2,5-Furandicarboxylic Acid Market Size - Global Industry, Share, Analysis, Trends and Forecast 2022 - 2030

Published :

Report ID:

Pages :

Format :

2,5-Furandicarboxylic Acid Market Size - Global Industry, Share, Analysis, Trends and Forecast 2022 - 2030

Report Coverage

- Industry Dynamics

- Market Size and Forecast Data

- Segment Analysis

- Competitive Landscape

- Regional Analysis with a Niche Focus on Country-Level Data

- High Level Analysis - Porter's, PESTEL, Value Chain, etc.

- Company Profiles of Key Players

- Option to Customize the Report As Per Your Specific Need

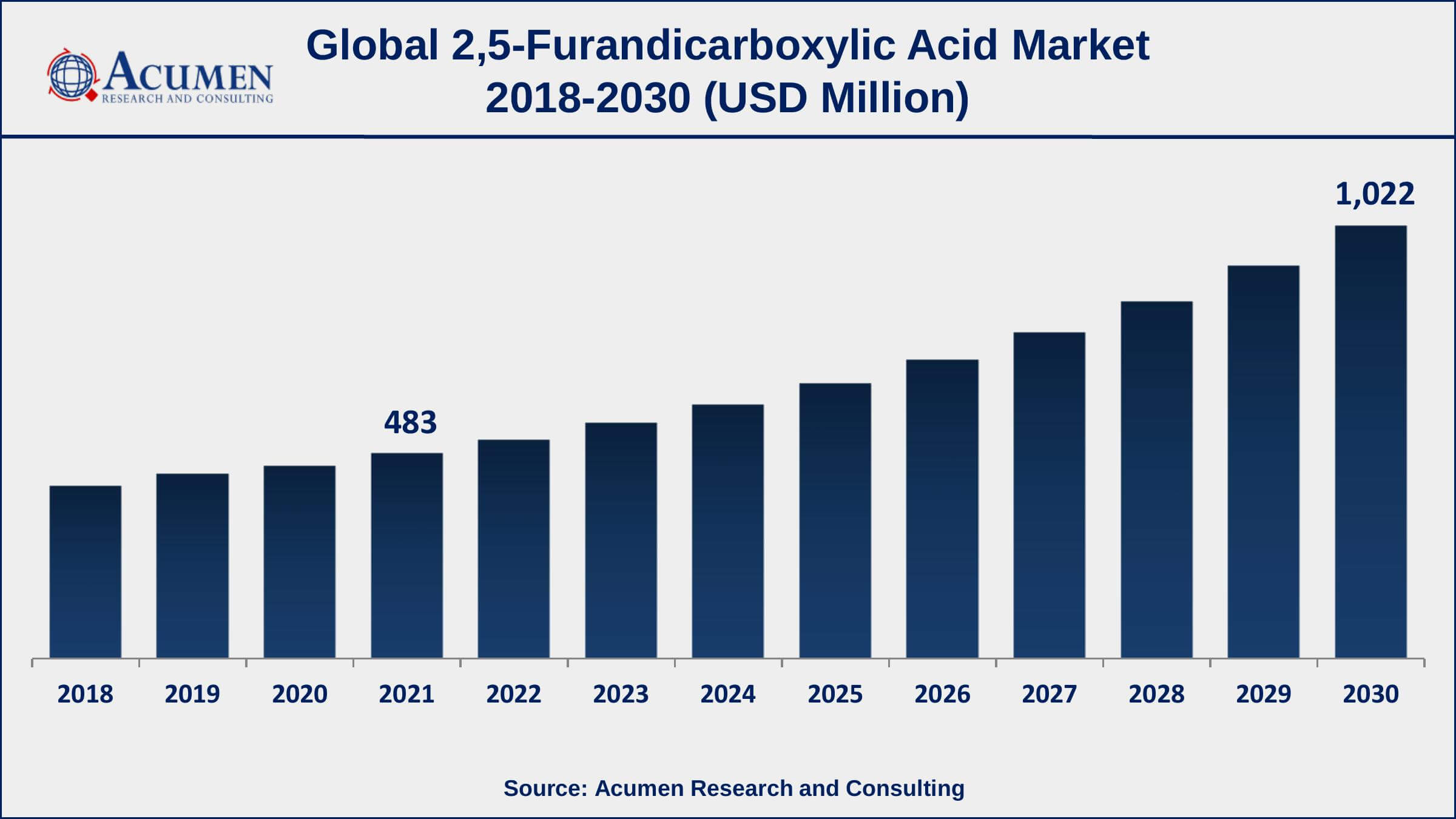

Request Sample Report

The Global 2,5-Furandicarboxylic Acid Market Size accounted for USD 483 Million in 2021 and is estimated to achieve a market size of USD 1,022 