Agricultural Adjuvants Market Size - Global Industry, Share, Analysis, Trends and Forecast 2023 - 2032

Published :

Report ID:

Pages :

Format :

Agricultural Adjuvants Market Size - Global Industry, Share, Analysis, Trends and Forecast 2023 - 2032

Report Coverage

- Industry Dynamics

- Market Size and Forecast Data

- Segment Analysis

- Competitive Landscape

- Regional Analysis with a Niche Focus on Country-Level Data

- High Level Analysis - Porter's, PESTEL, Value Chain, etc.

- Company Profiles of Key Players

- Option to Customize the Report As Per Your Specific Need

Request Sample Report

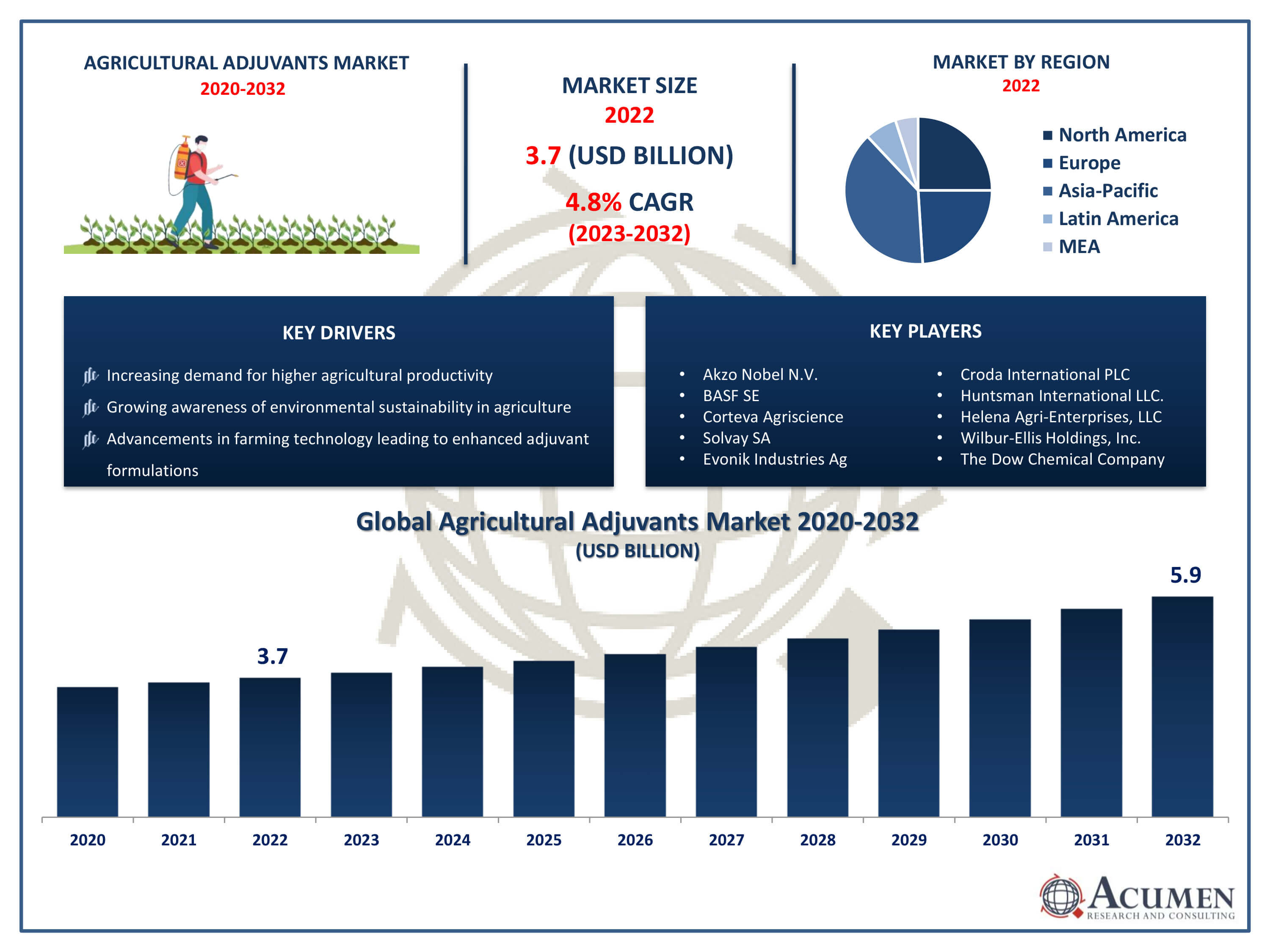

The Agricultural Adjuvants Market Size accounted for USD 3.7 Billion in 2022 and is projected to achieve a market size of USD 5.9 Billion by 2032 growing at a CAGR of 4.8% from 2023 to 2032.

Agricultural Adjuvants Market Highlights

- Global agricultural adjuvants market revenue is expected to increase by USD 5.9 Billion by 2032, with a 4.8% CAGR from 2023 to 2032

