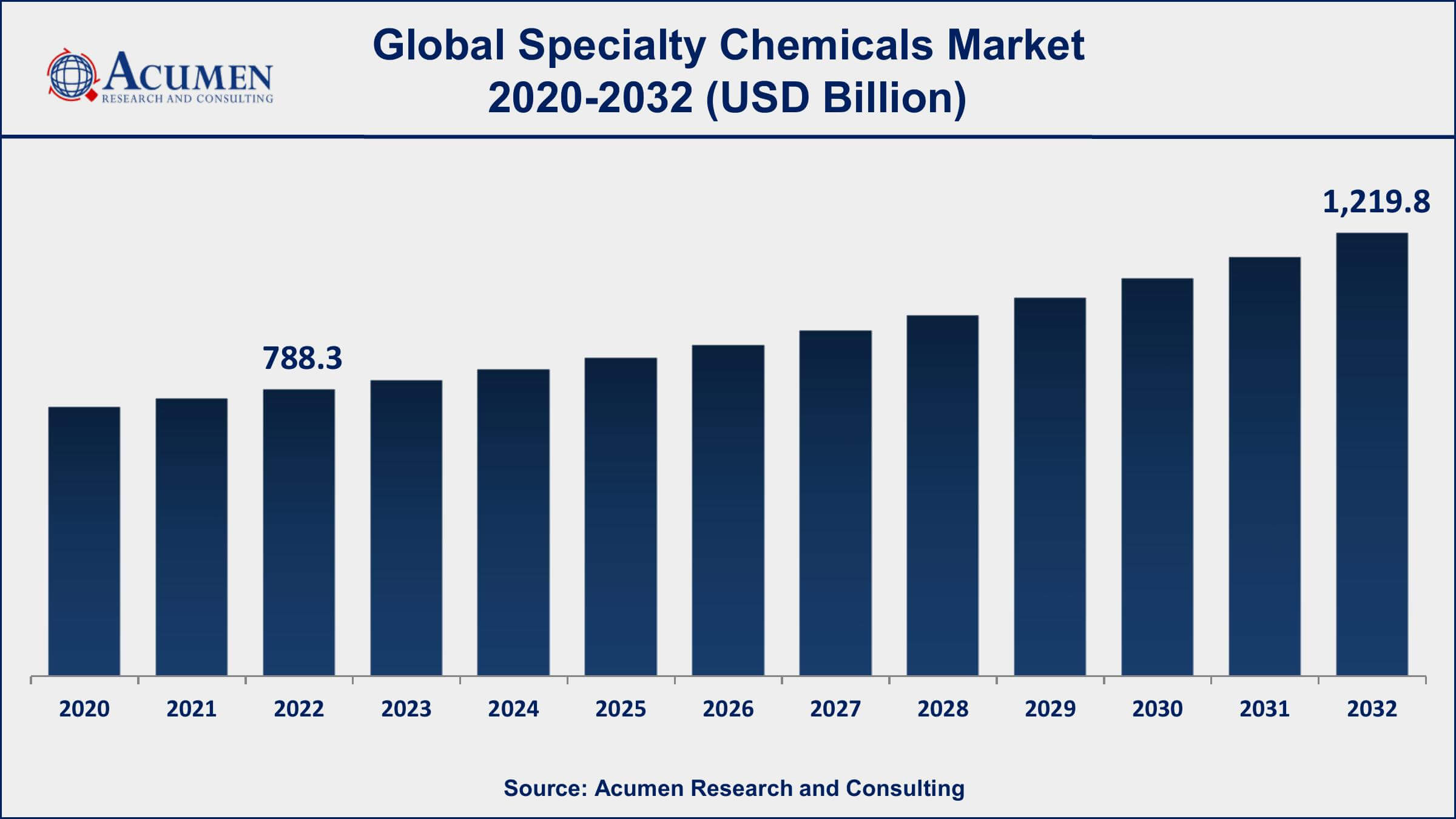

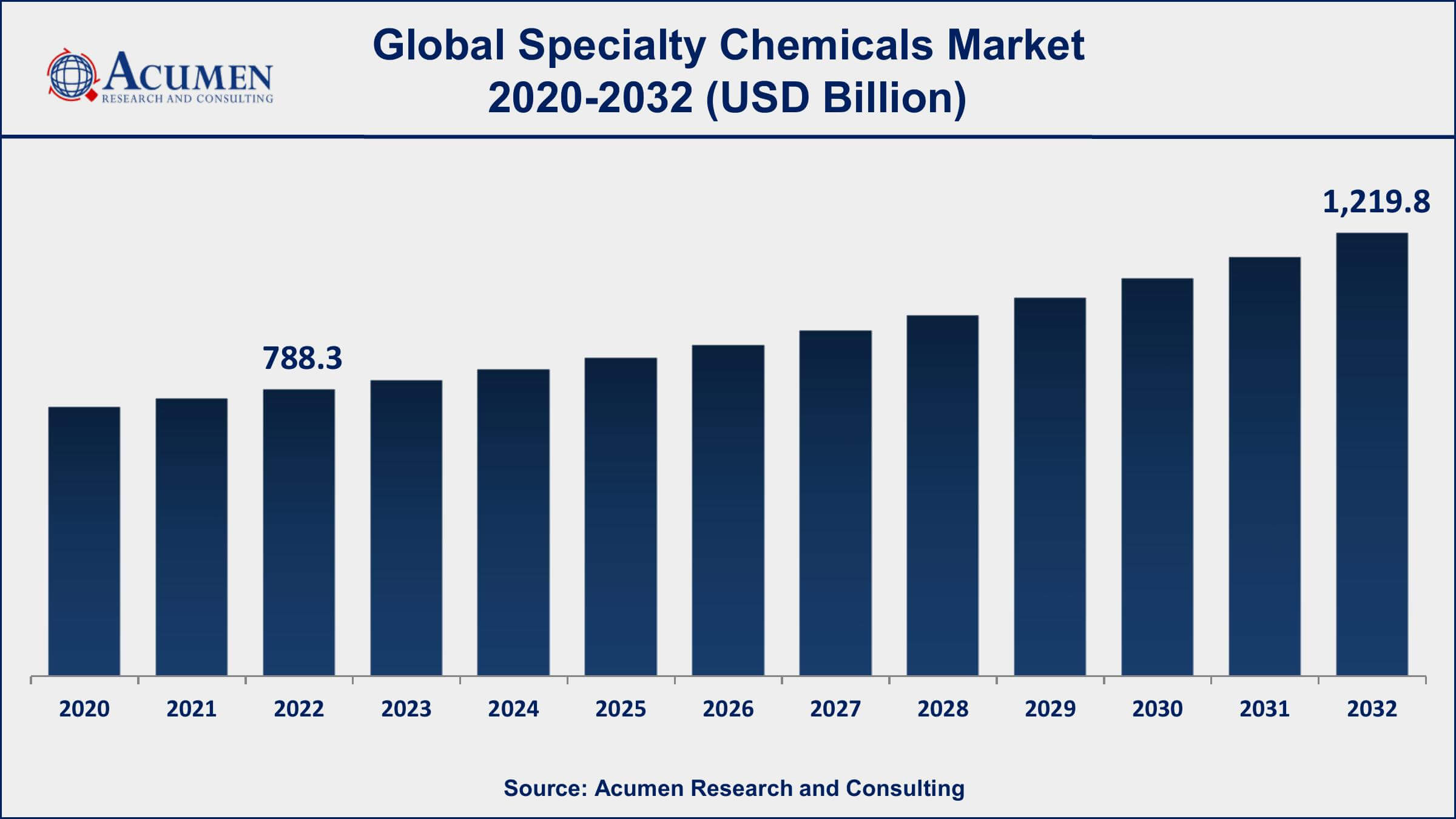

The Global Specialty Chemicals Market Size accounted for USD 788.3 Billion in 2022 and is projected to achieve a market size of USD 1,219.8 Billion by 2032 growing at a CAGR of 4.6% from 2023 to 2032.

Specialty Chemicals Market Report Key Highlights

- Global specialty chemicals market revenue is expected to increase by USD 1,219.8 Billion by 2032, with a 4.6% CAGR from 2023 to 2032

