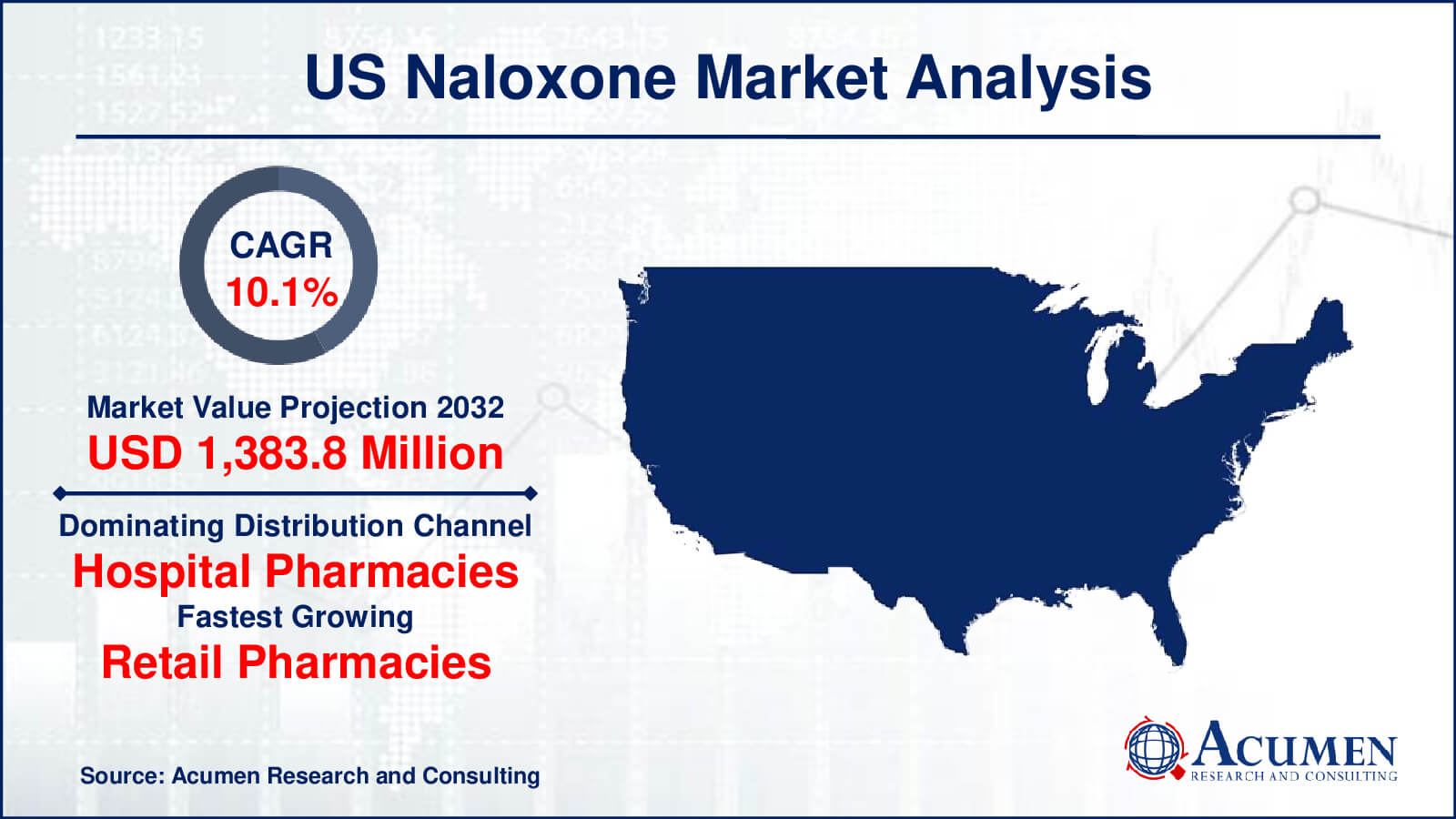

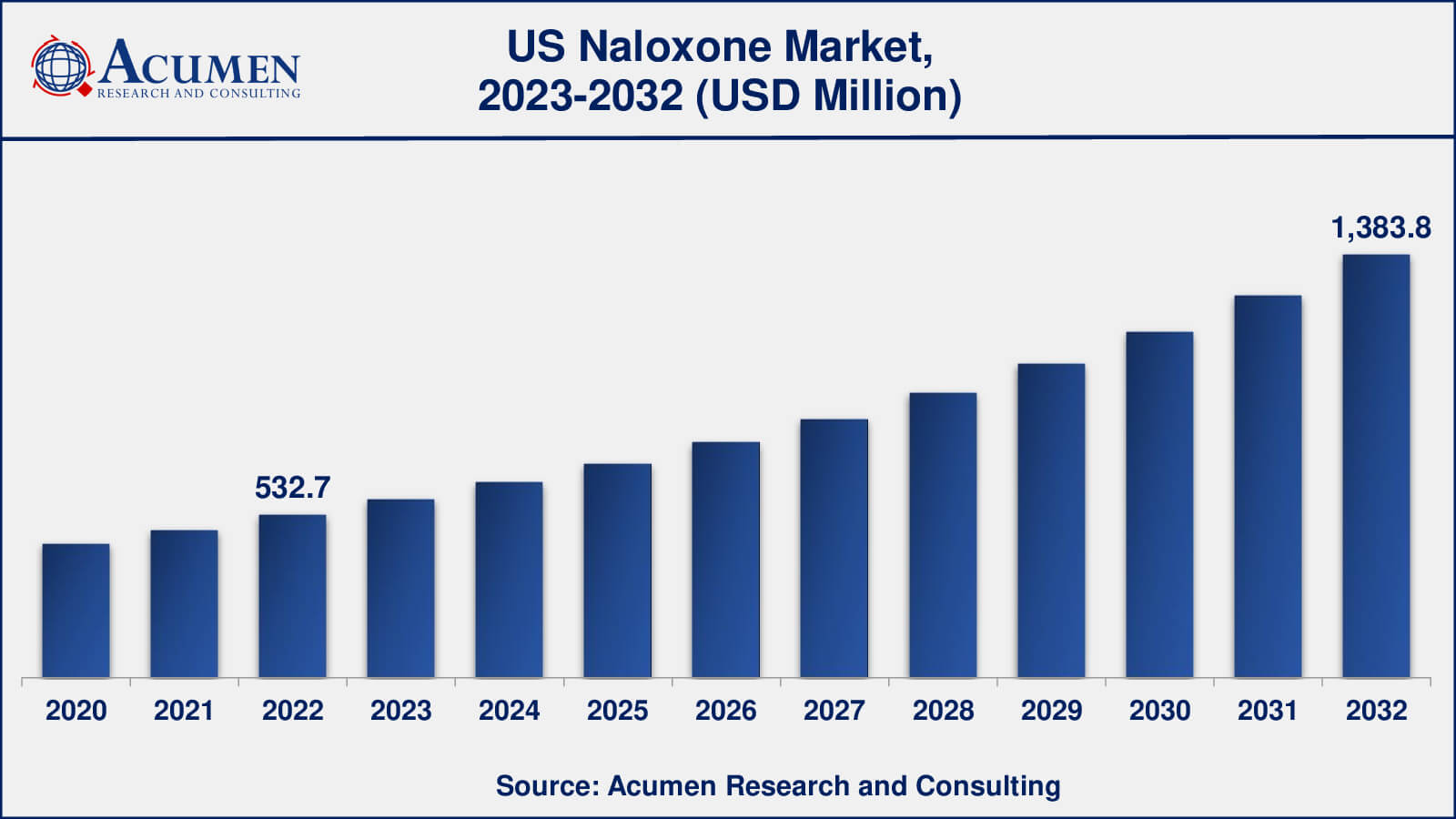

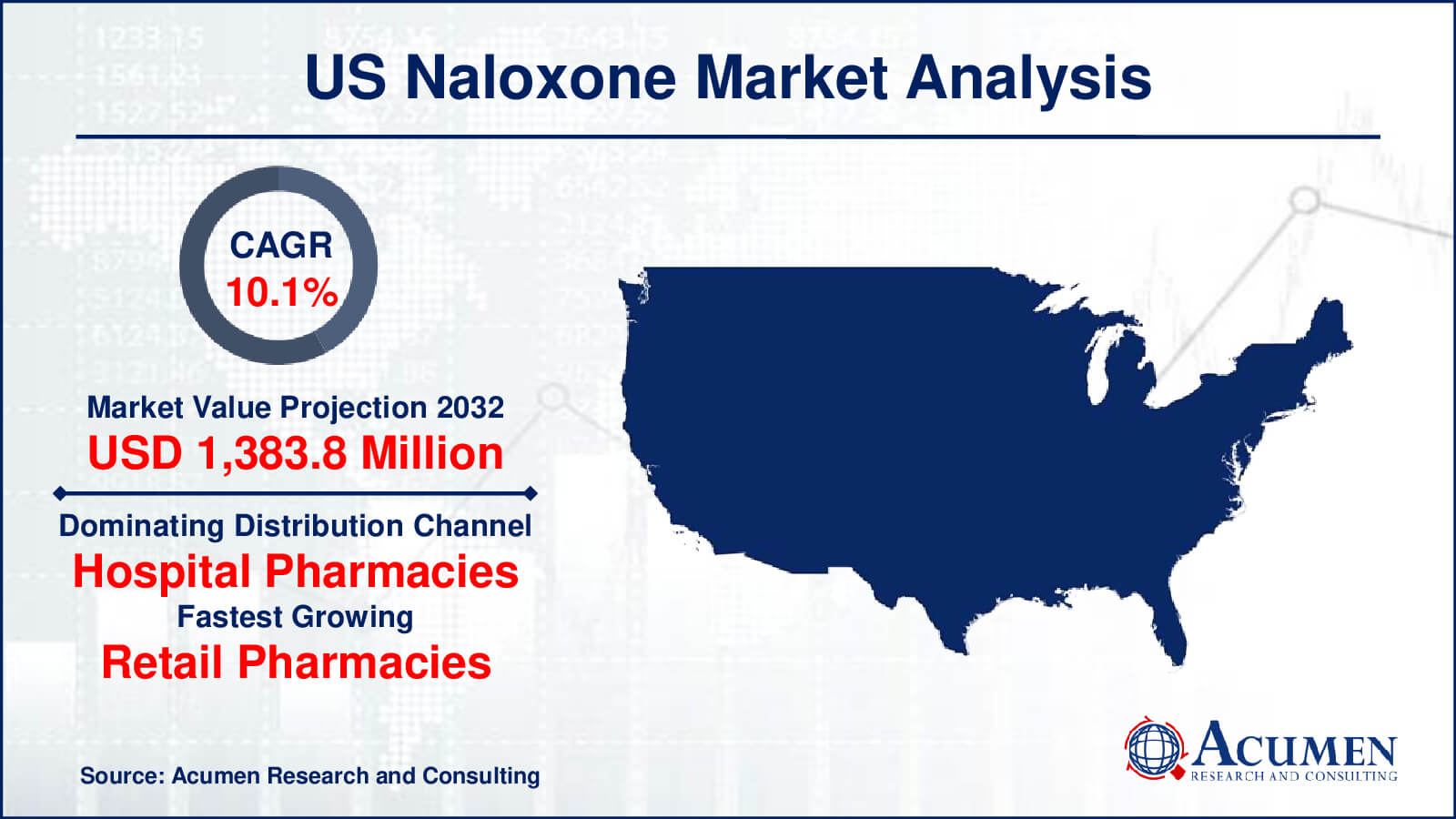

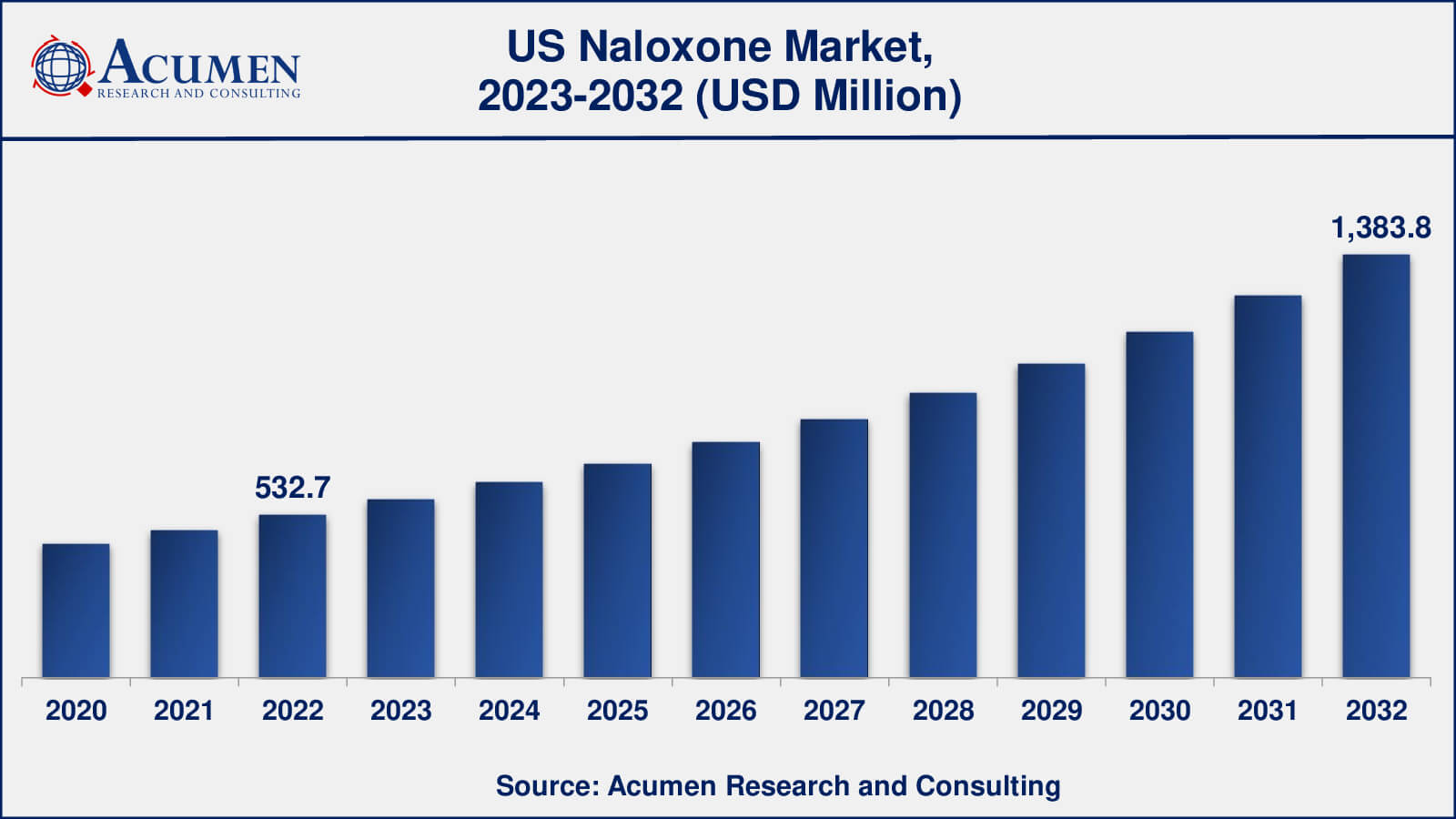

The United States Naloxone Market gathered USD 532.7 Million in 2022 and is expected to reach USD 1,383.8 Million by 2032, growing at a CAGR of 10.1% from 2023 to 2032.

United States Naloxone Market Highlights

- The US naloxone market is poised to achieve a revenue of USD 1,383.8 million by 2032, experiencing a CAGR of 10.1% from 2023 to 2032

- Among strengths, the 2.0 mg/0.1 ml and 4.0 mg/ml sub-segment accounted for revenue exceeding USD 271 million in 2022

