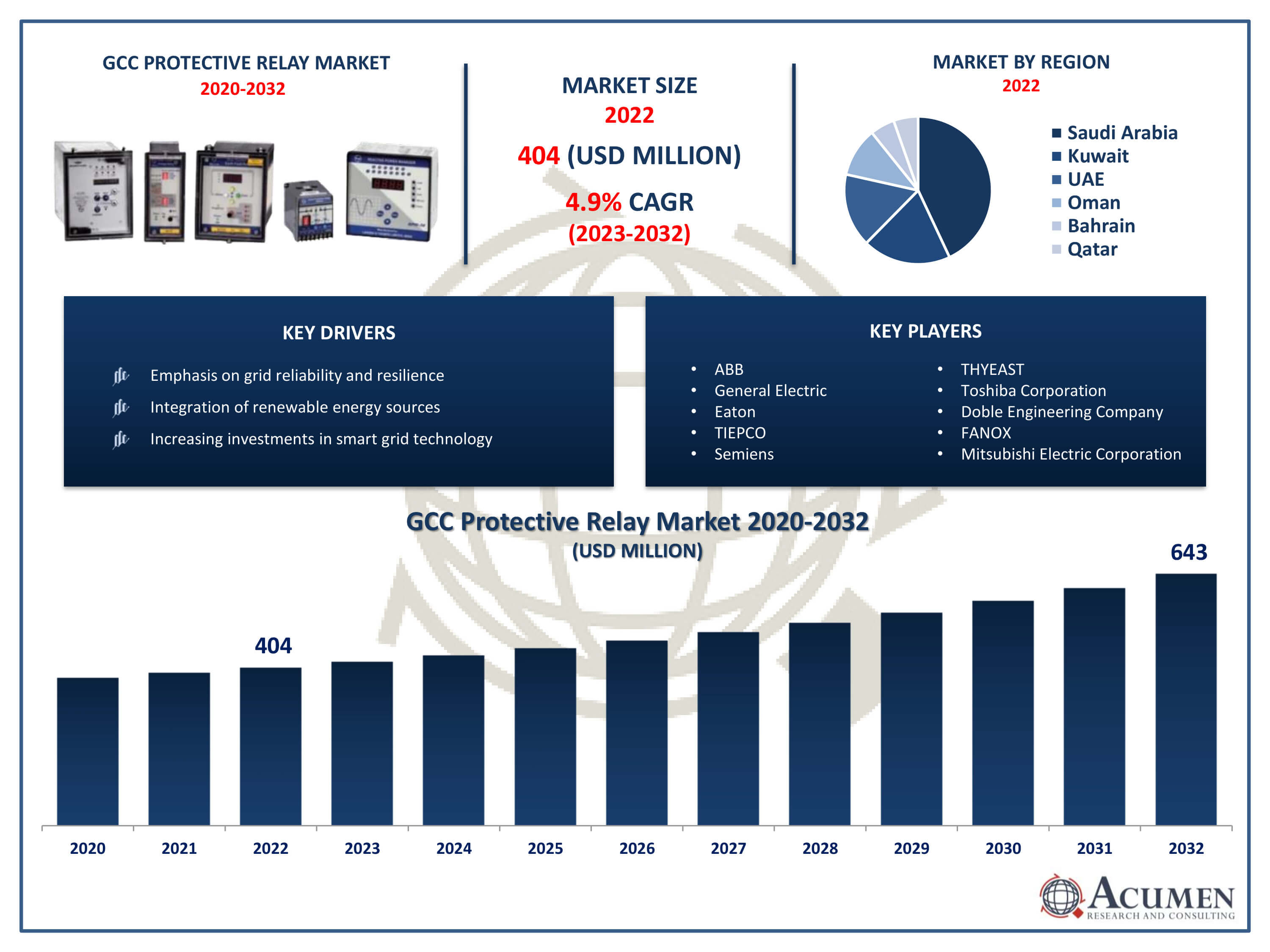

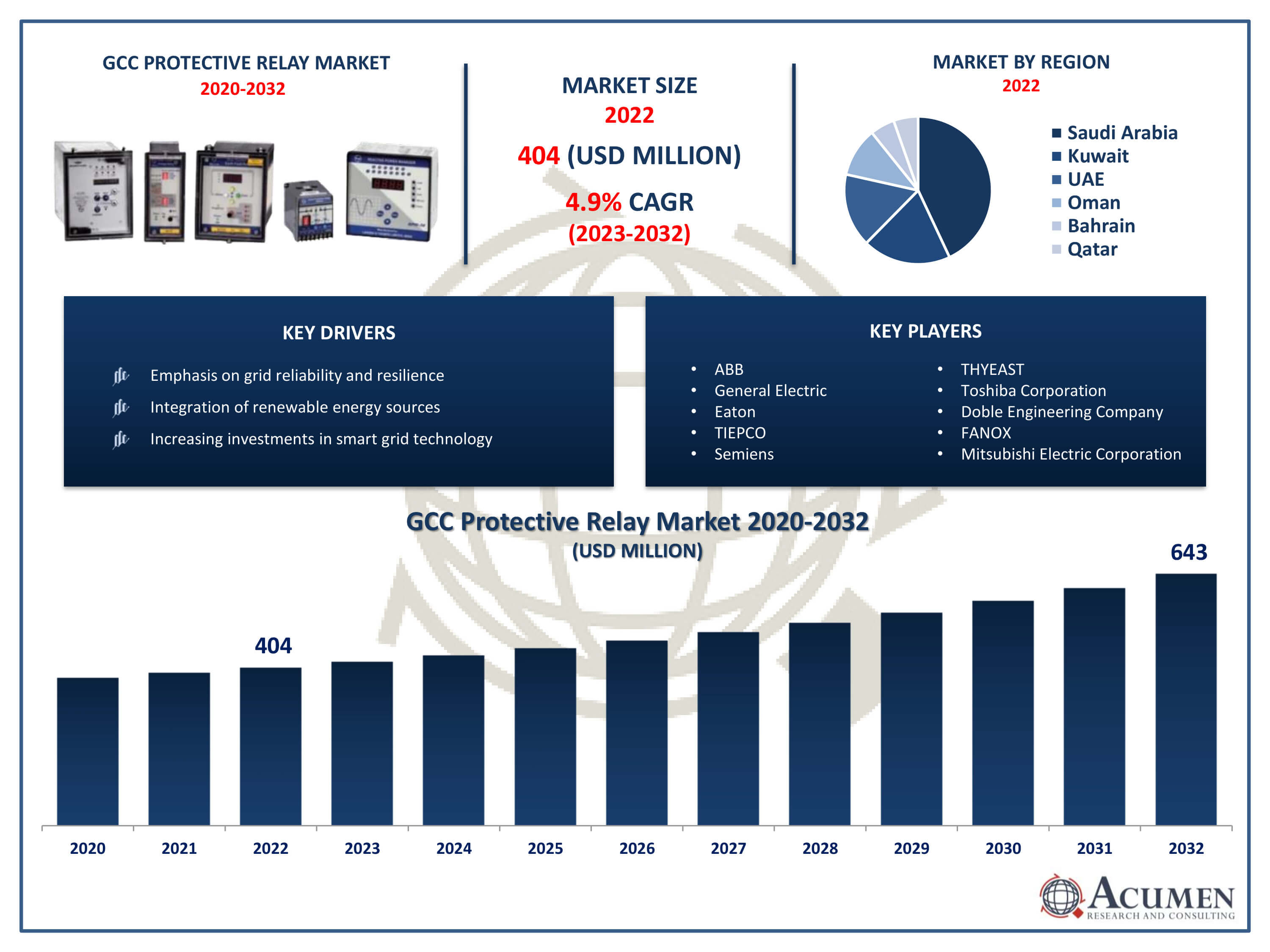

The GCC Protective Relay Market Size accounted for USD 404 Million in 2022 and is projected to achieve a market size of USD 643 Million by 2032 growing at a CAGR of 4.9% from 2023 to 2032.

