AC Microgrid Market Size - Global Industry, Share, Analysis, Trends and Forecast 2023 - 2032

Published :

Report ID:

Pages :

Format :

AC Microgrid Market Size - Global Industry, Share, Analysis, Trends and Forecast 2023 - 2032

Report Coverage

- Industry Dynamics

- Market Size and Forecast Data

- Segment Analysis

- Competitive Landscape

- Regional Analysis with a Niche Focus on Country-Level Data

- High Level Analysis - Porter's, PESTEL, Value Chain, etc.

- Company Profiles of Key Players

- Option to Customize the Report As Per Your Specific Need

Request Sample Report

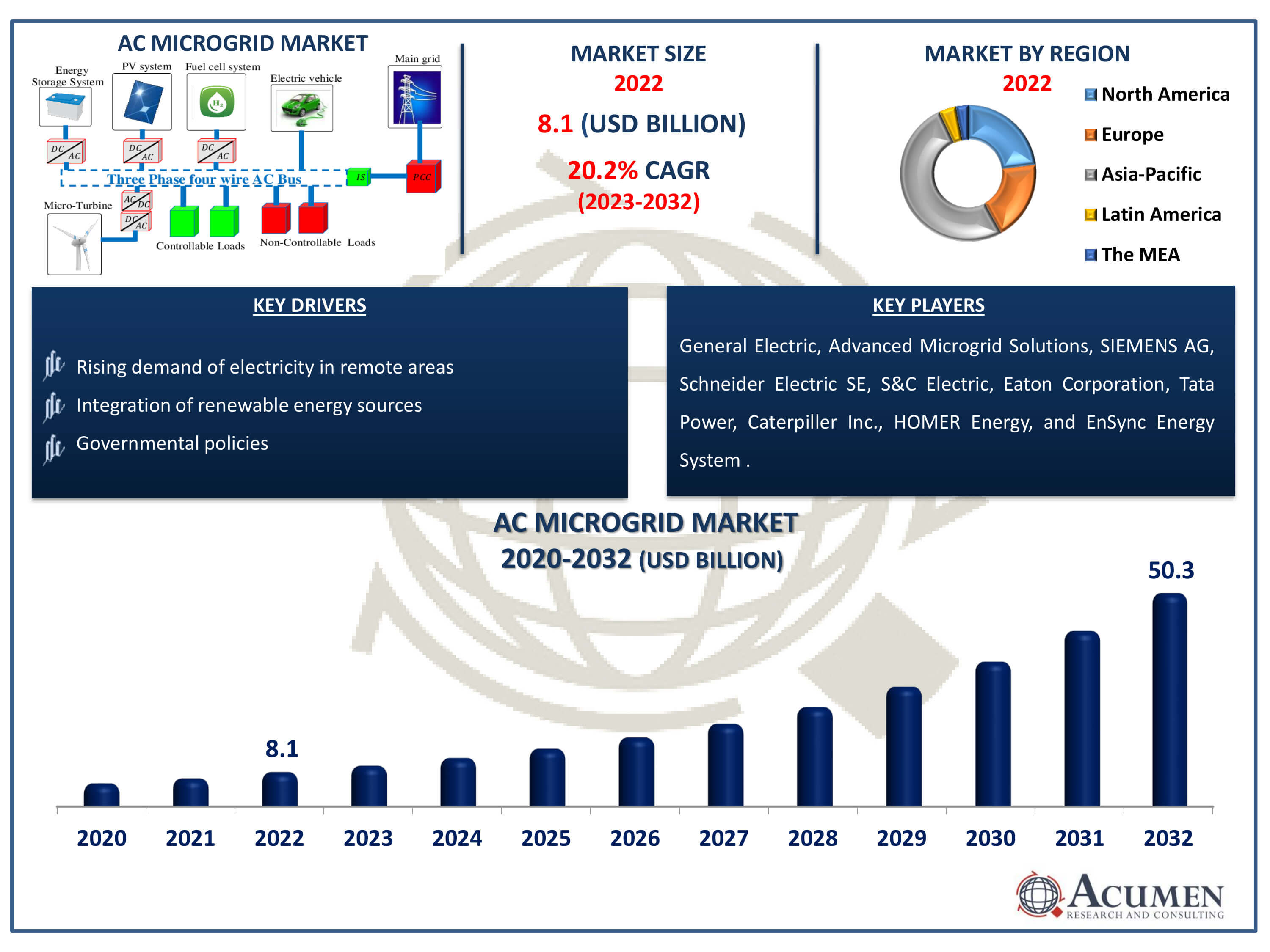

The AC Microgrid Market Size accounted for USD 8.1 Billion in 2022 and is estimated to achieve a market size of USD 50.3 Billion by 2032 growing at a CAGR of 20.2% from 2023 to 2032.

AC Microgrid Market Highlights

- Global AC microgrid market revenue is poised to garner USD 50.3 billion by 2032 with a CAGR of 20.2% from 2023 to 2032

