Agricultural And Farm Machinery Market | Acumen Research and Consulting

Agricultural and Farm Machinery Market Size - Global Industry, Share, Analysis, Trends and Forecast 2023 - 2032

Published :

Report ID:

Pages :

Format :

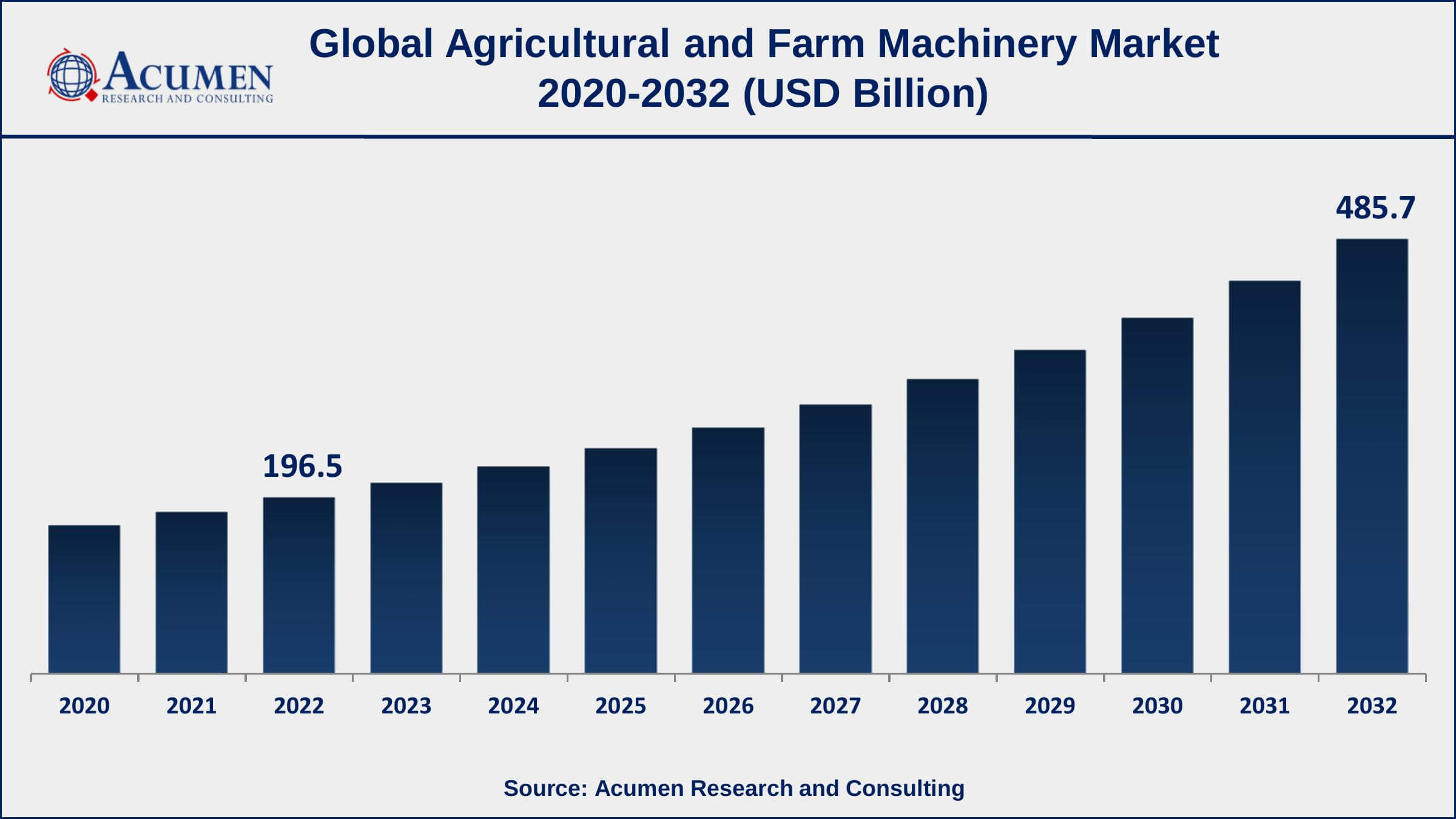

The Global Agricultural and Farm Machinery Market Size accounted for USD 196.5 Billion in 2022 and is projected to achieve a market size of USD 485.7 Billion by 2032 growing at a CAGR of 8.6% from 2023 to 2032. The agricultural and farm machinery market has been growing in recent years, driven by increasing demand for food and other agricultural products, advances in technology, and a growing population. The use of modern and efficient machinery in farming has led to higher productivity and profitability, making it a critical component of the agriculture industry. With the increasing trend toward precision agriculture, the market for advanced farm machineries, such as GPS-controlled tractors, drones, and autonomous vehicles, is expected to grow in the coming years. Additionally, increasing demand for biofuels and the growing popularity of organic farming are also driving growth in the agricultural machinery market value.

