AdTech Market Size - Global Industry, Share, Analysis, Trends and Forecast 2023 - 2032

Published :

Report ID:

Pages :

Format :

AdTech Market Size - Global Industry, Share, Analysis, Trends and Forecast 2023 - 2032

Report Coverage

- Industry Dynamics

- Market Size and Forecast Data

- Segment Analysis

- Competitive Landscape

- Regional Analysis with a Niche Focus on Country-Level Data

- High Level Analysis - Porter's, PESTEL, Value Chain, etc.

- Company Profiles of Key Players

- Option to Customize the Report As Per Your Specific Need

Request Sample Report

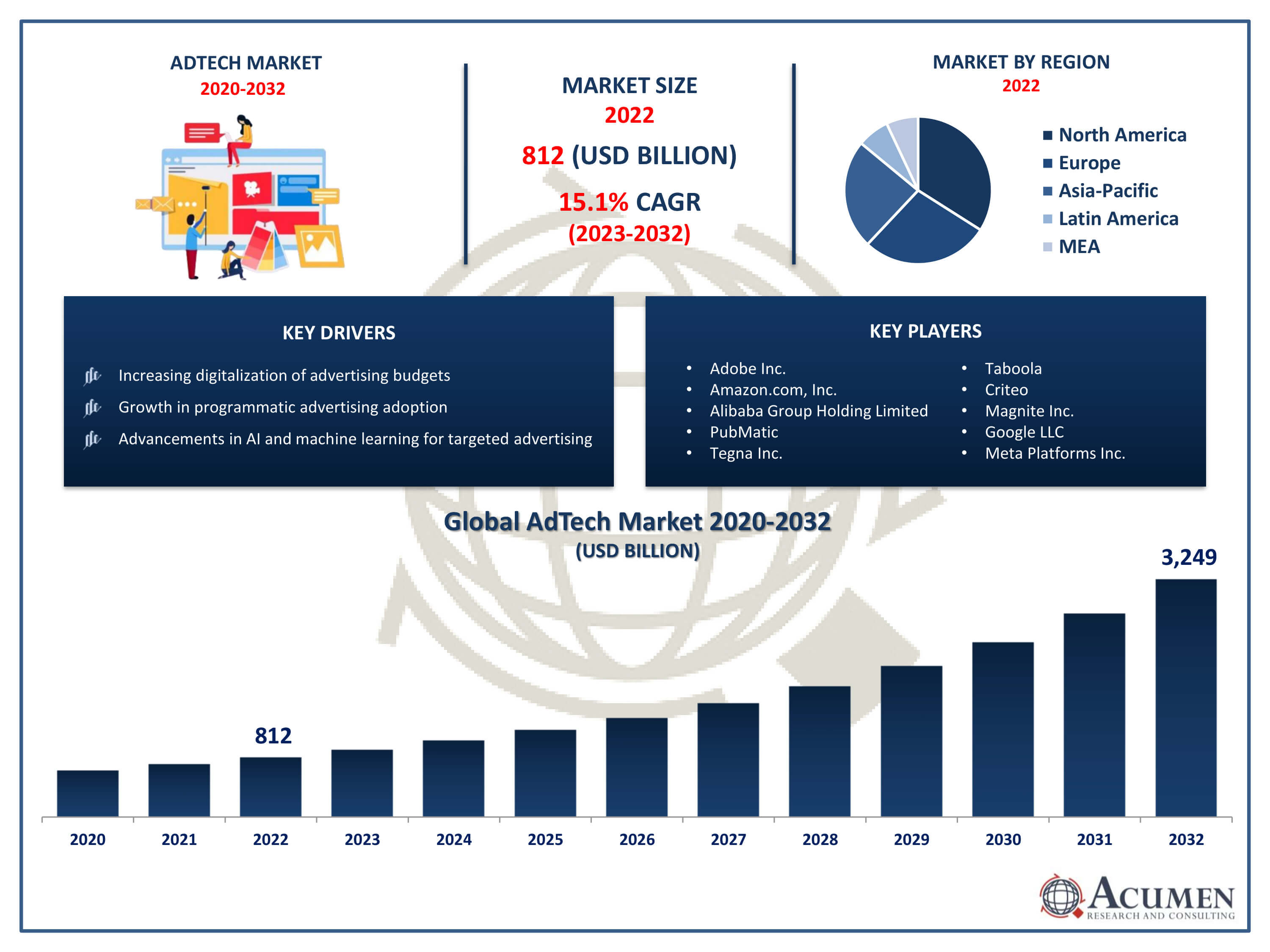

The AdTech Market Size accounted for USD 812 Billion in 2022 and is projected to achieve a market size of USD 3,249 Billion by 2032 growing at a CAGR of 15.1% from 2023 to 2032.

