Aesthetic Equipment Market | Acumen Research and Consulting

Aesthetic Equipment Market Size - Global Industry, Share, Analysis, Trends and Forecast 2023 - 2032

Published :

Report ID:

Pages :

Format :

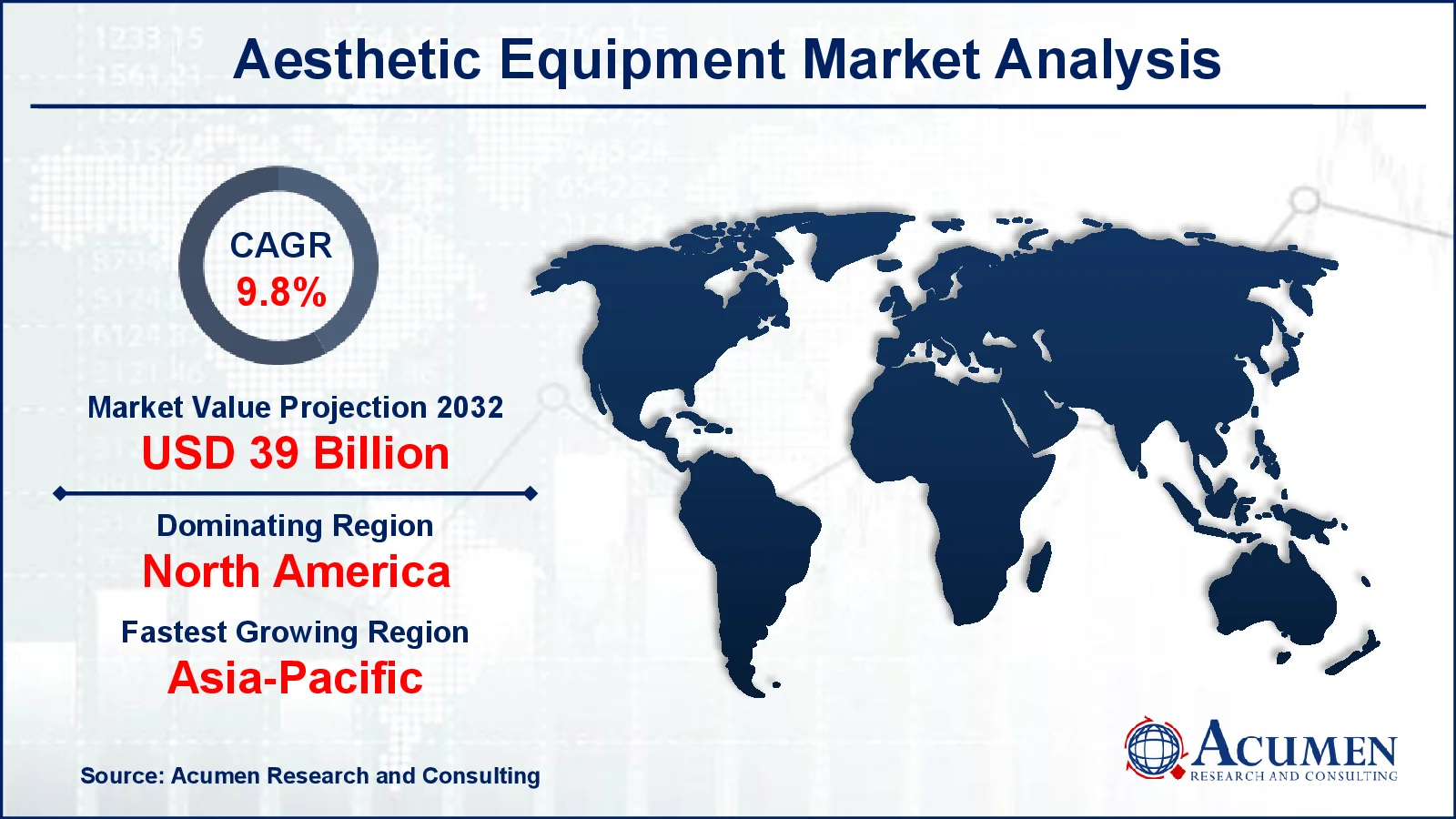

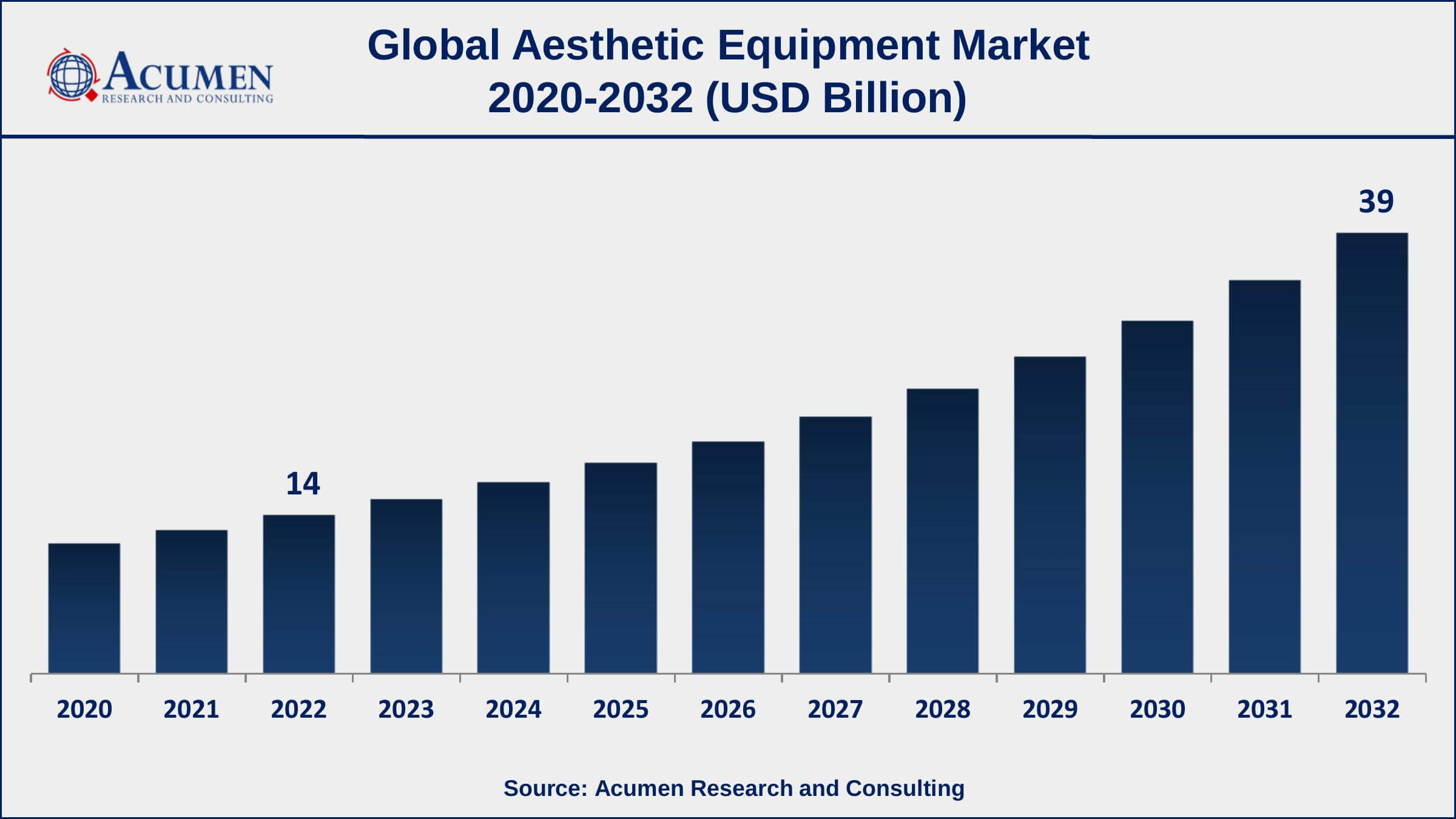

The Global Aesthetic Equipment Market Size accounted for USD 14 Billion in 2022 and is projected to achieve a market size of USD 39 Billion by 2032 growing at a CAGR of 9.8% from 2023 to 2032. The aesthetic equipment market is expected to grow significantly in the coming years due to increasing demand for non-invasive cosmetic procedures, rising awareness about the benefits of aesthetic procedures, and the growing demand for minimally invasive cosmetic treatments. Additionally, the rising number of cosmetic procedures among men and women and the increasing focus on personal appearance and beauty are also contributing to the growth of the aesthetic equipment market value. With advancements in technology and the increasing demand for aesthetic procedures, the market is expected to continue to grow in the coming years.

Aesthetic Equipment Market Report Key Highlights

- Global Aesthetic Equipment market revenue is expected to increase by USD 39 Billion by 2032, with a 9.8% CAGR from 2023 to 2032

- North America region led with more than 35% of Aesthetic Equipment market share in 2022

