Ablation Technologies Market Size - Global Industry, Share, Analysis, Trends and Forecast 2023 - 2032

Published :

Report ID:

Pages :

Format :

Ablation Technologies Market Size - Global Industry, Share, Analysis, Trends and Forecast 2023 - 2032

Report Coverage

- Industry Dynamics

- Market Size and Forecast Data

- Segment Analysis

- Competitive Landscape

- Regional Analysis with a Niche Focus on Country-Level Data

- High Level Analysis - Porter's, PESTEL, Value Chain, etc.

- Company Profiles of Key Players

- Option to Customize the Report As Per Your Specific Need

Request Sample Report

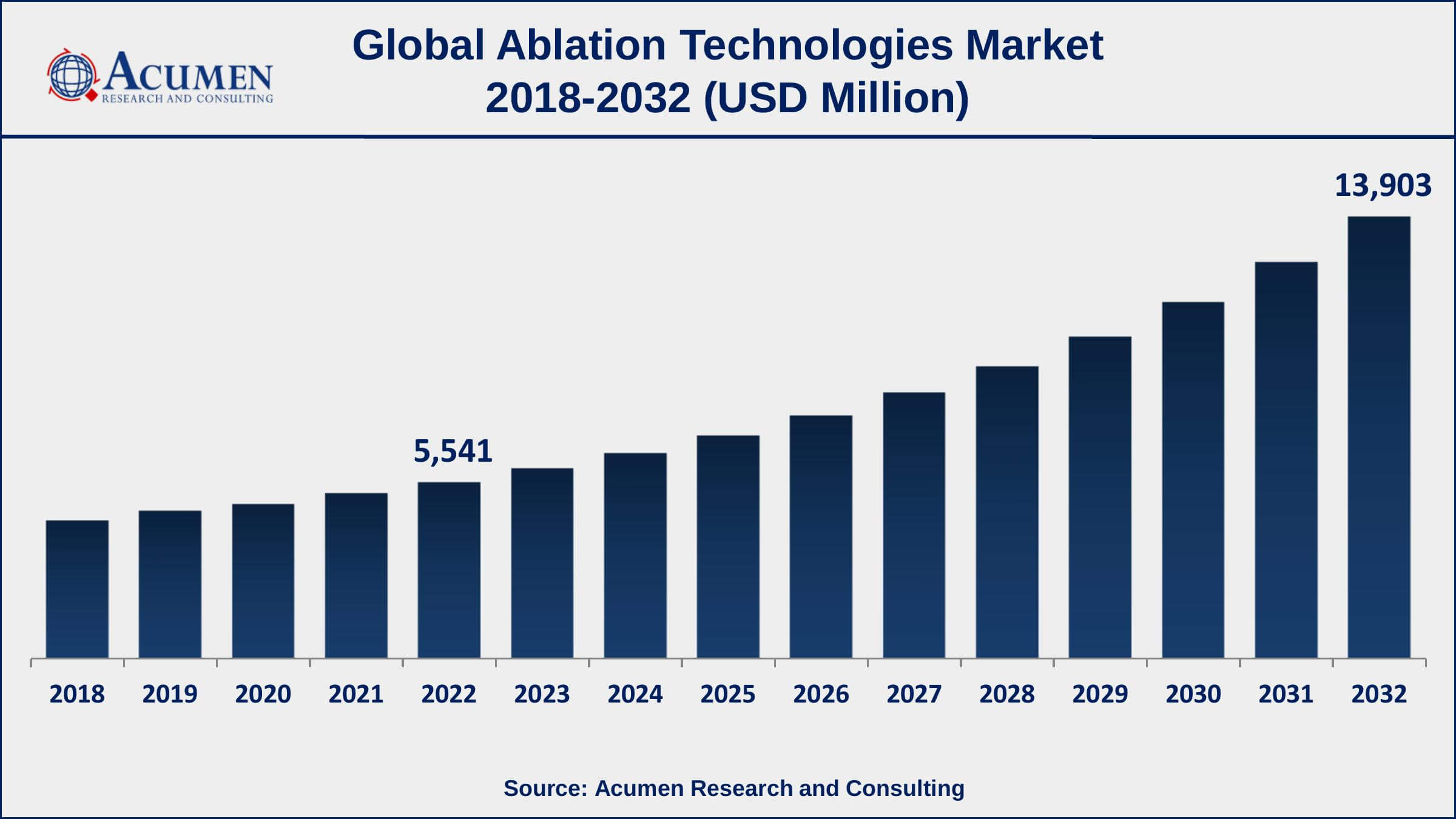

The Global Ablation Technologies Market Size accounted for USD 5,541 Million in 2022 and is estimated to achieve a market size of USD 13,903 Million by 2032 growing at a CAGR of 9.9% from 2023 to 2032. The