Europe Teeth Cleaning Machine Market Size - Industry, Share, Analysis, Trends and Forecast 2024 - 2032

CHAPTER 1. Industry Overview of Europe Teeth Cleaning Machine Market

1.1. Definition and Scope

1.1.1. Definition of Europe Teeth Cleaning Machine

1.1.2. Market Segmentation

1.1.3. Years Considered for the Study

1.1.4. Assumptions and Acronyms Used

1.1.4.1. Market Assumptions and Market Forecast

1.1.4.2. Acronyms Used in Europe Teeth Cleaning Machine

1.2. Summary

1.2.1. Executive Summary

1.2.2. Europe Teeth Cleaning Machine Market By Type

1.2.3. Europe Teeth Cleaning Machine Market By Procedure

1.2.4. Europe Teeth Cleaning Machine Market By Application

1.2.5. Europe Teeth Cleaning Machine Market By Region

CHAPTER 2. Research Approach

2.1. Methodology

2.1.1. Research Programs

2.1.2. Market Size Estimation

2.1.3. Market Breakdown and Data Triangulation

2.2. Data Source

2.2.1. Secondary Sources

2.2.2. Primary Sources

CHAPTER 3. Market Dynamics And Competition Analysis

3.1. Market Drivers

3.1.1. Driver 1

3.1.2. Driver 2

3.2. Restraints and Challenges

3.2.1. Restraint 1

3.2.2. Restraint 2

3.3. Growth Opportunities

3.3.1. Opportunity 1

3.3.2. Opportunity 2

3.4. Porter’s Five Forces Analysis

3.4.1. Bargaining Power of Suppliers

3.4.2. Bargaining Power of Buyers

3.4.3. Threat of Substitute

3.4.4. Threat of New Entrants

3.4.5. Degree of Competition

3.5. Market Concentration Ratio and Market Maturity Analysis of Europe Teeth Cleaning Machine Market

3.5.1. Go To Market Strategy

3.5.1.1. Introduction

3.5.1.2. Growth

3.5.1.3. Maturity

3.5.1.4. Saturation

3.5.1.5. Possible Development

3.6. Technological Roadmap for Europe Teeth Cleaning Machine Market

3.7. Value Chain Analysis

3.7.1. List of Key Manufacturers

3.7.2. List of Customers

3.7.3. Level of Integration

3.8. Cost Structure Analysis

3.8.1. Price Trend of Key Raw Materials

3.8.2. Raw Material Suppliers

3.8.3. Proportion of Manufacturing Cost Structure

3.8.3.1. Raw Material

3.8.3.2. Labor Cost

3.8.3.3. Manufacturing Expense

3.9. Regulatory Compliance

3.10. Competitive Landscape, 2023

3.10.1. Player Positioning Analysis

3.10.2. Key Strategies Adopted By Leading Players

CHAPTER 4. Manufacturing Plant Analysis

4.1. Manufacturing Plant Location and Establish Date of Major Manufacturers in 2023

