Agricultural Drones Market Size - Global Industry, Share, Analysis, Trends and Forecast 2023 - 2032

Published :

Report ID:

Pages :

Format :

Agricultural Drones Market Size - Global Industry, Share, Analysis, Trends and Forecast 2023 - 2032

Report Coverage

- Industry Dynamics

- Market Size and Forecast Data

- Segment Analysis

- Competitive Landscape

- Regional Analysis with a Niche Focus on Country-Level Data

- High Level Analysis - Porter's, PESTEL, Value Chain, etc.

- Company Profiles of Key Players

- Option to Customize the Report As Per Your Specific Need

Request Sample Report

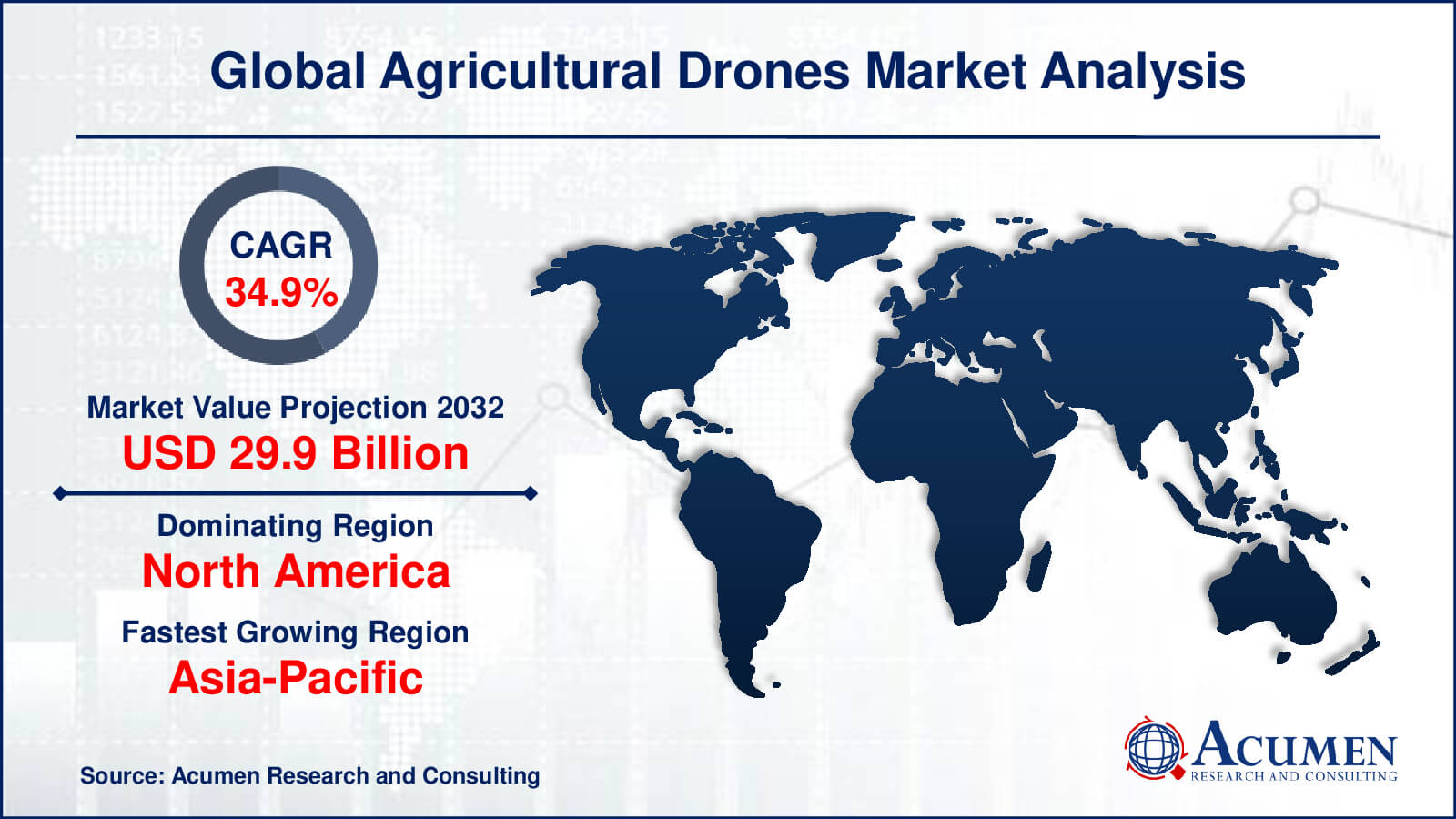

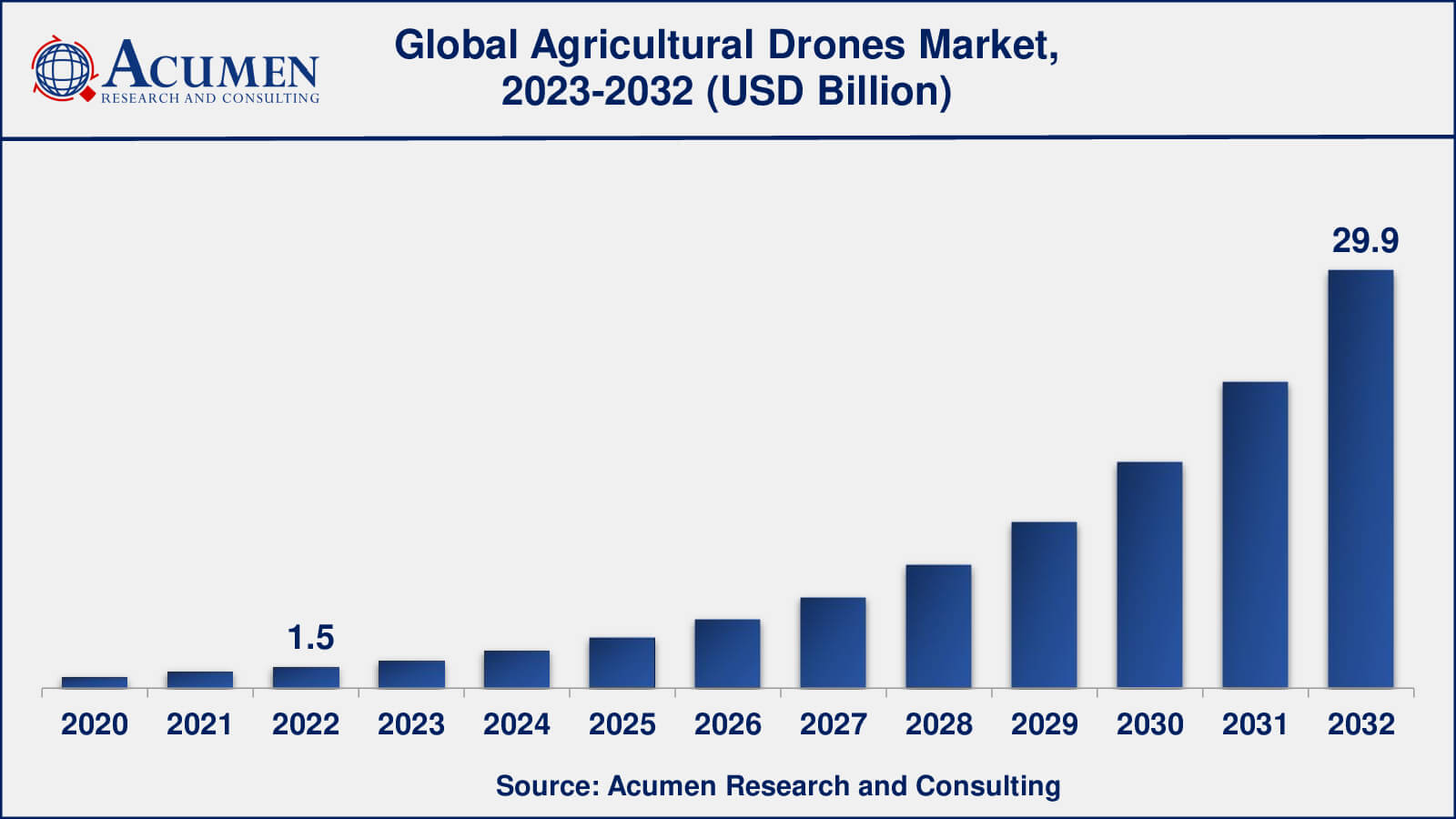

The Global Agricultural Drones Market Size collected USD 1.5 Billion in 2022 and is set to achieve a market size of USD 29.9 Billion in 2032 growing at a CAGR of 34.9% from 2023 to 2032.