Million by 2030 growing at a CAGR of 8.9% from 2022 to 2030. The 2,5-Furandicarboxylic Acid (FDCA) market growth is propelled by the installation of harsh restrictions against polymer use as well as carbon emission combined with a paradigm change towards sustainable products. Furthermore, government tax incentives and subsidy breaks for chemical businesses producing eco-friendly packaging may support 2,5-furan dicarboxylic acid (FDCA) market value through 2030.

2,5-Furandicarboxylic Acid Market Report Key Highlights

- Global 2,5-furandicarboxylic acid market revenue is expected to increase by USD 1,022 million by 2030, with a 8.9% CAGR from 2022 to 2030

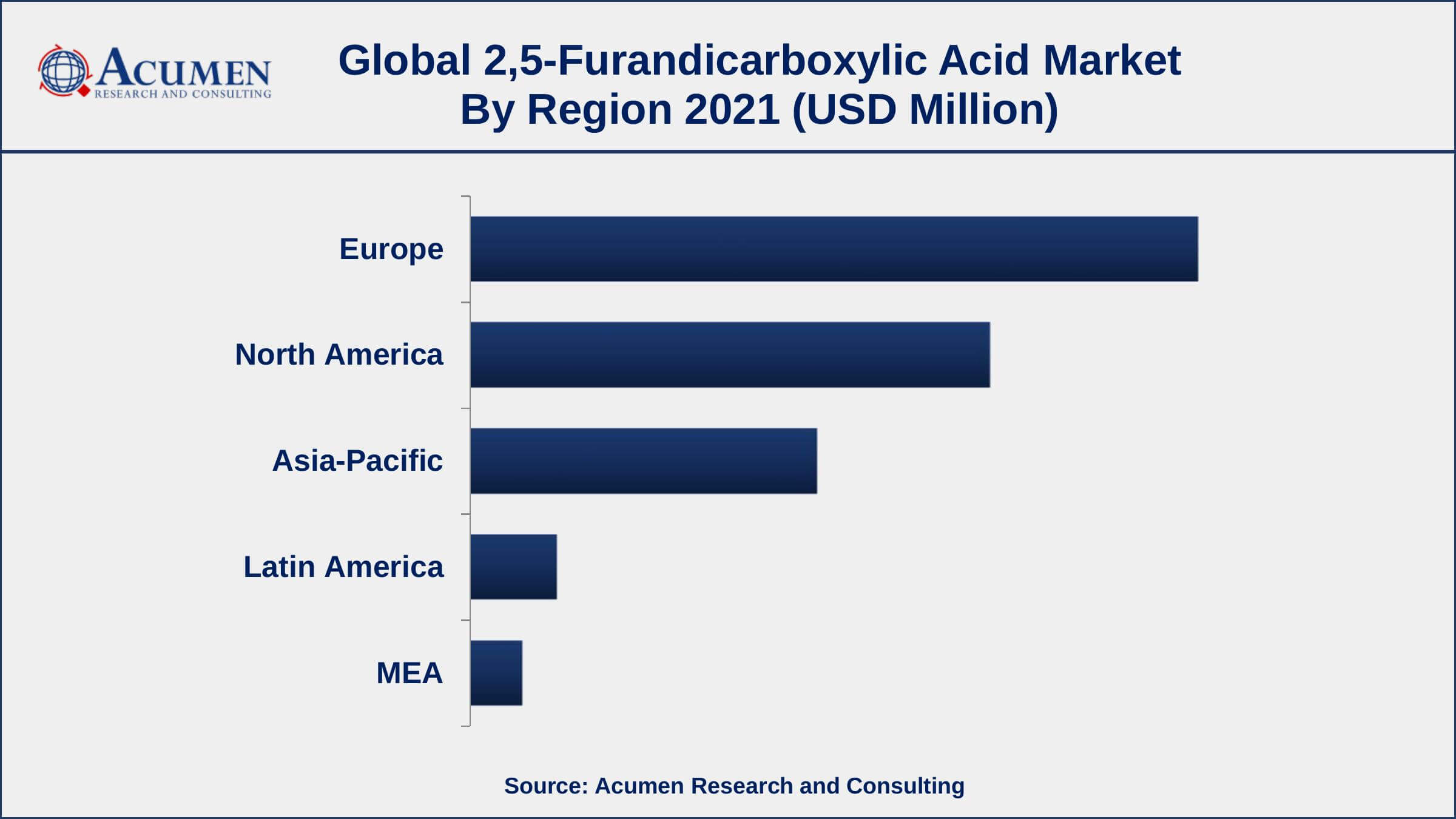

- Europe region led with more than 42% of 2,5-furandicarboxylic acid market share in 2021