GCC Protective Relay Market Highlights

- GCC Protective Relay Market revenue is expected to increase by USD 643 Million by 2032, with a 4.9% CAGR from 2023 to 2032

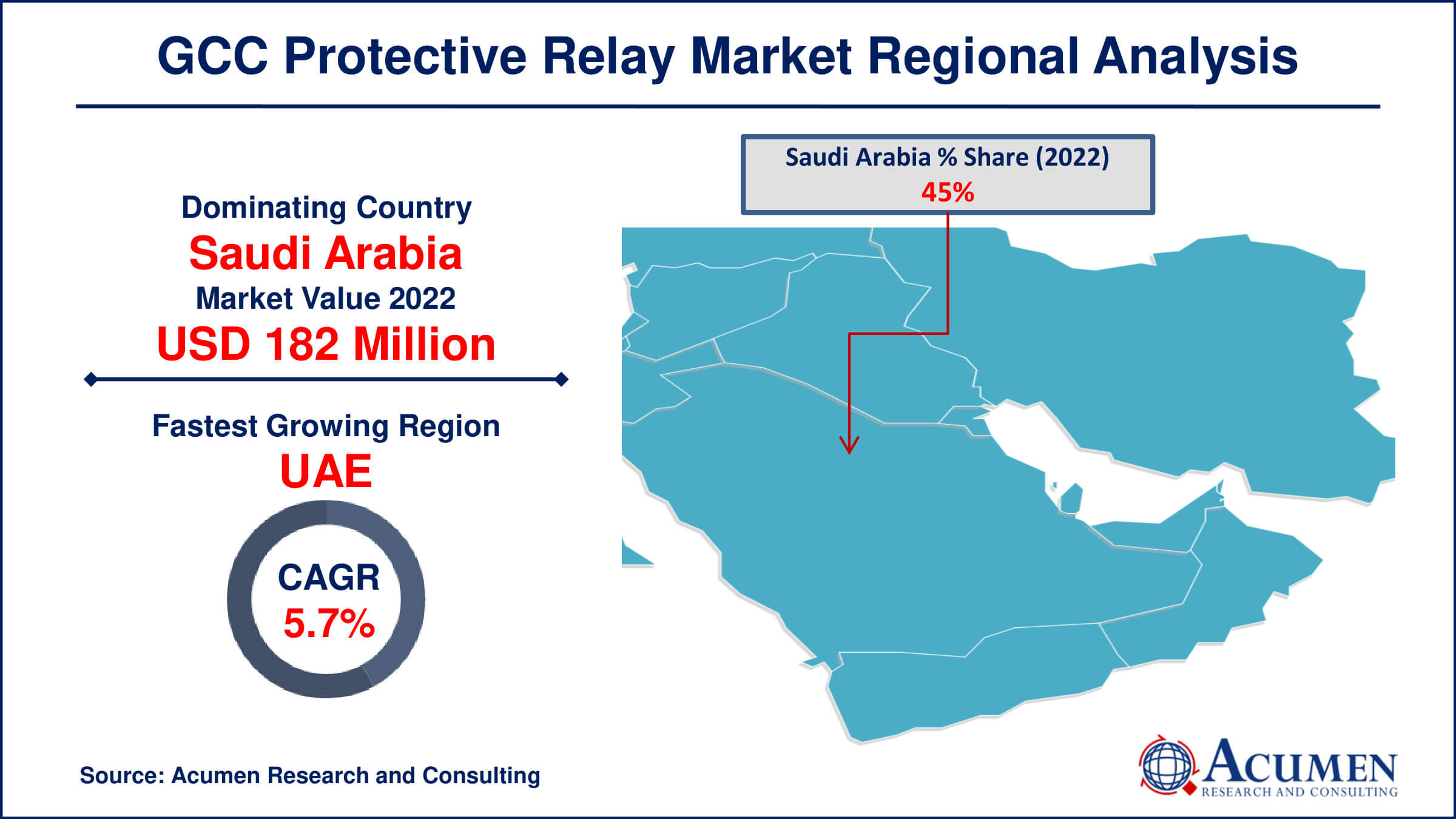

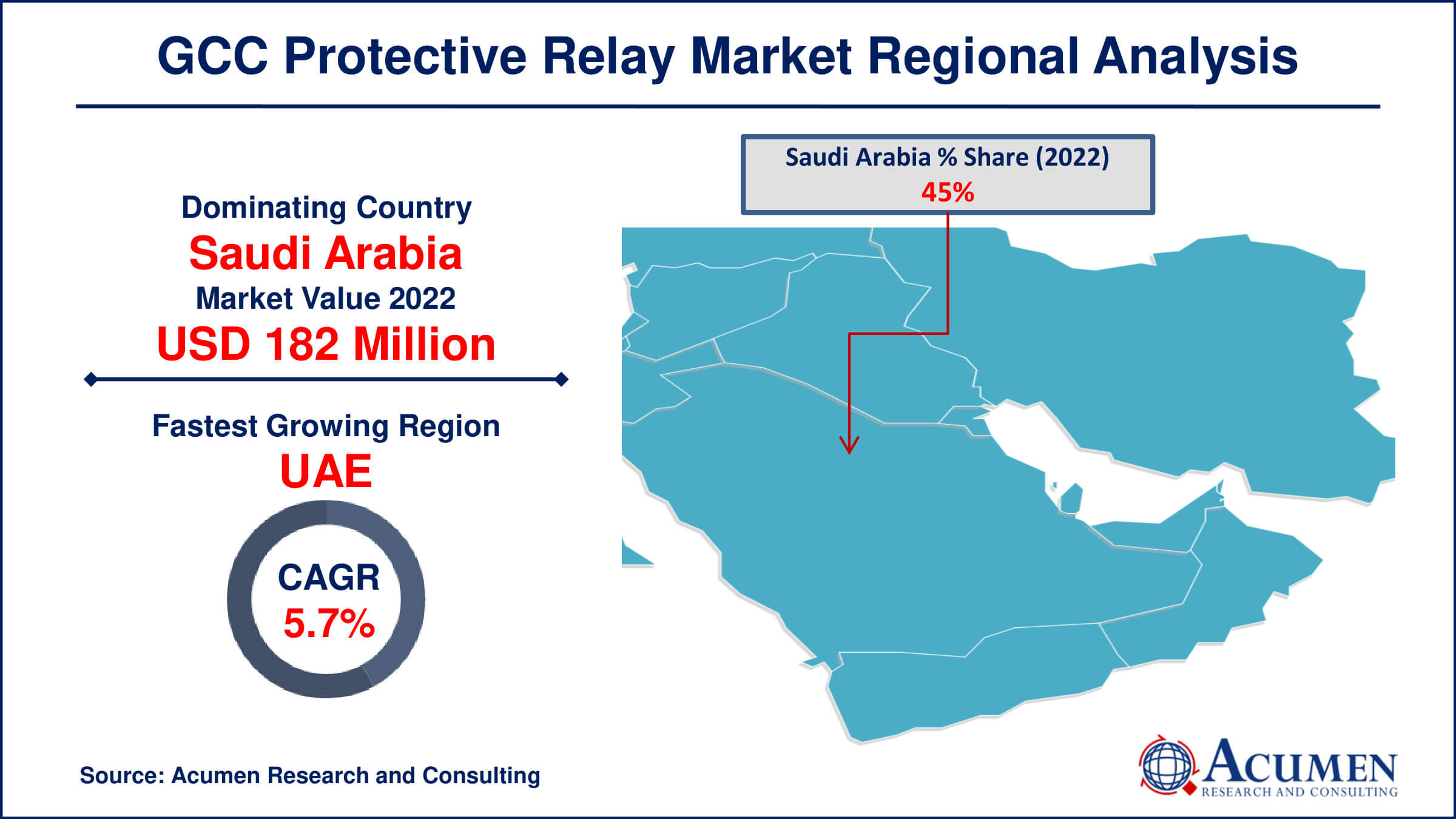

- Saudi Arabia region led with more than 45% of Protective Relay Market share in 2022

- UAE Protective Relay Market growth will record a CAGR of more than 5.7% from 2023 to 2032

- By voltage, the medium voltage segment captured more than 44% of revenue share in 2022.

- By end use, the infrastructure segment is predicted to raise at a notable CAGR of 5.5% between 2023 and 2032

- Growing demand for electricity and expanding power infrastructure, drives the Protective Relay Market value

A protective relay is an essential component in electrical power systems designed to detect abnormal conditions, such as overloads, faults, or voltage variations, and initiate appropriate actions to isolate the affected part of the system. Its primary function is to safeguard power equipment and ensure the reliability and stability of the electrical grid. Protective relays play a crucial role in preventing equipment damage, minimizing downtime, and enhancing overall system performance.

