String Inverter Market Size - Global Industry, Share, Analysis, Trends and Forecast 2024 - 2032

Select Access Type

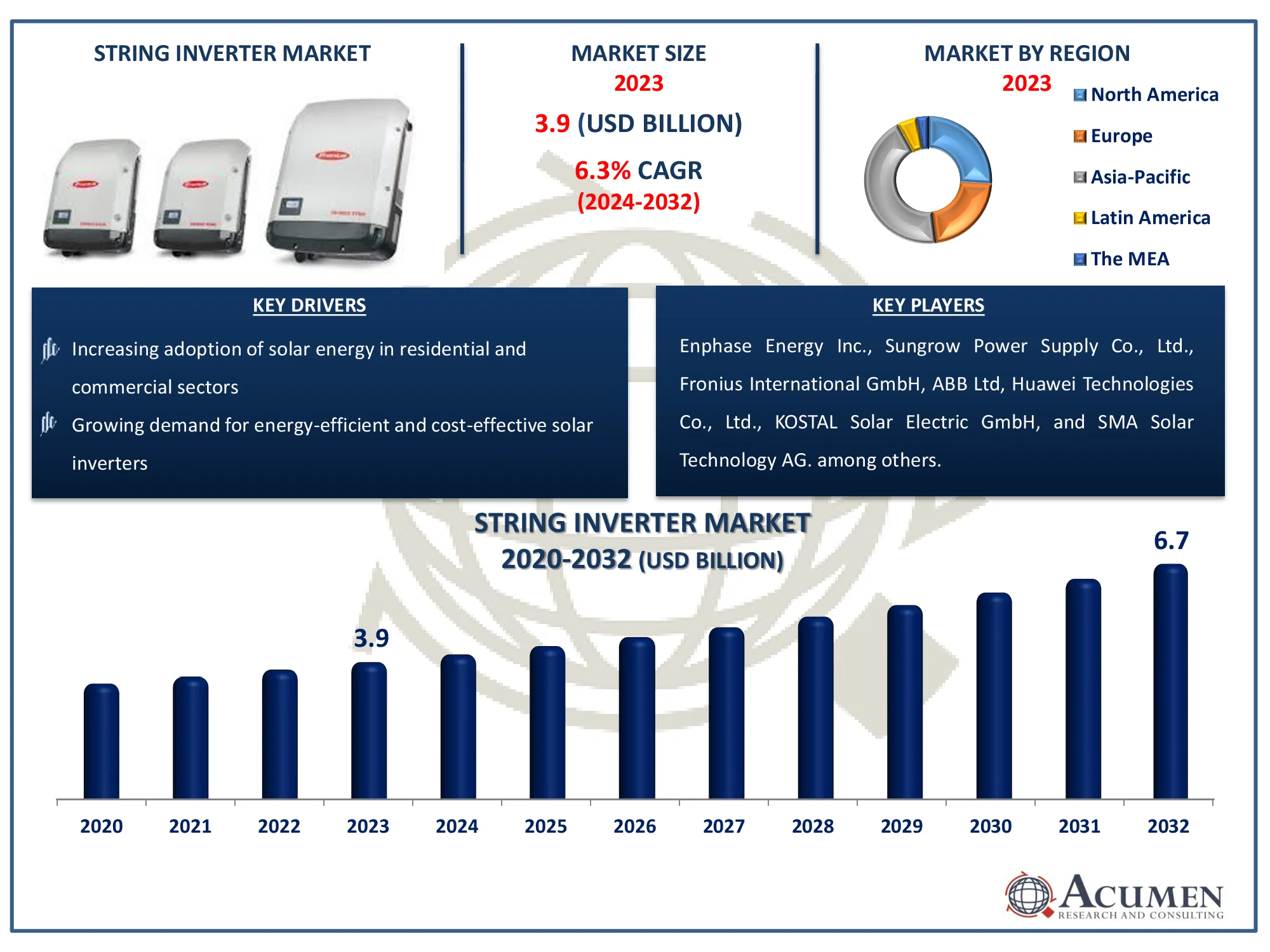

The Global String Inverter Market Size accounted for USD 3.9 Billion in 2023 and is estimated to achieve a market size of USD 6.7 Billion by 2032 growing at a CAGR of 6.3% from 2024 to 2032.