- In terms of distribution channel, the hospital pharmacies sub-segment claimed a significant share, surpassing 40% in 2022

- Expansion of naloxone distribution through retail pharmacies and community initiatives is one of the notable US naloxone market trends

Naloxone, also recognized by its brand names Narcan or naxolene, is a medication designed for the swift reversal of opioid overdoses. Opioids encompass a wide spectrum, from prescription painkillers like oxycodone and hydrocodone to illicit substances such as heroin and the potent synthetic opioid, fentanyl. Naloxone's mechanism of action involves binding to the same brain receptors that opioids target, effectively blocking their effects. In doing so, it rapidly reverses life-threatening symptoms associated with overdose, notably the slowed breathing.

Available in both injectable and nasal spray forms, naloxone is designed to be user-friendly and can be administered by individuals with basic training. This accessibility extends to family members, healthcare professionals, and first responders. Studies have consistently demonstrated the high effectiveness of naloxone in reversing opioid overdoses, making it a crucial tool in saving lives when administered promptly.

However, it's essential to understand that naloxone is not a panacea for addiction. While it plays a pivotal role in preventing overdose fatalities, it doesn't address the root causes of substance abuse or provide a solution for addiction itself. Instead, naloxone serves as a critical intervention, offering a lifeline to individuals in crisis and affording them the opportunity to seek treatment and support for their addiction.

