Bioimplants Market Size - Global Industry, Share, Analysis, Trends and Forecast 2023 - 2032

Select Access Type

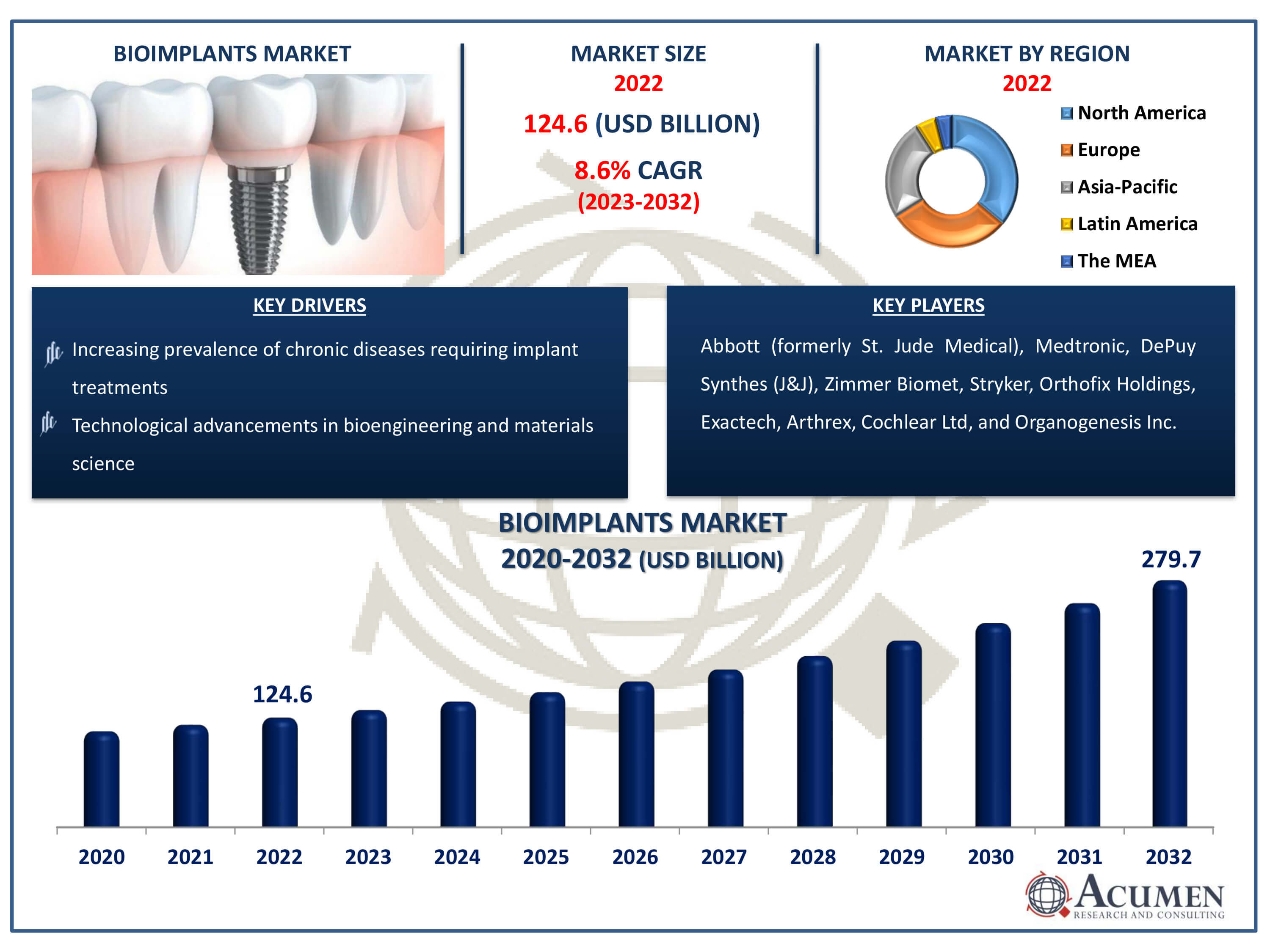

The Bioimplants Market Size accounted for USD 124.6 Billion in 2022 and is estimated to achieve a market size of USD 279.7 Billion by 2032 growing at a CAGR of 8.6% from 2023 to 2032.

