Active Electronic Components Market Size - Global Industry, Share, Analysis, Trends and Forecast 2023 - 2032

Published :

Report ID:

Pages :

Format :

Active Electronic Components Market Size - Global Industry, Share, Analysis, Trends and Forecast 2023 - 2032

Report Coverage

- Industry Dynamics

- Market Size and Forecast Data

- Segment Analysis

- Competitive Landscape

- Regional Analysis with a Niche Focus on Country-Level Data

- High Level Analysis - Porter's, PESTEL, Value Chain, etc.

- Company Profiles of Key Players

- Option to Customize the Report As Per Your Specific Need

Request Sample Report

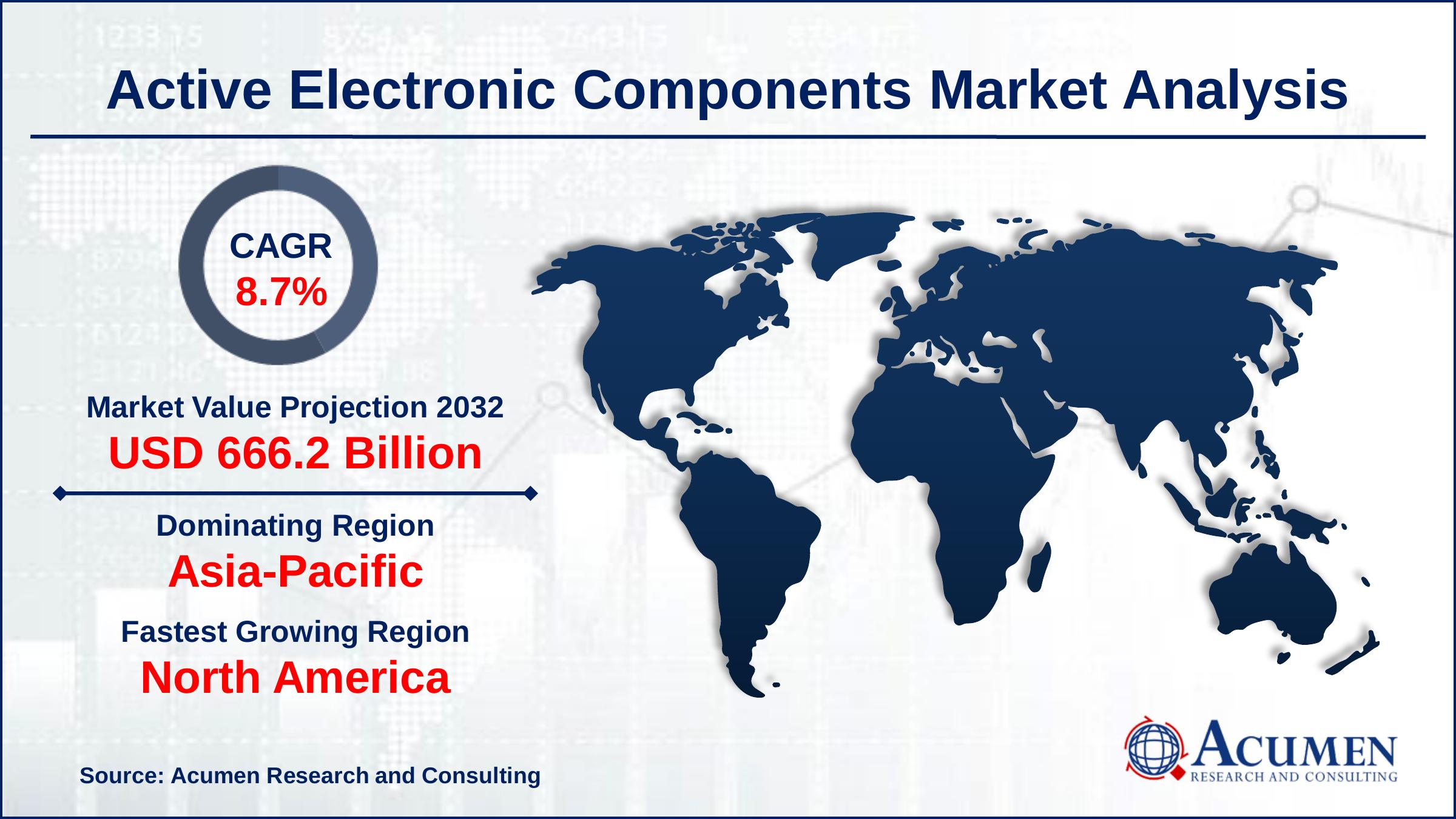

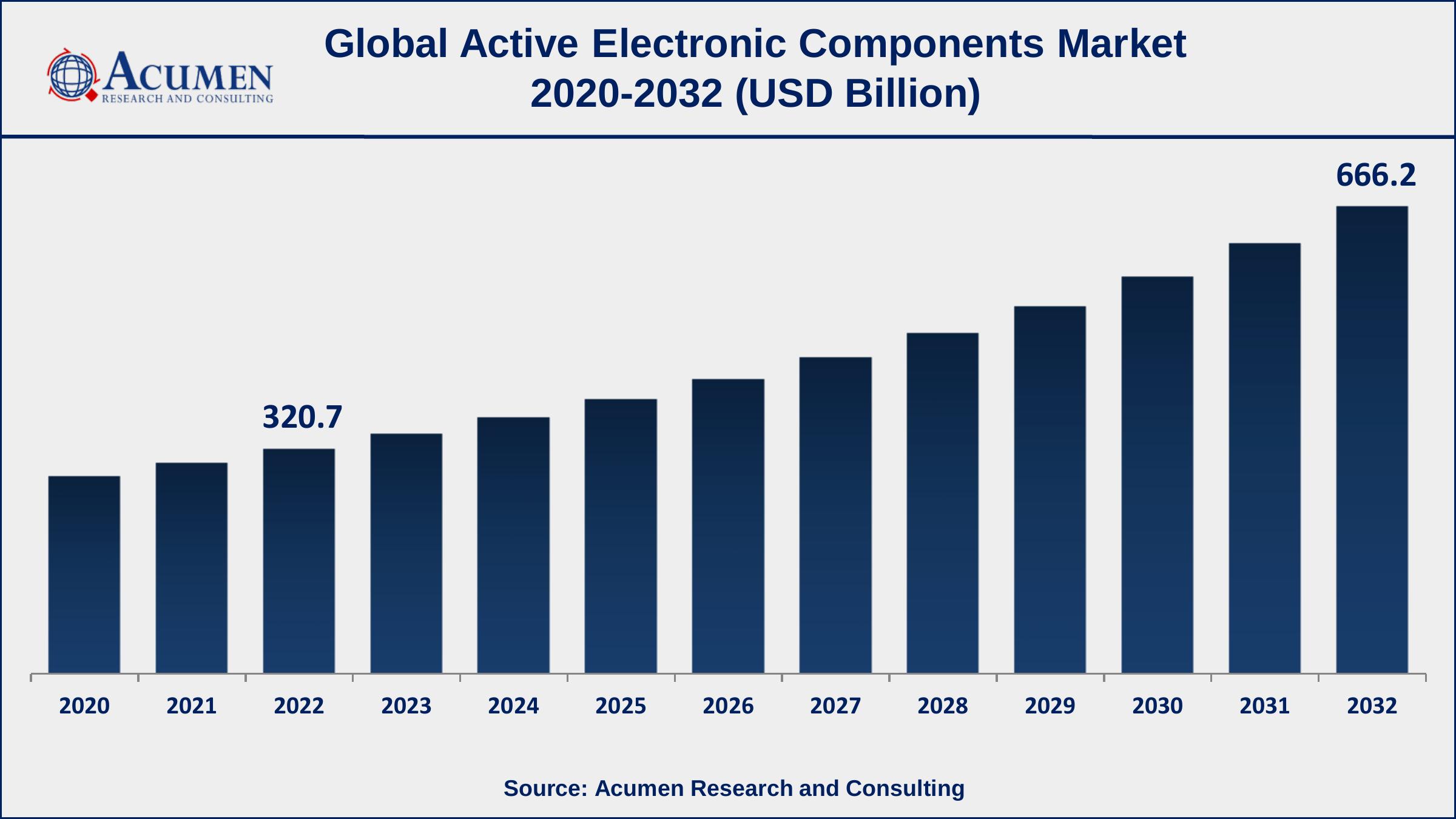

The Global Active Electronic Components Market Size accounted for USD 320.7 Billion in 2022 and is projected to achieve a market size of USD 666.2 Billion by 2032 growing at a CAGR of 8.7% from 2023 to 2032. The active electronic components market growth has been experiencing steady in recent years due to increasing demand for electronics in various industries, including automotive, aerospace, and consumer electronics. Factors such as the rise of the Internet of Things (IoT) and the growing trend of automation have contributed to the growth of this market. Additionally, the introduction of new technologies such as Artificial Intelligence (AI) and Machine Learning (ML) has increased the demand for advanced electronic components.

