Asia-Pacific Diabetes Devices Market Size - Global Industry, Share, Analysis, Trends and Forecast 2023 - 2032

CHAPTER 1. Industry Overview of Asia Pacific Diabetes Devices Market

1.1. Definition and Scope

1.1.1. Definition of Diabetes Devices

1.1.2. Market Segmentation

1.1.3. Years Considered for the Study

1.1.4. Assumptions and Acronyms Used

1.1.4.1. Market Assumptions and Market Forecast

1.1.4.2. Acronyms Used in Asia-Pacific Diabetes Devices Market

1.2. Summary

1.2.1. Executive Summary

1.2.2. Asia Pacific Diabetes Devices Market By Type

1.2.3. Asia Pacific Diabetes Devices Market By Distribution Channel

CHAPTER 2. Research Approach

2.1. Methodology

2.1.1. Research Programs

2.1.2. Market Size Estimation

2.1.3. Market Breakdown and Data Triangulation

2.2. Data Distribution Channel

2.2.1. Secondary Source

2.2.2. Primary Source

CHAPTER 3. Market Dynamics And Competition Analysis

3.1. Market Drivers

3.1.1. Driver 1

3.1.2. Driver 2

3.2. Restraints and Challenges

3.2.1. Restraint 1

3.2.2. Restraint 2

3.3. Growth Opportunities

3.3.1. Opportunity 1

3.3.2. Opportunity 2

3.4. Porter’s Five Forces Analysis

3.4.1. Bargaining Power of Suppliers

3.4.2. Bargaining Power of Buyers

3.4.3. Threat of Substitute

3.4.4. Threat of New Entrants

3.4.5. Degree of Competition

3.5. Market Concentration Ratio and Market Maturity Analysis of Diabetes Devices Market

3.5.1. Go To Market Strategy

3.5.1.1. Introduction

3.5.1.2. Growth

3.5.1.3. Maturity

3.5.1.4. Saturation

3.5.1.5. Possible Development

3.6. Technological Roadmap for Diabetes Devices Market

3.7. Value Chain Analysis

3.7.1. List of Key Manufacturers

3.7.2. List of Customers

3.7.3. Level of Integration

3.8. Price Trend of Key Raw Materials

3.8.1. Raw Material Suppliers

3.8.2. Proportion of Manufacturing Cost Structure

3.8.2.1. Raw Material

3.8.2.2. Labor Cost

3.8.2.3. Manufacturing Expense

3.9. Regulatory Compliance

3.10. Competitive Landscape, 2022

3.10.1. Player Positioning Analysis