growing prevalence of chronic diseases such as cancer, cardiovascular disease, and liver disease is driving the ablation technology market growth. Moreover, the development of new and advanced ablation technologies, such as microwave ablation and robotic-assisted ablation, is increasing the effectiveness and precision of ablation procedures and therefore driving the growth of the ablation technologies market value.

Ablation Technologies Market Report Key Highlights

- Global ablation technology market revenue is expected to increase by USD 13,903 Million by 2032, with a 9.9% CAGR from 2023 to 2032

- According to WHO studies, the global cancer incidence would rise by around 70% over the next two decades

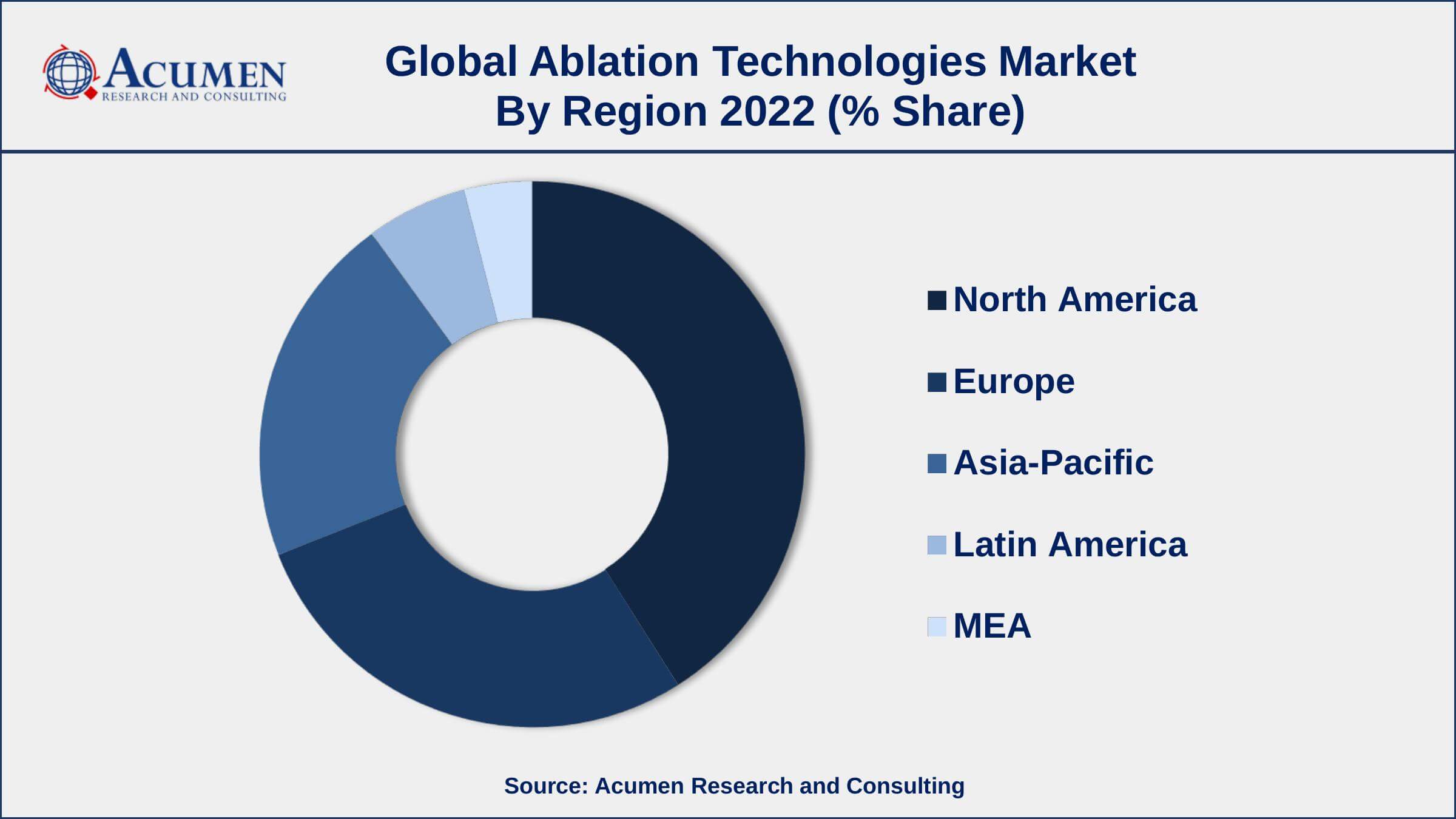

- North America region led with more than 41% of ablation technology market share in 2022