AdTech Market Key Highlights

- Global AdTech market revenue is expected to increase by USD 3,249 Billion by 2032, with a 15.1% CAGR from 2023 to 2032

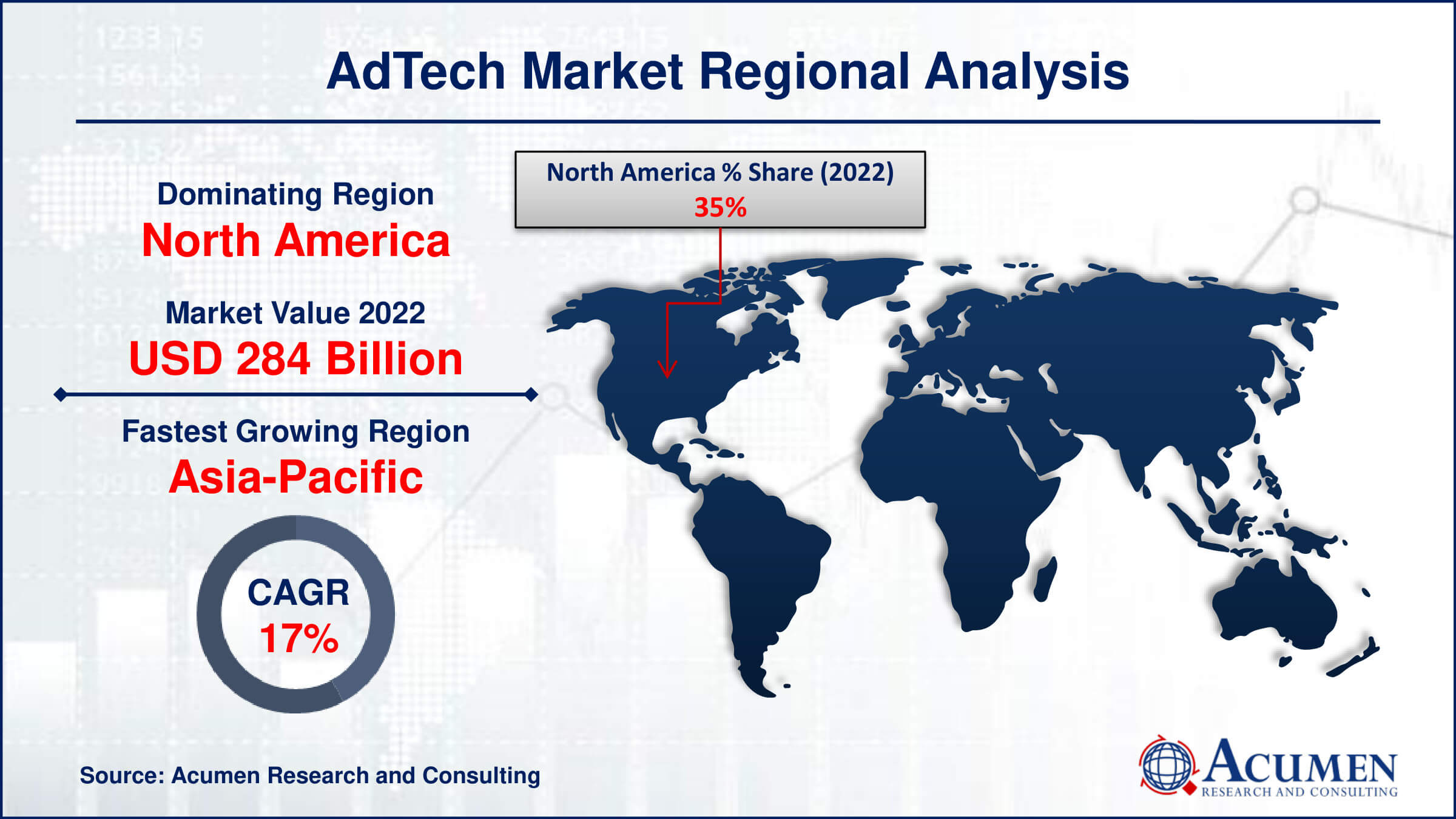

- North America region led with more than 35% of AdTech market share in 2022

- Asia-Pacific AdTech market growth will record a CAGR of more than 16.8% from 2023 to 2032

