1 4 Butanediol Bdo Polytetramethylene Ether Glycol Ptmeg And Spandex Market | Acumen Research and Consulting

1,4-Butanediol (BDO), Polytetramethylene Ether Glycol (PTMEG) and Spandex Market Size - Global Industry, Share, Analysis, Trends and Forecast 2024 - 2032

Published :

Report ID:

Pages :

Format :

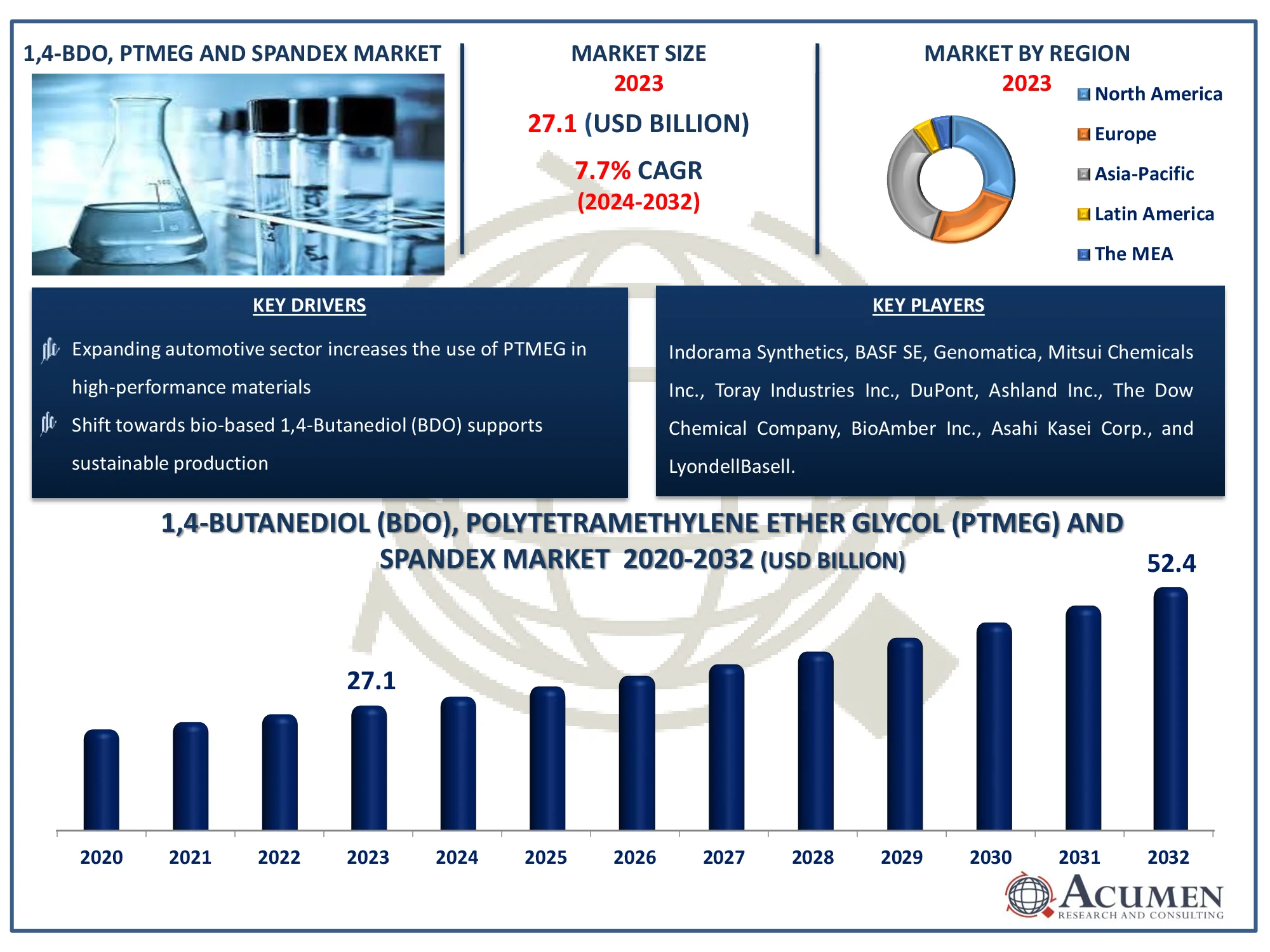

The Global 1,4-Butanediol (BDO), Polytetramethylene Ether Glycol (PTMEG) and Spandex Market Size accounted for USD 27.1 Billion in 2023 and is estimated to achieve a market size of USD 52.4 Billion by 2032 growing at a CAGR of 7.7% from 2024 to 2032.