- According to the American Society of Plastic Surgeons, 7.23 million Botox treatments were done in the United States in 2019

- In 2019, 2.64 million dermal filler procedures were performed in the United States

- The majority of aesthetic procedures are performed by dermatologists, plastic surgeons, and aestheticians

- In 2019, 1.3 million skin tightening procedures were performed in the United States

- By end user, the hospitals and clinics captured the majority of the market

- Growing demand for home-based aesthetic treatments, drives the aesthetic equipment market size

Aesthetic refers to pleasing appearance or beauty and is derived from the Greek word aesthetics meaning esthetic (sense and sentient). Growing consciousness of aesthetics among the elderly population is fueling the demand for aesthetic devices to be utilized in aesthetic procedures. Some major aesthetic procedures include liposuction, body lift, hair replacement, bra line back lift, skin rejuvenation, thigh lifts, eyelid surgery, breast augmentation, chin surgery, tummy tuck, brow lifts, and facelift surgery and are gaining preference across the globe. Aesthetic procedures are generally performed to enhance the self-esteem of individuals and their appearance. Aesthetic surgeries garner confidence in people. Major equipment used in aesthetic surgeries includes light-emitting diodes, dermal lasers, micro-dermal abraders, dermal fillers, energy-based devices, and intense pulsed light devices. Aesthetic equipment is the outcome of a quest and thus providing optimal solutions and enabling them to provide beneficial results for patients opting for hair reduction, facial skin treatments, pigmented lesions, acne scars, body contouring, and varicose veins.

Global Aesthetic Equipment Market Trends

Market Drivers

- Increasing demand for non-invasive cosmetic procedures

- Rising awareness about the benefits of aesthetic procedures

- Growing demand for minimally invasive cosmetic treatments

- Increasing number of beauty clinics, spas, and aesthetic clinics

Market Restraints

- High cost of aesthetic equipment

- Lack of awareness in some regions

Market Opportunities

- Growing demand for home-based aesthetic treatments

- Increasing focus on anti-aging treatments

- Growing medical tourism industry

Aesthetic Equipment Market Report Coverage

| Market | Aesthetic Equipment Market |

| Aesthetic Equipment Market Size 2022 | USD 14 Billion |

| Aesthetic Equipment Market Forecast 2032 | USD 39 Billion |

| Aesthetic Equipment Market CAGR During 2023 - 2032 | 9.8% |

| Aesthetic Equipment Market Analysis Period | 2020 - 2032 |

| Aesthetic Equipment Market Base Year | 2022 |

| Aesthetic Equipment Market Forecast Data | 2023 - 2032 |

| Segments Covered | By Product Type, By Application, By End User, And By Geography |

