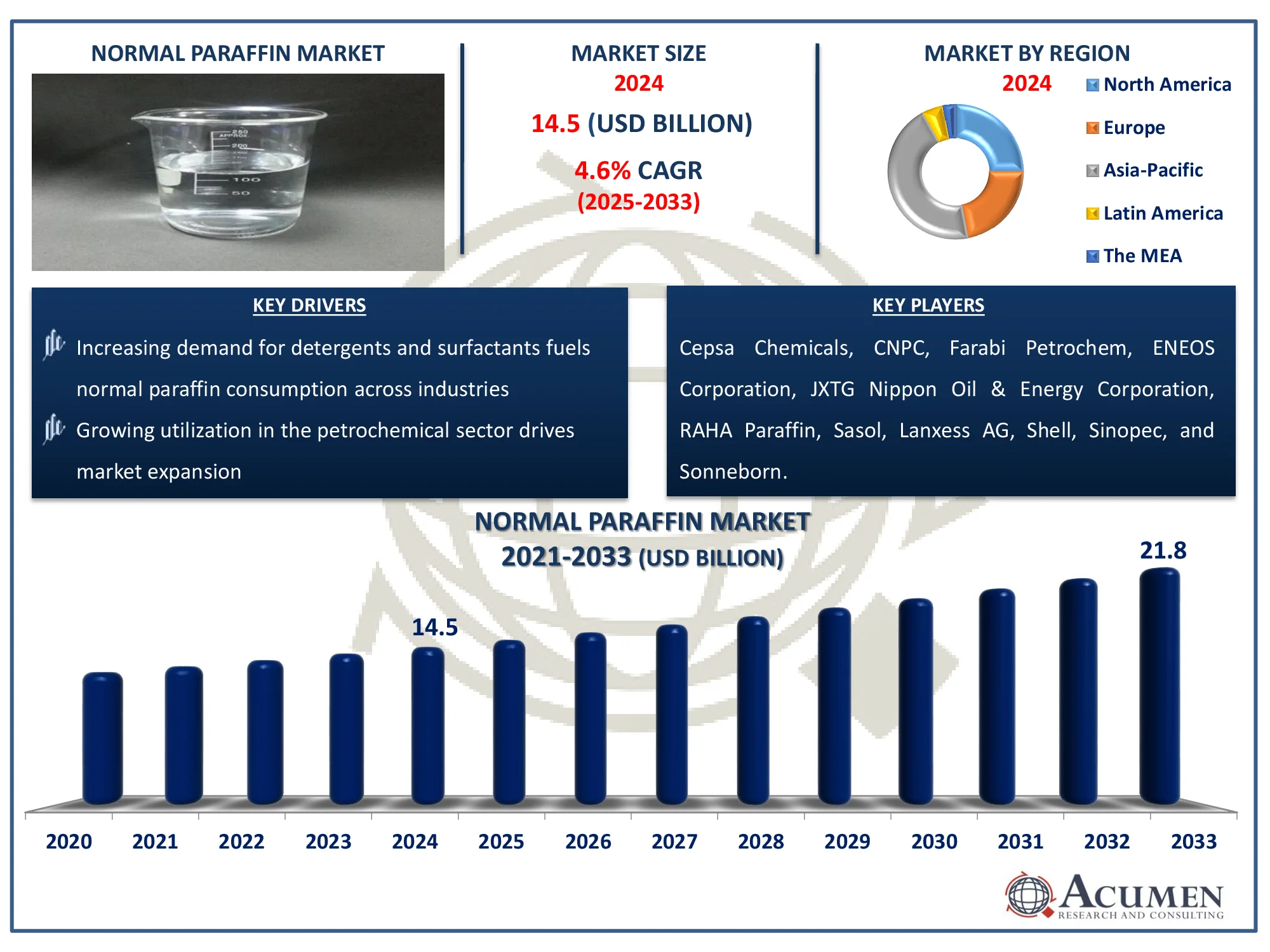

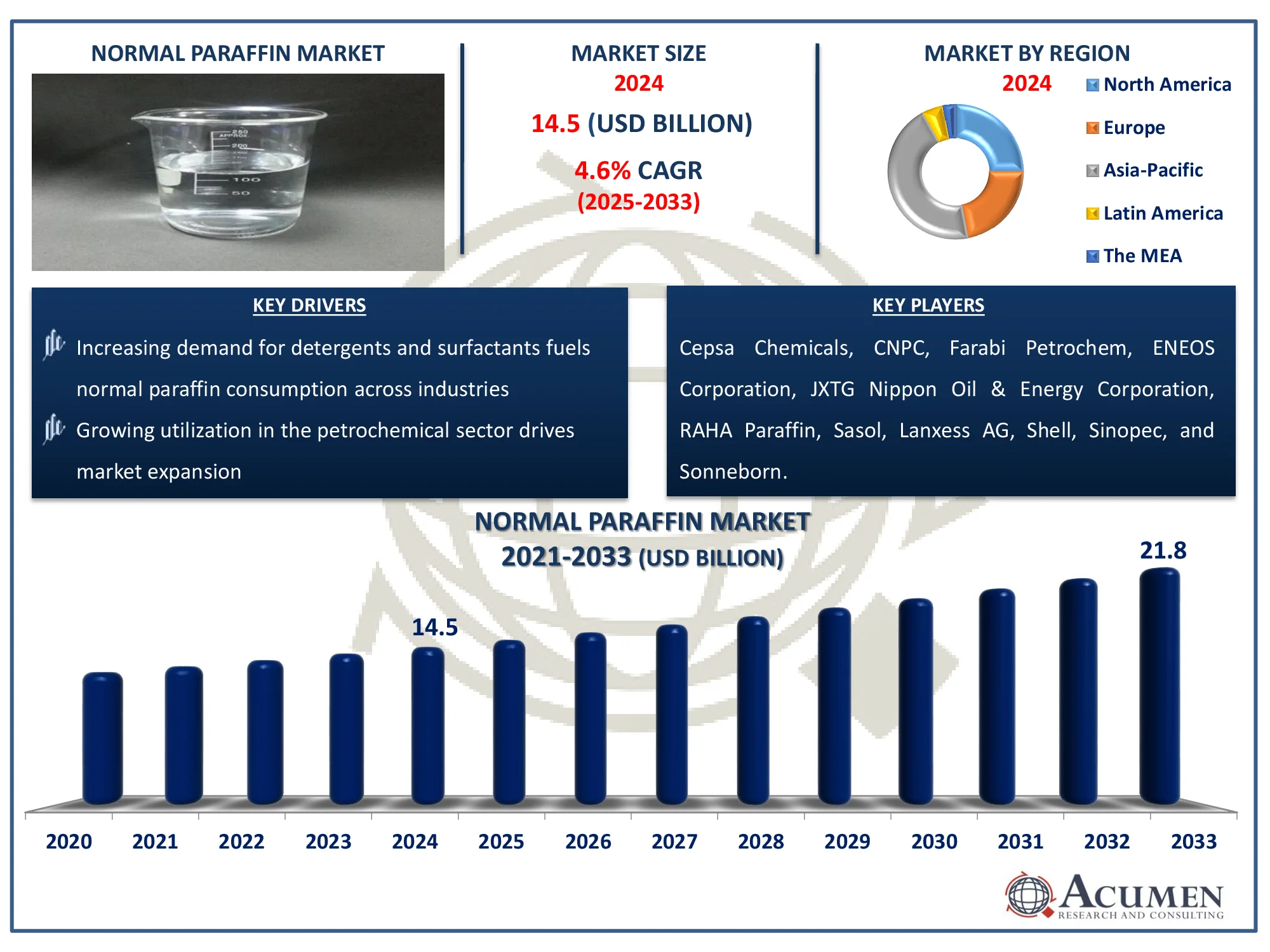

The Global Normal Paraffin Market Size accounted for USD 14.5 Billion in 2024 and is estimated to achieve a market size of USD 21.8 Billion by 2033 growing at a CAGR of 4.6% from 2025 to 2033.