- By platform, the mobile segment contributed over 60% of revenue share in 2022

- By industry verticals, the retail and consumer goods segment captured more than 28% of revenue share in 2022

- Rising demand for personalized and interactive ad experiences, drives the AdTech market value

AdTech, or advertising technology, refers to a collection of software and tools used to simplify the process of generating, targeting, delivering, and analyzing digital advertising campaigns. It covers a wide range of technologies, such as demand-side platforms (DSPs), supply-side platforms (SSPs), data management platforms (DMPs), ad exchanges, and analytics and measurement tools. AdTech plays an important part in the digital advertising ecosystem. Furthermore, market players are increasingly engaging in acquisitions to achieve greater scale in AdTech solutions. For instance, ArabyAds, a Dubai-based adtech business, purchased national Dmenta in February 2021 to strategically strengthen complementary products and attain larger scale in the Middle East and North Africa region's advertising technology market. These achievements by key manufacturers in AdTech solutions are expected to significantly grow the market in the coming years.

AdTech, or advertising technology, refers to a collection of software and tools used to simplify the process of generating, targeting, delivering, and analyzing digital advertising campaigns. It covers a wide range of technologies, such as demand-side platforms (DSPs), supply-side platforms (SSPs), data management platforms (DMPs), ad exchanges, and analytics and measurement tools. AdTech plays an important part in the digital advertising ecosystem. Furthermore, market players are increasingly engaging in acquisitions to achieve greater scale in AdTech solutions. For instance, ArabyAds, a Dubai-based adtech business, purchased national Dmenta in February 2021 to strategically strengthen complementary products and attain larger scale in the Middle East and North Africa region's advertising technology market. These achievements by key manufacturers in AdTech solutions are expected to significantly grow the market in the coming years.

Global AdTech Market Dynamics

Market Drivers

- Increasing digitalization of advertising budgets

- Growth in programmatic advertising adoption

- Advancements in AI and machine learning for targeted advertising

- Expansion of digital advertising channels, such as mobile and connected TV

- Demand for data-driven advertising strategies

Market Restraints

- Privacy concerns and regulatory changes impacting data usage

- Ad blocking software and consumer resistance to intrusive ads

Market Opportunities

- Rising demand for personalized and interactive ad experiences

- Expansion of emerging advertising formats like audio and digital out-of-home

AdTech Market Report Coverage

| Market | AdTech Market |

| AdTech Market Size 2022 | USD 812 Billion |

| AdTech Market Forecast 2032 |

USD 3,249 Billion |

| AdTech Market CAGR During 2023 - 2032 | 15.1% |

| AdTech Market Analysis Period | 2020 - 2032 |

| AdTech Market Base Year |

2022 |

| AdTech Market Forecast Data | 2023 - 2032 |

| Segments Covered | By Solution, By Enterprise Size, By Platform, By Advertising Type, By Industry Vertical, And By Geography |

| Regional Scope | North America, Europe, Asia Pacific, Latin America, and Middle East & Africa |

| Key Companies Profiled | Adobe Inc., Amazon.com, Inc., Alibaba Group Holding Limited, PubMatic, Tegna Inc., Taboola, Criteo, Magnite Inc., Google LLC, Meta Platforms Inc., Netapp Inc., and Microsoft Corporation. |

| Report Coverage |

Market Trends, Drivers, Restraints, Competitive Analysis, Player Profiling, Covid-19 Analysis, Regulation Analysis |

Increasing digitalization of advertising budgets drives the growth of the AdTech market. Retail spending on digital advertising is projected to reach $73.55 billion in 2023. Retail, financial services, and CPG sectors are expected to account for 54.3% of total US digital ad spending in the same year. This surge in digital advertising expenditure is expected to propel the AdTech market in the coming years. Furthermore, the expansion of digital advertising channels, such as mobile and connected TV, further accelerates market growth. For example, as of 2023, online ads delivered through search engines, popular social media platforms, and other digital channels account for 87% of total advertising in China. With an increasing number of people shopping online, industry experts predict that this figure will rise to 90% by 2027. This expansion of advertising channels leads to heightened demand for AdTech solutions.