Agricultural Drones Market Report Statistics

- Global agricultural drones market revenue is estimated to reach USD 29.9 billion by 2032 with a CAGR of 34.9% from 2023 to 2032

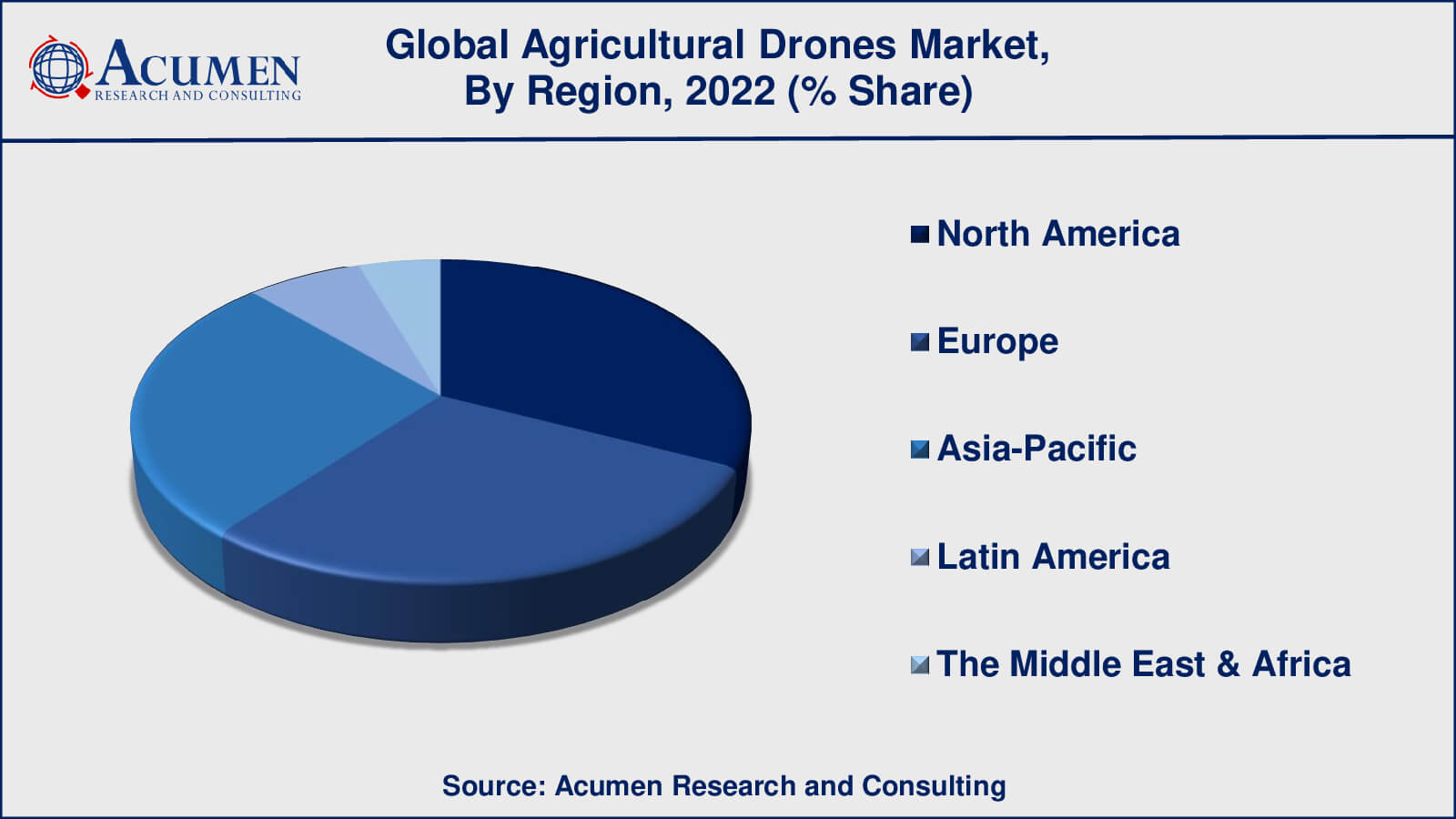

- North America agricultural drones market value occupied more than USD 17.7 billion in 2022