Bioimplants Market Highlights

- Global bioimplants market revenue is poised to garner USD 279.7 billion by 2032 with a CAGR of 8.6% from 2023 to 2032

- North America bioimplants market value occupied around USD 44.9 billion in 2022

- Asia-Pacific bioimplants market growth will record a CAGR of more than 10% from 2023 to 2032

- Among product, the cardiovascular implants sub-segment generated more than USD 39.9 billion revenue in 2022

- Based on material, the biomaterial metal (titanium, gold, silver, platinum) sub-segment generated around 40% market share in 2022

- Collaboration between industry stakeholders to streamline implant development and delivery processes is a popular bioimplants market trend that fuels the industry demand

A bio-implant, a marvel of modern medical technology, encompasses a sophisticated assembly of biological tissues intricately linked with adjunct molecules. These remarkable prostheses serve a vital role in restoring and maintaining the delicate balance of physiological functions within the human body. Crafted with meticulous care, they are predominantly fashioned from a variety of biological materials, showcasing the ingenuity of biosynthetic elements like collagen, which provide structural support and biocompatibility. Additionally, they incorporate innovative tissue-engineered products, exemplified by artificial skin and tissues, engineered to mimic natural counterparts with astonishing precision. Through the seamless integration of advanced materials and cutting-edge engineering, bio-implants represent a beacon of hope for those in need of medical intervention, offering renewed functionality and quality of life.

Global Bioimplants Market Dynamics

Market Drivers

- Increasing prevalence of chronic diseases requiring implant treatments

- Technological advancements in bioengineering and materials science

- Growing aging population worldwide

- Rising demand for minimally invasive surgical procedures

Market Restraints

- High cost associated with implant procedures

- Stringent regulatory approval processes for new implant technologies

- Limited reimbursement coverage for certain implant procedures

Market Opportunities

- Expansion of emerging markets with increasing healthcare investments

- Development of innovative biomaterials for enhanced implant performance

- Adoption of value-based healthcare models promoting cost-effective implant solutions

Bioimplants Market Report Coverage

| Market | Bio-implants Market |

| Bio-implants Market Size 2022 | USD 124.6 Billion |

| Bio-implants Market Forecast 2032 | USD 279.7 Billion |

| Bio-implants Market CAGR During 2023 - 2032 | 8.6% |

| Bio-implants Market Analysis Period | 2020 - 2032 |

| Bio-implants Market Base Year |

2022 |

| Bio-implants Market Forecast Data | 2023 - 2032 |

| Segments Covered | By Product, By Origin, By Material, By End-use, And By Geography |

| Regional Scope | North America, Europe, Asia Pacific, Latin America, and Middle East & Africa |

| Key Companies Profiled | Abbott (formerly St. Jude Medical), Medtronic, DePuy Synthes (J&J), Zimmer Biomet, Stryker, Orthofix Holdings, Exactech, Arthrex, Cochlear Ltd, and Organogenesis Inc. |

| Report Coverage |

Market Trends, Drivers, Restraints, Competitive Analysis, Player Profiling, Covid-19 Analysis, Regulation Analysis |

Bioimplants Market Insights

The rising aging population and continuous innovation in implant technologies are key drivers of market growth for bio-implants. Additionally, evolving lifestyles and a growing awareness of both cosmetic and non-surgical bio-implants are fueling demand worldwide. The increasing preference for minimally invasive surgeries (MIS) further accelerates market expansion. Furthermore, the rapid development of healthcare sectors in emerging economies, coupled with ongoing research and development efforts, is poised to unlock new opportunities throughout the bioimplants industry forecast period from 2023 to 2032.

However, access to bio-implant procedures remains limited for many patients due to the high cost of implants, posing a significant obstacle to market growth. Research, development, and manufacturing costs contribute to this expense, dissuading both patients and healthcare providers. Moreover, reimbursement challenges exacerbate affordability issues, particularly for elective procedures not covered by insurance. Additionally, stringent regulatory frameworks impose strict requirements on safety, efficacy, and quality control, increasing compliance costs and delaying product releases. Overcoming these obstacles requires innovative approaches, including technological advancements and strategic collaborations. For instance, regulatory agency partnerships can streamline approval processes, accelerating product launches while ensuring safety standards. Furthermore, investments in R&D to enhance materials and manufacturing techniques can yield cost savings, making bio-implants more accessible to a broader patient base. Embracing value-based healthcare models and exploring opportunities in developing nations with more flexible regulations can also spur growth in the bio-implants industry.

Bioimplants Market Segmentation

The worldwide market for bioimplants is split based on product, origin, material, end-use, and geography.

Bioimplant Products

- Cardiovascular Implants

- Orthopedic Implants

- Spinal Implants

- Dental Implants

- Ophthalmic Implants

- Neurostimulators Implants

- Others

According to bioimplants industry analysis, cardiovascular implants hold the highest proportion of the market since they play a crucial role in the management of cardiovascular illnesses worldwide. Implants that treat problems including coronary artery disease, heart failure, and arrhythmias fall under this broad category. Examples of these devices include pacemakers, stents, and prosthetic heart valves. Innovative cardiovascular implant solutions are in greater demand due to the ageing population and the rising frequency of cardiovascular diseases. The creation of bioresorbable stents and less invasive treatments are examples of technological developments that contribute to the market's growth. Cardiovascular implants represent a significant market area within the bioimplants business, and their growth is mostly due to rising awareness of the need of adopting healthy lifestyles and preventive healthcare measures.

