Access Control and Authentication Market Size - Global Industry, Share, Analysis, Trends and Forecast 2023 - 2032

Published :

Report ID:

Pages :

Format :

Access Control and Authentication Market Size - Global Industry, Share, Analysis, Trends and Forecast 2023 - 2032

Report Coverage

- Industry Dynamics

- Market Size and Forecast Data

- Segment Analysis

- Competitive Landscape

- Regional Analysis with a Niche Focus on Country-Level Data

- High Level Analysis - Porter's, PESTEL, Value Chain, etc.

- Company Profiles of Key Players

- Option to Customize the Report As Per Your Specific Need

Request Sample Report

The Access Control and Authentication Market Size collected USD 14.4 Billion in 2022 and is set to achieve a market size of USD 37.2 Billion in 2032 growing at a CAGR of 11.4% from 2023 to 2032.

Access control and authentication are the numerous measures, which can be either electronic or physical, designed for monitoring objects and people, and controlling access to and precluding intrusion of any information or property. The primary objective of access control and authentication is to restrict the physical access of any unauthorized person in a controlled facility. These systems are the security devices that control access to resources in the operating system. Also, access control and authentication systems are significant tools used for investigating or preventing crimes that may take place in public places such as multiplexes, shopping malls, airports, casinos, banks, ATMs, and other such places. Security requires cost expenditure and has some drawbacks that restrict it from eliminating the risks.

Access Control and Authentication Market Report Statistics

- Global access control and authentication market revenue is estimated to reach USD 37.2 Billion by 2032 with a CAGR of 11.4% from 2023 to 2032

- North America access control and authentication market value occupied more than USD 5 billion in 2022

- Asia-Pacific access control market growth will register a CAGR of around 11.5% from 2023 to 2032