- Asia-Pacific agricultural drones market growth will record a CAGR of over 9% from 2023 to 2032

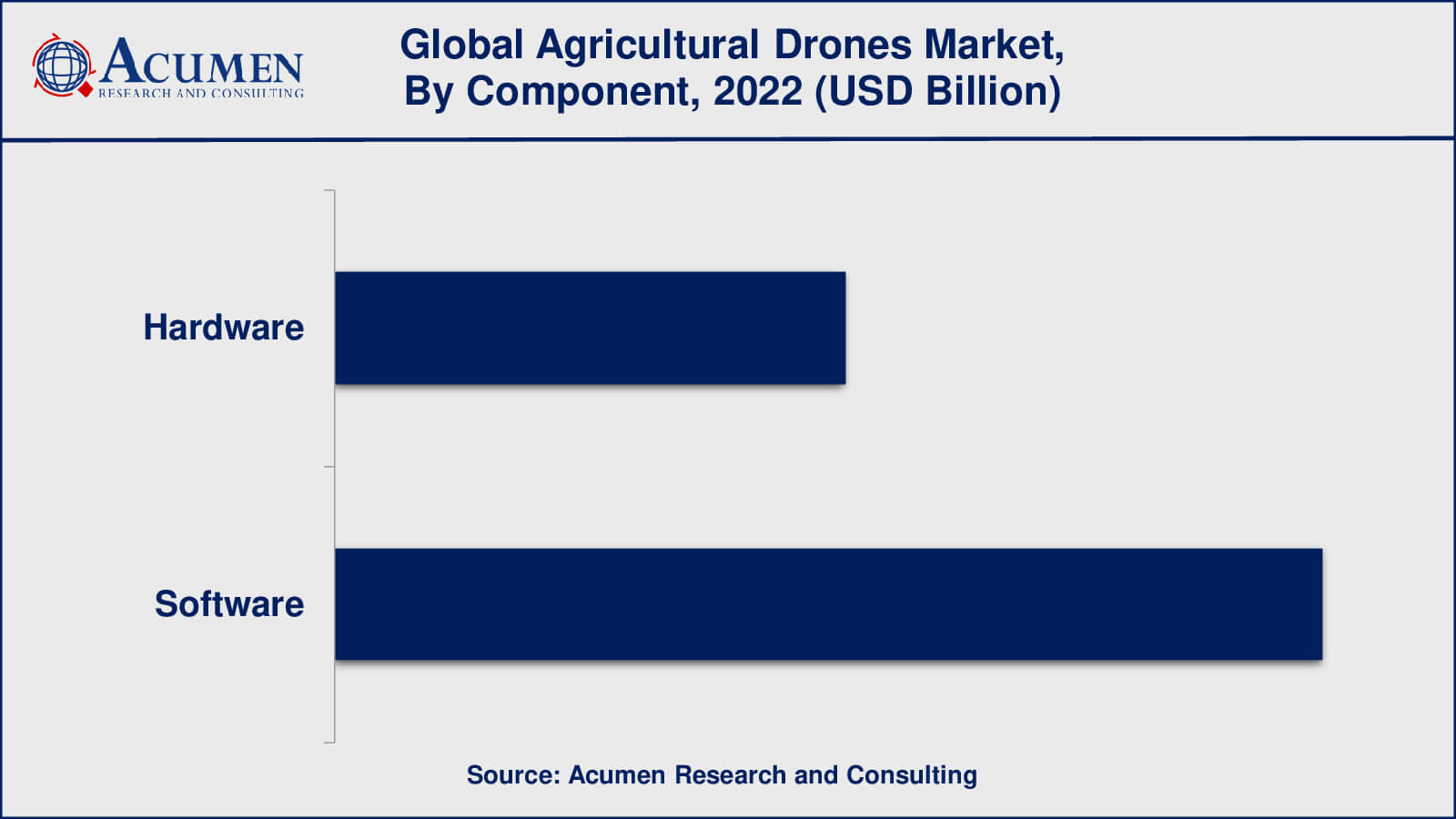

- Based on application, the hardware generated US $ 450 million revenue in 2022

- Among type, the rotary-wing sub-segment generated around 40% share in 2022

- Increasing interest in hybrid drones is a popular agricultural drones market trend that fuels the industry demand

Agricultural drones are on the verge of taking the place of workhorses in farm fields. With increasing focus on crop productivity in the farming sector, agricultural drones can act as key beneficial objects to achieve precise control of farm operations and monitoring as well as improved automation. Robots are already transforming the way of agriculture sector functioning. The advent of agricultural drones can take that change to the whole next level. Companies are quickly spotting the opportunities in the agricultural drone market and have lined up a variety of agricultural drones designed for specific tasks such as for those farmers who are looking to adopt advanced technology in their farming practices.

