Acetone Market Size - Global Industry, Share, Analysis, Trends and Forecast 2023 - 2032

Published :

Report ID:

Pages :

Format :

Acetone Market Size - Global Industry, Share, Analysis, Trends and Forecast 2023 - 2032

Report Coverage

- Industry Dynamics

- Market Size and Forecast Data

- Segment Analysis

- Competitive Landscape

- Regional Analysis with a Niche Focus on Country-Level Data

- High Level Analysis - Porter's, PESTEL, Value Chain, etc.

- Company Profiles of Key Players

- Option to Customize the Report As Per Your Specific Need

Request Sample Report

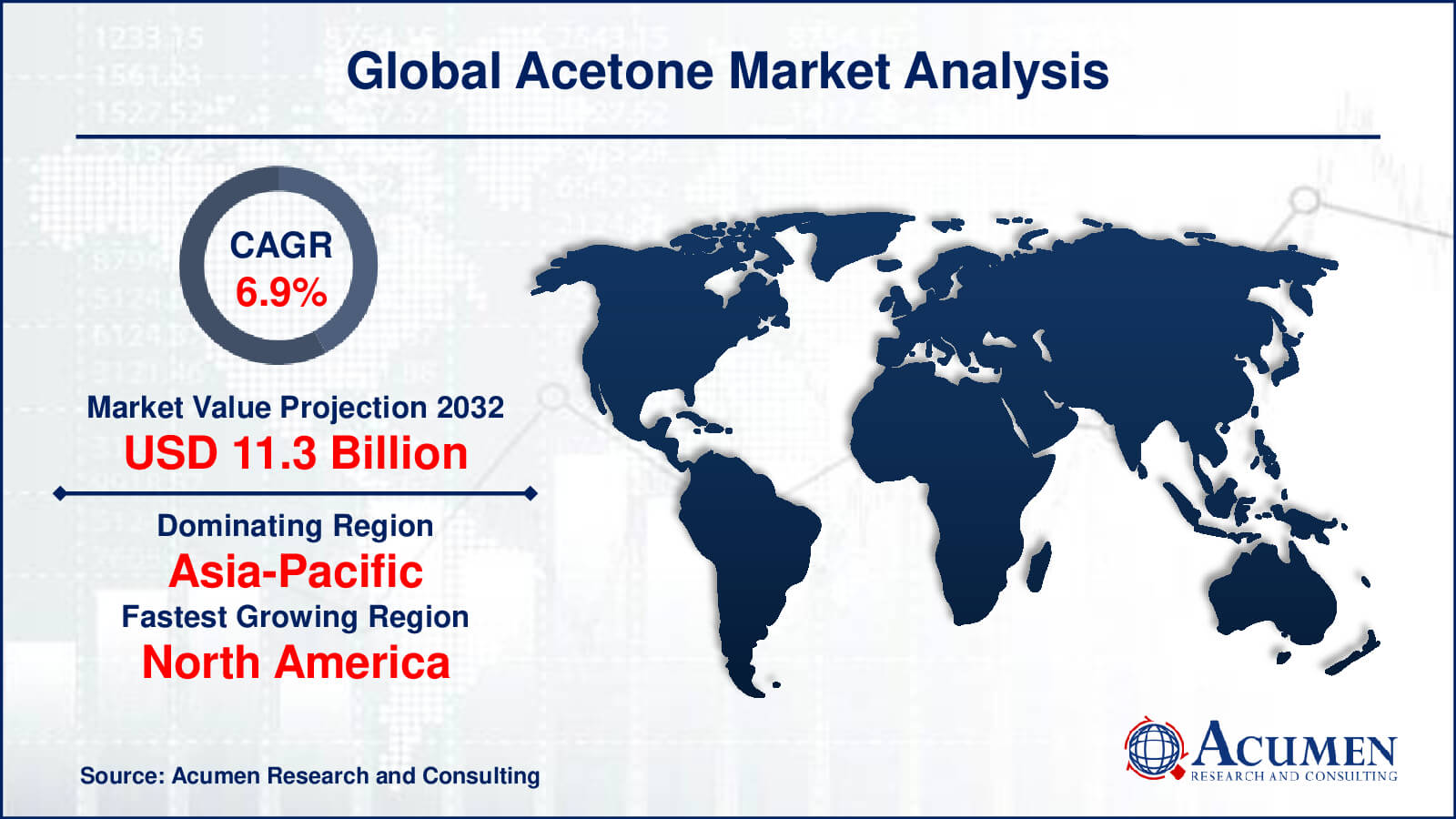

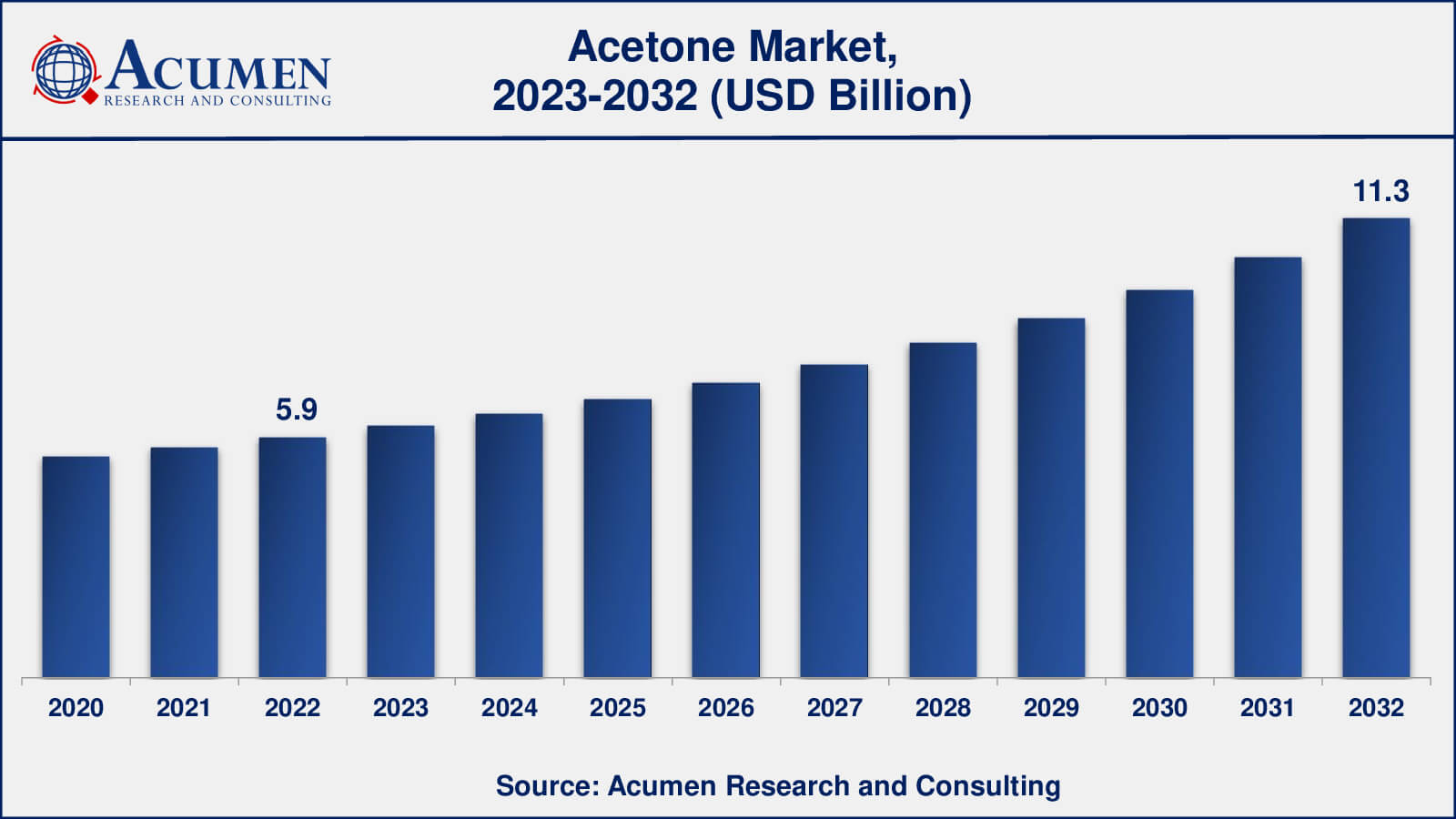

The Global Acetone Market Size accounted for USD 5.9 Billion in 2022 and is estimated to achieve a market size of USD 11.3 Billion by 2032 growing at a CAGR of 6.9% from 2023 to 2032.