3.10.2. Key Strategies Adopted By Leading Players

CHAPTER 4. Manufacturing Plant Analysis

4.1. Manufacturing Plant Location and Establish Date of Major Manufacturers in 2022

4.2. R&D Status of Major Manufacturers in 2022

CHAPTER 5. Asia Pacific Diabetes Devices Market By Type

5.1. Introduction

5.2. Asia Pacific Diabetes Devices Revenue By Type

5.2.1. Asia Pacific Diabetes Devices Revenue (USD Billion) and Forecast, By Type, 2020-2032

5.2.2. BGM Devices

5.2.2.1. BGM Devices Market Revenue (USD Billion) and Growth Rate (%), 2020-2032

5.2.3. Self-Monitoring Devices

5.2.3.1. Self-Monitoring Devices Market Revenue (USD Billion) and Growth Rate (%), 2020-2032

5.2.4. Testing Strips

5.2.4.1. Testing Strips Market Revenue (USD Billion) and Growth Rate (%), 2020-2032

5.2.5. Blood Glucose Meters

5.2.5.1. Blood Glucose Meters Market Revenue (USD Billion) and Growth Rate (%), 2020-2032

5.2.6. Lancets

5.2.6.1. Lancets Market Revenue (USD Billion) and Growth Rate (%), 2020-2032

5.2.7. Continuous Glucose Monitoring Devices

5.2.7.1. Continuous Glucose Monitoring Devices Market Revenue (USD Billion) and Growth Rate (%), 2020-2032

5.2.8. Receiver

5.2.8.1. Receiver Market Revenue (USD Billion) and Growth Rate (%), 2020-2032

5.2.9. Sensors

5.2.9.1. Sensors Market Revenue (USD Billion) and Growth Rate (%), 2020-2032

5.2.10. Transmitters

5.2.10.1. Transmitters Market Revenue (USD Billion) and Growth Rate (%), 2020-2032

5.2.11. Insulin Delivery Devices

5.2.11.1. Insulin Delivery Devices Market Revenue (USD Billion) and Growth Rate (%), 2020-2032

5.2.12. Syringes

5.2.12.1. Syringes Market Revenue (USD Billion) and Growth Rate (%), 2020-2032

5.2.13. Pumps

5.2.13.1. Pumps Market Revenue (USD Billion) and Growth Rate (%), 2020-2032

5.2.14. Pens

5.2.14.1. Pens Market Revenue (USD Billion) and Growth Rate (%), 2020-2032

5.2.15. Jet Injectors

5.2.15.1. Jet Injectors Market Revenue (USD Billion) and Growth Rate (%), 2020-2032

CHAPTER 6. Asia Pacific Diabetes Devices Market By Distribution Channel

6.1. Introduction