Global Agricultural Drones Market Dynamics

Market Drivers

- Increasing demand for food

- Advancements in drone technology

- Increasing focus on sustainability

- Government support

Market Restraints

- Limited flight time and payload capacity

- Security and privacy concerns

Market Opportunities

- Increasing demand for precision agriculture

- Surging environmental benefits

Agricultural Drones Market Report Coverage

| Market | Agricultural Drones Market |

| Agricultural Drones Market Size 2022 | USD 1.5 Billion |

| Agricultural Drones Market Forecast 2032 | USD 29.9 Billion |

| Agricultural Drones Market CAGR During 2023 - 2032 | 34.9% |

| Agricultural Drones Market Analysis Period | 2020 - 2032 |

| Agricultural Drones Market Base Year | 2022 |

| Agricultural Drones Market Forecast Data | 2023 - 2032 |

| Segments Covered | By Component, By Application, And By Geography |

| Regional Scope | North America, Europe, Asia Pacific, Latin America, and Middle East & Africa |

| Key Companies Profiled | DJI, Trimble Navigation Ltd., Agribotix, Autocopter Corp., Eagle UAV Services, URSULA Agriculture, Honeycomb Corp., Drone Deploy, AgEagle Aerial Systems Inc., Parrot SA, Yamaha Motor, Delair Tech, AeroVironment Inc., Precision Hawk, and 3DR. |

| Report Coverage |

Market Trends, Drivers, Restraints, Competitive Analysis, Player Profiling, Covid-19 Analysis, Regulation Analysis |

Agricultural Drones Market Growth Factors

The agricultural drones market has boarded the flight with manufacturers such as GoPro which announced the launch of agricultural drones in 2016. Several other e-commerce websites including eBay and Amazon have started supplying commercial drones and are projected to expand their product portfolio by including agricultural drones in the foreseeable months. Aerial drones are expected to account for a significant revenue generation in the global agricultural drone market. There are numerous applications of agricultural drones in a farm, some of which include improving the overall status quo. For instance, agricultural drones can be deployed for thermal imaging mechanisms to identify the patches which require more water or pesticides in a farm by furnishing exact information about specific sections of the farm which have distressed crops. Agricultural drones installed with infrared cameras can be used by farmers to determine the time when the farm is ready to harvest crops. Opportunities are just beginning to emerge in the global agricultural drone market and will only expand over the next decade. The use of drones is analyzed to increase the ability to monitor weather and farm conditions as per the reach of an average farmer, thereby propelling the confidence of stakeholders in the agricultural sector worldwide.

In developing countries such as China and India where farming and agriculture forms the backbone of the economy, various opportunities can be identified in the areas including insecticide and pesticide spraying, mapping, pest control, seeding, remote sensing, and thermal imaging. Besides drones ushering in the field of digital farming, agricultural drones are expected to create a huge sales and service market. The need for applications and software specifically designed for the agricultural sector is, in turn, anticipated to provide bright opportunities in the agriculture sector.

Agricultural Drones Market Segmentation

The worldwide agricultural drones market is categorized based on component, type, application, and geography.

Agricultural Drones Market By Component

- Hardware

- Frames

- Control System

- Propulsion System

- Navigation System

- Payload

- Avionics

- Others

- Software

- Imaging Software

- Data Management Software

- Data Analytics Software

- Others

According to the agricultural drones market forecast, in terms of application, hardware will dominate the agricultural drones market. The hardware component also includes the physical components of drones such as the drone itself, cameras, sensors, and other equipment. While hardware is critical to the operation of drones, it has not seen the same level of innovation and growth as software in recent years. The software component of agricultural drones, on the other hand, is constantly evolving, with new applications and tools being developed to meet the changing needs of farmers. For example, software applications that analyze crop data and make predictive recommendations using machine learning algorithms are becoming increasingly popular.