Acetone Market Highlights

- Global acetone market revenue is poised to garner USD 11.3 billion by 2032 with a CAGR of 6.9% from 2023 to 2032

- Asia-Pacific acetone market value occupied around USD 2.7 billion in 2022

- North America acetone market growth will record a CAGR of more than 7% from 2023 to 2032

- Among grade, the specialty grade sub-segment generated over US$ 5.7 billion revenue in 2022

- Based on application, the solvents sub-segment generated around 45% share in 2022

- Utilization of acetone in pharmaceutical manufacturing and medical devices is a popular acetone market trend that fuels the industry demand

Acetone also known as propanone or dimethyl ketone is a colorless liquid having the chemical formula CH3COCH3. Acetone is also an organic solvent commonly used in pharma applications. Acetone supply is generally abundant around the world. One unit of acetone is created for every two units of phenol produced. The solvent chain, the methyl methacrylate (MMA) sector, and bisphenol A (BPA) derivatives are the key drivers of the global acetone industry. Acetone is found in paint removers, nail polish removers, and varnish removers, among other things. Moreover, acetone is also used to make polymers, lacquers, and fabrics.

Global Acetone Market Dynamics

Market Drivers

- Growing application of acetone as a solvent

- Increasing use of acetone as a solvent, feedstock, and intermediate in various chemical processes

- Rising demand for acetone-based paints, coatings, and adhesives in the automotive industry

- Use of acetone in energy storage and conversion technologies like advanced batteries and supercapacitors

- Surging use of polycarbonates

Market Restraints

- Price volatility of feedstocks like propylene impacts the production cost of acetone

- Stringent regulations on volatile organic compound (VOC) emissions

- Availability of substitutes

Market Opportunities

- Robust demand from electronics industry in APAC region

- Emerging opportunities for sustainable acetone production from biomass or renewable sources

- Increasing focus on eco-friendly processes and products

- Growing production of plastic resins

- Growing industrialization and urbanization in developing countries

Acetone Market Report Coverage

| Market | Acetone Market |

| Acetone Market Size 2022 | USD 5.9 Billion |

| Acetone Market Forecast 2032 | USD 11.3 Billion |

| Acetone Market CAGR During 2023 - 2032 | 6.9% |

| Acetone Market Analysis Period | 2020 - 2032 |

| Acetone Market Base Year | 2022 |

| Acetone Market Forecast Data | 2023 - 2032 |

| Segments Covered | By Grade, By Application, By End-User,, And By Geography |

| Regional Scope | North America, Europe, Asia Pacific, Latin America, and Middle East & Africa |

| Key Companies Profiled | ALTIVIA, CepsaQuimica, S.A., Honeywell Chemicals, INEOS Phenol GmbH, Kumho P&B Chemicals, LyondellBasell Industries, Mitsui Chemicals Inc., Royal Dutch Shell Co, SABIC, and The Dow Chemical Company |

| Report Coverage |

Market Trends, Drivers, Restraints, Competitive Analysis, Player Profiling, Covid-19 Analysis, Regulation Analysis |

Covid-19 Impact on the Global Acetone Industry

The acetone industry and its derivatives have experienced a decline in demand due to economic disturbances, logistic and supply chain disruptions following the outbreak of COVID-19. Government-imposed restrictions on mobility and manufacturing activities, along with the risk of infection to the workforce, have added a new dimension to the crisis. China, one of the world's primary dimethyl ketone manufacturers, witnessed a threefold price increase since April.

Acetone Market Insights

The global acetone market growth is primarily driven by factors such as robust demand in the pharma, paints & adhesives, and cosmetics industries. For instance, in the pharmaceutical industry, acetone is used in manufacturing pills and liquid medicines to achieve the appropriate density. It is also utilized as an antiseptic in the pharmaceutical industry. In the cosmetics sector, acetone serves as a key ingredient in nail polish removers. Additionally, in the paints & adhesives industry, it is used to prepare metal surfaces for painting. This colorless liquid is ideal for cleaning old brushes or dried paint pans.

Acetone finds common use as an industrial solvent, leading to its widespread application across numerous end-use industries. For example, the growing demand in the textile industry to degrease wool and degum silk, as well as in the formulation of lacquers, is expected to boost the acetone market growth. However, health risks associated with acetone exposure are hindering market expansion. Direct exposure to acetone can cause liver damage, blindness, and vomiting. Moreover, acetone is highly flammable, necessitating careful handling. Furthermore, the increasing regulations by the EU Commission for the ban of BPA in plastic bottles have also had a negative impact on market growth. On the other hand, the rise in demand for medications, various drugs, and hygiene products amid the pandemic has created several growth opportunities for the market in the coming years.

