Agricultural Disinfectants Market | Acumen Research and Consulting

Agricultural Disinfectants Market Size - Global Industry, Share, Analysis, Trends and Forecast 2023 - 2032

Published :

Report ID:

Pages :

Format :

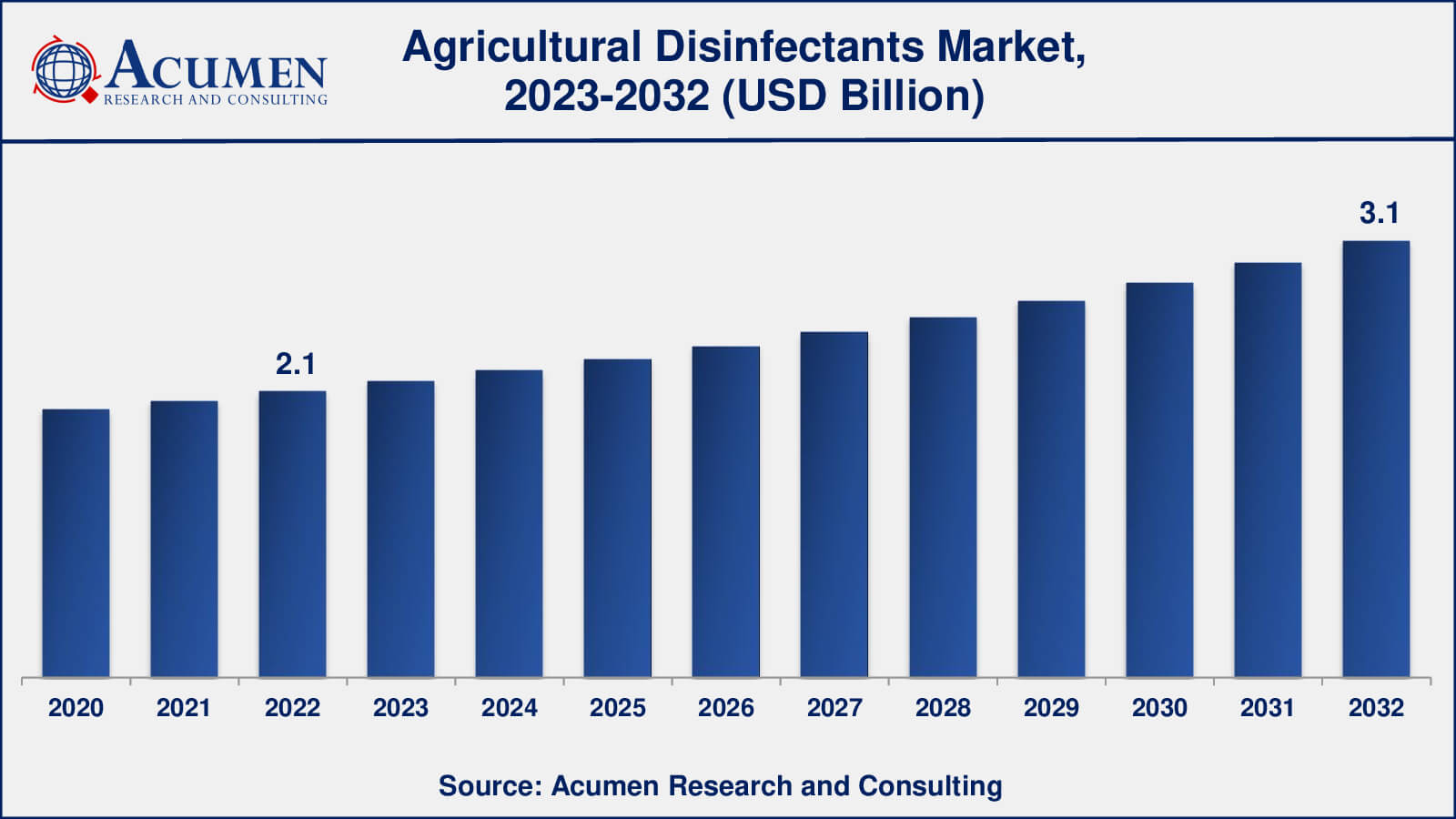

The Global Agricultural Disinfectants Market Size accounted for USD 2.1 Billion in 2022 and is estimated to achieve a market size of USD 3.1 Billion by 2032 growing at a CAGR of 4.4% from 2023 to 2032.