4.2. R&D Status of Major Manufacturers in 2023

CHAPTER 5. Europe Teeth Cleaning Machine Market By Type

5.1. Introduction

5.2. Europe Teeth Cleaning Machine Market Revenue By Type

5.2.1. Europe Teeth Cleaning Machine Market Revenue (USD Million) and Forecast, By Type, 2020-2032

5.2.2. Ultrasonic Cavitron

5.2.2.1. Ultrasonic Cavitron Market Revenue (USD Million) and Growth Rate (%), 2020-2032

5.2.3. Sandblasting teeth cleaning machine

5.2.3.1. Sandblasting Teeth Cleaning Machine Market Revenue (USD Million) and Growth Rate (%), 2020-2032

CHAPTER 6. Europe Teeth Cleaning Machine Market By Procedure

6.1. Introduction

6.2. Europe Teeth Cleaning Machine Market Revenue By Procedure

6.2.1. Europe Teeth Cleaning Machine Market Revenue (USD Million) and Forecast, By Procedure, 2020-2032

6.2.2. Above the gum line

6.2.2.1. Above the gum line Market Revenue (USD Million) and Growth Rate (%), 2020-2032

6.2.3. Below the gum line

6.2.3.1. Below the gum line Market Revenue (USD Million) and Growth Rate (%), 2020-2032

CHAPTER 7. Europe Teeth Cleaning Machine Market By Application

7.1. Introduction

7.2. Europe Teeth Cleaning Machine Market Revenue By Application

7.2.1. Europe Teeth Cleaning Machine Market Revenue (USD Million) and Forecast, By Application, 2020-2032

7.2.2. Treatment

7.2.2.1. Treatment Market Revenue (USD Million) and Growth Rate (%), 2020-2032

7.2.2.2. Scaling

7.2.2.2.1. Scaling Market Revenue (USD Million) and Growth Rate (%), 2020-2032

7.2.2.3. Root Planning

7.2.2.3.1. Root Planning Market Revenue (USD Million) and Growth Rate (%), 2020-2032

7.2.2.4. Others

7.2.2.4.1. Others Market Revenue (USD Million) and Growth Rate (%), 2020-2032

7.2.3. Medical Beauty

7.2.3.1. Medical Beauty Market Revenue (USD Million) and Growth Rate (%), 2020-2032

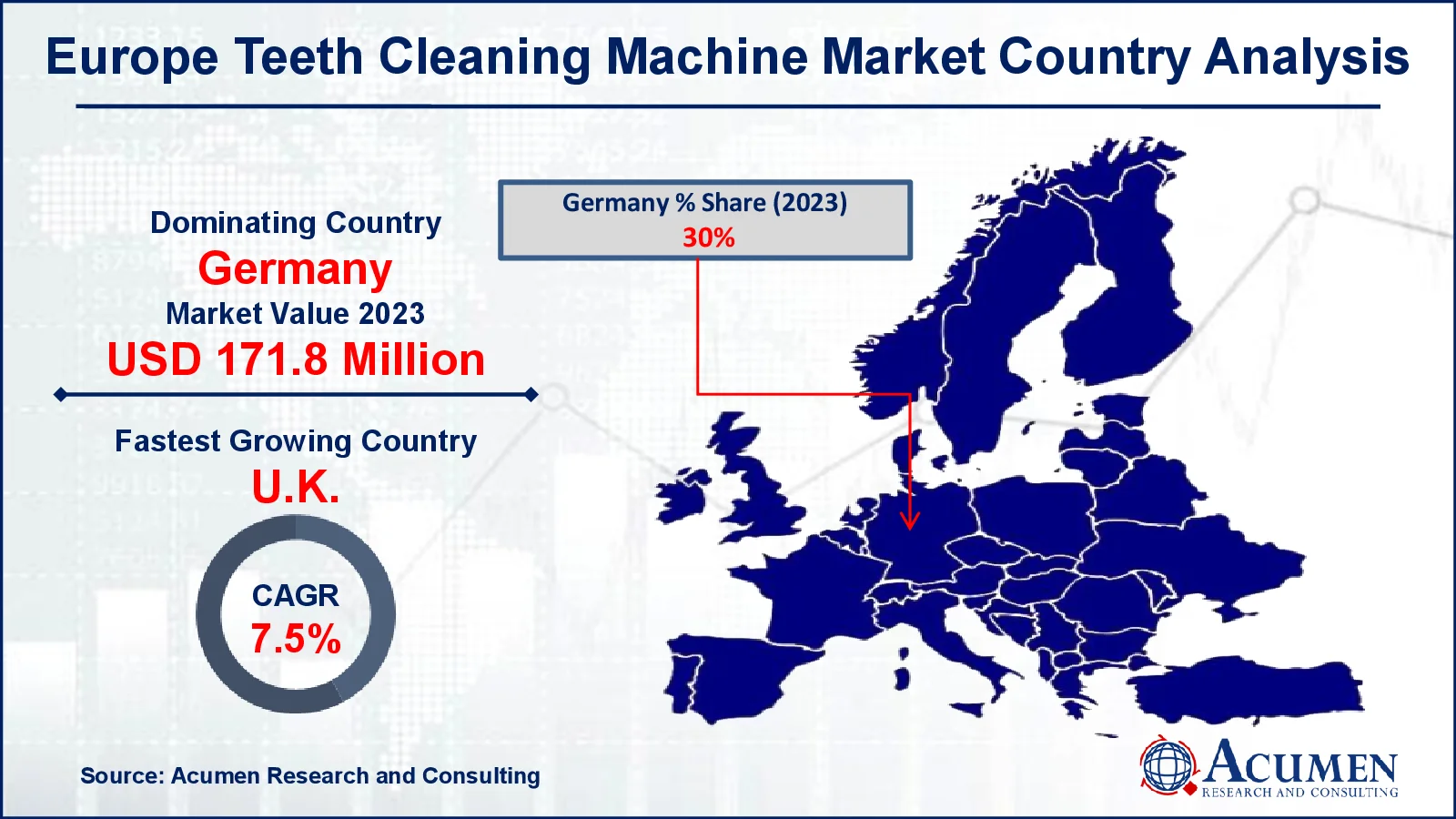

CHAPTER 8. Europe Teeth Cleaning Machine Market By Country

8.1. Europe Teeth Cleaning Machine Market Overview

8.2. U.K.

8.2.1. U.K. Europe Teeth Cleaning Machine Market Revenue (USD Million) and Forecast By Type, 2020-2032

8.2.2. U.K. Europe Teeth Cleaning Machine Market Revenue (USD Million) and Forecast By Procedure, 2020-2032

8.2.3. U.K. Europe Teeth Cleaning Machine Market Revenue (USD Million) and Forecast By Application, 2020-2032

8.3. Germany