6.2. Asia Pacific Diabetes Devices Revenue By Distribution Channel

6.2.1. Asia Pacific Diabetes Devices Revenue (USD Billion) and Forecast, By Distribution Channel, 2020-2032

6.2.2. Hospital pharmacies

6.2.2.1. Hospital pharmacies Market Revenue (USD Billion) and Growth Rate (%), 2020-2032

6.2.3. Diabetes Clinics/Centers

6.2.3.1. Diabetes Clinics/Centers Market Revenue (USD Billion) and Growth Rate (%), 2020-2032

6.2.4. Retail Pharmacies

6.2.4.1. Retail Pharmacies Market Revenue (USD Billion) and Growth Rate (%), 2020-2032

6.2.5. Online Pharmacies

6.2.5.1. Online Pharmacies Market Revenue (USD Billion) and Growth Rate (%), 2020-2032

6.2.6. Others

6.2.6.1. Others Market Revenue (USD Billion) and Growth Rate (%), 2020-2032

CHAPTER 7. Asia Pacific Diabetes Devices Market By Country

7.1. Asia Pacific Diabetes Devices Market Overview

7.2. China

7.2.1. China Diabetes Devices Revenue (USD Billion) and Forecast By Type, 2020-2032

7.2.2. China Diabetes Devices Revenue (USD Billion) and Forecast By Distribution Channel, 2020-2032

7.3. Japan

7.3.1. Japan Diabetes Devices Revenue (USD Billion) and Forecast By Type, 2020-2032

7.3.2. Japan Diabetes Devices Revenue (USD Billion) and Forecast By Distribution Channel, 2020-2032

7.4. India

7.4.1. India Diabetes Devices Revenue (USD Billion) and Forecast By Type, 2020-2032

7.4.2. India Diabetes Devices Revenue (USD Billion) and Forecast By Distribution Channel, 2020-2032

7.5. Australia

7.5.1. Australia Diabetes Devices Revenue (USD Billion) and Forecast By Type, 2020-2032

7.5.2. Australia Diabetes Devices Revenue (USD Billion) and Forecast By Distribution Channel, 2020-2032

7.6. South Korea

7.6.1. South Korea Diabetes Devices Revenue (USD Billion) and Forecast By Type, 2020-2032

7.6.2. South Korea Diabetes Devices Revenue (USD Billion) and Forecast By Distribution Channel, 2020-2032

7.7. Rest of Asia-Pacific

7.7.1. Rest of Asia-Pacific Diabetes Devices Revenue (USD Billion) and Forecast By Type, 2020-2032

