Spinal Fusion Devices Market Size - Global Industry, Share, Analysis, Trends and Forecast 2023 - 2032

Select Access Type

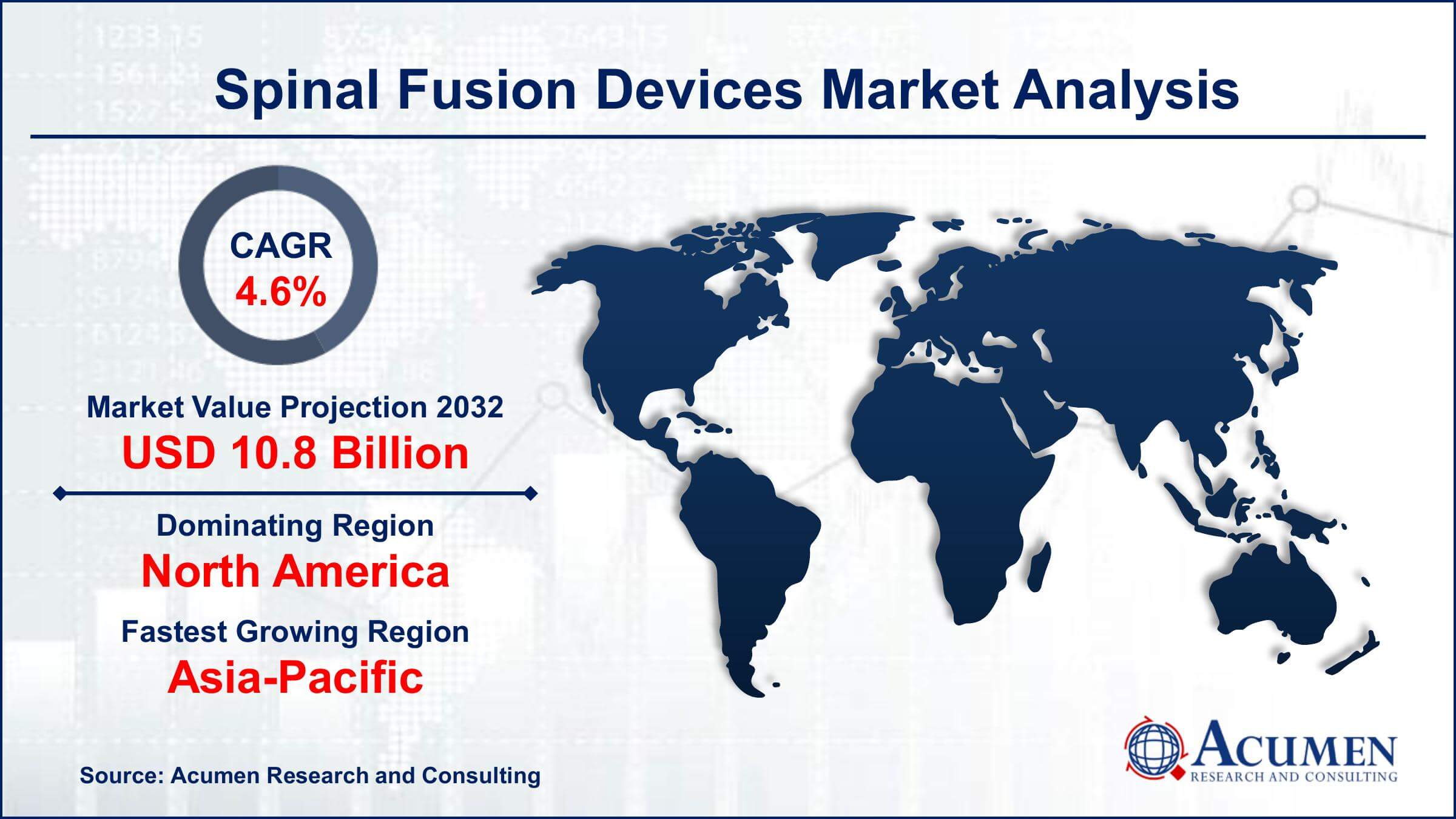

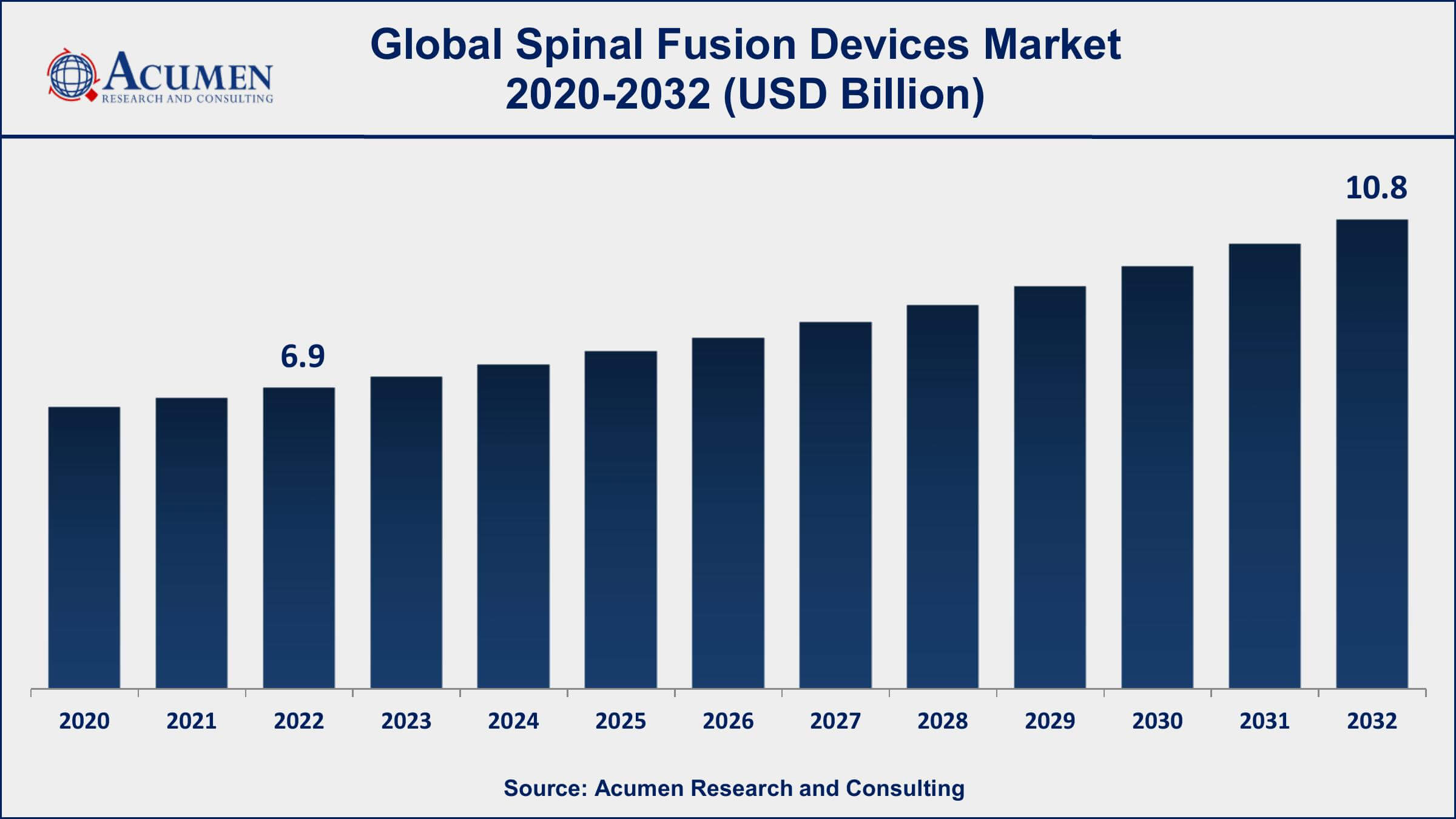

The Global Spinal Fusion Devices Market Size accounted for USD 6.9 Billion in 2022 and is projected to achieve a market size of USD 10.8 Billion by 2032 growing at a CAGR of 4.6% from 2023 to 2032.

Spinal Fusion Devices Market Highlights

- Global spinal fusion devices market revenue is expected to increase by USD 10.8 Billion by 2032, with a 4.6% CAGR from 2023 to 2032

- North America region led with more than 40% of spinal fusion devices market share in 2022

- Asia-Pacific spinal fusion devices market growth will record a CAGR of around 5% from 2023 to 2032

- Degenerative disc disease is a leading cause of spinal fusion surgeries and generated more than 41% of the market share in 2022

- By type, the thoracolumbar devices segment has accounted more than 56% of the revenue share in 2022

- Growing prevalence of spinal disorders and degenerative conditions, drives the spinal fusion devices market value

Spinal fusion devices are medical implants used in surgical procedures to stabilize and fuse vertebrae in the spine. The procedure involves the insertion of various devices, such as plates, screws, rods, cages, and interbody fusion devices, to promote bone growth and immobilize the affected spinal segments. Spinal fusion is commonly performed to treat conditions like spinal fractures, degenerative disc disease, spinal deformities, and spinal instability.