Agricultural Disinfectant Market Highlights

- Global agricultural disinfectants market revenue is poised to garner USD 3.1 billion by 2032 with a CAGR of 4.4% from 2023 to 2032

- North America agricultural disinfectants market value occupied around USD 16.1 billion in 2022

- Asia-Pacific agricultural disinfectants market growth will record a CAGR of more than 5% from 2023 to 2032

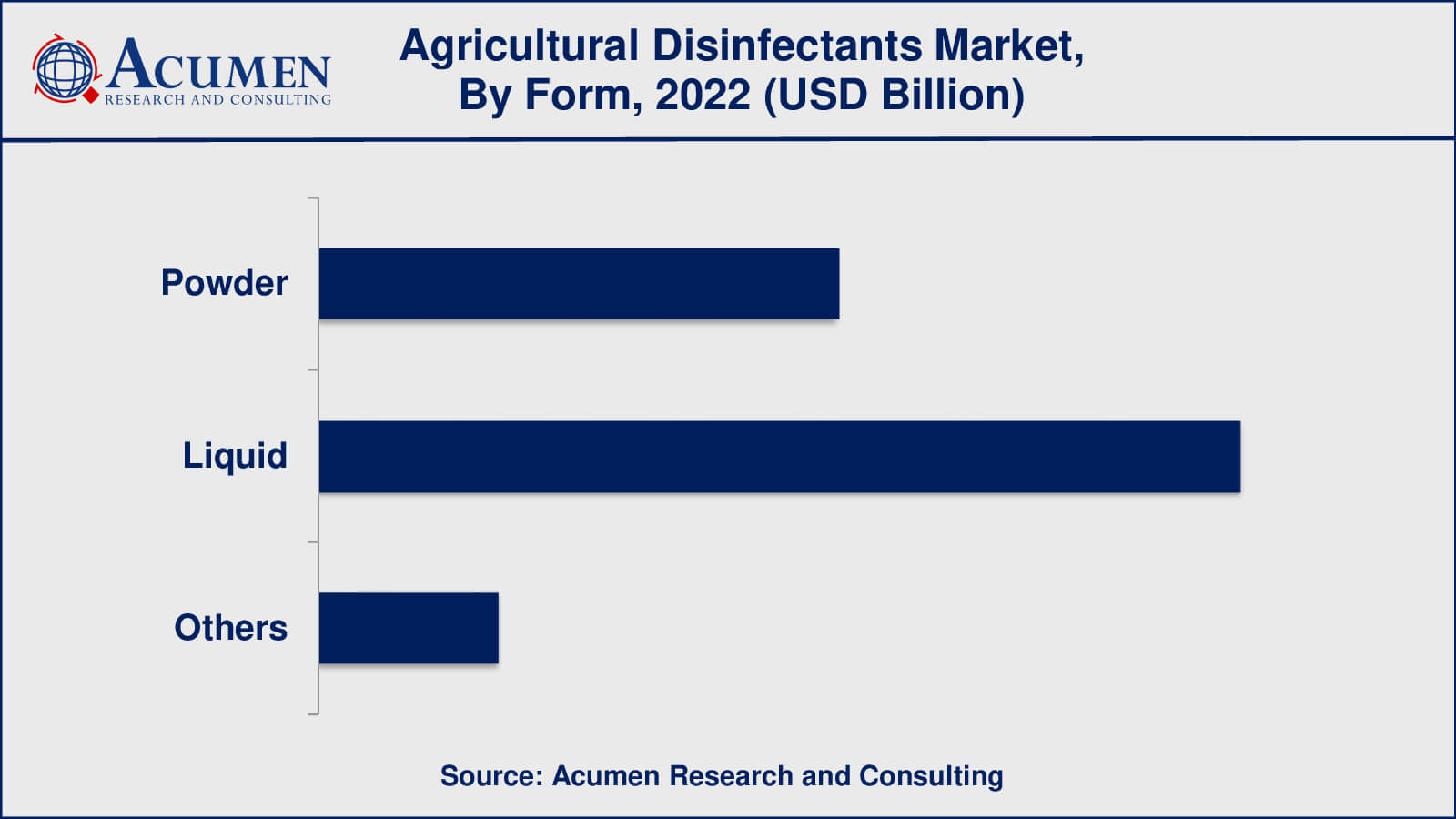

- Among form, the liquid sub-segment generated over US$ 1.17 billion revenue in 2022

