T-Cell Therapy Market Size - Global Industry, Share, Analysis, Trends and Forecast 2023 - 2032

Published :

Report ID:

Pages :

Format :

T-Cell Therapy Market Size - Global Industry, Share, Analysis, Trends and Forecast 2023 - 2032

Report Coverage

- Industry Dynamics

- Market Size and Forecast Data

- Segment Analysis

- Competitive Landscape

- Regional Analysis with a Niche Focus on Country-Level Data

- High Level Analysis - Porter's, PESTEL, Value Chain, etc.

- Company Profiles of Key Players

- Option to Customize the Report As Per Your Specific Need

Request Sample Report

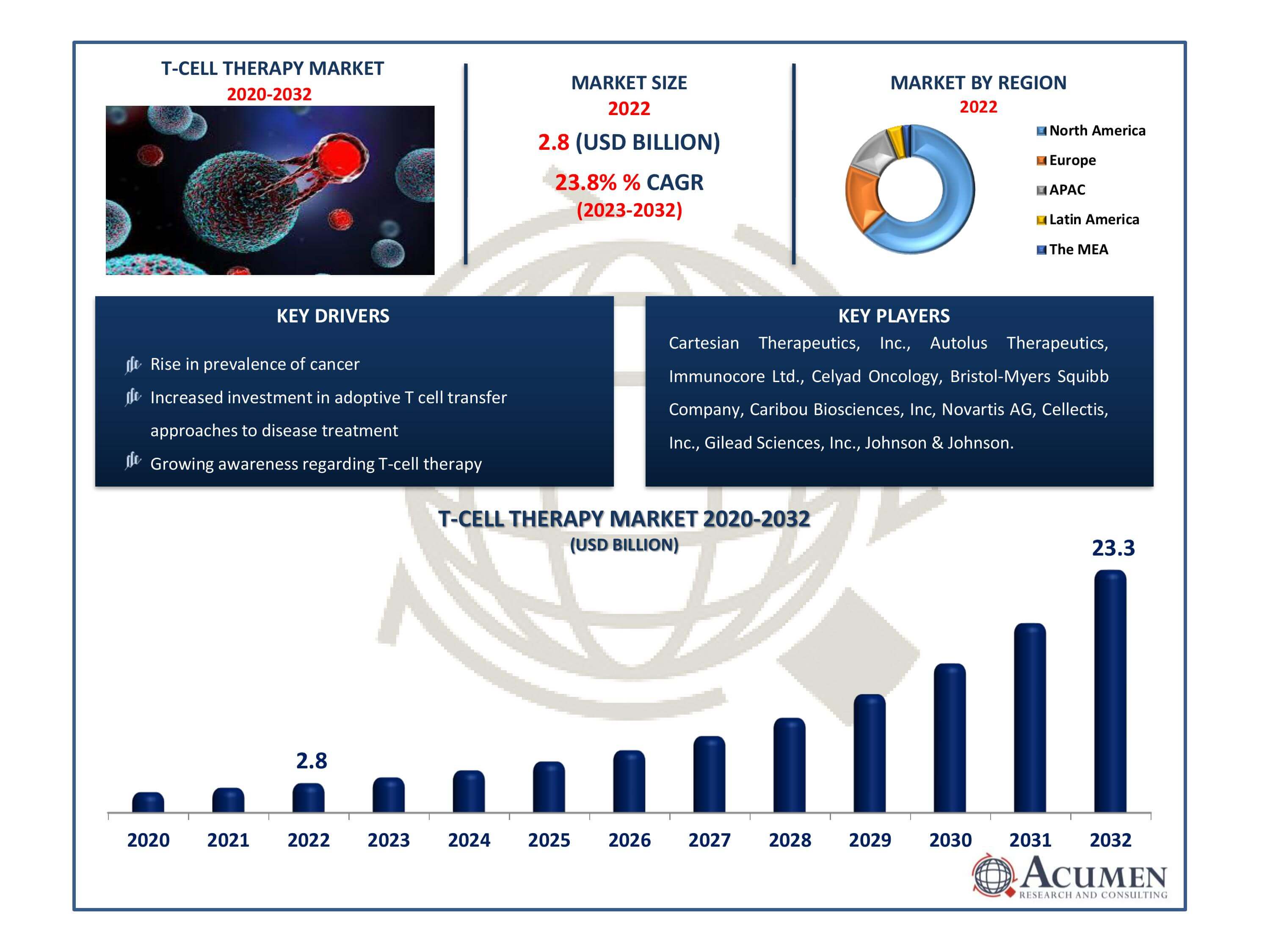

The Global T-Cell Therapy Market Size accounted for USD 2.8 Billion in 2022 and is estimated to achieve a market size of USD 23.3 Billion by 2032 growing at a CAGR of 23.8% from 2023 to 2032.

T-Cell Therapy Market Highlights

- Global T-cell therapy market revenue is poised to garner USD 23.3 billion by 2032 with a CAGR of 23.8% from 2023 to 2032

