Aerospace Composites Market Size - Global Industry, Share, Analysis, Trends and Forecast 2022 - 2030

Published :

Report ID:

Pages :

Format :

Aerospace Composites Market Size - Global Industry, Share, Analysis, Trends and Forecast 2022 - 2030

Report Coverage

- Industry Dynamics

- Market Size and Forecast Data

- Segment Analysis

- Competitive Landscape

- Regional Analysis with a Niche Focus on Country-Level Data

- High Level Analysis - Porter's, PESTEL, Value Chain, etc.

- Company Profiles of Key Players

- Option to Customize the Report As Per Your Specific Need

Request Sample Report

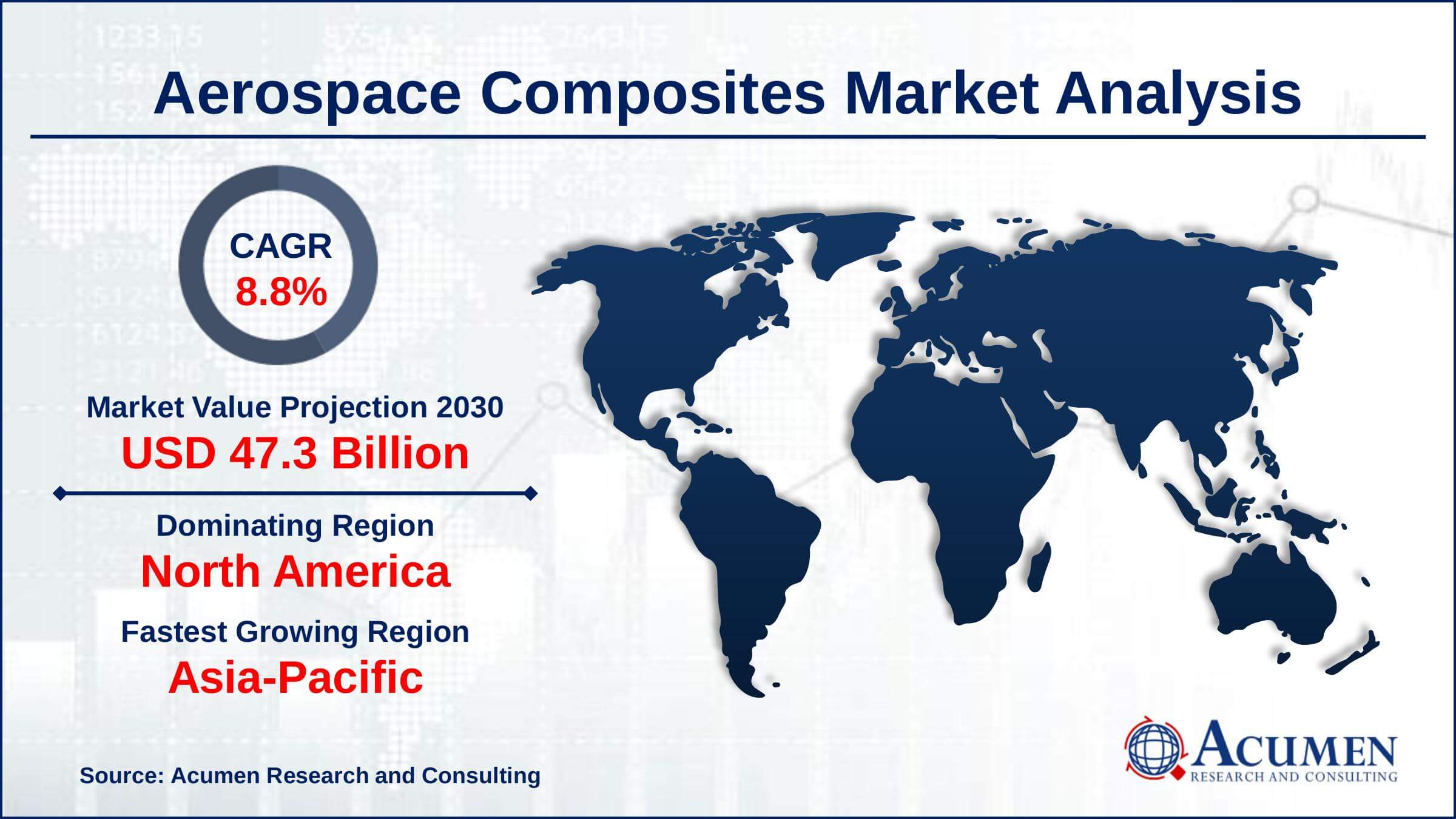