Acetone Market Segmentation

The worldwide market for Acetone is split based on grade, application, end-user, and geography.

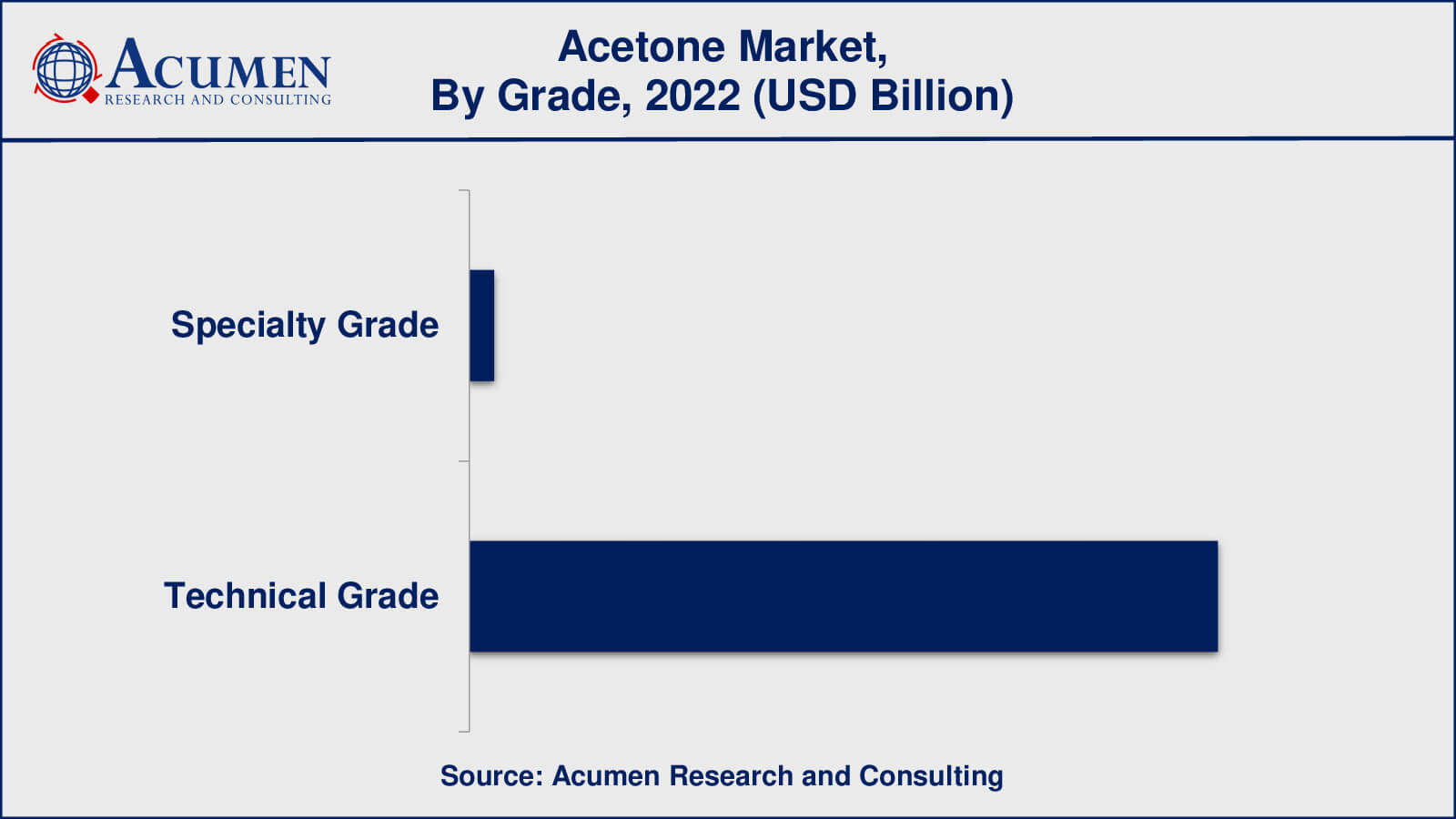

Acetone Grades

- Specialty Grade

- Technical Grade

According to acetone industry analysis, the grade segment is divided into specialty grade and technical grade. As per the acetone industry analysis, the technical grade segment acquired the highest market share in previous years. The substantial growth in this segment can be attributed to its primary use in the production of BPA and MMA. This grade is available at a lower price and is gaining high preference in the construction industry due to its binding properties. However, the specialty grade segment is expected to register the fastest compound annual growth rate (CAGR) throughout the forecast period from 2023 to 2032.

