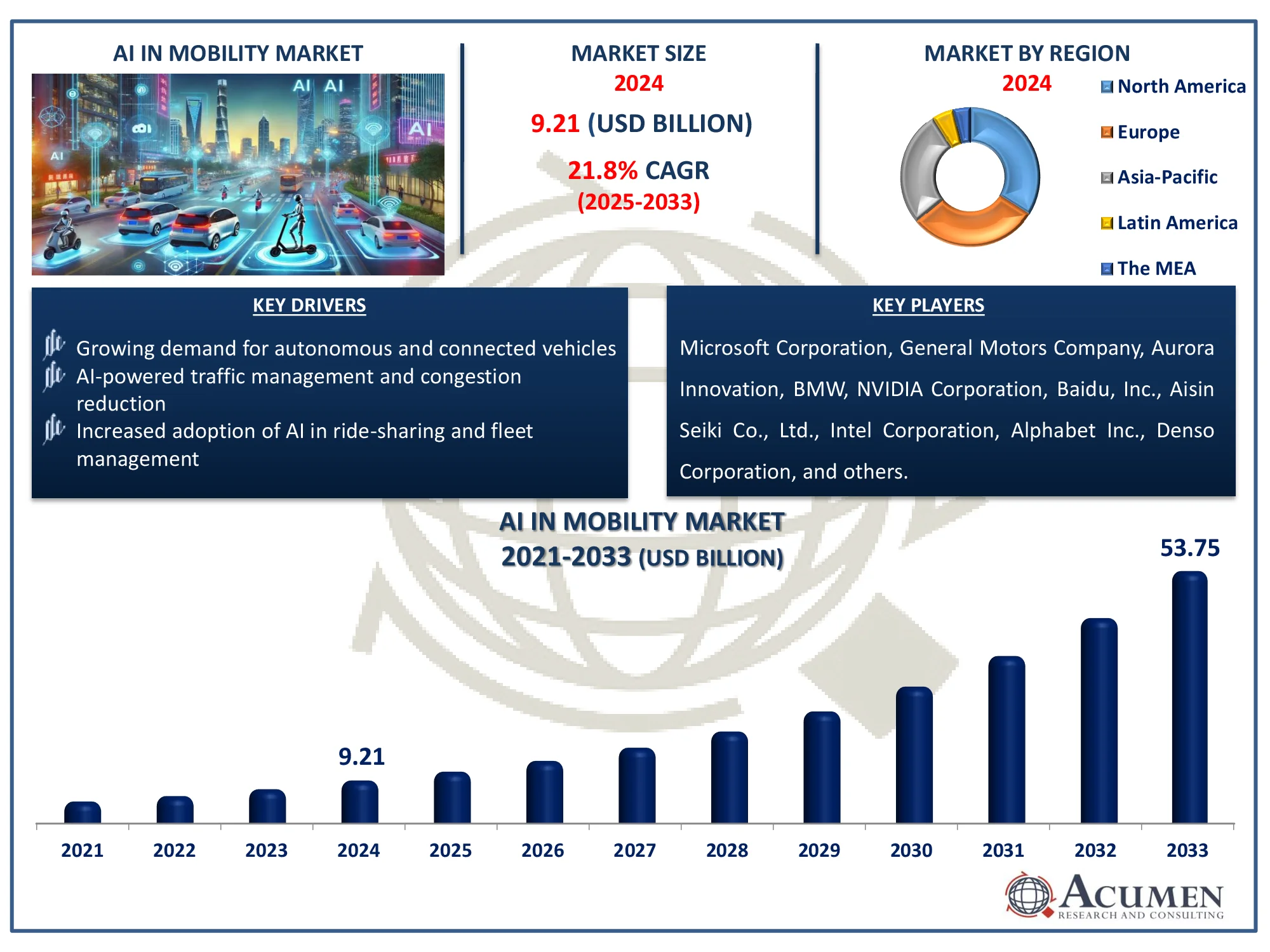

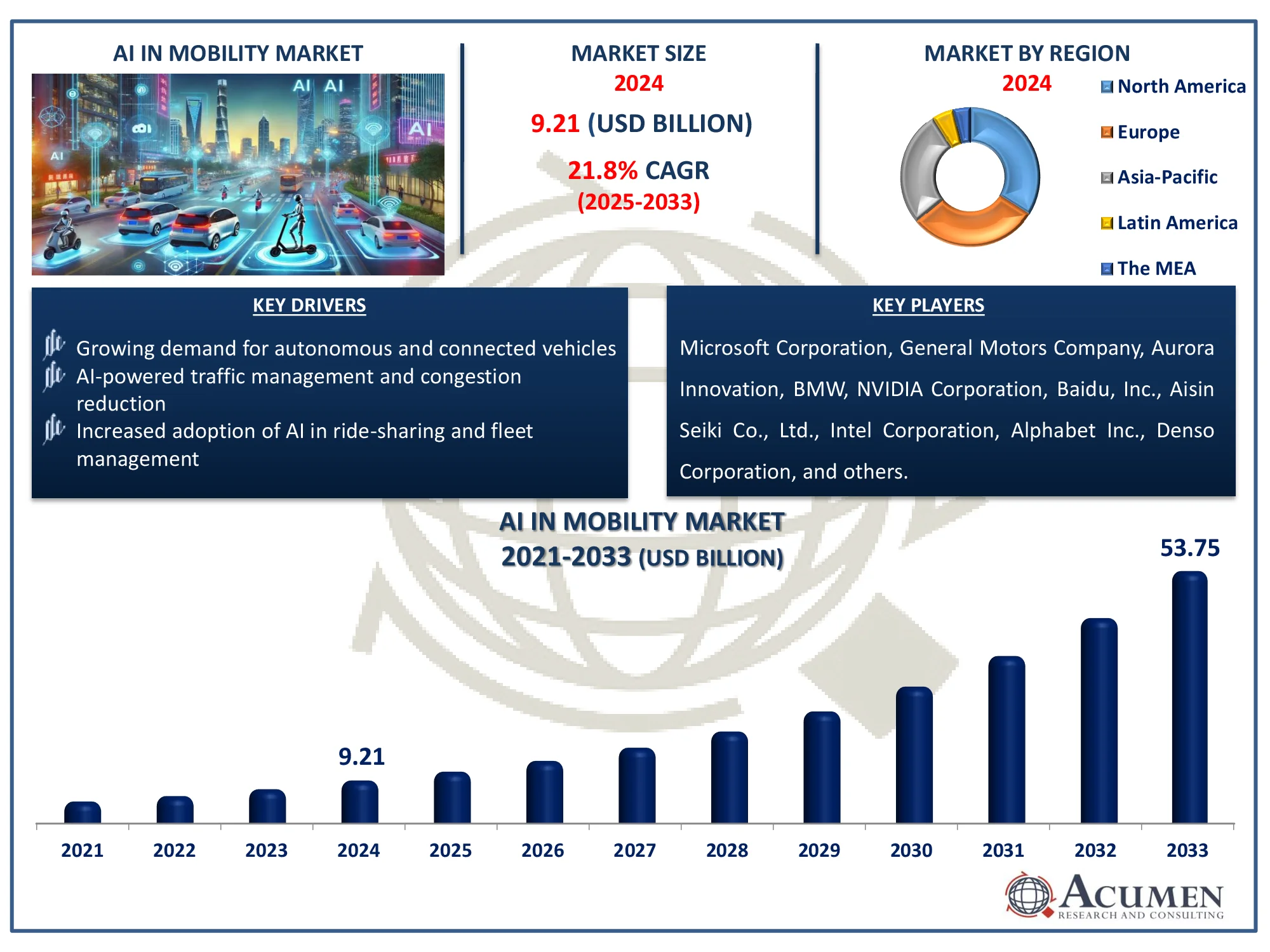

The Global AI in Mobility Market Size accounted for USD 9.21 Billion in 2024 and is estimated to achieve a market size of USD 53.75 Billion by 2033 growing at a CAGR of 21.8% from 2025 to 2033.