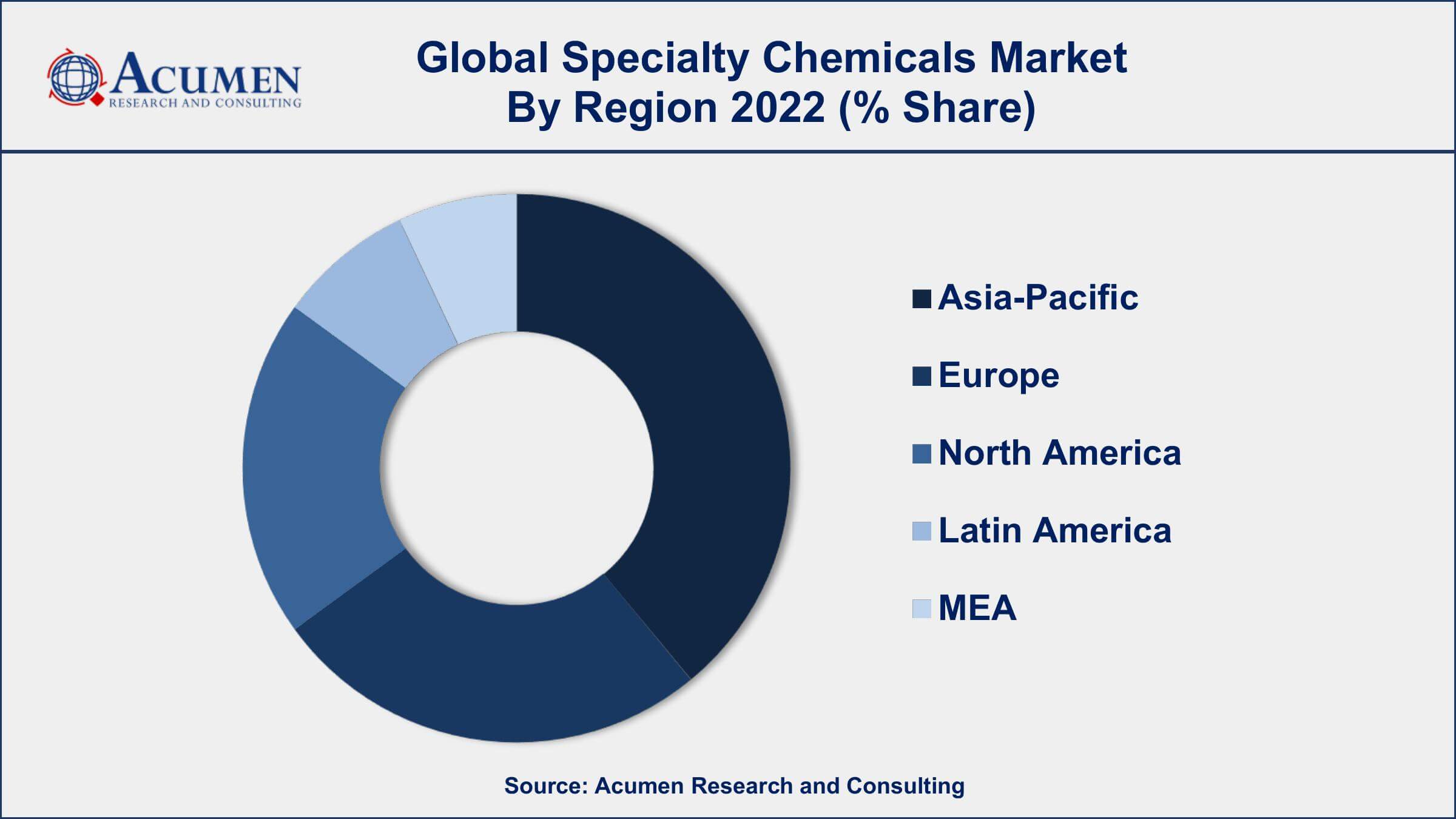

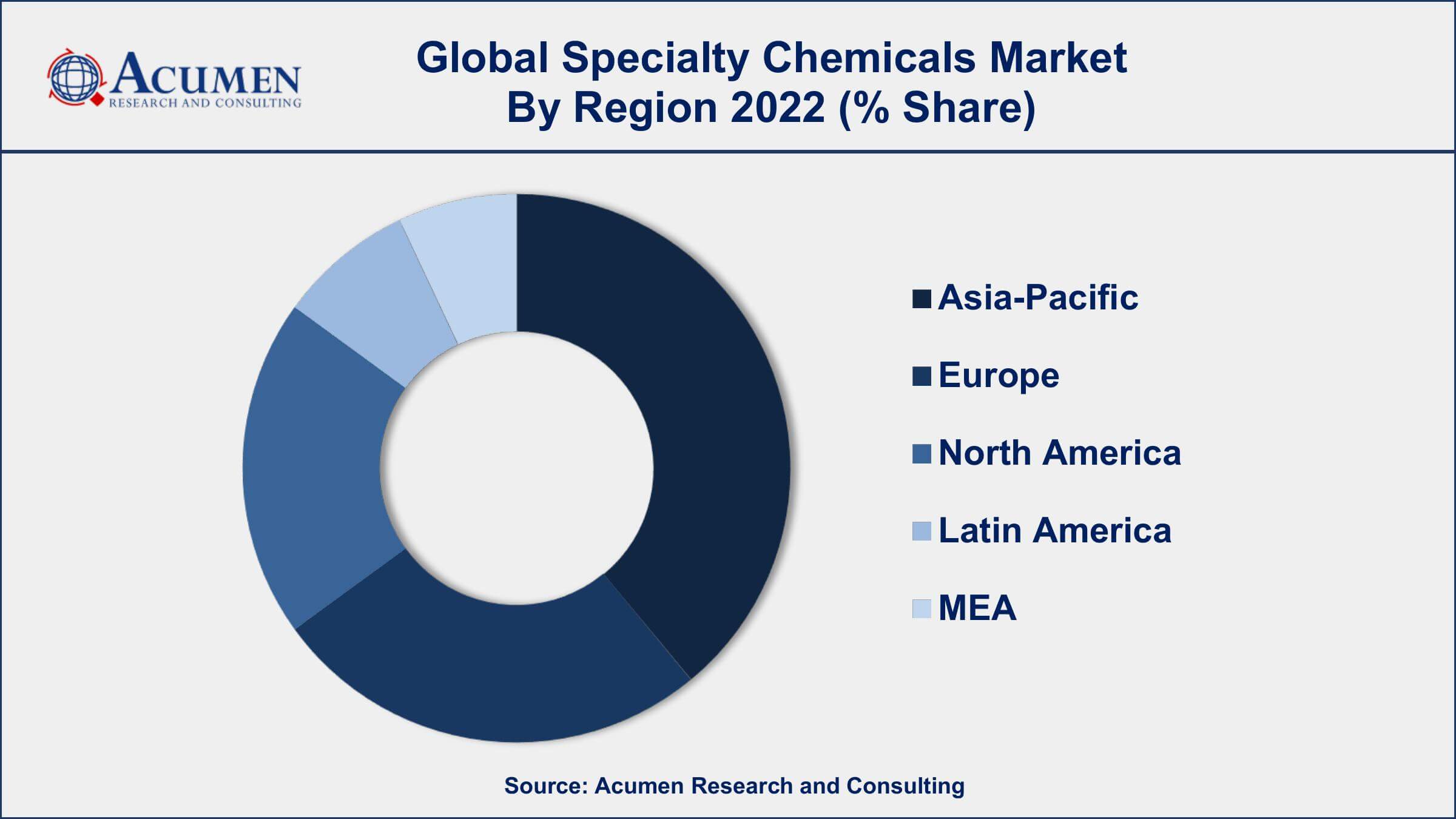

- Asia-Pacific region led with more than 42% of specialty chemicals market share in 2022

- The construction chemicals is the fastest-growing segment in market, with a CAGR of 5% from 2023 to 2032

- pharmaceutical ingredients are the largest segment of specialty chemicals used in the pharmaceutical industry

- The top 10 specialty chemical companies in the world accounted for approximately 35% of the global market share in 2022

- BASF SE is the largest chemical producer in the world and has a diverse portfolio of specialty chemicals, including coatings, plastics, performance chemicals, and nutrition and care products

- The key application areas for specialty chemicals include adhesives and sealants, coatings and paints, construction chemicals, electronic chemicals, flavors and fragrances, and personal care and cosmetics

- Growing demand for environmentally friendly chemicals, drives the specialty chemicals market size

Specialty chemicals refer to high-value-added chemicals that are used in a wide range of applications, such as pharmaceuticals, cosmetics, food additives, and specialty coatings. These chemicals are typically produced in small quantities, but they offer unique properties and benefits that cannot be obtained from other chemicals. The specialty chemicals industry plays a critical role in the global economy and is expected to experience significant growth in the coming years.

The market for specialty chemicals has been growing rapidly in recent years, driven by increasing demand from end-user industries such as automotive, electronics, and healthcare. In addition, the rising demand for specialty chemicals in emerging economies, such as China, India, and Brazil, is expected to further boost the market growth. One of the key drivers of the specialty chemicals market growth is the increasing demand for high-performance materials that offer superior properties, such as durability, chemical resistance, and fire resistance. These materials are used in a wide range of applications, such as construction, automotive, and electronics, and they are expected to fuel market growth in the coming years.

Global Specialty Chemicals Market Trends

Market Drivers

- Increasing demand for high-performance materials in various end-use industries, such as construction, automotive, and electronics

- Growing demand for environmentally friendly chemicals, such as bio-based chemicals and green solvents

- Increasing focus on research and development to develop new and innovative specialty chemicals

- Growing demand for specialty chemicals in the healthcare industry, particularly for pharmaceuticals and medical devices

Market Restraints

- High cost of specialty chemicals compared to traditional chemicals

- Stringent regulations and compliance requirements for specialty chemical production and usage

Market Opportunities

- Growing demand for specialty chemicals in the personal care and cosmetics industries

- Increasing focus on sustainable and eco-friendly specialty chemicals and production processes

