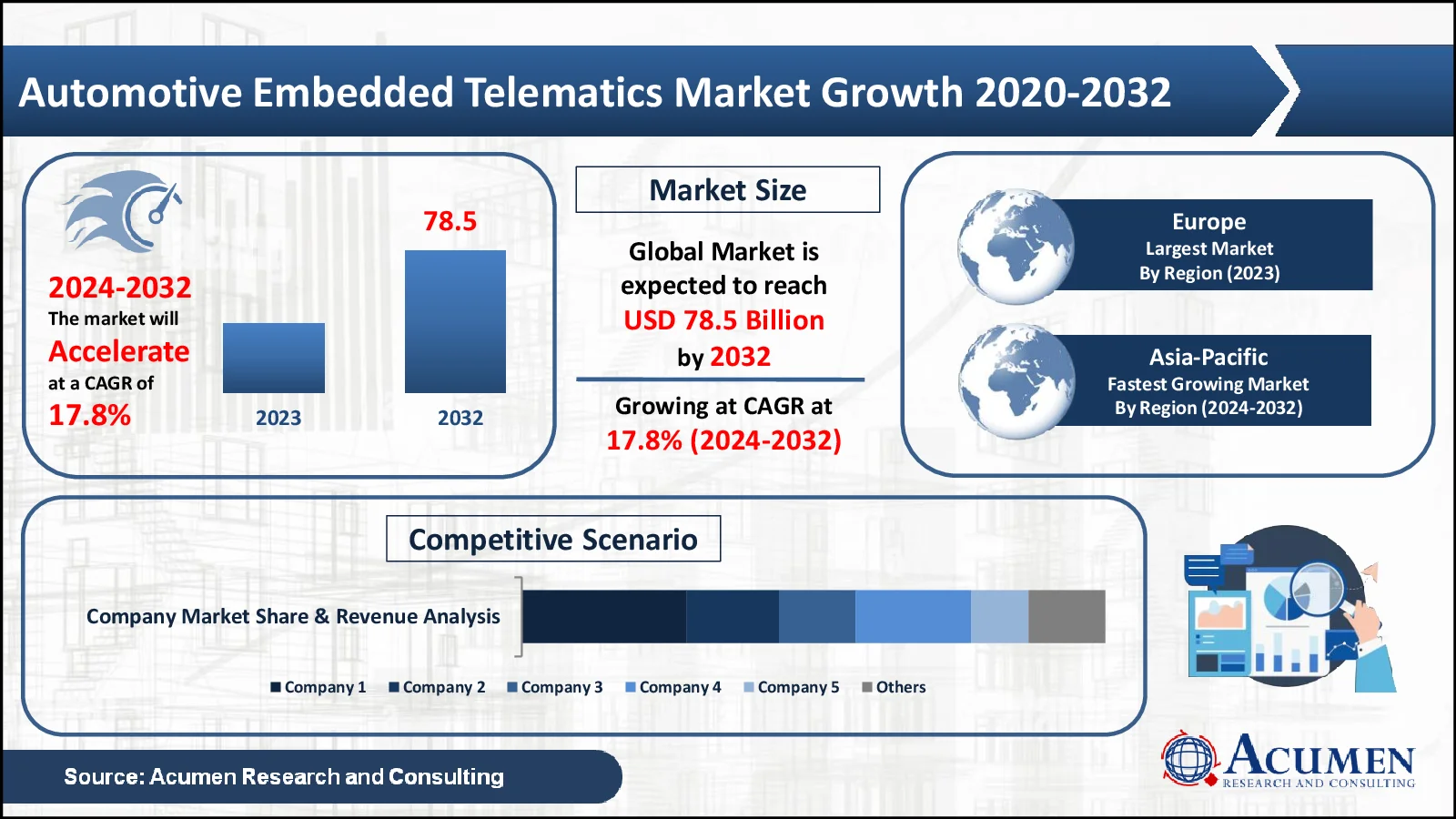

Automotive Embedded Telematics Market Size to Reach USD 78.5 Billion by 2032

The Automotive Embedded Telematics market, valued at USD 18.2 Billion in 2023, is projected to surpass USD 78.5 Billion by 2032, indicating a robust CAGR of 17.8%

Automotive embedded telematics refers to the integration of telecommunications and monitoring systems within vehicles, enabling real-time data exchange and connectivity. This technology supports various functions such as GPS navigation, emergency assistance, and vehicle diagnostics, enhancing both driver safety and convenience. It allows for remote monitoring and control of vehicle systems, including tracking maintenance needs and vehicle location. Additionally, it facilitates advanced driver assistance systems (ADAS), providing features like adaptive cruise control and lane-keeping assistance. By connecting vehicles to the internet, telematics also supports infotainment systems and over-the-air software updates. Overall, automotive telematics is crucial for improving driving experience, safety, and vehicle management.

The high installation and maintenance costs of telematics systems have acted as a restraint on the automotive embedded telematics market. Additionally, the expansion of aftermarket services and fleet management solutions utilizing telematics has influenced the market dynamics.