However, privacy concerns and regulatory changes impacting data usage pose challenges to the growth of the AdTech market. For instance, a survey on digital usage in China revealed that one in five respondents faced challenges regarding the misuse of their digital data in 2023. As consumers become more aware of their privacy rights, they demand greater transparency and control over how their data is collected and used for advertising purposes. This has led to the implementation of stricter regulations such as GDPR and CCPA, which limit the ability of AdTech companies to track users without their explicit consent. These regulatory hurdles regarding data usage could hinder the growth of the AdTech market in the coming years.

On the other hand, the expansion of emerging advertising formats like audio and digital out-of-home (DOOH) presents significant opportunities in the AdTech industry. For example, in 2023, DOOH advertising is expected to experience an increase in creative formats. Dynamic creative optimization (DCO) provides real-time customization that aligns with customer mindsets, while audio-based DOOH and anamorphic 3D videos offer newer and more immersive experiences. These innovative advertising formats increase engagement and provide immersive experiences, thereby promoting the AdTech market significantly.

AdTech Market Segmentation

The global AdTech market segmentation is based on solution, enterprise size, platform, advertising type, industry vertical, and geography.

AdTech Market By Solution

- Demand-side Platforms (DSPs)

- Data Management Platforms (DMPs)

- Supply-side Platforms (SSPs)

- Ad Networks

- Others

According to AdTech industry analysis, the demand-side platforms (DSPs) segment dominated the market in 2022. In recent years, the DSP industry has experienced radical growth, driven by factors such as increased use of programmatic advertising, the expansion of digital channels, and advancements in data analytics and targeting technology. Additionally, marketers are seeking more efficient ways to reach their target audiences. For instance, Google LLC extended its CTV inventory in the video 360 demand-side platform and CTV inventory to improve CTV advertising. The company also added new features to Display and Video and Google Marketing Platform in May 2022. Consequently, this expansion is expected to lead to increased demand for DSPs in the coming years.

AdTech Market By Enterprise Size

- Large Enterprises

- SMEs

In terms of enterprise size, the large enterprise segment is expected to dominate the market in 2022. This trend is fueled by the growing digitalization of advertising budgets and the complexity of marketing plans within multinational organizations. One of the primary drivers of growth in the large enterprise segment is the demand for advanced analytics and targeting capabilities offered by AdTech solutions. Large organizations typically have vast amounts of customer data at their disposal, and they require robust analytics solutions to effectively leverage this data for targeted advertising campaigns.

AdTech Market By Platform

- Web

- Mobile

- Others

According to the AdTech market forecast, the mobile segment is poised to experience significant growth in the coming years. With customers spending more time on their mobile devices, advertisers are increasingly focusing on mobile advertising. For example, in January 2023, India had 467.0 million social media users, representing 32.8 percent of the population. Additionally, India had 1.10 billion active cellular mobile connections in early 2023. This trend has led to a surge in demand for AdTech solutions tailored specifically for mobile platforms, including mobile ad networks, mobile demand-side platforms (DSPs), and mobile analytics software. One of the primary drivers of growth in the mobile segment is the rapid expansion of mobile app usage. Consequently, the mobile segment of the AdTech industry is experiencing significant growth

AdTech Market By Advertising Type

- Programmatic Advertising

- Display Advertising

- Search Advertising

- Mobile Advertising

- Native Advertising

- Email Marketing

- Others

Based on the advertising type, the programmatic advertising segment is expected to witness significant growth in the coming years. One of the key drivers of this growth is the increased use of data-driven advertising methods by advertisers and marketers. For example, AI has enhanced marketers' ability to analyze large volumes of data, personalize content, predict consumer behavior, and optimize campaigns. By 2023, it is projected that more than 61% of marketers will have incorporated AI into their marketing activities. Furthermore, programmatic advertising enables marketers to leverage vast amounts of data to segment their target audiences based on demographics, interests, and behaviors. This allows them to deliver highly relevant and personalized ads at scale, driving the growth of the programmatic advertising segment.