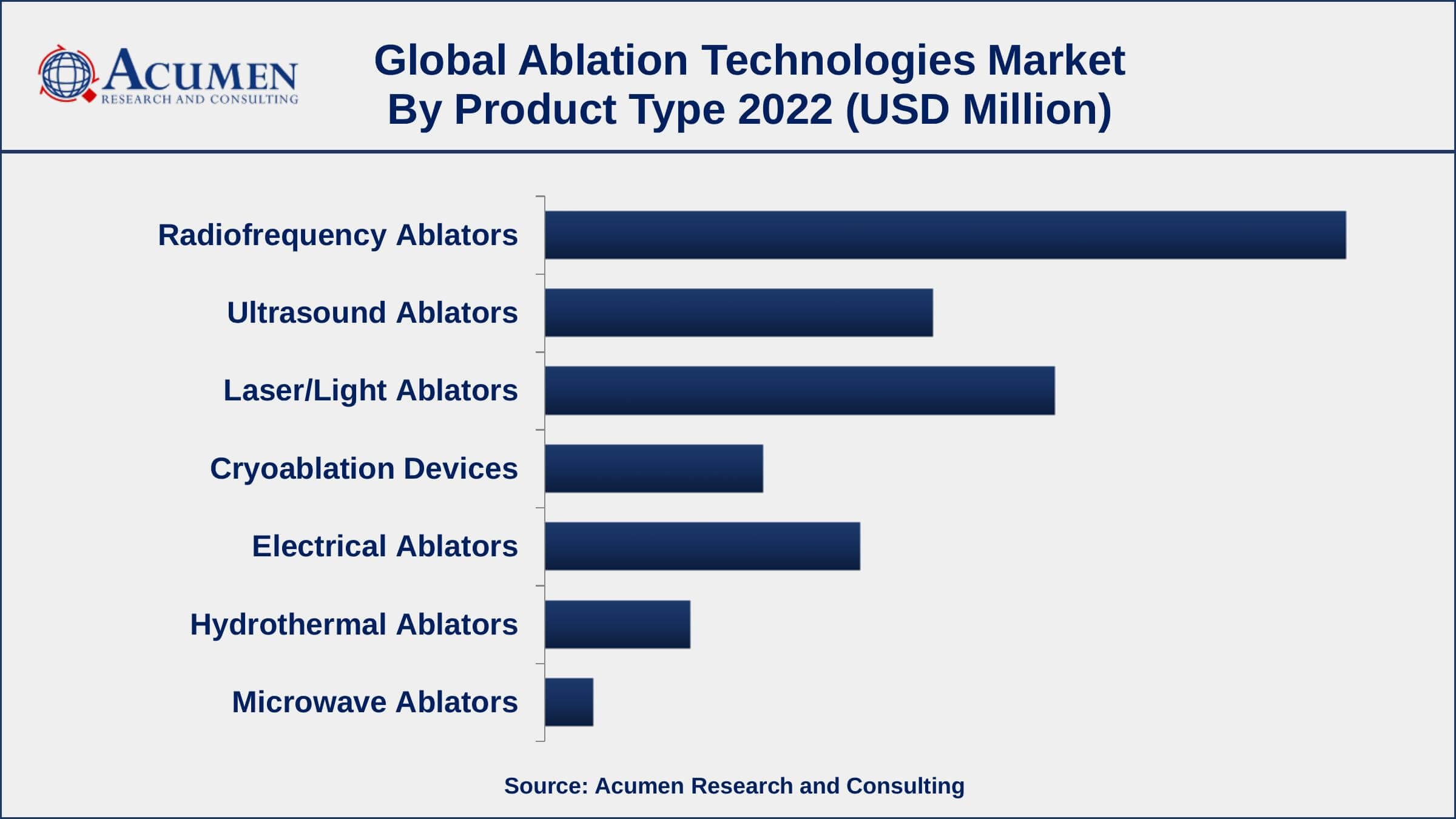

- By product type, the radiofrequency ablators segment has accounted market share of over 33% in 2022

