1,4 Butanediol Market Size - Global Industry, Share, Analysis, Trends and Forecast 2023 - 2032

Published :

Report ID:

Pages :

Format :

1,4 Butanediol Market Size - Global Industry, Share, Analysis, Trends and Forecast 2023 - 2032

Report Coverage

- Industry Dynamics

- Market Size and Forecast Data

- Segment Analysis

- Competitive Landscape

- Regional Analysis with a Niche Focus on Country-Level Data

- High Level Analysis - Porter's, PESTEL, Value Chain, etc.

- Company Profiles of Key Players

- Option to Customize the Report As Per Your Specific Need

Request Sample Report

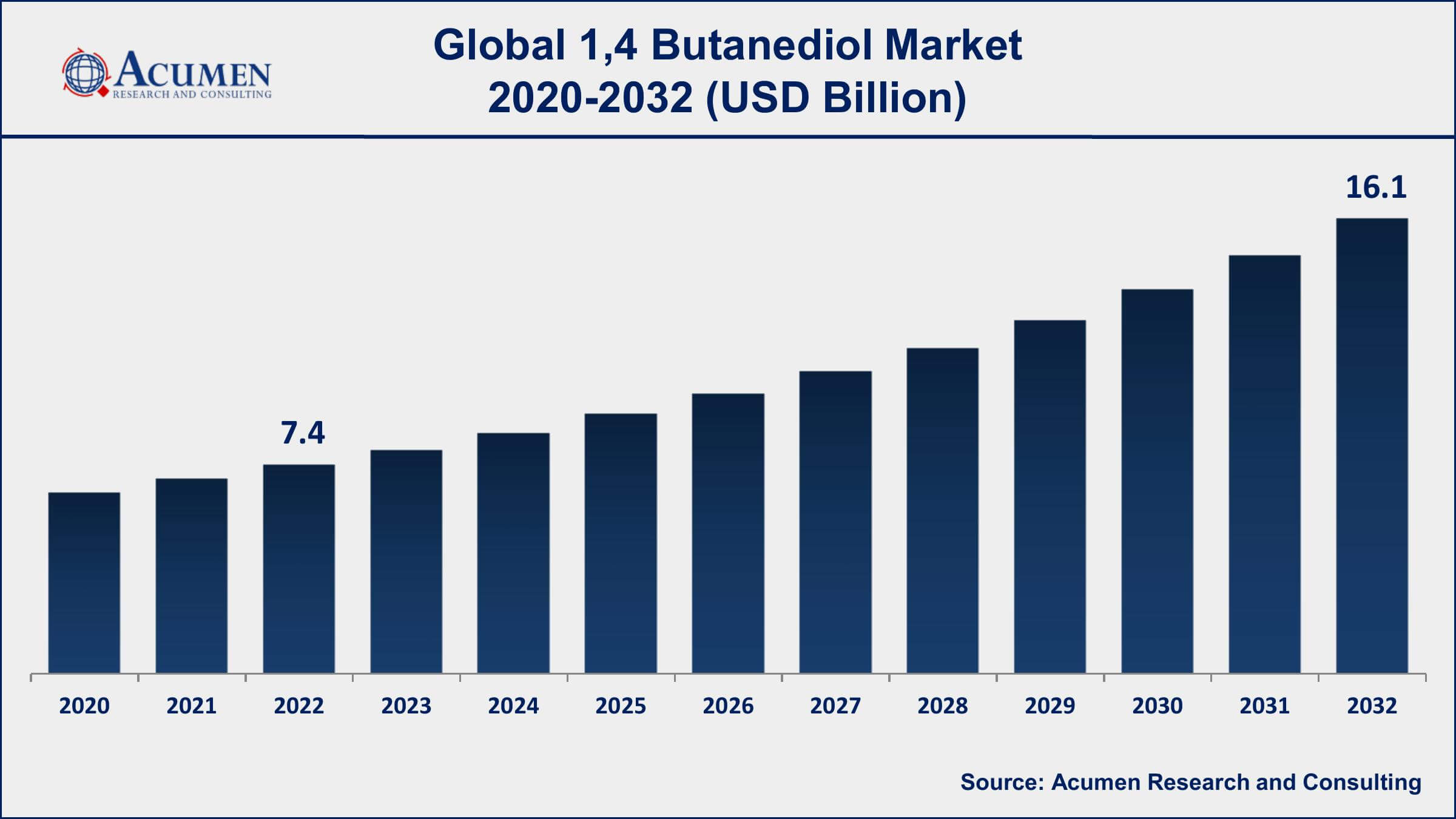

The Global 1,4 Butanediol Market Size accounted for USD 7.4 Billion in 2022 and is projected to achieve a market size of USD 16.1 Billion by 2032 growing at a CAGR of 8.2% from 2023 to 2032.