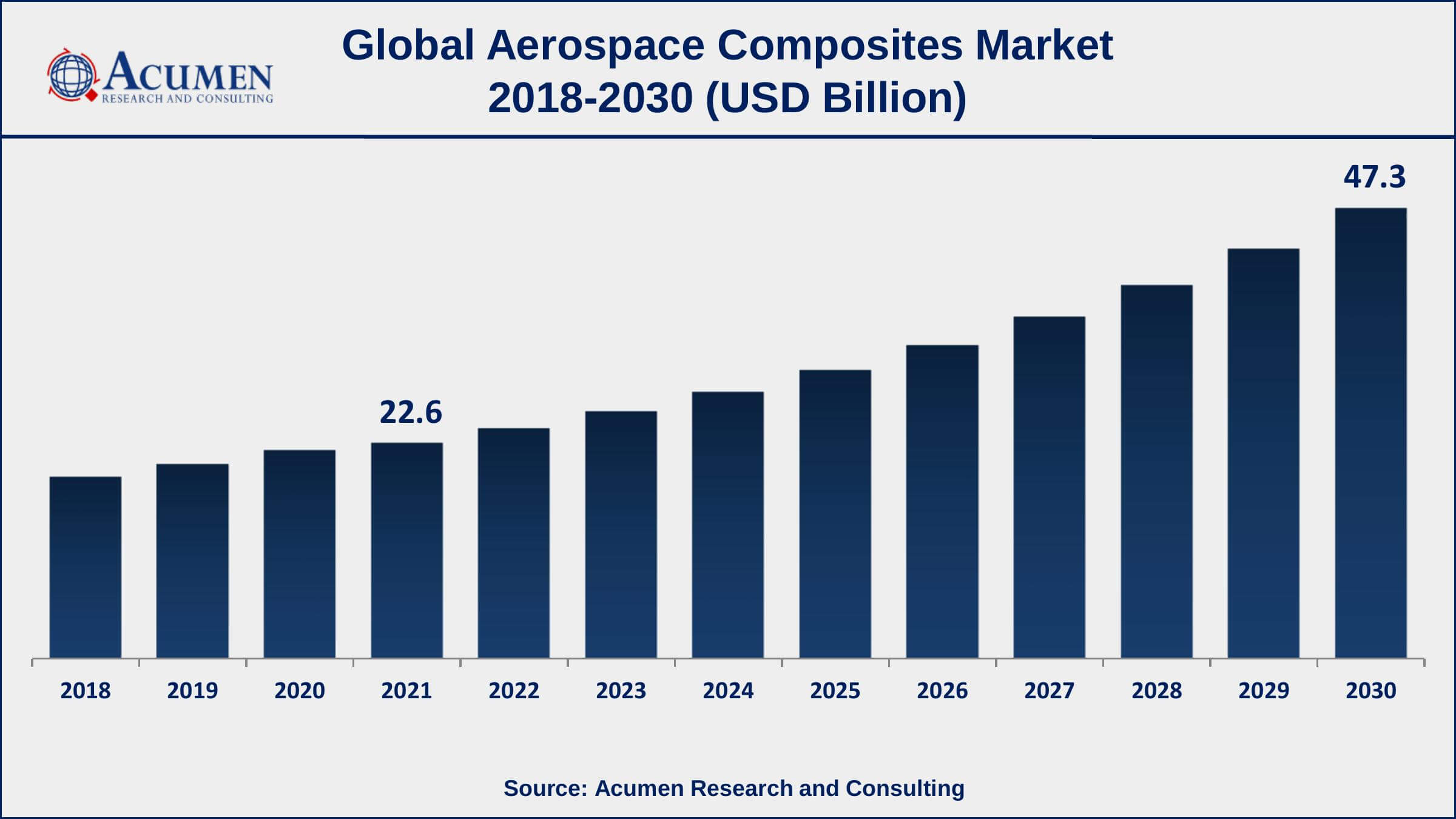

The Global Aerospace Composites Market Size accounted for USD 22.6 Billion in 2021 and is estimated to achieve a market size of USD 47.3 Billion by 2030 growing at a CAGR of 8.8% from 2022 to 2030. A growing number of commercial and military aircraft are using composite materials, which is driving the expansion of the aerospace composites market value. Additionally, the development of fuel-efficient aviation, the deployment of more aircraft, and the replacement of outdated aircraft with newer models are some other factors driving the aerospace composites market growth.