- Based on application, the surface sub-segment generated around 45% share in 2022

- Stringent regulations promoting hygiene and disease control is a popular agricultural disinfectants market trend that fuels the industry demand

Disinfectants are products used to prevent infection by killing bacteria and inhibiting the growth of harmful microorganisms. Agricultural disinfectants are employed by farmers to enhance product quality and minimize infection risks. Livestock farmers use them on newborn animals, which are highly susceptible to infections. Additionally, agricultural farmers use these disinfectants to improve irrigation water quality. These disinfectants are available in various forms, including powders, liquids, and others. They are utilized to enhance both plant and animal health, promoting overall well-being.

Global Agricultural Disinfectants Market Dynamics

Market Drivers

- Increasing need to safeguard crops from pests and diseases

- Growing consumer demand for safe and contamination-free food

- The emergence of greenhouse vegetable production and vertical farming

- Ban of antibiotics in animal feed

Market Restraints

- Lack of awareness and low adoption rate

- Economic constraints for small-scale farmers

- Negative impact of disinfectants

Market Opportunities

- Rising interest in eco-friendly options

- Incorporation of automation and IoT

- Developing countries expected to witness strong demand

- Growth in the occurrence of disease outbursts among livestock

Agricultural Disinfectants Market Report Coverage

| Market | Agricultural Disinfectants Market |

| Agricultural Disinfectants Market Size 2022 | USD 2.1 Billion |

| Agricultural Disinfectants Market Forecast 2032 | USD 3.1 Billion |

| Agricultural Disinfectants Market CAGR During 2023 - 2032 | 4.4% |

| Agricultural Disinfectants Market Analysis Period | 2020 - 2032 |

| Agricultural Disinfectants Market Base Year | 2022 |

| Agricultural Disinfectants Market Forecast Data | 2023 - 2032 |

| Segments Covered | By Type, By Form, By Application, By End-User, And By Geography |

| Regional Scope | North America, Europe, Asia Pacific, Latin America, and Middle East & Africa |

| Key Companies Profiled | Entaco NV, FINK TEC GmbH, Neogen Corporation, Nufarm Limited, Quat-Chem Ltd., Safechem, Stepan Company, Thymox Technology, The Chemours Company, The Dow Chemical Company, and Zoetis. |

| Report Coverage |

Market Trends, Drivers, Restraints, Competitive Analysis, Player Profiling, Covid-19 Analysis, Regulation Analysis |

Agricultural Disinfectants Market Insights

The global agricultural disinfectants market size is primarily driven by the continuous rise of various infectious diseases. The rapidly increasing population is driving the demand for high agricultural productivity, and there is a growing awareness among people regarding the importance of agricultural disinfectants. A variety of disinfectants are available in the market. Among these, quaternary ammonium compounds and phenols are the most widely used types of chemicals, holding a leading share in the market.

Moreover, the deterioration of water quality and environmental constraints are further increasing the need for agricultural disinfectants, ultimately driving market growth. The rising demand for meat products and strict rules and regulations for the use of antibiotics in animal feed have supported the growth of the agricultural disinfectants market. In the near future, organic agricultural disinfectants are likely to create opportunities for the agricultural disinfectants market.

On the other hand, health hazards caused by agricultural disinfectants and environmental issues may slow market growth.

Agricultural Disinfectants Market Segmentation

The worldwide market for agricultural disinfectants is split based on type, form, application, end-user, and geography.

Agricultural Disinfectant Types

- Hypochlorites & halogens

- Quaternary ammonium compounds & phenols

- Oxidizing agents & aldehydes

- Others

Based on the type segment, the market is categorized into hypochlorites & halogens, quaternary ammonium compounds & phenols, oxidizing agents & aldehydes, and other types. According to the Agricultural Disinfectant industry analysis, quaternary ammonium compounds & phenols have held the largest share in the type segment in recent years. Moreover, this segment is expected to be the fastest-growing during the forecast period. It finds applications in water purification, textiles, and more due to its bacteria-killing qualities. Quaternary ammonium compounds & phenols offer several benefits such as being non-toxic, effective, non-irritating, preventing regrowth, and having no odor or flavor. Additionally, they are available at a low price. The oxidizing agents & aldehydes segment is projected to experience significant growth during the forecast period.