Bioimplant Origins

- Allograft

- Autograft

- Xenograft

- Synthetic

In the bioimplants market, the synthetic category is the largest among the ones mentioned. A variety of biocompatible materials, including metals, ceramics, polymers, and composites, are used to artificially produce synthetic bioimplants. Orthopedics, cardiovascular surgery, ophthalmology, and other medical specialties make extensive use of these devices, which are made to resemble the shape and functionality of real tissues or organs. Comparing synthetic bioimplants to other types reveals various benefits, such as consistent quality, lower chance of disease transmission, and customizable features to meet the demands of individual patients. The efficacy and adaptability of synthetic bioimplants are being improved by continuing developments in materials science and manufacturing technologies, which is propelling their wider use. Given the rising need for novel medical treatments as well as the rising incidence of trauma injuries and chronic illnesses, the synthetic segment of the bioimplants market continues to be the mainstay, offering its adaptability and dependability to meet a wide range of patient requirements.

Bioimplant Materials

- Ceramics

- Polymers (natural polymers & synthetic polymers)

- Alloys

- Biomaterial Metal (Titanium, Gold, Silver, Platinum)

Biomaterial metals, which include titanium, gold, silver, and platinum, are the most popular of the various materials used in bioimplants. These metals are excellent for a variety of implant applications because of their remarkable mechanical strength, corrosion resistance, and biocompatibility. Titanium is a highly favored material for orthopedic, dental, and cardiovascular implants due to its exceptional durability, lightweight design, and compatibility with human tissues. Because of their malleability, electrical conductivity, and inertness, metals like gold, silver, and platinum are prized for their use in specialized implant applications like heart electrodes and neurological probes. The demand for biomaterial metals in bioimplants is being driven by the rising frequency of chronic diseases as well as improvements in material science and manufacturing techniques. This has solidified biomaterial metals' position as the most popular material category in the market.

Bioimplant End-Uses

- Hospitals

- Clinics

- Specialty Centers

- Others

The market for bioimplants is dominated by hospitals. Hospitals are the main healthcare facility where a variety of treatments, including surgeries involving implants, are carried out. They can perform difficult implant treatments in a variety of medical specialties, including dentistry, cardiology, and orthopedics, because they have the infrastructure, tools, and knowledge required. Hospitals also frequently draw a sizable patient base, including those in need of specialized implant treatments, because of their extensive medical programs and multidisciplinary approach to patient care. Additionally, hospitals usually work with research centers and medical device manufacturers, which makes access to cutting-edge implant breakthroughs and technologies easier. In general, hospitals are key players in the bioimplants market because they supply necessary implant-related services and generate a sizable amount of demand for the goods and processes associated with bioimplants.

Bioimplants Market Regional Outlook

North America

- U.S.

- Canada

Europe

- U.K.

- Germany

- France

- Spain

- Rest of Europe

Asia-Pacific

- India

- Japan

- China

- Australia

- South Korea

- Rest of Asia-Pacific

Latin America

- Brazil

- Mexico

- Rest of Latin America

The Middle East & Africa

- South Africa

- GCC Countries

- Rest of the Middle East & Africa (ME&A)

Bioimplants Market Regional Analysis

North America leads the market with the highest revenue share and is expected to maintain its dominance throughout the bioimplants market forecast period from 2023 to 2032. The well-established healthcare infrastructure and awareness about implants in developed economies like the US and Canada support the regional market value. The increasing incidence of chronic diseases among the aging population is also accelerating demand.

Asia-Pacific is experiencing significant growth, particularly in emerging economies such as China and India. The development of healthcare infrastructure and increased investment in the field to provide efficient benefits to patients are driving regional market growth. For example, according to a publication from Japan's Keio University in 2019, around 100,000 patients in Japan were paralyzed due to spinal cord injuries. However, the approval of iPS technology is expected to help such patients in the country in the near future. This factor is projected to provide potential opportunities in the bio-implants market.

Bioimplants Market Players

Some of the top bioimplants companies offered in our report includes Abbott (formerly St. Jude Medical), Medtronic, DePuy Synthes (J&J), Zimmer Biomet, Stryker, Orthofix Holdings, Exactech, Arthrex, Cochlear Ltd, and Organogenesis Inc.