Normal Paraffin Market Highlights

- The global normal paraffin market is projected to reach USD 21.8 billion by 2033, growing at a CAGR of 4.6% from 2025 to 2033

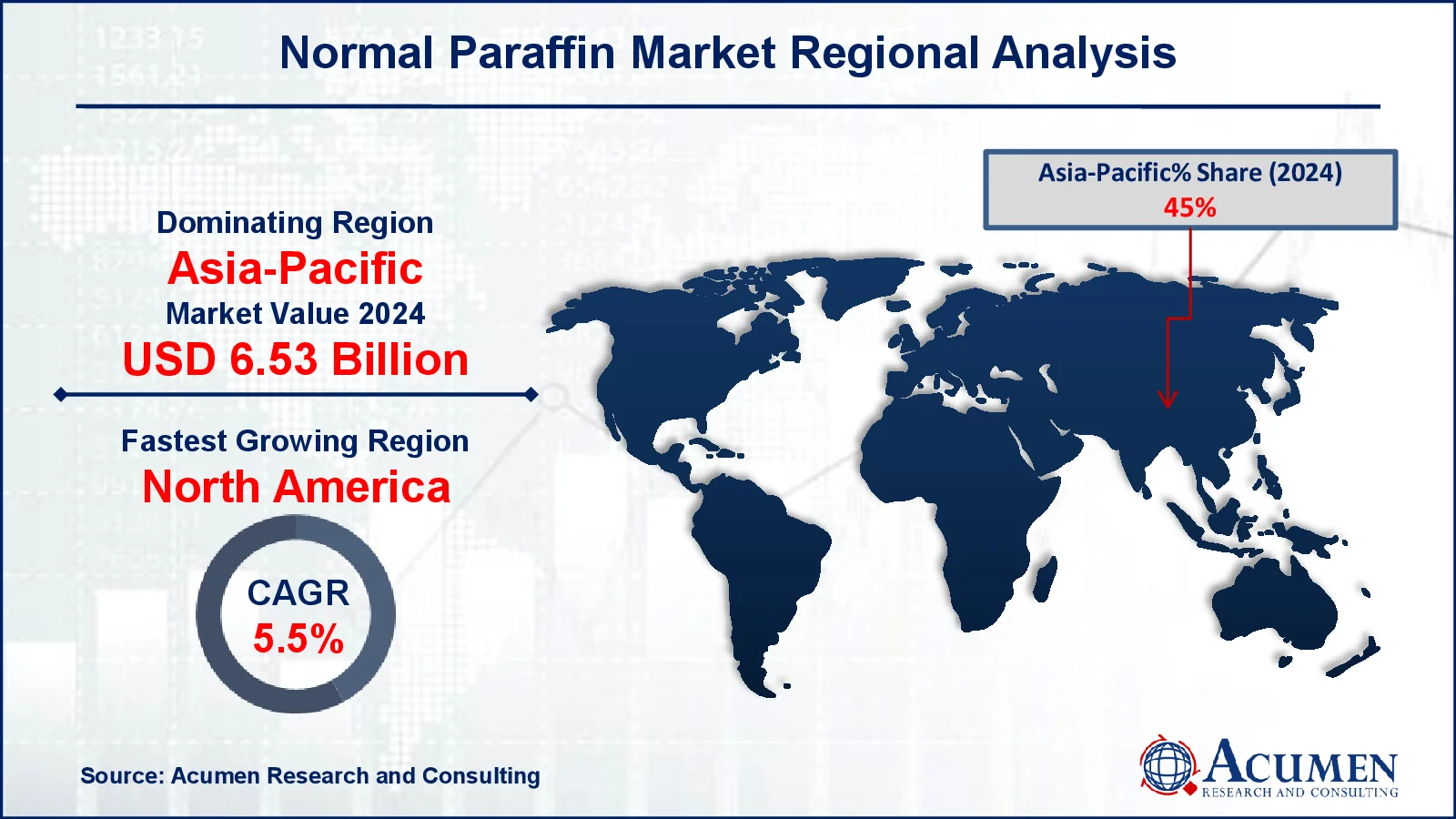

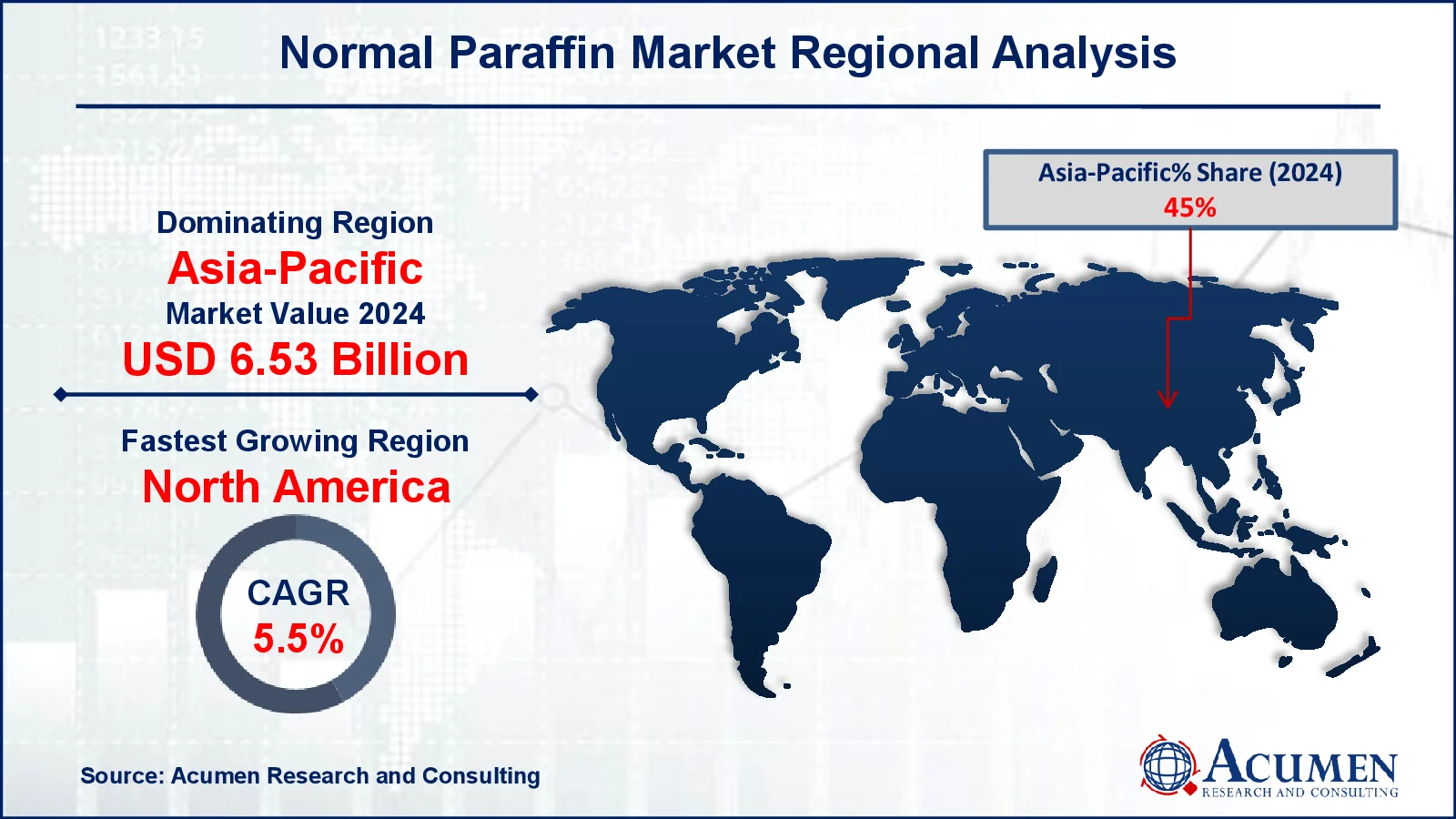

- The Asia-Pacific normal paraffin market was valued at approximately USD 6.53 billion in 2024

