Adsorbent Market | Acumen Research and Consulting

Adsorbent Market Size - Global Industry, Share, Analysis, Trends and Forecast 2023 - 2032

Published :

Report ID:

Pages :

Format :

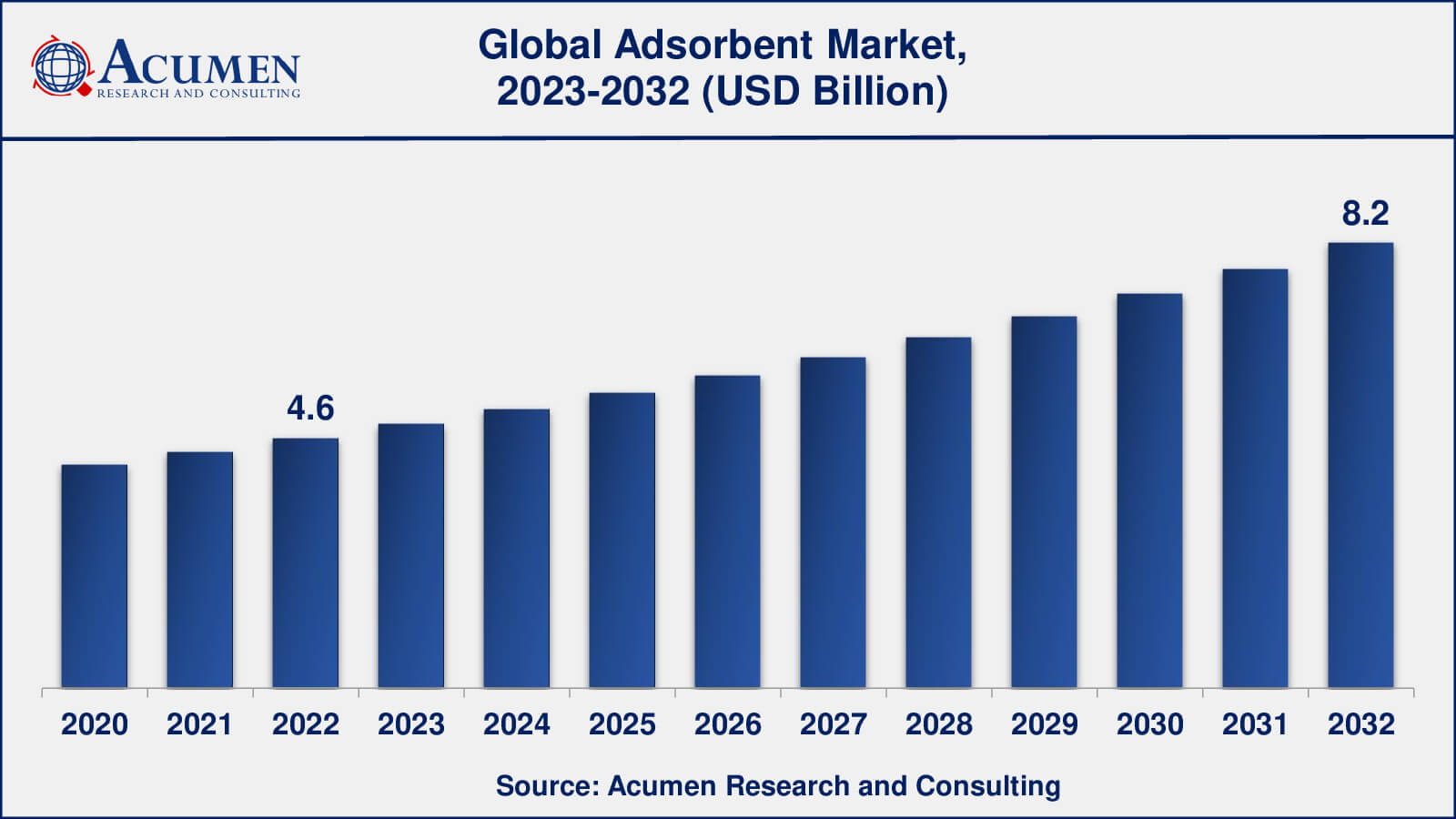

The Global Adsorbent Market Size collected USD 4.6 Billion in 2022 and is set to achieve a market size of USD 8.2 Billion in 2032 growing at a CAGR of 6.0% from 2023 to 2032.