Aerospace Composites Market Report Key Highlights

- Global aerospace composites market revenue intended to gain USD 47.3 billion by 2030 with a CAGR of 8.8% from 2022 to 2030

- North America region led with more than 36% aerospace composites market share in 2021

- Asia-Pacific aerospace composites market growth will observe strongest CAGR from 2022 to 2030

- By fiber type, carbon fiber segment generated about 47% market share in 2021

- By aircraft type, the commercial aircraft engaged more than 38% of the total market share in 2021

- Increasing demand for fuel-efficient aircraft, drives the aerospace composites market size

In the aircraft industry, composite material is used for various purposes. The advantage of composites is that they preserve their identities and do not integrate completely. If combined, the materials create a more structurally stable composite material for airspace components. Composites used in the aerospace industry are made up of, or blends of, fiberglass fiber, and fiber-reinforced matrix structures. In different structures, including the wings, the interior, and the fuselage, aerospace composites are used as they can withstand extreme operating pressures, including high temperatures, high stresses, shocks, and impact loads. Basically, composites in aerospace are designed to deal with the dust, corrosion, and fire rate regulators of the materials.

Global Aerospace Composites Market Trends

Market Drivers

- Growing number of aircraft in the aviation industry

- Increasing demand for fuel-efficient airplanes

- Advancing space exploration and the defense sector

- Rising demand for high-strength, lightweight composite materials

Market Restraints

- High manufacturing and material costs

- Scarcity of manufacturing technology standards

Market Opportunities

- Lowering the cost of carbon-based composite materials

- Advancement of sophisticated software solutions for aerospace composites

Aerospace Composites Market Report Coverage

| Market | Aerospace Composites Market |

| Aerospace Composites Market Size 2021 | USD 22.6 Billion |

| Aerospace Composites Market Forecast 2030 | USD 47.3 Billion |

| Aerospace Composites Market CAGR During 2022 - 2030 | 8.8% |

| Aerospace Composites Market Analysis Period | 2018 - 2030 |

| Aerospace Composites Market Base Year | 2021 |

| Aerospace Composites Market Forecast Data | 2022 - 2030 |

| Segments Covered | By Fiber Type, By Application, By Manufacturing Process, By Aircraft Type, And By Geography |

| Regional Scope | North America, Europe, Asia Pacific, Latin America, and Middle East & Africa |

| Key Companies Profiled | Dupont, Solvay, Hexcel, Gurit Holding Co., Owens Corning, Kaneka Corporation, Axioms Materials, Royal Tencate, Argosy International, Toray Industries Inc., and BASF SE. |

| Report Coverage |

Market Trends, Drivers, Restraints, Competitive Analysis, Player Profiling, Regulation Analysis |

Commercial aircraft associated with defense and military activities mainly drive the aerospace composite market. Air composites are used in various application areas, such as passengers and plenums, cargo panels, galleys, winglets deck-panels, cabin ducts, overhead compartments, toilets, bars, deck panels, clothing, and fins, bracks, trailing edges, and gear doors among others. Aerospace composites are also used in the field of air traffic. Aerospace composites are being used in military and defense applications for the manufacturing of components required in helicopters, launches and aircraft, and others. Compounds for airspace aid components in the management of wear and tear, fire, and severe weather. Aerospace composites also help components enhance aircraft performance. In the aerospace industry, maintenance, repair, and overhaul are major segments and a major opportunity for airspace composites during the forecast period.

However, higher prices and issues with recyclability for the composites of aerospace are expected to hinder market growth in the forecast period.

Covid-19 Impact on Global Aerospace Composites Market

Covid-19 has slowed down the growth of the aerospace composites market worldwide particularly in the 2nd and 3rd quarters of 2020. The disrupted supply chain for the period due to the lockdown and major restrictions on multinational operations has resulted in decreased growth. The timely arrival of raw materials has been disrupted, as well as absenteeism of workers and shut down of factories and other associated operations have contributed to the slower growth of the global aerospace composites market.