Specialty Chemicals Market Report Coverage

| Market |

Specialty Chemicals Market |

| Specialty Chemicals Market Size 2022 |

USD 788.3 Billion |

| Specialty Chemicals Market Forecast 2032 |

USD 1,219.8 Billion |

| Specialty Chemicals Market CAGR During 2023 - 2032 |

4.6% |

| Specialty Chemicals Market Analysis Period |

2020 - 2032 |

| Specialty Chemicals Market Base Year |

2022 |

| Specialty Chemicals Market Forecast Data |

2023 - 2032 |

| Segments Covered |

By Application, And By Geography

|

| Regional Scope |

North America, Europe, Asia Pacific, Latin America, and Middle East & Africa |

| Key Companies Profiled |

Dow, Inc., BASF SE, Bayer AG, Lanxess AG, Evonik Industries AG, Solvay SA, Huntsman International LLC, Clariant AG, Albemarle Corporation, Sumitomo Chemical Company, Nouryon, and Ashland LLC.

|

Report Coverage

|

Market Trends, Drivers, Restraints, Competitive Analysis, Player Profiling, Covid-19 Analysis, Regulation Analysis |

Specialty Chemicals Market Dynamics

Specialty chemicals also called effect chemicals or specialties, are specific chemical products that furnish a large number and variety of effects on which the growth of various other industries depends. Some of the types of specialty chemicals include agrichemicals, adhesives, cosmetic additives, cleaning materials, elastomers, construction chemicals, food additives, flavors, industrial gases, lubricants, fragrances, surfactants, polymers and textile auxiliaries among others. Various industrial sectors including aerospace, automobile, cosmetics, food, manufacturing, agriculture, and textile depend largely on such specialty chemical products. Specialty chemicals are those chemicals that are used depending on their functions and performance. As a result, specialty chemicals are often referred to as formulation chemicals or performance chemicals. Specialty chemicals can be a mixture of molecules or unique molecules also called formulations. The chemical and physical characteristics of the formulated mixture or single molecules as well as the composition of the aforementioned mixtures affect the overall performance of the end product. In various commercial applications, specialty chemical manufacturers concentrate on bringing innovative technology solutions for their group of customers. Hence, this is a differentiating facility in the options furnished by specialty chemical manufacturers when they are related to other sectors of the global industry including commodity chemicals, fine chemicals, pharmaceuticals, and petrochemicals.

Rising industrial activities, especially in the sectors such as food, agriculture, cosmetics, and other sectors in developing economies including Brazil, India, and China are some key factors anticipated to drive the demand for specialty chemicals during the forecast period. In addition, the increasing use of specialty chemicals in the water treatment process across the globe is another factor fuelling the global specialty chemicals market value. Further, increasing development and introduction of relatively more sophisticated water treatment processes including ion exchange involves the use of specialty chemicals. Stringent government norms on the use of specific specialty chemicals in the food industry may hamper the global specialty chemicals market size over the forecast period. Furthermore, increasing industrial activities, especially in developing economies such as China, India, Turkey, Russia, Poland, Indonesia, and Brazil in turn increased the demand for specialty chemicals. Japan and China are anticipated to maintain their dominance in the Asia-Pacific specialty chemicals market throughout the forecast period. Institutional and industrial cleaners, specialty polymers, electronic chemicals, construction chemicals, and some specific flavors and fragrances are widely used specialty chemicals across the globe.

Specialty Chemicals Market Segmentation

The global Specialty Chemicals market segmentation is based on application, and geography.