In the Gulf Cooperation Council (GCC) region, which includes countries such as Saudi Arabia, the United Arab Emirates, Qatar, Kuwait, Bahrain, and Oman, the market for protective relays has experienced significant growth. This growth can be attributed to the increasing demand for electricity, rapid industrialization, and the ongoing expansion of power infrastructure in the region. As these countries invest in upgrading and modernizing their power systems to meet the rising energy needs, there is a corresponding surge in the demand for advanced protective relay technologies. The emphasis on improving grid resilience and reliability further contributes to the adoption of sophisticated protective relay solutions in the GCC market.

GCC Protective Relay Market Trends

Market Drivers

- Growing demand for electricity and expanding power infrastructure

- Emphasis on grid reliability and resilience

- Integration of renewable energy sources

- Increasing investments in smart grid technology

Market Restraints

- Economic uncertainties impacting investment decisions

- Technical and interoperability challenges

Market Opportunities

- Rising awareness of the importance of power system protection

- Government initiatives promoting sustainable energy solutions

GCC Protective Relay Market Report Coverage

| Market |

GCC Protective Relay Market

|

| GCC Protective Relay Market Size 2022 |

USD 404 Million |

| GCC Protective Relay Market Forecast 2032 |

USD 643 Million |

| GCC Protective Relay Market CAGR During 2023 - 2032 |

4.9% |

| GCC Protective Relay Market Analysis Period |

2020 - 2032 |

GCC Protective Relay Market Base Year

|

2022 |

| GCC Protective Relay Market Forecast Data |

2023 - 2032 |

| Segments Covered |

By Voltage, By Application, By End Use, And By Geography

|

| Regional Scope |

Saudi Arabia, Kuwait, UAE, Oman, Bahrain, and Qatar |

| Key Companies Profiled |

ABB, General Electric, Eaton, TIEPCO, Semiens, THYEAST, Toshiba Corporation, Doble Engineering Company, FANOX, Mitsubishi Electric Corporation, NR Electric Co., Ltd., and Schneider Electric.

|

Report Coverage

|

Market Trends, Drivers, Restraints, Competitive Analysis, Player Profiling, Covid-19 Analysis, Regulation Analysis |

GCC Protective Relay Market Dynamics

A protective relay is a specialized device used in electrical power systems to monitor and detect abnormal conditions within the system, such as overloads, short circuits, voltage variations, and other faults. Its primary purpose is to initiate appropriate actions, such as tripping circuit breakers or isolating specific parts of the system, to prevent damage to equipment and ensure the overall stability and reliability of the electrical grid. Protective relays act as the first line of defense, swiftly responding to potential issues and minimizing the impact of faults on the power system. The application of protective relays is diverse and critical across various sectors of the power industry. In transmission and distribution networks, protective relays are employed to detect and isolate faults, preventing the spread of disturbances and minimizing downtime.

The protective relay market in the Gulf Cooperation Council (GCC) has witnessed robust growth in recent years, driven by several factors contributing to the region's expanding power sector. The relentless demand for electricity, primarily fueled by rapid industrialization and population growth, has prompted significant investments in power infrastructure across GCC countries. This heightened activity in the construction and development of power plants, transmission lines, and distribution networks has directly fueled the demand for advanced protective relay systems. The increasing complexity and scale of these power systems necessitate sophisticated protection mechanisms to ensure reliability, mitigate risks, and minimize downtime. Furthermore, the GCC's strategic focus on enhancing grid resilience and reliability has propelled the adoption of state-of-the-art protective relay technologies. As these countries continue to invest in upgrading their power grids to meet the challenges of a modern energy landscape, there is a growing market for innovative protective relay solutions.

GCC Protective Relay Market Segmentation

The GCC Protective Relay Market segmentation is based on voltage, application, end use, and geography.

