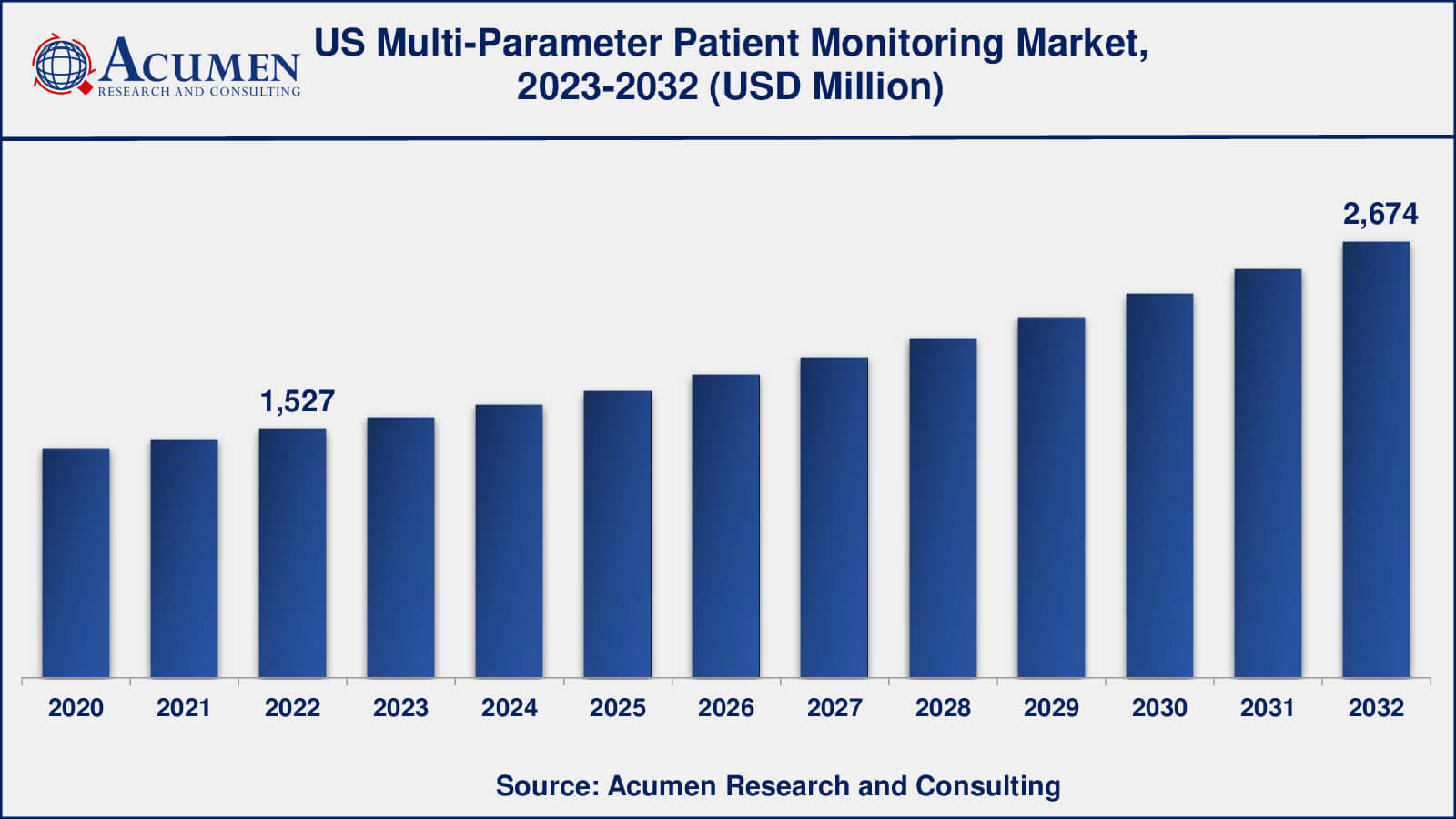

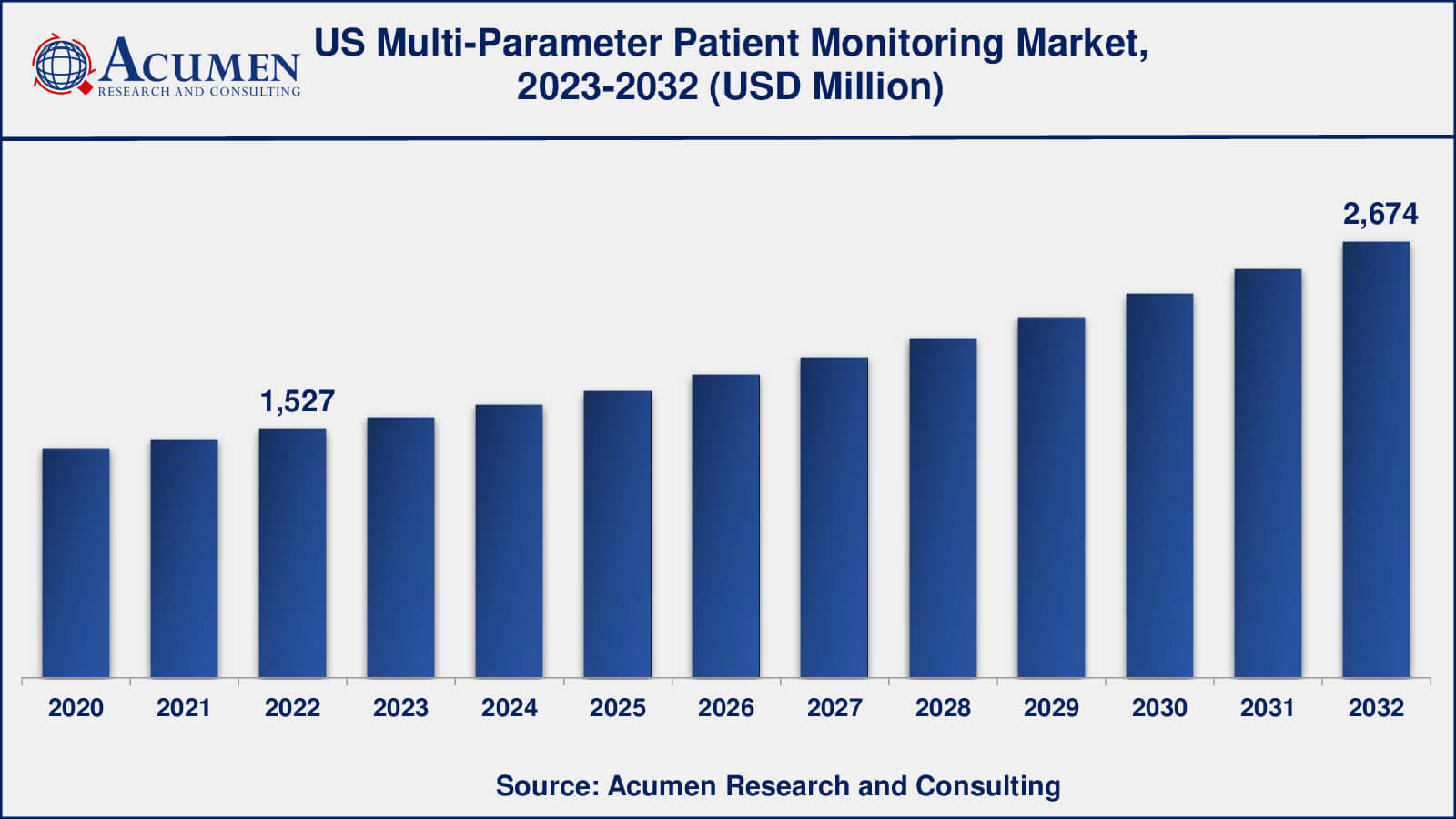

The United States Multi-Parameter Patient Monitoring Market gathered USD 1,527 Million in 2022 and is expected to reach USD 2,673.8 Million by 2032, growing at a CAGR of 5.9% from 2023 to 2032.