| Regional Scope | North America, Europe, Asia Pacific, Latin America, and Middle East & Africa |

| Key Companies Profiled | Allergan plc, Zimmer Biomet Holdings, Inc., Johnson & Johnson, Dentsply Sirona Inc., Hologic, Inc., SYNERON MEDICAL LTD, MERZ PHARMA GMBH & CO. KGAA, LUMENIS LTD, Sientra Inc, and VALEANT PHARMACEUTICAL INTERNATIONAL, INC |

| Report Coverage |

Market Trends, Drivers, Restraints, Competitive Analysis, Player Profiling, Covid-19 Analysis, Regulation Analysis |

Aesthetic Equipment Market Dynamics

Increasing aesthetic consciousness involving minimally invasive procedures is a key factor driving the global aesthetic equipment market. Also, growth in technological advances and the number of obesity cases is evolving device innovation in the global aesthetic equipment market. Moreover, the rise in demand for aesthetic medical procedures among youngsters is expected to propel the growth of the global aesthetic equipment market. In addition, increasing demand for non-invasive and minimally invasive aesthetic surgeries coupled with technological advancements are some of the key factors driving the growth of the overall market. Also, increasing growth in the type of cosmetic procedures is another major aspect boosting the growth of the global aesthetic equipment market. Improving treatment results through aesthetic procedures, increasing awareness among patients as well as decreasing side effects coupled with a gain in the confidence of the consumers are some other factors fuelling the growth of the global aesthetic equipment market.

However, stringent regulations for aesthetic surgeries are an important factor hampering the growth of the global aesthetic equipment market. Moreover, lack of reimbursements for aesthetic procedures, high costs, and social stigmas among lower and middle-class people are anticipated to hinder the growth of the global aesthetic equipment market.

Aesthetic Equipment Market Segmentation

The global aesthetic equipment market segmentation is based on product type, application, end user, and geography.