Agricultural Drones Market By Type

- Fixed-Wing

- Rotary-Wing

- Others

In 2021, rotary-wing dominated the largest market share in the type segment. Rotary-wing drones are more agile and maneuverable than fixed-wing drones, making them better suited for smaller farms and more confined areas, such as orchards and vineyards. They can take off and land vertically, which can be useful in areas where there is limited space or where takeoff and landing locations are restricted. Additionally, rotary-wing drones are well-suited for tasks such as crop spraying, which require precise control and maneuverability. Fixed-wing drones are typically larger and have a longer flight time than rotary-wing drones, making them well-suited for large-scale agricultural operations, such as crop mapping and surveying. They can cover more ground in a single flight and are generally more stable in windy conditions, which can be a significant advantage in open fields. As a result, fixed-wing drones are often used in precision agriculture applications, including crop mapping, yield estimation, and plant health assessment.

Agricultural Drones Market By Application

- Crop Monitoring

- Soil & Field Analysis

- Planting & Seeding

- Crop Spray

- Others

Crop monitoring, according to our agricultural drones industry analysis, is one of the most important and widely used applications for agricultural drones, accounting for the largest market share in the agricultural drones market. Crop monitoring entails the use of drones outfitted with sensors and cameras to collect data on crop health, growth, and yield, which can assist farmers in making more informed decisions about fertilization, irrigation, and pest control. Drones can take high-resolution aerial images of crops, which can then be analyzed with specialized software to identify areas of stress or disease. Drones can also collect data on soil moisture and temperature, allowing farmers to optimize irrigation and manage crop stress.

Agricultural Drones Market Regional Outlook

North America

- U.S.

- Canada

Europe

- U.K.

- Germany

- France

- Spain

- Rest of Europe

Asia-Pacific

- India

- Japan

- China

- Australia

- South Korea

- Rest of Asia-Pacific

Latin America

- Brazil

- Mexico

- Rest of Latin America

The Middle East & Africa

- South Africa

- GCC Countries

- Rest of the Middle East & Africa (ME&A)

Agricultural Drones Market Regional Analysis

In developing countries such as China and India where farming and agriculture forms the backbone of the economy, various opportunities can be identified in the areas including insecticide and pesticide spraying, mapping, pest control, seeding, remote sensing and thermal imaging. Besides drones ushering in the field of digital farming, agricultural drones are expected to create huge sales and service market. The need for applications and software specifically designed for the agricultural sector is, in turn, anticipated to provide bright opportunities in the agriculture sector.

Agricultural Drones Market Players

Some of the key players in the global agricultural drones market include 3DR, AeroVironment Inc., Agribotix, AgEagle Aerial Systems Inc., Autocopter Corp., Delair Tech, DJI, Drone Deploy, Eagle UAV Services, Honeycomb Corp, Parrot SA, Precision Hawk Trimble Navigation Ltd., URSULA Agriculture, and Yamaha Motor.

Frequently Asked Questions

How big is the agricultural drones market?

The agricultural drones market size was USD 1.5 Billion in 2022.

What is the CAGR of the global agricultural drones market during forecast period of 2023 to 2032?

The CAGR of agricultural drones market is 34.9% during the analysis period of 2023 to 2032.

Which are the key players operating in the market?

The key players operating in the global market are 3DR, AeroVironment Inc., Agribotix, AgEagle Aerial Systems Inc., Autocopter Corp., Delair Tech, DJI, Drone Deploy, Eagle UAV Services, Honeycomb CorpParrot SA, Precision Hawk Trimble Navigation Ltd., URSULA Agriculture, and Yamaha Motor.

Which region held the dominating position in the global agricultural drones market?

North America held the dominating position in agricultural drones market during the analysis period of 2023 to 2032.

Which region registered the fastest growing CAGR for the forecast period of 2023 to 2032?

Asia-Pacific region exhibited fastest growing CAGR for agricultural drones market during the analysis period of 2023 to 2032.

What are the current trends and dynamics in the global agricultural drones market?

The current trends and dynamics in the agricultural drones industry include increasing demand for food, advancements in drone technology, and government support.

Which component held the maximum share in 2022?

The hardware component held the maximum share of the agricultural drones market.