5G in Defense Market Size - Global Industry, Share, Analysis, Trends and Forecast 2022 - 2030

Published :

Report ID:

Pages :

Format :

5G in Defense Market Size - Global Industry, Share, Analysis, Trends and Forecast 2022 - 2030

Report Coverage

- Industry Dynamics

- Market Size and Forecast Data

- Segment Analysis

- Competitive Landscape

- Regional Analysis with a Niche Focus on Country-Level Data

- High Level Analysis - Porter's, PESTEL, Value Chain, etc.

- Company Profiles of Key Players

- Option to Customize the Report As Per Your Specific Need

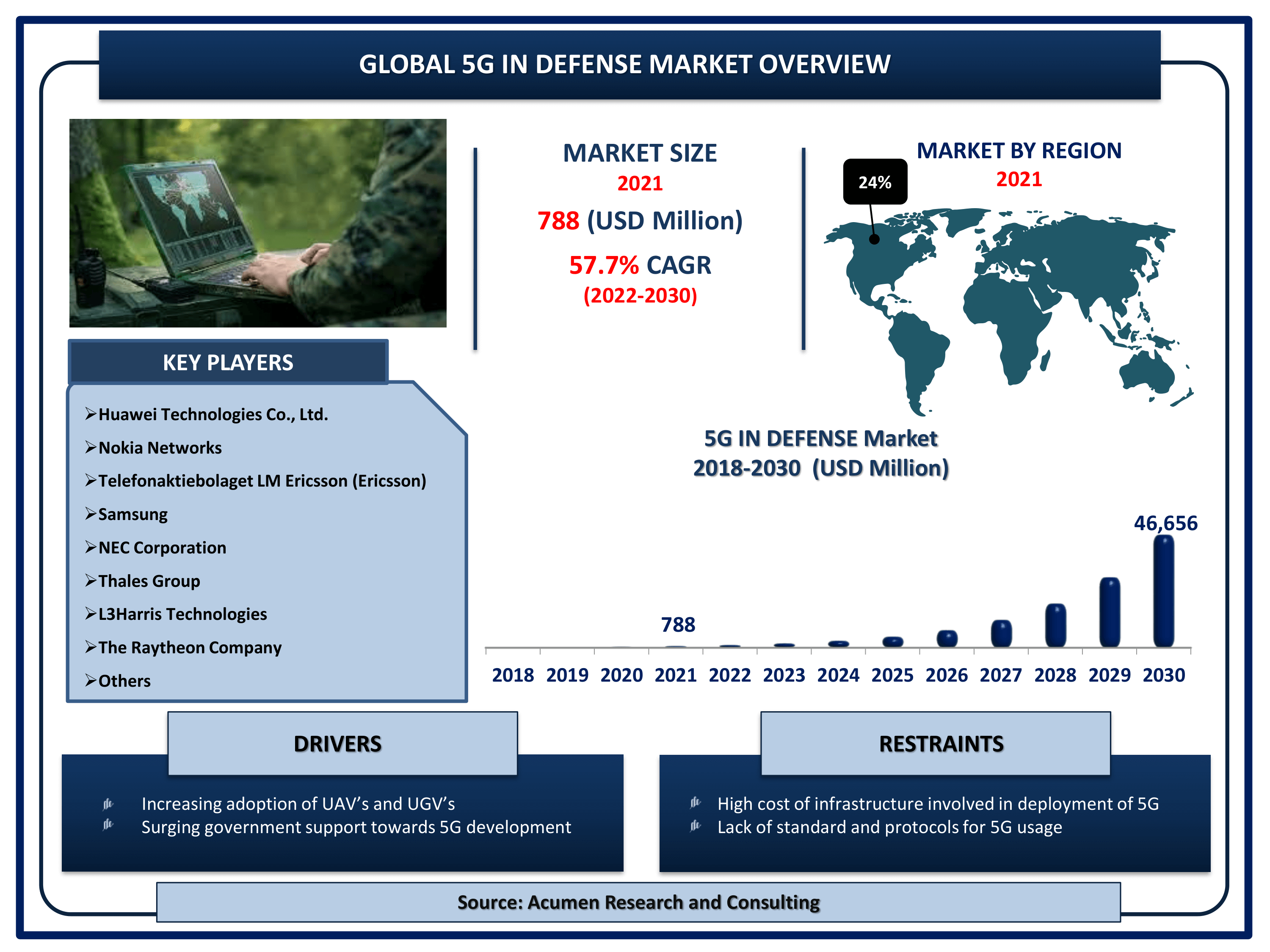

Request Sample Report

The Global 5G in Defense Market Size accounted for USD 788 Million in 2021 and is projected to achieve a market size of USD 46,656 Million by 2030 rising at a CAGR of 57.7% from 2022 to 2030. The fifth-generation (5G) of mobile technologies will improve data transfer speed and bandwidth over existing fourth generation (4G) technologies, enabling new military and commercial applications. 5G for the military could also improve intelligence, surveillance, and reconnaissance (ISR) systems and processing, enable new methods of command and control, and streamline logistics systems for greater efficiency, among other applications. 5G technology has a lot of potential for future defense networks. Along with AI, cloud, and cybersecurity, one of the four pillars of the Defense Department's 2019 Digital Modernization Strategy is advancing the capabilities of command, control, and communications systems.