Agricultural Disinfectant Forms

- Powder

- Liquid

- Others

According to the agricultural disinfectant market, the form segment is divided into powder, liquid, and other forms. Within the Form segment, the liquid category emerged as the leader in terms of revenue share in previous years. This segment is easy to use and is available at a low cost compared to others. Due to these factors, the segment is expected to dominate the market throughout the forecast period. Liquid-based agricultural disinfectants are mainly used to improve crop production in agricultural fields. Hence, the market is expected to rise in this segment in the near future.

Agricultural Disinfectant Applications

- Surface

- Water sanitizing

- Aerial

- Others

In terms of the application segment, the market is categorized into surface, water sanitizing, aerial, and other applications. The water sanitizing segment accounts for the largest share of the market, primarily utilized to improve water quality. This market is mainly used for cleaning surfaces, aerial areas, and water sanitizing. In aerial applications, agricultural disinfectants are employed to reduce dust and microbes. Moreover, agricultural disinfectants are used on surfaces to remove microbes or any organic matter. This factor is expected to drive the growth of the segment in the coming years.

Agricultural Disinfectant End-Users

- Agricultural Farms

- Livestock Farms

On the basis of end-users, the agricultural disinfectant market includes agricultural farms and livestock farms. According to the Agricultural Disinfectant market forecast, the livestock farms segment has dominated the market share and is likely to continue its dominance throughout the forecasted timeframe from 2023 to 2032. There are always concerns and awareness in livestock farms due to rising diseases in barns, pens for lambing, calving, weaning, and animal housing. Newborn and young animals, as well as pregnant animals, can easily get infected due to their weak immune systems. These factors are expected to contribute to the growth of the market.

Agricultural Disinfectants Market Regional Outlook

North America

- U.S.

- Canada

Europe

- U.K.

- Germany

- France

- Spain

- Rest of Europe

Asia-Pacific

- India

- Japan

- China

- Australia

- South Korea

- Rest of Asia-Pacific

Latin America

- Brazil

- Mexico

- Rest of Latin America

The Middle East & Africa

- South Africa

- GCC Countries

- Rest of the Middle East & Africa (ME&A)