- According to study, radiofrequency ablation has an 85-90% success rate

- By end-user, the hospitals, surgical centers, and ablation centers segment captured the majority of the market

- Increasing demand for minimally invasive procedures, drives the ablation technologies market size

Ablation technologies are the techniques involving the removal of any material from an object’s surface generally by chipping, vaporization, or an erosive process. Ablation technologies find a large number of applications in the healthcare and medical industries. In the medical industry, ablation technologies refer to the removal of body tissues surgically. In most cases, ablation is done especially for cardiac ailments and generally involves the removal of small areas of the heart causing heart rhythm problems.

Global Ablation Technologies Market Trends

Market Drivers

- Increasing incidence of chronic diseases

- Favorable reimbursement policies

- Growing adoption of minimally invasive procedures

- Rising awareness about the benefits of ablation procedures

Market Restraints

- High cost of ablation procedures

- Risk of complications associated with ablation procedures

Market Opportunities

- Development of new ablation technologies

- Increase in funding for research and development in ablation technologies

Ablation Technologies Market Report Coverage

| Market | Ablation Technologies Market |

| Ablation Technology Market Size 2022 | USD 5,541 Million |

| Ablation Technology Market Forecast 2032 | USD 13,903 Million |

| Ablation Technology Market CAGR During 2023 - 2032 | 9.9% |

| Ablation Technology Market Analysis Period | 2018 - 2032 |

| Ablation Technology Market Base Year | 2022 |

| Ablation Technology Market Forecast Data | 2023 - 2032 |

| Segments Covered | By Product Type, By Application, By End-user, And By Geography |

| Regional Scope | North America, Europe, Asia Pacific, Latin America, and Middle East & Africa |

| Key Companies Profiled | Medtronic, PLC, Abbott, Johnson & Johnson, Boston Scientific Corporation, Smith & Nephew Plc, Stryker, Olympus Corporation, CONMED Corporation, Atricure Inc., and Dornier MedTech. |

| Report Coverage |

Market Trends, Drivers, Restraints, Competitive Analysis, Player Profiling, Covid-19 Analysis, Regulation Analysis |

Ablation technologies can be either thermal or non-thermal. Thermal ablation includes ultrasound, radiofrequency, electrical, hydrothermal, microwave, etc. whereas non-thermal ablation includes cryoablation technology. Cardiac ablation involves the measurement of the heart’s electrical activities using small wires or electrodes placed inside the heart. When the source of the issue is diagnosed, the tissue causing complications is destroyed. Cardiac ablation is done through two major methods namely cryoablation and radiofrequency ablation. Cryoablation involves surgical ablation that comprises culling into the chest and making smaller incisions whereas radiofrequency ablation involves the insertion of a flexible tube into a blood vessel, generally the leg or neck. The principal advantages of ablation procedures over open surgeries include minimal invasion, lesser blood loss, short recovery time, low risk of infection, and shorter hospital stays. Ablation technologies find vast applications such as cardiac, urology, ophthalmology, orthopedics, cancer, and gynecology.

However, older healthcare reforms by healthcare departments and product recall from various companies are some key factors hindering the growth of the global ablation technologies market. Also, reprocessing and reuse of ablation products as well as healthcare cost containment measures coupled with the rising trend of bulk purchasing, especially by integrated health networks and group purchasing organizations are some key factors intensifying the price pressure on key players, thus limiting the overall growth of the global ablation technologies market.

Ablation Technologies Market Segmentation

The global ablation technologies market segmentation is based on product type, application, end-user, and geography.

Ablation Technologies Market By Product Type

- Radiofrequency Ablators

- Ultrasound Ablators

- Laser/Light Ablators

- Cryoablation Devices

- Electrical Ablators

- Hydrothermal Ablators

- Microwave Ablators

According to an ablation technologies industry analysis, the radiofrequency ablation (RFA) segment leads the market in 2021. Radiofrequency ablation is a minimally invasive surgery that involves heating and destroying aberrant tissue with high-frequency radio waves. Radiofrequency ablation is a highly successful and safe treatment for a variety of disorders, including cancer and benign tumors. It can also be used to treat a variety of illnesses, such as bone tumors, lung cancer, kidney cancer, and liver cancer. Furthermore, the development of novel RFA devices, such as micro-electrode RFA and cooled RFA, is boosting the precision and effectiveness of the procedure.

