Advanced Analytics Market Size - Global Industry, Share, Analysis, Trends and Forecast 2022 � 2030

Published :

Report ID:

Pages :

Format :

Advanced Analytics Market Size - Global Industry, Share, Analysis, Trends and Forecast 2022 � 2030

Report Coverage

- Industry Dynamics

- Market Size and Forecast Data

- Segment Analysis

- Competitive Landscape

- Regional Analysis with a Niche Focus on Country-Level Data

- High Level Analysis - Porter's, PESTEL, Value Chain, etc.

- Company Profiles of Key Players

- Option to Customize the Report As Per Your Specific Need

Request Sample Report

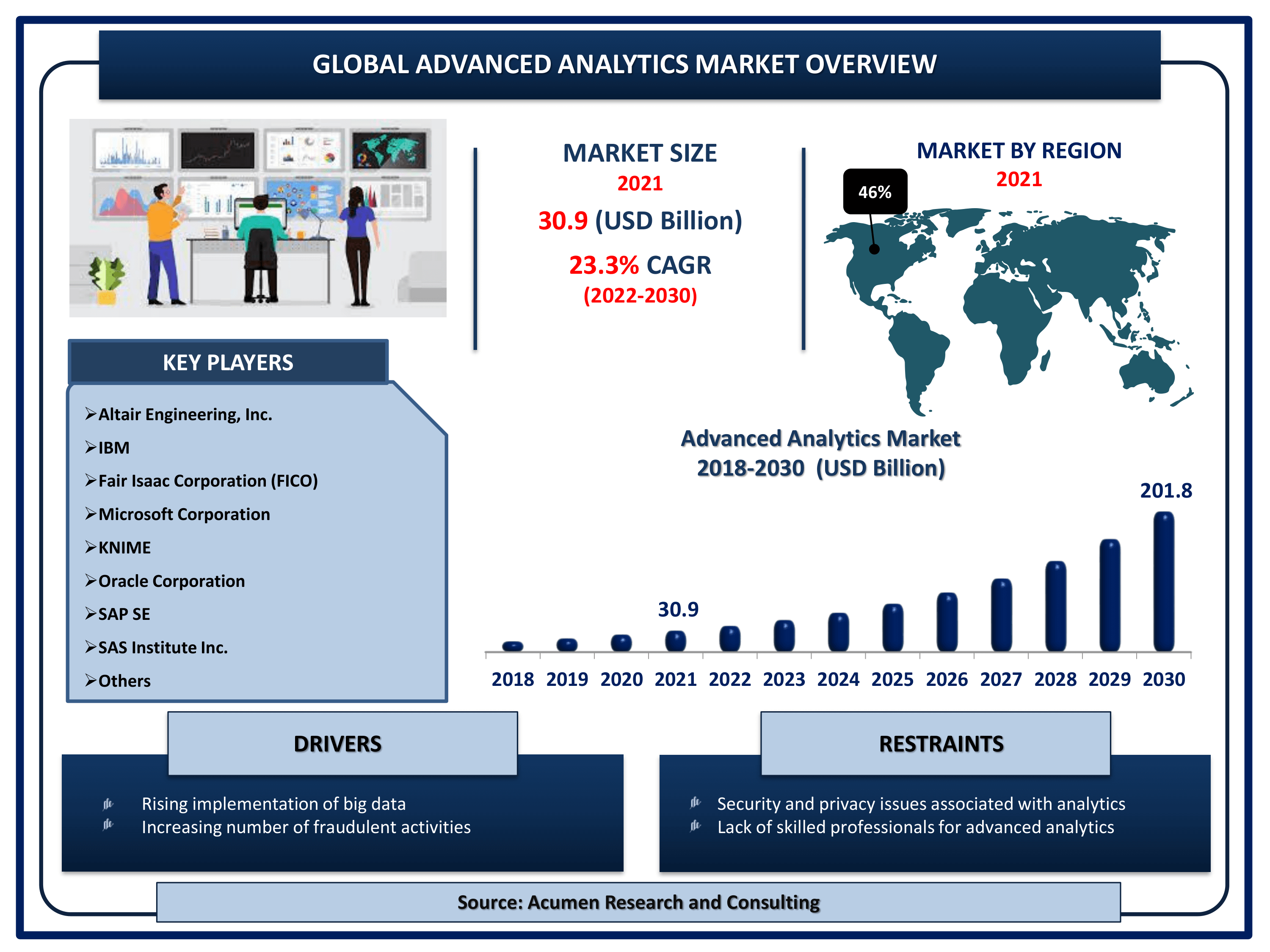

The Global Advanced Analytics Market Size accounted for USD 30.9 Billion in 2021 and is projected to achieve a market size of USD 201.8 Billion by 2030 rising at a CAGR of 23.3% from 2022 to 2030. Advanced analytics is a data analysis methodology that analyses business information from a variety of data sources using predictive modeling, machine learning algorithms, deep learning, business process automation, and other statistical methods. Advanced analytics is a valuable technique for enterprises because it allows an organization to operate with greater accountability from its own data sets, regardless of where the data is stored or whether it is available in any format. Advanced analytics can help businesses address key issues that traditional business intelligence (BI) cannot.

Advanced Analytics Market Report Statistics

- Global advanced analytics market revenue is estimated to reach USD 201.8 Billion by 2030 with a CAGR of 23.3% from 2022 to 2030

- According to our a recent study, Netflix saves US$ 1 billion per year on customer retention using big data analytics

- North America advanced analytics market share accounted for over 46% shares in 2021

- Asia-Pacific advanced analytics market growth will record fastest CAGR from 2022 to 2030

- Based on type, big data analytics acquired over 36% of the overall market share in 2021

- Growing adoption of big data will fuel the global advanced analytics market value

- Advent of machine learning is a popular advanced analytics market trend that is fueling the industry demand

Where Advanced Analytics Had Helped During COVID-19?

According to the TDWI report, advanced analytics played a critical role during the unprecedented situations of COVID-19. During the COVID-19 response, the organization began by identifying new business challenges and setting up central nerve centers, mobilizing business, and analytics resources to address the COVID-19 challenges to the organization. Building new data streams, reporting business-critical issues to guide near-term decisions, and developing a longer-term view of data for a broader perspective are all part of this. Several businesses are currently opting for analytics, adopting new analytics solutions and redesigning existing ones to support the critical business priorities arising from the COVID-19 pandemic.

Global Advanced Analytics Market Dynamics

Market Drivers

- Rising implementation of big data

- Surging adoption of artificial intelligence and machine learning for analytics