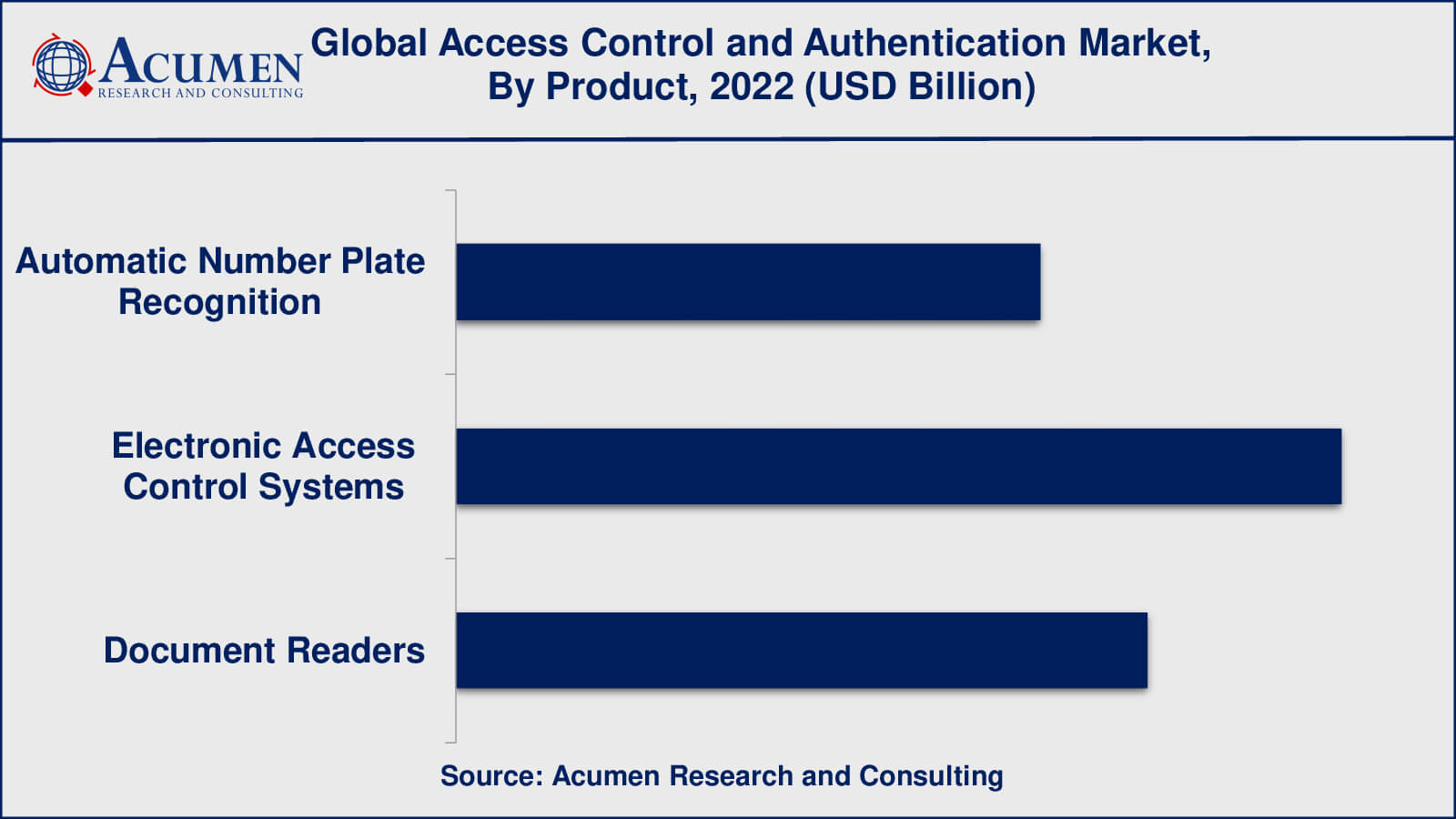

- Among product, the electronic access control systems sub-segment generated around 40% share in 2022