7.7.2. Rest of Asia-Pacific Diabetes Devices Revenue (USD Billion) and Forecast By Distribution Channel, 2020-2032

7.8. Asia Pacific PEST Analysis

CHAPTER 8. Player Analysis Of Asia Pacific Diabetes Devices Market

8.1. Diabetes Devices Market Company Share Analysis

8.2. Competition Matrix

8.2.1. Competitive Benchmarking Of Key Players By Price, Presence, Market Share, And R&D Investment

8.2.2. New Product Launches and Product Enhancements

8.2.3. Mergers And Acquisition In Asia-Pacific Diabetes Devices Market

8.2.4. Partnership, Joint Ventures and Strategic Alliances/ Sales Agreements

CHAPTER 9. Company Profile

9.1. Roche Diabetes Care

9.1.1. Company Snapshot

9.1.2. Business Overview

9.1.3. Financial Overview

9.1.3.1. Revenue (USD Billion), 2022

9.1.3.2. Roche Diabetes Care 2022 Diabetes Devices Business Regional Distribution

9.1.4. Product /Service and Specification

9.1.5. Recent Developments & Business Strategy

9.2. Abbott Laboratories

9.3. Medtronic plc

9.4. Johnson & Johnson

9.5. Becton, Dickinson and Company

9.6. Novo Nordisk A/S

9.7. Sanofi S.A.

9.8. Terumo Corporation

9.9. Ypsomed AG

9.10. Ascensia Diabetes Care Holdings AG

Frequently Asked Questions

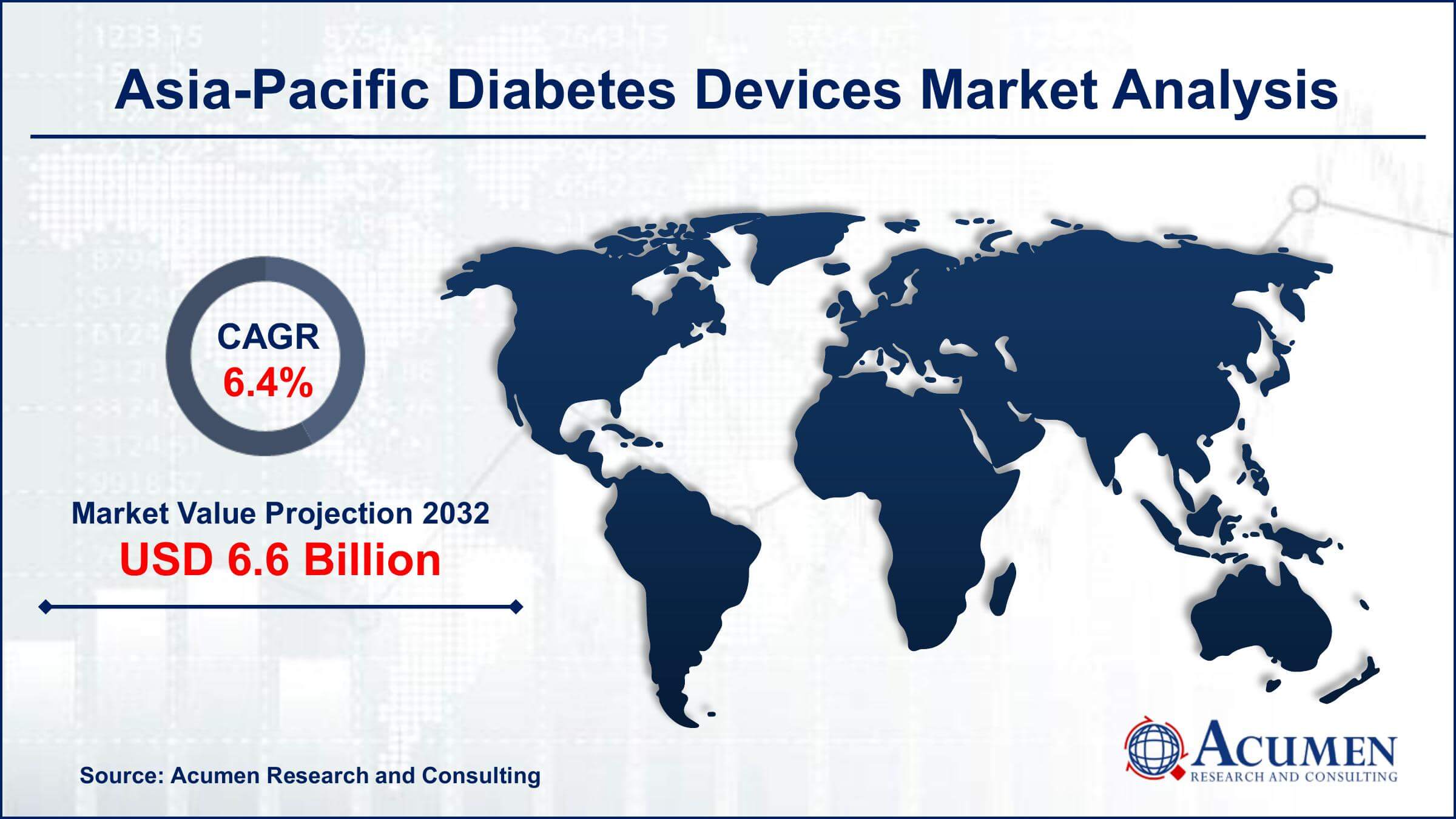

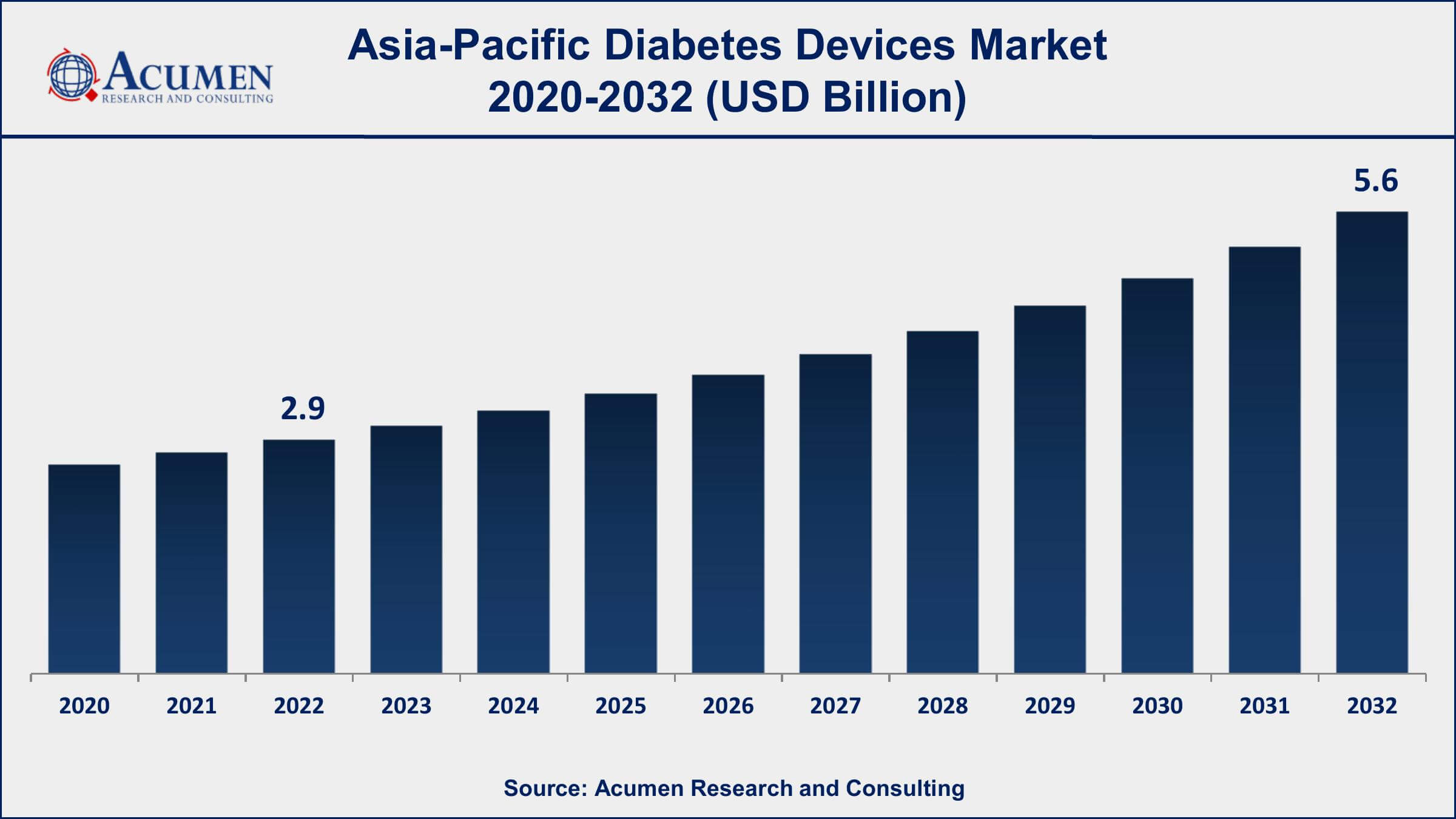

What was the market size of the Asia-Pacific diabetes devices in 2022?

The market size of Asia-Pacific diabetes devices was USD 2.9 Billion in 2022.

What is the CAGR of the Asia-Pacific diabetes devices market during forecast period of 2023 to 2032?

The CAGR of Asia-Pacific diabetes devices market is 7.2% during the analysis period of 2023 to 2032.

Which are the key players operating in the market?

The key players operating in the Asia-Pacific diabetes devices market are Roche Diabetes Care, Abbott Laboratories, Medtronic plc, Johnson & Johnson, Becton, Dickinson and Company, Novo Nordisk A/S, Sanofi S.A., Terumo Corporation, Ypsomed AG, and Ascensia Diabetes Care Holdings AG.

What are the current trends and dynamics in the Asia-Pacific diabetes devices market?