United States Multi-Parameter Patient Monitoring Market Highlights

- The US multi-parameter patient monitoring market is poised to achieve a revenue of USD 2,673.8 Million by 2032, experiencing a CAGR of 5.9% from 2023 to 2032

- Among type, the portable sub-segment accounted for revenue exceeding USD 1 billion in 2022

- In terms of age group, the geriatric sub-segment claimed a significant share, surpassing 60% in 2022

- Collaborations between healthcare providers and technology companies is one of the notable US multi-parameter patient monitoring market trends

Multi-parameter patient monitoring involves the continuous measurement and recording of various vital signs and physiological parameters of patients in healthcare settings. These parameters typically include heart rate, blood pressure, respiratory rate, oxygen saturation levels, temperature, and sometimes additional data like ECG (electrocardiogram) readings. The monitoring equipment is designed to provide healthcare professionals with real-time information about a patient's condition, helping in early detection of critical changes, timely interventions, and improving patient care. Multi-parameter patient monitoring systems are crucial in intensive care units (ICUs), operating rooms, recovery rooms, and other clinical settings where constant monitoring of patient health is essential for effective medical treatment and patient safety. Advances in technology have led to the development of portable and wireless monitoring devices, enabling continuous monitoring even in non-traditional healthcare environments, such as home care and remote telehealth settings.

United States Multi-Parameter Patient Monitoring Market Dynamics

Market Drivers

- Growing aging population and chronic disease prevalence

- Technological advancements in patient monitoring devices

- Increased demand for remote patient monitoring solutions

- Rising healthcare expenditure and focus on patient outcomes

Market Restraints

- High cost of advanced monitoring equipment

- Regulatory hurdles and data privacy concerns

- Limited interoperability between different monitoring systems

- Shortage of skilled healthcare professionals

Market Opportunities

- Expansion of telehealth and virtual care services

- Integration of AI and machine learning in monitoring

- Emerging markets with untapped potential

US Multi-Parameter Patient Monitoring Market Report Coverage

| Market |

US Multi-Parameter Patient Monitoring Market

|

| US Multi-Parameter Patient Monitoring Market Size 2022 |

USD 1,527 Million |

| US Multi-Parameter Patient Monitoring Market Forecast 2032 |

USD 2,673.8 Million |

| US Multi-Parameter Patient Monitoring Market CAGR During 2023 - 2032 |

5.9% |

| US Multi-Parameter Patient Monitoring Market Analysis Period |

2020 - 2032 |

US Multi-Parameter Patient Monitoring Market Base Year

|

2022 |

| US Multi-Parameter Patient Monitoring Market Forecast Data |

2023 - 2032 |

| Segments Covered |

By Type, By Acuity Level, By Age Group, By End-Use, And By Geography

|

| Key Companies Profiled |

Philips Healthcare, Medtronic, General Electric (GE) Healthcare, Masimo Corporation, Nihon Kohden, Welch Allyn (Hillrom), Smiths Medical, Spacelabs Healthcare, Mindray, and ZOLL Medical Corporation.

|

Report Coverage

|

Market Trends, Drivers, Restraints, Competitive Analysis, Player Profiling, Covid-19 Analysis, Regulation Analysis |

US Multi-Parameter Patient Monitoring Market Insights

The U.S. multi-parameter patient monitoring market, characterized by its advanced healthcare infrastructure and continuous technological innovation, exhibits dynamic trends and influences. This robust market has witnessed sustained growth attributed to several key factors. Firstly, the increasing aging population and a rising prevalence of chronic diseases are driving the demand for multi-parameter patient monitoring solutions. As the U.S. population ages, there is a heightened need for continuous monitoring to manage and prevent health complications.

Technological advancements in the healthcare sector have significantly shaped the United States multi-parameter patient monitoring market. The integration of artificial intelligence (AI) and machine learning in monitoring devices has enhanced their capabilities, enabling more accurate diagnoses and predictive analytics. These innovations have not only improved patient outcomes but also expanded the market's scope and competitiveness.

The COVID-19 pandemic further accelerated the adoption of multi-parameter patient monitoring solutions. Healthcare facilities needed to monitor patients remotely, leading to a surge in demand for telehealth and virtual care services. This unforeseen development highlighted the critical role of continuous monitoring in managing public health crises and is expected to continue influencing the market.