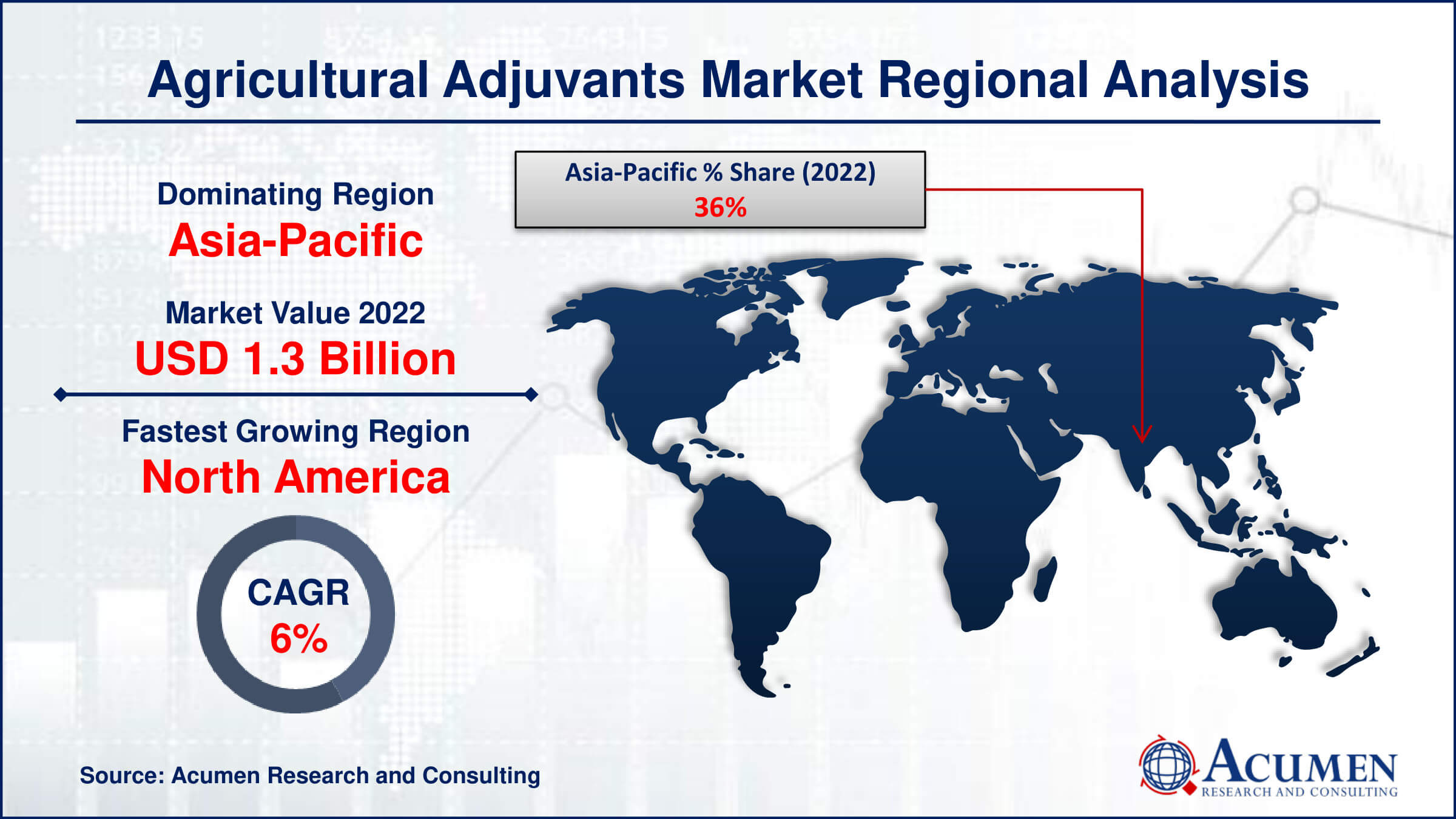

- Asia-Pacific region led with more than 36% of agricultural adjuvants market share in 2022

- North America agricultural adjuvants market growth will record a CAGR of more than 5.6% from 2023 to 2032

- By type, the activator adjuvant segment captured more than 68% of revenue share in 2022.

- By crop type, the cereals & oilseeds segment is projected to expand at the fastest CAGR over the projected period

- Increasing demand for higher agricultural productivity, drives the agricultural adjuvants market value

Agricultural adjuvants are substances added to pesticides, herbicides, fungicides, and other agricultural chemicals to enhance their effectiveness. These adjuvants can improve the performance of the active ingredients by aiding in their penetration, spreading, or retention on plant surfaces. They can also help in reducing drift, minimizing runoff, and increasing overall efficiency while reducing environmental impact. Agricultural adjuvants come in various forms, including surfactants, oils, spreaders, stickers, and buffering agents.

The market for agricultural adjuvants has been experiencing steady growth in recent years due to several factors. One key driver is the increasing demand for higher agricultural productivity to feed a growing global population. Farmers are turning to adjuvants to optimize the performance of their crop protection products, leading to improved yields and profitability. Additionally, there is a growing emphasis on sustainable agriculture and environmental stewardship, which has led to the development and adoption of adjuvants that can reduce chemical usage and minimize off-target effects. Another factor contributing to the growth of the agricultural adjuvants market is the advancements in formulation technology.

Global Agricultural Adjuvants Market Trends