AI in Mobility Market Highlights

- Global AI in mobility market revenue is poised to garner USD 53.75 Billion by 2033 with a CAGR of 21.8% from 2025 to 2033

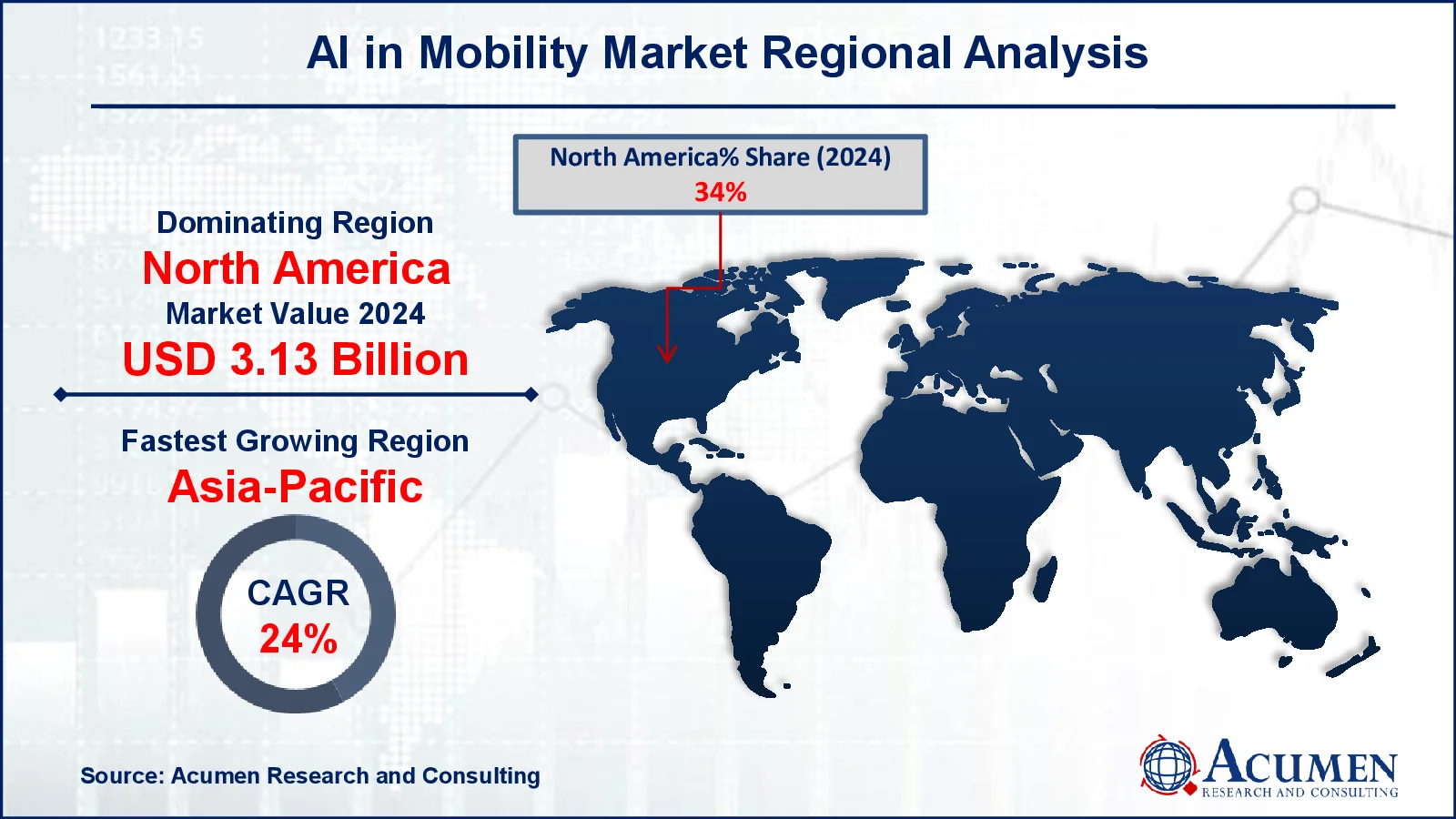

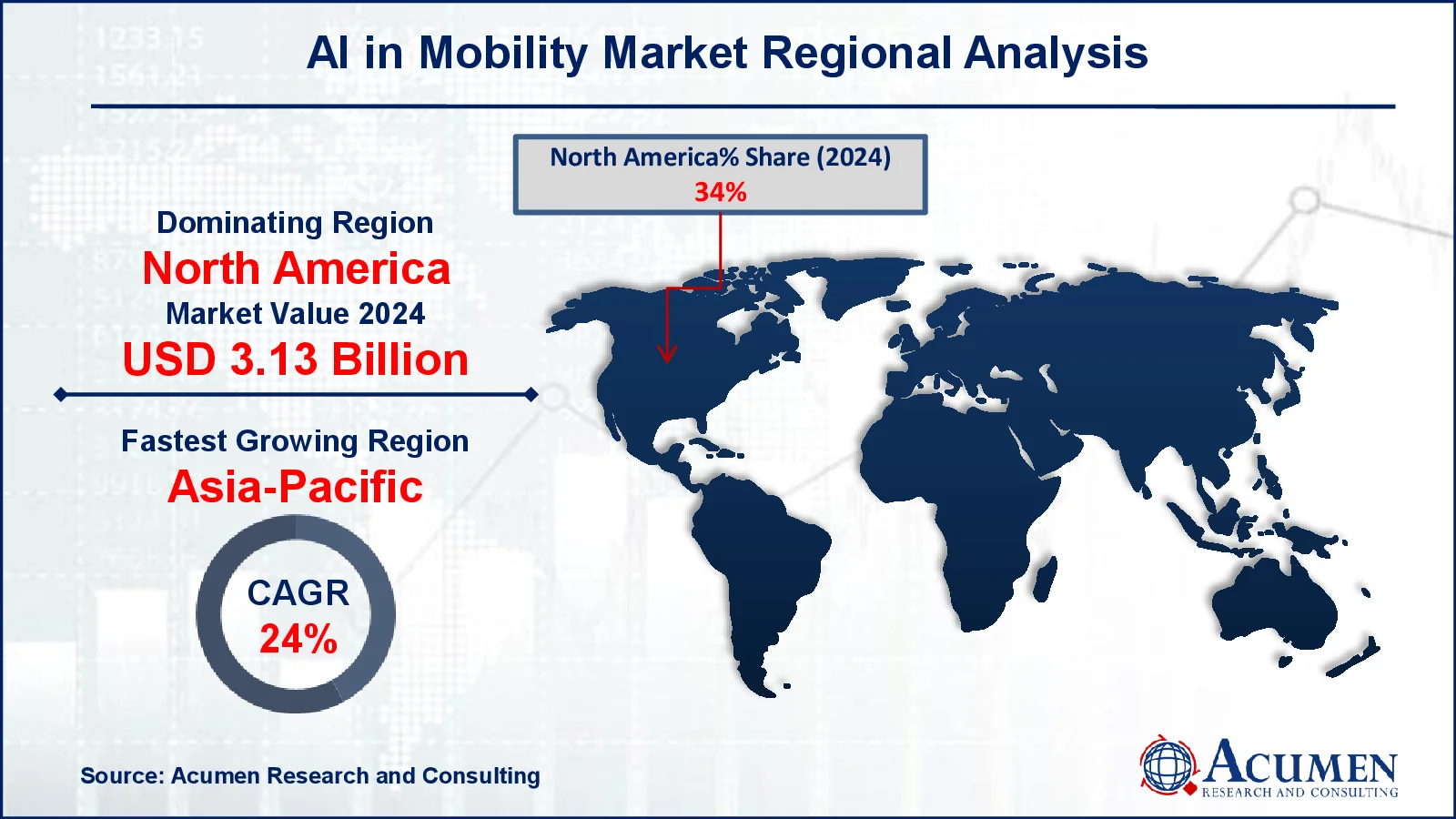

- North America AI in mobility market value occupied around USD 3.13 billion in 2024

- Asia-pacific AI in mobility market growth will record a CAGR of more than 24% from 2025 to 2033

- Cloud-based deployment segment holds notable share in AI in mobility market

- AI is enhancing ride-sharing, public transport optimization, and predictive maintenance for seamless and efficient urban mobility solutions is a popular AI in mobility market trend that fuels the industry demand

AI in mobility refers to the use of artificial intelligence technologies to enhance transportation systems, improve traffic management, and optimize mobility solutions. It enables real-time decision-making, predictive analytics, and automation in various transportation sectors, including ride-sharing, autonomous vehicles, and smart traffic control.