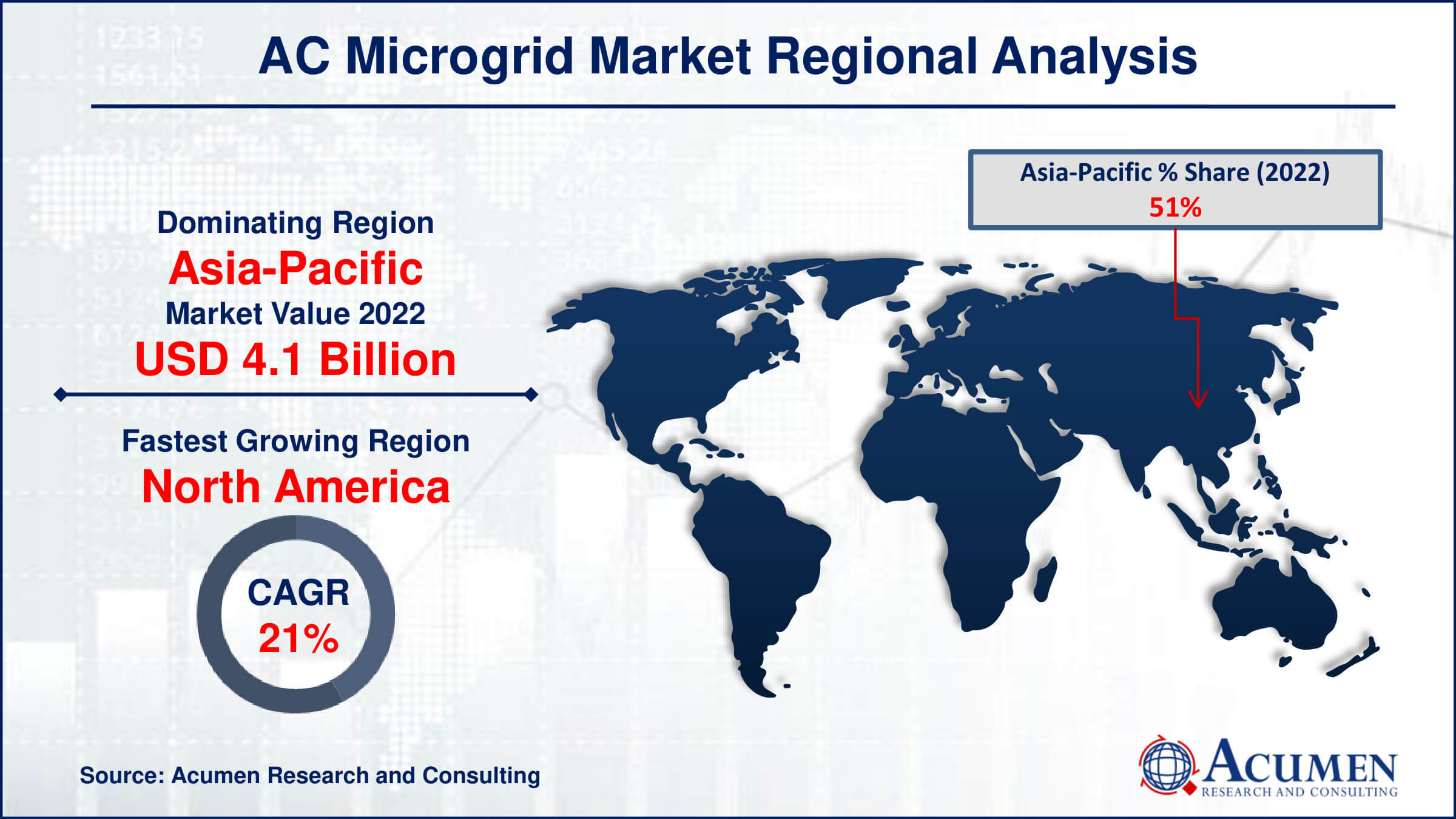

- Asia-Pacific AC microgrid market value occupied around 51% market share in 2022

- North America AC microgrid market growth will record a CAGR of more than 21% from 2023 to 2032

- Among connectivity, the grid connected sub-segment generated 70% market share in 2022

- Based on power source, the natural gas sub-segment occupied significant market share in 2022

- By storage device, lithium-ion sub-segment gathered USD 4.5 billion revenue in 2022

- Among applications, industrial/commercial segment generated considerable share in 2022

- Growing demand of electricity becoming a trend in the AC microgrid market

An AC microgrid, or alternating current microgrid, is a localized and autonomous power system that operates independently or in conjunction with the main grid. It typically comprises a network of interconnected loads, distributed energy resources (DERs), energy storage systems (ESS), and control systems. The primary characteristic of an AC microgrid is its ability to balance electricity supply and demand within its boundary, while maintaining stability and reliability. Additionally, they find applications in remote areas, providing reliable electricity where grid connection is challenging. Microgrids enhance resilience during natural disasters, ensuring continuous power supply. They facilitate the integration of renewables, optimize energy use for industries, support military operations, and provide sustainable power for island communities. Overall, they offer flexible and reliable solutions for diverse energy needs, contributing to sustainability and economic development.

Global AC Microgrid Market Dynamics

Market Drivers

- Rising demand of electricity in remote areas

- Integration of renewable energy sources

- Governmental policies

Market Restraints

- High initial investments

- Regulatory hurdles and grid integration challenges

Market Opportunities

- Advancements in the smart grid technology

- Growing digitalization

AC Microgrid Market Report Coverage

| Market | AC Microgrid Market |