United States Naloxone Market Dynamics

Market Drivers

- Rising opioid overdose rates and the opioid epidemic

- Expanding access to naloxone through legislation and distribution programs

- Growing awareness and education on opioid overdose prevention

- Increased adoption of naloxone by first responders and community organizations

Market Restraints

- Pricing and affordability challenges for naloxone products

- Stigma associated with opioid use disorders limiting naloxone access

- Variability in naloxone distribution and training across states

- Concerns about naloxone enabling risky opioid behavior

Market Opportunities

- Technological innovations in naloxone delivery systems

- Collaborative efforts between government, healthcare, and community organizations

- Integration of naloxone into broader harm reduction strategies

United States Naloxone Market Report Coverage

| Market |

US Naloxone Market

|

| US Naloxone Market Size 2022 |

USD 532.7 Million |

| US Naloxone Market Forecast 2032 |

USD 1,383.8 Million |

| US Naloxone Market CAGR During 2023 - 2032 |

10.1% |

| US Naloxone Market Analysis Period |

2020 - 2032 |

US Naloxone Market Base Year

|

2022 |

| US Naloxone Market Forecast Data |

2023 - 2032 |

| Segments Covered |

By Strength, By Route of Administration, By Distribution Channel, And By Geography

|

| Key Companies Profiled |

Amphastar Pharmaceuticals, Inc., Adapt Pharma, Inc., Kaleo, Inc., Indivior Plc., Emergent BioSolutions Inc., Mylan N.V., Purdue Pharma L.P., Teleflex Incorporated, AptarGroup, Inc., and Sandoz Inc.

|

Report Coverage

|

Market Trends, Drivers, Restraints, Competitive Analysis, Player Profiling, Covid-19 Analysis, Regulation Analysis |

US Naloxone Market Insights

The US has experienced a sharp increase in opioid overdose rates, driven by the misuse of prescription opioids, illicit opioids like heroin, and potent synthetic opioids such as fentanyl. This alarming trend has fueled the demand for naloxone as a critical tool to reverse overdoses. The sheer scale of the opioid epidemic has created a substantial and sustained need for naloxone in the US.

State and federal policymakers have recognized the urgency of the opioid crisis and have taken various steps to increase naloxone access. Many states have implemented "standing orders" or "prescription rescue" programs, allowing pharmacists to dispense naloxone without an individual prescription. Additionally, Good Samaritan laws protect those who administer naloxone from legal liability. These legislative changes have significantly expanded naloxone distribution, making it more accessible to at-risk individuals and their families.

Community organizations harm reduction programs, and grassroots initiatives have played a crucial role in distributing naloxone. Training programs educate community members, first responders, and healthcare providers on how to administer naloxone effectively. These efforts have been instrumental in getting naloxone into the hands of those who are most likely to encounter overdose situations.

Pharmaceutical companies in the US have responded to the demand for naloxone by producing various formulations, including nasal sprays and injectable forms. Product innovation has focused on user-friendly delivery systems to ensure that naloxone can be administered rapidly and effectively by a wide range of individuals, even those with minimal medical training.

Despite progress, challenges remain in the United States naloxone market. Pricing and affordability of naloxone products have been areas of concern, with some formulations being relatively expensive. Stigma associated with addiction can also deter individuals from seeking naloxone or using it in emergency situations. Variability in naloxone distribution and training across states and regions is another challenge, with disparities in access and education.

United States Naloxone Market Segmentation

The US market for naloxone is categorized into strength, route of administration, distribution channel, and geography.

US Naloxone Strength Outlook

- 1 mg/ml

- 0.4 mg/ml

- 2.0 mg/0.1 ml and 4.0 mg/ml

- Others

According to United States naloxone industry analysis, 1 mg/ml concentration is commonly used in the production of injectable Naloxone products. It allows for precise dosing when administered intravenously or intramuscularly, making it an essential option for healthcare providers in emergency situations. 0.4 mg/ml which is lower concentration is suitable for intranasal administration, typically delivered as a nasal spray. It provides a measured dose suitable for reversing opioid overdoses when administered through the nasal mucosa.