Adsorbent Market Report Statistics

- Global adsorbent market revenue is estimated to reach USD 8.2 billion by 2032 with a CAGR of 6.0% from 2023 to 2032

- Asia-Pacific adsorbent market value occupied more than USD 1.5 billion in 2022

- North America adsorbent market growth will record a CAGR of over 6% from 2023 to 2032

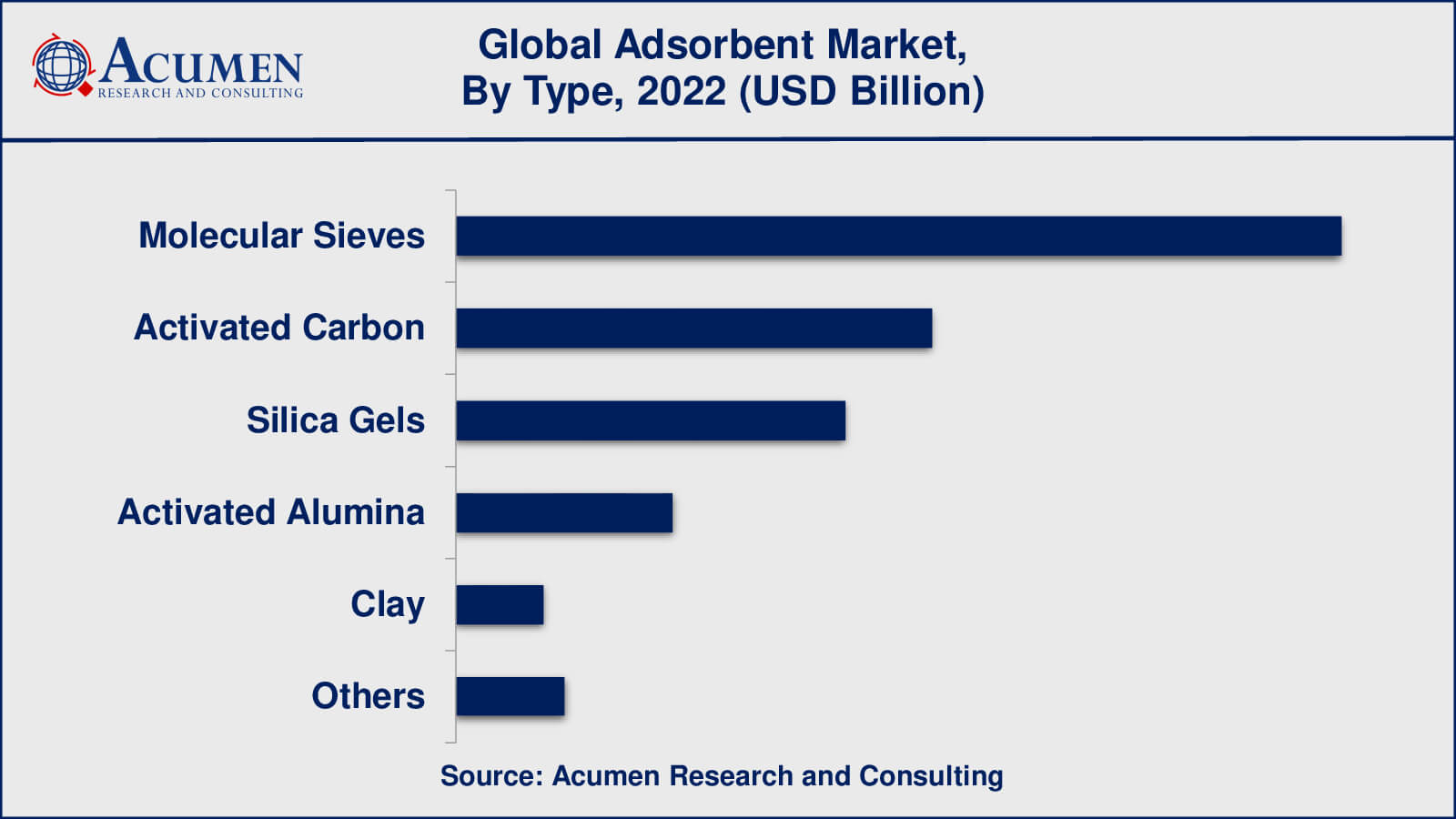

- Among type, the molecular sieves sub-segment generated around 41% share in 2022