| AC Microgrid Market Size 2022 | USD 8.1 Billion |

| AC Microgrid Market Forecast 2032 |

USD 50.3 Billion |

| AC Microgrid Market CAGR During 2023 - 2032 | 20.2% |

| AC Microgrid Market Analysis Period | 2020 - 2032 |

| AC Microgrid Market Base Year |

2022 |

| AC Microgrid Market Forecast Data | 2023 - 2032 |

| Segments Covered | By Connectivity, By Power Source, By Storage Device, By Application, And By Geography |

| Regional Scope | North America, Europe, Asia Pacific, Latin America, and Middle East & Africa |

| Key Companies Profiled | General Electric, Advanced Microgrid Solutions, SIEMENS AG, Schneider Electric SE, S&C Electric, Eaton Corporation, Tata Power, Caterpiller Inc., HOMER Energy, and EnSync Energy System. |

| Report Coverage |

Market Trends, Drivers, Restraints, Competitive Analysis, Player Profiling, Covid-19 Analysis, Regulation Analysis |

AC Microgrid Market Insights

The AC microgrid market has experienced steady growth in recent years due to the rising demand for electricity in remote areas. Nowadays, electricity has become an important part of everyone’s life, so utilization will also rise. For instance, the highest recorded daily electricity usage peaks at 56 kW, while the lowest recorded daily usage is 5 kW. On average, a small-scale household consumes approximately 1.2 kWh of energy per day. This translates to a monthly average consumption of 36 kWh. Additionally, electricity became a crucial factor for the U.S. economy. According to the U.S Energy Information Administration, peoples in the U.S. uses electricity for heating, refrigeration, cooling, computers, lighting, machinery, public transportation systems, and electronics. Furthermore, providing consistent electricity access in rural areas can lead to heightened demand, particularly when coupled with opportunities for engaging in additional income-generating activities. So, this rising demand for electricity in remote areas will boost the growth of the AC microgrid market. Moreover, the integration of renewable energy sources and governmental policies further drives the market growth.

