Aerospace Riveting Equipment Market Size - Global Industry, Share, Analysis, Trends and Forecast 2023 - 2032

Published :

Report ID:

Pages :

Format :

Aerospace Riveting Equipment Market Size - Global Industry, Share, Analysis, Trends and Forecast 2023 - 2032

Report Coverage

- Industry Dynamics

- Market Size and Forecast Data

- Segment Analysis

- Competitive Landscape

- Regional Analysis with a Niche Focus on Country-Level Data

- High Level Analysis - Porter's, PESTEL, Value Chain, etc.

- Company Profiles of Key Players

- Option to Customize the Report As Per Your Specific Need

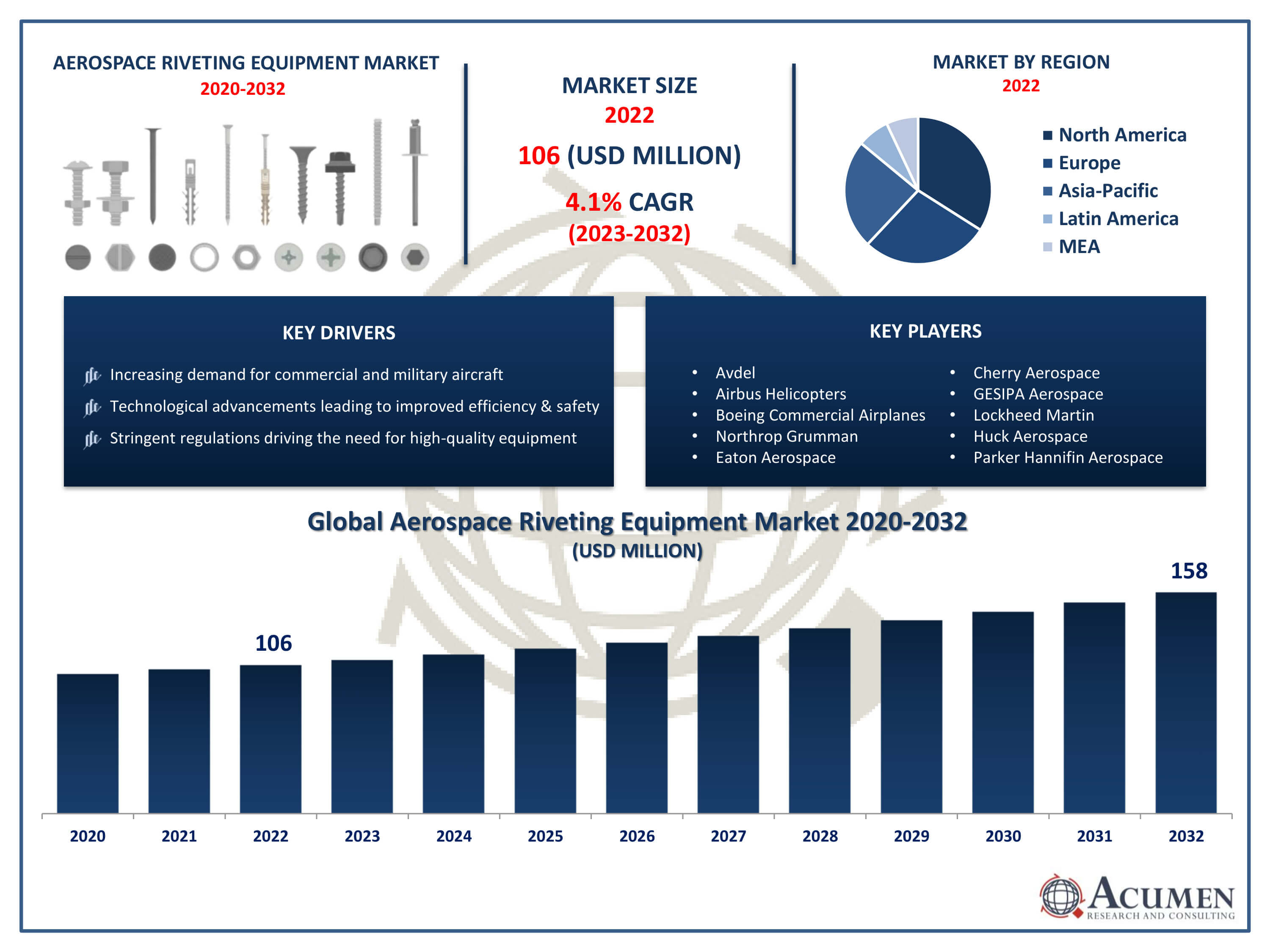

Request Sample Report

The Aerospace Riveting Equipment Market Size accounted for USD 106 Million in 2022 and is projected to achieve a market size of USD 158 Million by 2032 growing at a CAGR of 4.1% from 2023 to 2032.

