AC Power Sources Market Size - Global Industry, Share, Analysis, Trends and Forecast 2023 - 2032

Published :

Report ID:

Pages :

Format :

AC Power Sources Market Size - Global Industry, Share, Analysis, Trends and Forecast 2023 - 2032

Report Coverage

- Industry Dynamics

- Market Size and Forecast Data

- Segment Analysis

- Competitive Landscape

- Regional Analysis with a Niche Focus on Country-Level Data

- High Level Analysis - Porter's, PESTEL, Value Chain, etc.

- Company Profiles of Key Players

- Option to Customize the Report As Per Your Specific Need

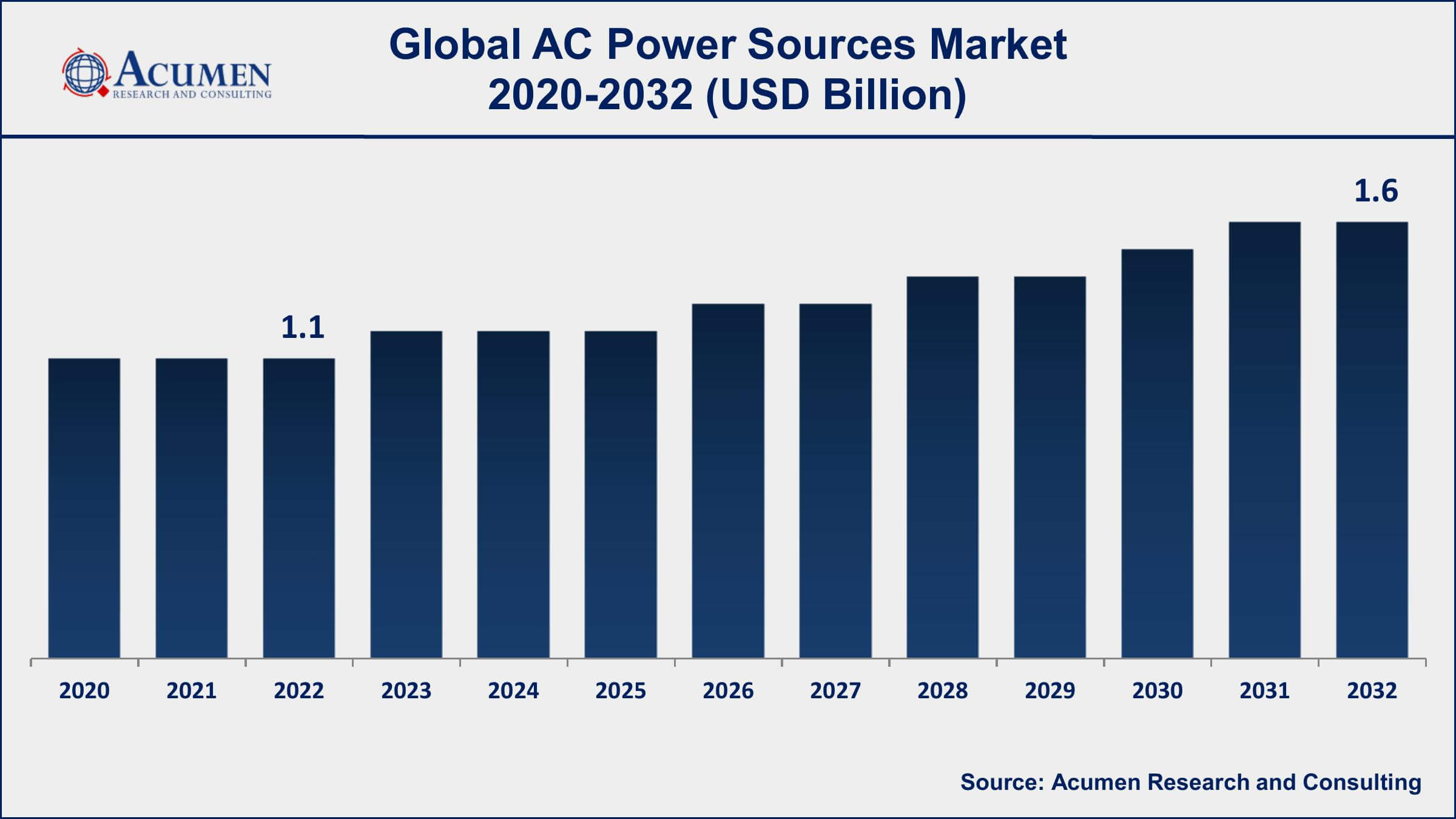

Request Sample Report

The Global AC Power Sources Market Size accounted for USD 1.1 Billion in 2022 and is projected to achieve a market size of USD 1.6 Billion by 2032 growing at a CAGR of 3.9% from 2023 to 2032.