- Increasing number of fraudulent activities

- Growing popularity of online shopping

Market Restraints

- Security and privacy issues associated with analytics

- Lack of skilled professionals for advanced analytics

Market Opportunities

- Increasing trend of social media platforms

- Rising demand to make real-time analytical decisions

Advanced Analytics Market Report Coverage

| Market | Advanced Analytics Market |

| Advanced Analytics Market Size 2021 | USD 30.9 Billion |

| Advanced Analytics Market Forecast 2030 | USD 201.8 Billion |

| Advanced Analytics Market CAGR During 2022 - 2030 | 23.3% |

| Advanced Analytics Market Analysis Period | 2018 - 2030 |

| Advanced Analytics Market Base Year | 2021 |

| Advanced Analytics Market Forecast Data | 2022 - 2030 |

| Segments Covered | By Type, By Deployment, By Enterprise Size, By End-Use, And By Geography |

| Regional Scope | North America, Europe, Asia Pacific, Latin America, and Middle East & Africa |

| Key Companies Profiled | Altair Engineering, Inc., Fair Isaac Corporation (FICO), International Business Machines Corporation, KNIME, Microsoft Corporation, Oracle Corporation, RapidMiner, Inc., SAP SE, SAS Institute Inc., and Trianz. |

| Report Coverage |

Market Trends, Drivers, Restraints, Competitive Analysis, Player Profiling, Regulation Analysis |

Advanced Analytics Market Growth Factors

Future of Advanced Analytics in Several End-User Industries

According to a report released by Project HOPE: The People-to-People Health Foundation, Inc., advanced analytics in healthcare is rapidly adopting electronic health records (EHS), which will dramatically increase the amount of clinical data available electronically. As a result, rapid progress is being made in the field of advanced analytics, which involves techniques for analyzing large quantities of data. As a result, there are several opportunities to use advanced analytics for large amounts of data and discover new insights for the analytical view. Companies in other industries have had great success using advanced analytics to improve the efficiency of their business operations. Such factors have a positive impact on the global advanced analytics market's growth.

Big Calls for "Advanced Analytics" in Managing Operations at Organizational Level

According to Harvard Business School Publishing statistics, incorporating advanced analytics into organization gains 85% of the organization significant business and IT benefits. Furthermore, 70% reported that advanced analytics are enterprise-driven technologies, and 75% reported that their incorporation has a positive impact across multiple lines of business. As data management and analysis become increasingly important for the public and private sectors to manage day-to-day operations more efficiently and make informed decisions to serve the client base. Given that the problems to be solved in the public sector are far more complex and multifaceted than those in the private sector, advanced analytics is viewed as an unavoidable path that every organization must take.