Aerospace Riveting Equipment Market Highlights

- Global aerospace riveting equipment market revenue is expected to increase by USD 158 Million by 2032, with a 4.1% CAGR from 2023 to 2032

- North America region led with more than 33% of aerospace riveting equipment market share in 2022

- Asia-Pacific aerospace riveting equipment market growth will record a CAGR of around 4.8% from 2023 to 2032

- By equipment, the hydraulic riveting equipment segment is the largest segment in the market, accounting for over 38% of the market share in 2022

- By end-use, the original equipment manufacturers (OEM) segment has recorded more than 60% of the revenue share in 2022

- Increasing demand for commercial and military aircraft, drives the aerospace riveting equipment market value

Aerospace riveting equipment plays a crucial role in the assembly of aircraft structures, where rivets are used to join metal components together securely. This equipment includes rivet guns, rivet squeezers, and rivet hammers, among others. Riveting is a preferred method in aerospace manufacturing due to its reliability, strength, and durability. The equipment must meet stringent standards set by regulatory bodies to ensure the safety and integrity of the assembled aircraft.

The market for aerospace riveting equipment has witnessed steady growth over the years, driven primarily by the increasing demand for commercial and military aircraft worldwide. As air travel continues to rise, aircraft manufacturers are under pressure to ramp up production to meet this demand. This, in turn, drives the need for advanced riveting equipment that can streamline the assembly process while maintaining high-quality standards. Additionally, technological advancements in riveting equipment, such as automation and robotics, are further propelling market growth by improving efficiency and precision in the assembly line. Furthermore, the aerospace industry's focus on lightweight materials and fuel efficiency has spurred innovation in riveting equipment, leading to the development of tools capable of handling a wide range of materials, including composites and alloys.

Global Aerospace Riveting Equipment Market Trends

Market Drivers

- Increasing demand for commercial and military aircraft

- Technological advancements leading to improved efficiency and safety

- Stringent regulations driving the need for high-quality equipment

- Adoption of lightweight materials in aircraft construction

- Focus on sustainability and eco-friendly manufacturing processes

Market Restraints

- High initial investment costs

- Economic uncertainties impacting aerospace spending

Market Opportunities

- Development of automated riveting systems for increased productivity

- Integration of digitalization and Industry 4.0 technologies

Aerospace Riveting Equipment Market Report Coverage

| Market | Aerospace Riveting Equipment Market |

| Aerospace Riveting Equipment Market Size 2022 | USD 106 Million |

| Aerospace Riveting Equipment Market Forecast 2032 |

USD 158 Million |

| Aerospace Riveting Equipment Market CAGR During 2023 - 2032 | 4.1% |

| Aerospace Riveting Equipment Market Analysis Period | 2020 - 2032 |

| Aerospace Riveting Equipment Market Base Year |

2022 |

| Aerospace Riveting Equipment Market Forecast Data | 2023 - 2032 |

| Segments Covered | By Equipment, By Type, By Technology, By End-Use, And By Geography |

| Regional Scope | North America, Europe, Asia Pacific, Latin America, and Middle East & Africa |

| Key Companies Profiled | Avdel, Airbus Helicopters, Boeing Commercial Airplanes, Northrop Grumman, Eaton Aerospace, Cherry Aerospace, GESIPA Aerospace, Lockheed Martin, Huck Aerospace, Parker Hannifin Aerospace, PSM Aerospace, and POP Aviation & Industrial. |

| Report Coverage |

Market Trends, Drivers, Restraints, Competitive Analysis, Player Profiling, Covid-19 Analysis, Regulation Analysis |

