Aerospace Coating Market Size - Global Industry, Share, Analysis, Trends and Forecast 2024 - 2032

Published :

Report ID:

Pages :

Format :

Aerospace Coating Market Size - Global Industry, Share, Analysis, Trends and Forecast 2024 - 2032

Report Coverage

- Industry Dynamics

- Market Size and Forecast Data

- Segment Analysis

- Competitive Landscape

- Regional Analysis with a Niche Focus on Country-Level Data

- High Level Analysis - Porter's, PESTEL, Value Chain, etc.

- Company Profiles of Key Players

- Option to Customize the Report As Per Your Specific Need

Request Sample Report

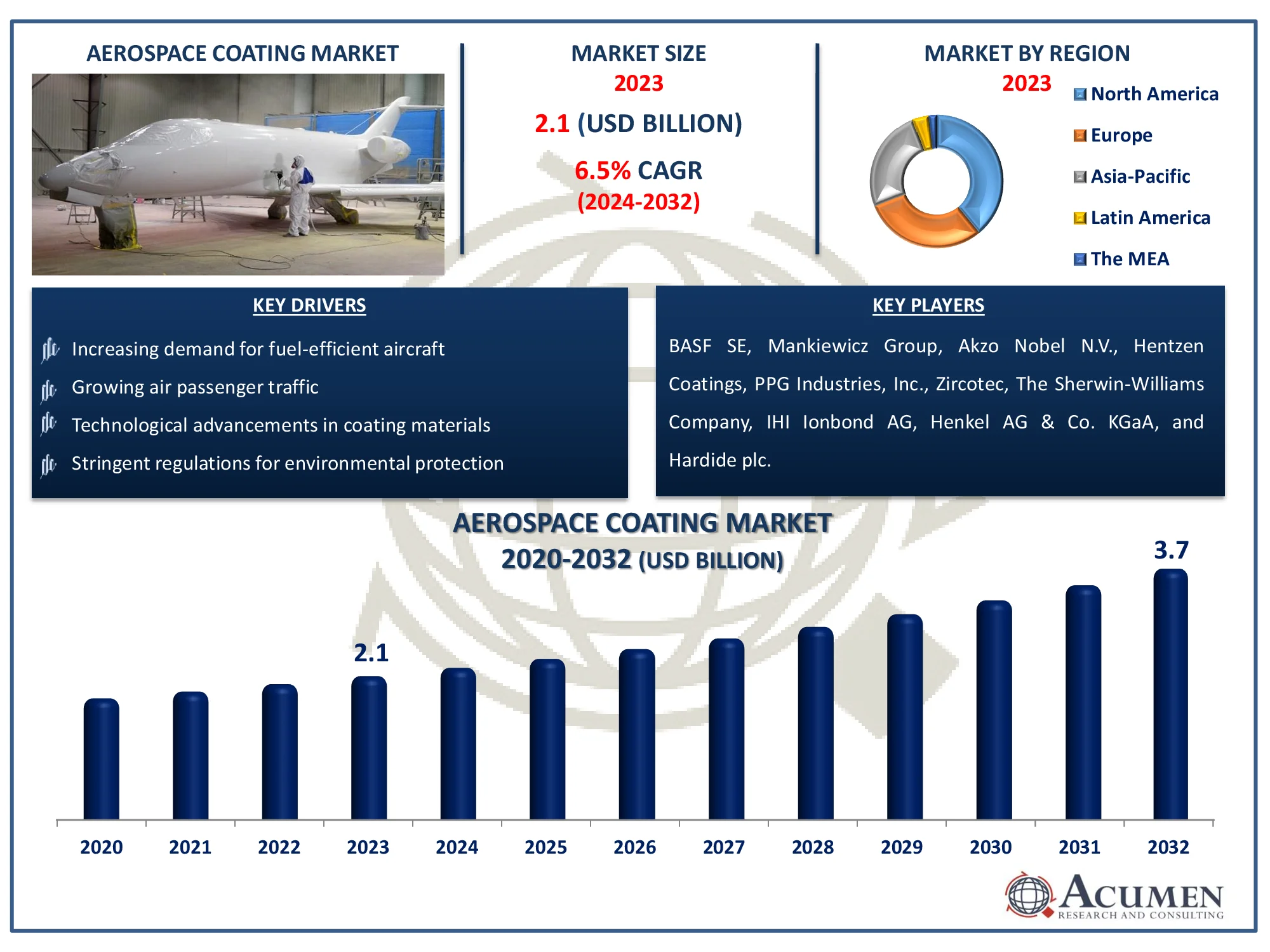

The Global Aerospace Coating Market Size accounted for USD 2.1 Billion in 2023 and is estimated to achieve a market size of USD 3.7 Billion by 2032 growing at a CAGR of 6.5% from 2024 to 2032.

Aerospace Coating Market (By Product: Liquid and Powder; By Resin: Polyurethane, Epoxy, and Others: By Industry: OEM and MRO; By Application: Interior and Exterior; By End-User: Commercial, Military, and Others; and By Region: North America, Europe, Asia-Pacific, Latin America, and the MEA)

Aerospace Coating Market Highlights

- Global aerospace coating market revenue is poised to garner USD 3.7 billion by 2032 with a CAGR of 6.5% from 2024 to 2032

