Acetylcysteine Market | Acumen Research and Consulting

Acetylcysteine Market Size - Global Industry, Share, Analysis, Trends and Forecast 2023 - 2032

Published :

Report ID:

Pages :

Format :

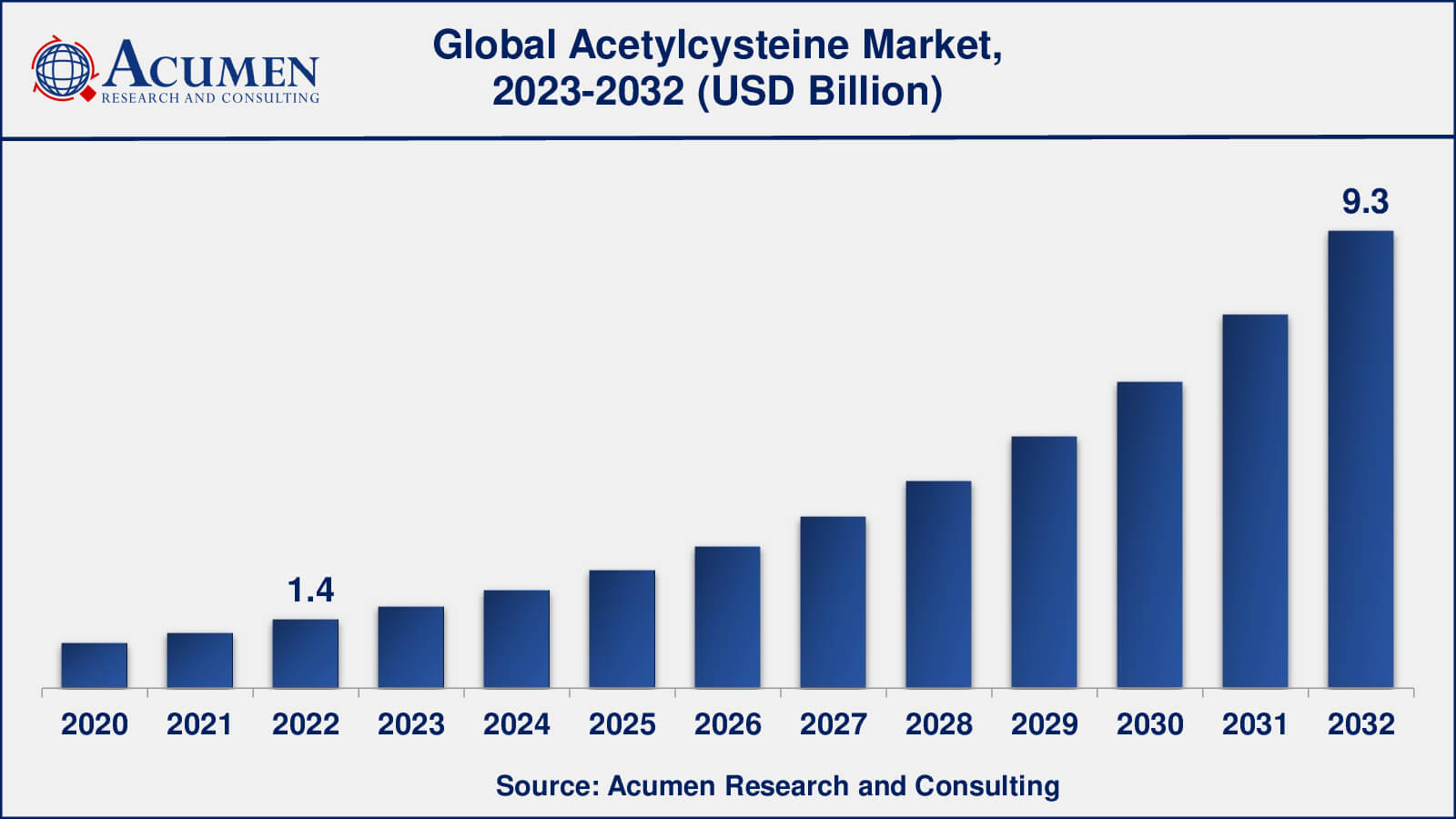

The Global Acetylcysteine Market Size accounted for USD 1.4 Billion in 2022 and is estimated to achieve a market size of USD 9.3 Billion by 2032 growing at a CAGR of 21.1% from 2023 to 2032.