Aerospace Riveting Equipment Market Dynamics

Aerospace riveting equipment encompasses a range of tools and machinery specifically designed for the riveting process in aerospace manufacturing. Riveting is a fundamental technique for joining metal components together in aircraft construction. The equipment includes various devices such as rivet guns, rivet squeezers, rivet hammers, and associated accessories like bucking bars and rivet sets. These tools are essential for securely fastening metal plates or structures by driving rivets into pre-drilled holes, creating a permanent and robust connection. The applications of aerospace riveting equipment span across the entire aircraft assembly process. From constructing the airframe to assembling wings, fuselage sections, and other structural components, riveting plays a vital role in ensuring the integrity and strength of aerospace structures. Riveting equipment is utilized in the fabrication of both commercial and military aircraft, as well as in the aerospace supply chain for components and subassemblies.

The aerospace riveting equipment market has witnessed significant growth in recent years and is projected to continue expanding in the foreseeable future. This growth can be attributed to several key factors driving demand for aerospace manufacturing equipment. Firstly, the increasing global demand for air travel has led to a surge in aircraft production, thereby boosting the requirement for riveting equipment used in aircraft assembly. Additionally, the development of new commercial and military aircraft programs, coupled with advancements in aerospace technology, has further fueled the demand for high-quality riveting machinery to meet stringent industry standards. Moreover, technological innovations in aerospace riveting equipment have played a crucial role in driving market growth. Manufacturers are increasingly investing in automated riveting systems and digitalization to enhance production efficiency, accuracy, and safety. These advancements not only improve the overall productivity of the assembly process but also contribute to cost reduction and waste minimization.

Aerospace Riveting Equipment Market Segmentation

The global aerospace riveting equipment market segmentation is based on equipment, type, technology, end-use, and geography.

Aerospace Riveting Equipment Market By Equipment

- Hydraulic Riveting Equipment

- Electric Riveting Equipment

- Pneumatic Riveting Equipment

According to the aerospace riveting equipment industry analysis, the hydraulic riveting equipment segment accounted for the largest market share in 2022. Hydraulic riveting machines offer high precision, efficiency, and reliability, making them ideal for the demanding requirements of aircraft assembly. These machines utilize hydraulic power to exert precise force during the riveting process, ensuring consistent and secure fastening of aircraft components. One of the key drivers propelling the growth of the hydraulic riveting equipment segment is the aerospace industry's emphasis on lightweight materials and advanced manufacturing techniques. As aircraft designs incorporate more composite materials to reduce weight and improve fuel efficiency, the need for specialized riveting equipment capable of handling these materials has surged. Hydraulic riveting machines are well-suited for working with composites, offering the necessary force and control without causing damage to the delicate materials.

Aerospace Riveting Equipment Market By Type

- Blind Rivet

- Solid Rivet

- Semi-Tubular Rivet

In terms of types, the blind rivet segment is expected to witness significant growth in the coming years. Blind rivets, also known as pop rivets, offer unique advantages in aircraft assembly, particularly in situations where access to the rear side of the joint is limited or impossible. This characteristic makes blind rivets indispensable in the construction of aircraft structures, where traditional riveting methods may be impractical or time-consuming. One of the primary drivers of the blind rivet segment's growth in the aerospace industry is the increasing adoption of lightweight materials, such as composites and aluminum alloys, in aircraft manufacturing. These materials offer significant weight savings and fuel efficiency benefits but often require specialized fastening solutions. Blind rivets are well-suited for joining lightweight materials, providing secure and reliable connections without compromising structural integrity.

Aerospace Riveting Equipment Market By Technology

- Manual Riveting Equipment

- Automated Riveting Equipment

According to the aerospace riveting equipment market forecast, the automated riveting equipment segment is expected to witness significant growth in the coming years. Automated riveting systems offer several advantages over traditional manual riveting methods, including higher throughput, consistent quality, and reduced labor costs. As aerospace manufacturers seek to streamline production processes and meet the growing demand for aircraft, automated riveting equipment has become an integral component of modern assembly lines. One of the key drivers of the growth in the automated riveting equipment segment is the aerospace industry's shift towards advanced manufacturing technologies. Automation allows for faster and more precise riveting operations, leading to increased output and shorter lead times. Additionally, automated systems can perform complex riveting tasks with a high degree of repeatability, ensuring consistent quality across large production runs. With the ongoing trend towards Industry 4.0 and smart manufacturing, automated riveting equipment is becoming increasingly integrated into connected and digitally-enabled production environments.