Specialty Chemicals Market By Application

- Agrochemicals

- Insecticide

- Herbicides

- Fungicides

- Ammonium Sulphate Fertilizers

- Calcium Nitrate Fertilizers

- Others

- Flavors Ingredients

- Dairy

- Savory

- Beverages

- Others

- Fragrances Ingredients

- Personal Care

- Hair Care

- Fabric Care

- Others

- Dyes & Pigments

- Personal Care Active Ingredients

- Water Treatment Chemicals

- Corrosion and Scale Inhibitor

- Biocides and Disinfectants

- Coagulants and Flocculants

- Activated Car

- Surfactants

- Cationic

- Nonionic

- Amphoteric

- Anionic

- Others

- Bio-based Chemicals

- Acetic Acid

- Ethanol

- Furfural

- Others

- Construction Chemicals

- Asphalt Additives

- Adhesives and Sealants

- Concrete Admixtures

- Protective Coatings

- Others

- Textile Chemicals

- Finishing Chemicals

- Colorants and Auxiliaries

- Coating and Sizing Chemicals

- Others

- Polymer Additive

- Oilfield Chemicals

- Drilling Fluids

- Cementing Chemicals

- Fracturing Chemicals

- Acidizing Chemicals

- Oil Production Chemicals

- Others

- Electronics Chemicals

- Specialty Gases

- Conductive Polymers

- Photoresist Chemicals

- Wet Chemicals

- Silicon Wafers

- PCB Laminates

- Others

- Specialty Polymers

- Pharmaceutical Ingredients

- Chemical API

- Biological API

- Paper & Pulp Chemicals

- Bleaching & RCF Chemicals

- Pigments & Fillers

- Process Chemicals

- Functional Chemicals

- Coating chemicals

- Others

According to the specialty chemicals industry analysis, the pharmaceutical ingredient segment held the largest market share in 2022. Specialty chemicals are used extensively in the pharmaceutical industry to develop and manufacture active pharmaceutical ingredients (APIs) and other key components of pharmaceutical products. APIs are the primary active components in pharmaceutical drugs, and they are responsible for their therapeutic effects. Specialty chemicals are used in the production of APIs to enhance their efficacy, stability, and bioavailability. They are also used in the development of pharmaceutical excipients, which are non-active ingredients that are used to improve the formulation and delivery of APIs. The pharmaceutical industry is a major consumer of specialty chemicals, and it is expected to remain a key driver of market growth in the coming years. The increasing demand for innovative and effective drugs, particularly for chronic and lifestyle diseases, is expected to fuel the demand for specialty chemicals in the pharmaceutical industry.

Moreover, as per the specialty chemicals market forecast, the construction chemicals segment is expected to grow significantly in the coming years. Construction chemicals are specialty chemicals that are used in the construction industry to enhance the performance, durability, and aesthetic appeal of buildings and structures. Construction chemicals include a wide range of products, such as adhesives, sealants, coatings, waterproofing materials, and concrete additives. These products are used in various stages of the construction process, from the foundation to the finishing stages, to improve the quality, safety, and sustainability of buildings. The construction industry is a major consumer of specialty chemicals, and it is expected to remain a key driver of market growth in the coming years.

Specialty Chemicals Market Regional Outlook

North America

Europe

- U.K.

- Germany

- France

- Spain

- Rest of Europe

Asia-Pacific

- India

- Japan

- China

- Australia

- South Korea

- Rest of Asia-Pacific

Latin America

- Brazil

- Mexico

- Rest of Latin America

The Middle East & Africa

- South Africa

- GCC Countries

- Rest of the Middle East & Africa (ME&A)

Specialty Chemicals Market Regional Analysis

Asia-Pacific is one of the largest and fastest-growing markets for specialty chemicals, accounting for a significant share of the global market. The region's dominance in the specialty chemicals market can be attributed to several factors, including rapid industrialization, growing population and urbanization, favorable government policies, and increasing foreign investment. The region's growing focus on sustainable and eco-friendly chemicals, combined with the increasing adoption of advanced technologies and manufacturing processes, is also creating new opportunities for specialty chemical companies in the region. Moreover, the region has a strong manufacturing base and is home to many large chemical companies that produce and export specialty chemicals to other parts of the world. The favorable business environment, low labor costs, and access to raw materials are some of the factors that make the region an attractive location for chemical manufacturers.

Specialty Chemicals Market Player

Some of the top specialty chemicals market companies offered in the professional report includes Dow, Inc., BASF SE, Bayer AG, Lanxess AG, Evonik Industries AG, Solvay SA, Huntsman International LLC, Clariant AG, Albemarle Corporation, Sumitomo Chemical Company, Nouryon, and Ashland LLC.