The market for spinal fusion devices has been experiencing significant growth over the years. Factors driving this growth include an ageing population, increasing prevalence of spinal disorders and degenerative conditions, advancements in surgical techniques, and the rising demand for minimally invasive procedures. Additionally, technological advancements in implant materials, such as titanium and biocompatible polymers, have improved the success rate and outcomes of spinal fusion surgeries. The market growth for spinal fusion devices is also influenced by the expanding scope of applications and the introduction of innovative products. Companies are investing in research and development to create new devices that offer improved biocompatibility, better integration with bone, and enhanced surgical techniques. The market is highly competitive, with major players continuously launching new products and engaging in strategic partnerships and acquisitions to expand their market share.

Global Spinal Fusion Devices Market Trends

Market Drivers

- Growing prevalence of spinal disorders and degenerative conditions

- Increasing aging population worldwide, leading to a higher demand for spinal fusion procedures

- Advancements in surgical techniques and technologies, such as minimally invasive procedures

- Rising awareness about the benefits of spinal fusion surgeries among patients and healthcare professionals

Market Restraints

- High cost associated with spinal fusion surgeries and devices

- Risks and complications associated with spinal fusion procedures, including infection, nerve damage, and implant failure

Market Opportunities

- Development of innovative implant materials and technologies that offer better biocompatibility, durability, and fusion rates

- Expansion into adjacent markets, such as robotic-assisted spinal fusion surgeries and computer-assisted navigation systems

Spinal Fusion Devices Market Report Coverage

| Market | Spinal Fusion Devices Market |

| Spinal Fusion Devices Market Size 2022 | USD 6.9 Billion |

| Spinal Fusion Devices Market Forecast 2032 | USD 10.8 Billion |

| Spinal Fusion Devices Market CAGR During 2023 - 2032 | 4.6% |

| Spinal Fusion Devices Market Analysis Period | 2020 - 2032 |

| Spinal Fusion Devices Market Base Year | 2022 |

| Spinal Fusion Devices Market Forecast Data | 2023 - 2032 |

| Segments Covered | By Type, By Disease Type, By Surgery, By End User, And By Geography |

| Regional Scope | North America, Europe, Asia Pacific, Latin America, and Middle East & Africa |

| Key Companies Profiled | Medtronic plc, DePuy Synthes, Stryker Corporation, NuVasive, Inc., Zimmer Biomet Holdings, Inc., Globus Medical, Inc., Alphatec Holdings, Inc., Orthofix Medical Inc., RTI Surgical Holdings, Inc., and Aesculap Implant Systems. |

| Report Coverage |

Market Trends, Drivers, Restraints, Competitive Analysis, Player Profiling, Covid-19 Analysis, Regulation Analysis |

Spinal fusion devices are medical implants used in surgical procedures to treat various spinal conditions by promoting bone growth and stabilizing the spine. The goal of spinal fusion is to join or fuse two or more vertebrae together, limiting motion at the affected spinal segment. These devices are typically made of biocompatible materials such as titanium, stainless steel, or biocompatible polymers.

Spinal fusion devices find application in the treatment of various spinal conditions, including degenerative disc disease, spinal fractures, spinal deformities (such as scoliosis), spinal instability, and spinal tumors. The devices are implanted during surgical procedures to provide stability and support to the spine while facilitating the fusion process. They may include plates, screws, rods, cages, and interbody fusion devices. Plates and screws are used to fixate the vertebrae, while rods help in maintaining alignment and correcting deformities. Cages and interbody fusion devices are inserted between the vertebrae to restore disc height and promote fusion.

The spinal fusion devices market has witnessed steady growth in recent years and is expected to continue expanding in the coming years. The market growth can be attributed to several factors. Firstly, there is a rising prevalence of spinal disorders and degenerative conditions, driven by factors such as an aging population and sedentary lifestyles. This has led to an increased demand for spinal fusion surgeries, thereby driving the market growth for spinal fusion devices. Moreover, advancements in surgical techniques and technologies have significantly improved the outcomes of spinal fusion procedures. Minimally invasive techniques, such as endoscopic and laparoscopic approaches, have gained popularity due to their benefits of reduced trauma, quicker recovery, and shorter hospital stays. These advancements have not only increased patient satisfaction but have also expanded the market for spinal fusion devices.

Spinal Fusion Devices Market Segmentation

The global spinal fusion devices market segmentation is based on type, disease type, surgery, end user, and geography.

Spinal Fusion Devices Market By Type

- Cervical Fixation Devices

- Thoracolumbar Devices

- Interbody Fusion Devices

According to the spinal fusion devices industry analysis, the thoracolumbar devices segment accounted for the largest market share in 2022. One of the primary drivers for the growth of the thoracolumbar devices segment is the increasing prevalence of spinal disorders and degenerative conditions in the thoracic and lumbar regions. Conditions such as herniated discs, spinal stenosis, and degenerative disc diseases often require surgical intervention, including spinal fusion procedures in the thoracolumbar region. The growing ageing population and sedentary lifestyles contribute to the rise in these conditions, fueling the demand for thoracolumbar devices.