Aerospace Riveting Equipment Market By End-Use

- Original Equipment Manufacturers (OEM)

- Maintenance, Repair, and Overhaul (MRO)

Based on the end-use, the original equipment manufacturers (OEM) segment is expected to continue its growth trajectory in the coming years. As OEMs are at the forefront of aircraft production, they play a pivotal role in driving the demand for riveting equipment. With the continuous evolution of aircraft designs, materials, and technologies, OEMs are increasingly seeking advanced riveting equipment to meet stringent performance, efficiency, and safety requirements. One of the primary drivers of growth in the OEM segment is the expanding global demand for commercial and military aircraft. OEMs are tasked with fulfilling large-scale orders from airlines, defense agencies, and other customers, necessitating the use of sophisticated riveting equipment to streamline production processes and ensure timely delivery. Additionally, OEMs are investing in innovative riveting technologies to enhance manufacturing capabilities, optimize supply chain management, and maintain a competitive edge in the market.

Aerospace Riveting Equipment Market Regional Outlook

North America

- U.S.

- Canada

Europe

- U.K.

- Germany

- France

- Spain

- Rest of Europe

Asia-Pacific

- India

- Japan

- China

- Australia

- South Korea

- Rest of Asia-Pacific

Latin America

- Brazil

- Mexico

- Rest of Latin America

The Middle East & Africa

- South Africa

- GCC Countries

- Rest of the Middle East & Africa (ME&A)