Active Electronic Components Market Report Key Highlights

- Global active electronic components market revenue is expected to increase by USD 666.2 Billion by 2032, with a 8.7% CAGR from 2023 to 2032

- The first active electronic component was the vacuum tube, invented in 1904 by John Ambrose Fleming

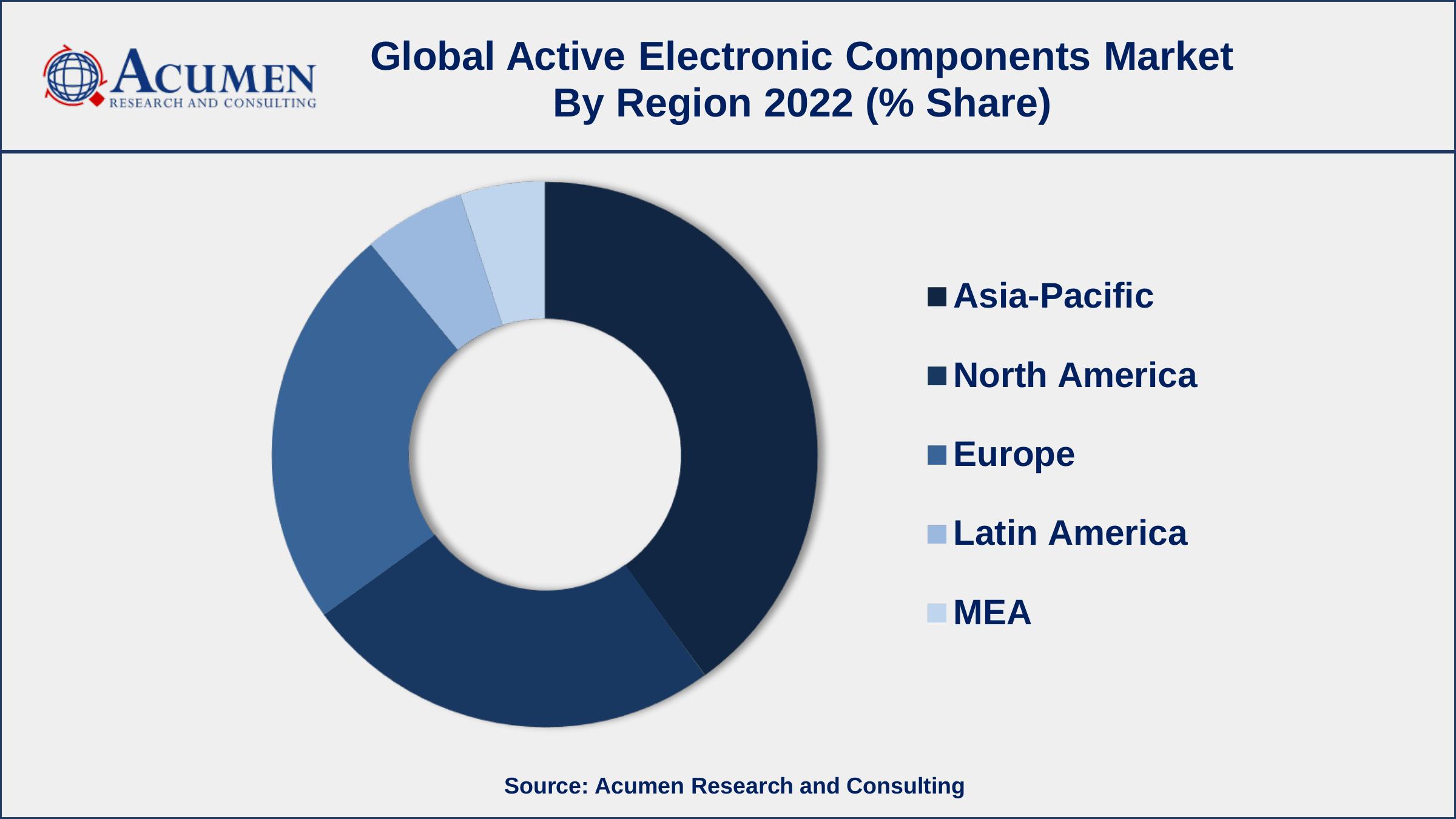

- Asia-Pacific region led with more than 40% of Active Electronic Components market share in 2022