CHAPTER 1. Industry Overview of Specialty Chemicals Market

1.1. Definition and Scope

1.1.1. Definition of Specialty Chemicals

1.1.2. Market Segmentation

1.1.3. Years Considered for the Study

1.1.4. Assumptions and Acronyms Used

1.1.4.1. Market Assumptions and Market Forecast

1.1.4.2. Acronyms Used in Global Specialty Chemicals Market

1.2. Summary

1.2.1. Executive Summary

1.2.2. Specialty Chemicals Market By Application

1.2.3. Specialty Chemicals Market By Region

CHAPTER 2. Research Approach

2.1. Methodology

2.1.1. Research Programs

2.1.2. Market Size Estimation

2.1.3. Market Breakdown and Data Triangulation

2.2. Data Application

2.2.1. Secondary Source

2.2.2. Primary Source

CHAPTER 3. Market Dynamics And Competition Analysis

3.1. Market Drivers

3.1.1. Driver 1

3.1.2. Driver 2

3.2. Restraints and Challenges

3.2.1. Restraint 1

3.2.2. Restraint 2

3.3. Growth Opportunities

3.3.1. Opportunity 1

3.3.2. Opportunity 2

3.4. Porter’s Five Forces Analysis

3.4.1. Bargaining Power of Suppliers

3.4.2. Bargaining Power of Buyers

3.4.3. Threat of Substitute

3.4.4. Threat of New Entrants

3.4.5. Degree of Competition

3.5. Market Concentration Ratio and Market Maturity Analysis of Specialty Chemicals Market

3.5.1. Go To Market Strategy

3.5.1.1. Introduction

3.5.1.2. Growth

3.5.1.3. Maturity

3.5.1.4. Saturation

3.5.1.5. Possible Development

3.6. Technological Roadmap for Specialty Chemicals Market

3.7. Value Chain Analysis

3.7.1. List of Key Manufacturers

3.7.2. List of Customers

3.7.3. Level of Integration

3.8. Price Trend of Key Raw Materials

3.8.1. Raw Material Suppliers

3.8.2. Proportion of Manufacturing Cost Structure

3.8.2.1. Raw Material

3.8.2.2. Labor Cost

3.8.2.3. Manufacturing Expense

3.9. Regulatory Compliance

3.10. Competitive Landscape, 2022

3.10.1. Player Positioning Analysis

3.10.2. Key Strategies Adopted By Leading Players

CHAPTER 4. Manufacturing Plant Analysis

4.1. Manufacturing Plant Location and Establish Date of Major Manufacturers in 2022

4.2. R&D Status of Major Manufacturers in 2022

CHAPTER 5. Specialty Chemicals Market By Application

5.1. Introduction

5.2. Specialty Chemicals Revenue By Application

5.2.1. Specialty Chemicals Revenue (USD Billion) and Forecast, By Application, 2020-2032

5.2.2. Flavors Ingredients

5.2.2.1. Flavors Ingredients Market Revenue (USD Billion) and Growth Rate (%), 2020-2032

5.2.3. Agrochemicals

5.2.3.1. Agrochemicals Market Revenue (USD Billion) and Growth Rate (%), 2020-2032

5.2.4. Dyes & Pigments

5.2.4.1. Dyes & Pigments Market Revenue (USD Billion) and Growth Rate (%), 2020-2032

5.2.5. Fragrances Ingredients

5.2.5.1. Fragrances Ingredients Market Revenue (USD Billion) and Growth Rate (%), 2020-2032

5.2.6. Water Treatment Chemicals

5.2.6.1. Water Treatment Chemicals Market Revenue (USD Billion) and Growth Rate (%), 2020-2032

5.2.7. Personal Care Active Ingredients

5.2.7.1. Personal Care Active Ingredients Market Revenue (USD Billion) and Growth Rate (%), 2020-2032

5.2.8. Surfactants

5.2.8.1. Surfactants Market Revenue (USD Billion) and Growth Rate (%), 2020-2032

5.2.9. Construction Chemicals

5.2.9.1. Construction Chemicals Market Revenue (USD Billion) and Growth Rate (%), 2020-2032

5.2.10. Bio-based Chemicals

5.2.10.1. Bio-based Chemicals Market Revenue (USD Billion) and Growth Rate (%), 2020-2032

5.2.11. Textile Chemicals

5.2.11.1. Textile Chemicals Market Revenue (USD Billion) and Growth Rate (%), 2020-2032

5.2.12. Oilfield Chemicals

5.2.12.1. Oilfield Chemicals Market Revenue (USD Billion) and Growth Rate (%), 2020-2032

5.2.13. Polymer Additive

5.2.13.1. Polymer Additive Market Revenue (USD Billion) and Growth Rate (%), 2020-2032

5.2.14. Electronics Chemicals

5.2.14.1. Electronics Chemicals Market Revenue (USD Billion) and Growth Rate (%), 2020-2032

5.2.15. Paper & Pulp Chemicals

5.2.15.1. Paper & Pulp Chemicals Market Revenue (USD Billion) and Growth Rate (%), 2020-2032

5.2.16. Pharmaceutical Ingredients

5.2.16.1. Pharmaceutical Ingredients Market Revenue (USD Billion) and Growth Rate (%), 2020-2032

5.2.17. Specialty Polymers

