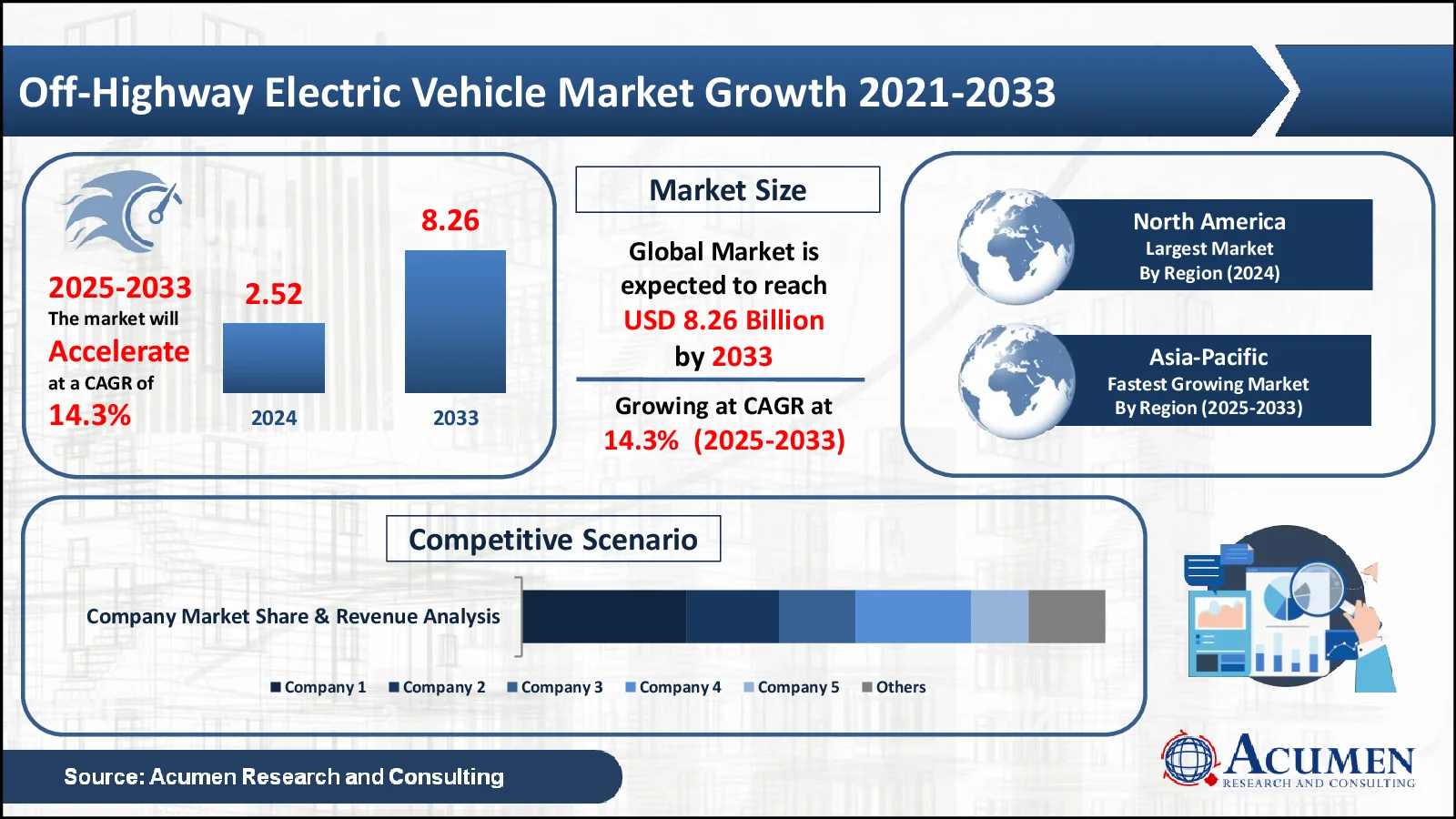

Off-Highway Electric Vehicle Market Size to Reach USD 8.26 Billion by 2033 growing at 14.3% CAGR - Exclusive Report by Acumen Research and Consulting

The Off-Highway Electric Vehicle Market, valued at USD 2.52 Billion in 2024, is anticipated to surpass USD 8.26 Billion by 2033, reflecting a projected CAGR of 14.3%

The off-highway electric vehicle market is quickly developing, because of a mix of environmental legislation, technology advancements, and economic incentives. This industry encompasses a wide range of vehicles, including construction equipment, agricultural machinery, mining trucks, and port equipment, all powered by internal combustion engines. The desire to reduce greenhouse gas emissions and increase operational efficiency is pushing the transition to electrification. Manufacturers are making significant investments in R&D to build long-lasting and trustworthy electric powertrains, novel battery systems, and intelligent charging methods. The market is characterized by an increasing need for sustainable solutions that not only decrease environmental effect but also save money over time.

Off-Highway Electric Vehicle Market Statistics

- In 2024, the global off-highway electric vehicle market was valued at USD 2.9 billion

- From 2025 to 2033, the market is projected to grow at a 9.6% annual pace

- North America accounts for 33% of the off-highway electric vehicle industry

- Asia-Pacific off-highway electric vehicle market is growing at a 15.1% CAGR

- The hybrid electric vehicle propulsion generates the highest revenue

- The construction application has significantly contributed to revenue growth

- Government incentives promoting electric vehicle adoption acts as a off-highway electric vehicle market trend.