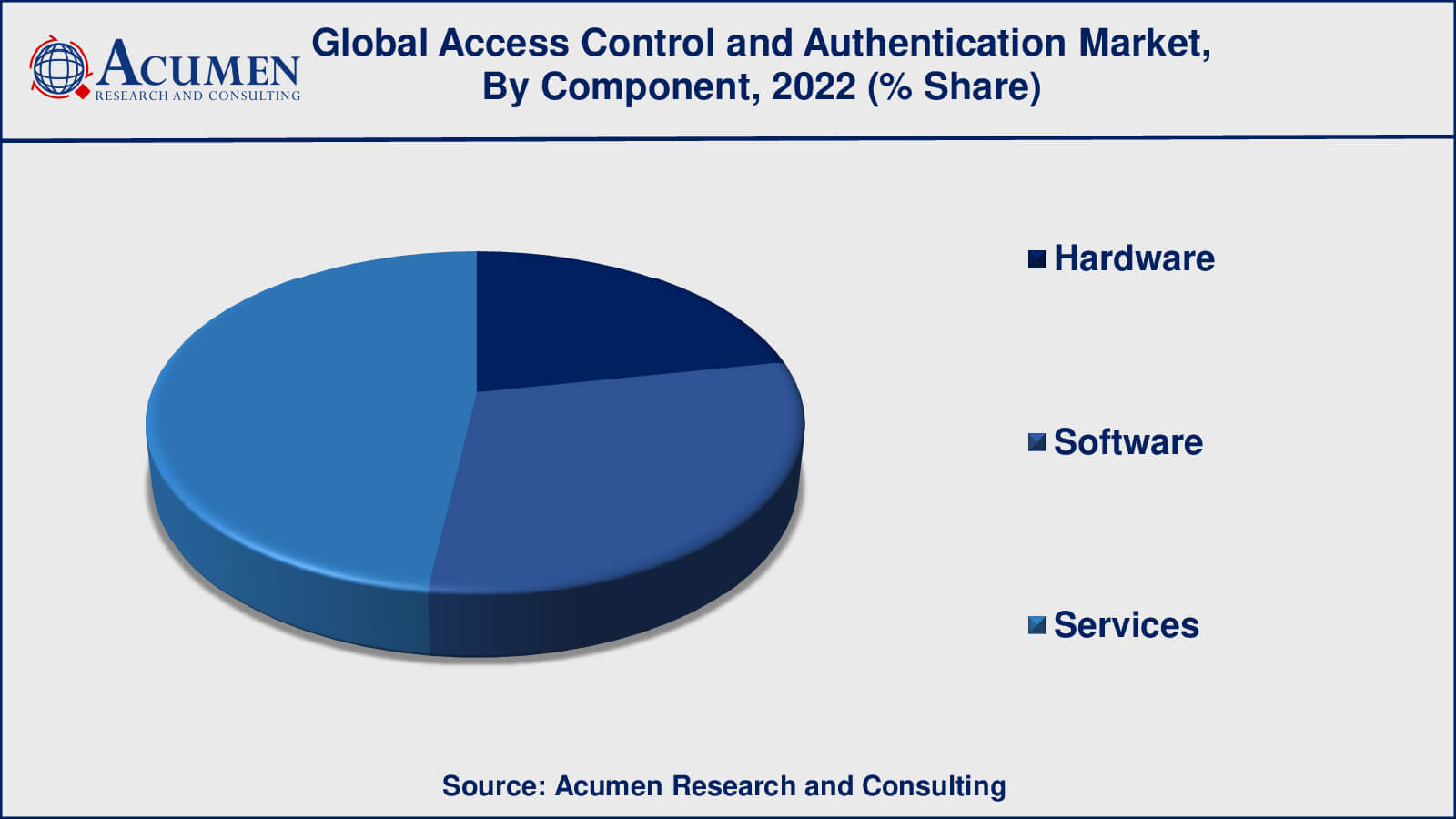

- Based on component, the services sub-segment generated US $ 6.9 billion revenue in 2022

- Integration with smart technologies is a popular access control market trend that fuels the industry demand

Access Control Market Dynamics

Market Drivers

- Increasing demand for security solutions

- Rising threat of cyber attacks

- Emphasis on biometric authentication

- Government regulations and compliance requirements

Market Restraints

- Growing privacy concerns

- Increase in system complexities along with integration issues

Market Opportunities

- Increasing demand for mobile access control

- Rising adoption of mobile and cloud-based solutions

Access Control and Authentication Market Report Coverage

| Market | Access Control and Authentication Market |

| Access Control and Authentication Market Size 2022 | USD 14.4 Billion |

| Access Control and Authentication Market Forecast 2032 | USD 37.2 Billion |

| Access Control and Authentication Market CAGR During 2023 - 2032 | 11.4% |

| Access Control and Authentication Market Analysis Period | 2020 - 2032 |

| Base Year | 2022 |

| Forecast Data | 2023 - 2032 |

| Segments Covered | By Product, By Component, By End-User, And By Geography |

| Regional Scope | North America, Europe, Asia Pacific, Latin America, and Middle East & Africa |

| Key Companies Profiled | 3M Company, Allegion plc, ASSA ABLOY, Axis Communications, Bosch Security Systems, Genetec Inc., Honeywell Security Group, Identiv, Inc., Johnson Controls, Panasonic Systems Networks Co. Ltd, and Zhejiang Dahua Technology Co. Ltd. |

| Report Coverage |

Market Trends, Drivers, Restraints, Competitive Analysis, Player Profiling, Covid-19 Analysis, Regulation Analysis |

Access Control Market Growth Factors

Increasing incidences of terrorism, and safety & security concerns are the major factors influencing the growth of the access control and authentication systems market, globally. Also, with the advancement of infrastructure developments, business organizations are extensively adopting access control and authentication systems. Increased criminal activities are also boosting the market for access control and authentication systems and making the market complicated and sophisticated. A few other factors bolstering the market include the increasing trend of biometric authentication procedures in mobile devices. Fingerprint recognition is used as a feature for authentication in high-end mobile phones and is soon expected to be added as a feature in mid-range devices too. With the growing smartphone usage day-by-day, these devices have become crucial for saving important information. Thus, the concern of smartphone users towards unauthorized access to their mobile devices is driving the market for access control and authentication. The rising concerns regarding illegal immigration and the subsequent risk of document counterfeiting have also increased the demand for document readers. Additionally, the rising threat of terrorism is another factor bolstering market growth.

In the past few years, the use of access control and authentication systems has increased in different applications ranging from defense to commercial sectors. High growth is witnessed in the hospital, banking, retail, and IT sector thereby, increasing the demand for access control and authentication systems. However, factors such as high costs, false alarms, and lack of awareness among people particularly, in Asian countries are a few factors hampering the market growth. Although, with the advancement in technology, the costs of these systems are anticipated to decrease which may result in rising adoption of these devices in the APAC region.

Access Control and Authentication Market Segmentation

The worldwide access control and authentication market is categorized based on product, component, end-user, and geography.

Access Control and Authentication Market By Product

- Automatic Number Plate Recognition

- Electronic Access Control Systems

- Document Readers

According to the access control and authentication industry analysis, the electronic access control systems (EACS) dominated the largest market share in the global access control market. EACS includes solutions such as smart cards, biometric systems, and RFID-based access control systems that are used to regulate access to physical and digital resources. EACS are widely used in a variety of industries, including government, commercial, industrial, and residential sectors. They offer enhanced security features such as multi-factor authentication, real-time monitoring, and centralized management, making them popular among businesses and organizations seeking to protect their assets and data.