5.2.17.1. Specialty Polymers Market Revenue (USD Billion) and Growth Rate (%), 2020-2032

5.2.18. Others

5.2.18.1. Others Market Revenue (USD Billion) and Growth Rate (%), 2020-2032

CHAPTER 6. North America Specialty Chemicals Market By Country

6.1. North America Specialty Chemicals Market Overview

6.2. U.S.

6.2.1. U.S. Specialty Chemicals Revenue (USD Billion) and Forecast By Application, 2020-2032

6.3. Canada

6.3.1. Canada Specialty Chemicals Revenue (USD Billion) and Forecast By Application, 2020-2032

6.4. North America PEST Analysis

CHAPTER 7. Europe Specialty Chemicals Market By Country

7.1. Europe Specialty Chemicals Market Overview

7.2. U.K.

7.2.1. U.K. Specialty Chemicals Revenue (USD Billion) and Forecast By Application, 2020-2032

7.3. Germany

7.3.1. Germany Specialty Chemicals Revenue (USD Billion) and Forecast By Application, 2020-2032

7.4. France

7.4.1. France Specialty Chemicals Revenue (USD Billion) and Forecast By Application, 2020-2032

7.5. Spain

7.5.1. Spain Specialty Chemicals Revenue (USD Billion) and Forecast By Application, 2020-2032

7.6. Rest of Europe

7.6.1. Rest of Europe Specialty Chemicals Revenue (USD Billion) and Forecast By Application, 2020-2032

7.7. Europe PEST Analysis

CHAPTER 8. Asia Pacific Specialty Chemicals Market By Country

8.1. Asia Pacific Specialty Chemicals Market Overview

8.2. China

8.2.1. China Specialty Chemicals Revenue (USD Billion) and Forecast By Application, 2020-2032

8.3. Japan

8.3.1. Japan Specialty Chemicals Revenue (USD Billion) and Forecast By Application, 2020-2032

8.4. India

8.4.1. India Specialty Chemicals Revenue (USD Billion) and Forecast By Application, 2020-2032

8.5. Australia

8.5.1. Australia Specialty Chemicals Revenue (USD Billion) and Forecast By Application, 2020-2032

8.6. South Korea

8.6.1. South Korea Specialty Chemicals Revenue (USD Billion) and Forecast By Application, 2020-2032

8.7. Rest of Asia-Pacific

8.7.1. Rest of Asia-Pacific Specialty Chemicals Revenue (USD Billion) and Forecast By Application, 2020-2032

8.8. Asia Pacific PEST Analysis

CHAPTER 9. Latin America Specialty Chemicals Market By Country

9.1. Latin America Specialty Chemicals Market Overview

9.2. Brazil

9.2.1. Brazil Specialty Chemicals Revenue (USD Billion) and Forecast By Application, 2020-2032

9.3. Mexico

9.3.1. Mexico Specialty Chemicals Revenue (USD Billion) and Forecast By Application, 2020-2032

9.4. Rest of Latin America

9.4.1. Rest of Latin America Specialty Chemicals Revenue (USD Billion) and Forecast By Application, 2020-2032

9.5. Latin America PEST Analysis

CHAPTER 10. Middle East & Africa Specialty Chemicals Market By Country

10.1. Middle East & Africa Specialty Chemicals Market Overview

10.2. GCC

10.2.1. GCC Specialty Chemicals Revenue (USD Billion) and Forecast By Application, 2020-2032

10.3. South Africa

10.3.1. South Africa Specialty Chemicals Revenue (USD Billion) and Forecast By Application, 2020-2032

10.4. Rest of Middle East & Africa

10.4.1. Rest of Middle East & Africa Specialty Chemicals Revenue (USD Billion) and Forecast By Application, 2020-2032

10.5. Middle East & Africa PEST Analysis

CHAPTER 11. Player Analysis Of Specialty Chemicals Market

11.1. Specialty Chemicals Market Company Share Analysis

11.2. Competition Matrix

11.2.1. Competitive Benchmarking Of Key Players By Price, Presence, Market Share, And R&D Investment

11.2.2. New Product Launches and Product Enhancements

11.2.3. Mergers And Acquisition In Global Specialty Chemicals Market

11.2.4. Partnership, Joint Ventures and Strategic Alliances/ Sales Agreements

CHAPTER 12. Company Profile

12.1. BASF SE

12.1.1. Company Snapshot

12.1.2. Business Overview

12.1.3. Financial Overview

12.1.3.1. Revenue (USD Billion), 2022

12.1.3.2. BASF SE 2022 Specialty Chemicals Business Regional Distribution

12.1.4. Product /Service and Specification

12.1.5. Recent Developments & Business Strategy

12.2. Dow, Inc.

12.3. Bayer AG

12.4. Evonik Industries AG

12.5. Lanxess AG

12.6. Solvay SA

12.7. Clariant AG

12.8. Huntsman International LLC

12.9. Albemarle Corporation

12.10. Nouryon

12.11. Sumitomo Chemical Company

12.12. Ashland LLC.