Download Sample Report Copy: https://www.acumenresearchandconsulting.com/request-sample/2070

Off-Highway Electric Vehicle Market Dynamics

Off-Highway Electric Vehicle Market Driver: Stringent Emission Regulations

The global push for decarbonization is resulting in more strict emission limits, particularly in urban and environmentally vulnerable locations. Governments and regulatory agencies are establishing rules to reduce pollutants emitted by off-highway vehicles, which contribute significantly to air pollution and greenhouse gas emissions. For example, the European Union's Stage V emission limits, as well as related laws in North America, are compelling manufacturers to use cleaner technologies. These rules frequently include limitations on particulate matter, nitrogen oxide, and carbon dioxide emissions, providing a strong incentive for the use of electric powertrains.

Furthermore, urban development sites and mining operations near residential areas are under increased scrutiny and stiffer laws. Tax credits, subsidies, and grants are all incentives to encourage the use of electric off-highway vehicles. The growing emphases on sustainability, as well as the requirement to meet changing environmental norms, are key drivers of the off-highway EV industry.

Total Cost of Ownership:

While the initial capital expenditure for off-highway EVs may be higher than that of traditional diesel-powered vehicles, the long-term total cost of ownership (TCO) often favors electric solutions. Electric vehicles often require less maintenance since their powertrains are simpler, with fewer moving components and less frequent repair. Furthermore, the cost of electricity is typically lower than that of diesel fuel, resulting in significant operational savings during the vehicle's life.

In industries such as mining and construction, where vehicles work for long periods of time and consume large amounts of gasoline, the TCO advantage of electric vehicles is very appealing. As battery technology progresses and charging infrastructure expands, the TCO of off-highway EVs is likely to become even more competitive, hastening their adoption. Furthermore, many firms want to improve their ESG scores, and adding electric vehicles to their fleets can help them do so.

Off-Highway Electric Vehicle Market Opportunity: Development of Smart and Autonomous Off-Highway EVs:

The combination of smart technologies and autonomous capabilities offers a tremendous opportunity to improve off-highway efficiency, safety, and production. Autonomous off-highway electric vehicles can operate 24 hours a day, seven days a week, minimizing downtime and improving output in industries like mining and construction. In agriculture, self-driving electric tractors can accomplish precise tasks while improving resource use and reducing environmental impact. The integration of sensor technology and data analytics enables real-time monitoring of vehicle performance, predictive maintenance, and reduced equipment downtime.

Furthermore, smart charging systems and fleet management software help optimize energy use and boost overall operational efficiency. Advanced control systems and artificial intelligence algorithms are enabling the development of self-driving off-highway vehicles that can navigate difficult settings and complete tasks with minimal human interaction.

Off-Highway Electric Vehicle Market Segmentation

The worldwide off-highway electric vehicle market is divided into 5 segments: propulsion, battery type, storage type, application, and regional markets

- Propulsion: hybrid electric vehicle (HEV), and battery electric vehicle (BEV)

- Battery Type: lead-acid, and lithium-ion (Li-ion)

- Storage Type: <50 kWh, 50–200 kWh, and >200 kW

- Application: construction, mining, agriculture, and others

- Regional: the Middle East & Africa, Asia-Pacific, Europe, Latin America, and North America

Off-Highway Electric Vehicle Market Regional Outlook

The global off-highway EV market exhibits diverse regional dynamics, influenced by factors such as regulatory frameworks, infrastructure development, and economic conditions. North America is leading the way in off-highway EV adoption, thanks to rigorous pollution standards and government incentives. These regions have well-established infrastructure and a strong commitment to sustainability. The European Union's Green Deal and comparable measures in North America are hastening the transition to electric vehicles in a variety of industries. The Asia-Pacific area, notably China, is experiencing significant expansion, driven by increased industry and government support for electric vehicle adoption. China is a key manufacturing base for off-road equipment, and its emphasis on electric vehicle technology is propelling market growth.

Off-Highway Electric Vehicle Market Players

Off-Highway Electric Vehicle companies profiled in the report include J C Bamford Excavators Ltd., Volvo Construction Equipment AB, Hitachi Construction Machinery Co., Ltd., Doosan Corporation, Caterpillar, Inc., Komatsu Ltd., CNH Industrial N.V., Deere & Company, Sandvik AB, and Epiroc AB.

Buy Now This Report: https://www.acumenresearchandconsulting.com/buy-now/0/2070

Off-Highway Electric Vehicle Market Insights

|

Parameter |

Details |

|

Size in 2024 |

USD 2.52 Billion |

|

Forecast by 2033 |

USD 8.26 Billion |

|

CAGR During 2025 - 2033 |

14.3% |

|

Largest Propulsion Segment (% Share 2024) |

Hybrid Electric Vehicle – 66% |

|

Largest Region Size (2024) |

North America - USD 831.6 Million |

|

Fastest Growing Region (% CAGR) |

Asia-Pacific – 15.1% |

|

Key Players Covered |

J C Bamford Excavators Ltd., Volvo Construction Equipment AB, Hitachi Construction Machinery Co., Ltd., Doosan Corporation, Caterpillar, Inc., Komatsu Ltd., CNH Industrial N.V., Deere & Company, Sandvik AB, and Epiroc AB. |

|

Request Customization |

Mr. Richard Johnson

Acumen Research and Consulting

India: +91 8983225533

E-mail: [email protected]