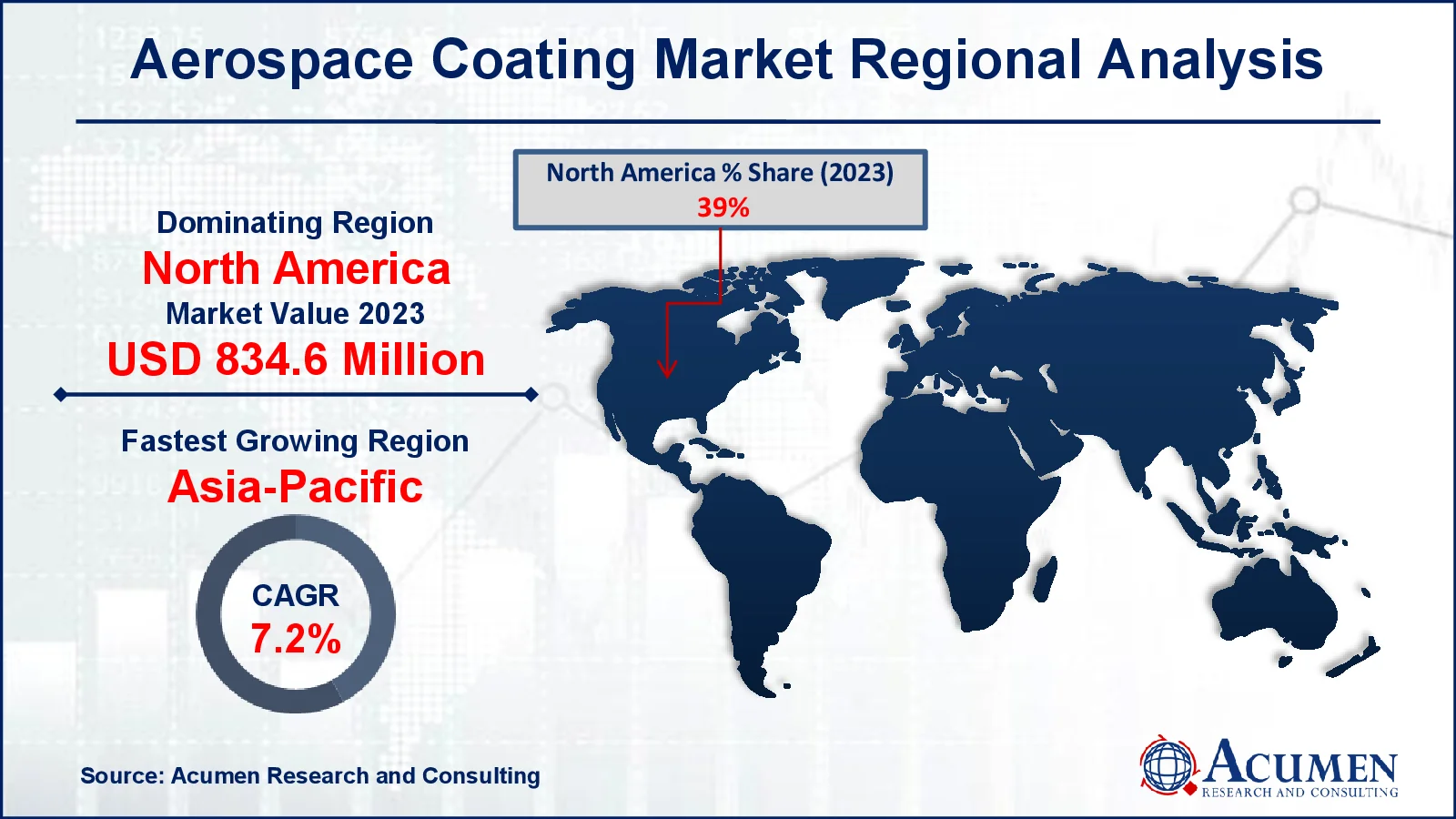

- North America aerospace coating market value occupied around USD 834.6 million in 2023

- Asia-Pacific aerospace coating market growth will record a CAGR of more than 7.2% from 2024 to 2032

- Among product, the liquid sub-segment generated noteworthy revenue in 2023

- Based on resin, the polyurethane sub-segment generated 64% aerospace coating market share in 2023

- Advancements in nanotechnology for superior coating performance is a popular aerospace coating market trend that fuels the industry demand

Aerospace coatings are specialized materials applied to the surfaces of aircraft and spacecraft to protect them from environmental factors, improve performance, and enhance aesthetics. These coatings are engineered to withstand extreme conditions, such as high altitudes, temperature fluctuations, UV radiation, and exposure to various chemicals. They play a critical role in reducing maintenance costs and extending the lifespan of aerospace components. Aerospace coatings typically include primers, topcoats, and specialty coatings like anti-corrosive, anti-static, and heat-resistant variants. Innovations in this field focus on lightweight materials, environmentally friendly formulations, and advanced application techniques to ensure compliance with stringent safety and environmental regulations. Major players in the aerospace coatings market include BASF SE, Akzo Nobel N.V., and PPG Industries, Inc., who continuously develop new products to meet the evolving demands of the aerospace industry. Overall, aerospace coatings are essential for maintaining the structural integrity and performance efficiency of modern aircraft and spacecraft.

Global Aerospace Coating Market Dynamics

Market Drivers

- Increasing demand for fuel-efficient aircraft

- Growing air passenger traffic

- Technological advancements in coating materials

- Stringent regulations for environmental protection

Market Restraints

- High cost of raw materials

- Stringent regulatory approval processes