Acetylcysteine Market Highlights

- Global acetylcysteine market revenue is poised to garner USD 9.3 billion by 2032 with a CAGR of 21.1% from 2023 to 2032

- North America acetylcysteine market value occupied almost USD 560 million in 2022

- Asia-Pacific acetylcysteine market growth will record a CAGR of over 22% from 2023 to 2032

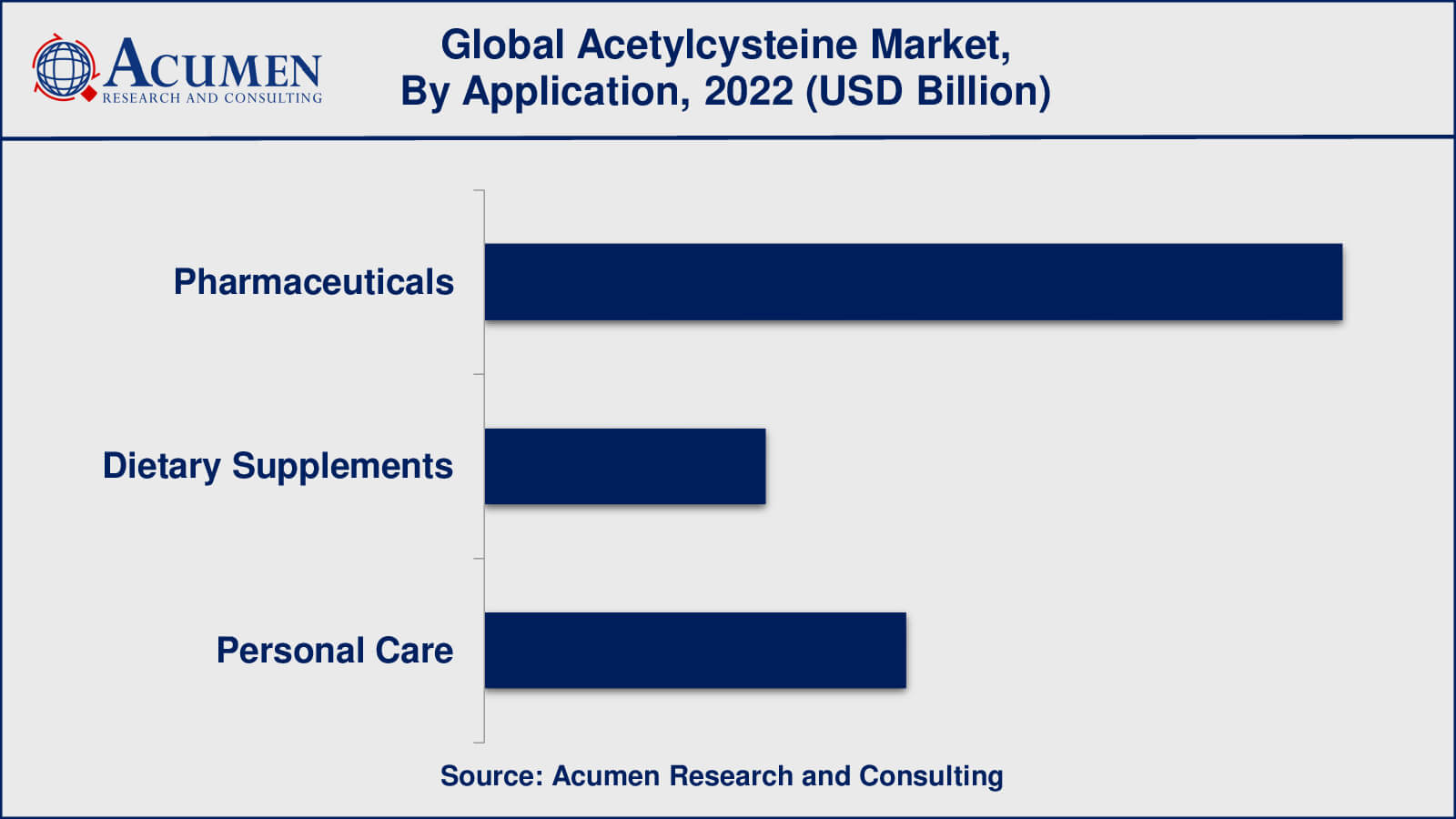

- Among application, the pharmaceuticals sub-segment generated over US$ 770 million revenue in 2022