- The North American market is expected to expand at a CAGR of over 5.5% from 2025 to 2033

- The C5-C9 segment accounted for 36% of the market share in 2024

- Industrial-grade normal paraffin holds a 45% market share among different grades

- Detergents and surfactants applications contributed to 54% of the market share in 2024

- Based on form, the liquid segment dominates, holding 60% of the market share in 2024

- The rising demand for sustainable and eco-friendly products is a key Normal paraffin market trend driving industry growth

Normal paraffin, or n-paraffin, is a type of hydrocarbon characterized by a straight-chain molecular structure. Belonging to the alkane family, it consists of carbon and hydrogen atoms, following the general formula CnH2n+2. These compounds are saturated, meaning all carbon atoms are connected by single bonds, which enhances their stability. They naturally occur in crude oil and natural gas and are extracted and refined for various industrial purposes.

Due to their chemical properties, n-paraffins have numerous applications. They serve as key raw materials in the production of linear alkylbenzene (LAB), a crucial ingredient in detergents and surfactants. Additionally, they are used as solvents in the pharmaceutical and chemical industries, as well as in the manufacturing of chlorinated paraffins. In the petrochemical sector, they act as feedstock for producing various compounds. Their high purity and low reactivity also make them ideal for use in synthetic lubricant bases and specialty wax formulations.

Global Normal Paraffin Market Dynamics

Market Drivers

- Increasing demand for detergents and surfactants fuels normal paraffin consumption across industries

- Growing utilization in the petrochemical sector drives market expansion

- Rising applications in pharmaceuticals and chemical industries boost demand

- Growth in the renewable energy sector creates opportunities for bio-based normal paraffin products

Market Restraints

- Fluctuations in crude oil prices impact market stability and profitability

- Environmental concerns regarding fossil fuel derivatives present challenges

- Strict regulatory policies hinder market growth and expansion

Market Opportunities

- Development of bio-based normal paraffins addresses environmental and regulatory concerns

- Advancements in sustainable production processes improve efficiency and reduce carbon footprint

- Expanding markets in emerging economies provide significant growth opportunities

Normal Paraffin Market Report Coverage

|

Market

|

Normal Paraffin Market

|

|

Normal Paraffin Market Size 2024

|

USD 14.5 Billion

|

|

Normal Paraffin Market Forecast 2033

|

USD 21.8 Billion

|

|

Normal Paraffin Market CAGR During 2025 - 2033

|

4.6%

|

|

Normal Paraffin Market Analysis Period

|

2021 - 2033

|

|

Normal Paraffin Market Base Year

|

2024

|

|

Normal Paraffin Market Forecast Data

|

2025 - 2033

|

|

Segments Covered

|

By Type, By Grade, By Form, By Application, and By Geography

|

|

Regional Scope

|

North America, Europe, Asia Pacific, Latin America, and Middle East & Africa

|

|

Key Companies Profiled

|

Cepsa Chemicals, CNPC, Farabi Petrochem, ENEOS Corporation, JXTG Nippon Oil & Energy Corporation, RAHA Paraffin, Sasol, Lanxess AG, Shell, Sinopec, and Sonneborn

|

|

Report Coverage

|

Market Trends, Drivers, Restraints, Competitive Analysis, Player Profiling, Covid-19 Analysis, Regulation Analysis

|

Normal Paraffin Market Insights

Several key factors drive the growth and expansion of the normal paraffin market. One significant driver is the increasing demand for detergents and surfactants, essential components in household and industrial cleaning solutions. Normal paraffins, particularly those used in the production of linear alkylbenzene (LAB), play a crucial role in detergent manufacturing. The rising global population, urbanization, and improved living standards have led to higher consumption of cleaning products, boosting the demand for normal paraffins. Additionally, the expanding petrochemical industry, which relies on normal paraffins as feedstock for various chemical processes, further contributes to N-paraffin market growth.