- Volatility in the prices of crude oil affecting production costs

Market Opportunities

- Rising demand for military and defense aircraft

- Expansion of the commercial aviation sector in emerging markets

- Development of eco-friendly and sustainable coating solutions

Aerospace Coating Market Report Coverage

| Market | Aerospace Coating Market |

| Aerospace Coating Market Size 2022 |

USD 2.1 Billion |

| Aerospace Coating Market Forecast 2032 | USD 3.7 Billion |

| Aerospace Coating Market CAGR During 2023 - 2032 | 6.5% |

| Aerospace Coating Market Analysis Period | 2020 - 2032 |

| Aerospace Coating Market Base Year |

2022 |

| Aerospace Coating Market Forecast Data | 2023 - 2032 |

| Segments Covered | By Product, By Resin, By Industry, By Application, By End-User, And By Geography |

| Regional Scope | North America, Europe, Asia Pacific, Latin America, and Middle East & Africa |

| Key Companies Profiled | BASF SE, Mankiewicz Group, Akzo Nobel N.V., Hentzen Coatings, PPG Industries, Inc., Zircotec, The Sherwin-Williams Company, IHI Ionbond AG, Henkel AG & Co. KGaA, and Hardide plc. |

| Report Coverage |

Market Trends, Drivers, Restraints, Competitive Analysis, Player Profiling, Covid-19 Analysis, Regulation Analysis |

Aerospace Coating Market Insights

These coatings are additionally utilized by different end-users, including military, commercial, and general aviation fleet producers. Key players in the market are investing in R&D activities to broaden the application scope and market reach of the product and, thus, sustain their competitive positions. Increasing spending power in countries such as the U.S. and Europe is significantly driving the need for air travel. This, in turn, is resulting in an increased demand for the product, predominantly driven by commercial fleet manufacturers. The use of solvent-based coatings is limited in regions such as Europe and North America due to stringent regulations on harmful emissions, including volatile organic compounds. Water-based alternatives are anticipated to see a strong rise in demand over the coming years.