Agricultural and Farm Machinery Market Report Key Highlights

- Global agricultural and farm machinery market revenue is expected to increase by USD 485.7 Billion by 2032, with a 8.6% CAGR from 2023 to 2032

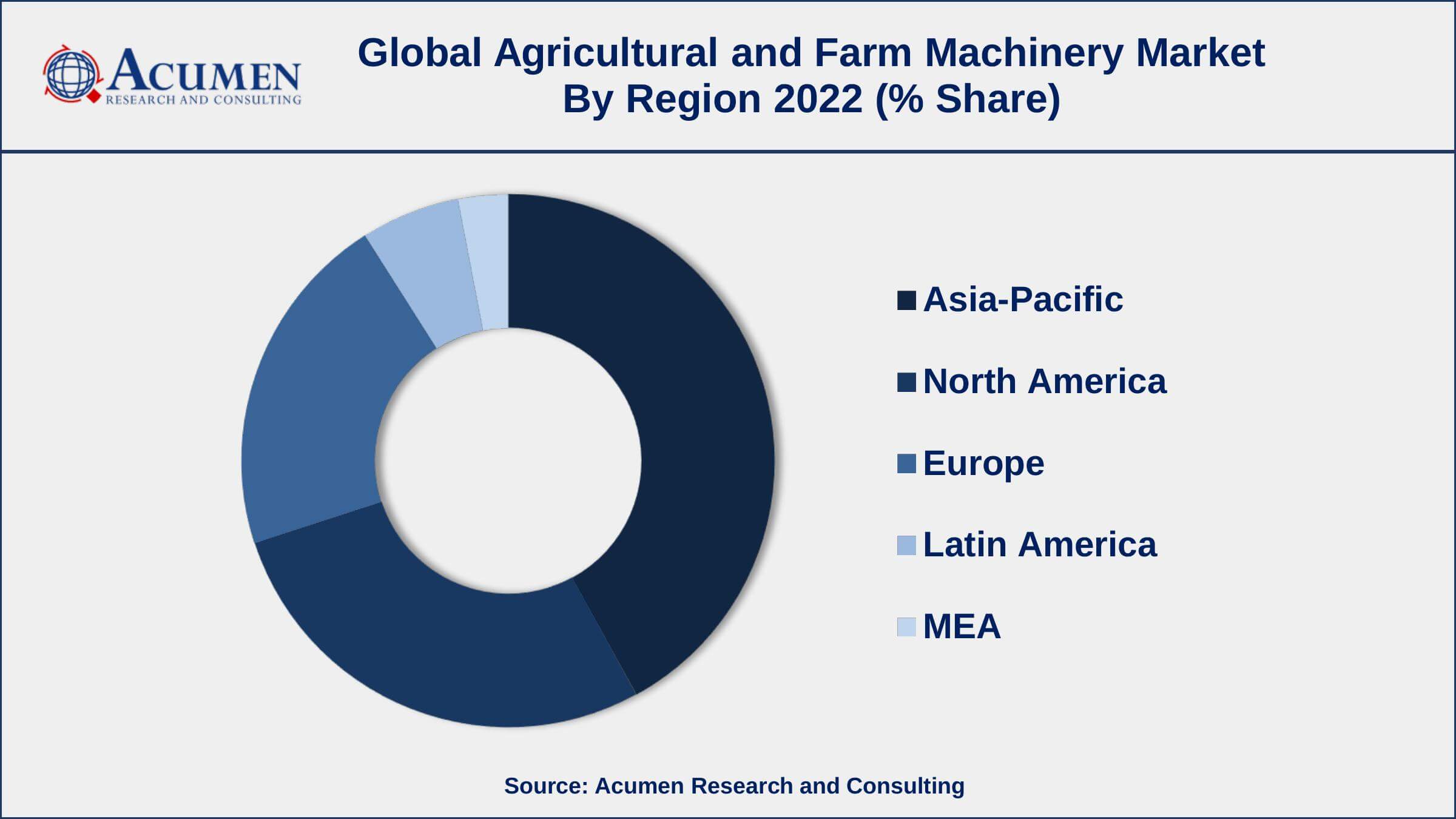

- Asia-Pacific region led with more than 42% of agricultural and farm machinery market share in 2022

- In 2020, the U.S. Department of Agriculture allocated $5.5 billion in aid to farmers affected by the COVID-19 pandemic

- Tractors are the most widely used type of farm machinery, accounting for over 50% of the global market share

- In 2020, the demand for combine harvesters increased due to the growth in global food production.