String Inverter Market Highlights

- Global string inverter market revenue is poised to garner USD 6.7 billion by 2032 with a CAGR of 6.3% from 2024 to 2032

- Asia-Pacific string inverter market value occupied around USD 1.7 billion in 2023

- North America string inverter market growth will record a CAGR of more than 7% from 2024 to 2032

- Among power class, the three phase sub-segment generated USD 3 billion revenue in 2023

- Based on connectivity, the on-grid sub-segment generated 60% string inverter market share in 2023

- Growth in rooftop solar installations in urban areas is a popular string inverter market trend that fuels the industry demand

A string inverter is an essential component of solar power systems, transforming the direct current (DC) electricity generated by solar panels into alternating current (AC) electricity that can be used by household appliances or fed into the electrical grid. In a common configuration, many solar panels are connected in series to form a "string," and the inverter regulates the total energy produced by the string. String inverters are widely utilized in home and commercial solar installations because of their efficiency and cost-effectiveness. They provide centralized control, are simple to maintain, and are ideal for locations in which the panels receive regular sunshine exposure, resulting in excellent energy conversion and system efficiency.

Global String Inverter Market Dynamics

Market Drivers

- Increasing adoption of solar energy in residential and commercial sectors

- Growing demand for energy-efficient and cost-effective solar inverters

- Technological advancements improving inverter efficiency and durability

- Government incentives and policies promoting renewable energy adoption

Market Restraints

- High initial investment costs for solar energy systems

- Complex installation and maintenance requirements

- Compatibility issues with older solar panel technologies

Market Opportunities

- Expansion of solar power in emerging markets

- Development of advanced inverters with better grid integration features

- Rising demand for energy storage systems alongside solar installations

String Inverter Market Report Coverage

|

Market |

String Inverter Market |

|

String Inverter Market Size 2023 |

USD 3.9 Billion |

|

String Inverter Market Forecast 2032 |

USD 6.7 Billion |

|

String Inverter Market CAGR During 2024 - 2032 |

6.3% |

|

String Inverter Market Analysis Period |

2020 - 2032 |

|

String Inverter Market Base Year |

2023 |

|

String Inverter Market Forecast Data |

2024 - 2032 |

|

Segments Covered |

By Power Class, By Nominal Output Power, By Nominal Output Voltage, By Connectivity, By Application, and By Geography |

|

Regional Scope |

North America, Europe, Asia Pacific, Latin America, and Middle East & Africa |

|

Key Companies Profiled |

Enphase Energy Inc., Sungrow Power Supply Co., Ltd., Fronius International GmbH, ABB Ltd, Huawei Technologies Co., Ltd., KOSTAL Solar Electric GmbH, SMA Solar Technology AG, SolarEdge Technologies Inc., Ginlong Technologies, Schneider Electric SE, and Delta Electronics Inc. |

|

Report Coverage |

Market Trends, Drivers, Restraints, Competitive Analysis, Player Profiling, Covid-19 Analysis, Regulation Analysis |

String Inverter Market Insights

Driver: Increasing Adoption of Solar Energy

The growing use of solar energy in residential, commercial, and industrial applications is a primary driver of the string inverter market. As global awareness of climate change and the need for sustainable energy solutions grows, more individuals and businesses are investing in solar power systems. String inverters are critical components of these systems because they convert the direct current (DC) generated by solar panels into alternating current (AC), which is used by electrical networks and appliances. Government incentives, such as tax credits and rebates, help to drive up adoption by making solar installations more affordable. Furthermore, the lower cost of solar panels and technological developments have expedited this trend, increasing need for efficient and dependable string inverters.

Restraint: High Initial Investment Costs

Despite the increased interest in solar electricity, one important barrier to the string inverter market is the expensive initial investment necessary for solar energy systems. The cost of buying and installing solar panels, inverters, and other components can be high. This upfront cost may deter some potential users, especially in areas with limited financial support or where solar technology is less established. Although the long-term savings on energy bills and environmental advantages are significant, the high initial expenditures may limit market expansion, particularly in residential sectors where budgets are tighter.

Opportunity: Expansion of Solar Power in Emerging Markets

The expansion of solar electricity in emerging nations presents an attractive prospect for the string inverter market. Countries in Asia-Pacific, Latin America, and Africa are increasing their investment in solar energy due to their high solar potential and growing energy demands. As these markets grow, string inverter makers have a big chance to enter and establish themselves in these locations. Companies that offer affordable, efficient, and dependable inverters can tap into a rising client base while also contributing to the global transition toward renewable energy.

String Inverter Market Segmentation

The worldwide market for string inverter is split based on power class, nominal output power, nominal output voltage, connectivity, applications, and geography.

String Inverter Market By Power Class

- Single Phase

- Three Phase

- Low Power (≤99 kW)

- High Power (>99 kW)

According to string inverter industry analysis, the three-phase section has gained popularity due to its applicability for larger and more complicated solar power systems. Three-phase inverters can manage higher power outputs than single-phase inverters, making them appropriate for commercial and industrial applications with high energy demands. They improve performance and stability by distributing the electrical load more evenly across three phases, lowering the risk of overloading while increasing efficiency. This balanced distribution improves system reliability and increases equipment lifespan. As more enterprises and larger facilities use solar energy solutions, the need for three-phase string inverters increases, cementing their market dominance.