While these drivers fuel United States multi-parameter patient monitoring market growth, several challenges and restraints persist. The high cost of advanced monitoring equipment can strain healthcare budgets, limiting widespread adoption. Regulatory hurdles and concerns related to data privacy are also significant obstacles. The interoperability between different monitoring systems and the shortage of skilled healthcare professionals capable of effectively utilizing these technologies represent additional barriers to market expansion.

However, amidst these challenges lie ample opportunities for market players. The expansion of telehealth and the integration of AI and machine learning in monitoring devices present promising avenues for growth. Emerging markets within the U.S. offer untapped potential, particularly in remote and underserved areas. Moreover, the shift towards home-based patient monitoring solutions, driven by patient preferences and the need to reduce hospital readmissions, is poised to reshape the market landscape. Collaborations between healthcare providers and technology companies are also likely to drive innovation and market expansion, creating a dynamic and evolving ecosystem for multi-parameter patient monitoring in the United States.

Multi-Parameter Patient Monitoring Market Segmentation

The Unites States market for multi-parameter patient monitoring is categorized into type, acuity level, age group, end-use, and geography.

US Multi-Parameter Patient Monitoring Type Outlook

According to United States multi-parameter patient monitoring industry analysis, fixed type dominated the industry in 2022. With advancements in technology and a growing trend toward home healthcare and remote patient monitoring, portable devices have gained significant traction. These devices are designed to be compact and easy to move, making them suitable for use in various settings, including homes and ambulances. They allow for continuous monitoring of patients outside of traditional hospital environments, which has become increasingly important, especially for patients with chronic conditions.

Fixed multi-parameter patient monitoring systems are typically found in hospitals, intensive care units (ICUs), operating rooms, and other clinical settings where continuous monitoring of patients is essential. Fixed monitors are hardwired into the healthcare facility's infrastructure and provide a stable and reliable source of real-time patient data. In such clinical environments, fixed monitoring systems have traditionally been dominant

US Multi-Parameter Patient Monitoring Acuity Level Outlook

- High-Acuity

- Mid-Acuity

- Low-Acuity

According to the multi-parameter patient monitoring market analysis, high-acuity patient monitoring accounted for significant industry.

High-acuity monitoring is typically associated with critical care settings, such as intensive care units (ICUs) and emergency departments. Patients in these settings often require continuous and comprehensive monitoring of vital signs and physiological parameters. High-acuity monitoring systems are designed to handle complex cases and provide real-time data for critical decision-making. In such settings, high-acuity monitoring tends to dominate due to the critical nature of patient conditions.

Mid-acuity monitoring is often found in step-down units, progressive care units, and post-surgical recovery areas. Patients in these settings may have less severe conditions compared to ICU patients but still require continuous monitoring to detect any deterioration. Mid-acuity monitoring strikes a balance between comprehensive monitoring and patient mobility, making it suitable for various inpatient care scenarios.

Low-acuity monitoring is typically associated with general wards, long-term care facilities, and home healthcare. Patients in these settings often have stable conditions or chronic illnesses that require periodic monitoring. Low-acuity monitoring solutions are designed to provide essential data while allowing patients to maintain a higher degree of mobility and independence. In these settings, low-acuity monitoring solutions may dominate due to the emphasis on cost-effectiveness and patient comfort.

US Multi-Parameter Patient Monitoring Age Group Outlook

- Pediatric

- Adult

- Geriatric

As per the United States Multi-Parameter Patient Monitoring Market forecast, as the population ages, the geriatric patient population has been growing. Geriatric patients often have multiple chronic conditions and complex healthcare needs. Geriatric monitoring may require specialized equipment to address age-related conditions, such as monitoring for cardiovascular disease, diabetes, and respiratory issues. Long-term care facilities and home healthcare settings often focus on the geriatric population.

Pediatric patients include infants, children, and adolescents. Pediatric monitoring is specialized and requires devices designed to accommodate the smaller size and unique physiological characteristics of children. In pediatric intensive care units (PICUs) and neonatal intensive care units (NICUs), pediatric monitoring is critical.

Adults typically comprise the largest patient population in most healthcare settings. Hospitals, clinics, and outpatient facilities primarily serve adult patients. Monitoring devices designed for adults are the most commonly used in healthcare facilities. These devices cover a wide range of medical conditions and can include standard multi-parameter patient monitoring equipment.