Spinal Fusion Devices Market By Disease Type

- Degenerative Disc

- Trauma & Fractures

- Complex Deformity

- Others

In terms of disease type, the degenerative disc segment is expected to witness significant growth in the coming years. Degenerative disc disease is a common condition characterized by the breakdown and deterioration of intervertebral discs, leading to chronic pain, reduced mobility, and spinal instability. As a result, there is a growing demand for spinal fusion procedures to treat degenerative disc disease, contributing to the growth of the degenerative disc segment in the market. One of the key factors driving the growth of the degenerative disc segment is the increasing prevalence of degenerative disc disease worldwide. Factors such as aging populations, sedentary lifestyles, and the rise in obesity rates contribute to the higher incidence of degenerative disc conditions. As the condition progresses, patients often require surgical intervention, including spinal fusion, to alleviate pain and restore spinal stability. This has led to an increased demand for spinal fusion devices specifically designed for degenerative disc treatment.

Spinal Fusion Devices Market By Surgery

- Minimally Invasive Spine Surgery

- Open Spine Surgery

According to the spinal fusion devices market forecast, the minimally invasive spine surgery segment is expected to witness significant growth in the coming years. Minimally invasive spine surgeries offer several advantages over traditional open surgeries, including smaller incisions, reduced tissue damage, shorter hospital stays, and quicker recovery times. These benefits have led to an increasing preference for minimally invasive techniques, driving the demand for specialized spinal fusion devices tailored for these procedures. One of the primary factors driving the growth of the minimally invasive spine surgery segment is the rising awareness and acceptance of these procedures among patients and healthcare professionals. Patients are seeking less invasive options that minimize pain, scarring, and post-operative complications.Surgeons are also embracing minimally invasive techniques due to the potential for improved patient outcomes and shorter recovery periods. This growing demand for minimally invasive approaches is fueling the need for specialized devices designed to support these procedures.

Spinal Fusion Devices Market By End User

- Hospitals

- Specialty Clinics

- Others

Based on the end user, the hospitals segment is expected to continue its growth trajectory in the coming years. Hospitals play a central role in providing specialized healthcare services, including spinal fusion surgeries. As the demand for spinal fusion procedures increases, the hospitals segment experiences growth due to the rising number of surgeries performed and the need for advanced medical devices, including spinal fusion devices. One of the primary drivers for the growth of the hospitals segment is the increasing prevalence of spinal disorders and degenerative conditions. As the population ages and lifestyles become more sedentary, there is a higher incidence of spinal conditions that require surgical intervention. Hospitals, equipped with specialized surgical infrastructure and skilled healthcare professionals, are the primary centers where spinal fusion procedures are performed, leading to the growth of the hospitals segment in the market.

Spinal Fusion Devices Market Regional Outlook

North America

- U.S.

- Canada

Europe

- U.K.

- Germany

- France

- Spain

- Rest of Europe

Asia-Pacific

- India

- Japan

- China

- Australia

- South Korea

- Rest of Asia-Pacific

Latin America

- Brazil

- Mexico

- Rest of Latin America

The Middle East & Africa

- South Africa

- GCC Countries

- Rest of the Middle East & Africa (ME&A)

Spinal Fusion Devices Market Regional Analysis

North America dominates the spinal fusion devices market for several reasons. Firstly, the region has a high prevalence of spinal disorders and degenerative conditions, primarily driven by an aging population and sedentary lifestyles. This leads to a significant demand for spinal fusion procedures and associated devices. The well-established healthcare infrastructure and access to advanced medical technologies in North America allow for the efficient diagnosis, treatment, and management of spinal conditions, contributing to the dominance of the market in the region. Moreover, North America has a strong presence of major medical device manufacturers specializing in spinal fusion devices. These companies have extensive research and development capabilities, allowing them to innovate and introduce advanced products to the market. Their robust distribution networks and strong collaborations with healthcare providers facilitate the widespread availability and adoption of spinal fusion devices.

Spinal Fusion Devices Market Player

Some of the top spinal fusion devices market companies offered in the professional report include Medtronic plc, DePuy Synthes, Stryker Corporation, NuVasive, Inc., Zimmer Biomet Holdings, Inc., Globus Medical, Inc., Alphatec Holdings, Inc., Orthofix Medical Inc., RTI Surgical Holdings, Inc., and Aesculap Implant Systems.