Automotive Embedded Telematics Market Statistics

- The global automotive embedded telematics market, which generated USD 18.2 billion in 2023, is expected to experience a robust compound annual growth rate (CAGR) of over 17.8% from 2024 to 2032

- Europe is leading with significant revenue, reaching USD 6.2 billion in 2023

- The Asia-Pacific region is projected to see remarkable growth, with an anticipated CAGR of 20%

- In terms of components, the service segment dominated with 52% of the market share in 2023

- Regarding solutions, the safety and security sub-segment held a 48% share in 2023

- A discernible trend in the automotive embedded telematics market is increased emphasis on protecting telematics systems from cyber threats and data breaches

Access Table Of Content: https://www.acumenresearchandconsulting.com/table-of-content/automotive-embedded-telematics-market

Automotive Embedded Telematics Market Dynamics

Government Regulations Mandating Telematics for Improved Vehicle Safety and Emission Control Fuels the Automotive Embedded Telematics Market Value

Government regulations requiring telematics systems in vehicles for safety are significantly driving the growth of the automotive embedded telematics market. For instance, Federal Motor Vehicle Safety Standards (FMVSS) are regulations established by the government to ensure vehicle safety. One of these standards pertains to Automatic Emergency Braking Systems (AEB), as outlined by the American Association of Motor Vehicle Administrators (AAMVA). These regulations mandate the integration of advanced telematics to enhance vehicle safety, monitor driving behavior, and ensure compliance with emission standards. As a result, automakers are increasingly adopting embedded telematics solutions to meet regulatory demands and improve vehicle performance. This adoption not only helps in real-time data collection and diagnostics but also aids in proactive maintenance and emission control. Consequently, the market for automotive embedded telematics is expanding rapidly as vehicles become more connected and regulated.

Advancements In 5G Technology Enabling Faster and More Reliable Telematics Services Offer Significant Automotive Embedded Telematics Market Opportunity

Advancements in 5G technologies are revolutionizing automotive embedded telematics by providing faster and more reliable connectivity. For instance, in April 2023, Continental AG introduced a new 5G-enabled telematics control unit (TCU) designed for connected vehicles. This advanced TCU aims to deliver faster and more reliable connectivity, supporting features like real-time traffic updates, high-definition mapping, and remote vehicle diagnostics. Continental AG hopes to capitalize on the rising demand for 5G-connected vehicles and enhance its presence in market. Additionally, the increased bandwidth and lower latency of 5G enable real-time data transmission, enhancing vehicle-to-everything (V2X) communication and improving safety features. This leap in technology supports more sophisticated applications, such as autonomous driving and advanced driver-assistance systems (ADAS). Enhanced connectivity also facilitates better vehicle diagnostics and maintenance through continuous data monitoring. As a result, the automotive embedded telematics market is poised for significant growth, driven by the demand for these advanced, data-rich services. The integration of 5G technology thus presents a lucrative opportunity for both automakers and tech developers.

Automotive Embedded Telematics Market Segmentation

The global market for automotive embedded telematics has been segmented into component, component, and application, and region.

- Component is classified into hardware, service, and connectivity

- Solutions are divided into safety & security, information & navigation, entertainment, and remote diagnostics

- Applications are categorized into passenger cars, and commercial vehicles

- The automotive embedded telematics market is geographically split into Europe, North America, Latin America, APAC, and the Middle East and Africa

Automotive Embedded Telematics Market Regional Outlook

Regional analysis of automotive embedded telematics market, Europe's dominance in the market is attributed to its advanced automotive infrastructure, stringent regulatory standards, and high consumer demand for sophisticated telematics systems. The region's focus on safety, connectivity, and innovative technologies supports its leading position. For instance, in February 2021, Bosch and Microsoft joined forces to create a software platform designed for vehicle-to-cloud connectivity. This platform seeks to integrate vehicle data smoothly with cloud-based services, paving the way for innovative telematics applications and services. The collaboration aims to capitalize on the increasing demand for connected vehicle solutions, offering automotive manufacturers and solution providers a flexible and scalable platform.

Conversely, Asia-Pacific's rapid growth in this sector is driven by increasing automotive production, rising disposable incomes, and a burgeoning middle class. The adoption of smart technologies and supportive government policies in countries like China and India further fuel the expansion. As automotive manufacturers in Asia-Pacific increasingly integrate telematics solutions, the region's market rapidly evolves, creating a dynamic and competitive landscape.

Automotive Embedded Telematics Market Players

Automotive embedded telematics companies profiled in the report include Continental AG, Hyundai Motor Company, Verizon, General Motors, Ford Motor Company, Toyota Motor Corporation, Infiniti Motor Company, MiX Telematics, BMW Group and TomTom International BV.

Enquire Before Buying https://www.acumenresearchandconsulting.com/inquiry-before-buying/980

Receive our personalized services and customization by clicking here https://www.acumenresearchandconsulting.com/request-customization/980

Mr. Richard Johnson

Acumen Research and Consulting

India: +91 8983225533