1,4-Butanediol (BDO), Polytetramethylene Ether Glycol (PTMEG) and Spandex Market Highlights

- Global 1,4-butanediol (BDO), polytetramethylene ether glycol (PTMEG) and spandex market revenue is poised to garner USD 52.4 billion by 2032 with a CAGR of 7.7% from 2024 to 2032

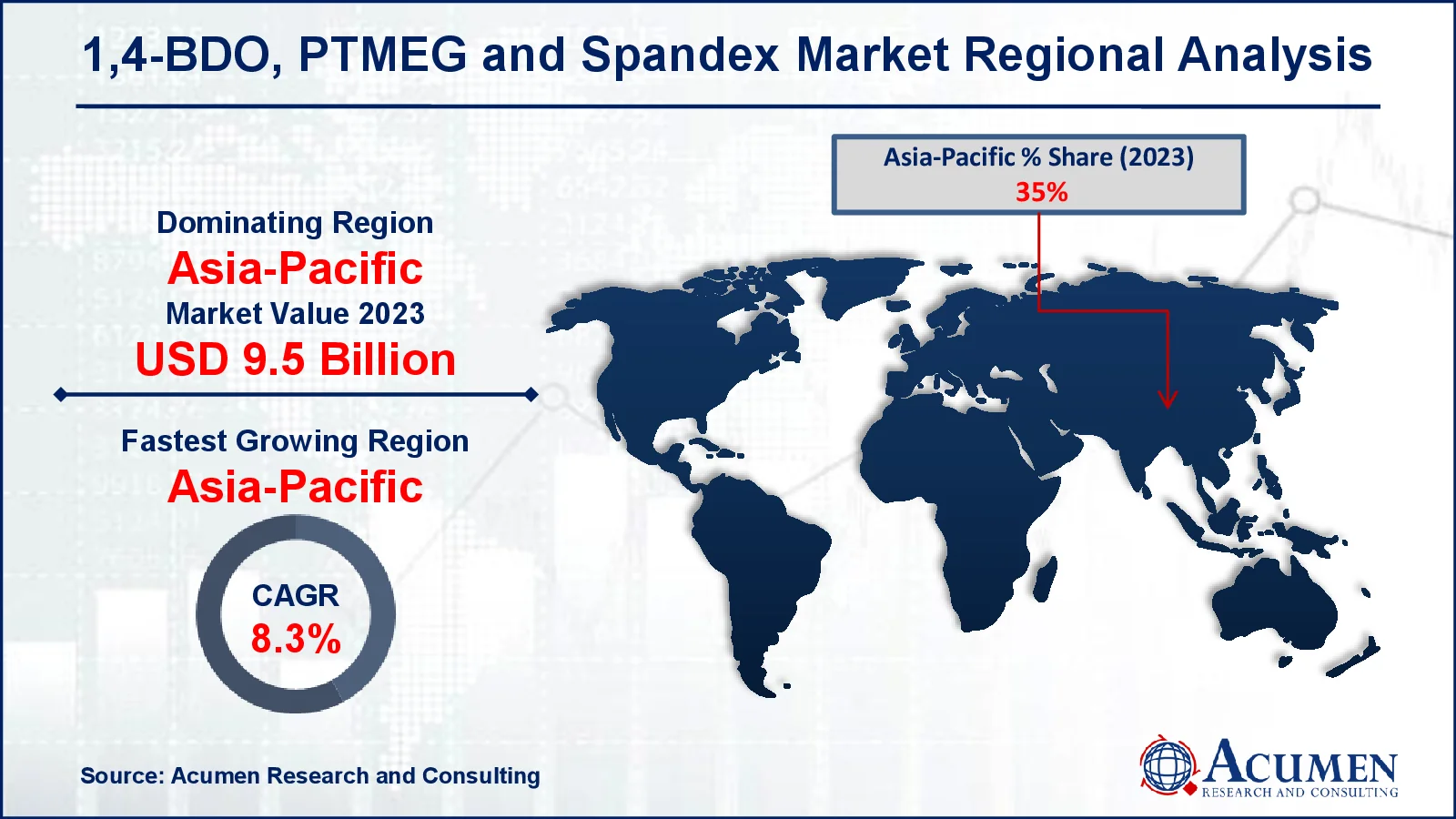

- Asia-Pacific 1,4-butanediol (BDO), polytetramethylene ether glycol (PTMEG) and spandex market value occupied around USD 9.5 billion in 2023

- Asia-Pacific 1,4-butanediol (BDO), polytetramethylene ether glycol (PTMEG) and spandex market growth will record a CAGR of more than 8.3% from 2024 to 2032