However, high initial investments pose a significant barrier to the growth of the AC microgrid market. AC microgrids, which offer resilient power solutions, require substantial straight capital for infrastructure development, including generation, distribution, and control systems. This financial burden discourages potential adopters, particularly in regions with limited access to funding or where traditional grid infrastructure is already established. Even though the long-term cost savings and benefits in terms of energy reliability and sustainability, the initial capital expenditure remains a major hurdle for widespread adoption of AC microgrids. In addition to that, regulatory hurdles and grid integration challenges further impede market growth.

Nevertheless, advancements in the smart grid technology have become an opportunity for the AC microgrid market during the forecast timeframe 2024 to 2032. These developments have enabled more efficient management and distribution of electricity within microgrids, allowing for better integration of renewable energy sources, such as solar and wind power. Smart grid capabilities, including advanced metering infrastructure, real-time monitoring, and predictive analytics, enhance the stability, reliability, and resilience of AC microgrids. As a result, businesses and communities are increasingly adopting AC microgrid solutions to optimize energy consumption, reduce costs, and minimize environmental impact. This trend is expected to continue growing as smart grid technology evolves further, driving expansion in the AC microgrid market in the forthcoming years. Lastly, growing digitalization is also expected to further create an opportunity in the coming years.

AC Microgrid Market Segmentation

The worldwide market for AC microgrid is split based on connectivity, power source, storage device, application, and geography.

AC Microgrid Connectivity

- Grid Connected

- Off Grid

According to AC microgrid industry analysis, based on the connectivity, grid connected segment dominates the market in 2022. Grid-connected connectivity is vital in AC microgrids for several reasons. Firstly, it ensures stability and reliability by providing a backup power source in case of fluctuations or failures within the microgrid itself. This interconnection also facilitates efficient energy management. Additionally, grid connectivity enhances the resilience of the microgrid. Furthermore, it promotes scalability and flexibility, as the microgrid can easily expand or adapt to changing energy demands and incorporate renewable energy sources. Overall, grid-connected connectivity enhances the performance and sustainability of AC microgrids, making them integral components of modern energy systems.

AC Microgrid Power Sources

- Diesel generators

- Natural gas

- Solar PV

- CHP

- Others

According to the AC microgrid market analysis, based on the power source, the natural gas segment is experiencing significant growth due to several factors. Natural gas offers a cleaner and more efficient alternative to traditional fossil fuels, making it increasingly attractive for microgrid systems aiming to reduce emissions and environmental impact. Additionally, advancements in natural gas technologies, such as combined heat and power (CHP) systems and microturbines, are enhancing the reliability and affordability of natural gas-based microgrids. Furthermore, the abundant availability of natural gas resources in various regions contributes to its widespread adoption in microgrid deployments, driving further expansion and investment in this segment of the market.

AC Microgrid Storage Devices

- Lithium-ion

- Lead acid

- Flow battery

- Flywheels

- Others

According to the AC microgrid industry analysis, based on the storage device, lithium-ion segment dominates the market. Lithium-ion power storage systems are increasingly gaining prominence in the AC Microgrid market due to their high energy density, long cycle life, and rapid response capabilities. These systems play a crucial role in stabilizing grid operations by storing excess energy during low demand periods and supplying it during peak demand or when renewable energy sources like solar or wind are unavailable. Additionally, lithium-ion batteries offer scalability and modularity, allowing microgrid operators to easily expand their storage capacity as needed. As such, the adoption of lithium-ion power storage is expected to continue growing, driving innovation and efficiency in the AC Microgrid market.