Advanced Analytics Market Segmentation

The worldwide advanced analytics market is split based on type, deployment, enterprise size, end-use, and geography.

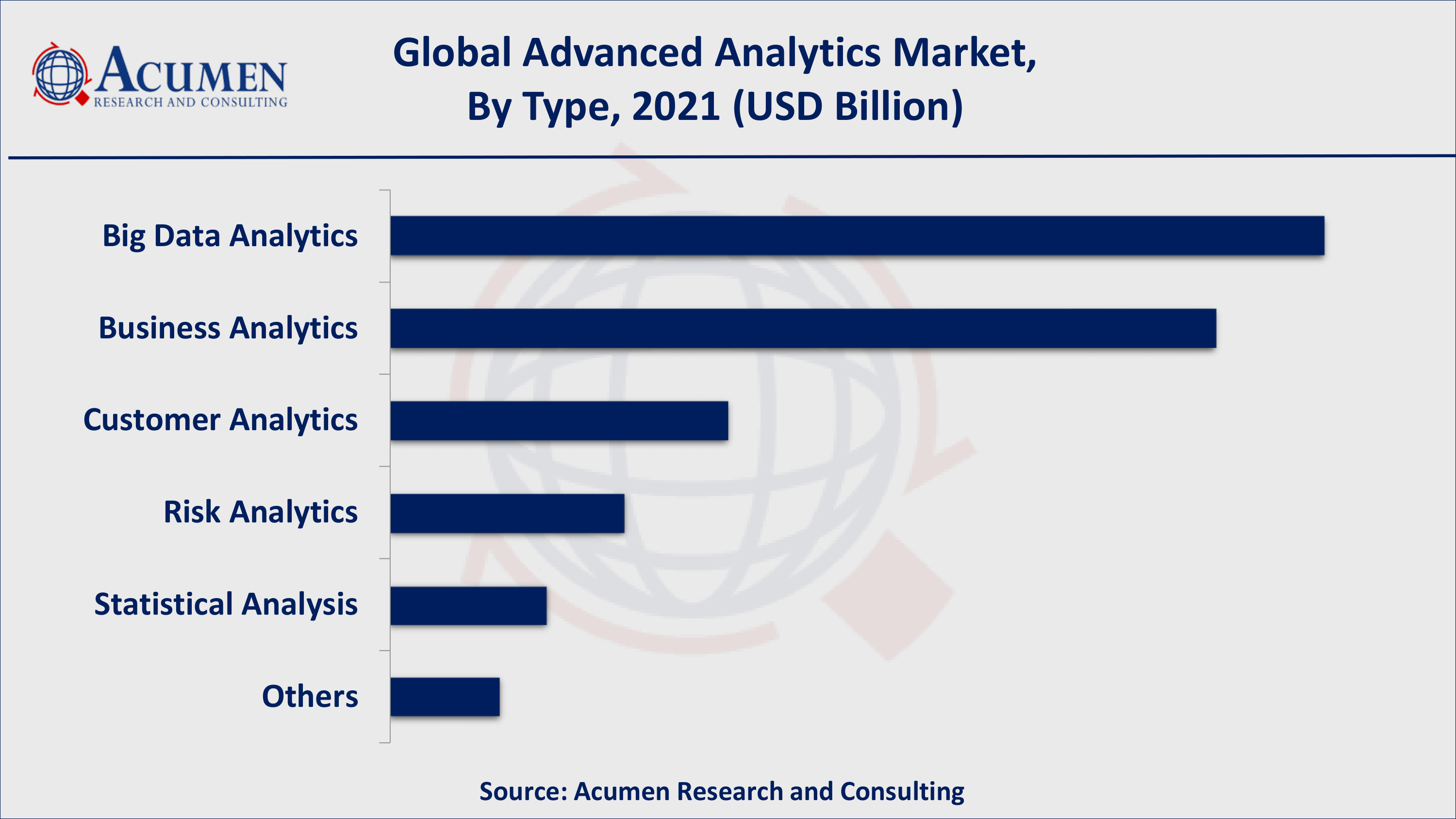

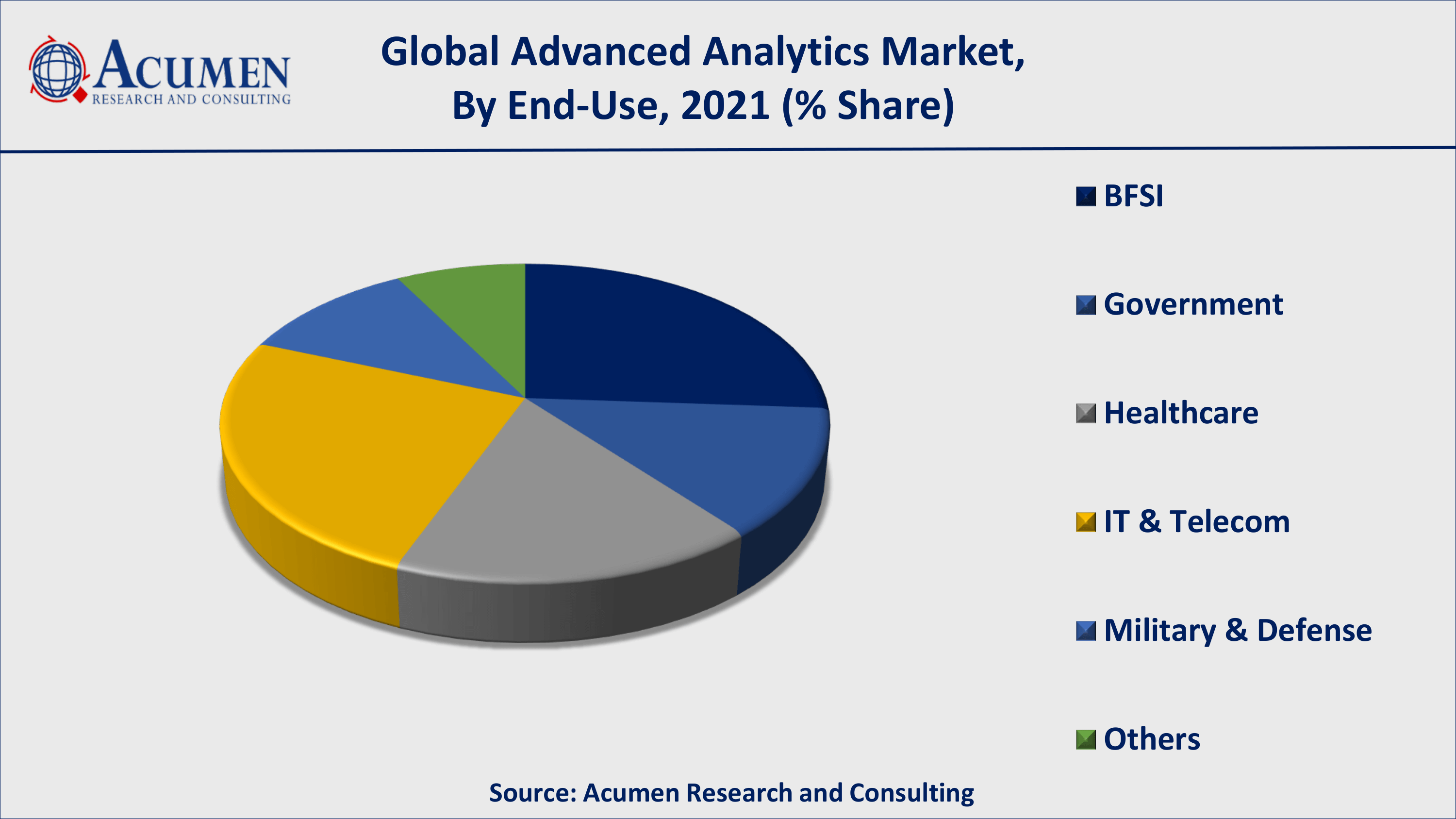

Based on type, the big data analytics segment accounted largest market share for the global advanced analytics market. By deployment, the on-premise segment holds the dominating revenue share for the global advanced analytics market. Based on enterprise size, the large enterprise segment holds the dominating share from the past and is expected to continue similar trend till the forecast period. Based on end-user, the BFSI segment accounted largest market share for the global advanced analytics market.

Big data is ranked 20th out of 33 key technologies. In the telecom and financial services industries, 53% of companies are using big data analytics, up from 17% in 2015, propelling the growth of the global market for advanced analytics.