8.3.1. Germany Europe Teeth Cleaning Machine Market Revenue (USD Million) and Forecast By Type, 2020-2032

8.3.2. Germany Europe Teeth Cleaning Machine Market Revenue (USD Million) and Forecast By Procedure, 2020-2032

8.3.3. Germany Europe Teeth Cleaning Machine Market Revenue (USD Million) and Forecast By Application, 2020-2032

8.4. France

8.4.1. France Europe Teeth Cleaning Machine Market Revenue (USD Million) and Forecast By Type, 2020-2032

8.4.2. France Europe Teeth Cleaning Machine Market Revenue (USD Million) and Forecast By Procedure, 2020-2032

8.4.3. France Europe Teeth Cleaning Machine Market Revenue (USD Million) and Forecast By Application, 2020-2032

8.5. Spain

8.5.1. Spain Europe Teeth Cleaning Machine Market Revenue (USD Million) and Forecast By Type, 2020-2032

8.5.2. Spain Europe Teeth Cleaning Machine Market Revenue (USD Million) and Forecast By Procedure, 2020-2032

8.5.3. Spain Europe Teeth Cleaning Machine Market Revenue (USD Million) and Forecast By Application, 2020-2032

8.6. Rest of Europe

8.6.1. Rest of Europe Teeth Cleaning Machine Market Revenue (USD Million) and Forecast By Type, 2020-2032

8.6.2. Rest of Europe Teeth Cleaning Machine Market Revenue (USD Million) and Forecast By Procedure, 2020-2032

8.6.3. Rest of Europe Teeth Cleaning Machine Market Revenue (USD Million) and Forecast By Application, 2020-2032

8.7. Europe PEST Analysis

CHAPTER 9. Player Analysis Of Europe Teeth Cleaning Machine Market

9.1. Europe Teeth Cleaning Machine Market Company Share Analysis

9.2. Competition Matrix

9.2.1. Competitive Benchmarking of key players by price, presence, market share, and R&D investment

9.2.2. New Product Launches and Product Enhancements

9.2.3. Mergers And Acquisition In Europe Teeth Cleaning Machine

9.2.4. Partnership, Joint Ventures and Strategic Alliances/ Sales Agreements

CHAPTER 10. Company Profile

10.1. W&H Dentalwerk International

10.1.1. Company Snapshot

10.1.2. Business Overview

10.1.3. Financial Overview

10.1.3.1. Revenue (USD Million), 2023

10.1.3.2. W&H Dentalwerk International 2023 Europe Teeth Cleaning Machine Business Regional Distribution

10.1.4. Product /Service and Specification

10.1.5. Recent Developments & Business Strategy

10.2. Dentsply Sirona

10.3. LM-Instruments Oy

10.4. Straumann