AC Microgrid Applications

- Healthcare

- Educational Institute

- Military

- Utility

- Industrial/Commercial

- Remote

- Others

According to the AC microgrid market forecast, based on the application, industrial and commercial segment is expected to contribute a notable share throughout 2024 to 2032. In the forecast year, the AC microgrid market is anticipated to witness significant growth within the industrial and commercial segments. This growth is propelled by several factors, including increasing demand for reliable and efficient power supply solutions in industrial settings and commercial establishments. AC microgrids offer a versatile approach to power management to integrate renewable energy sources more effectively. Additionally, advancements in technology and favorable government initiatives promoting energy sustainability are further driving the adoption of AC microgrid solutions in industrial and commercial sectors.

AC Microgrid Market Regional Outlook

North America

- U.S.

- Canada

Europe

- U.K.

- Germany

- France

- Spain

- Rest of Europe

Asia-Pacific

- India

- Japan

- China

- Australia

- South Korea

- Rest of Asia-Pacific

Latin America

- Brazil

- Mexico

- Rest of Latin America

The Middle East & Africa

- South Africa

- GCC Countries

- Rest of the Middle East & Africa (ME&A)

AC Microgrid Market Regional Analysis

In terms of AC microgrid market analysis, based on regional analysis, the market is segmented into North America, Europe, Asia Pacific, Latin America, and Middle East, and Africa. Asia Pacific dominates the AC microgrid market. The Asia-Pacific region has emerged as a dominant force in the AC microgrid market, owing to several key factors. Rapid industrialization, urbanization, and increasing energy demand in countries like China, India, Japan, and South Korea have driven the adoption of microgrid solutions. For instance, in 2023, China substantially boosted its investment in clean-energy sectors, reaching an estimated 6.3 trillion yuan ($890 billion), marking a significant increase from the 4.6 trillion yuan invested in 2022. This surge represented a stunning 40% of the rise annually, showcasing the nation's commitment to cleaner energy sources. Clean energy investments accounted for 13% of the total investment in fixed assets in China for 2023, a notable increase from the 9% share seen the previous year. This surge in clean energy investment has had move effects across various sectors, particularly in the electricity industry. For instance, in India 20 lakh crore of investment had done in the power and renewable energy sector in the last nine years. 190 GW of power generation capacity has added in this sector. The increased investment has facilitated growth in the AC microgrid market, as the demand for efficient and sustainable energy solutions continues to rise.

In addition, North America is expected to be the fastest growing region in the AC microgrid market. Government initiatives promoting renewable energy integration and energy security have fueled market growth. Technological advancements, favorable regulatory policies, and rising investments in smart grid infrastructure have also contributed to the region's leadership in the AC microgrid sector. With ongoing efforts to enhance energy resilience and sustainability, the North America will maintain its position in market.

AC Microgrid Market Players

Some of the top AC microgrid companies offered in our report include General Electric, Advanced Microgrid Solutions, SIEMENS AG, Schneider Electric SE, S&C Electric, Eaton Corporation, Tata Power, Caterpiller Inc., HOMER Energy, and EnSync Energy System.

Frequently Asked Questions

How big is the AC microgrid market?

The AC microgrid market size was valued at USD 8.1 billion in 2022.

What is the CAGR of the global AC microgrid market from 2023 to 2032?

The CAGR of AC microgrid is 20.2% during the analysis period of 2023 to 2032.

Which are the key players in the AC microgrid market?

The key players operating in the global market are General Electric, Advanced Microgrid Solutions, SIEMENS AG, Schneider Electric SE, S&C Electric, Eaton Corporation, Tata Power, Caterpiller Inc., HOMER Energy, and EnSync Energy System.

Which region dominated the global AC microgrid market share?

Asia-Pacific held the dominating position in AC microgrid industry during the analysis period of 2023 to 2032.

Which region registered fastest CAGR from 2023 to 2032?

North America region exhibited fastest growing CAGR for market of AC microgrid during the analysis period of 2023 to 2032.

What are the current trends and dynamics in the global AC microgrid industry?

The current trends and dynamics in the AC microgrid market are raising demand of electricity in remote areas, integration of renewable energy sources, and governmental policies.

Which connectivity held the maximum share in 2022?

Grid connected held the maximum share of the AC microgrid market.