The current trends and dynamics in the diabetes devices industry include the growing demand for high-performance asphalt in road construction and maintenance activities.

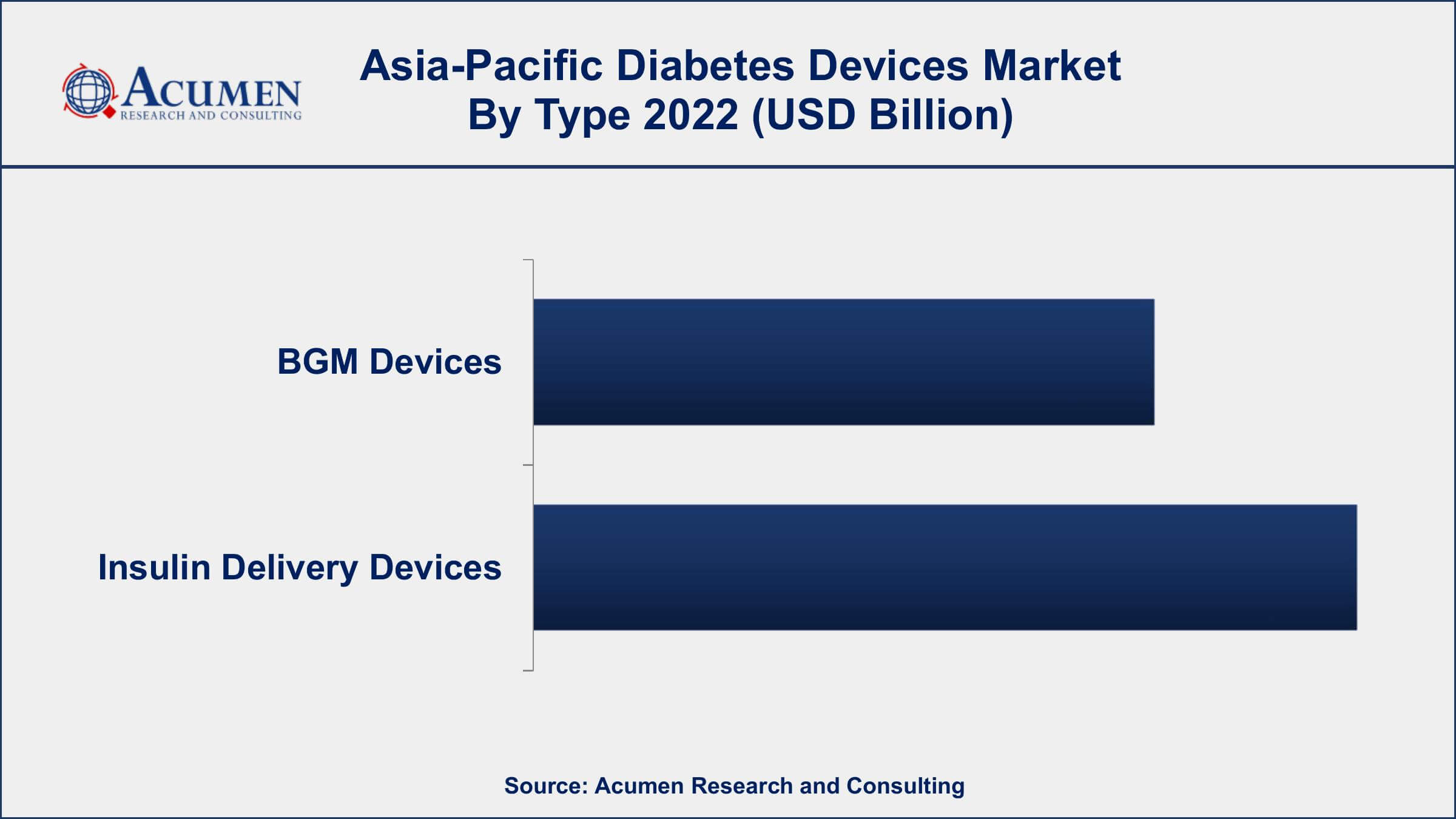

Which type held the maximum share in 2022?

The insulin delivery devices type held the maximum share of the diabetes devices market.

Select Licence Type

Connect with our sales team

Why Acumen Research And Consulting

100%

Customer Satisfaction

24x7

Availability - we are always there when you need us

200+

Fortune 50 Companies trust Acumen Research and Consulting

80%

of our reports are exclusive and first in the industry

100%

more data and analysis

1000+

reports published till date