AC Power Sources Market Highlights

- Global AC power sources market revenue is expected to increase by USD 1.6 Billion by 2032, with a 3.9% CAGR from 2023 to 2032

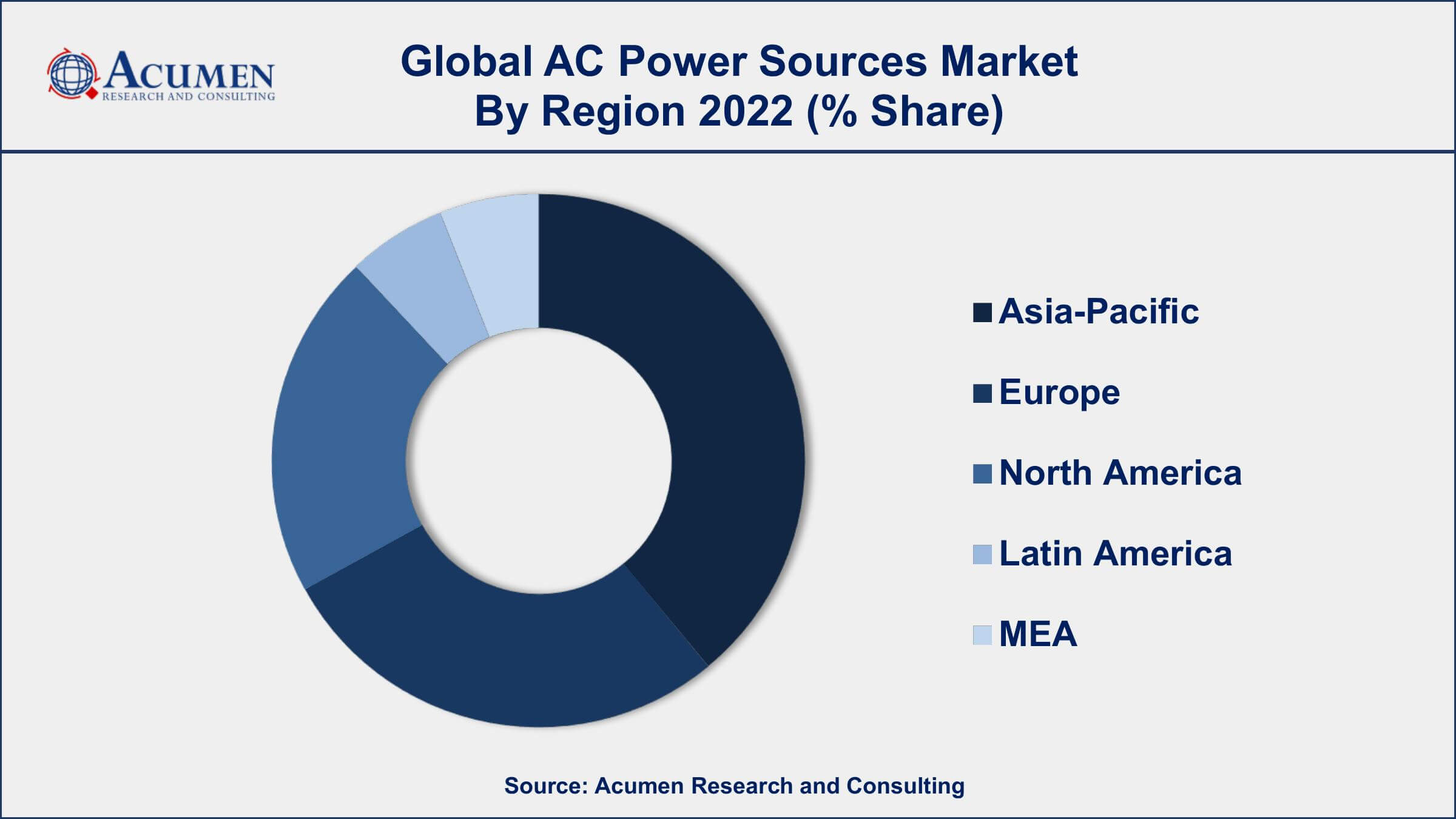

- Asia-Pacific region led with more than 44% of AC power sources market share in 2022

- By modulation type, the linear AC power sources segment held the largest share of the market in 2022

- By application, the consumer electronics segment is expected to grow at a CAGR of 5.1% from 2023 to 2032

- Some of the key players in the market include AMETEK Programmable Power, B&K Precision Corporation, Chroma ATE Inc., Keysight Technologies, and Tektronix Inc.