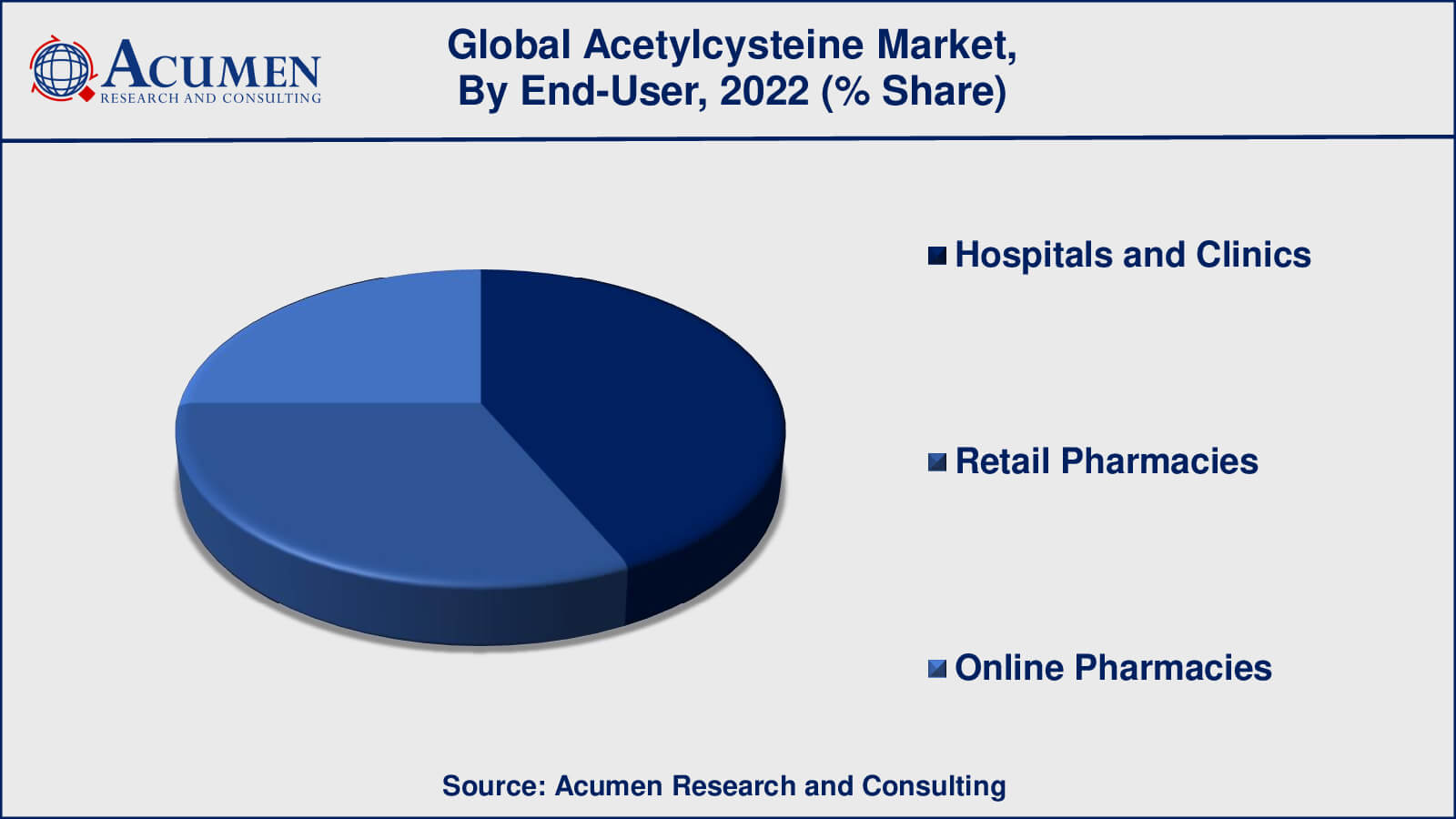

- Based on end-user, the hospital pharmacies sub-segment generated around 45% share in 2022

- Increasing adoption of online pharmacies is a popular acetylcysteine market trend that fuels the industry demand

Acetylcysteine, otherwise called N-acetylcysteine (NAC), is an amino acid that is utilized as a counteractant for acetaminophen overdose to avoid hepatic damage. Acetylcysteine is a hepatoprotective operator and has not been connected to huge serum chemical heights amid treatment or to examples of clinically obvious intense liver damage.