Aerospace Composites Market Segmentation

The worldwide aerospace composites market segmentation is based on the fiber type, application, manufacturing process, aircraft type, and geography.

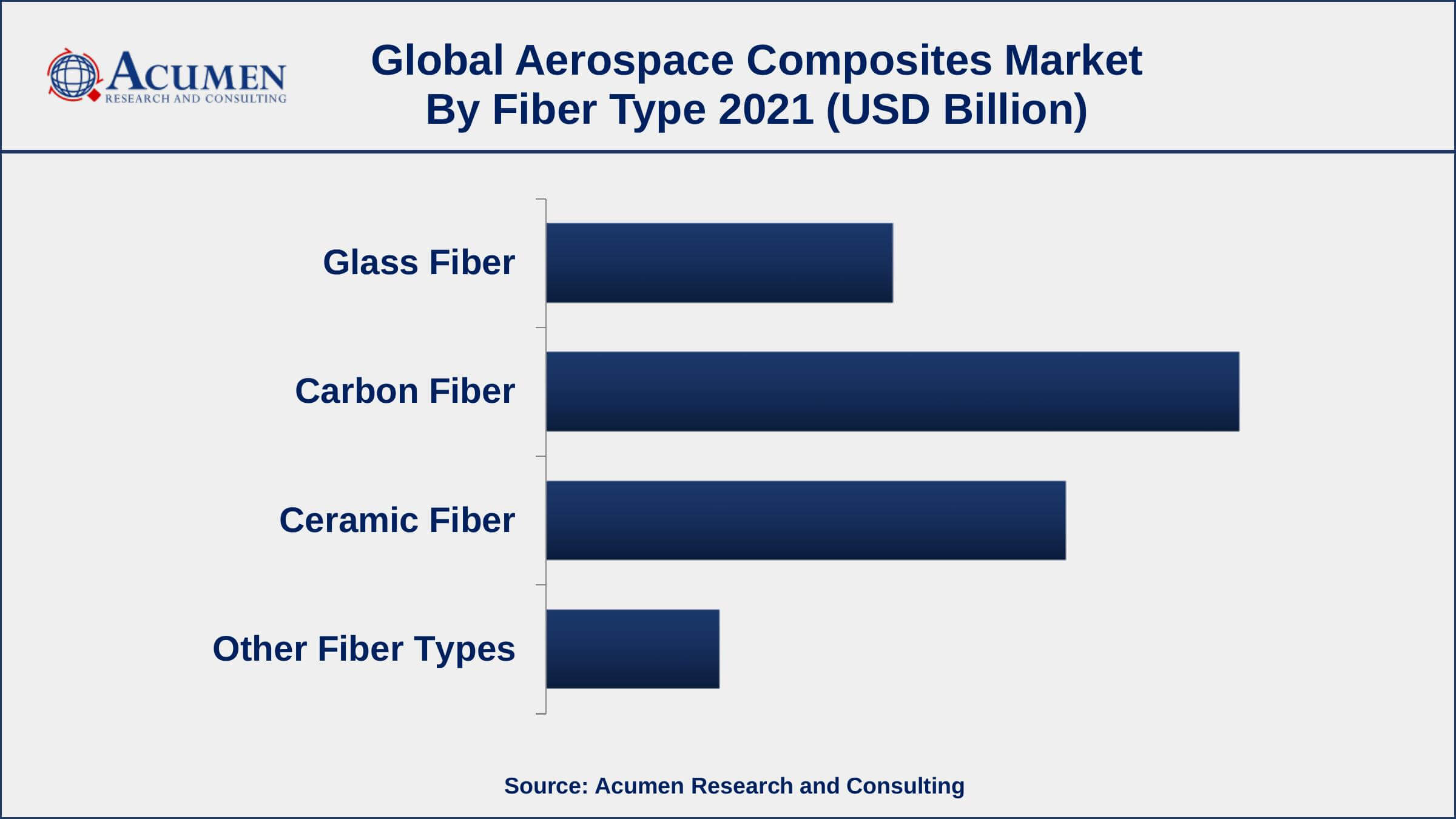

Aerospace Composites Market By Fiber Type

- Glass Fiber

- Carbon Fiber

- Ceramic Fiber

- Other Fiber Types

According to an aerospace composites industry analysis, carbon fiber dominates the market and is predicted to keep supremacy over other segments. Carbon fiber is approximately twice as tough as ceramic and glass fibers, making it the material of choice for airplanes and space vehicles. Furthermore, the high-strength carbon fiber lowers aircraft weight, enhancing engine efficiency as well as cutting fuel consumption.