Market Drivers

- Increasing demand for higher agricultural productivity

- Advancements in farming technology leading to enhanced adjuvant formulations

- Stringent regulations promoting the use of adjuvants for reduced chemical usage

- Growing awareness of environmental sustainability in agriculture

- Expansion of precision farming techniques requiring optimized spray applications

Market Restraints

- Concerns over potential environmental and health impacts of adjuvants

- High initial costs associated with some advanced adjuvant formulations

Market Opportunities

- Development of environmentally friendly and biodegradable adjuvant formulations

- Integration of adjuvants with precision agriculture technologies

Agricultural Adjuvants Market Report Coverage

| Market | Agricultural Adjuvants Market |

| Agricultural Adjuvants Market Size 2022 | USD 3.7 Billion |

| Agricultural Adjuvants Market Forecast 2032 | USD 5.9 Billion |

| Agricultural Adjuvants Market CAGR During 2023 - 2032 | 4.8% |

| Agricultural Adjuvants Market Analysis Period | 2020 - 2032 |

| Agricultural Adjuvants Market Base Year |

2022 |

| Agricultural Adjuvants Market Forecast Data | 2023 - 2032 |

| Segments Covered | By Type, By Crop Type, By Application, And By Geography |

| Regional Scope | North America, Europe, Asia Pacific, Latin America, and Middle East & Africa |

| Key Companies Profiled | Amazon Web Services Inc., Hitachi Ltd., Cisco Systems Inc., Intel Corporation, Huawei Technologies Co. Ltd., Microsoft Corporation, International Business Machines Corporation, Oracle Corporation, NEC Corporation (AT&T Inc.), Siemens AG, SAP SE, and Telefonaktiebolaget LM Ericsson. |

| Report Coverage |

Market Trends, Drivers, Restraints, Competitive Analysis, Player Profiling, Covid-19 Analysis, Regulation Analysis |