Acetone Applications

- Methyl Methacrylate (MMA)

- Solvents

- Bisphenol-A

- Others

.jpg)

In terms of application, the acetone market is segmented into methyl methacrylate (MMA), solvents, bisphenol-A, and others. Among these applications, the solvents segment accounted for a significant portion of the market share in recent years. The high demand for solvents across various end-use industries such as chemicals, petrochemicals, pharmaceuticals, cosmetics, personal care, and paints & coatings is driving the growth of this segment. Furthermore, bisphenol-A is expected to achieve the fastest growth during the predicted period due to its increased usage in polycarbonate production.

Acetone End-Users

- Automotive

- Electronics

- Cosmetics and Personal Care

- Paints, Coatings, and Adhesives

- Pharmaceutical

- Others

In the past year, acetone has exhibited a significant growth rate in the application segment. According to our acetone market forecast, cosmetics & personal care holds the maximum market share and is expected to maintain its dominance throughout the forecasted timeframe from 2023 to 2032, primarily due to its role in maintaining product consistency in polish removers. Acetone denatures certain alcohols and is used as an additive in makeup and skin creams. One of the primary ingredients in nail polish remover is acetone. Furthermore, the rising occurrence of skincare problems and the demand for anti-aging products are fueling the growth of the acetone market.

Acetone Market Regional Outlook

North America

- U.S.

- Canada

Europe

- U.K.

- Germany

- France

- Spain

- Rest of Europe

Asia-Pacific

- India

- Japan

- China

- Australia

- South Korea

- Rest of Asia-Pacific

Latin America

- Brazil

- Mexico

- Rest of Latin America

The Middle East & Africa

- South Africa

- GCC Countries

- Rest of the Middle East & Africa (ME&A)

Acetone Market Regional Analysis

Affordable infrastructure and labor costs propel the Asia-Pacific acetone market. The APAC region leads the global acetone industry with a prominent market share in 2022, owing to the easy availability of raw materials and lower labor costs in countries such as China and India. Rapid industrialization and the growth of manufacturing facilities are also factors supporting the expansion of the APAC market. North America held the second-largest position globally, as the region boasts significant manufacturing and a substantial consumer base for dimethyl ketone. Additionally, increased consumer expenditure on technology has led to higher demand for consumer electronics, thereby boosting Bisphenol A consumption in the U.S.

North America is also a significant player in the global acetone industry. Significant production capabilities and a huge customer base for acetone goods, particularly dimethyl ketone, contribute to the region's prominence. Furthermore, rising consumer expenditure on technology and electronics has raised demand for acetone-derived goods such as Bisphenol A in the United States.

Europe has a strong presence in the acetone market, with various industries such as chemicals, pharmaceuticals, and cosmetics driving demand for acetone-based goods. The regulatory emphasis on environmental sustainability and green chemical practices has also altered regional market dynamics.

Acetone Market Players

Some of the top acetone companies offered in our report include ALTIVIA, CepsaQuimica, S.A., Honeywell Chemicals, INEOS Phenol GmbH, Kumho P&B Chemicals, LyondellBasell Industries, Mitsui Chemicals Inc., Royal Dutch Shell Co, SABIC, and The Dow Chemical Company.

Frequently Asked Questions

What was the market size of the global acetone in 2022?

The market size of acetone was USD 5.9 billion in 2022.

What is the CAGR of the global acetone market from 2023 to 2032?

The CAGR of acetone is 6.9% during the analysis period of 2023 to 2032.

Which are the key players in the acetone market?

The key players operating in the global market are including ALTIVIA, CepsaQuimica, S.A., Honeywell Chemicals, INEOS Phenol GmbH, Kumho P&B Chemicals, LyondellBasell Industries, Mitsui Chemicals Inc., Royal Dutch Shell Co, SABIC, and The Dow Chemical Company.

Which region dominated the global acetone market share?

Asia-Pacific held the dominating position in acetone industry during the analysis period of 2023 to 2032.

Which region registered fastest CAGR from 2023 to 2032?

North America region exhibited fastest growing CAGR for market of acetone during the analysis period of 2023 to 2032.

What are the current trends and dynamics in the global acetone industry?

The current trends and dynamics in the acetone industry include growing application of acetone as a solvent, growing demand from numerous end-use industries, and surging use of polycarbonates.

Which grade held the maximum share in 2022?

The technical grade held the maximum share of the acetone industry.