Agricultural Disinfectants Market Regional Analysis

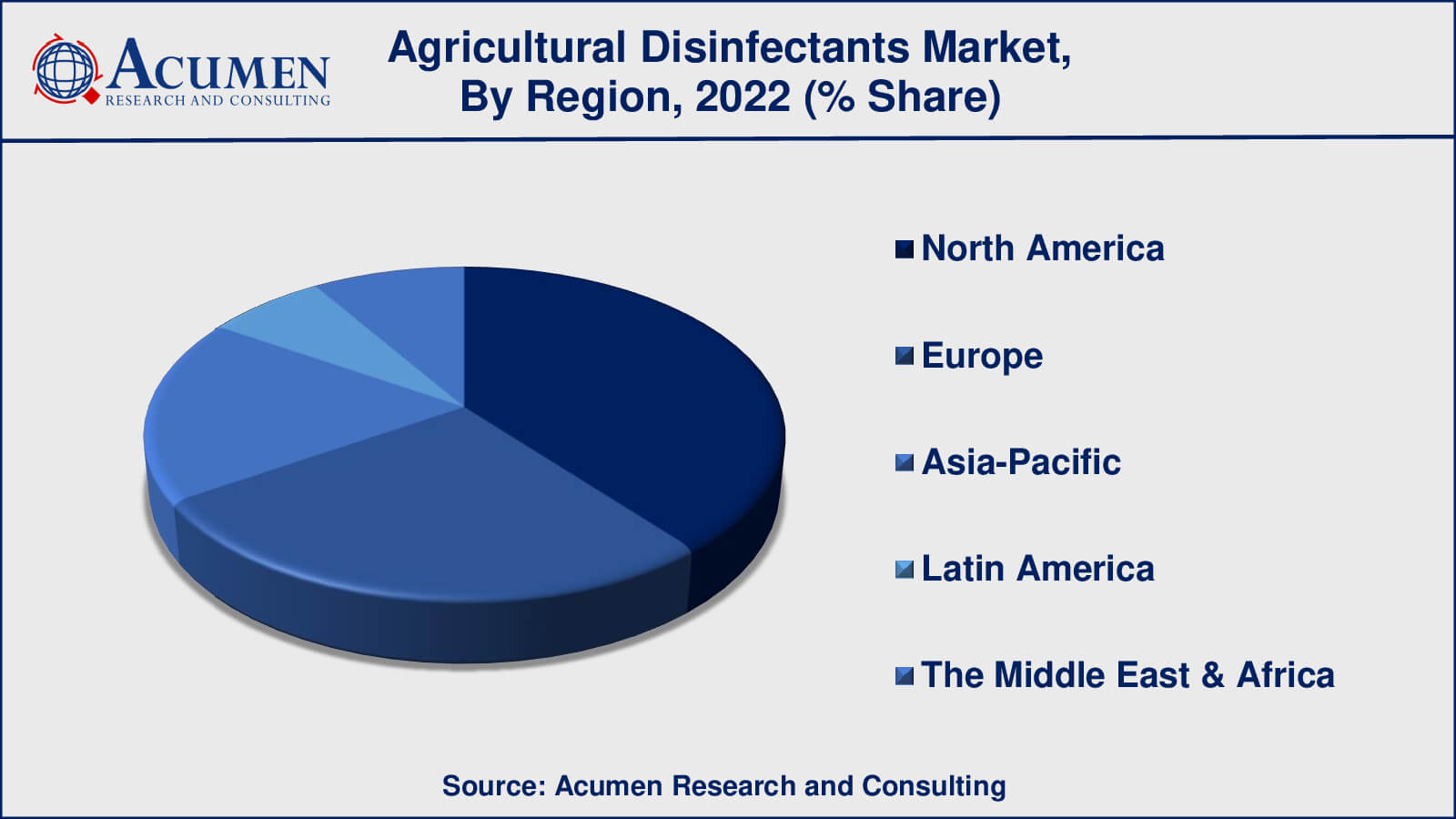

By geography, the global agricultural disinfectants market is segmented into North America, Europe, Asia Pacific, and Latin America, Middle East & Africa.

North America is expected to command the major share in the market, followed by Europe, owing to the increasing prevalence of livestock diseases, strict regulatory rules, and growing awareness among the people.

Europe accounts for the second position in the market, and its growth is mainly driven by increasing government support, significant awareness about various diseases, and high spending on safety. France, with a large number of agricultural fields, captures the dominant share in the European market. The increasing attention in Germany regarding the importance of crop and livestock protection is likely to support the agricultural disinfectant market in this region.

Asia-Pacific is anticipated to grow gradually over the forecast period owing to the rising need for meat products, increasing awareness among the population, and rising per capita income. Moreover, increasing government support and various awareness programs run by organizations are expected to boost the growth of the agricultural disinfectant market in this region.

On the other hand, LAMEA holds the least share in the growing market. Increasing awareness among the people and the rising prevalence of various livestock diseases have boosted the growth of the market.

Agricultural Disinfectants Market Players

Some of the top agricultural disinfectant companies offered in our report include Entaco NV, FINK TEC GmbH, Neogen Corporation, Nufarm Limited, Quat-Chem Ltd., Safechem, Stepan Company, Thymox Technology, The Chemours Company, The Dow Chemical Company, and Zoetis.

Frequently Asked Questions

What was the market size of the global agricultural disinfectants in 2022?

The market size of agricultural disinfectants was USD 2.1 Billion in 2022.

What is the CAGR of the global agricultural disinfectants market from 2023 to 2032?

The CAGR of agricultural disinfectants is 4.4% during the analysis period of 2023 to 2032.

Which are the key players in the agricultural disinfectants market?

The key players operating in the global market are including Entaco NV, FINK TEC GmbH, Neogen Corporation, Nufarm Limited, Quat-Chem Ltd., Safechem, Stepan Company, Thymox Technology, The Chemours Company, The Dow Chemical Company, and Zoetis.

Which region dominated the global agricultural disinfectants market share?

North America held the dominating position in agricultural disinfectants industry during the analysis period of 2023 to 2032.

Which region registered fastest CAGR from 2023 to 2032?

Asia-Pacific region exhibited fastest growing CAGR for market of agricultural disinfectants during the analysis period of 2023 to 2032.

What are the current trends and dynamics in the global agricultural disinfectants industry?

The current trends and dynamics in the agricultural disinfectants industry include increasing need to safeguard crops from pests and diseases, growing consumer demand for safe and contamination-free food, and emergence of greenhouse vegetable production and vertical farming.

Which type held the maximum share in 2022?

The liquid type held the maximum share of the agricultural disinfectants industry.