String Inverter Market By Nominal Output Power

- ≤500 W

- 500-1500W

- > 1500 W

In the string inverter market, the 500-1500 W category has emerged as the notable. This line finds a compromise between efficiency and cost, making it suitable for a wide range of applications, including residential and small commercial installations. Inverters in this power range are versatile, able to handle the energy production of several solar panels while remaining affordable. They provide adequate capacity for most household solar systems and modest commercial setups without incurring the additional costs associated with more powerful inverters. The expanding trend of residential solar installations, combined with the increasing acceptance of small-scale commercial solar projects, promotes demand for inverters in this power range, reinforcing its market leadership.

String Inverter Market By Nominal Output Voltage

- ≤ 230 V

- 230 - 400 V

- > 400 V

In the string inverter market, the 230 - 400 V categories is predicted to be the largest. This voltage range is ideal for both residential and commercial solar installations, balancing the requirements of smaller systems with the ability to handle moderate power outputs. Inverters in this voltage range efficiently control the energy generated by conventional solar panel arrays, making them suitable for a variety of applications. They are most common in areas where 230 volts is the usual home voltage, although they can also handle somewhat higher voltages for small to medium-sized business installations. As a result, the 230 - 400 V category is expected to dominate, owing to its extensive applicability and compatibility with various solar energy systems.

String Inverter Market By Connectivity

- Off-Grid

- On-Grid

The on-grid section is the largest during the string inverter market forecast period due to its widespread use in solar energy systems that are linked to the utility grid. On-grid inverters help to integrate solar power with the existing electrical system by allowing excess electricity generated by solar panels to be fed back into the grid. This capability offers users the benefit of net metering, which can reduce energy expenditures and maximize return on investment. The growing adoption of grid-connected solar systems, driven by both the residential and commercial sectors, increases demand for on-grid inverters. Furthermore, governmental support and incentives for renewable energy increase the attraction of on-grid systems, making them the market's most prominent segment.

String Inverter Market By Application

- Residential

- Commercial and Industrial

- Utility

The residential segment leads because to the growing tendency of homeowners installing solar panels to reduce energy costs and promote environmental sustainability. As more people seek to harness solar energy for personal use, residential solar systems are becoming more popular. These systems require string inverters, which are intended for smaller-scale applications and provide a cost-effective and efficient solution for transforming solar power into usable electricity. Residential solar installations are also increasing due to favorable government incentives, lower solar technology prices, and innovations that make solar systems more accessible and affordable to homeowners. Furthermore, the emphasis on energy independence and lowering carbon footprints contributes to the residential segment's rapid growth, confirming its position as the market leader in string inverters.

String Inverter Market Regional Outlook

North America

- U.S.

- Canada

Europe

- U.K.

- Germany

- France

- Spain

- Rest of Europe

Asia-Pacific

- India

- Japan

- China

- Australia

- South Korea

- Rest of Asia-Pacific

Latin America

- Brazil

- Mexico

- Rest of LATAM

The Middle East & Africa

- South Africa

- GCC Countries

- Rest of the Middle East & Africa (ME&A)

String Inverter Market Regional Analysis

In terms of string inverter market analysis, the Asia-Pacific region is predicted to have the largest due to its quick increase in solar energy adoption and high market size. Countries such as China and India are driving this expansion, owing to ambitious renewable energy objectives, massive investments in solar infrastructure, and favorable government policies. China, in particular, has become a global leader in solar panel manufacture and installation, driving up demand for string inverters.

In contrast, the North America region is expected to develop the fastest during the string inverter industry forecast period. This expansion is linked to increased investments in solar energy projects, which are motivated by the need for energy diversification and sustainability. Countries such as Brazil and Mexico are making significant progress in extending their solar capacity, aided by excellent climate conditions and government incentives to promote renewable energy. As these countries improve their solar infrastructure, the demand for efficient and dependable string inverters grows. Rising energy demands, supportive legislation, and a growing emphasis on sustainable development make Latin America a dynamic and fast changing market for string inverters.

String Inverter Market Players

Some of the top string inverter companies offered in our report includes Enphase Energy Inc., Sungrow Power Supply Co., Ltd., Fronius International GmbH, ABB Ltd, Huawei Technologies Co., Ltd., KOSTAL Solar Electric GmbH, SMA Solar Technology AG, SolarEdge Technologies Inc., Ginlong Technologies, Schneider Electric SE, and Delta Electronics Inc.