Aesthetic Equipment Market By Product Type

- Devices

- Energy-based Aesthetic Device

- Ultrasound Aesthetic Device

- Radiofrequency (RF)-based Aesthetic Device

- Laser-based Aesthetic Device

- Light-based Aesthetic Device

- Non-energy-based Aesthetic Device

- Microdermabrasion

- Dermal Fillers and Aesthetic Threads

- Botulinum Toxin

- Other

- Energy-based Aesthetic Device

- Aesthetic Implants

- Breast Implants

- Facial Implants

- Others

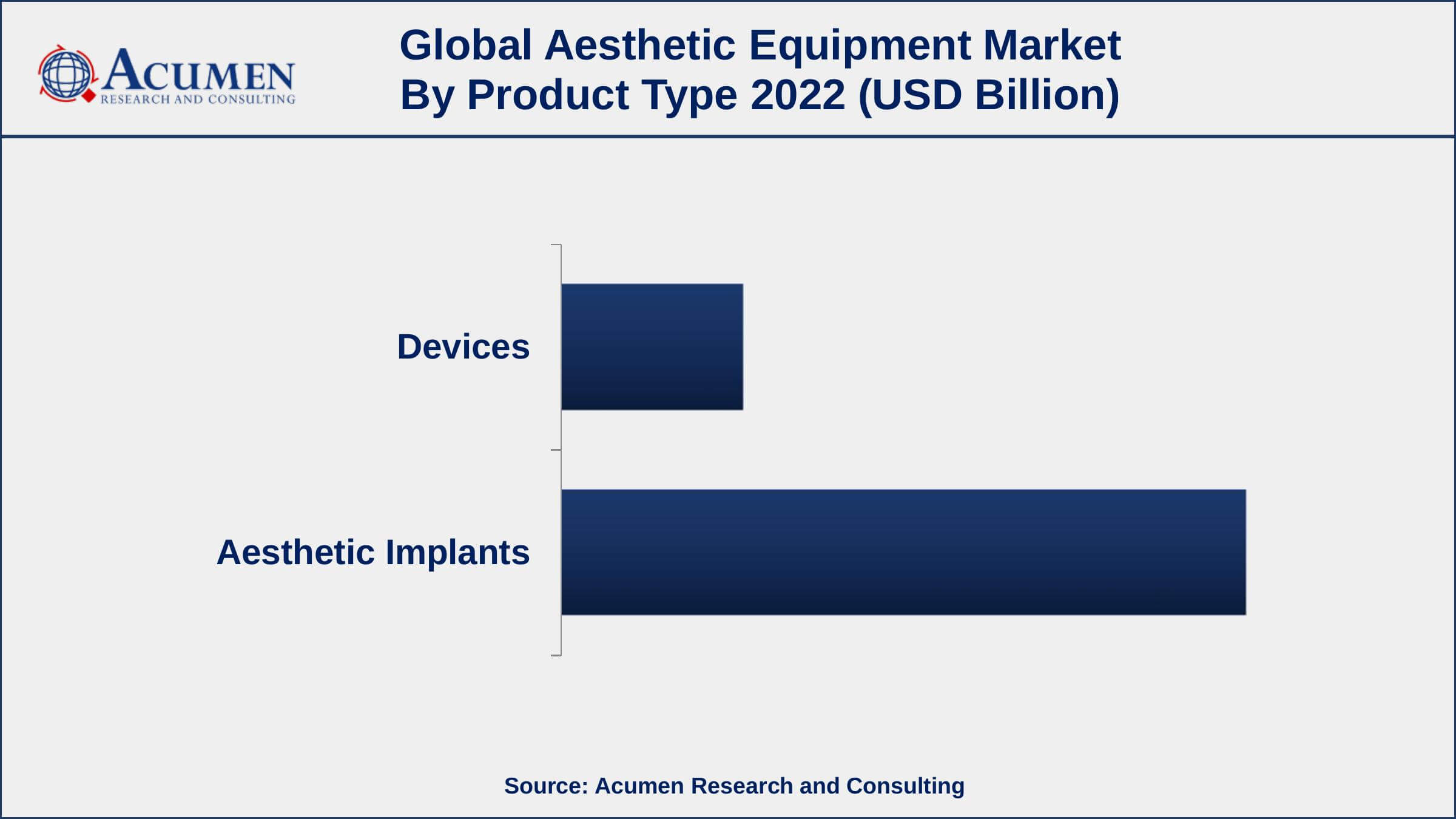

According to an aesthetic equipment industry analysis, the aesthetic implants segment holds the largest market share in 2022. This segment is driven by the increasing demand for cosmetic procedures such as breast augmentation, face lifts, and rhinoplasty, among others. The growing demand for minimally invasive cosmetic treatments and the increasing focus on personal appearance and beauty are also contributing to the growth of the market. Aesthetic implants come in various forms, including silicone, saline, and polyurethane foam, among others. The increasing demand for silicone implants, due to their natural feel and long-lasting results, is driving the growth of the silicone implants segment of the market. Additionally, the growing demand for minimally invasive treatments such as non-surgical body contouring procedures is expected to drive the growth of the aesthetic implants market in the coming years.