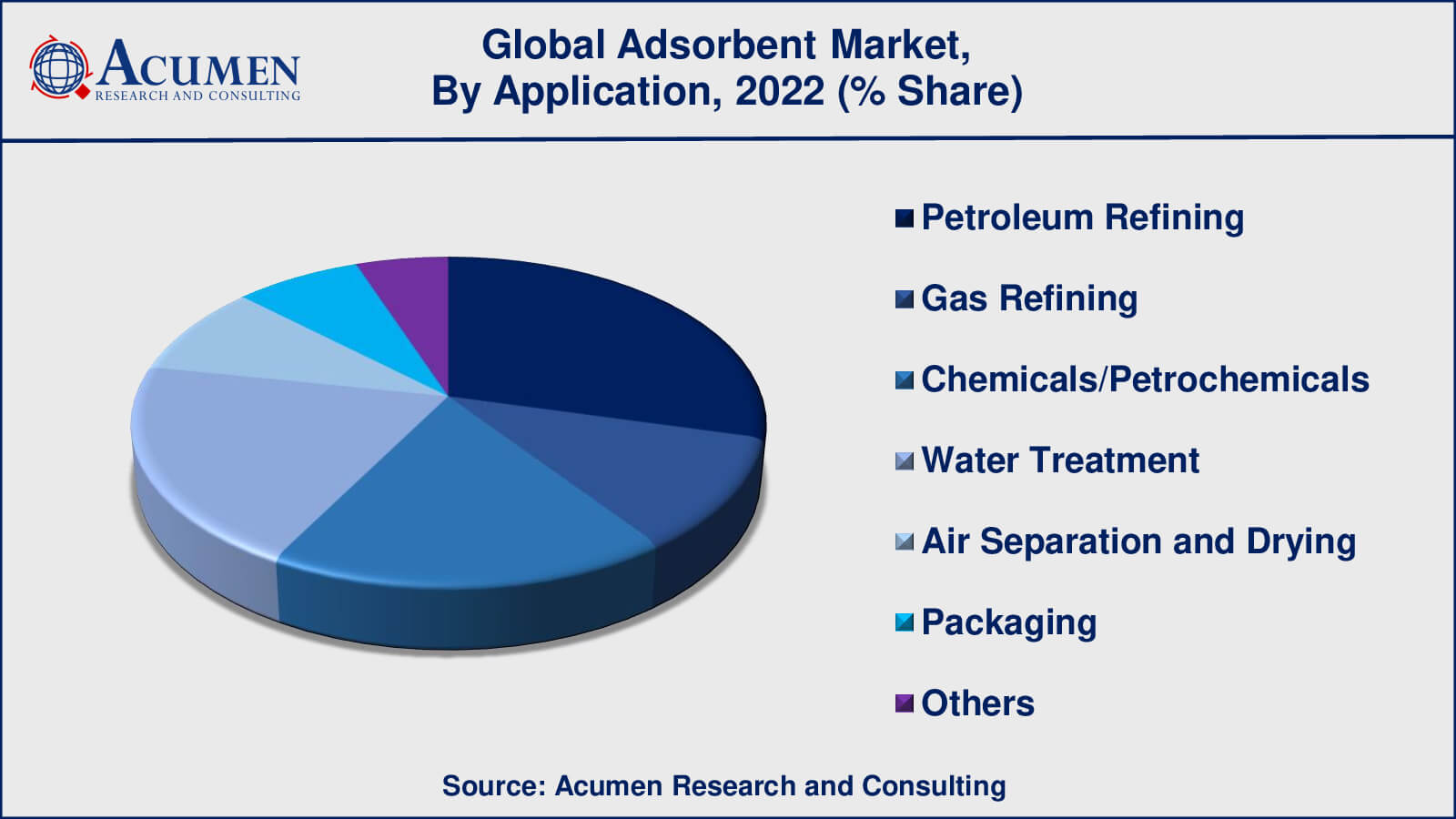

- Based on application, the petroleum refining generated more than US $ 1.3 billion revenue in 2022