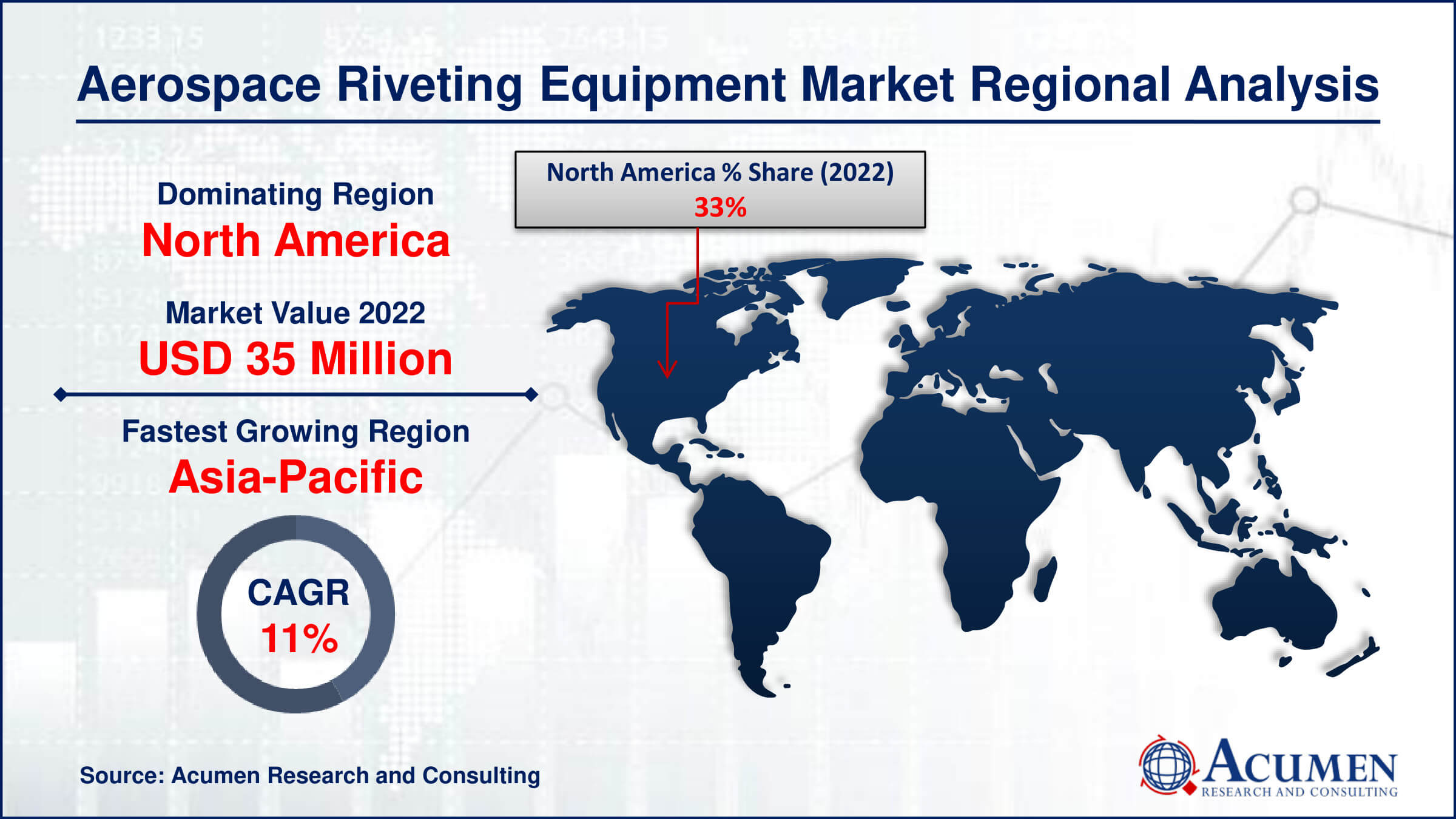

Aerospace Riveting Equipment Market Regional Analysis

North America dominates the aerospace riveting equipment market due to several key factors that position the region as a hub for aerospace manufacturing and innovation. North America boasts a significant presence of leading aerospace OEMs, such as Boeing and Airbus North America, as well as a multitude of tier-one and tier-two suppliers. These companies drive the demand for advanced riveting equipment to support the production of commercial and military aircraft, helicopters, spacecraft, and unmanned aerial vehicles (UAVs). The concentration of major aerospace players in North America creates a robust ecosystem for riveting equipment suppliers, fostering collaboration, innovation, and technology transfer. Additionally, North America benefits from a highly skilled workforce and advanced manufacturing infrastructure, including state-of-the-art facilities and research centers dedicated to aerospace engineering and technology. The region's emphasis on research and development (R&D) and continuous technological advancements contribute to the competitiveness of its aerospace industry. As a result, North American riveting equipment manufacturers are at the forefront of developing cutting-edge solutions tailored to the evolving needs of aerospace manufacturers. Furthermore, the presence of supportive regulatory frameworks and government initiatives aimed at promoting aerospace innovation and competitiveness further strengthens North America's dominance in the aerospace riveting equipment market.

Aerospace Riveting Equipment Market Player

Some of the top aerospace riveting equipment market companies offered in the professional report include Avdel, Airbus Helicopters, Boeing Commercial Airplanes, Northrop Grumman, Eaton Aerospace, Cherry Aerospace, GESIPA Aerospace, Lockheed Martin, Huck Aerospace, Parker Hannifin Aerospace, PSM Aerospace, and POP Aviation & Industrial.

Frequently Asked Questions

How big is the aerospace riveting equipment market?

The aerospace riveting equipment market size was USD 106 Million in 2022.

What is the CAGR of the global aerospace riveting equipment market from 2023 to 2032?

The CAGR of aerospace riveting equipment is 4.1% during the analysis period of 2023 to 2032.

Which are the key players in the aerospace riveting equipment market?

The key players operating in the global market are including Avdel, Airbus Helicopters, Boeing Commercial Airplanes, Northrop Grumman, Eaton Aerospace, Cherry Aerospace, GESIPA Aerospace, Lockheed Martin, Huck Aerospace, Parker Hannifin Aerospace, PSM Aerospace, and POP Aviation & Industrial.

Which region dominated the global aerospace riveting equipment market share?

North America held the dominating position in aerospace riveting equipment industry during the analysis period of 2023 to 2032.

Which region registered fastest CAGR from 2023 to 2032?

Asia-Pacific region exhibited fastest growing CAGR for market of aerospace riveting equipment during the analysis period of 2023 to 2032.

What are the current trends and dynamics in the global aerospace riveting equipment industry?

The current trends and dynamics in the aerospace riveting equipment industry include increasing demand for commercial and military aircraft, technological advancements leading to improved efficiency and safety, and stringent regulations driving the need for high-quality equipment.

Which type held the maximum share in 2022?

The blind rivet type held the maximum share of the aerospace riveting equipment industry.