.

Agricultural Lubricant Market By Type

- Mineral Oil

- Bio-based

- Synthetic

In terms of types, the mineral oil segment is one of the largest and most established segments in the agricultural lubricant market. Mineral oil-based lubricants are derived from petroleum and are widely used in various applications due to their excellent lubricating properties and low cost. These lubricants are particularly suitable for heavy-duty applications in the agriculture sector, such as transmissions, hydraulic systems, and gearboxes. One of the main factors affecting the growth of the mineral oil segment is the increasing demand for bio-based and eco-friendly lubricants. This trend is driven by the growing awareness of environmental concerns and the need for sustainable practices. As a result, there is a shift towards the use of bio-based lubricants made from renewable resources such as vegetable oils, which are biodegradable and less harmful to the environment.

Agricultural Lubricant Market By Application

- Gears & Transmission

- Engines

- Hydraulics

- Implements

- Greasing

According to the agricultural lubricant market forecast, the hydraulics segment is expected to witness significant growth in the coming years. Hydraulic systems are widely used in agriculture, particularly in machinery such as tractors, combines, and sprayers. These systems require high-performance lubricants to ensure smooth operation, protect against wear and corrosion, and extend equipment life. The growth of the hydraulics segment in the agricultural lubricant market is driven by several factors. One of the main factors is the increasing use of hydraulic systems in modern farming equipment, which is driven by the need for greater efficiency and productivity. Additionally, the growing adoption of precision farming techniques, such as variable rate application and automated steering, requires advanced hydraulic systems that require high-performance lubricants to operate efficiently. Moreover, hydraulic fluids play a crucial role in the efficient operation of hydraulic systems, which is crucial for maximizing productivity in agricultural operations. Hence, there is an increasing demand for high-quality hydraulic fluids that provide excellent performance, longer service life, and better protection for the equipment.

Agricultural Lubricant Market Regional Outlook

North America

- U.S.

- Canada

Europe

- U.K.

- Germany

- France

- Spain

- Rest of Europe

Asia-Pacific

- India

- Japan

- China

- Australia

- South Korea

- Rest of Asia-Pacific

Latin America

- Brazil

- Mexico

- Rest of Latin America

The Middle East & Africa

- South Africa

- GCC Countries

- Rest of the Middle East & Africa (ME&A)

Agricultural Lubricant Market Regional Analysis

The Asia-Pacific region is dominating the agricultural lubricant market due to several factors. One of the main factors is the significant growth in the agriculture sector in this region, which is driven by the increasing demand for food and the growing population. The Asia-Pacific region is home to some of the world's most populous countries, such as China and India, which have large agricultural sectors that require lubricants for efficient operations. Moreover, the increasing adoption of modern farming techniques and equipment in the Asia-Pacific region is driving the demand for high-performance lubricants. These modern farming techniques require advanced lubricants that can operate efficiently in harsh and challenging environments, such as high temperatures, heavy loads, and dusty conditions. Furthermore, the Asia-Pacific region has a large number of lubricant manufacturers, which are focusing on product innovation and development to meet the specific requirements of the agriculture sector in the region.

Agricultural Lubricant Market Player

Some of the top agricultural lubricant market companies offered in the professional report include ExxonMobil, Royal Dutch Shell, Chevron Corporation, Total S.A., BP p.l.c., Fuchs Petrolub SE, The Lubrizol Corporation, Phillips 66 Company, Petro-Canada Lubricants Inc., Idemitsu Kosan Co., Ltd., Renewable Lubricants Inc., and Schaeffer Manufacturing Co.

Frequently Asked Questions

What was the market size of the global agricultural lubricant in 2022?

The market size of agricultural lubricant was USD 3.1 Billion in 2022.

What is the CAGR of the global agricultural lubricant market from 2023 to 2032?

The CAGR of agricultural lubricant is 4% during the analysis period of 2023 to 2032.

Which are the key players in the agricultural lubricant market?

The key players operating in the global market are including ExxonMobil, Royal Dutch Shell, Chevron Corporation, Total S.A., BP p.l.c., Fuchs Petrolub SE, The Lubrizol Corporation, Phillips 66 Company, Petro-Canada Lubricants Inc., Idemitsu Kosan Co., Ltd., Renewable Lubricants Inc., and Schaeffer Manufacturing Co.

Which region dominated the global agricultural lubricant market share?

Asia-Pacific held the dominating position in agricultural lubricant industry during the analysis period of 2023 to 2032.

Which region registered fastest CAGR from 2023 to 2032?

Europe region exhibited fastest growing CAGR for market of agricultural lubricant during the analysis period of 2023 to 2032.

What are the current trends and dynamics in the global agricultural lubricant industry?

The current trends and dynamics in the agricultural lubricant industry include increasing demand for food and expanding agricultural production, technological advancements in farming equipment and machinery, and rising adoption of bio-based lubricants.

Which type held the maximum share in 2022?

The mineral oil type held the maximum share of the agricultural lubricant industry.