GCC Protective Relay Market By Voltage

- Low voltage

- High voltage

- Medium voltage

According to the protective relay industry analysis, the medium voltage segment accounted for the largest market share in 2022. Medium voltage refers to the voltage range typically found in distribution networks, making it a critical component in the electricity supply chain. As industries and urban areas expand, the demand for reliable and efficient medium voltage power distribution has increased, leading to a parallel surge in the adoption of advanced protective relay solutions. One key driver of growth in the medium voltage protective relay market is the emphasis on grid reliability and resilience. As power distribution networks become more complex and interconnected, the need for timely and accurate fault detection and isolation is paramount. Medium voltage protective relays play a crucial role in identifying and responding to abnormalities, helping prevent equipment damage, reduce downtime, and ensure the uninterrupted supply of electricity to end-users.

GCC Protective Relay Market By Application

- Feeder protection

- Bus-bar protection

- Generator protection

- Capacitor bank protection

- Transformer protection

- Breaker protection

- Others

In terms of applications, the feeder protection segment is expected to witness significant growth in the coming years. This growth is growth due to the increasing complexity of power distribution networks and the critical role of feeders in delivering electricity from substations to end-users. Feeders are the arteries of distribution systems, and their reliable operation is vital for ensuring a stable and continuous power supply. With the rise in urbanization, industrialization, and the integration of renewable energy sources, the demand for efficient and adaptive feeder protection solutions has grown significantly. One of the key drivers contributing to the growth of the feeder protection segment is the expanding deployment of smart grid technologies. Smart grids leverage advanced communication and control systems to enhance the monitoring and management of distribution networks.

GCC Protective Relay Market By End Use

- Infrastructure

- Government

- Power

- Industrial

- Others

According to the protective relay market forecast, the infrastructure segment is expected to witness significant growth in the coming years. As nations invest in expanding and upgrading their overall infrastructure, including power generation, transmission, and distribution systems, there is a parallel need for advanced protective relay solutions. Infrastructure projects, such as the construction of new power plants, substations, and transmission lines, require robust protection mechanisms to ensure the longevity and resilience of the installed electrical systems. One significant driver of growth in the infrastructure segment is the ongoing global trend toward urbanization. Rapidly growing urban areas necessitate the development of new infrastructure projects to meet increasing energy demands. Protective relays play a crucial role in safeguarding critical components of these infrastructure projects, preventing equipment failures, and minimizing the risk of power outages. Additionally, the increasing integration of smart technologies in infrastructure development, often referred to as smart infrastructure, further propels the adoption of protective relays.

GCC Protective Relay Market Regional Outlook

- Saudi Arabia

- UAE

- Bahrain

- Kuwait

- Qatar

- Oman

GCC Protective Relay Market Regional Analysis

Saudi Arabia has emerged as a dominant force in the Gulf Cooperation Council (GCC) protective relay market, showcasing significant growth and influence in recent years. The Kingdom's dominance can be attributed to several factors, including its strategic investments in expanding power infrastructure and commitment to ensuring a reliable and resilient electrical grid. As the largest economy in the GCC, Saudi Arabia has experienced rapid industrialization and urbanization, driving an unprecedented demand for electricity. In response to this surge, the country has undertaken ambitious projects to develop and modernize its power generation, transmission, and distribution systems, creating a substantial market for protective relay technologies. Furthermore, Saudi Arabia's leadership role in embracing advanced technologies and innovations has contributed to its dominance in the protective relay market. The country has been proactive in adopting smart city platform, which integrate sophisticated protective relays to enhance grid intelligence and responsiveness. The Saudi government's Vision 2030 initiative, which aims to diversify the economy and achieve sustainable development, includes significant investments in the power sector, further propelling the demand for protective relay systems.

GCC Protective Relay Market Player

Some of the top GCC protective relay market companies offered in the professional report include ABB, General Electric, Eaton, TIEPCO, Semiens, THYEAST, Toshiba Corporation, Doble Engineering Company, FANOX, Mitsubishi Electric Corporation, NR Electric Co., Ltd., and Schneider Electric.