- Rise of electric vehicles and increasing use of advanced electronics in vehicles, drives the AC power sources market value

AC power sources are devices that generate alternating current (AC) electrical power to provide a reliable source of electricity for various applications. They are used in a wide range of industries, including automotive, aerospace and defense, telecommunications, medical devices, and consumer electronics, among others. AC power sources are essential for the testing and validation of electronic devices and systems, as well as for powering complex machinery and equipment.

The market for AC power sources has been steadily growing in recent years, driven by the increasing demand for high-quality and reliable power sources across various industries. The growth of the market is also driven by the increasing adoption of renewable energy sources, which require reliable and efficient AC power sources for energy conversion and storage. Additionally, the rise of electric vehicles and the increasing use of advanced electronics in vehicles have further increased the demand for AC power sources. With the growing focus on renewable energy sources and the increasing use of advanced electronics in various applications, the demand for AC power sources is expected to remain strong, creating new opportunities for companies operating in the market.

Global AC Power Sources Market Trends

Market Drivers

- Growing demand for reliable and high-quality power sources across various industries

- Increasing adoption of renewable energy sources

- Rise of electric vehicles and increasing use of advanced electronics in vehicles

- Increasing demand for wireless devices and infrastructure

- Growing focus on energy efficiency and sustainability

Market Restraints

- High cost of AC power sources

- Challenges in integrating renewable energy sources with existing power grids

Market Opportunities

- Growing demand for energy storage solutions

- Advancements in smart grid technologies and distributed energy systems

- Increasing demand for AC power sources in the aerospace and defense industry

AC Power Sources Market Report Coverage

| Market | AC Power Sources Market |

| AC Power Sources Market Size 2022 | USD 1.1 Billion |

| AC Power Sources Market Forecast 2032 | USD 1.6 Billion |

| AC Power Sources Market CAGR During 2023 - 2032 | 3.9% |

| AC Power Sources Market Analysis Period | 2020 - 2032 |

| AC Power Sources Market Base Year | 2022 |

| AC Power Sources Market Forecast Data | 2023 - 2032 |

| Segments Covered | By Phase Type, By Modulation Type, By Application, And By Geography |

| Regional Scope | North America, Europe, Asia Pacific, Latin America, and Middle East & Africa |

| Key Companies Profiled | Keysight Technologies Inc., Chroma ATE Inc., AMETEK Programmable Power, Inc., B&K Precision Corporation, National Instruments Corporation, Tektronix Inc., California Instruments Corporation, Kikusui Electronics Corporation, Matsusada Precision Inc., Preen (AC Power Corp.), and NF Corporation. |

| Report Coverage |

Market Trends, Drivers, Restraints, Competitive Analysis, Player Profiling, Covid-19 Analysis, Regulation Analysis |

An AC power source, also known as an AC power supply, is a device that converts electrical power from a source into a form suitable for use by electrical equipment. AC power sources are commonly used to power a wide range of electrical devices, including consumer electronics, industrial equipment, and scientific instruments. AC power sources are designed to provide a stable and reliable source of electrical power, ensuring that electrical devices operate efficiently and safely. They typically operate using alternating current (AC), which is the type of electrical current that is supplied to most homes and businesses. AC power sources are available in a range of sizes and configurations, from small desktop units to large industrial-scale systems.

The application of AC power sources is vast and varied. They are used in many different industries and settings, including manufacturing, telecommunications, healthcare, and research laboratories. In the manufacturing industry, AC power sources are used to power and control industrial equipment, such as motors, pumps, and machinery. In the telecommunications industry, AC power sources are used to power telecommunications equipment, such as cell towers, routers, and switches.

The AC power sources market is experiencing significant growth due to various factors, such as the increasing demand for reliable and efficient power sources for various industries and the rising adoption of renewable energy sources. Additionally, the growing demand for consumer electronics and portable devices is also driving the AC power sources market growth. One of the key drivers of the market is the increasing adoption of renewable energy sources, such as solar and wind power. These sources of energy require efficient and reliable AC power sources for energy conversion and storage. The demand for AC power sources is also increasing due to the rising need for energy-efficient devices and the growing trend toward sustainability and environmental consciousness.

AC Power Sources Market Segmentation

The global AC power sources market segmentation is based on phase type, modulation type, application, and geography.

AC Power Sources Market By Phase Type

- Single Phase

- Three Phase

According to the AC power sources industry analysis, the single-phase AC power sources segment is expected to grow at a significant rate during the forecast period. Single-phase AC power sources are used in a wide range of applications, including residential, commercial, and industrial settings, where they provide a reliable and cost-effective source of electricity. Single-phase AC power sources are also used in various electronic devices and systems, such as computers, audio equipment, and lighting systems. The market for single-phase AC power sources is expected to grow significantly in the coming years, driven by the increasing demand for reliable and high-quality power sources in various industries. The growth of the segment is also driven by the increasing adoption of renewable energy sources, which require efficient and reliable AC power sources for energy conversion and storage.