The increasing need for air travel from countries such as China and Japan is expected to drive the market in the Asia Pacific over the forecast period. The presence of various long-haul carrier routes in the Asia Pacific is boosting the demand for aviation coatings. Several government initiatives in countries encouraging private investment in the aircraft industry to enable domestic aviation companies to compete globally are expected to facilitate the need for aviation coatings in the Asia Pacific. Government regulations for the aerospace coating market are overseen by various administrative bodies, including the Occupational Safety and Health Administration (OSHA) and the National Toxicology Program (NTP). These regulations determine the chemical hazards of raw materials used in the manufacturing process. The application, curing, and overall safety of coatings and their raw materials, such as epoxy resins, aluminum, and chromium, are permitted when safety regulations are strictly followed.

Aerospace Coating Market Segmentation

The worldwide market for aerospace coating is split based on product, resin, industry, application, end-users, and geography.

Aerospace Coating Products

- Liquid

- Solvent-based

- Water-based

- Powder

According to aerospace coating industry analysis, the liquid coating segment holds the largest share in the market due to its extensive use in both commercial and military aviation. Liquid coatings offer superior application versatility, providing a smoother and more uniform finish compared to powder coatings. They are preferred for their excellent adhesion properties and ability to protect aircraft surfaces from harsh environmental conditions, including UV radiation, extreme temperatures, and chemical exposure. Additionally, liquid coatings are easier to apply on complex geometries and intricate surfaces, ensuring comprehensive coverage and protection. Despite environmental concerns related to volatile organic compounds (VOCs), advancements in eco-friendly, water-based liquid coatings have further bolstered their adoption, maintaining their dominance in the market.

Aerospace Coating Resins

- Polyurethane

- Epoxy

- Others

Polyurethane has emerged as the prominent segment in the aerospace coating market due to its exceptional performance characteristics. Known for its durability and resistance to abrasion, polyurethane coatings provide long-lasting protection for aircraft surfaces, which is crucial for maintaining structural integrity and reducing maintenance costs. These coatings also offer excellent resistance to UV radiation and weathering, making them ideal for exterior applications. Moreover, polyurethane’s flexibility allows it to expand and contract with temperature changes, preventing cracks and damage. Its compatibility with a variety of substrates and ability to produce a high-gloss finish enhances the aesthetic appeal of aircraft. The combination of these attributes ensures that polyurethane remains the preferred choice among aerospace manufacturers and operators.

Aerospace Coating Industries

- OEM

- MRO

As per the aerospace coating market forecast, the original equipment manufacturer (OEM) segment is anticipated to be the largest throughout 2024 to 2032. This dominance is driven by the continuous production of new aircraft to meet the rising global demand for air travel. OEM coatings are integral during the manufacturing process, ensuring that new aircraft are equipped with high-performance, protective finishes from the start. These coatings are crucial for enhancing the durability and longevity of the aircraft, providing resistance against environmental factors and wear. With the expansion of the aviation industry, particularly in emerging markets, and the ongoing advancements in aircraft technology, the OEM segment is poised to see sustained growth, reinforcing its leading position in the market.

Aerospace Coating Applications

- Exterior

- Interior

The exterior segment is leading throughout the aerospace coating market forecast period due to its critical role in protecting aircraft from harsh environmental conditions. Exterior coatings are essential for safeguarding aircraft surfaces against UV radiation, temperature extremes, and chemical exposure, which can significantly impact performance and safety. These coatings also contribute to aerodynamic efficiency by providing a smooth surface, reducing drag, and enhancing fuel efficiency. Additionally, exterior coatings are crucial for aesthetic purposes, allowing airlines to maintain brand identity through distinctive liveries. With the constant exposure to challenging conditions, the demand for advanced, durable exterior coatings remains high, ensuring their dominant position in the aerospace coating market.