5G in Defense Market Report Statistics

- Global 5G in defense market revenue is estimated to reach USD 46,656 Million by 2030 with a CAGR of 57.7% from 2022 to 2030

- North America 5G in defense market share accounted for over 24% shares in 2021

- According to the Stockholm International Peace Research Institute data, global military spending surpassed USD 2,113 billion in 2021

- Asia-Pacific 5G in defense market growth will record fastest CAGR from 2022 to 2030

- Based on communication infrastructure, small cell gathered over 45% of the overall market share in 2021

- Increasing incidences of terrorist activities will fuel the global 5G in defense market value

- Increasing adoption of AI, ML, and big data in defense is a popular 5G in defense market trend that is fueling the industry demand

5G in Defense Market Key Takeaways

The Department of Defense (DOD) announced that it received US$ 600 Mn as grants for 5G experimentation and testing at five US military test sites in October 2020. This is one of the world's largest full-scale 5G tests center specialized in testing through dual-use applications. Each installation is collaborating with defense services (military), corporate leaders, and academic experts, to advance 5G capabilities. Furthermore, with the introduction of 5G enabled technologies that incorporate augmented/virtual reality for various mission planning and training aspects, 5G enabled smart warehouses and the evaluation of 5G technologies for improving distributed command and control are two important aspects of the project planning.

Global 5G in Defense Market Dynamics

Market Drivers

- Increasing adoption of UAV’s and UGV’s

- Surging government support towards 5G development

- Rapidly growing digital transformation

- Benefits such as high network speed and lower latency in 5G

Market Restraints

- High cost of infrastructure involved in deployment of 5G

- Lack of standard and protocols for 5G usage

Market Opportunities

- Increasing technological advancements in 5G network

- Surging adoption of IoT, AI, ML, and data analytics

5G in Defense Market Report Coverage

| Market | 5G in Defense Market |

| 5G in Defense Market Size 2021 | USD 788 Million |

| 5G in Defense Market Forecast 2030 | USD 46,656 Million |

| 5G in Defense Market CAGR During 2022 - 2030 | 57.7% |

| 5G in Defense Market Analysis Period | 2018 - 2030 |

| 5G in Defense Market Base Year | 2021 |

| 5G in Defense Market Forecast Data | 2022 - 2030 |

| Segments Covered | By Communication Infrastructure, By Core Network Technology, By Type, By Chipset, By Platform, And By Geography |

| Regional Scope | North America, Europe, Asia Pacific, Latin America, and Middle East & Africa |

| Key Companies Profiled | Telefonaktiebolaget LM Ericsson (Ericsson), Huawei Technologies Co., Ltd., Nokia Networks, Samsung, NEC Corporation, Thales Group, L3Harris Technologies, The Raytheon Company, Ligado Networks, and Wind River Systems, Inc. |

| Report Coverage |

Market Trends, Drivers, Restraints, Competitive Analysis, Player Profiling, Regulation Analysis |

5G in Defense Market Insights

Market Driver

High Government Involvement Supports the Growth of Global 5G in Defense Market

According to the National Defense Industrial Association report, the Defense Department announced rolling of a 5G strategy in May 2021, pinpointing to accelerate deployment of 5G technology supported by AI and other advanced technologies. These successful rolling of the project will ensure systems as well as those of US allied to stay protected, resilient, and reliable. For this program the department announced US$ 600 Mn in awards in 2020 for 5G testing and defense experimentation using 5G across the country. These operations will take place in Utah, Washington, Georgia, California, and Nevada. The federal government of the United States has already prohibited federal contractors from using Huawei and other Chinese-made telecommunications equipment.

Market Restraint

As the 5G infrastructure for defense is being developed, companies involved in this technology must deal with issues such as information access, experimentation with military platforms, and the availability of regulations for development and testing, among others. Defense companies are also concerned about a lack of skilled labor.

5G in Defense Market Segmentation

The worldwide 5G in military market is split based on communication infrastructure, core network technology, network type, chipset, platform, and geography.

