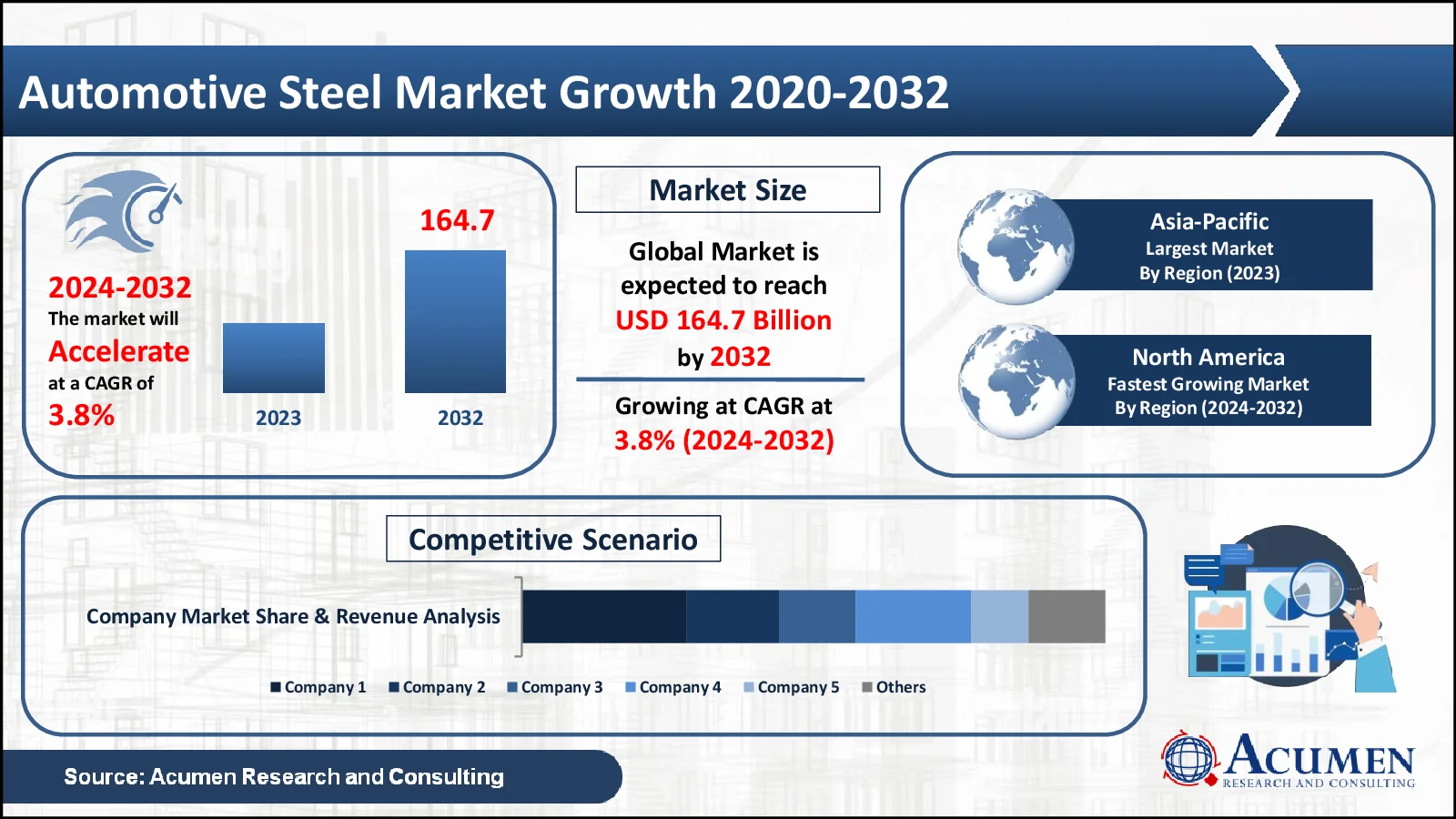

Automotive Steel Market Size to Reach USD 164.7 Billion by 2032 growing at 3.8% CAGR - Exclusive Report by Acumen Research and Consulting

The Automotive Steel Market, valued at USD 118.3 Billion in 2023, is anticipated to surpass USD 164.7 Billion by 2032, reflecting a projected CAGR of 3.8%

The automotive steel market is a crucial component of the automotive industry, providing essential materials for vehicle manufacturing. This market is influenced by several factors, including demand for lightweight materials, advances in steel processing technologies, and regulatory requirements for fuel efficiency and safety. The global automotive steel market is expected to grow steadily, driven by increasing vehicle production and a rising emphasis on vehicle safety and fuel efficiency. The market size is influenced by the overall automotive industry dynamics and the shift towards advanced high-strength steels (AHSS) and lightweight materials.

Asia-Pacific is the largest market for automotive steel, primarily due to high vehicle production in countries like China and India. North America and Europe also hold significant shares, driven by advancements in automotive technologies and stricter emission regulations. Key drivers include the increasing demand for fuel-efficient and safer vehicles, advancements in steel processing technologies, and government regulations promoting vehicle emissions reduction. Trends such as the rise of electric vehicles (EVs) and the growing use of aluminum and composite materials may also impact the demand for automotive steel. The market faces challenges such as fluctuations in raw material prices, environmental regulations, and competition from alternative materials.