- Rising demand for adsorbents in the healthcare industry is a popular adsorbent market trend that fuels the industry demand

Adsorption refers to a chemical process in which atoms, ions, or molecules from a dissolved solid, liquid, or gas adheres to a specific surface. In the process of adsorption, a thin film is generated on the adsorbent by the adsorbate. Adsorption is a result of surface energy likewise surface tension. Adsorption exists in various biological, chemical, natural, and physical systems which have applications in the widely categorized industrial sector. Adsorbents are generally found in the form of spherical pellets, rods, and moldings which have a diameter of around 0.5 to 10mm. Adsorbents that are considered to be effective should have strong resistance to high thermal stability and abrasion with small pore diameters. They should also have a distinct pore structure to help them in the speedy transit of gaseous vapors. Industrial adsorbents are categorized as carbon-based compounds which are hydrophobic and nonpolar and include various materials such as activated carbon and graphite. Oxygen-containing compounds, which are polar as well as hydrophilic, including materials such as silica gel and zeolites, the polymer-based compounds that are generally polar or non-polar functional groups in a polymer matrix.

Global Adsorbent Market Dynamics

Market Drivers

- Growing demand from various end-use industries

- Environmental regulations and sustainability concerns

- Increasing demand for clean and safe drinking water

- Development of advanced adsorbent materials

Market Restraints

- Environmental regulation

- Volatility of crude oil prices

Market Opportunities

- Growing healthcare industry

- Increasing demand for natural and sustainable adsorbents

- Increasing use of adsorbents in the food and beverage industry

Adsorbent Market Report Coverage

| Market | Adsorbent Market |

| Adsorbent Market Size 2022 | USD 4.6 Billion |

| Adsorbent Market Forecast 2032 | USD 8.2 Billion |

| Adsorbent Market CAGR During 2023 - 2032 | 6.0% |

| Adsorbent Market Analysis Period | 2020 - 2032 |

| Adsorbent Market Base Year | 2022 |

| Adsorbent Market Forecast Data | 2023 - 2032 |

| Segments Covered | By Type, By Application, And By Geography |

| Regional Scope | North America, Europe, Asia Pacific, Latin America, and Middle East & Africa |

| Key Companies Profiled | Arkema, Axens, Clariant, BASF, Cabot, Calgon Carbon, Grace, MeadWestvaco Corporation, UOP, Graver Technologies, Zeolyst International, Sorbead India and Zeochem LLC. |

| Report Coverage |

Market Trends, Drivers, Restraints, Competitive Analysis, Player Profiling, Covid-19 Analysis, Regulation Analysis |

Adsorbent Market Growth Factors

Some of the major drivers in the global adsorbent market include innovations and advancements to introduce advanced and new adsorbent materials. The end-user industries require adsorbents for a broad range of applications having varied requirements and characteristics. To serve the aforementioned purpose, the major companies are now focusing on technological innovations to develop new adsorbent materials to be applied in distinct commercial and industrial areas. The increasing technological developments to manufacture cost-effective adsorbents are one of the major factors anticipated to generate high revenues in the global adsorbent market over the forecast period.

Adsorbent Market Segmentation

The worldwide adsorbent market is categorized based on type, application, and geography.