2.0 mg/0.1 ml and 4.0 mg/ml are higher concentrations of Naloxone intended for specific applications. The 2.0 mg/0.1 ml concentration is often used in auto-injector devices, while the 4.0 mg/ml concentration may be used for rapid intravenous administration in critical care settings. These higher concentrations ensure swift and effective reversal of opioid overdose. Other category may encompass additional Naloxone formulations and concentrations tailored to unique requirements or delivery methods.

US Naloxone Route of Administration Outlook

- Intranasal

- Intramuscular/Subcutaneous

- Intravenous

According to the U.S. naloxone market analysis, Intranasal administration involves delivering naloxone as a nasal spray. This route is particularly favored for its ease of use, making it accessible to first responders, family members, and laypersons. It provides a non-invasive method of delivering naloxone, making it suitable for community-based overdose response programs.

Intramuscular (IM) or subcutaneous (SC) administration typically involves injecting naloxone into the muscle or under the skin. This route is commonly used by healthcare professionals in clinical settings or by trained responders in emergency situations. It allows for rapid absorption and action of Naloxone to reverse opioid overdoses.

Intravenous (IV) administration involves directly injecting naloxone into a vein. This route delivers the medication quickly and is often used in critical care settings or when an immediate and precise response is needed, such as in hospitals or during advanced life support interventions.

US Naloxone Distribution Channel Outlook

- Hospitals Pharmacies

- Clinics Pharmacies

- Retail Pharmacies

- Others

As per the US naxolene market forecast, hospital pharmacies play a critical role in supplying naloxone within healthcare institutions. They ensure that naloxone is readily available for use by medical staff in emergency departments, intensive care units, and other hospital settings. Hospitals are key hubs for responding to severe opioid overdoses, and having naloxone readily accessible is vital in these environments.

Clinics and outpatient healthcare facilities often maintain their own pharmacies. These clinics may provide naloxone to patients receiving opioid addiction treatment, chronic pain management, or other opioid-related care. This ensures that individuals at risk of opioid overdose have access to naloxone as part of their treatment plan.

Retail pharmacies, such as community drug stores and chain pharmacies, have become essential distribution points for naloxone. They offer accessibility to the general public, making naloxone available without a prescription in many states. Retail pharmacies are instrumental in expanding access to naloxone for individuals, family members, and caregivers concerned about opioid overdose risks.

Others category encompasses additional distribution channels and settings that may provide naloxone, such as harm reduction programs, public health initiatives, and community-based organizations. These unconventional distribution methods are crucial for reaching marginalized populations and individuals at risk of opioid overdose.

US Naloxone Market Players

Some of the top US naloxone companies offered in our report includes Amphastar Pharmaceuticals, Inc., Adapt Pharma, Inc., Kaleo, Inc., Indivior Plc., Emergent BioSolutions Inc., Mylan N.V., Purdue Pharma L.P., Teleflex Incorporated, AptarGroup, Inc., and Sandoz Inc.