5G in Defense Market By Communication Infrastructure

- Small Cell

- Macro Cell

- Radio Access Network (RAN)

-1.png)

5G in Defense Market By Core Network Technology

- Software-Defined Networking (SDN)

- Fog Computing (FC)

- Mobile Edge Computing (MEC)

- Network Functions Virtualization (NFV)

5G in Defense Market By Network Type

- Enhanced Mobile Broadband (eMBB)

- Ultra-Reliable Low-Latency Communications (URLLC)

- Massive Machine Type Communications (MMTC)

5G in Defense Market By Chipset

- Application-specific Integrated Circuit (ASIC) Chipset

- Radio Frequency Integrated Circuit (RFIC) Chipset

- Millimeter Wave (mmWave) Chipset

5G in Defense Market By Platform

- Land

- Naval

- Airborne

-2.png)

5G in Defense Market Regional Outlook

North America

- U.S.

- Canada

Europe

- U.K.

- Germany

- France

- Spain

- Rest of Europe

Asia-Pacific

- India

- Japan

- China

- Australia

- South Korea

- Rest of Asia-Pacific

Latin America

- Brazil

- Mexico

- Rest of Latin America

The Middle East & Africa

- South Africa

- GCC Countries

- Rest of the Middle East & Africa (ME&A)

5G in Defense Market Regional Analysis

North America Dominates; Asia-Pacific Records Fastest Growing CAGR for the 5G in Defense Market

North America has taken the lead in the 5G in armed forces market. This is due to significant government involvement, progressive technology adoption, and notable technological advancements, which are the primary factors driving the growth of 5G in military market. According to a report released by the Center for Strategic & International Studies (CSIS), 5G will shape the United States' economic future in the same way that the commercialization of the internet did 25 years ago. Unsurprisingly for a technological superpower, the United States leads in 5G deployments, with up to 270 million people having access to 5G services in the United States. Spectrum sharing, in which multiple users can access the same spectrum bands, is becoming more feasible in the United States as sharing technology matures. For example, NTIA and the Department of Defense are working to together to develop dynamic spectrum sharing capability known as Incumbent Informing Capability (IIC) for maximum usage of spectrum access for commercial 5G and defense use. This apart from that, a number of congressional initiatives has authorized federal action to accelerate 5G deployment, but they have not been accompanied by appropriations. As per the Center for Strategic & International Studies report, the US is holding more prominence in 5G. It is a central part of a new digitalized environment that uplift the advent of new technology involving AI, cloud computing, and 5G networks to enable new services and products. Further, defense priorities will need to accommodate 5G spectrum allocation. In the US by deployment of 5G, it will always be on the forefront by not compromising for the economic harm and damage to national security.

In contrast, Asia-Pacific is expected to have the fastest growing CAGR for 5G in the defense market in the coming years. Over the next decade or so, 5G will provide enormous benefits to the Indian armed forces. It is widely regarded as cutting-edge technology that will have an impact on military operations. Furthermore, advancements in the processing and operation of ISR (intelligence, surveillance, and reconnaissance) systems are one of the driving forces behind the growth of 5G in the defense market.

5G in Defense Market Players

Some of the global 5G in defense companies include Telefonaktiebolaget LM Ericsson (Ericsson), Huawei Technologies Co., Ltd., Nokia Networks, Samsung, NEC Corporation, Thales Group, L3Harris Technologies, The Raytheon Company, Ligado Networks, and Wind River Systems, Inc.

Frequently Asked Questions

What is the size of global 5G in Defense market in 2021?

The market size of 5G in defense market in 2021 was accounted to be USD 788 Million.

What is the CAGR of global 5G in Defense market during forecast period of 2022 to 2030?

The projected CAGR of 5G in defense market during the analysis period of 2022 to 2030 is 57.7%.

Which are the key players operating in the market?

The prominent players of the global 5G in defense market are Telefonaktiebolaget LM Ericsson (Ericsson), Huawei Technologies Co., Ltd., Nokia Networks, Samsung, NEC Corporation, Thales Group, L3Harris Technologies, The Raytheon Company, Ligado Networks, and Wind River Systems, Inc.

Which region held the dominating position in the global 5G in Defense market?

North America held the dominating 5G in defense during the analysis period of 2022 to 2030.

Which region registered the fastest growing CAGR for the forecast period of 2022 to 2030?

Asia-Pacific region exhibited fastest growing CAGR for 5G in defense during the analysis period of 2022 to 2030.

What are the current trends and dynamics in the global 5G in Defense market?

Increasing adoption of UAV�s and UGV�s, surging government support towards 5G development, and rapidly growing digital transformation drives the growth of global 5G in defense market.

Which communication infrastructure held the maximum share in 2021?

Based on communication infrastructure, small cell segment is expected to hold the maximum share 5G in defense market.