- Among 1,4-BDO application, the tidal stream generator sub-segment generated more than USD 13 billion revenue in 2023

- Based on spandex application, the textiles sub-segment generated around 70% market share in 2023

- Expanding textile and apparel industry in emerging markets is a popular 1,4-butanediol (BDO), polytetramethylene ether glycol (PTMEG) and spandex market trend that fuels the industry demand

The chemical, which mainly uses polyside, GBL, polybutylene terepthalate, tetrahydrofuran, and solvent in the production of a few of the other downstream chemicals, is 1,4-butanediol, polytethylene ether glycol (PTMEG) and spandex (BDO). The product is gradually being used in medicinal preparations which have been fascinated by several legislation and measures concerning the secure use of the chemical. Applications of butanediol (BDO) include plastics, cosmetics, pesticides, hardener, fiber, artificial leather, plasticizers and medications.

Global 1,4-Butanediol (BDO), Polytetramethylene Ether Glycol (PTMEG) and Spandex Market Dynamics

Market Drivers

- Rising demand for spandex in activewear and sportswear

- Expanding automotive sector increases the use of PTMEG in high-performance materials

- Shift towards bio-based 1,4-Butanediol (BDO) supports sustainable production

- Growing healthcare sector drives spandex demand for medical applications

Market Restraints

- High production costs of PTMEG and spandex limit market expansion

- Volatile raw material prices impact profitability

- Stringent environmental regulations restrict the use of petrochemical-based BDO

Market Opportunities

- Development of bio-based PTMEG offers eco-friendly alternatives

- Innovations in chemical recycling of spandex improve sustainability

- Growing demand for lightweight and durable materials in automotive boosts BDO and PTMEG use

1,4-Butanediol (BDO), Polytetramethylene Ether Glycol (PTMEG) and Spandex Market Report Coverage

|

Market |

1,4-Butanediol, Polytetramethylene Ether Glycol and Spandex Market |

|

1,4-Butanediol (BDO), Polytetramethylene Ether Glycol (PTMEG) and Spandex Market Size 2023 |

USD 27.1 Billion |

|

1,4-Butanediol (BDO), Polytetramethylene Ether Glycol (PTMEG) & Spandex Market Forecast 2032 |

USD 52.4 Billion |

|

1,4-Butanediol (BDO), Polytetramethylene Ether Glycol (PTMEG) and Spandex Market CAGR During 2024 - 2032 |

7.7% |

|

1,4-Butanediol (BDO), Polytetramethylene Ether Glycol (PTMEG) and Spandex Market Analysis Period |

2020 - 2032 |

|

1,4-Butanediol (BDO), Polytetramethylene Ether Glycol (PTMEG) and Spandex Market Base Year |

2023 |

|

1,4-Butanediol (BDO), Polytetramethylene Ether Glycol (PTMEG) and Spandex Market Forecast Data |

2024 - 2032 |

|

Segments Covered |

By 1,4-BDO Application, By PTMEG Application, By Spandex Application, and By Geography |

|

Regional Scope |

North America, Europe, Asia Pacific, Latin America, and Middle East & Africa |

|

Key Companies Profiled |

Indorama Synthetics, BASF SE, Genomatica, Mitsui Chemicals Inc., Toray Industries Inc., DuPont, Ashland Inc., The Dow Chemical Company, BioAmber Inc., Asahi Kasei Corp., and LyondellBasell. |

|

Report Coverage |

Market Trends, Drivers, Restraints, Competitive Analysis, Player Profiling, Covid-19 Analysis, Regulation Analysis |

1,4-Butanediol (BDO), Polytetramethylene Ether Glycol (PTMEG) and Spandex Market Insights

The growing demand for improved quality stretch fabrics is projected to drive development across different textural apps. The development is expected to continue with the growing amount of sports and the knowledge of fitness and healthy lifestyles. In Asia-Pacific, the 1,4-butanediol (BDO), polytetramethylene ether glycol (PTMEG) and spandex market will continue to grow rapidly because of the population explosion, increased availability revenues and developing end-use sectors. The application industry in the United States represented Tetrahydrofuran (THF) with the biggest market share and its dominance over the projected period is expected to continue. The reason is that extremely qualified employees, sophisticated technology and processing, infrastructural development and an growing amount of research and development operations are available in the area. On the other side, it is estimated that the PBT industry will develop as rapidly as a healthy CAGR in the next era.