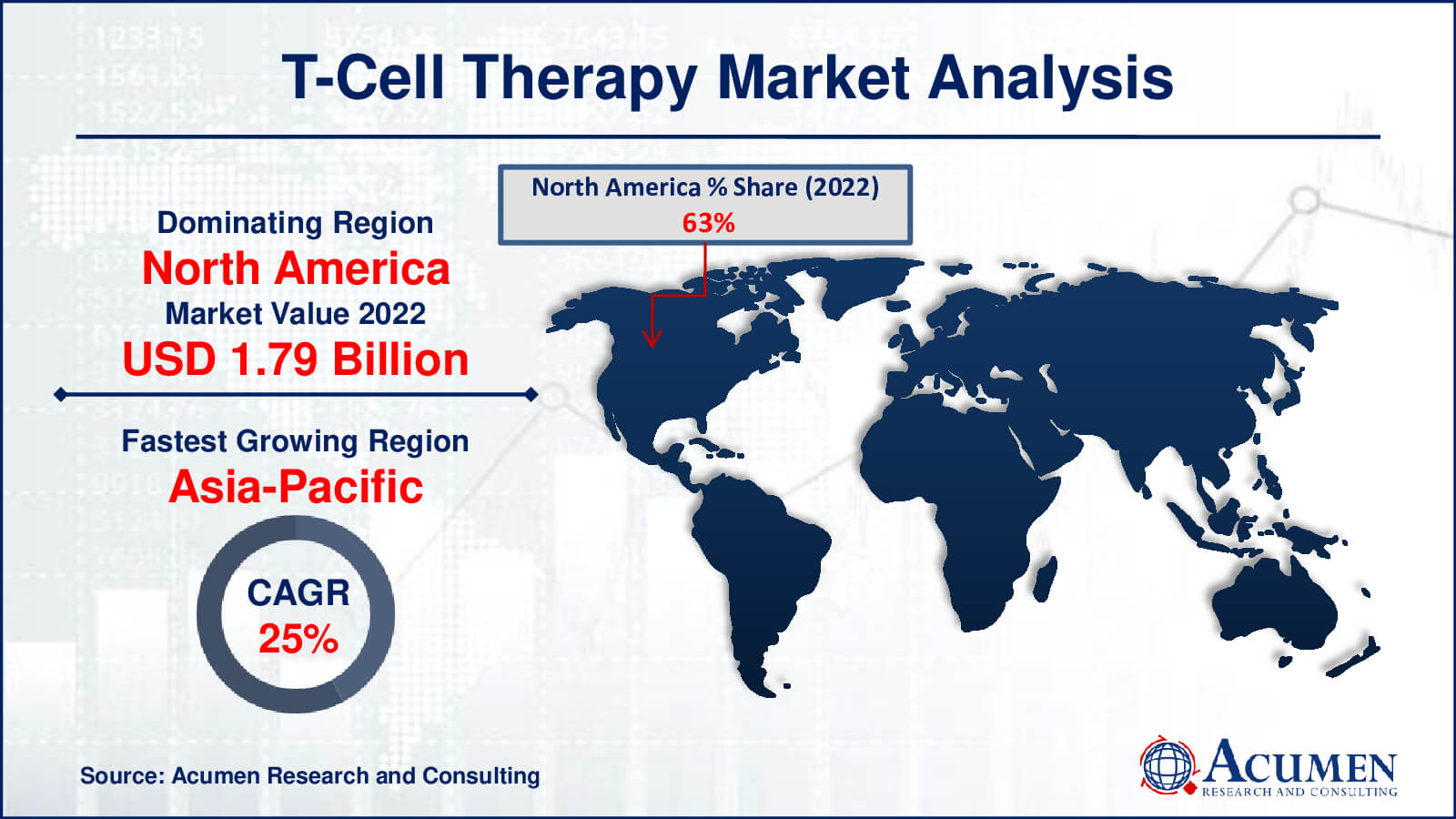

- North America T- cell therapy market value occupied around USD 1.79 billion in 2022

- Asia-Pacific T-cell therapy market growth will record a CAGR of more than 25% from 2023 to 2032

- Among therapy type, the CAR t-cell therapy sub-segment generated over US$ 2.67 billion revenue in 2022

- Based on indication, the hospitals sub-segment generated around 51% share in 2022

- Developing T-cell therapies with improved safety profiles T-cell therapy market trend that fuels the industry demand

T-cell therapy is a revolutionary immunotherapy method that is revolutionizing the treatment of numerous malignancies and autoimmune illnesses. It entails employing a patient's own T-cells, which are immunological cells, to target and remove disease-causing cells. T-cells from the patient's blood are often extracted and genetically modified to express chimeric antigen receptors (CARs) or T-cell receptors (TCRs) specific to the target antigen on cancer cells or autoantigens in autoimmune illnesses. These modified T-cells are then enlarged in the lab before being pumped back into the patient, where they seek out and destroy the targeted cells while leaving healthy cells alone. The T cell therapy market has witnessed remarkable growth due to its remarkable success in clinical trials and approvals for various indications.

Global T-Cell Therapy Market Dynamics

Market Drivers

- Technological advancements in manufacturing process

- Rise in prevalence of cancer

- Increased investment in adoptive T cell transfer approaches to disease treatment

- Growing awareness regarding T-cell therapy

- Developments in CAR T-cell therapy market for solid tumors

Market Restraints

- Strict government regulation for approval of drugs

- High prices of therapies

- CAR T limitations

Market Opportunities

- Increase in R&D activities to develop T-cell therapeutics

- Facility expansion for cell and gene therapies

T-Cell Therapy Market Report Coverage

| Market | T-Cell Therapy Market |