By investing in advanced analytics tools, banks can gain real-time insights into individual prospects and personalize engagement. These tools' actionable and accurate insights help to generate interest in products and services for a large customer base and improve customer segmentation. Citibank's adoption of advanced analytics, for example, has resulted in an analytical approach and the implementation of experiments with innovative use cases of analytics by deconstructing data. The bank analyzed its customer data using machine learning algorithms and used the results to target promotional spending. These factors have a positive impact on segmental growth, which ultimately contributes to the growth of the global advanced analytics market.

Advanced Analytics Market By Type

- Big Data Analytics

- Business Analytics

- Customer Analytics

- Risk Analytics

- Statistical Analysis

- Others

Advanced Analytics Market By Deployment

- On-Premise

- Cloud

Advanced Analytics Market By Enterprise Size

- Large Enterprises

- Small & Medium Enterprises (SMEs)

Advanced Analytics Market By End-Use

- BFSI

- Government

- Healthcare

- IT & Telecom

- Military & Defense

- Others

Advanced Analytics Market Regional Outlook

North America

- U.S.

- Canada

Europe

- U.K.

- Germany

- France

- Spain

- Rest of Europe

Asia-Pacific

- India

- Japan

- China

- Australia

- South Korea

- Rest of Asia-Pacific

Latin America

- Brazil

- Mexico

- Rest of Latin America

The Middle East & Africa

- South Africa

- GCC Countries

- Rest of the Middle East & Africa (ME&A)

Advanced Analytics Market Regional Analysis

North America dominates, Asia-Pacific to Record Fastest Growing CAGR for the Advanced Analytics Market

North America has dominated the advanced analytics market in the past and is expected to do so again during the forecast period. According to TDWI statistics, advanced analytics adoption is increasing, and enterprises are reaping significant benefits. 44% of respondents have seen differentiation or transformational benefits from the use of advanced analytics. Aside from that, the presence of diverse end-use industries fuels the adoption of advanced analytics, ultimately contributing to the market's overall growth. The telecommunications and financial services industries were the first to adopt advanced analytics, with technology and healthcare coming in third and fourth. Furthermore, because of the numerous job opportunities associated with advanced analytics, it is a widely used technology that contributes to the overall market's growth. According to a report by the Information and Communications Technology Council, big data adoption employs 43,700 Canadians both directly and indirectly. It is expected to reach around 56,000 by 2020 for the development and earning of more profitable business models.

Asia-Pacific, on the other hand, is expected to have the fastest growing CAGR in the advanced analytics market. Data and analytics are reshaping industries by upending long-held business models and providing unprecedented insights into the global market. Various organizations are utilizing data and analytics to increase revenue and reduce costs. For example, by implementing predictive analytics, an Indian automotive OEM increased its sales by nearly 50%. Furthermore, the growth of several end-user industries in India has shown promising growth, particularly in sectors involving telecommunications, financial services, and information technology, which are responsible for the growth of advanced analytics. Furthermore, Asian businesses are investing more in technology to become more digital and agile.

Advanced Analytics Market Players

Some of the global advanced analytics companies include Altair Engineering, Inc., International Business Machines Corporation, Fair Isaac Corporation (FICO), Microsoft Corporation, KNIME, Oracle Corporation, SAP SE, SAS Institute Inc., RapidMiner, Inc., and Trianz.

Frequently Asked Questions

What is the size of global advanced analytics market in 2021?

The market size of advanced analytics market in 2021 was accounted to be USD 30.9 Billion.

What is the CAGR of global advanced analytics market during forecast period of 2022 to 2030?

The projected CAGR of advanced analytics market during the analysis period of 2022 to 2030 is 23.3%.

Which are the key players operating in the market?

The prominent players of the global advanced analytics market are Altair Engineering, Inc., International Business Machines Corporation, Fair Isaac Corporation (FICO), Microsoft Corporation, KNIME, Oracle Corporation, SAP SE, SAS Institute Inc., RapidMiner, Inc., and Trianz.

Which region held the dominating position in the global advanced analytics market?

Asia-Pacific held the dominating advanced analytics during the analysis period of 2022 to 2030.

Which region registered the fastest growing CAGR for the forecast period of 2022 to 2030?

North America region exhibited fastest growing CAGR for advanced analytics during the analysis period of 2022 to 2030.

What are the current trends and dynamics in the global advanced analytics market?

Rising implementation of big data, surging adoption of artificial intelligence and machine learning for analytics, an increasing number of fraudulent activities drives the growth of global advanced analytics market.

Which type held the maximum share in 2021?

Based on type, big data analytics segment is expected to hold the maximum share advanced analytics market.