- Semiconductors constituted the most popular type of active electronic component in 2022, accounting for more than half of the market

- In terms of application, automotive industry is expected to grow with a CAGR of 10% from 2023 to 2032

- Some of the leading companies are Texas Instruments, Analog Devices, STMicroelectronics, Infineon Technologies, and NXP Semiconductors

- Increasing demand for smartphones, laptops, and other consumer electronics, drives the active electronic components market size

An electronic component refers to a basic physical entity or device in an electronic system that is used for affecting electrons or their associated field. Electronic components have three major types that are active electronic components, electromechanical components, and passive electronic components. Active electronic components are devices having an electronic filter and are capable to amplify a signal or to generate a power gain. A usual active electronic component would be a transistor, integrated circuit, or oscillator. These components function as an alternating current circuit in a device that works to generate or increase voltage, active power, or current. All of the active electronic components require a source of energy to function, which is usually supplied by a DC circuit.

Global Active Electronic Components Market Trends

Market Drivers

- Increasing demand for consumer electronics

- Advancements in technology and increasing automation

- Growing adoption of electric vehicles and renewable energy sources

- Rising demand for medical devices

- Increase in urbanization and infrastructure development

Market Restraints

- High cost of active electronic components

- Limited availability of rare earth materials required for manufacturing

Market Opportunities

- Growing demand for Internet of Things (IoT) devices

- Rising adoption of artificial intelligence (AI) and machine learning (ML) technologies

- Increasing use of active electronic components in aerospace and defense industry

Active Electronic Components Market Report Coverage

| Market | Active Electronic Components Market |

| Active Electronic Components Market Size 2022 | USD 320.7 Billion |

| Active Electronic Components Market Forecast 2032 | USD 666.2 Billion |

| Active Electronic Components Market CAGR During 2023 - 2032 | 8.7% |

| Active Electronic Components Market Analysis Period | 2018 - 2032 |

| Active Electronic Components Market Base Year | 2022 |

| Active Electronic Components Market Forecast Data | 2023 - 2032 |

| Segments Covered | By Product, By End User, And By Geography |

| Regional Scope | North America, Europe, Asia Pacific, Latin America, and Middle East & Africa |

| Key Companies Profiled | Panasonic Corporation, Infineon Technologies AG, Toshiba Corporation, Maxim Integrated Products Inc., Diotec Semiconductor AG, ST Microelectronics NV, Analog Devices, Inc., ON Semiconductor, Texas Instruments, Inc., NXP Semiconductors NV, and Fairchild Semiconductor International, Inc. |

| Report Coverage |

Market Trends, Drivers, Restraints, Competitive Analysis, Player Profiling, Covid-19 Analysis, Regulation Analysis |

The increasing technological advancements in the semiconductor and electronics industry have led to the improvements in applications of these components. Semiconductor devices such as diodes, integrated circuits, transistors, and optoelectronic components are used on a large scale. Whereas, display devices such as X-ray tubes, triodes, microwave tubes, cathode ray tubes, and photoelectric tools are largely used devices. The key factor that is positively influencing the market growth for active electronic components is the increasing growth of portable devices such as portable displays and portable electronic devices. Furthermore, the demand and need for energy-efficient electrical products and the addition of new applications are the factors anticipated to bolster the growth of active electronic components market value in the coming years.

In the past, the use of active electronic components was limited to a few applications such as printed circuit boards and consumer electronics; however, the use of these devices has increased in space & satellite technology, automobiles, and military applications. The growing trend for the use of hybrid and electric vehicles and the rising adoption of renewable energy is propelling the market growth for these devices. Several renewable energy equipment or fixtures comprises devices such as solar turbines, panels, and invertors, and these devices further consist of active electronic components such as photo-transistors and photodiodes. Moreover, with the innovation and advancement in technology, the demand for small mobile devices such as tablets, smartphones, and PDAs has increased, which is resulting in the growing demand for active electronic components. Also, the demand for miniaturized electronic components is propelling with the new developments taking place in wearable devices such as smart wristbands (fitness bands) and smartwatches.