AdTech Market By Industry Vertical

- Media and Entertainment

- Education

- BFSI

- Retail and Consumer Goods

- Healthcare

- IT and Telecom

- Others

In terms of industry verticals, the retail and consumer goods segment has experienced significant growth in recent years. This growth is fueled by the increasing digitalization of purchasing habits and heightened competition among businesses to capture consumers' attention online. With more customers turning to online purchases, the retail and consumer goods industries are making substantial investments in digital advertising to enhance brand visibility. For example, digital advertising spending is projected to reach INR 31,500 crore in FY 2023-24, with further growth expected to INR 41,000 crore by the end of Circa 2024. This upward trend has led to a sharp increase in demand for AdTech solutions tailored to the needs of the retail and consumer goods industries.

AdTech Market Regional Outlook

North America

- U.S.

- Canada

Europe

- U.K.

- Germany

- France

- Spain

- Rest of Europe

Asia-Pacific

- India

- Japan

- China

- Australia

- South Korea

- Rest of Asia-Pacific

Latin America

- Brazil

- Mexico

- Rest of Latin America

The Middle East & Africa

- South Africa

- GCC Countries

- Rest of the Middle East & Africa (ME&A)

AdTech Market Regional Analysis

AdTech Market Regional Analysis

North America dominates the AdTech market for several reasons, including its well-established digital advertising ecosystem, robust technology infrastructure, and significant investments in advertising and marketing. For example, Canadian advertising expenditure is projected to increase from 15.37 billion Canadian dollars in 2018 to 20.24 billion in 2023. Additionally, the region is home to some of the world's leading digital advertising platforms, such as Google, Facebook, and Amazon, which collectively control a substantial portion of the digital advertising market. These companies continually innovate and invest in AdTech solutions, driving growth and innovation in the North American AdTech sector. Furthermore, North America boasts a mature and sophisticated advertising industry, with many marketers, agencies, and publishers aggressively adopting digital advertising strategies. For instance, according to PwC's "IAB Internet Advertising Revenue Report: Full Year 2023," internet advertising revenues in the region reached a record high of $225 billion, growing by 7.3% year on year between 2022 and 2023. Ongoing developments by key players, such as Meta's introduction of generative AI tools for advertisers in October 2023, further fuel market growth, contributing to increased demand for AdTech solutions.

Asia-Pacific emerges as the fastest-growing region in the AdTech market due to factors such as growing internet penetration and the increasing popularity of social media platforms in countries like China, India, Japan, South Korea, and Australia. For instance, a survey of digital usage in China revealed that approximately 87.3% of respondents used WeChat as of the third quarter of 2023. Additionally, the presence of robust key players in the Asia Pacific region boosts demand for AdTech solutions through their research and development activities. For example, in February 2023, InMobi Technology Services Private Limited collaborated with Point Pickup to provide an industry-first product discovery and monetization solution to Point Pickup's grocery retail partners through adtech services. With ongoing developments and innovations, Asia-Pacific is expected to maintain its position in the AdTech market in the forecast years.

AdTech Market Players

Some of the top AdTech market companies offered in the professional report include Adobe Inc., Amazon.com, Inc., Alibaba Group Holding Limited, PubMatic, Tegna Inc., Taboola, Criteo, Magnite Inc., Google LLC, Meta Platforms Inc., Netapp Inc., and Microsoft Corporation.

Frequently Asked Questions

How big is the AdTech market?

The AdTech market size was USD 812 Billion in 2022.

What is the CAGR of the global AdTech marketfrom 2023 to 2032?

The CAGR of AdTech is 15.1% during the analysis period of 2023 to 2032.

Which are the key players in the AdTech market?

The key players operating in the global market are including Adobe Inc., Amazon.com, Inc., Alibaba Group Holding Limited, PubMatic, Tegna Inc., Taboola, Criteo, Magnite Inc., Google LLC, Meta Platforms Inc., Netapp Inc., and Microsoft Corporation.

Which region dominated the global AdTech market share?

North America held the dominating position in AdTech industry during the analysis period of 2023 to 2032.

Which region registered fastest CAGR from 2023 to 2032?

Asia-Pacific region exhibited fastest growing CAGR for market of AdTech during the analysis period of 2023 to 2032.

What are the current trends and dynamics in the global AdTech industry?

The current trends and dynamics in the AdTech industry include increasing digitalization of advertising budgets, growth in programmatic advertising adoption, and advancements in AI and machine learning for targeted advertising.

Which solution held the maximum share in 2022?

The demand-side platforms (DSPs) solution held the maximum share of the AdTech industry.