- Asia-Pacific 2,5-furandicarboxylic acid market growth will observe strongest CAGR from 2022 to 2030

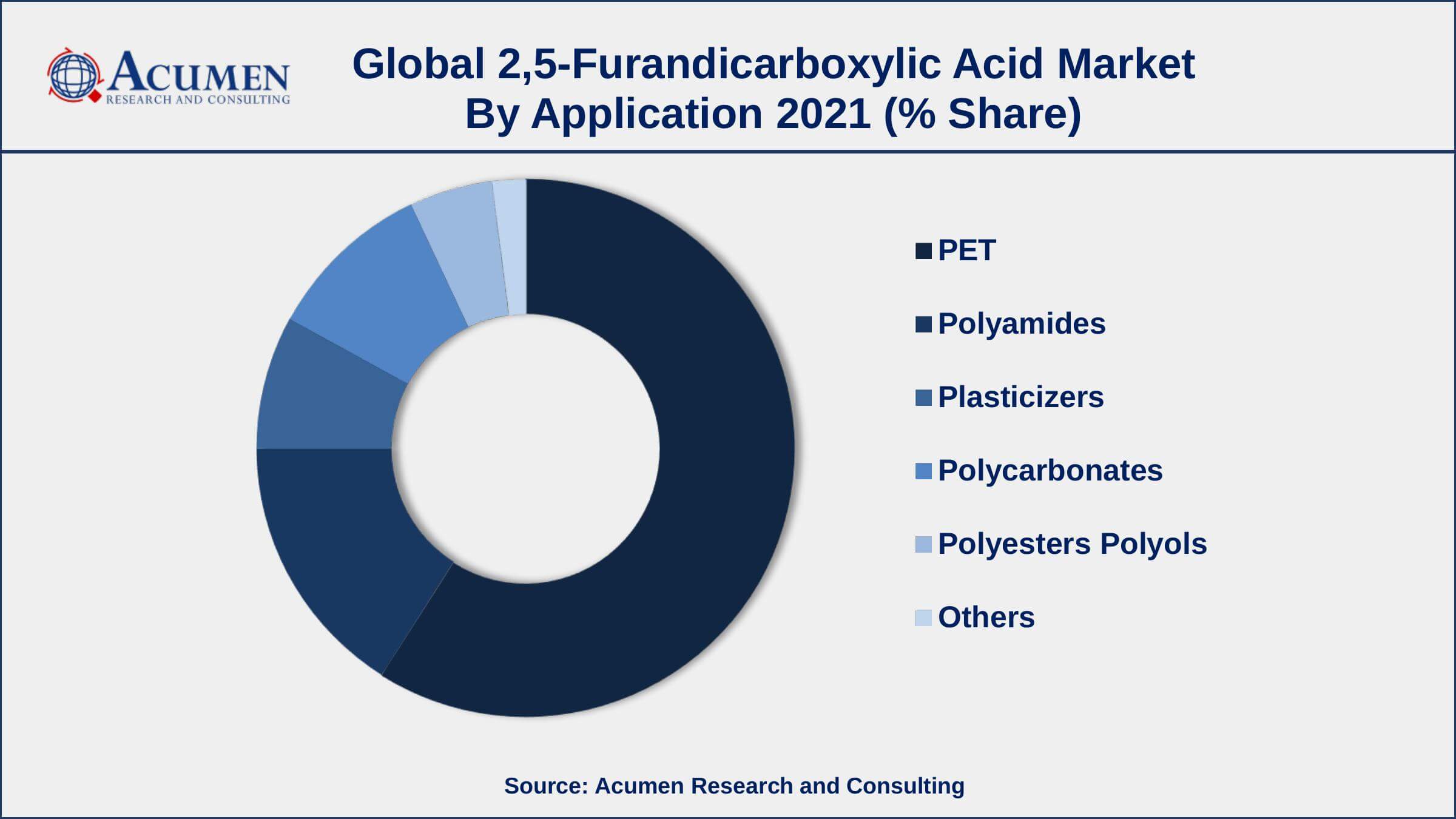

- By type, the PET segment has accounted market share of over 35% in 2021

- By end-user, pharmaceutical segment is expected to grow at a CAGR of 9.3% from 2022 to 2030