Access Control and Authentication Market By Component

- Hardware

- Readers

- Controllers

- Serial Access Controllers

- IP Access Controllers

- Integrated Solutions

- Software

- Services

- Support & Maintenance

- Installation & Integration

According to component segment, the services sub-segment held the largest market share in 2021 and is expected to continue to do so in the coming years. In the access control and authentication market, the services component, which includes installation, maintenance, and support services, has the largest market share. This is due to the fact that access control and authentication solutions necessitate specialized knowledge and skills for installation, configuration, and ongoing support. With the increased adoption of these solutions, the demand for services such as installation, integration, and maintenance of access control and authentication systems is expected to rise. The second-largest market share is held by the software component of access control and authentication solutions, which involves identity management software, access control management software, and authentication software. The need for intelligent access control systems that can incorporate with other security systems and can provide advanced features such as real-time monitoring and reporting drives the demand for software.

Access Control and Authentication Market By End-User

- Residential & Commercial

- Government & Public Sector

- BFSI

- IT & Telecom

- Retail

- Healthcare

- Military & Defense

- Manufacturing

- Hospitality

- Education

- Others

According to the access control market forecast, the government and public sector dominated the utmost market share in access control and authentication. Government and public sector organizations, including law enforcement agencies, airports, and border control, require high levels of security to protect their assets, infrastructure, and citizens. Access control and authentication solutions are used in these sectors to regulate access to sensitive areas, data, and resources. Access control and authentication solutions are increasingly being used to provide security and control access to various areas in homes, apartments, and commercial buildings. Banking, financial services, and insurance (BFSI) is a critical industry that necessitates high levels of security in order to safeguard sensitive customer information and financial assets. In this industry, access control and authentication solutions are employed to ensure secure access to financial systems and customer data.

Access Control and Authentication Market Regional Outlook

North America

- U.S.

- Canada

Europe

- U.K.

- Germany

- France

- Spain

- Rest of Europe

Asia-Pacific

- India

- Japan

- China

- Australia

- South Korea

- Rest of Asia-Pacific

Latin America

- Brazil

- Mexico

- Rest of Latin America

The Middle East & Africa

- South Africa

- GCC Countries

- Rest of the Middle East & Africa (ME&A)

Access Control and Authentication Market Regional Analysis

North America is dominating the global access control market, but Asia-Pacific is expected to surpass North America over the forecast period. The increased frequency of security breaches and cyber-attacks has increased demand for advanced security solutions. Access control and authentication systems are widely used to protect both physical and digital assets, making them a must-have tool for organizations looking to protect their data and assets.

The growth in Asia-Pacific is attributed to the decreasing cost of access control and authentication devices, rising security concerns, and increased public awareness of this technology. The Asia-Pacific region is rapidly urbanizing and industrializing, which is driving up demand for advanced security solutions to protect people and assets in these environments. Smart technologies, such as smart cities, smart homes, and the Internet of Things, are becoming increasingly popular in the Asia-Pacific region (IoT). These technologies are propelling the region's access control market, as they necessitate advanced security solutions to safeguard data and assets.

Access Control and Authentication Market Players

Some of the leading access control and authentication companies include 3M Company, Allegion plc, ASSA ABLOY, Axis Communications, Bosch Security Systems, Genetec Inc., Honeywell Security Group, Identiv, Inc., Johnson Controls, Panasonic Systems Networks Co. Ltd, and Zhejiang Dahua Technology Co. Ltd.

Frequently Asked Questions

How big is the access control and authentication market?

The market size of access control and authentication was USD 14.4 Billion in 2022.

What is the CAGR of the global access control and authentication market during forecast period of 2023 to 2032?

The CAGR of access control and authentication market is 11.4% during the analysis period of 2023 to 2032.

Which are the key players operating in the market?

The key players operating in the global market are 3M Company, Allegion plc, ASSA ABLOY, Axis Communications, Bosch Security Systems, Genetec Inc., Honeywell Security Group, Identiv, Inc., Johnson Controls, Panasonic Systems Networks Co. Ltd, and Zhejiang Dahua Technology Co. Ltd.

Which region held the dominating position in the global access control and authentication market?

North America held the dominating position in access control and authentication market during the analysis period of 2023 to 2032.

Which region registered the fastest growing CAGR for the forecast period of 2023 to 2032?

Asia-Pacific region exhibited fastest growing CAGR for access control and authentication market during the analysis period of 2023 to 2032.

What are the current trends and dynamics in the global access control and authentication market?

The current trends and dynamics in the access control and authentication industry include increasing demand for security solutions, rising threat of cyber attacks, and government regulations and compliance requirements.

Which product held the maximum share in 2022?

The electronic access control systems product held the maximum share of the access control and authentication market.