- In Europe, the use of tractors has increased due to the rise in demand for biofuel crops such as sugar beet and corn.

- Increasing demand for food to feed a growing global population, drives the agricultural and farm machinery market size

Agriculture and farm machinery comprise machinery and tools required by farmers to increase agricultural productivity and can be used in agricultural farmlands. Agriculture and farm machinery products include harvesting machinery, tractors, cultivators, and plowers which are deployed for several purposes such as tilling, plowing, disking, and harvesting among others. The increased mechanization of technologies in agriculture has resolved a lot of problems regarding farming such as wastage of energy and time as well as the scarcity of labor. Increasing technological advancements in the design of agricultural machinery have improved the overall output efficiency of farmers and are a key aspect fuelling the demand for farm machinery. Various advancements in the manufacturing of tractors such as the incorporation of telemetry and GPS devices for tracking the location of tractors are another key trend being followed in the global agricultural and farm machinery market.

Global Agricultural and Farm Machinery Market Trends

Market Drivers

- Increasing demand for food

- Growing popularity of precision agriculture

- Government support to purchase and use of modern and efficient farm machinery

- Technological advancements in farming equipment

Market Restraints

- High cost of farm machinery

- Limited availability of skilled operators

Market Opportunities

- Growing popularity of organic farming

- Growing demand for biofuels

Agricultural and Farm Machinery Market Report Coverage

| Market | Agricultural and Farm Machinery Market |

| Agricultural and Farm Machinery Market Size 2022 | USD 196.5 Billion |

| Agricultural and Farm Machinery Market Forecast 2032 | USD 485.7 Billion |

| Agricultural and Farm Machinery Market CAGR During 2023 - 2032 | 8.6% |

| Agricultural and Farm Machinery Market Analysis Period | 2020 - 2032 |

| Agricultural and Farm Machinery Market Base Year | 2022 |

| Agricultural and Farm Machinery Market Forecast Data | 2023 - 2032 |

| Segments Covered | By Equipment Type, By Application, And By Geography |

| Regional Scope | North America, Europe, Asia Pacific, Latin America, and Middle East & Africa |

| Key Companies Profiled | John Deere, CNH Industrial, AGCO Corporation, Kubota Corporation, Mahindra & Mahindra Ltd., Claas KGaA mbH, Yanmar Co., Ltd., SDF Group, and Iseki & Co., Ltd. |

| Report Coverage |

Market Trends, Drivers, Restraints, Competitive Analysis, Player Profiling, Covid-19 Analysis, Regulation Analysis |

An increase in demand for harvesting machinery and farm tractors is projected to fuel the overall market to grow since the aforementioned machinery is used for several purposes such as plowing, harrowing, planting, and tilling. Rising awareness towards the use of high-end technology in agriculture to maximize output is helping in increasing profit margins for farmers. Moreover, the increasing population across the globe is, in turn, increasing the consumption of food which is posing heightened pressure to increase food production. Since agriculture and farm machinery boost the efficacy of food production. Increasing depreciation in agricultural land and modernization are some other factors accelerating global agriculture and farm machinery market growth. In addition, the incorporation of self-driven mechanisms, GPS systems, and monitoring systems aids in allowing the efficient and precise use of material and enhancing fuel economy.

Various multinational players are showing interest in investing huge funds, especially in emerging economies to expand their facilities worldwide. The governments of developing countries like India, China, Indonesia, Germany, and Brazil are focusing on escalating the introduction of subsidies on farm machinery to promote mechanization in farming and agriculture. Furthermore, other companies are manufacturing low-power tractors at affordable prices for small-scale consumers. In 2013, a tractor multinational company, John Deere launched the 5E and 4M tractors series to facilitate the needs of small-scale farmers.

Some major factors driving the growth of the global agriculture and farm machinery market include innovations in technology, growing demand for advanced agricultural and farm machinery, mechanization in farming techniques, etc. The rise in per capita disposable income is another major element projected to propel the growth of the global market.

Agricultural and Farm Machinery Market Segmentation

The global agricultural and farm machinery market segmentation is based on equipment type, application, and geography.