10.5. Denticator Inc.

10.6. Ningbo Runyes Medical Instrument Co. Ltd.

10.7. GC Europe NV

10.8. Ivoclar Vivadent

10.9. Dürr Dental

10.10. 3M Company

Frequently Asked Questions

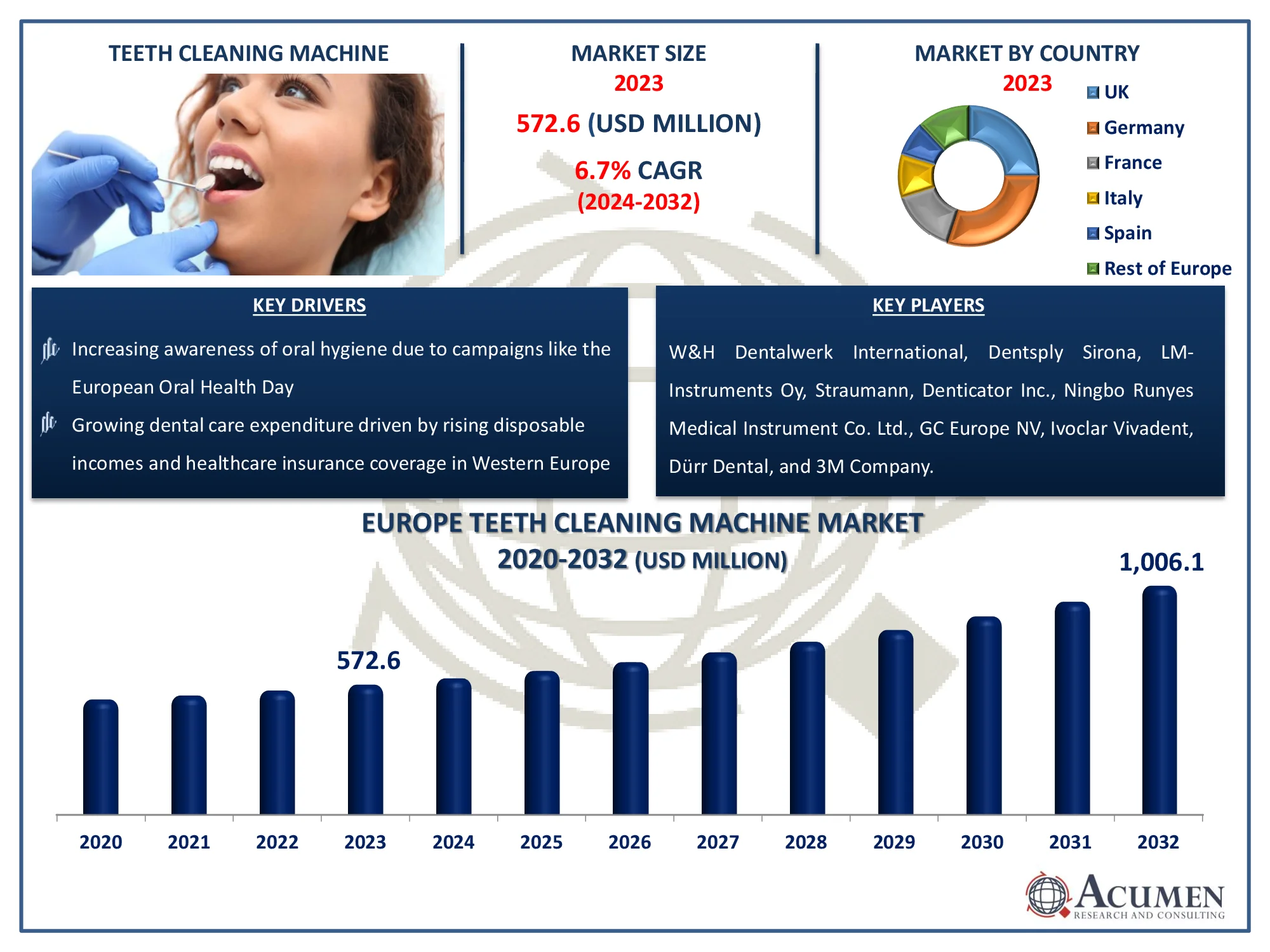

How big is the Europe teeth cleaning machine market?

The Europe teeth cleaning machine market size was valued at USD 572.6 Million in 2023.

What is the CAGR of the Europe teeth cleaning machine market from 2024 to 2032?

The CAGR of Europe teeth cleaning machine market is 6.7% during the analysis period of 2024 to 2032.

Which are the key players in the Europe teeth cleaning machine market?

The key players operating in the Europe market are including W W&H Dentalwerk International, Dentsply Sirona, LM-Instruments Oy, Straumann, Denticator Inc., Ningbo Runyes Medical Instrument Co. Ltd., GC Europe NV, Ivoclar Vivadent, Dürr Dental, and 3M Company.

Which region dominated the Europe teeth cleaning machine industry share?

North America held the dominating position in Europe teeth cleaning machine industry during the analysis period of 2024 to 2032.

Which region registered fastest CAGR from 2024 to 2032?

Europe region exhibited fastest growing CAGR for market of Europe Teeth Cleaning Machine during the analysis period of 2024 to 2032.

What are the current trends and dynamics in the Europe teeth cleaning machine industry?

The current trends and dynamics in the Europe teeth cleaning machine industry include increasing awareness of oral hygiene due to campaigns like the European Oral Health Day, growing dental care expenditure driven by rising disposable incomes and healthcare insurance coverage in Western Europe, and rising prevalence of dental disorders such as periodontitis, particularly among aging populations in countries like Germany and Italy.

Which procedure held the maximum share in 2023?

The tidal stream generator procedure held the maximum share of the europe teeth cleaning machine industry.

Select Licence Type

Connect with our sales team

Why Acumen Research And Consulting

100%

Customer Satisfaction

24x7

Availability - we are always there when you need us

200+

Fortune 50 Companies trust Acumen Research and Consulting

80%

of our reports are exclusive and first in the industry

100%

more data and analysis

1000+

reports published till date