To meet the growing demand for acetylcysteine, several companies in the market have increased their production capacity. This should ensure a steady supply of acetylcysteine products and help the market grow.

In recent years, the acetylcysteine market has seen a number of acquisitions and collaborations. Zambon Group, for example, acquired Breath Therapeutics in 2020, a company aimed at creating inhalable treatments for respiratory diseases, including acetylcysteine formulations. These collaborations and partnerships are projected to stimulate innovation and market growth in the coming years.

Global Acetylcysteine Market Dynamics

Market Drivers

- Increasing prevalence of respiratory diseases

- Rising geriatric population

- Growing awareness about the benefits of acetylcysteine

- Increasing healthcare expenditure

Market Restraints

- Side effects of acetylcysteine

- Availability of alternative treatments

- Stringent regulatory requirements

Market Opportunities

- Growing demand for inhalable acetylcysteine formulations

- Increasing focus on research and development

- Growing demand for dietary supplements

Acetylcysteine Market Report Coverage

| Market | Acetylcysteine Market |

| Acetylcysteine Market Size 2022 | USD 1.4 Billion |

| Acetylcysteine Market Forecast 2032 | USD 9.3 Billion |

| Acetylcysteine Market CAGR During 2023 - 2032 | 21.1% |

| Acetylcysteine Market Analysis Period | 2020 - 2032 |

| Acetylcysteine Market Base Year | 2022 |

| Acetylcysteine Market Forecast Data | 2023 - 2032 |

| Segments Covered | By Application, By End-User, And By Geography |

| Regional Scope | North America, Europe, Asia Pacific, Latin America, and Middle East & Africa |

| Key Companies Profiled | Zambon Group, Cipla Inc., Mylan N.V., Teva Pharmaceutical Industries Ltd., Aurobindo Pharma Ltd., Sandoz International GmbH, Sagent Pharmaceuticals, Inc., Apotex Inc., WOCKHARDT, Sun Pharmaceutical Industries Ltd., Chengyi Pharma, and Wuhan Grand Hoyo Co. Ltd. |

| Report Coverage |

Market Trends, Drivers, Restraints, Competitive Analysis, Player Profiling, Covid-19 Analysis, Regulation Analysis |

Acetylcysteine Market Insights

In the treatment of acetaminophen overdose, acetylcysteine is used to maintain the amount of glutathione in the liver as well as improve the non-harmful digestion of acetaminophen. These activities serve to shield liver cells from NAPQI harmfulness. This medication is increasingly used for thinning mucus in the air pipe of individuals suffering from lung diseases such as cystic fibrosis, pneumonia, bronchitis, and tuberculosis. Additionally, it is also used to detoxify the liver which is expected to significantly drive the market demand. Inhalable acetylcysteine formulations are in high demand for the treatment of respiratory diseases such as COPD, bronchitis, and cystic fibrosis. This is because acetylcysteine inhalable formulations can directly target the lungs and provide faster relief.

Acetylcysteine is used as an antidote for paracetamol overdose, which can damage the liver. The use of acetylcysteine for this purpose has increased as paracetamol overdose cases have increased.

There is ongoing research and development of new acetylcysteine formulations, including sustained-release formulations and new delivery systems. This is expected to drive innovation in the acetylcysteine market and open up new growth opportunities.

Acetylcysteine Market, By Segmentation

The worldwide market for acetylcysteine is split based on application, end-user, and geography.

Acetylcysteine Market, By Application

- Pharmaceuticals

- Dietary Supplements

- Personal Care

According to an acetylcysteine industry analysis, acetylcysteine is primarily used in the pharmaceutical industry to treat respiratory diseases such as COPD, cystic fibrosis, and bronchitis. It is also used as a mucolytic agent, which reduces the viscosity of mucus and allows it to be removed from the lungs more easily. Acetylcysteine's most common application is in the pharmaceutical industry.

In addition, acetylcysteine is used as a dietary supplement to support liver health and detoxification. It is thought to have antioxidant properties that can protect the liver from toxicity and other harmful substances. The use of acetylcysteine as a dietary supplement is a relatively small market segment.