1,4 Butanediol Market Highlights

- Global 1,4 butanediol market revenue is expected to increase by USD 16.1 Billion by 2032, with a 8.2% CAGR from 2023 to 2032

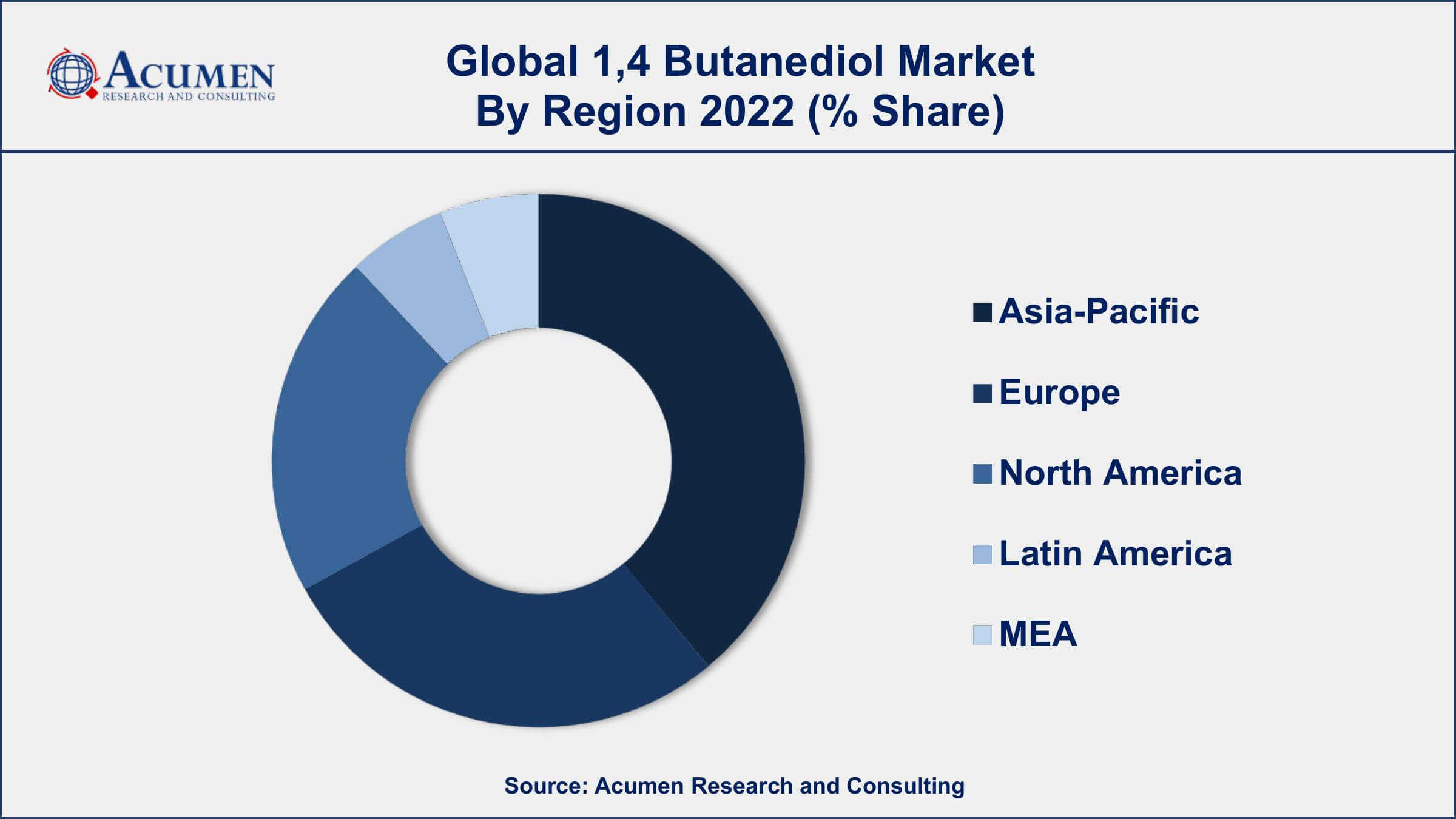

- Asia-Pacific region led with more than 59% of 1,4 butanediol market share in 2022

- North America 1,4 butanediol market growth will record a CAGR of more than 9% from 2023 to 2032

- By derivatives, the tetrahydrofuran (THF) segment accounted for the largest share of the market in 2022

- By end-user industry, the automotive channel is expected to grow at a CAGR of 9.3% from 2023 to 2032

- Increasing demand for polyurethane and thermoplastic polyurethane, drives the 1,4 butanediol market value

1,4 butanediol, also known as BDO, is a colorless, odorless, and viscous organic compound with a wide range of applications in various industries. It is primarily used as a raw material in the production of plastics, fibers, and polyurethanes. BDO is also used as a solvent, a cleaning agent, and a fuel additive. Additionally, it has applications in the pharmaceutical and cosmetic industries. Due to its versatility and wide range of applications, the demand for 1,4 butanediol has been steadily growing.