Aesthetic Equipment Market By Application

- Surgical

- Non Surgical

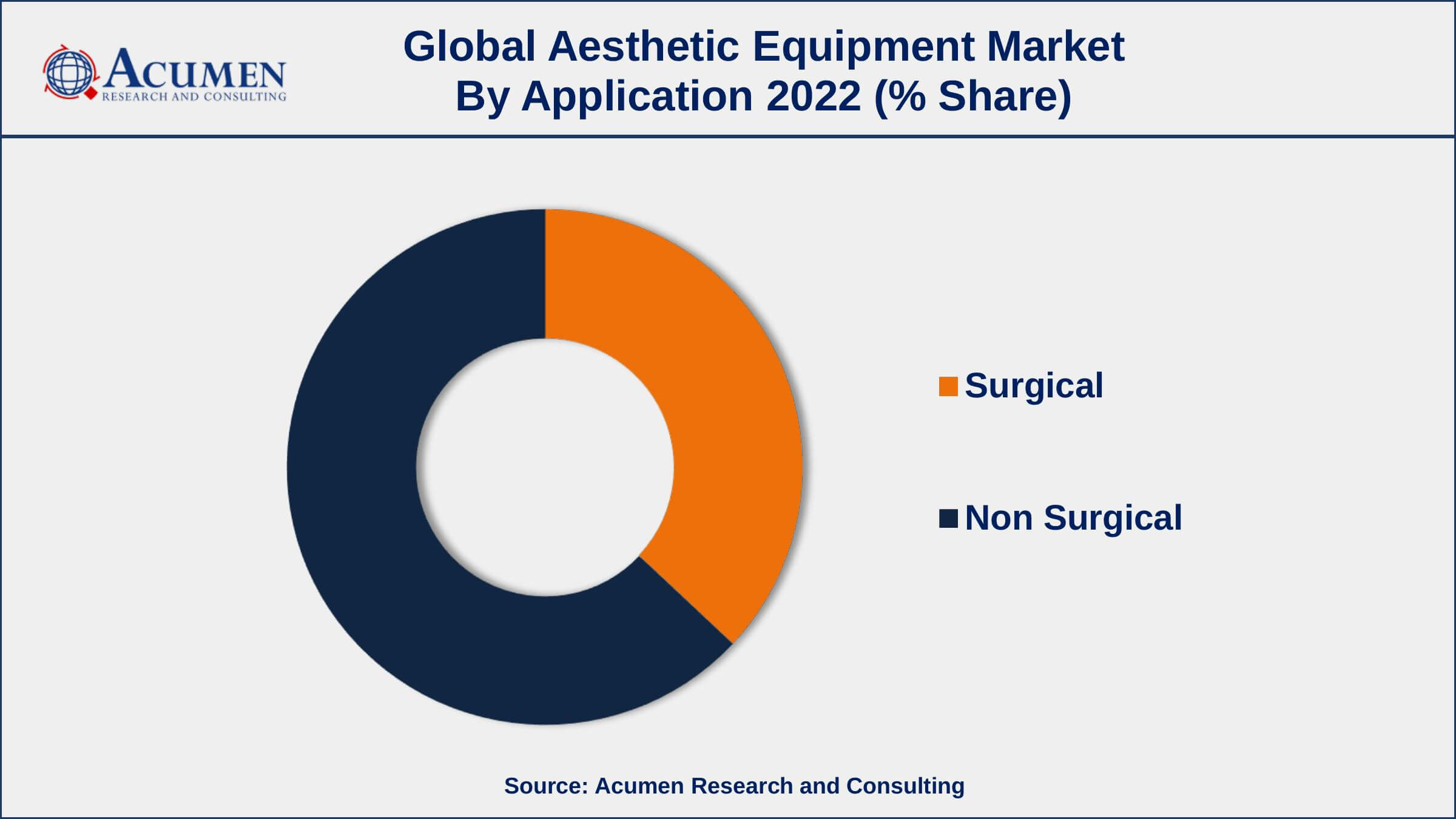

In terms of application, the non-surgical segment leading the aesthetic equipment market. The increasing demand for non-invasive cosmetic procedures and the growing demand for minimally invasive cosmetic treatments are driving the growth of the non-surgical aesthetic market. The non-surgical aesthetic market has been growing rapidly in recent years due to the increasing demand for minimally invasive treatments, the growing focus on personal appearance and beauty, and the increasing number of beauty clinics, spas, and aesthetic clinics. The increasing demand for Botox injections, dermal fillers, and laser hair removal treatments is driving the growth of the market. Additionally, the increasing demand for home-based aesthetic treatments and the growing medical tourism industry is expected to provide further growth opportunities for the market.