Despite these growth drivers, the normal paraffin market faces several challenges. One major concern is the volatility of crude oil prices, as normal paraffins are derived from petroleum. Fluctuating oil prices create uncertainty in production costs and can impact market stability. Environmental concerns surrounding fossil fuel derivatives also pose limitations. As global awareness of sustainability issues increases, industries face mounting pressure to reduce their carbon footprint, which may restrict the use of traditional paraffins. Additionally, stringent regulatory policies aimed at lowering emissions and promoting sustainability impose compliance costs and operational constraints on market participants.

However, these challenges also create opportunities for innovation and N-paraffin market expansion. The development of bio-based normal paraffins, sourced from renewable materials like biomass, is gaining traction as a sustainable alternative to conventional paraffins. This shift is driven by both regulatory requirements and growing consumer demand for eco-friendly products. Advancements in sustainable production processes, aimed at reducing emissions and improving energy efficiency, further open new avenues for growth. Moreover, emerging economies present significant potential, as industrialization and urbanization continue to drive demand for normal paraffin-based products. Companies that successfully navigate these market dynamics are well-positioned to capitalize on the evolving industry landscape.

Normal Paraffin Market Segmentation

Normal Paraffin Market Segmentation

The worldwide market for normal paraffin is split based on treatment, type, grade, form, application, and geography.

Normal Paraffin Market By Type

- C5-C9

- C10-C13

- C14-C17

- C18-C20

According to normal paraffin industry analysis, the C5-C9 segment holds a dominant position in the N-paraffin market due to its extensive use in specialized chemical applications. These shorter-chain paraffins are widely utilized as solvents, fuel additives, and intermediates in the production of various petrochemical products, including synthetic resins and adhesives. Their high volatility and efficient combustion properties make them ideal for use in gasoline blending, aerosols, and industrial formulations, further strengthening their market leadership.

Normal Paraffin Market By Grade

- Industrial Grade

- Pharmaceutical Grade

- Cosmetic Grade

According to normal paraffin industry analysis, the industrial-grade N-paraffin segment has emerged as the dominant category due to its extensive applications across multiple industries. It is widely utilized in the production of detergents and surfactants, lubricants, chlorinated paraffins, and chemical solvents. Its versatility and cost-effectiveness make it the preferred choice for large-scale industrial use, contributing to its significant market share. The rising demand for industrial cleaning agents, petrochemicals, and other industrial products has further strengthened the market position of industrial-grade N-paraffin.

Normal Paraffin Market By Form

According to normal paraffin industry analysis, the liquid form of N-paraffin has dominated the market due to its versatility and broad applications across various industries. It is widely used as a solvent in industrial processes, a base material for lubricants and oilfield chemicals, and a key component in the formulation of detergents and surfactants. Its fluid nature allows for easier handling and seamless integration into formulations, making it ideal for industries requiring precision mixing and application. The strong demand for liquid N-paraffins is driven by their efficient performance and adaptability across multiple sectors, reinforcing their N-paraffin market leadership.

Normal Paraffin Market By Application

- Detergents and Surfactants

- Lubricants

- Chlorinated Paraffins

- Solvents

- Oilfield Chemicals

- Others

According to normal paraffin market forecast, the detergents and surfactants sub-segment is projected to generate substantial revenue from 2024 to 2032. N-paraffins, particularly those used in the production of linear alkylbenzene (LAB), serve as essential raw materials for manufacturing household and industrial detergents and surfactants. The consistent demand for effective cleaning solutions across residential, commercial, and industrial sectors has driven the high utilization of N-paraffins in this application. Their ability to enhance cleaning efficiency and performance in various formulations has solidified their position as the leading application segment in the N-paraffin market.

Normal Paraffin Market Regional Outlook

North America

Europe

- U.K.

- Germany

- France

- Spain

- Rest of Europe

Asia-Pacific

- India

- Japan

- China

- Australia

- South Korea

- Rest of Asia-Pacific

Latin America

- Brazil

- Mexico

- Rest of LATAM

The Middle East & Africa

- South Africa

- GCC Countries

- Rest of the Middle East & Africa (ME&A)

Normal Paraffin Market Regional Analysis

Normal Paraffin Market Regional Analysis

In terms of regional segments, the Asia-Pacific region emerges as a key growth hub, driven by rapid industrialization in China, India, and Southeast Asia. A growing manufacturing base, coupled with rising investments in infrastructure and consumer goods, fuels strong demand for normal paraffins across diverse applications, including detergents, solvents, and lubricants.