US Multi-Parameter Patient Monitoring End-Use Outlook

- Hospitals

- Ambulatory Surgical Centers

- Homecare Settings

As per the U.S. multi parameter patient monitoring market forecast, hospitals, especially larger medical centers and tertiary care facilities, have traditionally been significant users of multi-parameter patient monitoring systems. They require continuous monitoring of patients in various departments, including intensive care units (ICUs), emergency departments, operating rooms, and general wards. Hospitals serve a diverse patient population with a wide range of medical conditions, making patient monitoring systems a critical component of their healthcare infrastructure.

Ambulatory surgical centers (ASCs) are outpatient facilities that focus on providing same-day surgical procedures. While ASCs may not require the same level of continuous monitoring as hospitals, they often use multi-parameter patient monitoring systems to ensure patient safety during procedures and post-surgery recovery. Furthermore, homecare settings, including home healthcare agencies and individual homes, have seen a significant rise in the use of multi-parameter patient monitoring devices. This trend has been driven by the desire to provide care in a more comfortable and cost-effective environment, especially for patients with chronic conditions or those recovering from surgeries. Portable and remote monitoring solutions have become essential for home-based patient care

US Multi-Parameter Patient Monitoring Market Players

Some of the top multi-parameter patient monitoring companies offered in our report includes Philips Healthcare, Medtronic, General Electric (GE) Healthcare, Masimo Corporation, Nihon Kohden, Welch Allyn (Hillrom), Smiths Medical, Spacelabs Healthcare, Mindray, and ZOLL Medical Corporation.