CHAPTER 1. Industry Overview of Protective Relay Market

1.1. Definition and Scope

1.1.1. Definition of Protective Relay

1.1.2. Market Segmentation

1.1.3. Years Considered for the Study

1.1.4. Assumptions and Acronyms Used

1.1.4.1. Market Assumptions and Market Forecast

1.1.4.2. Acronyms Used in GCC Protective Relay Market

1.2. Summary

1.2.1. Executive Summary

1.2.2. Protective Relay Market By Voltage

1.2.3. Protective Relay Market By Application

1.2.4. Protective Relay Market By End Use

1.2.5. Protective Relay Market By Region

CHAPTER 2. Research Approach

2.1. Methodology

2.1.1. Research Programs

2.1.2. Market Size Estimation

2.1.3. Market Breakdown and Data Triangulation

2.2. Data Source

2.2.1. Secondary Source

2.2.2. Primary Source

CHAPTER 3. Market Dynamics And Competition Analysis

3.1. Market Drivers

3.1.1. Driver 1

3.1.2. Driver 2

3.2. Restraints and Challenges

3.2.1. Restraint 1

3.2.2. Restraint 2

3.3. Growth Opportunities

3.3.1. Opportunity 1

3.3.2. Opportunity 2

3.4. Porter’s Five Forces Analysis

3.4.1. Bargaining Power of Suppliers

3.4.2. Bargaining Power of Buyers

3.4.3. Threat of Substitute

3.4.4. Threat of New Entrants

3.4.5. Degree of Competition

3.5. Market Concentration Ratio and Market Maturity Analysis of Protective Relay Market

3.5.1. Go To Market Strategy

3.5.1.1. Introduction

3.5.1.2. Growth

3.5.1.3. Maturity

3.5.1.4. Saturation

3.5.1.5. Possible Development

3.6. Technological Roadmap for Protective Relay Market

3.7. Value Chain Analysis

3.7.1. List of Key Manufacturers

3.7.2. List of Customers

3.7.3. Level of Integration

3.8. Price Trend of Key Raw Material

3.8.1. Raw Material Suppliers

3.8.2. Proportion of Manufacturing Cost Structure

3.8.2.1. Raw Material

3.8.2.2. Labor Cost

3.8.2.3. Manufacturing Expense

3.9. Regulatory Compliance

3.10. Competitive Landscape, 2022

3.10.1. Player Positioning Analysis

3.10.2. Key Strategies Adopted By Leading Players

CHAPTER 4. Manufacturing Plant Analysis

4.1. Manufacturing Plant Location and Establish Date of Major Manufacturers in 2022

4.2. R&D Status of Major Manufacturers in 2022

CHAPTER 5. Protective Relay Market By Voltage

5.1. Introduction

5.2. Protective Relay Revenue By Voltage

5.2.1. Protective Relay Revenue (USD Million) and Forecast, By Voltage, 2020-2032

5.2.2. Low voltage

5.2.2.1. Low Voltage Market Revenue (USD Million) and Growth Rate (%), 2020-2032

5.2.3. High voltage

5.2.3.1. High Voltage Market Revenue (USD Million) and Growth Rate (%), 2020-2032

5.2.4. Medium voltage

5.2.4.1. Medium Voltage Market Revenue (USD Million) and Growth Rate (%), 2020-2032

CHAPTER 6. Protective Relay Market By Application

6.1. Introduction

6.2. Protective Relay Revenue By Application

6.2.1. Protective Relay Revenue (USD Million) and Forecast, By Application, 2020-2032

6.2.2. Feeder Protection

6.2.2.1. Feeder Protection Market Revenue (USD Million) and Growth Rate (%), 2020-2032

6.2.3. Bus-bar Protection

6.2.3.1. Bus-bar Protection Market Revenue (USD Million) and Growth Rate (%), 2020-2032

6.2.4. Generator Protection

6.2.4.1. Generator Protection Market Revenue (USD Million) and Growth Rate (%), 2020-2032

6.2.5. Capacitor bank Protection

6.2.5.1. Capacitor Bank Protection Market Revenue (USD Million) and Growth Rate (%), 2020-2032

6.2.6. Transformer Protection

6.2.6.1. Transformer Protection Market Revenue (USD Million) and Growth Rate (%), 2020-2032

6.2.7. Breaker Protection

6.2.7.1. Breaker Protection Market Revenue (USD Million) and Growth Rate (%), 2020-2032

6.2.8. Others