Active Electronic Components Market Segmentation

The global active electronic components market segmentation is based on product, end user, and geography.

Active Electronic Components Market By Product

- Display Devices

- Photoelectric Tubes

- Cathode-ray Tubes

- Triodes

- X-ray Tubes

- Microwave Tubes

- Semiconductor Devices

- Optoelectronic Components

- Diodes

- Transistors

- Integrated Circuits

- Vacuum Tubes

- Optoelectronic

- Others

According to an active electronic components industry analysis, the semiconductor devices segment held the majority of the share in 2022. Active electronic components play a crucial role in semiconductor devices, which are electronic components that utilize the properties of semiconductors to perform various functions. Some of the most common semiconductor devices that use active electronic components include diodes, transistors, and integrated circuits (ICs). The active electronic components market in semiconductor devices is driven by the increasing demand for smaller, faster, and more efficient electronic devices. As a result, semiconductor manufacturers are constantly developing new technologies and designs to improve the performance of their products. This creates opportunities for active electronic component manufacturers to provide innovative solutions that meet the needs of semiconductor manufacturers and end-users.

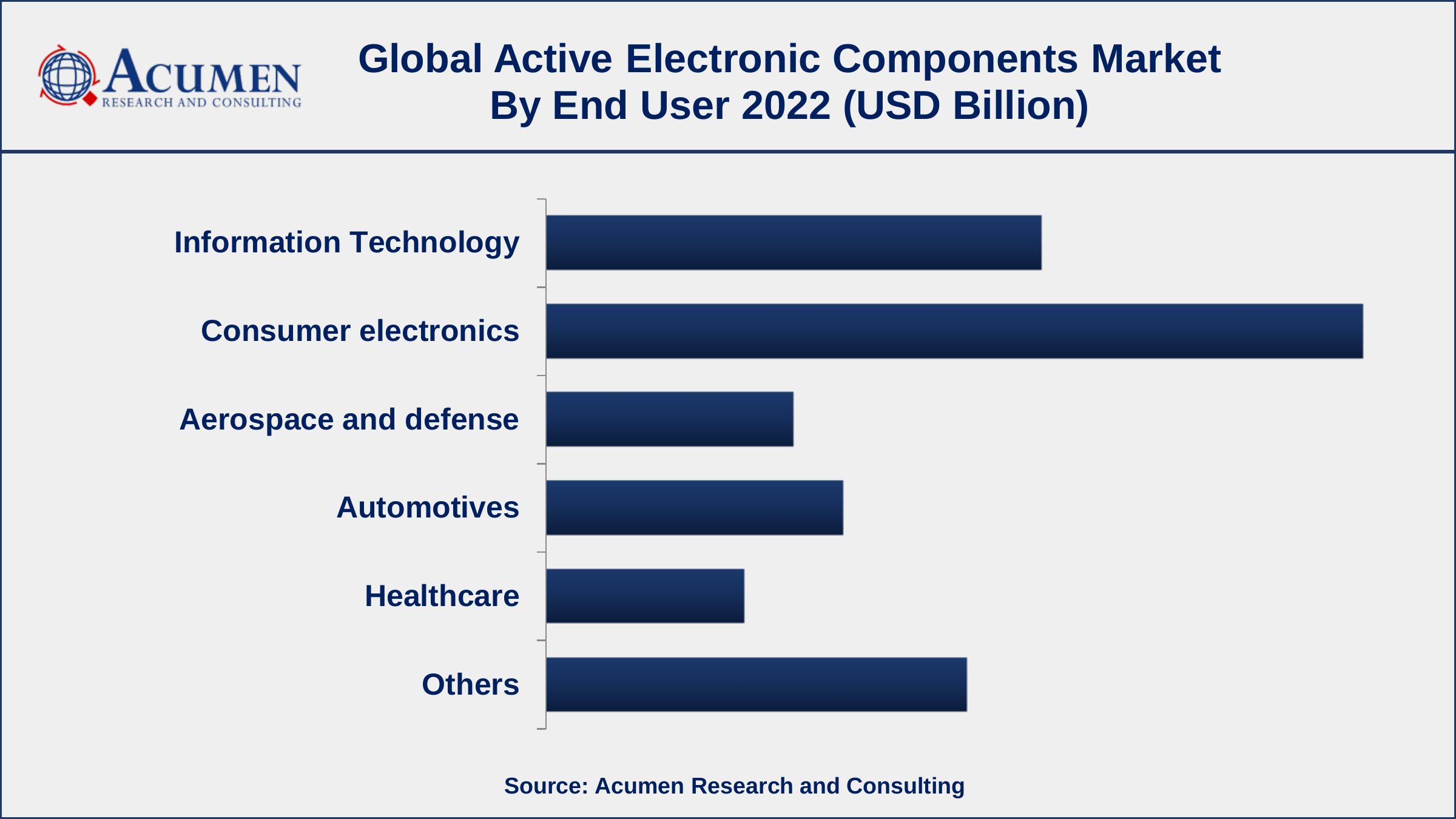

Active Electronic Components Market By End User

- Information Technology

- Consumer electronics

- Aerospace and defense

- Automotives

- Healthcare

- Others

According to the active electronic components market forecast, the consumer electronics segment is expected to grow significantly in the coming years. The active electronic components industry in consumer electronics is a major driver of the overall market, and it encompasses a wide range of products, including smartphones, laptops, tablets, gaming consoles, and home entertainment systems. Active electronic components play a critical role in the functionality of these devices, providing power management, data processing, and connectivity capabilities. One of the key drivers of the active electronic components market in consumer electronics is the increasing demand for more advanced, feature-rich devices. Consumers are seeking devices that offer faster processing speeds, longer battery life, and improved connectivity options, and active electronic components are critical in meeting these demands.

Active Electronic Components Market Regional Outlook

North America

- U.S.

- Canada

Europe

- U.K.

- Germany

- France

- Spain

- Rest of Europe

Asia-Pacific

- India

- Japan

- China

- Australia

- South Korea

- Rest of Asia-Pacific

Latin America

- Brazil

- Mexico

- Rest of Latin America

The Middle East & Africa

- South Africa

- GCC Countries

- Rest of the Middle East & Africa (ME&A)

Active Electronic Components Market Regional Analysis