Adsorbent Market By Type

- Molecular Sieves

- Activated Carbon

- Silica Gels

- Activated Alumina

- Clay

- Others

The adsorbent market forecast predicts that molecular sieves will gain a significant market share in the adsorbents market. Molecular sieves are highly porous materials with uniform pore sizes that can adsorb molecules based on size and shape. They have a wide range of applications, including natural gas drying, petroleum refining, and air and gas purification. Chemicals such as detergents, solvents, and pharmaceuticals are also manufactured using molecular sieves. Several factors are driving the increased demand for molecular sieves, including their high selectivity, capacity, and ability to remove impurities from liquids and gases. Furthermore, the development of new and enhanced molecular sieve materials with increased selectivity and capacity is driving their adoption in a variety of end-use industries. Molecular sieves are also thought to be more environmentally friendly and sustainable than other adsorbents, which is driving their use in a variety of applications.

Adsorbent Market By Application

- Petroleum Refining

- Gas Refining

- Chemicals/Petrochemicals

- Water Treatment

- Air Separation and Drying

- Packaging

- Others

Petroleum refining is one of the most important applications for adsorbents, accounting for a sizable portion of the adsorbent market. Adsorbents are used in the petroleum refining industry to remove impurities such as sulphur and nitrogen compounds from various fractions of crude oil. Impurities in crude oil can degrade the quality of finished petroleum products while also polluting the environment. In the petroleum refining industry, adsorbents such as activated carbon, molecular sieves, and silica gels are widely used. Organic sulphur compounds are removed using activated carbon, while inorganic sulphur and nitrogen compounds are removed using molecular sieves and silica gels. The use of adsorbents in petroleum refining is expected to increase in the coming years, driven by rising demand for high-quality petroleum products and stricter sulfur-emissions regulations.

Adsorbent Market Regional Outlook

North America

- U.S.

- Canada

Europe

- U.K.

- Germany

- France

- Spain

- Rest of Europe

Asia-Pacific

- India

- Japan

- China

- Australia

- South Korea

- Rest of Asia-Pacific

Latin America

- Brazil

- Mexico

- Rest of Latin America

The Middle East & Africa

- South Africa

- GCC Countries

- Rest of the Middle East & Africa (ME&A)

Adsorbent Market Regional Analysis

Asia-Pacific is projected to be the largest market for adsorbents across the globe owing to rising demands from India and China. Russia and China are anticipated to be the largest consumers of adsorbents. Moreover, developed economies are contributing to the huge demand for adsorbents. Emerging economies are expected to be one of the most potential markets for adsorbents across the globe with increasing production capacity. Hence, increasing demands from emerging economies may tender bright opportunities for the global adsorbents market.

The robust demand in Asia-Pacific is expected to be the major driving factor for the growth of the global adsorbents market. China is anticipated to account for the largest share and lead the overall demand for adsorbents owing to the increasing industrial production over the last few years. The markets in other developing countries such as Brazil, Argentina, and India are also anticipated to grow rapidly throughout the forecast period.

Adsorbent Market Players

Some of the key players in the global adsorbent market include Arkema, Axens, Clariant, BASF, Cabot, Calgon Carbon, Grace, MeadWestvaco Corporation, UOP, Graver Technologies, Zeolyst International, Sorbead India and Zeochem LLC.

Frequently Asked Questions

What was the market size of the global adsorbent in 2022?

The market size of Adsorbent was USD 4.6 Billion in 2022.

What is the CAGR of the global adsorbent market during forecast period of 2023 to 2032?

The CAGR of Adsorbent market is 6.0% during the analysis period of 2023 to 2032.

Which are the key players operating in the market?

The key players operating in the global market are Arkema, Axens, Clariant, BASF, Cabot, Calgon Carbon, Grace, MeadWestvaco Corporation, UOP, Graver Technologies, Zeolyst International, Sorbead India and Zeochem LLC.

Which region held the dominating position in the global adsorbent market?

Asia-Pacific held the dominating position in adsorbent market during the analysis period of 2023 to 2032.

Which region registered the fastest growing CAGR for the forecast period of 2023 to 2032?

North America region exhibited fastest growing CAGR for adsorbent market during the analysis period of 2023 to 2032.

What are the current trends and dynamics in the global adsorbent market?

The current trends and dynamics in the adsorbent industry include growing demand from various end-use industries, environmental regulations and sustainability concerns, and increasing demand for clean and safe drinking water.

Which type held the maximum share in 2022?

The molecular sieves type held the maximum share of the adsorbent market.