In addition, the government's initiative to support U.S. companies, the Manufacturing Extension Partnership (MEP), with individual tailor made facilities, is expected to make an important contribution to the development of the 1,4-butanediol market by enabling industry to boost productivity, economical competitiveness and the capacities of technology. Moreover, coal production of BDO will probably alter the dynamics of the economy over the next few years. In the latest technological tendency to increase market growth, development of new spandex products, including a flat-stretched curve, a good denier and 3D Lycra are projected to increase 1,4-butanediol (BDO), polytetramethylene ether glycol (PTMEG) and spandex market growth.

In addition, regulatory policies for the prevention of dangerous and carcinogenic products, such as 1,4 BDO and GBL, are expected to challenge 1,4-BDO, PTMEG & Spandex market growth over the predicted era to produce PTMEG and Spandex. A principal derivative of 1,4-butanediol THF undergoes catalyzed polymerization for polytetramethylene ether (PTMEG) production. The product is a white wax solid that is also used in materials like polyesters, urethane elastomers, TPUs, polyamides and COPE. One of PTMEG's most important uses, however, is the production of lycra / elasthene / spandex fiber, used in various end uses ranging from automotive to textile interiors.

1,4-Butanediol (BDO), Polytetramethylene Ether Glycol (PTMEG) and Spandex Market Segmentation

The worldwide market for 1,4-butanediol (BDO), polytetramethylene ether glycol (PTMEG) and spandex is split based on 1,4-BDO application, PTMEG application, spandex application, and geography.

1,4-Butanediol (BDO), Polytetramethylene Ether Glycol (PTMEG) and Spandex Market By 1,4-BDO Applications

- Gamma-Butyrolactone (GBT)

- Reaction Turbin

- Polybutylene Terephthalate (PBT)

- Tetrahydrofuran (THF)

- Polyurethane (PU)

- Others

According to 1,4-BDO, PTMEG & Spandex market analysis, based on BDO apps such as tetrahydrofuran (THF), polybutylene terephthalate (PBT), gamma-butyrolactone (GBL), and polyurethane (PU), the 1,4-butanediol (BDO), polytetramethylene ether glycol (PPTMEG) and spandex is segmented. Over the last few years, THF has developed as a result of the increasing use of urethane elastomers and fibers in the production of PTMEG, a polymer widely used.

In addition, it is a versatile, multi application solvent in fields such as adhesives, vinyl and cellophane, industrial resins, elastomers, coatings and printing inks. They are used solely for formulating PVC cements, and they are also used before joint formation as a PVC-type cleaner. The implementation industry for polyurethane (PU) is also expected to be small as a result of powerful industrial development in developing Asia-Pacific and Latin America, which has in turn broadened the scope of implementation of PU goods.

1,4-Butanediol (BDO), Polytetramethylene Ether Glycol (PTMEG) and Spandex Market By PTMEG Application

- Spandex

- Urethanes

- Co-polyester-Ether Elastomers (COPE)

- Others

Spandex, copolyester ether (COPE) and urethane are included in the PTMEG application. Spandex is the biggest PTMEG application industry with a substantial expansion of CAGR in terms of income due to strong demand for flexible sports equipment and textiles manufacture. Due to their outstanding properties such as elevated elasticity and durability, as well as greater flexibility than rubber, these fibers is used solely. The demand for spandex over the forecast period is anticipated to drive higher health requirements due to innovative medical apps for wound dressing and protective clothing.

The applications for spandex include fabrics, sanitation and interior automobiles. Due to product innovation and the growth of nonwoven fabrics, the textiles industry accounted for the biggest 1,4-butanediol (BDO), polytetramethylene ether glycol (PTMEG) and spandex market share and it is expected to grow at significant CAGR over the period of prediction. In Germany, growing textiles and strong demand for spandex are projected to boost development in the medical and hygiene industries. Medical and hygiene is the fastest increasing industry and, due to increased demand by the healthcare industry, is expected to account for important 1,4-butanediol (BDO), polytetramethylene ether glycol (PTMEG) and spandex market share during the forecast era.

1,4-Butanediol (BDO), Polytetramethylene Ether Glycol (PTMEG) and Spandex Market By Spandex Applications

- Textiles

- Automotive Interiors

- Medical & Hygiene

- Others

The textiles category dominates the 1,4-butanediol (BDO), polytetramethylene ether glycol (PTMEG) and spandex market due to its widespread application in clothes, notably activity, sportswear, and intimate apparel. Spandex is widely sought in textiles because to its remarkable flexibility, comfort, and durability, which improves fabric performance by offering a snug fit while allowing for freedom of movement. The increased demand for athleisure and performance-driven clothes has accelerated the use of spandex in the textile sector. Furthermore, its ability to blend easily with other fibers such as cotton, polyester, and nylon makes it suitable for a variety of fabric kinds. As fashion trends shift toward comfort and flexibility, the textiles industry continues to dominate spandex applications.