- Rising demand for bio-based PET, drives the 2,5-furandicarboxylic acid market size

2, 5-Furandicarboxylic acid, or FDCA is an oxidized furan subsidiary and is an extremely steady compound. Due to its capability of being utilized as a substitute for an extensive range of petrochemicals such as terephthalic acid and adipic acid, there has been broad R&D over the previous decade on FDCA. FDCA was characterized by the US Department of Energy as one of 12 essential concoctions for setting up the "green" science industry of the future.

Global 2,5-Furandicarboxylic Acid Market Trends

Market Drivers

- Rising demand for bio-based PET

- Increase in the utilization of a variety of petrochemicals

- Stringent regulatory requirements for the use of phthalate-based plasticizers

- Increasing the application of FDCA as a bio-based adipic acid alternative

Market Restraints

- Economically unviable production processes

- A scarcity of raw materials

Market Opportunities

- An increase in the utilization of FDCA

- Increasing R&D spending in sustainable packaging solutions

2,5-Furandicarboxylic Acid Market Report Coverage

| Market | 2,5-Furandicarboxylic Acid Market |

| 2,5-Furandicarboxylic Acid Market Size 2021 | USD 483 Million |

| 2,5-Furandicarboxylic Acid Market Forecast 2030 | USD 1,022 Million |

| 2,5-Furandicarboxylic Acid Market CAGR During 2022 - 2030 | 8.9% |

| 2,5-Furandicarboxylic Acid Market Analysis Period | 2018 - 2030 |

| 2,5-Furandicarboxylic Acid Market Base Year | 2021 |

| 2,5-Furandicarboxylic Acid Market Forecast Data | 2022 - 2030 |

| Segments Covered | By Type, By Application, By End-User, And By Geography |

| Regional Scope | North America, Europe, Asia Pacific, Latin America, and Middle East & Africa |

| Key Companies Profiled | Tokyo Chemical Industry Co., Ltd., R&D Synbias Ltd, Eastman Chemical Company, SATACHEM, Toronto Research Chemicals Inc., Avantium Technologies, Synbias, Carbone Scientific, V&V Pharma Industries, and Novamont SPA. |

| Report Coverage |

Market Trends, Drivers, Restraints, Competitive Analysis, Player Profiling, Regulation Analysis |

Until today, FDCA was never marketed in modern volumes as the production procedure was not financially reasonable. The major concern for the monetary generation of FDCA is the insecurity of the intermediate required for the production of FDCA - 5-hydroxymethylfurfural (HMF). The combination of 2,5-Furandicarboxylic acid is a lot simpler than the union of HMF, where the principle issues are the requirement for costly impetuses, the requirement for high weight, deterioration of HMF to levulinic and formic corrosive, the partition of DMSO and poisonous quality of results if DMSO utilized as a dissolvable.

Economic production of FDCA is projected to lead to a massive stipulation for bio-based FDCA as it can possibly replace countless based synthetic substances and furthermore bio-based intermediates, for example, succinic acid and levulinic acid. The properties of FDCA result in the predominant final result and lesser side effects. Avantium recently announced that it had discovered an inexpensive method to produce FDCA from sugar. Nonetheless, the accessibility of crude material would be a key matter of concern through the following years. The large-scale manufacturing of FDCA must be served by tremendous feedstock input which would make the crude material providers a key piece of the market. Cargill is one of the biggest providers of bio-based crude materials, for example, sugar. Avantium has worked together with Cargill for the supply of starch-based feedstock to run their pilot plant.

2,5-Furandicarboxylic Acid Market Segmentation

The global 2,5-furandicarboxylic acid market segmentation is based on type, application, end-user, and geography.

2,5-Furandicarboxylic Acid Market By Type

- 0.98

- 0.99

According to a 2,5-furandicarboxylic acid industry analysis, the 0.99 segment type held the largest market share in 2021. Due to its potential as a replacement for a range of petrochemicals such as adipic acid and terephthalic acid, this type of 2,5-furandicarboxylic acid is an important renewable resource for the modern world. The product is growing in popularity owing to its biodegradability and biocompatibility, allowing it the most desired material for the production of polyesters such as PET & PBT, as well as plastics. 99% of 2,5-furandicarboxylic acid's greatest prospective uses are in the production of polyamides, polyurethanes, and polyesters.