According to the Startup Nation Central Organization, Israel's tech ecosystem takes a bold and aggressive approach to innovation on the global arena, notably in the transportation and mobility sectors. Waze, for example, uses AI to deliver real-time traffic statistics and navigation help, thereby enhancing urban mobility and lowering congestion. Moovex is a smart mobility platform that manages and optimizes complicated transportation operations for businesses, governments, and transportation providers. It converts complex transportation demands into optimal shared trips. Companies like Waze and Moovex show how AI can improve efficiency and reduce congestion in urban transportation, demonstrating the potential of AI-driven mobility solutions.

Global AI in Mobility Market Dynamics

Market Drivers

- Growing demand for autonomous and connected vehicles

- AI-powered traffic management and congestion reduction

- Increased adoption of AI in ride-sharing and fleet management

Market Restraints

- High costs of AI integration and infrastructure development

- Data privacy, cybersecurity risks, and ethical concerns

- Regulatory uncertainties and legal challenges

Market Opportunities

- Advancements in AI-driven public transportation systems

- AI-enabled predictive maintenance for vehicles and infrastructure

- Integration of AI with smart city initiatives

AI in Mobility Market Report Coverage

|

Market

|

AI in Mobility Market

|

|

AI in Mobility Market Size 2024

|

USD 9.21 Billion

|

|

AI in Mobility Market Forecast 2033

|

USD 53.75 Billion

|

|

AI in Mobility Market CAGR During 2025 - 2033

|

21.8%

|

|

AI in Mobility Market Analysis Period

|

2021 - 2033

|

|

AI in Mobility Market Base Year

|

2024

|

|

AI in Mobility Market Forecast Data

|

2025 - 2033

|

|

Segments Covered

|

By Technology, By Deployment Mode, By Mobility Type, By Application, And By Geography

|

|

Regional Scope

|

North America, Europe, Asia Pacific, Latin America, and Middle East & Africa

|

|

Key Companies Profiled

|

Microsoft Corporation, General Motors Company, Aurora Innovation, Inc., BMW AG, NVIDIA Corporation, Baidu, Inc., Aisin Seiki Co., Ltd., Intel Corporation, Alphabet Inc., Denso Corporation, Ford Motor Company, International Business Machines Corp., Continental AG, and Magna International Inc.

|

|

Report Coverage

|

Market Trends, Drivers, Restraints, Competitive Analysis, Player Profiling, Covid-19 Analysis, Regulation Analysis

|

AI in Mobility Market Insights

In July 2023, Volkswagen unveiled its strategic plan to introduce autonomous vehicles for ride-hailing and goods delivery services in Austin, Texas, with a targeted launch in 2026. The rise of self-driving technology is accelerating AI adoption in the mobility sector, enabling safer and more efficient transportation. AI-powered connected vehicles enhance real-time decision-making, reducing accidents and improving traffic flow and thrives growth of artificial intelligence in mobility market.

AI-driven traffic management systems analyze real-time data to optimize traffic signals, minimize congestion, and enhance urban mobility. For example, Bengaluru’s Adaptive Traffic Control System (BATCS), developed in collaboration with the Centre for Development of Advanced Computing (C-DAC), dynamically adjusts traffic signals at 165 intersections, significantly reducing delays and improving travel times. This initiative highlights AI’s capability to address real-world traffic challenges, further driving investment in AI-powered mobility solutions such as smart traffic management, autonomous vehicles, and intelligent transport systems which contributes to the growth of artificial intelligence in mobility market.

However, AI-driven mobility solutions rely on vast amounts of user and vehicle data, raising concerns about privacy breaches and cybersecurity threats. Addressing these challenges requires stringent data protection policies, secure AI frameworks, and regulatory compliance to ensure safe and responsible AI deployment.

In September 2023, during the Internationale Automobil-Ausstellung (IAA) Mobility 2023 in Munich, Mobileye and Valeo announced a strategic alliance to develop software-defined, high-performance imaging radars for ADAS and autonomous driving features in next-generation vehicles. This partnership accelerates AI integration in the mobility sector by enhancing real-time perception and decision-making, further advancing autonomous and ADAS-equipped vehicle capabilities driving artificial intelligence in mobility market growth.

AI in Mobility Market Segmentation

The worldwide market for AI in mobility is split based on technology, deployment mode, mobility type, application, and geography.