1,4-Butanediol (BDO), Polytetramethylene Ether Glycol (PTMEG) and Spandex Market Regional Outlook

North America

- U.S.

- Canada

Europe

- U.K.

- Germany

- France

- Spain

- Rest of Europe

Asia-Pacific

- India

- Japan

- China

- Australia

- South Korea

- Rest of Asia-Pacific

Latin America

- Brazil

- Mexico

- Rest of LATAM

The Middle East & Africa

- South Africa

- GCC Countries

- Rest of the Middle East & Africa (ME&A)

1,4-Butanediol (BDO), Polytetramethylene Ether Glycol (PTMEG) and Spandex Market Regional Analysis

Asia Pacific accounted for 2023 for the biggest in the 1,4-BDO, PTMEG & Spandex market value and, due to the growing final-use sectors and accessibility of low cost labor, is expected to continue to prevail over the forecast period. As a result of rising consumption disposable income, China is projected to be the main user of 1,4 BDO, PTMEG, and Spandex markets.

In view of the growing exportations to North American and EU nations, Asia-Pacific is anticipated to stay the biggest textile 1,4-butanediol (BDO), polytetramethylene ether glycol (PTMEG) and spandex market. The development of the spandex market is expected to have positive implications over the forecast period for increased ability, modernization, and diversified textiles sector. North America and Europe will stay profitable to creative manufacturers who draw on bio-based resources to satisfy sustainable manufacturing requirements, despite being comparatively mature and saturated end of use markets.

It is estimated that Central and South America (CSA) is growing lucratively during the prediction era as a result of infrastructure development and increasing use of sophisticated technology. In addition, in the evolving CSA markets, market players have unused possibilities with customers becoming increasingly conscious of the advantages for the hobby, sport clothing and even medical textiles of spandex and other elastic fabric.

1,4-Butanediol (BDO), Polytetramethylene Ether Glycol (PTMEG) and Spandex Market Players

Some of the top 1,4-butanediol (BDO), polytetramethylene ether glycol (PTMEG) and spandex companies offered in our report includes Indorama Synthetics, BASF SE, Genomatica, Mitsui Chemicals Inc., Toray Industries Inc., DuPont, Ashland Inc., The Dow Chemical Company, BioAmber Inc., Asahi Kasei Corp., and LyondellBasell.

Frequently Asked Questions

How big is the 1,4-butanediol (BDO), polytetramethylene ether glycol (PTMEG) and spandex market?

The 1,4-butanediol (BDO), polytetramethylene ether glycol (PTMEG) and spandex market size was valued at USD 27.1 billion in 2023.

What is the CAGR of the global 1,4-BDO, PTMEG & Spandex market from 2024 to 2032?

The CAGR of 1,4-BDO, PTMEG & Spandex is 7.7% during the analysis period of 2024 to 2032.

Which are the key players in the 1,4-butanediol (BDO), polytetramethylene ether glycol (PTMEG) and spandex market?

The key players operating in the global market are including Indorama Synthetics, BASF SE, Genomatica, Mitsui Chemicals Inc., Toray Industries Inc., DuPont, Ashland Inc., The Dow Chemical Company, BioAmber Inc., Asahi Kasei Corp., and LyondellBasell.

Which region dominated the global 1,4-butanediol (BDO), polytetramethylene ether glycol (PTMEG) and spandex market share?

Asia-Pacific held the dominating position in 1,4-butanediol (BDO), polytetramethylene ether glycol (PTMEG) and spandex industry during the analysis period of 2024 to 2032.

Which region registered fastest CAGR from 2024 to 2032?

Asia-Pacific region exhibited fastest growing CAGR for market of 1,4-butanediol (BDO), polytetramethylene ether glycol (PTMEG) and spandex during the analysis period of 2024 to 2032.

What are the current trends and dynamics in the global 1,4-butanediol (BDO), polytetramethylene ether glycol (PTMEG) and spandex industry?

The current trends and dynamics in the 1,4-butanediol (BDO), polytetramethylene ether glycol (PTMEG) and spandex industry include rising demand for spandex in activewear and sportswear, expanding automotive sector increases the use of PTMEG in high-performance materials, shift towards bio-based 1,4-butanediol (BDO) supports sustainable production, and growing healthcare sector drives spandex demand for medical applications.

Which spandex application held the maximum share in 2023?

The tidal stream generator textiles spandex application held the maximum share of the 1,4-butanediol (BDO), polytetramethylene ether glycol (PTMEG) and spandex industry.