CHAPTER 1. Industry Overview of US Multi-Parameter Patient Monitoring Market

1.1. Definition and Scope

1.1.1. Definition of Multi-Parameter Patient Monitoring

1.1.2. Market Segmentation

1.1.3. Years Considered for the Study

1.1.4. Assumptions and Acronyms Used

1.1.4.1. Market Assumptions and Market Forecast

1.1.4.2. Acronyms Used in US Multi-Parameter Patient Monitoring Market

1.2. Summary

1.2.1. Executive Summary

1.2.2. US Multi-Parameter Patient Monitoring Market By Type

1.2.3. US Multi-Parameter Patient Monitoring Market By Acuity Level

1.2.4. US Multi-Parameter Patient Monitoring Market By Age Group

1.2.5. US Multi-Parameter Patient Monitoring Market By End-Use

1.2.6. US Multi-Parameter Patient Monitoring Market By Region

CHAPTER 2. Research Approach

2.1. Methodology

2.1.1. Research Programs

2.1.2. Market Size Estimation

2.1.3. Market Breakdown and Data Triangulation

2.2. Data Source

2.2.1. Secondary Sources

2.2.2. Primary Sources

CHAPTER 3. Market Dynamics And Competition Analysis

3.1. Market Drivers

3.1.1. Driver 1

3.1.2. Driver 2

3.2. Restraints and Challenges

3.2.1. Restraint 1

3.2.2. Restraint 2

3.3. Growth Opportunities

3.3.1. Opportunity 1

3.3.2. Opportunity 2

3.4. Porter’s Five Forces Analysis

3.4.1. Bargaining Power of Suppliers

3.4.2. Bargaining Power of Buyers

3.4.3. Threat of Substitute

3.4.4. Threat of New Entrants

3.4.5. Degree of Competition

3.5. Market Concentration Ratio and Market Maturity Analysis of US Multi-Parameter Patient Monitoring Market

3.5.1. Go To Market Strategy

3.5.1.1. Introduction

3.5.1.2. Growth

3.5.1.3. Maturity

3.5.1.4. Saturation

3.5.1.5. Possible Development

3.6. Technological Roadmap for US Multi-Parameter Patient Monitoring Market

3.7. Value Chain Analysis

3.7.1. List of Key Manufacturers

3.7.2. List of Customers

3.7.3. Level of Integration

3.8. Regulatory Compliance

3.9. Competitive Landscape, 2022

3.9.1. Player Positioning Analysis

3.9.2. Key Strategies Adopted By Leading Players

CHAPTER 4. US Multi-Parameter Patient Monitoring Market By Type

4.1. Introduction

4.2. US Multi-Parameter Patient Monitoring Market Revenue By Type

4.2.1. US Multi-Parameter Patient Monitoring Market Revenue (USD Million) and Forecast, By Type, 2020-2032

4.2.2. Fixed

4.2.2.1. Fixed Market Revenue (USD Million) and Growth Rate (%), 2020-2032

4.2.3. Portable

4.2.3.1. Portable Market Revenue (USD Million) and Growth Rate (%), 2020-2032

CHAPTER 5. US Multi-Parameter Patient Monitoring Market By Acuity Level

5.1. Introduction

5.2. US Multi-Parameter Patient Monitoring Market Revenue By Acuity Level

5.2.1. US Multi-Parameter Patient Monitoring Market Revenue (USD Million) and Forecast, By Acuity Level, 2020-2032

5.2.2. High-Acuity

5.2.2.1. High-Acuity Market Revenue (USD Million) and Growth Rate (%), 2020-2032

5.2.3. Mid-Acuity

5.2.3.1. Mid-Acuity Market Revenue (USD Million) and Growth Rate (%), 2020-2032

5.2.4. Low-Acuity

5.2.4.1. Low-Acuity Market Revenue (USD Million) and Growth Rate (%), 2020-2032

CHAPTER 6. US Multi-Parameter Patient Monitoring Market By Age Group

6.1. Introduction

6.2. US Multi-Parameter Patient Monitoring Market Revenue By Age Group

6.2.1. US Multi-Parameter Patient Monitoring Market Revenue (USD Million) and Forecast, By Age Group, 2020-2032

6.2.2. Pediatric

6.2.2.1. Pediatric Market Revenue (USD Million) and Growth Rate (%), 2020-2032

6.2.3. Adult

6.2.3.1. Adult Market Revenue (USD Million) and Growth Rate (%), 2020-2032

6.2.4. Geriatric

6.2.4.1. Geriatric Market Revenue (USD Million) and Growth Rate (%), 2020-2032

CHAPTER 7. US Multi-Parameter Patient Monitoring Market By End-Use

7.1. Introduction

7.2. US Multi-Parameter Patient Monitoring Market Revenue By End-Use

7.2.1. US Multi-Parameter Patient Monitoring Market Revenue (USD Million) and Forecast, By End-Use, 2020-2032

7.2.2. Hospitals

7.2.2.1. Hospitals Market Revenue (USD Million) and Growth Rate (%), 2020-2032

7.2.3. Ambulatory Surgical Centers

7.2.3.1. Ambulatory Surgical Centers Market Revenue (USD Million) and Growth Rate (%), 2020-2032

7.2.4. Homecare Settings

7.2.4.1. Homecare Settings Market Revenue (USD Million) and Growth Rate (%), 2020-2032

CHAPTER 8. Player Analysis Of US Multi-Parameter Patient Monitoring Market

8.1. US Multi-Parameter Patient Monitoring Market Company Share Analysis

8.2. Competition Matrix

8.2.1. Competitive Benchmarking of key players by price, presence, market share, and R&D investment

8.2.2. New Product Launches and Product Enhancements

8.2.3. Mergers And Acquisition In US Multi-Parameter Patient Monitoring Market

8.2.4. Partnership, Joint Ventures and Strategic Alliances/ Sales Agreements

CHAPTER 9. Company Profile

9.1. Philips Healthcare

9.1.1. Company Snapshot

9.1.2. Business Overview

9.1.3. Financial Overview

9.1.3.1. Revenue (USD Million), 2022

9.1.3.2. Philips Healthcare 2022 Multi-Parameter Patient Monitoring Business Regional Distribution

9.1.4. Product /Service and Specification

9.1.5. Recent Developments & Business Strategy

9.2. Medtronic

9.3. General Electric (GE) Healthcare

9.4. Masimo Corporation

9.5. Nihon Kohden

9.6. Welch Allyn (Hillrom)

9.7. Smiths Medical

9.8. Spacelabs Healthcare

9.9. Mindray

9.10. ZOLL Medical Corporation