| T-Cell Therapy Market Size 2022 | USD 2.8 Billion |

| T-Cell Therapy Market Forecast 2032 | USD 23.3 Billion |

| T-Cell Therapy Market CAGR During 2023 - 2032 | 23.8% |

| T-Cell Therapy Market Analysis Period | 2020 - 2032 |

| T-Cell Therapy Market Base Year |

2022 |

| T-Cell Therapy Market Forecast Data | 2023 - 2032 |

| Segments Covered | By Modality, By Therapy Type, By Indication, By End-User, And By Geography |

| Regional Scope | North America, Europe, Asia Pacific, Latin America, and Middle East & Africa |

| Key Companies Profiled | Cartesian Therapeutics, Inc., Autolus Therapeutics, Immunocore Ltd., Celyad Oncology, Bristol-Myers Squibb Company, Caribou Biosciences, Inc, Novartis AG, Cellectis, Inc., Gilead Sciences, Inc., and Johnson & Johnson. |

| Report Coverage |

Market Trends, Drivers, Restraints, Competitive Analysis, Player Profiling, Covid-19 Analysis, Regulation Analysis |

T-Cell Therapy Market Insights

Rapid advancements in immunotherapy, increasing investments by major players in R&D activities, and a focus on developing protein and small molecule-based treatments to adoptive therapies are expected to drive the growth of the global T cell therapy market. The gradual increase in the number of patients suffering from chronic cancer and the rising number of clinical trials by major players are factors that are poised to boost market growth. According to the U.S. Department of Health & Human Tumor Infiltrating Lymphocytes (TIL)-based, each year in the United States, approximately 24,000 men and 10,000 women are diagnosed with liver cancer, resulting in about 25,000 men and 9,000 women succumbing to the disease. Presently, there are 362 investigational cell and gene therapies in clinical development, marking a 20 percent increase from 2025, as reported by the Pharmaceutical Research and Manufacturers of America (PhRMA) in March. The increasing product pipeline and government approvals for novel products are expected to further augment the growth of the T-cell therapy market.