AI in Mobility Market By Technology

- Machine Learning

- Natural Language Processing (NLP)

- Computer Vision

- Robotics

- Deep Learning

According to AI in mobility industry analysis, core mobility applications rely on machine learning (ML), including autonomous driving, predictive analytics, and traffic management. ML-powered systems also help with demand forecasting in ride-hailing and fleet management, making transportation more efficient and cost-effective. For instance, Baidu, Inc. will extend its driverless car services by expanding its autonomous ride-hailing platform, Apollo Go, to Wuhan Tianhe International Airport in August 2023.

Natural language processing (NLP) improves in-car communication and voice assistants; computer vision is vital for object identification, lane tracking, and driver monitoring; and robots plays a critical part in autonomous delivery. Deep learning is revolutionizing mobility by enabling self-driving cars, maximizing traffic flow, and boosting public transportation.

AI in Mobility Market By Deployment Mode

Cloud-based deployments are likely to dominate the AI in mobility market because to their scalability, real-time data processing, and cost efficiency. It provides easy access to massive datasets for AI-powered applications such as traffic management, ride-sharing, and self-driving cars. Cloud infrastructure also facilitates over-the-air updates, which ensure that AI algorithms continue to advance without the need for hardware upgrades. On-premises deployment is preferred by enterprises that prioritize data security and control, such as automobile manufacturers and government agencies. It improves privacy and reliability, but requires significant infrastructure investment and upkeep.

AI in Mobility Market By Mobility Type

- Shared Mobility

- Personal Mobility

- Public Transport

- Freight & Logistics

In the AI in mobility industry analysis, freight & logistics segment is rapidly increasing due to adoption of AI-driven automation, predictive analytics, and autonomous delivery solutions. AI enhances route optimization, reduces operational costs, and improves supply chain efficiency, making it essential for logistics companies. Additionally, the rise of e-commerce and demand for last-mile delivery services further accelerates AI integration in this sector. Shared mobility is growing with AI-powered ride-hailing and fleet management solutions, personal mobility benefits from AI-driven driver assistance systems, while public transport is leveraging AI for smart ticketing, route planning, and real-time passenger information systems.

AI in Mobility Market By Application

- Autonomous Vehicles

- Smart Transportation Infrastructure

- Fleet Management

- Traffic Management Systems

- Smart Parking

- Public Transportation Optimization

According to AI in mobility market forecast, autonomous vehicles anticipated to lead due to heavy investments in self-driving technology, AI-powered perception, and real-time decision-making. Major automotive and tech companies are integrating AI for Level 3–5 automation, enhancing safety, efficiency, and reducing human errors. For instance, Valeo and DiDi Autonomous Driving entered into a strategic collaboration and investment pact. Valeo is set to invest in DiDi Autonomous Driving and the collaborative effort between the two entities focuses on crafting intelligent safety solutions for L4 robotaxis. The rise of robotaxis, autonomous delivery, and AI-driven ADAS further accelerates artificial intelligence (AI) in mobility market expansion.

AI in Mobility Market Regional Outlook

North America

Europe

- U.K.

- Germany

- France

- Spain

- Rest of Europe

Asia-Pacific

- India

- Japan

- China

- Australia

- South Korea

- Rest of Asia-Pacific

Latin America

- Brazil

- Mexico

- Rest of LATAM

The Middle East & Africa

- South Africa

- GCC Countries

- Rest of the Middle East & Africa (ME&A)

AI in Mobility Market Regional Analysis

North America has been a leader in the artificial intelligence (AI) in mobility market. The presence of major tech companies, automotive giants, and a well-established regulatory framework has accelerated innovation and large-scale deployment of AI-powered mobility solutions. For instance, in June 2023, Geotab Inc. announced that it introduced generative AI models into its platform by setting a new machine learning model in the connected transportation industry. This advancement enhances connected transportation by providing users with on-demand insights into the efficiency, sustainability, and performance of their vehicles. Additionally, strong investments in autonomous vehicles, smart transportation infrastructure, and AI-driven traffic management continue to drive market growth in the region.

Asia-Pacific is rapidly growing in the artificial intelligence (AI) in mobility market, fueled by government initiatives, stringent safety regulations, and a strong push for sustainable and smart transportation. For instance, as per IndiaAI, Onboard Driver Assistance Warning System (ODWAS) - Initiated by the Indian government in April 2022, ODWAS is a pioneering project designed for public transportation. It uses sensors to monitor vehicle surroundings and driver behavior, providing real-time alerts to minimize accidents. ODWAS contributes to the growth of AI in the mobility market in Asian region by showcasing AI’s role in enhancing road safety through real-time driver assistance, encouraging wider adoption of AI-driven transport solutions.