Ablation Technologies Market By Application

- Cardiovascular Diseases Treatment

- Ophthalmologic Treatment

- Cancer Treatment

- Gynecological Treatment

- Pain Management

- Urological Treatment

- Cosmetic Surgery

- Orthopedic Treatment

- Other

In terms of application, cardiovascular disease treatment is a rapidly growing segment in the ablation technologies market. The growing prevalence of cardiovascular diseases such as atrial fibrillation and heart failure is driving the demand for ablation technologies in cardiovascular disease treatment. The development of new and advanced ablation technologies, such as cryoablation and laser ablation, is increasing the effectiveness and precision of ablation procedures in cardiovascular disease treatment. Moreover, The aging population is more susceptible to cardiovascular diseases, which is driving the demand for ablation technologies in cardiovascular disease treatment.

Ablation Technologies Market By End-user

- Hospitals, Surgical Centers, and Ablation Centers

- Medical Spas & Aesthetic Clinics

- Ambulatory Surgical Centers

- Others

According to the ablation technologies market forecast, the hospitals, surgical centers, and ablation centers segment is expected to grow significantly in the market over the forecasting years. Ablation procedures are most commonly performed in hospitals, due to the availability of trained physicians, advanced equipment, and the ability to handle complications that may arise during the procedure. The hospitals segment growth is driven by the increasing incidence of chronic diseases and the growing adoption of minimally invasive procedures. Overall, the market growth is driven by the increasing incidence of chronic diseases, advancements in technology, and favorable reimbursement policies. The market is expected to grow at a steady rate in the coming years, with hospitals and surgical centers expected to be the major contributors to this growth.

Ablation Technologies Market Regional Outlook

North America

- U.S.

- Canada

Europe

- U.K.

- Germany

- France

- Spain

- Rest of Europe

Asia-Pacific

- India

- Japan

- China

- Australia

- South Korea

- Rest of Asia-Pacific

Latin America

- Brazil

- Mexico

- Rest of Latin America

The Middle East & Africa

- South Africa

- GCC Countries

- Rest of the Middle East & Africa (ME&A)

Geographically, North America is currently the largest market for ablation technologies, with the United States being the major contributor to this growth. The growth of the ablation technologies market in North America is driven by factors such as the increasing incidence of chronic diseases, advancements in technology, and favorable reimbursement policies. The availability of a large number of trained physicians and the presence of major market players in the region also contribute to the growth of the market in North America.

Europe is the second-largest market for ablation technologies, with nations such as the United Kingdom, France, and Germany being key contributors to regional growth. The growth of the ablation technologies market in Europe is driven by factors such as the increasing incidence of chronic diseases, advancements in technology, and favorable reimbursement policies.

Ablation Technologies Market Players

Some of the top ablation technologies market companies offered in the professional report include Medtronic, PLC, Abbott, Johnson & Johnson, Boston Scientific Corporation, Smith & Nephew Plc, Stryker, Olympus Corporation, CONMED Corporation, Atricure Inc., and Dornier MedTech.

Frequently Asked Questions

What was the market size of the global ablation technologies in 2022?

The market size of ablation technologies was USD 5,541 Million in 2022.

What is the CAGR of the global ablation technologies market during forecast period of 2023 to 2032?

The CAGR of ablation technologies market is 9.9% during the analysis period of 2023 to 2032.

Which are the key players operating in the market?

The key players operating in the global ablation technologies market are Medtronic, PLC, Abbott, Johnson & Johnson, Boston Scientific Corporation, Smith & Nephew Plc, Stryker, Olympus Corporation, CONMED Corporation, Atricure Inc., and Dornier MedTech.

Which region held the dominating position in the global ablation technologies market?

North America held the dominating position in ablation technologies market during the analysis period of 2023 to 2032.

Which region registered the fastest growing CAGR for the forecast period of 2023 to 2032?

Asia-Pacific region exhibited fastest growing CAGR for ablation technologies market during the analysis period of 2023 to 2032.

What are the current trends and dynamics in the global ablation technologies market?

The current trends and dynamics in the ablation technologies industry include the Increasing incidence of chronic diseases and growing adoption of minimally invasive procedures.

Which End-user held the maximum share in 2022?

The hospitals, surgical centers, and ablation centers end-user held the maximum share of the ablation technologies market.