2,5-Furandicarboxylic Acid Market By Application

- PET

- Polyamides

- Plasticizers

- Polycarbonates

- Polyesters Polyols

- Others

In terms of applications, the PET segment leads the industry with a considerable market share in 2021. PET is widely utilized in the food and packaging industries, and the growing preference for bio-based PET will drive segment expansion. The vast utilization of FDCA is attributable to its desire for the production of renewable power polyurethanes as the monomers replace TPA. Due to its biodegradability and biocompatibility, FDCA is the preferred material for the production of synthetic fibers such as PET & polybutylene terephthalate (PBT).

2,5-Furandicarboxylic Acid Market By End-User

- Chemical

- Pharmaceuticals

- Scientific Research

According to the 2,5-furandicarboxylic acid market forecast, the pharmaceutical segment is expected to grow significantly over the forecasting years. In the pharmaceutical industry, technological advancements are revolutionizing drug production and development. Due to significant R&D expenditure, consistent technological advancement is predicted. Whereas, in the chemical industry, there are some of the technology reforms underway and are about to introduce due to rising global green awareness. This, combined with other factors, is projected to provide attractive growth prospects in the coming years.

2,5-Furandicarboxylic Acid Market Regional Outlook

North America

- U.S.

- Canada

Europe

- U.K.

- Germany

- France

- Spain

- Rest of Europe

Asia-Pacific

- India

- Japan

- China

- Australia

- South Korea

- Rest of Asia-Pacific

Latin America

- Brazil

- Mexico

- Rest of Latin America

The Middle East & Africa

- South Africa

- GCC Countries

- Rest of the Middle East & Africa (ME&A)

Europe Dominates The Global 2,5-Furandicarboxylic Acid Market

Geographically, the Europe region leads the 2,5-furandicarboxylic acid (FDCA) industry and will be continuing to do so throughout the projected timeframe due to the existence of significant main players, the usage of bio-based resources in the petrochemical industry, and increasing consumer consciousness about sustainable products. Asia-Pacific, on the other hand, will continue to predict the greatest CAGR for this period due to the region's rapid urbanization and industrialization and growing desire for bio-based solutions in chemical manufacturing organizations.

2,5-Furandicarboxylic Acid Market Players

Some of the top 2,5-furandicarboxylic acid market companies offered in the professional report include Tokyo Chemical Industry Co., Ltd., R&D Synbias Ltd, Eastman Chemical Company, SATACHEM, Toronto Research Chemicals Inc., Avantium Technologies, Synbias, Carbone Scientific, V&V Pharma Industries, and Novamont SPA.

Frequently Asked Questions

What is the size of global 2,5-furandicarboxylic acid market in 2021?

The estimated value of global 2,5-furandicarboxylic acid market in 2021 was accounted to be USD 483 Million.

What is the CAGR of global 2,5-furandicarboxylic acid market during forecast period of 2022 to 2030?

The projected CAGR 2,5-furandicarboxylic acid market during the analysis period of 2022 to 2030 is 8.9%.

Which are the key players operating in the market?

The prominent players of the global 2,5-furandicarboxylic acid market are Tokyo Chemical Industry Co., Ltd., R&D Synbias Ltd, Eastman Chemical Company, SATACHEM, Toronto Research Chemicals Inc., Avantium Technologies, Synbias, Carbone Scientific, V&V Pharma Industries, and Novamont SPA.

Which region held the dominating position in the global 2,5-furandicarboxylic acid market?

Europe held the dominating 2,5-furandicarboxylic acid market during the analysis period of 2022 to 2030.

Which region registered the fastest growing CAGR for the forecast period of 2022 to 2030?

Asia-Pacific region exhibited fastest growing CAGR for 2,5-furandicarboxylic acid market during the analysis period of 2022 to 2030.

What are the current trends and dynamics in the global 2,5-furandicarboxylic acid market?

Rising demand for bio-based PET and increase in the utilization of a variety of petrochemicals drives the growth of global 2,5-furandicarboxylic acid market.

By application segment, which sub-segment held the maximum share?

Based on application, PET segment is expected to hold the maximum share of the 2,5-furandicarboxylic acid market.