Furthermore, Europe shows robust growth in artificial intelligence (AI) in mobility market. Countries like Germany, France, and the UK are investing heavily in AI-driven ADAS, electrification, and intelligent traffic management to improve urban mobility.

AI in Mobility Market Players

Some of the top AI in mobility companies offered in our report includes Microsoft Corporation, General Motors Company, Aurora Innovation, Inc., BMW AG, NVIDIA Corporation, Baidu, Inc., Aisin Seiki Co., Ltd., Intel Corporation, Alphabet Inc., Denso Corporation, Ford Motor Company, International Business Machines Corp., Continental AG, and Magna International Inc.

Research Objective

Scope of the Study

Key Questions Answered in the Report

Research Objective

Market Research Process

Data Procurement and Data Mining

Data Analysis and Standardization

Data Processing and Market Formulation

Data Validation

Market Research Approach

Secondary Research

Primary Research

Assumptions & Limitations

Year Considered for the Study

CHAPTER 1. Executive Summary

1.1. Global AI in Mobility Market Snapshot

1.2. Global AI in Mobility Market

CHAPTER 2. Market Variables and Scope

2.1. Introduction to AI in Mobility

2.2. Classification and Scope

CHAPTER 3. Market Dynamics and Trends

3.1. Global AI in Mobility Market Dynamic

3.2. Drivers

3.3. Restraints

3.4. Growth Opportunities

CHAPTER 4. Premium Insights

4.1. Global AI in Mobility Market Dynamics, Impact Analysis

4.2. Porter’s Five Forces Analysis

4.2.1. Bargaining Power of Suppliers

4.2.2. Bargaining Power of Buyers

4.2.3. Threat of Substitute Products

4.2.4. Rivalry among Existing Firms

4.2.5. Threat of New Entrants

4.3. PESTEL Analysis

4.4. Value Chain Analysis

4.5. Market Attractiveness

4.6. Product Lifecycle Analysis

4.7. Product Pricing Analysis

4.8. Demand-Supply Analysis

4.9. Patent Analysis

4.10. Regulatory Framework

4.11. Vendor Landscape

4.11.1. List of Buyers

4.11.2. List of Suppliers

CHAPTER 5. AI in Mobility Market By Technology

5.1. Global AI in Mobility Market Snapshot, By Technology

5.2. Global AI in Mobility Market, By Technology, 2024 VS 2033

5.2.1. Market Size and Forecast

5.2.2. Machine Learning

5.2.2.1. Overview

5.2.2.2. Key Growth Factors and Opportunities

5.2.2.3. Market Size and Forecast

5.2.3. Natural Language Processing (NLP)

5.2.3.1. Overview

5.2.3.2. Key Growth Factors and Opportunities

5.2.3.3. Market Size and Forecast

5.2.4. Computer Vision

5.2.4.1. Overview

5.2.4.2. Key Growth Factors and Opportunities

5.2.4.3. Market Size and Forecast

5.2.5. Robotics

5.2.5.1. Overview

5.2.5.2. Key Growth Factors and Opportunities

5.2.5.3. Market Size and Forecast

5.2.6. Deep Learning

5.2.6.1. Overview

5.2.6.2. Key Growth Factors and Opportunities

5.2.6.3. Market Size and Forecast

CHAPTER 6. AI in Mobility Market By Deployment Mode

6.1. Global AI in Mobility Market Snapshot, By Deployment Mode

6.2. Global AI in Mobility Market, By Deployment Mode, 2024 VS 2033

6.2.1. Market Size and Forecast

6.2.2. Cloud-Based

6.2.2.1. Overview

6.2.2.2. Key Growth Factors and Opportunities

6.2.2.3. Market Size and Forecast

6.2.3. On-Premises

6.2.3.1. Overview

6.2.3.2. Key Growth Factors and Opportunities

6.2.3.3. Market Size and Forecast

CHAPTER 7. AI in Mobility Market By Mobility Type

7.1. Global AI in Mobility Market Snapshot, By Mobility Type