Furthermore, because of its antioxidant properties, acetylcysteine is used in personal care products such as skincare products and hair care products. It is thought to protect the skin and hair from free radicals and other external conditions. Acetylcysteine is also used in personal care products, which is a relatively small application segment of the market.

Acetylcysteine Market, By End-User

- Hospitals and Clinics

- Retail Pharmacies

- Online Pharmacies

According to the acetylcysteine market forecast, hospitals and clinics are the largest acetylcysteine end-users, accounting for the lion's share of the market. This is due to the fact that acetylcysteine is primarily used to treat respiratory diseases, which necessitate medical supervision and treatment in a clinical setting.

Retail pharmacies are the second-largest acetylcysteine end-users. They play an important role in facilitating access to over-the-counter (OTC) acetylcysteine products used for cough and cold relief, as well as inhalable formulations prescribed by healthcare professionals.

Because of their growing popularity and convenience, online pharmacies are becoming an important end-user of acetylcysteine products. They provide patients with a convenient way to buy prescription and over-the-counter acetylcysteine products from the comfort of their own homes, and this end-user category is projected to grow in the coming years.

Acetylcysteine Market Regional Outlook

- U.S.

- Canada

Europe

- U.K.

- Germany

- France

- Spain

- Rest of Europe

Asia-Pacific

- India

- Japan

- China

- Australia

- South Korea

- Rest of Asia-Pacific

Latin America

- Brazil

- Mexico

- Rest of Latin America

The Middle East & Africa

- South Africa

- GCC Countries

- Rest of the Middle East & Africa (ME&A)

Acetylcysteine Market Regional Analysis

North America is expected to hold a significant share in the acetylcysteine market due to the growing incidence of respiratory diseases such as COPD and asthma, which require acetylcysteine as a treatment. Growing public awareness of the benefits of acetylcysteine in the treatment of respiratory disorders is also propelling market growth.

The growing prevalence of chronic obstructive pulmonary disease (COPD) and cystic fibrosis in Europe is expected to drive significant growth in the acetylcysteine market. Furthermore, the presence of well-known pharmaceutical companies and research institutions is propelling market growth.

Asia-Pacific is expected to see significant growth in the acetylcysteine market because of the rising incidence of respiratory diseases, rising pollution levels, and a growing geriatric population. Furthermore, rising disposable income and expanding healthcare infrastructure in the region are propelling market growth.

Acetylcysteine Market Players

Some of the top acetylcysteine companies offered in the professional report includes Zambon Group, Cipla Inc., Mylan N.V., Teva Pharmaceutical Industries Ltd., Aurobindo Pharma Ltd., Sandoz International GmbH, Sagent Pharmaceuticals, Inc., Apotex Inc., WOCKHARDT, Sun Pharmaceutical Industries Ltd., Chengyi Pharma, and Wuhan Grand Hoyo Co. Ltd.

Frequently Asked Questions

What was the market size of the global acetylcysteine in 2022?

The market size of acetylcysteine was USD 1.4 billion in 2022.

What is the CAGR of the global acetylcysteine market from 2023 to 2032?

The CAGR of acetylcysteine is 21.1% during the analysis period of 2023 to 2032.

Which are the key players in the acetylcysteine market?

The key players operating in the global acetylcysteine market are including Zambon Group, Cipla Inc., Mylan N.V., Teva Pharmaceutical Industries Ltd., Aurobindo Pharma Ltd., Sandoz International GmbH, Sagent Pharmaceuticals, Inc., Apotex Inc., WOCKHARDT, Sun Pharmaceutical Industries Ltd., Chengyi Pharma, and Wuhan Grand Hoyo Co. Ltd.

Which region dominated the global acetylcysteine market share?

North America held the dominating position in acetylcysteine industry during the analysis period of 2023 to 2032.

Which region registered fastest CAGR from 2023 to 2032?

Asia-Pacific region exhibited fastest growing CAGR for market of acetylcysteine during the analysis period of 2023 to 2032.

What are the current trends and dynamics in the global acetylcysteine industry?

The current trends and dynamics in the acetylcysteine industry include increasing prevalence of respiratory diseases, rising geriatric population, and growing awareness about the benefits of acetylcysteine.

Which Application held the maximum share in 2022?

The pharmaceuticals application held the maximum share of the acetylcysteine industry.