6.2.8.1. Others Market Revenue (USD Million) and Growth Rate (%), 2020-2032

CHAPTER 7. Protective Relay Market By End Use

7.1. Introduction

7.2. Protective Relay Revenue By End Use

7.2.1. Protective Relay Revenue (USD Million) and Forecast, By End Use, 2020-2032

7.2.2. Infrastructure

7.2.2.1. Infrastructure Market Revenue (USD Million) and Growth Rate (%), 2020-2032

7.2.3. Government

7.2.3.1. Government Market Revenue (USD Million) and Growth Rate (%), 2020-2032

7.2.4. Power

7.2.4.1. Power Market Revenue (USD Million) and Growth Rate (%), 2020-2032

7.2.5. Industrial

7.2.5.1. Industrial Market Revenue (USD Million) and Growth Rate (%), 2020-2032

7.2.6. Others

7.2.6.1. Others Market Revenue (USD Million) and Growth Rate (%), 2020-2032

CHAPTER 8. GCC Protective Relay Market By Country

8.1. North America Protective Relay Market Overview

8.2. Saudi Arabia

8.2.1. Saudi Arabia Protective Relay Revenue (USD Million) and Forecast By Voltage, 2020-2032

8.2.2. Saudi Arabia Protective Relay Revenue (USD Million) and Forecast By Application, 2020-2032

8.2.3. Saudi Arabia Protective Relay Revenue (USD Million) and Forecast By End Use, 2020-2032

8.3. UAE

8.3.1. UAE Protective Relay Revenue (USD Million) and Forecast By Voltage, 2020-2032

8.3.2. UAE Protective Relay Revenue (USD Million) and Forecast By Application, 2020-2032

8.3.3. UAE Protective Relay Revenue (USD Million) and Forecast By End Use, 2020-2032

8.4. Bahrain

8.4.1. Bahrain Protective Relay Revenue (USD Million) and Forecast By Voltage, 2020-2032

8.4.2. Bahrain Protective Relay Revenue (USD Million) and Forecast By Application, 2020-2032

8.4.3. Bahrain Protective Relay Revenue (USD Million) and Forecast By End Use, 2020-2032

8.5. Kuwait

8.5.1. Kuwait Protective Relay Revenue (USD Million) and Forecast By Voltage, 2020-2032

8.5.2. Kuwait Protective Relay Revenue (USD Million) and Forecast By Application, 2020-2032

8.5.3. Kuwait Protective Relay Revenue (USD Million) and Forecast By End Use, 2020-2032

8.6. Qatar

8.6.1. Qatar Protective Relay Revenue (USD Million) and Forecast By Voltage, 2020-2032

8.6.2. Qatar Protective Relay Revenue (USD Million) and Forecast By Application, 2020-2032

8.6.3. Qatar Protective Relay Revenue (USD Million) and Forecast By End Use, 2020-2032

8.7. Oman

8.7.1. Oman Protective Relay Revenue (USD Million) and Forecast By Voltage, 2020-2032

8.7.2. Oman Protective Relay Revenue (USD Million) and Forecast By Application, 2020-2032

8.7.3. Oman Protective Relay Revenue (USD Million) and Forecast By End Use, 2020-2032

8.8. GCC PEST Analysis

CHAPTER 9. Player Analysis Of Protective Relay Market

9.1. Protective Relay Market Company Share Analysis

9.2. Competition Matrix

9.2.1. Competitive Benchmarking Of Key Players By Price, Presence, Market Share, And R&D Investment

9.2.2. New Product Launches and Product Enhancements

9.2.3. Mergers And Acquisition In GCC Protective Relay Market

9.2.4. Partnership, Joint Ventures and Strategic Alliances/ Sales Agreements

CHAPTER 10. Company Profile

10.1. ABB

10.1.1. Company Snapshot

10.1.2. Business Overview

10.1.3. Financial Overview

10.1.3.1. Revenue (USD Million), 2022

10.1.3.2. ABB 2022 Protective Relay Business Regional Distribution

10.1.4. Product /Service and Specification

10.1.5. Recent Developments & Business Strategy

10.2. General Electric

10.3. Eaton

10.4. TIEPCO

10.5. Semiens

10.6. THYEAST

10.7. Toshiba Corporation

10.8. Doble Engineering Company

10.9. FANOX

10.10. Mitsubishi Electric Corporation

10.11. NR Electric Co., Ltd.

10.12. Schneider Electric