The global 1,4 butanediol market has experienced significant growth in recent years and is expected to continue growing at a steady pace. The growing demand for BDO in the production of polyurethane and thermoplastic polyurethane, especially in the Asia Pacific region, is one of the major factors driving the market growth. The increasing use of BDO in the manufacture of spandex fibers, which are widely used in the textile industry, is another key factor contributing to the market growth. Furthermore, the increasing demand for biodegradable plastics, which can be produced using BDO, is expected to provide significant growth opportunities for the market in the coming years.

Global 1,4 Butanediol Market Trends

Market Drivers

- Increasing demand for polyurethane and thermoplastic polyurethane

- Growing demand for spandex fibers in the textile industry

- Rising demand for biodegradable plastics

- Growing demand for cosmetics and personal care products

- Increasing use of BDO in the pharmaceutical industry

Market Restraints

- Stringent government regulations and policies related to the production and use of BDO

- Fluctuations in raw material prices

- Increasing environmental concerns related to the production and use of BDO

Market Opportunities

- Growing demand for lightweight and fuel-efficient automobiles

- Rising demand for coatings and adhesives in the construction industry

1,4 Butanediol Market Report Coverage

| Market | 1,4 Butanediol Market |

| 1,4 Butanediol Market Size 2022 | USD 7.4 Billion |

| 1,4 Butanediol Market Forecast 2032 | USD 16.1 Billion |

| 1,4 Butanediol Market CAGR During 2023 - 2032 | 8.2% |

| 1,4 Butanediol Market Analysis Period | 2020 - 2032 |

| 1,4 Butanediol Market Base Year | 2022 |

| 1,4 Butanediol Market Forecast Data | 2023 - 2032 |

| Segments Covered | By Derivative, By End-user Industry, And By Geography |

| Regional Scope | North America, Europe, Asia Pacific, Latin America, and Middle East & Africa |

| Key Companies Profiled | BASF SE, Dairen Chemical Corporation, LyondellBasell Industries Holdings B.V., Mitsubishi Chemical Corporation, Nanya Plastics Corporation, INVISTA, Ashland Global Holdings Inc., Perstorp Holding AB, Shanxi Sanwei Group Co., Ltd., and BioAmber Inc. |

| Report Coverage |

Market Trends, Drivers, Restraints, Competitive Analysis, Player Profiling, Covid-19 Analysis, Regulation Analysis |

1,4 butanediol, additionally named as 1,4-Butylene glycol, or Butane-1,4-diol is a natural substance compound that finds a wide-scale application in the manufacturing of filaments, plastics, solvents, and so on among different applications. 1,4 butanediol is a dry and thick substance compound with a generally high breaking point as that of butane. This natural compound is one of the steady structures or isomers of butanediol. A standout amongst the most generally utilized production process, the Reppe Process, includes the reaction of acetylene with formaldehyde. On the other hand, it is additionally produced by the Davy process with maleic anhydride which is used as crude material. Different methods for the manufacture of 1,4 butanediol include the utilization of organic courses or the utilization of propylene oxide as a crude material. Significant applications of 1,4 Butanediol include the production of Poly Butylene Terephthalate (PBT), Tetrahydrofuran, Gamma-Butyrolactone (GBL), and polyurethanes, among others.

Increasing awareness about the benefits of 1,4 butanediol among consumers is anticipated to drive its demand throughout the forecast period. The rising disposable income of consumers is also expected to boost the growth of the global 1,4-Butylene glycol market over the forecast period. Another major reason for the rise in demand for 1,4 butanediol is the growing environmental concerns about the depletion of non-renewable resources such as natural gas and crude oil. The major companies in this market have adopted the strategy of product development as the target consumers demand innovations in this market. Emerging markets such as India and China are anticipated to boost the demand for polyurethane thus, driving the growth of the overall market. The volatility in raw material prices is expected to hamper the growth of the global 1,4 butanediol market over the forecast period. In addition to this, the high manufacturing cost is another factor restraining the market growth.

1,4 Butanediol Market Segmentation

The global 1,4 butanediol market segmentation is based on derivative, end-user industry, and geography.