Aerospace Coating End-Users

- Commercial

- Military

- Others

The commercial segment commands the largest share within the end-user category of the aerospace coating market due to its extensive and growing fleet of aircraft. As airlines expand their operations and invest in new aircraft to meet increasing passenger demand, the need for high-performance coatings becomes crucial. These coatings are essential for enhancing aircraft longevity and maintaining operational efficiency, which directly impacts airline profitability. Furthermore, commercial airlines prioritize aesthetics and brand identity, which are achieved through vibrant and durable coatings. The continuous influx of new aircraft and regular maintenance requirements for existing fleets further bolster the demand in the commercial sector, solidifying its dominant position in the aerospace coating market.

Aerospace Coating Market Regional Outlook

North America

- U.S.

- Canada

Europe

- U.K.

- Germany

- France

- Spain

- Rest of Europe

Asia-Pacific

- India

- Japan

- China

- Australia

- South Korea

- Rest of Asia-Pacific

Latin America

- Brazil

- Mexico

- Rest of Latin America

The Middle East & Africa

- South Africa

- GCC Countries

- Rest of the Middle East & Africa (ME&A)

Aerospace Coating Market Regional Analysis

In the terms of aerospace coating market analysis, North America stands out as the largest region, driven by its advanced aerospace industry and substantial fleet of commercial and military aircraft. The region's dominance is underpinned by the presence of major aerospace manufacturers, such as Boeing and Lockheed Martin, which drive demand for high-quality coatings. North America's focus on technological innovation, stringent regulations, and high maintenance standards further contribute to its leading position. Additionally, the region's significant investments in R&D ensure the continued development of advanced coating solutions, supporting its market leadership.

Asia-Pacific is the fastest-growing region and it is expected to growing over the aerospace coating industry forecast period, fueled by the rapid expansion of the aviation sector in countries like China and India. This growth is driven by increasing air travel demand, the rise of low-cost carriers, and government initiatives to boost domestic aviation industries. The presence of numerous emerging airlines and a burgeoning middle class contribute to the region's dynamic growth. Moreover, Asia-Pacific's expanding aerospace manufacturing capabilities and infrastructure development support the rising demand for aerospace coatings, positioning the region as a key player in the market's future expansion.

Aerospace Coating Market Players

Some of the top aerospace coating companies offered in our report includes BASF SE, Mankiewicz Group, Akzo Nobel N.V., Hentzen Coatings, PPG Industries, Inc., Zircotec, The Sherwin-Williams Company, IHI Ionbond AG, Henkel AG & Co. KGaA, and Hardide plc.

Frequently Asked Questions

How big is the aerospace coating market?

The aerospace coating market size was valued at USD 2.1 billion in 2023.

What is the CAGR of the global aerospace coating market from 2024 to 2032?

The CAGR of Aerospace Coating is 6.5% during the analysis period of 2024 to 2032.

Which are the key players in the aerospace coating market?

The key players operating in the global market are including BASF SE, Mankiewicz Group, Akzo Nobel N.V., Hentzen Coatings, PPG Industries, Inc., Zircotec, The Sherwin-Williams Company, IHI Ionbond AG, Henkel AG & Co. KGaA, and Hardide plc.

Which region dominated the global aerospace coating market share?

North America held the dominating position in aerospace coating industry during the analysis period of 2024 to 2032.

Which region registered fastest CAGR from 2024 to 2032?

Asia-Pacific region exhibited fastest growing CAGR for market of aerospace coating during the analysis period of 2024 to 2032.

What are the current trends and dynamics in the global aerospace coating industry?

The current trends and dynamics in the aerospace coating industry include increasing demand for fuel-efficient aircraft, growing air passenger traffic, technological advancements in coating materials, and stringent regulations for environmental protection.

Which polyurethane held the maximum share in 2023?

The polyurethane resin held the maximum share of the aerospace coating industry.