Agricultural and Farm Machinery Market By Equipment Type

- Agricultural tractors

- Spraying and handling equipment

- Harvesting equipment

- Irrigation and crop processing equipment

- Cultivation and soil preparation equipment

According to an agricultural and farm machinery industry analysis, the agricultural tractor segment accounted for the largest market share in 2021. Agricultural tractors are vehicles designed to pull implements and machinery used in farming and agriculture. They are a critical component of modern agriculture, providing farmers with the ability to perform tasks more efficiently and effectively. The demand for agricultural tractors is driven by several factors, including increasing demand for food, advances in technology, and government support. The use of modern and efficient tractors has led to higher productivity and profitability, making them a crucial component of the agriculture industry. With the growing trend towards precision agriculture, the market for advanced tractors, such as GPS-controlled tractors, is expected to grow in the coming years.

Agricultural and Farm Machinery Market By Application

- Land development

- Plant protection

- After agro processing

- Threshing and harvesting

- Others

According to the agricultural and farm machinery market forecast, the threshing and harvesting application is expected to grow significantly in the coming years. Threshing and harvesting machinery are essential components of modern agriculture, playing a critical role in the efficient and effective production of crops. Threshing machinery separates grain or seeds from the straw or husks while harvesting machinery cuts and gathers crops for threshing. The demand for threshing and harvesting machinery is driven by several factors, including increasing demand for food, advances in technology, and government support. With the growing trend towards precision agriculture, the market for advanced threshing and harvesting machinery, such as combines equipped with GPS and sensors, is expected to grow in the coming years.

Agricultural and Farm Machinery Market Regional Outlook

North America

- U.S.

- Canada

Europe

- U.K.

- Germany

- France

- Spain

- Rest of Europe

Asia-Pacific

- India

- Japan

- China

- Australia

- South Korea

- Rest of Asia-Pacific

Latin America

- Brazil

- Mexico

- Rest of Latin America

The Middle East & Africa

- South Africa

- GCC Countries

- Rest of the Middle East & Africa (ME&A)

Geographically, the agricultural and farm machinery market in the Asia-Pacific region has seen significant growth in recent years due to the increasing demand for food and the need for improved agricultural productivity. Some of the key drivers of growth in this market include population growth, urbanization, and economic development in countries such as China, India, and Indonesia.

In terms of specific machinery, there has been an increase in demand for tractors, harvesters, and planting equipment. Additionally, the use of precision agriculture technologies, such as GPS-based systems and sensors, has also been on the rise in the region, as farmers look to improve efficiency and reduce waste. Moreover, the Asia-Pacific agricultural and farm machinery market is expected to continue to grow in the coming years, driven by the need for increased food production and the continued development of the region's economies. Key players in the market include John Deere, Mahindra & Mahindra, Kubota, and CNH Industrial.

Agricultural and Farm Machinery Market Player

Some of the top agricultural and farm machinery market companies offered in the professional report include John Deere, CNH Industrial, AGCO Corporation, Kubota Corporation, Mahindra & Mahindra Ltd., Claas KGaA mbH, Yanmar Co., Ltd., SDF Group, and Iseki & Co., Ltd.

Frequently Asked Questions

What was the market size of the global agricultural and farm machinery in 2022?

The market size of agricultural and farm machinery was USD 196.5 Billion in 2022.

What is the CAGR of the global agricultural and farm machinery market during forecast period of 2023 to 2032?

The CAGR of agricultural and farm machinery market is 8.6% during the analysis period of 2023 to 2032.

Which are the key players operating in the market?

The key players operating in the global agricultural and farm machinery market are John Deere, CNH Industrial, AGCO Corporation, Kubota Corporation, Mahindra & Mahindra Ltd., Claas KGaA mbH, Yanmar Co., Ltd., SDF Group, and Iseki & Co., Ltd.

Which region held the dominating position in the global agricultural and farm machinery market?

Asia-Pacific North America held the dominating position in agricultural and farm machinery market during the analysis period of 2023 to 2032.

Which region registered the fastest growing CAGR for the forecast period of 2023 to 2032?

Asia-Pacific region exhibited fastest growing CAGR for agricultural and farm machinery market during the analysis period of 2023 to 2032.

What are the current trends and dynamics in the global agricultural and farm machinery market?

The current trends and dynamics in the agricultural and farm machinery industry include the increasing demand for food, and growing popularity of precision agriculture.

Which equipment type held the maximum share in 2022?

The agricultural tractors equipment type held the maximum share of the agricultural and farm machinery market.

Select Licence Type

Connect with our sales team

Why Acumen Research And Consulting

100%

Customer Satisfaction

24x7

Availability - we are always there when you need us

200+

Fortune 50 Companies trust Acumen Research and Consulting

80%

of our reports are exclusive and first in the industry

100%

more data and analysis

1000+

reports published till date