Factors such as the high cost associated with R&D activities and therapies are expected to hamper the growth of the global T cell therapy market. Additionally, stringent government regulations related to product approval are expected to challenge market growth. Nevertheless, increasing investments by major players, the introduction of innovative solutions, and a focus on expanding manufacturing facilities are expected to create new opportunities for companies operating in the T-cell therapy market in the forecast period. Furthermore, increasing partnerships between regional and international players and a focus on tapping into untapped markets in developing countries are factors that are likely to support revenue generation in the target market.

T-Cell Therapy Market Segmentation

The worldwide market for t-cell therapy is split based on modality, therapy type, indication, end-user, and geography.

T-Cell Therapy Modality

- Research

- Commercialized

According to T-cell therapy industry analysis, research have held the largest portion in the past years within the modality segment. The clinical effectiveness and efficacy of medicines within that study area is one of the most important factors. If a particular form of T-cell therapy has demonstrated significant outcomes in the treatment of a specific disease or cancer type, it is likely to garner increased attention and investment. T-cell therapies that have been commercialised have successfully completed clinical studies, gained regulatory authorization, and are now available for clinical use. These medicines have been subjected to comprehensive testing in order to demonstrate their safety and efficacy.

T-Cell Therapy Type

- CAR T-cell Therapy

- T-Cell Receptor (TCR)-based

- Tumor Infiltrating Lymphocytes (TIL)-based

Within the therapy type segment, the CAR t-cell therapy category emerged as the leader in terms of revenue share in previous years. CAR T-cell therapy has shown great clinical success in the treatment of specific forms of cancer, most notably blood malignancies such as acute lymphoblastic leukaemia (ALL), chronic lymphocytic leukaemia (CLL), and different lymphomas. The remarkable and frequently long-lasting reactions found in patients have gotten a lot of attention and acceptance.

T-Cell Therapy Indication

- Hematologic Malignancies

- Lymphoma

- Leukemia

- Myeloma

- Solid Tumors

- Melanoma

- Brain & Central Nervous System

- Liver Cancer

- Others

- Others

In recent years, the hematologic malignancies segment has emerged as the dominant Indication segment in the T-Cell Therapy industry. T-cell treatments, particularly CAR T-cell therapies, have shown exceptional success in the treatment of hematopoietic cancers such as lymphoma, leukaemia, and myeloma. various medicines have demonstrated strong response rates and long-term remissions in patients with various blood malignancies, resulting in their widespread use. Hematologic malignancies, which include lymphoma, leukaemia, and myeloma, account for a sizable proportion of cancer cases. Because of their ubiquity and the poor efficacy of standard treatments, there is a significant unmet medical need, which is driving the adoption of T-cell therapy.

T-Cell Therapy End-User

- Hospitals

- Cancer Treatment Centers

According to the T-cell therapy market forecast, the hospitals segments have dominated the market share. Because of their comprehensive healthcare facilities, which include specialised oncology departments and the infrastructure required for complex treatments, hospitals frequently dominate the T-cell therapy industry. They serve a varied patient group and are well-versed in a variety of medical ailments, including those treated with T-cell treatments. Hospitals are more likely to have the resources and infrastructure necessary to provide T-cell treatments for a wide range of cancer types and reasons.

T-Cell Therapy Market Regional Outlook

North America

- U.S.

- Canada

Europe

- U.K.

- Germany

- France

- Spain

- Rest of Europe

Asia-Pacific

- India

- Japan

- China

- Australia

- South Korea

- Rest of Asia-Pacific

Latin America

- Brazil

- Mexico

- Rest of Latin America

The Middle East & Africa

- South Africa

- GCC Countries

- Rest of the Middle East & Africa (ME&A)

T-Cell Therapy Market Regional Analysis

Because of the United States, North America controls the T-cell treatment industry. The United States leads in research and development, thanks to a strong regulatory structure that expedites approvals. The presence of major pharmaceutical and biotechnology businesses, academic institutions, and significant financing sources has fueled the market's rapid rise.