The active electronic components market in North America is one of the largest and most advanced in the world. The region has a highly developed electronics industry, with a large number of manufacturers and a highly skilled workforce. The market is driven by a range of factors, including the increasing demand for advanced electronic devices, the growth of the automotive industry, and the increasing adoption of renewable energy sources.

The United States is the largest market for active electronic components in North America, accounting for the majority of the region's revenue. The country is home to several major manufacturers of these components, including Intel, Texas Instruments, and Analog Devices. The demand for active electronic components in the United States is driven by the country's highly advanced technology sector, which includes the development of cutting-edge devices in fields such as healthcare, defense, and aerospace.

Active Electronic Components Market Player

Some of the top active electronic components market companies offered in the professional report include Panasonic Corporation, Infineon Technologies AG, Toshiba Corporation, Maxim Integrated Products Inc., Diotec Semiconductor AG, ST Microelectronics NV, Analog Devices, Inc., ON Semiconductor, Texas Instruments, Inc., NXP Semiconductors NV, and Fairchild Semiconductor International, Inc.

Frequently Asked Questions

What was the market size of the global active electronic components in 2022?

The market size of active electronic components was USD 320.7 Billion in 2022.

What is the CAGR of the global active electronic components market during forecast period of 2023 to 2032?

The CAGR of active electronic components market is 8.7% during the analysis period of 2023 to 2032.

Which are the key players operating in the market?

The key players operating in the global active electronic components market are Panasonic Corporation, Infineon Technologies AG, Toshiba Corporation, Maxim Integrated Products Inc., Diotec Semiconductor AG, ST Microelectronics NV, Analog Devices, Inc., ON Semiconductor, Texas Instruments, Inc., NXP Semiconductors NV, and Fairchild Semiconductor International, Inc.

Which region held the dominating position in the global active electronic components market?

Asia-Pacific held the dominating position in active electronic components market during the analysis period of 2023 to 2032.

Which region registered the fastest growing CAGR for the forecast period of 2023 to 2032?

North America region exhibited fastest growing CAGR for active electronic components market during the analysis period of 2023 to 2032.

What are the current trends and dynamics in the global active electronic components market?

The current trends and dynamics in the active electronic components industry include the increasing demand for consumer electronics, and advancements in technology and increasing automation.

Which product held the maximum share in 2022?

The semiconductor devices product held the maximum share of the active electronic components market.