Asia-Pacific is the largest market for automotive steel, primarily due to high vehicle production in countries like China and India. North America and Europe also hold significant shares, driven by advancements in automotive technologies and stricter emission regulations. Key drivers include the increasing demand for fuel-efficient and safer vehicles, advancements in steel processing technologies, and government regulations promoting vehicle emissions reduction. Trends such as the rise of electric vehicles (EVs) and the growing use of aluminum and composite materials may also impact the demand for automotive steel. The market faces challenges such as fluctuations in raw material prices, environmental regulations, and competition from alternative materials.

Automotive Steel Market Statistics

- In 2023, the global automotive steel market was valued at USD 118.3 billion

- The market is anticipated to expand at a consistent rate of 3.8% annually from 2024 to 2032

- Asia-Pacific leads the market with a substantial share of 49%

- North America is witnessing rapid growth, with an annual increase of 4.2%

- In 2023, the body structure application segment was the largest revenue generator

- Passenger vehicles have significantly contributed to revenue growth

- A automotive steel market notable trend is the increasing adoption of electric vehicles

Download Sample Report Copy : https://www.acumenresearchandconsulting.com/request-sample/1001

Automotive Steel Market Dynamics

Increasing Demand for Fuel Efficiency Fuels the Automotive Steel Market

The increasing demand for fuel-efficient vehicles is a major driver of the automotive steel market. This trend is largely influenced by rising fuel costs and growing environmental concerns, which have heightened awareness about the need for more efficient transportation solutions. As fuel prices continue to fluctuate and emissions regulations become stricter, both consumers and manufacturers are seeking ways to enhance vehicle fuel efficiency. Automotive steel, particularly advanced high-strength steels (AHSS), plays a pivotal role in meeting these demands. AHSS allows manufacturers to reduce vehicle weight significantly without compromising structural integrity or safety. Lighter vehicles consume less fuel, produce fewer emissions, and comply more easily with stringent environmental regulations. This makes AHSS an attractive option for automakers striving to balance performance with fuel economy.

In addition to consumer preferences, regulatory pressures drive the demand for fuel-efficient vehicles. Governments around the world are implementing stricter fuel economy standards and emissions regulations. These regulations compel automakers to innovate and adopt materials that improve vehicle efficiency. Automotive steel, with its ability to provide high strength at lower weights, becomes essential in developing vehicles that meet these regulations. Moreover, the growing popularity of electric vehicles (EVs) adds another layer to this driver. EVs, which are inherently more efficient but require lightweight materials to maximize battery performance, benefit from the use of advanced steel. As EV adoption increases, the need for high-performance, lightweight automotive steel grows correspondingly.

Expansion into Emerging Markets Offers Significant Automotive Steel Market Opportunities

The expansion into emerging markets presents a significant opportunity for the automotive steel industry. Rapid urbanization and economic development in regions like Southeast Asia, Latin America, and parts of Africa are leading to increased vehicle ownership. In these growing markets, there is a rising demand for affordable, reliable, and fuel-efficient vehicles. Automotive steel manufacturers have the chance to capitalize on this trend by establishing local production facilities, forming strategic partnerships with regional automakers, and tailoring products to meet specific market needs.

Emerging markets often require cost-effective solutions, creating a demand for high-strength low-alloy (HSLA) steels that provide durability at a lower cost compared to advanced alloys. Additionally, these regions may offer favorable conditions for new investments, such as lower labor costs and supportive government policies. By tapping into these markets, steel producers can diversify their revenue streams and achieve sustained growth. Furthermore, as these markets mature, there will be increasing opportunities for upgrading vehicle safety and performance standards, driving further demand for advanced steel solutions. The combination of growing vehicle markets and evolving consumer expectations creates a fertile ground for automotive steel companies to expand their presence and drive innovation.

Automotive Steel Market Segmentation

The global market for automotive steel is classified into 4 segments: process, vehicle type, application, and regional markets

- Process: basic oxygen furnace (BOF) and electric arc furnace (EAF)

- Vehicle type: passenger vehicles, light commercial vehicles, and heavy commercial vehicles

- Application: body structure, power train, suspension, and others

- Regional: North America, Latin America, Asia-Pacific, the Middle East & Africa, and Europe

Automotive Steel Market Regional Outlook

The Asia-Pacific region dominates the global automotive steel market, driven by its robust automotive manufacturing base, particularly in China, Japan, and South Korea. China is the largest automotive market globally, with high vehicle production volumes spurring significant demand for automotive steel. The region's focus on expanding infrastructure and increasing urbanization contributes to this demand. Additionally, the shift towards advanced high-strength steels (AHSS) and other innovations in steel technology is prominent as manufacturers aim to improve vehicle safety and fuel efficiency.

Buy Now This Report: https://www.acumenresearchandconsulting.com/buy-now/0/1001

Automotive Steel Market Key Insights:

|

Parameter |

Details |

|

Size in 2023 |

USD 118.3 Billion |

|

Forecast by 2032 |

USD 164.7 Billion |

|

CAGR During 2024 - 2032 |

3.8% |

|

Largest Region Size (2023) |

Asia-Pacific – USD 58 Billion |

|

Fastest Growing Region (% CAGR) |

North America– 4.2% |

|

Key Players Covered |

POSCO, China Steel Corporation, United States Steel Corporation, ArcelorMittal, Hyundai Steel, Nippon Steel & Sumitomo Metal Corporation, JSW Group, JFE Steel Corporation, TATA Steel, and NUCOR Corporation. |

|

Request Customization |

Mr. Richard Johnson

Acumen Reseonsulting

India: +91 8983225533arch and C

E-mail: [email protected]