AC Power Sources Market By Modulation Type

- Linear AC Power Sources

- PWM AC Power Sources

In terms of modulation types, the linear AC power sources segment is expected to grow significantly in the coming years. This growth is driven by the increasing demand for high-quality and reliable power sources across various industries. The growth of the segment is also driven by the increasing adoption of renewable energy sources, which require efficient and reliable AC power sources for energy conversion and storage. Linear AC power sources are widely used in a variety of industries, including telecommunications, automotive, aerospace and defense, medical devices, and consumer electronics. Linear AC power sources offer a reliable, stable, and low-noise source of electrical power, making them ideal for testing and validation of electronic devices and systems, as well as for powering complex machinery and equipment. Additionally, the rise of electric vehicles and the increasing use of advanced electronics in vehicles have further increased the demand for linear AC power sources.

AC Power Sources Market By Application

- Aerospace and Defense

- Automotive

- Consumer Electronics

- Medical Devices

- Telecommunications

- Others

According to the AC power sources market forecast, the consumer electronics segment is expected to witness significant growth in the coming years. Consumer electronics is a wide range of devices such as smartphones, laptops, televisions, gaming consoles, and other electronic devices. AC power sources are used to power and charge these devices, ensuring they function correctly and efficiently. With the growing demand for electronic devices and the increasing use of portable devices, the demand for AC power sources for consumer electronics is expected to grow significantly. The growth of the consumer electronics segment is driven by several factors, including the increasing penetration of smartphones and laptops, the growing demand for portable and wireless devices, and the rising trend of smart homes and Internet of Things (IoT) devices. Additionally, the increasing demand for high-quality and reliable power sources for these devices is further driving the growth of the consumer electronics segment.

AC Power Sources Market Regional Outlook

North America

- U.S.

- Canada

Europe

- U.K.

- Germany

- France

- Spain

- Rest of Europe

Asia-Pacific

- India

- Japan

- China

- Australia

- South Korea

- Rest of Asia-Pacific

Latin America

- Brazil

- Mexico

- Rest of Latin America

The Middle East & Africa

- South Africa

- GCC Countries

- Rest of the Middle East & Africa (ME&A)

AC Power Sources Market Regional Analysis

The Asia-Pacific region is currently dominating the AC power sources market due to several factors. One of the primary reasons is the significant increase in industrialization in the region, which has resulted in an increasing demand for high-quality and reliable power sources for various industries. Additionally, the region's growing population and increasing urbanization have led to a rise in demand for consumer electronics, driving the growth of the AC power sources market in the region. Another reason for the domination of the Asia-Pacific region in the AC power sources market is the increasing adoption of renewable energy sources, such as solar and wind power. The region is home to several countries that are investing heavily in renewable energy sources, creating a demand for efficient and reliable AC power sources for energy conversion and storage. Furthermore, the Asia-Pacific region is witnessing significant economic growth, which has led to the establishment of several manufacturing units, particularly in China and India.

AC Power Sources Market Player

Some of the top AC power sources market companies offered in the professional report include Keysight Technologies Inc., Chroma ATE Inc., AMETEK Programmable Power, Inc., B&K Precision Corporation, National Instruments Corporation, Tektronix Inc., California Instruments Corporation, Kikusui Electronics Corporation, Matsusada Precision Inc., Preen (AC Power Corp.), and NF Corporation.

Frequently Asked Questions

What was the market size of the global AC power sources in 2022?

The market size of AC power sources was USD 1.1 Billion in 2022.

What is the CAGR of the global AC power sources market from 2023 to 2032?

The CAGR of AC power sources is 3.9% during the analysis period of 2023 to 2032.

Which are the key players in the AC power sources market?

The key players operating in the global market are including Keysight Technologies Inc., Chroma ATE Inc., AMETEK Programmable Power, Inc., B&K Precision Corporation, National Instruments Corporation, Tektronix Inc., California Instruments Corporation, Kikusui Electronics Corporation, Matsusada Precision Inc., Preen (AC Power Corp.), and NF Corporation.

Which region dominated the global AC power sources market share?

Asia-Pacific held the dominating position in AC power sources industry during the analysis period of 2023 to 2032.

Which region registered fastest CAGR from 2023 to 2032?

Asia-Pacific region exhibited fastest growing CAGR for market of AC power sources during the analysis period of 2023 to 2032.

What are the current trends and dynamics in the global AC power sources industry?

The current trends and dynamics in the AC power sources industry include growing demand for reliable and high-quality power sources across various industries, increasing adoption of renewable energy sources, and rise of electric vehicles and increasing use of advanced electronics in vehicles.

Which modulation type held the maximum share in 2022?

The linear modulation type held the maximum share of the AC power sources industry.