Aerospace Composites Market By Application

- Interiors

- Exteriors

In terms of application, the external application segment will gain substantial market traction in the coming years. Composites with higher operating temps and better curing characteristics are required for exterior aircraft applications. They provide strong aerospace structures, which will increase industry income. Because of their extraordinary strength, improved stiffness-to-density proportion, & superior physical qualities, composites have seen significant use in military and commercial applications due to continuous R&D.

Aerospace Composites Market By Manufacturing Process

- AFP/ATL

- Resin Transfer Molding

- Lay-up

- Filament Winding

- Others

According to the aerospace composites market forecast, the AFP/ATL segment is predicted to increase significantly in the market over the next several years. In comparison to certain other manufacturing processes, this process is quick and allows for large-scale production of aircraft composites. The AFT/ATP technique is used to manufacture aircraft composites for next-generation airplane fuselages, wing boxes, wing skins, & tail skins.

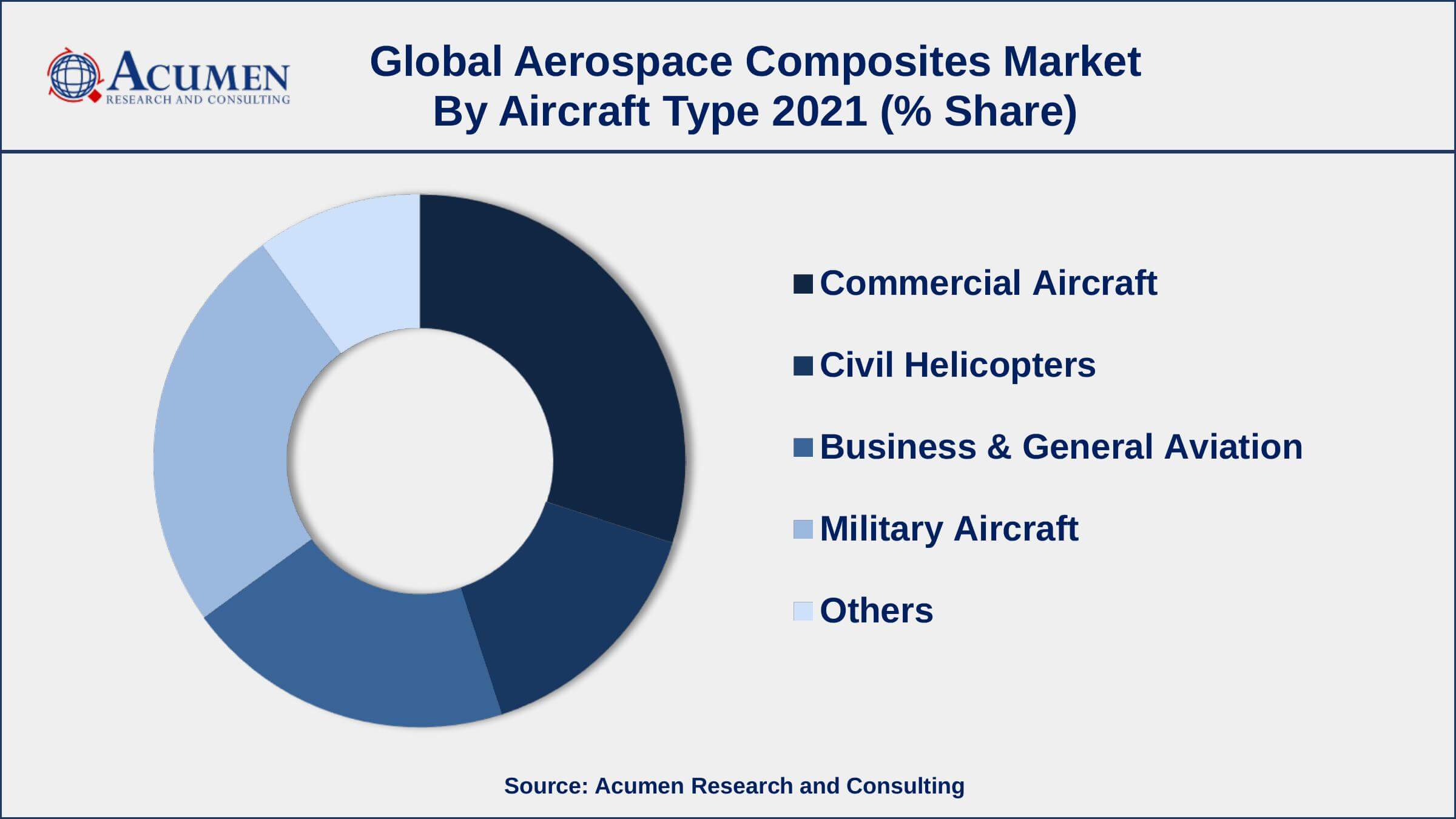

Aerospace Composites Market By Aircraft Type

- Commercial Aircraft

- Civil Helicopters

- Business & General Aviation

- Military Aircraft

- Others

In terms of aircraft types, the military segment is predicted to grow at the fastest rate during the forecast period. Due to the increased acquisition of military technology by the armed services to combat threats posed by terrorist attacks and regional conflicts. Nations are purchasing military aircraft to protect their boundaries from outside threats, creating demand for composite materials. Composite materials used in military helicopters are lightweight, strong, and resistant to chemicals and extreme temperatures. Composite materials used mostly in military planes also have ballistic qualities and are difficult for radars to detect.

Aerospace Composites Market Regional Outlook

North America

- U.S.

- Canada

Europe

- U.K.

- Germany

- France

- Spain

- Rest of Europe

Asia-Pacific

- India

- Japan

- China

- Australia

- South Korea

- Rest of Asia-Pacific

Latin America

- Brazil

- Mexico

- Rest of Latin America

The Middle East & Africa

- South Africa

- GCC Countries

- Rest of the Middle East & Africa (ME&A)

North America Holds Dominating Share of Aerospace Composites Market