Europe, particularly Germany and the United Kingdom, has a robust healthcare infrastructure as well as competence in cell-based medicines. Significant investment has been attracted by favorable regulatory frameworks and clinical trial conditions. The European Medicines Agency (EMA) is critical in the approval process.

The Asia-Pacific T-cell treatment market is expanding rapidly. China is emerging as a prominent player, owing to its vast population and government funding for biotechnology. Japan has a well-established regulatory structure, which makes it a desirable market. South Korea is likewise gaining popularity as a result of its advanced healthcare system.

The Latin American region is seeing modest acceptance, owing to improved healthcare infrastructure and increased cancer prevalence. Brazil and Mexico are critical markets.

Middle East and Africa Although still in its infancy, the Middle East and Africa are showing promise, owing mostly to increased investments in healthcare infrastructure and growing knowledge of T-cell therapy.

T-Cell Therapy Market Players

Some of the top T-cell therapy companies offered in our report includes Cartesian Therapeutics, Inc., Autolus Therapeutics, Immunocore Ltd., Celyad Oncology, Bristol-Myers Squibb Company, Caribou Biosciences, Inc, Novartis AG, Cellectis, Inc., Gilead Sciences, Inc., and Johnson & Johnson.

T-Cell Therapy Competitor Strategies

- In 2020, the U.S. Food and Drug Administration (FDA) approved "Tecartus" (brexucabtagene autoleucel), a cell-based gene therapy for the treatment of adult patients diagnosed with mantle cell lymphoma (MCL) who have not responded to or have relapsed following other forms of treatment. Tecartus, a chimeric antigen receptor (CAR) T cell therapy, is the first cell-based gene therapy approved by the FDA for MCL treatment.

- In 2021, OrganaBio, a global player in gene therapy, launched a new cell product called ImmunoPAC-T-CB T-cells, designed to support the development of allogeneic immune cell-based therapies, such as chimeric antigen receptor (CAR) T-cells. This product launch is expected to enhance the company's product portfolio and increase its revenue share.

- In 2020, Sanofi, a global biopharmaceutical company, acquired Kiadis, another biopharmaceutical company, for $359 million. This acquisition is expected to help the company develop NK cell-based medicines for patients undergoing hematopoietic stem cell transplants, treating liquid and solid tumors, and addressing other infectious diseases.

- In the same year, Astellas Pharma Inc., a pharmaceutical company, acquired Xyphos and its next-generation approach to CAR-T therapies. This acquisition is expected to expand the company's business presence and increase its revenue share.

Frequently Asked Questions

What was the market size of the global T-cell therapy in 2022?

The market size of t-cell therapy was USD 2.8 billion in 2022.

What is the CAGR of the global T-cell therapy market from 2023 to 2032?

The CAGR of t-cell therapy is 23.8% during the analysis period of 2023 to 2032.

Which are the key players in the T-cell therapy market?

The key players operating in the global market are including Cartesian Therapeutics, Inc., Autolus Therapeutics, Immunocore Ltd., Celyad Oncology, Bristol-Myers Squibb Company, Caribou Biosciences, Inc, Novartis AG, Cellectis, Inc., Gilead Sciences, Inc., and Johnson & Johnson.

Which region dominated the global T-cell therapy market share?

North America held the dominating position in t-cell therapy industry during the analysis period of 2023 to 2032.

Which region registered fastest CAGR from 2023 to 2032?

Asia-Pacific region exhibited fastest growing CAGR for market of t-cell therapy during the analysis period of 2023 to 2032.

What are the current trends and dynamics in the global T-cell therapy industry?

The current trends and dynamics in the t-cell therapy industry include technological advancements in manufacturing process, rise in prevalence of cancer, increased investment in adoptive t cell transfer approaches to disease treatment, growing awareness regarding t-cell therapy, and developments in car t-cell therapy market for solid tumors.

Which modality held the maximum share in 2022?

The research modality held the maximum share of the t-cell therapy industry.