In North America and Europe, the market is well-established, supported by mature industrial sectors and stringent environmental regulations promoting sustainable operations. The consistent demand for detergents, lubricants, and chemical intermediates sustains normal paraffin consumption in these regions.

Meanwhile, Latin America and the Middle East & Africa present emerging opportunities due to expanding industrial sectors and rising consumer demand. These regions are increasingly adopting sustainable practices, driving interest in bio-based and environmentally friendly paraffin alternatives. Overall, economic growth, regulatory policies, and shifting consumer preferences shape the geographical trends in the N-paraffin market.

Normal Paraffin Market Players

Some of the top normal paraffin companies offered in our report include Cepsa Chemicals, CNPC, Farabi Petrochem, ENEOS Corporation, JXTG Nippon Oil & Energy Corporation, RAHA Paraffin, Sasol, Lanxess AG, Shell, Sinopec, and Sonneborn.

CHAPTER 1.Executive Summary

1.1.Global Normal Paraffin Market Snapshot

1.2.Global Normal Paraffin Market

CHAPTER 2.Market Variables and Scope

2.1.Introduction to Normal Paraffin

2.2.Classification and Scope

CHAPTER 3.Market Dynamics and Trends

3.1.Global Normal Paraffin Market Dynamic

3.2.Drivers

3.3.Restraints

3.4.Growth Opportunities

CHAPTER 4.Premium Insights

4.1.Global Normal Paraffin Market Dynamics, Impact Analysis

4.2.Porter’s Five Forces Analysis

4.2.1.Bargaining Power of Suppliers

4.2.2.Bargaining Power of Buyers

4.2.3.Threat of Substitute Products

4.2.4.Rivalry among Existing Firms

4.2.5.Threat of New Entrants

4.3.PESTEL Analysis

4.4.Value Chain Analysis

4.5.Market Attractiveness

4.6.Product Lifecycle Analysis

4.7.Product Pricing Analysis

4.8.Demand-Supply Analysis

4.9.Patent Analysis

4.10.Regulatory Framework

4.11.Vendor Landscape

4.11.1.List of Buyers

4.11.2.List of Suppliers

CHAPTER 5.Normal Paraffin Market By Type

5.1.Global Normal Paraffin Market Snapshot, By Type

5.2.Global Normal Paraffin Market, By Type, 2024 VS 2033

5.2.1.Market Size and Forecast

5.2.2.C5-C9

5.2.2.1.Overview

5.2.2.2.Key Growth Factors and Opportunities

5.2.2.3.Market Size and Forecast

5.2.3.C10-C13

5.2.3.1.Overview

5.2.3.2.Key Growth Factors and Opportunities

5.2.3.3.Market Size and Forecast

5.2.4.C14-C17

5.2.4.1.Overview

5.2.4.2.Key Growth Factors and Opportunities

5.2.4.3.Market Size and Forecast

5.2.5.C18-C20

5.2.5.1.Overview

5.2.5.2.Key Growth Factors and Opportunities

5.2.5.3.Market Size and Forecast

CHAPTER 6.Normal Paraffin Market By Grade

6.1.Global Normal Paraffin Market Snapshot, By Grade

6.2.Global Normal Paraffin Market, By Grade, 2024 VS 2033

6.2.1.Market Size and Forecast

6.2.2.Industrial Grade

6.2.2.1.Overview

6.2.2.2.Key Growth Factors and Opportunities

6.2.2.3.Market Size and Forecast

6.2.3.Pharmaceutical Grade

6.2.3.1.Overview

6.2.3.2.Key Growth Factors and Opportunities

6.2.3.3.Market Size and Forecast

6.2.4.Cosmetic Grade