North America aerospace composites markets have expanded primarily as a result of mass aerospace product manufacturing in the region. As carbon fiber composites are increasingly needed, most companies in North America and Europe focus on developing their carbon fiber composite plants. In Europe, the aerospace sector, high-speed train competition, and other travel modes are driven by the aerospace composites market. The region's development of the aerospace composites market has risen over the past few years as air passenger traffic and the growing world aircraft leaders in the Asia Pacific. In Latin America, the market is projected to grow rapidly as Brazil's low-cost production and demand expand. The emergence of Embraer, one of the leading rivals, will also boost the region's market growth. The Middle East and Africa will also grow significantly due to the involvement of suppliers in aircraft and the growing amount of aircraft repairs, repair, and operations in the area. In the same way, during the projected era Central Europe and Russia will have a strong rate of growth in the aerospace composites market.

Aerospace Composites Market Players

Some of the top aerospace composites market companies offered in the professional report include Dupont, Solvay, Hexcel, Gurit Holding Co., Owens Corning, Kaneka Corporation, Axioms Materials, Royal Tencate, Argosy International, Toray Industries Inc., and BASF SE.

Frequently Asked Questions

What is the size of global aerospace composites market in 2021?

The estimated value of global aerospace composites market in 2021 was accounted to be USD 22.6 Billion.

What is the CAGR of global aerospace composites market during forecast period of 2022 to 2030?

The projected CAGR aerospace composites market during the analysis period of 2022 to 2030 is 8.8%.

Which are the key players operating in the market?

The prominent players of the global aerospace composites market are Dupont, Solvay, Hexcel, Gurit Holding Co., Owens Corning, Kaneka Corporation, Axioms Materials, Royal Tencate, Argosy International, Toray Industries Inc., and BASF SE.

Which region held the dominating position in the global aerospace composites market?

North America held the dominating aerospace composites during the analysis period of 2022 to 2030.

Which region registered the fastest growing CAGR for the forecast period of 2022 to 2030?

Asia-Pacific region exhibited fastest growing CAGR for aerospace composites during the analysis period of 2022 to 2030.

What are the current trends and dynamics in the global aerospace composites market?

Growing demand for generic medicines and rising acceptance of quality standards in API manufacturing, including GMP drives the growth of global aerospace composites market.

By fiber type segment, which sub-segment held the maximum share?

Based on fiber type, carbon fiber segment is expected to hold the maximum share aerospace composites market.