1,4 Butanediol Market By Derivative

- Tetrahydrofuran (THF)

- Polyurethane (PU)

- Gamma-Butyrolactone (GBL)

- Polybutylene Terephthalate (PBT)

- Others

In terms of derivatives, the tetrahydrofuran (THF) segment has seen significant growth in the 1,4 butanediol market in recent years. THF is a colorless, organic liquid with low viscosity and is commonly used as a solvent in various applications. The growth of the THF segment is driven by the growing demand for polytetramethylene ether glycol (PTMEG), which is a key intermediate used in the production of spandex fibers, thermoplastic polyurethane (TPU), and other elastomers. The growing demand for lightweight and fuel-efficient automobiles is also driving the growth of the THF segment, as THF is used as a key intermediate in the production of polyurethane foams, which are used in the manufacturing of automotive interiors. Furthermore, the increasing demand for THF as a solvent in various applications, such as pharmaceuticals and polymer manufacturing, is expected to provide significant growth opportunities for the THF segment in the coming years.

1,4 Butanediol Market By End-user Industry

- Automotive

- Electrical and Electronics

- Textile

- Healthcare and Pharmaceutical

- Others

According to the 1,4 butanediol market forecast, the automotive segment is expected to witness significant growth in the coming years. 1,4 butanediol is used as a key intermediate in the production of various automotive components, including polyurethane foams, thermoplastic polyurethanes (TPUs), and other elastomers. These components find wide-ranging applications in the automotive industry, such as in the manufacturing of seat cushions, interior trims, and other parts. The increasing demand for lightweight and fuel-efficient automobiles is one of the major factors driving the growth of the automotive segment in the BDO market. BDO-based polyurethane foams are widely used as cushioning materials in automotive seats and provide excellent comfort and durability while reducing the weight of the vehicle. Additionally, BDO-based TPUs are used in the production of various automotive components such as instrument panels, airbag covers, and steering wheels due to their superior strength, durability, and resistance to wear and tear.

1,4 Butanediol Market Regional Outlook

North America

- U.S.

- Canada

Europe

- U.K.

- Germany

- France

- Spain

- Rest of Europe

Asia-Pacific

- India

- Japan

- China

- Australia

- South Korea

- Rest of Asia-Pacific

Latin America

- Brazil

- Mexico

- Rest of Latin America

The Middle East & Africa

- South Africa

- GCC Countries

- Rest of the Middle East & Africa (ME&A)

1,4 Butanediol Market Regional Analysis

The Asia-Pacific region is dominating the 1,4 butanediol market due to the presence of a large number of end-use industries, such as textiles, automotive, construction, and electronics, which are driving the demand for 1,4 butanediol-based products. China is one of the major producers and consumers of 1,4 butanediol in the Asia-Pacific region, accounting for a significant share of the market. The growth of the construction industry, automotive sector, and textile industry in China is driving the demand for 1,4 butanediol in the region. The demand for 1,4 butanediol in other emerging economies such as India, Vietnam, and Indonesia is also growing due to the increasing use of BDO-based products in various industries. Another reason for the dominance of the Asia-Pacific region is the availability of raw materials such as n-butane and propylene, which are used in the production of 1,4 butanediol. The Asia-Pacific region has a significant presence of n-butane and propylene producers, which provide a steady supply of raw materials to the 1,4 butanediol manufacturers in the region.

1,4 Butanediol Market Player

Some of the top 1,4 butanediol market companies offered in the professional report include BASF SE, Dairen Chemical Corporation, LyondellBasell Industries Holdings B.V., Mitsubishi Chemical Corporation, Nanya Plastics Corporation, INVISTA, Ashland Global Holdings Inc., Perstorp Holding AB, Shanxi Sanwei Group Co., Ltd., and BioAmber Inc.

Frequently Asked Questions

What was the market size of the global 1,4 butanediol in 2022?

The market size of 1,4 butanediol was USD 7.4 Billion in 2022.

What is the CAGR of the global 1,4 butanediol market from 2023 to 2032?

The CAGR of 1,4 butanediol is 8.2% during the analysis period of 2023 to 2032.

Which are the key players in the 1,4 butanediol market?

The key players operating in the global market are including BASF SE, Dairen Chemical Corporation, LyondellBasell Industries Holdings B.V., Mitsubishi Chemical Corporation, Nanya Plastics Corporation, INVISTA, Ashland Global Holdings Inc., Perstorp Holding AB, Shanxi Sanwei Group Co., Ltd., and BioAmber Inc.

Which region dominated the global 1,4 butanediol market share?

Asia-Pacific held the dominating position in 1,4 butanediol industry during the analysis period of 2023 to 2032.

Which region registered fastest CAGR from 2023 to 2032?

North America region exhibited fastest growing CAGR for market of 1,4 butanediol during the analysis period of 2023 to 2032.

What are the current trends and dynamics in the global 1,4 butanediol industry?

The current trends and dynamics in the 1,4 butanediol industry include increasing demand for polyurethane and thermoplastic polyurethane, growing demand for spandex fibers in the textile industry, rising demand for biodegradable plastics, and growing demand for cosmetics and personal care products.

Which derivative held the maximum share in 2022?

The tetrahydrofuran derivative held the maximum share of the 1,4 butanediol industry.