7.2. Global AI in Mobility Market, By Mobility Type, 2024 VS 2033

7.2.1. Market Size and Forecast

7.2.2. Shared Mobility

7.2.2.1. Overview

7.2.2.2. Key Growth Factors and Opportunities

7.2.2.3. Market Size and Forecast

7.2.3. Personal Mobility

7.2.3.1. Overview

7.2.3.2. Key Growth Factors and Opportunities

7.2.3.3. Market Size and Forecast

7.2.4. Public Transport

7.2.4.1. Overview

7.2.4.2. Key Growth Factors and Opportunities

7.2.4.3. Market Size and Forecast

7.2.5. Freight & Logistics

7.2.5.1. Overview

7.2.5.2. Key Growth Factors and Opportunities

7.2.5.3. Market Size and Forecast

CHAPTER 8. AI in Mobility Market By Application

8.1. Global AI in Mobility Market Snapshot, By Application

8.2. Global AI in Mobility Market, By Application, 2024 VS 2033

8.2.1. Market Size and Forecast

8.2.2. Autonomous Vehicles

8.2.2.1. Overview

8.2.2.2. Key Growth Factors and Opportunities

8.2.2.3. Market Size and Forecast

8.2.3. Ride-Hailing & Sharing

8.2.3.1. Overview

8.2.3.2. Key Growth Factors and Opportunities

8.2.3.3. Market Size and Forecast

8.2.4. Fleet Management

8.2.4.1. Overview

8.2.4.2. Key Growth Factors and Opportunities

8.2.4.3. Market Size and Forecast

8.2.5. Traffic Management Systems

8.2.5.1. Overview

8.2.5.2. Key Growth Factors and Opportunities

8.2.5.3. Market Size and Forecast

8.2.6. Smart Infrastructure

8.2.6.1. Overview

8.2.6.2. Key Growth Factors and Opportunities

8.2.6.3. Market Size and Forecast

8.2.7. Public Transportation Optimization

8.2.7.1. Overview

8.2.7.2. Key Growth Factors and Opportunities

8.2.7.3. Market Size and Forecast

CHAPTER 9. AI in Mobility Market, by Region

9.1. Overview

9.2. Global AI in Mobility Market, By Region

9.2.1. Market Size and Forecast

9.3. North America

9.3.1. Market Size and Forecast

9.3.2. North America AI in Mobility Market, By Country

9.3.3. North America AI in Mobility Market, By Technology

9.3.4. North America AI in Mobility Market, By Deployment Mode

9.3.5. North America AI in Mobility Market, By Mobility Type

9.3.6. North America AI in Mobility Market, By Application

9.3.7. U.S.

9.3.7.1. U.S. AI in Mobility Market, By Technology

9.3.7.2. U.S. AI in Mobility Market, By Deployment Mode

9.3.7.3. U.S. AI in Mobility Market, By Mobility Type

9.3.7.4. U.S. AI in Mobility Market, By Application

9.3.8. Canada

9.3.8.1. Canada AI in Mobility Market, By Technology

9.3.8.2. Canada AI in Mobility Market, By Deployment Mode

9.3.8.3. Canada AI in Mobility Market, By Mobility Type

9.3.8.4. Canada AI in Mobility Market, By Application

9.4. Europe

9.5. Asia Pacific

9.6. LAMEA

CHAPTER 10. Competitive Landscape

10.1. Strategic Move Analysis

10.1.1. Top Player Positioning/Market Share Analysis

10.2. Recent Developments by the Market Participants (2024)

CHAPTER 11. Company Profile

11.1. Microsoft Corporation

11.1.1. Company Overview

11.1.2. Company Snapshot

11.1.3. Financial Performance

11.1.4. Business Overview

11.1.5. Product Portfolio

11.1.6. Strategic Growth

11.1.7. SWOT Analysis

11.2. General Motors Company

11.3. Aurora Innovation, Inc.

11.4. BMW AG

11.5. NVIDIA Corporation

11.6. Baidu, Inc.

11.7. Aisin Seiki Co., Ltd.

11.8. Intel Corporation

11.9. Alphabet Inc.

11.10. Denso Corporation

11.11. Ford Motor Company

11.12. International Business Machines Corp.

11.13. Continental AG

11.14. Magna International Inc