6.2.4.1.Overview

6.2.4.2.Key Growth Factors and Opportunities

6.2.4.3.Market Size and Forecast

CHAPTER 7.Normal Paraffin Market By Form

7.1.Global Normal Paraffin Market Snapshot, By Form

7.2.Global Normal Paraffin Market, By Form, 2024 VS 2033

7.2.1.Market Size and Forecast

7.2.2.Liquid

7.2.2.1.Overview

7.2.2.2.Key Growth Factors and Opportunities

7.2.2.3.Market Size and Forecast

7.2.3.Solid

7.2.3.1.Overview

7.2.3.2.Key Growth Factors and Opportunities

7.2.3.3.Market Size and Forecast

CHAPTER 8.Normal Paraffin Market By Application

8.1.Global Normal Paraffin Market Snapshot, By Application

8.2.Global Normal Paraffin Market, By Application, 2024 VS 2033

8.2.1.Market Size and Forecast

8.2.2.Detergents and Surfactants

8.2.2.1.Overview

8.2.2.2.Key Growth Factors and Opportunities

8.2.2.3.Market Size and Forecast

8.2.3.Lubricants

8.2.3.1.Overview

8.2.3.2.Key Growth Factors and Opportunities

8.2.3.3.Market Size and Forecast

8.2.4.Chlorinated Paraffins

8.2.4.1.Overview

8.2.4.2.Key Growth Factors and Opportunities

8.2.4.3.Market Size and Forecast

8.2.5.Solvents

8.2.5.1.Overview

8.2.5.2.Key Growth Factors and Opportunities

8.2.5.3.Market Size and Forecast

8.2.6.Oilfield Chemicals

8.2.6.1.Overview

8.2.6.2.Key Growth Factors and Opportunities

8.2.6.3.Market Size and Forecast

8.2.7.Others

8.2.7.1.Overview

8.2.7.2.Key Growth Factors and Opportunities

8.2.7.3.Market Size and Forecast

CHAPTER 9.Normal Paraffin Market, by Region

9.1.Overview

9.2.Global Normal Paraffin Market, By Region

9.2.1.Market Size and Forecast

9.3.North America

9.3.1.Market Size and Forecast

9.3.2.North America Normal Paraffin Market, By Country

9.3.3.North America Normal Paraffin Market, By Type

9.3.4.North America Normal Paraffin Market, By Grade

9.3.5.North America Normal Paraffin Market, By Form

9.3.6.North America Normal Paraffin Market, By Application

9.3.7.U.S.

9.3.7.1.U.S. Normal Paraffin Market, By Type

9.3.7.2.U.S. Normal Paraffin Market, By Grade

9.3.7.3.U.S. Normal Paraffin Market, By Form

9.3.7.4.U.S. Normal Paraffin Market, By Application

9.3.8.Canada

9.3.8.1.Canada Normal Paraffin Market, By Type

9.3.8.2.Canada Normal Paraffin Market, By Grade

9.3.8.3.Canada Normal Paraffin Market, By Form

9.3.8.4.Canada Normal Paraffin Market, By Application

9.4.Europe

9.5.Asia Pacific

9.6.LAMEA

CHAPTER 10.Competitive Landscape

10.1.Strategic Move Analysis

10.1.1.Top Player Positioning/Market Share Analysis

10.2.Recent Developments by the Market Participants (2024)

CHAPTER 11.Company Profile

11.1.Cepsa Chemicals

11.1.1.Company Overview

11.1.2.Company Snapshot

11.1.3.Financial Performance

11.1.4.Business Overview

11.1.5.Product Portfolio

11.1.6.Strategic Growth

11.1.7.SWOT Analysis

11.2.CNPC

11.3.Farabi Petrochem

11.4.ENEOS Corporation

11.5.JXTG Nippon Oil & Energy Corporation

11.6.RAHA Paraffin

11.7.Sasol

11.8.Lanxess AG

11.9.Shell

11.10.Sinopec

11.11.Sonneborn

Normal Paraffin Market Regional Analysis

Normal Paraffin Market Regional Analysis