Aesthetic Equipment Market By End User

- Hospitals and Clinics

- Medical Spas and Beauty Centers

According to the aesthetic equipment market forecast, the medical spas and beauty centers segment is predicted to rise significantly in the industry over the next few years. Medical spas and beauty centers have become increasingly popular in recent years due to the growing demand for minimally invasive cosmetic treatments and the increasing focus on personal appearance and beauty. Medical spas and beauty centers offer a variety of aesthetic treatments, including Botox injections, dermal fillers, laser hair removal, and microdermabrasion, among others. The increasing demand for these treatments is driving the growth of the aesthetic equipment market in medical spas and beauty centers. Additionally, the increasing number of medical spas and beauty centers and the availability of technologically advanced aesthetic equipment are also contributing to the growth of the market.

Aesthetic Equipment Market Regional Outlook

North America

- U.S.

- Canada

Europe

- U.K.

- Germany

- France

- Spain

- Rest of Europe

Asia-Pacific

- India

- Japan

- China

- Australia

- South Korea

- Rest of Asia-Pacific

Latin America

- Brazil

- Mexico

- Rest of Latin America

The Middle East & Africa

- South Africa

- GCC Countries

- Rest of the Middle East & Africa (ME&A)

Geographically, North America is one of the largest and most mature markets for aesthetic equipment, driven by the increasing demand for cosmetic procedures, the rising awareness about the benefits of aesthetic procedures, and the growing demand for minimally invasive cosmetic treatments. The United States is the largest market for aesthetic equipment in North America, driven by the high demand for non-invasive cosmetic procedures, such as Botox injections and dermal fillers, and the growing demand for minimally invasive treatments such as laser hair removal and microdermabrasion. Additionally, the increasing number of beauty clinics, spas, and aesthetic clinics in the United States is contributing to the growth of the market.

Aesthetic Equipment Market Player

Some of the top aesthetic equipment market companies offered in the professional report include Allergan plc, Zimmer Biomet Holdings, Inc., Johnson & Johnson, Dentsply Sirona Inc., Hologic, Inc., SYNERON MEDICAL LTD, MERZ PHARMA GMBH & CO. KGAA, LUMENIS LTD, Sientra Inc, and VALEANT PHARMACEUTICAL INTERNATIONAL, INC.

Frequently Asked Questions

What was the market size of the global aesthetic equipment in 2022?

The market size of aesthetic equipment was USD 8.8 Billion in 2022.

What is the CAGR of the global aesthetic equipment market during forecast period of 2023 to 2032?

The CAGR of aesthetic equipment market is 24.1% during the analysis period of 2023 to 2032.

Which are the key players operating in the market?

The key players operating in the global aesthetic equipment market are Allergan plc, Zimmer Biomet Holdings, Inc., Johnson & Johnson, Dentsply Sirona Inc., Hologic, Inc., SYNERON MEDICAL LTD, MERZ PHARMA GMBH & CO. KGAA, LUMENIS LTD, Sientra Inc, and VALEANT PHARMACEUTICAL INTERNATIONAL, INC.

Which region held the dominating position in the global aesthetic equipment market?

North America held the dominating position in aesthetic equipment market during the analysis period of 2023 to 2032.

Which region registered the fastest growing CAGR for the forecast period of 2023 to 2032?

Asia-Pacific region exhibited fastest growing CAGR for aesthetic equipment market during the analysis period of 2023 to 2032.

What are the current trends and dynamics in the global aesthetic equipment market?

The current trends and dynamics in the aesthetic equipment industry include the increasing demand for non-invasive cosmetic procedures and rising number of beauty clinics, spas, and aesthetic clinics.

Which product type held the maximum share in 2022?

The aesthetic implants product type held the maximum share of the aesthetic equipment market.