Agricultural adjuvants are substances added to agricultural spray solutions, including pesticides, herbicides, fungicides, and fertilizers, to enhance their effectiveness and performance. These adjuvants serve various functions such as improving the spread, penetration, retention, and overall efficiency of the active ingredients in the spray mixture. By modifying the physical properties of the spray solution, agricultural adjuvants can optimize the delivery of chemicals to target crops or pests, resulting in improved efficacy and reduced environmental impact. Adjuvants can also help mitigate factors such as evaporation, degradation, and wash-off, thereby maximizing the impact of the applied chemicals on agricultural operations. The applications of agricultural adjuvants span across various stages of crop production and pest management. During pre-planting activities, adjuvants are used to enhance the efficacy of soil-applied herbicides and fertilizers, ensuring optimal nutrient uptake and weed control.

The agricultural adjuvants market has been experiencing significant growth driven by several key factors. Increasing awareness among farmers about the benefits of adjuvants in enhancing the efficacy of agrochemicals and improving crop yields has been a major growth driver. Farmers are increasingly looking for ways to optimize their spray applications and minimize the environmental impact of pesticides, herbicides, and other chemicals. This has led to a greater adoption of adjuvants to improve the spread, penetration, and retention of these chemicals on target crops, thereby maximizing their effectiveness. Furthermore, advancements in agricultural technology and formulations have contributed to the expansion of the agricultural adjuvants market. Manufacturers are continuously developing innovative adjuvant formulations that offer improved performance and safety profiles. These advancements have helped address concerns such as drift, runoff, and environmental contamination, driving further adoption among farmers.

Agricultural Adjuvants Market Segmentation

The global agricultural adjuvants market segmentation is based on type, crop type, application, and geography.

Agricultural Adjuvants Market By Type

- Utility Adjuvant

- Activator Adjuvant

According to the agricultural adjuvants industry analysis, the activator adjuvant segment accounted for the largest market share in 2022. Activator adjuvants are designed to enhance the efficacy of pesticides, herbicides, and fungicides by improving their absorption and translocation within plant tissues. They work by facilitating the entry of active ingredients into plant cells, thereby maximizing their impact on target pests or pathogens. This segment has seen increased demand due to the need for more effective pest and weed control solutions as well as the desire to optimize the use of agrochemicals for better crop protection and yields. One of the key drivers behind the growth of the activator adjuvant segment is the rising adoption of integrated pest management (IPM) practices in agriculture. With increasing concerns over pesticide resistance and environmental sustainability, farmers are turning to IPM strategies that emphasize the use of multiple control tactics, including the use of adjuvants to enhance the effectiveness of chemical controls.

Agricultural Adjuvants Market By Crop Type

- Fruits & Vegetables

- Cereals & Oilseeds

- Others

In terms of crop types, the cereals & oilseeds segment is expected to witness significant growth in the coming years. Cereals such as wheat, corn, rice, and barley, along with oilseeds like soybeans, canola, and sunflowers, represent major crops globally, and their production is crucial for food security and various industrial applications. To optimize yields and protect these crops from pests, diseases, and weeds, farmers increasingly rely on agrochemicals such as herbicides, pesticides, and fungicides. Adjuvants play a vital role in ensuring the effective delivery and performance of these chemicals, thereby enhancing crop protection and yields in the cereals and oilseeds segment. One of the primary drivers behind the growth of adjuvants in the cereals and oilseeds segment is the increasing adoption of precision agriculture practices. Precision agriculture technologies enable farmers to precisely target inputs such as fertilizers and pesticides, optimizing resource use and minimizing environmental impact. Adjuvants enhance the efficacy of these inputs by improving their coverage, penetration, and retention on crop surfaces, thus maximizing their effectiveness. As precision agriculture continues to gain traction globally, the demand for adjuvants in the cereals and oilseeds segment is expected to rise further.