CHAPTER 1. Industry Overview of US Naloxone Market

1.1. Definition and Scope

1.1.1. Definition of Naloxone

1.1.2. Market Segmentation

1.1.3. Years Considered for the Study

1.1.4. Assumptions and Acronyms Used

1.1.4.1. Market Assumptions and Market Forecast

1.1.4.2. Acronyms Used in US Naloxone Market

1.2. Summary

1.2.1. Executive Summary

1.2.2. US Naloxone Market By Strength

1.2.3. US Naloxone Market By Route of Administration

1.2.4. US Naloxone Market By Distribution Channel

1.2.5. US Naloxone Market By Region

CHAPTER 2. Research Approach

2.1. Methodology

2.1.1. Research Programs

2.1.2. Market Size Estimation

2.1.3. Market Breakdown and Data Triangulation

2.2. Data Source

2.2.1. Secondary Sources

2.2.2. Primary Sources

CHAPTER 3. Market Dynamics And Competition Analysis

3.1. Market Drivers

3.1.1. Driver 1

3.1.2. Driver 2

3.2. Restraints and Challenges

3.2.1. Restraint 1

3.2.2. Restraint 2

3.3. Growth Opportunities

3.3.1. Opportunity 1

3.3.2. Opportunity 2

3.4. Porter’s Five Forces Analysis

3.4.1. Bargaining Power of Suppliers

3.4.2. Bargaining Power of Buyers

3.4.3. Threat of Substitute

3.4.4. Threat of New Entrants

3.4.5. Degree of Competition

3.5. Market Concentration Ratio and Market Maturity Analysis of US Naloxone Market

3.5.1. Go To Market Strategy

3.5.1.1. Introduction

3.5.1.2. Growth

3.5.1.3. Maturity

3.5.1.4. Saturation

3.5.1.5. Possible Development

3.6. Technological Roadmap for US Naloxone Market

3.7. Value Chain Analysis

3.7.1. List of Key Manufacturers

3.7.2. List of Customers

3.7.3. Level of Integration

3.8. Regulatory Compliance

3.9. Competitive Landscape, 2022

3.9.1. Player Positioning Analysis

3.9.2. Key Strategies Adopted By Leading Players

CHAPTER 4. US Naloxone Market By Strength

4.1. Introduction

4.2. US Naloxone Market Revenue By Strength

4.2.1. US Naloxone Market Revenue (USD Million) and Forecast, By Strength, 2020-2032

4.2.2. 2.0 mg/0.1 ml and 4.0 mg/ml

4.2.2.1. 2.0 mg/0.1 ml and 4.0 mg/ml Market Revenue (USD Million) and Growth Rate (%), 2020-2032

4.2.3. 1 mg/ml 0.4 mg/ml

4.2.3.1. 1 mg/ml 0.4 mg/ml Market Revenue (USD Million) and Growth Rate (%), 2020-2032

4.2.4. 0.4 mg/ml

4.2.4.1. 0.4 mg/ml Market Revenue (USD Million) and Growth Rate (%), 2020-2032

4.2.5. Others

4.2.5.1. Others Market Revenue (USD Million) and Growth Rate (%), 2020-2032

CHAPTER 5. US Naloxone Market By Route of Administration

5.1. Introduction

5.2. US Naloxone Market Revenue By Route of Administration

5.2.1. US Naloxone Market Revenue (USD Million) and Forecast, By Route of Administration, 2020-2032

5.2.2. Intranasal

5.2.2.1. Intranasal Market Revenue (USD Million) and Growth Rate (%), 2020-2032

5.2.3. Intramuscular/Subcutaneous

5.2.3.1. Intramuscular/Subcutaneous Market Revenue (USD Million) and Growth Rate (%), 2020-2032

5.2.4. Intravenous

5.2.4.1. Intravenous Market Revenue (USD Million) and Growth Rate (%), 2020-2032

CHAPTER 6. US Naloxone Market By Distribution Channel

6.1. Introduction

6.2. US Naloxone Market Revenue By Distribution Channel

6.2.1. US Naloxone Market Revenue (USD Million) and Forecast, By Distribution Channel, 2020-2032

6.2.2. Hospitals Pharmacies

6.2.2.1. Hospitals Pharmacies Market Revenue (USD Million) and Growth Rate (%), 2020-2032

6.2.3. Clinics Pharmacies

6.2.3.1. Clinics Pharmacies Market Revenue (USD Million) and Growth Rate (%), 2020-2032

6.2.4. Retail Pharmacies

6.2.4.1. Retail Pharmacies Market Revenue (USD Million) and Growth Rate (%), 2020-2032

6.2.5. Others

6.2.5.1. Others Market Revenue (USD Million) and Growth Rate (%), 2020-2032

CHAPTER 7. Player Analysis Of US Naloxone Market

7.1. US Naloxone Market Company Share Analysis

7.2. Competition Matrix

7.2.1. Competitive Benchmarking of key players by price, presence, market share, and R&D investment

7.2.2. New Product Launches and Product Enhancements

7.2.3. Mergers And Acquisition In US US Naloxone Market

7.2.4. Partnership, Joint Ventures and Strategic Alliances/ Sales Agreements

CHAPTER 8. Company Profile

8.1. Amphastar Pharmaceuticals, Inc.

8.1.1. Company Snapshot

8.1.2. Business Overview

8.1.3. Financial Overview

8.1.3.1. Revenue (USD Million), 2022

8.1.3.2. Amphastar Pharmaceuticals, Inc. 2022 Naloxone Business Regional Distribution

8.1.4. Product /Service and Specification

8.1.5. Recent Developments & Business Strategy

8.2. Adapt Pharma, Inc.

8.3. Kaleo, Inc.

8.4. Indivior Plc.

8.5. Emergent BioSolutions Inc.

8.6. Mylan N.V.

8.7. Purdue Pharma L.P.

8.8. Teleflex Incorporated

8.9. AptarGroup, Inc.

8.10. Sandoz Inc.