Agricultural Adjuvants Market By Application

- Herbicides

- Insecticides

- Fungicides

- Others

According to the agricultural adjuvants market forecast, the herbicides segment is expected to witness significant growth in the coming years. Herbicides are widely used in agriculture to control weeds, which compete with crops for nutrients, water, and sunlight, thereby reducing yields. Adjuvants play a crucial role in enhancing the effectiveness of herbicides by improving their coverage, absorption, and translocation within weed tissues. As farmers seek more efficient and sustainable weed control solutions, the demand for adjuvants in the herbicides segment has surged. One of the primary drivers behind the growth of adjuvants in the herbicides segment is the increasing adoption of genetically modified (GM) crops engineered for herbicide tolerance. GM crops, such as glyphosate-tolerant soybeans and maize, allow farmers to apply specific herbicides without harming the crops, simplifying weed management practices. Adjuvants are often used in conjunction with these herbicides to maximize their efficacy and ensure optimal weed control. With the continued adoption of GM crops globally, particularly in regions with high weed pressure, the demand for adjuvants in the herbicides segment is expected to rise further.

Agricultural Adjuvants Market Regional Outlook

North America

- U.S.

- Canada

Europe

- U.K.

- Germany

- France

- Spain

- Rest of Europe

Asia-Pacific

- India

- Japan

- China

- Australia

- South Korea

- Rest of Asia-Pacific

Latin America

- Brazil

- Mexico

- Rest of Latin America

The Middle East & Africa

- South Africa

- GCC Countries

- Rest of the Middle East & Africa (ME&A)

Agricultural Adjuvants Market Regional Analysis

The Asia-Pacific region has emerged as a dominating force in the agricultural adjuvants market, driven by several key factors. Firstly, the region encompasses a vast agricultural landscape with diverse climates and cropping systems, ranging from tropical to temperate zones. This diversity creates a high demand for a variety of agrochemicals, including herbicides, pesticides, and fungicides, all of which benefit from the use of adjuvants to enhance their efficacy. Additionally, the region's growing population and increasing urbanization have placed immense pressure on farmers to maximize crop yields and productivity, further driving the adoption of adjuvants to optimize agrochemical applications. Moreover, rapid economic development and rising disposable incomes in countries such as China, India, and Southeast Asian nations have fueled expansion in the agricultural sector. As a result, there has been a growing trend towards mechanization and modernization of farming practices, leading to increased adoption of advanced agricultural inputs, including adjuvants. Furthermore, government initiatives and support programs aimed at promoting sustainable agriculture and enhancing food security have encouraged farmers to adopt innovative technologies and practices, including the use of adjuvants.

Agricultural Adjuvants Market Player

Some of the top agricultural adjuvants market companies offered in the professional report include Akzo Nobel N.V., BASF SE, Corteva Agriscience, Solvay SA, Evonik Industries Ag, Croda International PLC, Huntsman International LLC, Helena Agri-Enterprises, LLC, Nufarm Limited, Wilbur-Ellis Holdings, Inc., The Dow Chemical Company, and Brandt Consolidated, Inc.

Frequently Asked Questions

How big is the agricultural adjuvants market?

The agricultural adjuvants market size was USD 3.7 Billion in 2022.

What is the CAGR of the global agricultural adjuvants market from 2023 to 2032?

The CAGR of agricultural adjuvants is 4.8% during the analysis period of 2023 to 2032.

Which are the key players in the agricultural adjuvants market?

The key players operating in the global market are including Akzo Nobel N.V., BASF SE, Corteva Agriscience, Solvay SA, Evonik Industries Ag, Croda International PLC, Huntsman International LLC, Helena Agri-Enterprises, LLC, Nufarm Limited, Wilbur-Ellis Holdings, Inc., The Dow Chemical Company, and Brandt Consolidated, Inc.

Which region dominated the global agricultural adjuvants market share?

Asia-Pacific held the dominating position in agricultural adjuvants industry during the analysis period of 2023 to 2032.

Which region registered fastest CAGR from 2023 to 2032?

North America region exhibited fastest growing CAGR for market of agricultural adjuvants during the analysis period of 2023 to 2032.

What are the current trends and dynamics in the global agricultural adjuvants industry?

The current trends and dynamics in the agricultural adjuvants industry include increasing demand for higher agricultural productivity, advancements in farming technology leading to enhanced adjuvant formulations, and growing awareness of environmental sustainability in agriculture.

Which crop type held the maximum share in 2022?

The cereals & oilseeds crop type held the maximum share of the agricultural adjuvants industry.